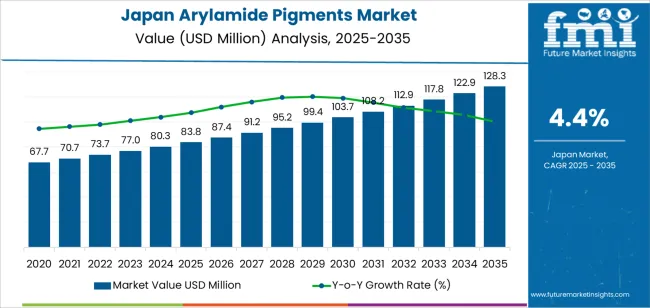

In 2025 the market for arylamide pigments in Japan stands at USD 83.8 million. By 2035 demand is expected to reach USD 128.3 million, corresponding to a CAGR of 4.4%. In the early phase (2025-2030) the market rises gradually from USD 83.8 million to about USD 99.4 million. This period reflects growing demand from the coatings, plastics, and textile sectors. Manufacturers respond to consumer preferences for vivid and long lasting colors in automotive coatings, home appliances, and consumer goods. Regulatory standards on paint quality and color consistency encourage use of high performance pigments. Demand also grows in specialty printing and packaging materials.

The later phase (2030-2035) shows a stronger momentum as the market moves from roughly USD 99.4 million to USD 128.3 million. During this stage adoption extends to newer applications such as high end plastics, advanced coatings for electric vehicles, and premium consumer products. Innovation in pigment purity, light fastness, and compatibility with eco friendly resins supports adoption. Local pigment producers and global chemical firms operating in Japan invest in R&D and high precision production methods. Shift towards higher end applications lead to greater value per unit consumption. The later growth curve reflects rising technical requirements in end use industries, enhanced pigment performance demand, and expansion across traditional and emerging applications.

From 2025 to 2030, demand for arylamide pigments in Japan is expected to rise from USD 83.8 million to about USD 87.4 million. This increment reflects a modest but stable increase, indicating a gradual expansion driven by increased use in coatings, inks, and specialty materials. The growth during this phase is underpinned by consistent demand in traditional end use industries such as automotive coatings and industrial paints. The steady incremental growth suggests no major disruption in supply or demand and indicates that the industry is consolidating its base while maintaining predictable annual increases.

From 2030 to 2035, the market moves from USD 87.4 million to USD 128.3 million, representing an absolute growth of USD 44.5 million and an overall scale-up of roughly 53% over the decade. This phase marks a breakpoint where demand accelerates substantially. Drivers for this breakpoint likely include expanded application of arylamide pigments in high-performance coatings, increased regulatory focus on pigment durability and lightfastness, and rising demand in sectors such as industrial coatings, automotive refinishing, and specialty polymers. The shift from gradual growth to accelerated expansion suggests structural change in demand patterns, making this period critical for capacity planning and strategic investment by pigment producers.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 83.8 million |

| Forecast Value (2035) | USD 128.3 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The demand for arylamide pigments in Japan reflects broader growth in the national pigments sector, which increasingly favours high performance and speciality pigments over legacy inorganic pigments. As manufacturers in automotive coatings, plastics, printing inks, and consumer goods seek pigments with superior lightfastness, heat resistance, and vivid colour strength, arylamide pigments have gained traction. The structural expansion of industries such as automotive, electronics, packaging, and textiles in Japan has increased demand for speciality pigment types rather than standard inorganic or conventional organic pigments. This trend has pushed pigment buyers and formulators to adopt arylamide pigments for applications requiring durable, high quality colour performance.

Looking ahead the demand outlook for arylamide pigments in Japan appears favourable as several market and regulatory factors evolve. Growing regulatory pressure on heavy metal based pigments and rising preference for pigments that meet stricter environmental and performance standards encourage adoption of arylamide solutions. Expansion in printing inks for high end packaging, increased production of plastics with aesthetic demands, and growing output of automotive coatings with durable finish requirements will drive further uptake.

Advances in pigment dispersion and formulation technology will enable broader use across plastics, textiles, and industrial coatings. While cost premiums relative to conventional pigments remain a constraint, the balance of regulatory compliance, performance needs, and industrial demand supports rising adoption of arylamide pigments in Japan.

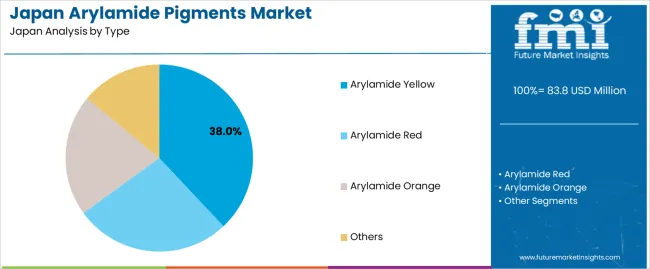

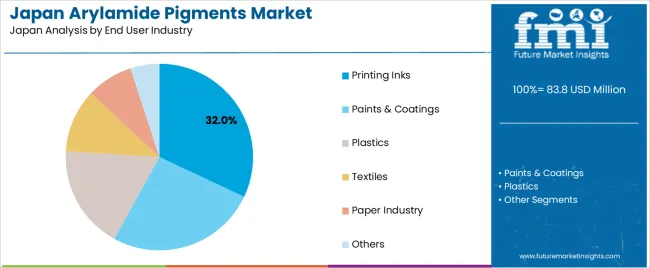

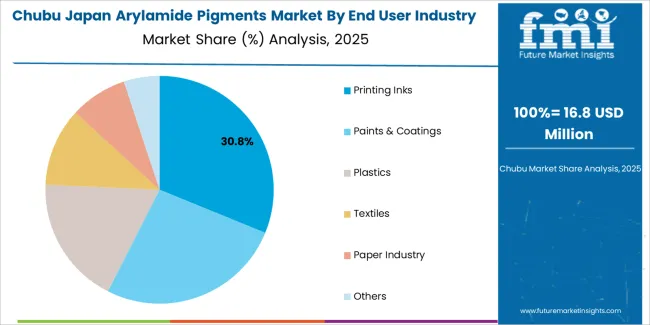

The demand for arylamide pigments in Japan is driven by both pigment type and end-user industry. The primary types of arylamide pigments include yellow, red, orange, and others, with arylamide yellow accounting for 38% of the total demand. In terms of end-user industries, the key sectors include printing inks (32%), paints and coatings, plastics, textiles, paper, and other applications. The choice of pigment type depends on the specific color requirements, application needs, and performance characteristics, such as lightfastness, heat stability, and chemical resistance. Industries like printing and coatings dominate the demand due to their reliance on vibrant, durable pigments for high-quality output.

Arylamide yellow pigments represent 38% of the total demand for arylamide pigments in Japan. This dominance is driven by their strong, vibrant color and excellent performance in various applications. Arylamide yellow pigments are widely used in printing inks, where they provide bright, consistent hues necessary for high-quality printing. These pigments also offer good lightfastness and heat resistance, making them suitable for use in outdoor applications and products exposed to sunlight. Their versatility allows them to be used in a wide range of industries, including paints and coatings, where durability and color accuracy are critical.

The continued demand for arylamide yellow pigments is also fueled by their cost-effectiveness and ease of incorporation into various formulations. In the printing industry, where high-quality color reproduction is paramount, these pigments provide a reliable and stable option. Additionally, the ongoing expansion of packaging and label printing in Japan’s thriving consumer goods sector continues to support the use of arylamide yellow pigments. As the demand for bright, durable colors across multiple industries remains strong, arylamide yellow will continue to be a key player in the pigment market.

Printing inks account for 32% of the total demand for arylamide pigments in Japan. This demand is primarily driven by the widespread use of printing inks in packaging, labels, and advertising materials, where vibrant and accurate color reproduction is crucial. Arylamide pigments, particularly yellow and red, are favored in the printing industry for their ability to deliver high-quality colors that are both stable and durable. The growing demand for visually appealing packaging and printed materials in Japan’s consumer goods market continues to drive the use of these pigments in printing inks.

The printing inks sector’s demand for arylamide pigments is also supported by the increasing emphasis on eco-friendly and sustainable printing practices. As consumer preferences shift toward environmentally conscious packaging, manufacturers are turning to pigments that meet these criteria without compromising on color intensity or performance. Arylamide pigments’ ability to provide excellent coverage and resistance to fading under UV exposure makes them ideal for high-quality printed materials. As the printing industry continues to expand and innovate, the demand for arylamide pigments in printing inks will remain robust in Japan.

Demand for arylamide pigments in Japan gains momentum from the country’s advanced manufacturing sectors such as automotive, electronics, consumer goods and high end coatings. Japanese auto makers and component suppliers require pigments capable of withstanding high heat, UV exposure and chemical stress, which makes arylamide pigments a favorable choice. Growth in plastic consumer electronics, appliances and decorative coatings adds further demand because these pigments offer strong tinting strength, good lightfastness and chemical resistance. Evolving consumer expectations for vibrant, durable finishes in products also encourages formulators to rely on high performance pigment solutions instead of conventional dyes or lower grade pigments.

In Japan diverse end use industries such as printing inks, plastics, textile coatings and industrial paints underpin arylamide pigment demand. Printing and packaging sectors increasingly favour organic pigments over traditional inorganic ones for brighter colours and lighter weight plastic packaging. Electronics and consumer goods manufacturers seek pigments that provide stable colour under repeated heat cycles and exposure to light. The presence of domestic chemical firms producing specialty pigments, combined with local formulation expertise, encourages industrial users to adopt arylamide-based colourants. This diversified demand base helps maintain stable uptake in spite of cyclic economic fluctuations.

Adoption of arylamide pigments in Japan faces constraints arising from cost, competition and regulatory pressures. Compared with standard inorganic pigments, arylamide pigments require more complex synthesis, which increases raw material and processing costs. In cost-sensitive segments such as basic coatings or low end plastic goods manufacturers may opt for cheaper alternatives. Regulatory scrutiny on pigment safety, heavy metal content and environmental compliance raises testing and documentation costs for suppliers and formulators. Intense competition from global and local pigment suppliers, producing inorganic, hybrid or newer pigment chemistries, limits pricing power for arylamide pigment producers in lower-margin segments.

In Japan the pigment market is shifting toward high performance, specialty and environmentally compliant formulations, which works in favor of arylamide pigments. Rising demand exists for pigments with high heat stability, excellent fade resistance and compatibility with advanced plastics and resins used in automotive and electronics. Simultaneously there is growing interest in pigments formulated for reduced volatile organic compound (VOC) coatings, waterborne paints, and solvent free ink systems, aligning with environmental regulations and consumer preferences. Custom pigment grading and improved dispersion technologies are enabling arylamide pigments to meet stringent Japanese quality expectations in sectors such as automotive coatings, consumer electronics, and premium packaging.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.4% |

| Kanto | 5.0% |

| Kinki | 4.4% |

| Chubu | 3.9% |

| Tohoku | 3.4% |

| Rest of Japan | 3.2% |

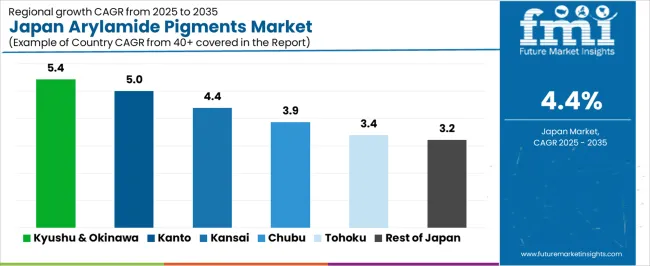

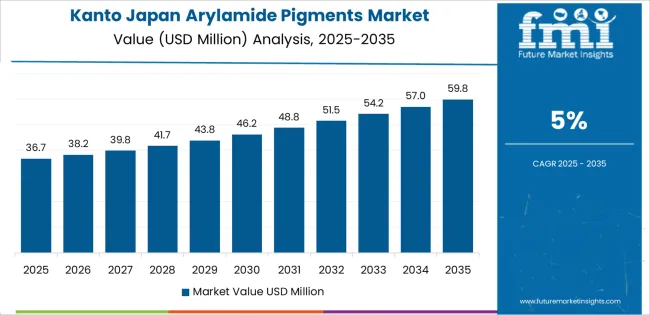

The demand for arylamide pigments in Japan is expected to grow unevenly across regions, with Kyushu & Okinawa leading at a CAGR of 5.4%. This higher growth likely reflects expanding demand from coatings, plastics, textiles and printing ink sectors that value arylamide pigments for their strong colour strength, heat resistance, and lightfastness. The Kanto region follows at 5.0%, supported by its concentration of automotive, electronic, and manufacturing industries that consume coatings and plastics.

In the Kinki region a 4.4% growth rate aligns with moderate industrial and manufacturing activity. The Chubu region at 3.9% shows slower but steady uptake. Tohoku and the Rest of Japan, at 3.4% and 3.2%, show comparatively lower growth. Overall the pattern reflects correlation between regional industrial concentration and pigment demand intensity.

Growth in Kyushu and Okinawa reflects a CAGR of 5.4% through 2035 for arylamide pigments, supported by expanding plastics, printing, and packaging activity across manufacturing hubs. Coatings, industrial inks, and polymer coloring remain primary application areas due to stable construction output and export focused manufacturing. The regional presence of packaging converters and molded plastics suppliers sustains pigment blending and dispersion demand. Marine exposure across coastal zones encourages color stability requirements in coatings. Logistics access through southern ports improves raw material availability and outbound pigment shipments serving domestic converters and overseas buyers with steady batch driven purchasing cycles.

Kanto advances at a CAGR of 5.0% through 2035 for arylamide pigment demand, driven by dense printing, packaging, automotive coatings, and consumer goods manufacturing. High consumption of branded packaging and commercial printing keeps ink and toner pigment usage elevated. Automotive refinishing and appliance coatings add steady industrial color requirements. Strong distributor networks in Tokyo and surrounding prefectures maintain inventory flow to downstream users. Demand is reinforced by fast turnover in retail packaging formats and large scale polymer processors supplying domestic consumer markets with frequent color reformulation cycles tied to product design updates.

Kinki records a CAGR of 4.4% through 2035 for arylamide pigment demand, supported by balanced contributions from packaging, plastics processing, and industrial coatings. Manufacturing clusters around Osaka drive sustained pigment usage in molded consumer goods and film packaging. Printing inks for commercial and food packaging remain stable demand channels. Architectural coatings for renovation projects also add incremental pigment consumption. Supply chains depend on regional chemical distributors serving medium scale processors. Color standardization requirements across branded packaging sustain purchase consistency even where overall manufacturing growth remains moderate.

Chubu expands at a CAGR of 3.9% through 2035 for arylamide pigment demand, led by plastics, automotive components, and industrial coatings consumption tied to manufacturing supply chains. Automotive interior parts and under hood plastics rely on durable pigmentation for heat and wear resistance. Packaging demand remains steady from food and industrial goods logistics. Pigment demand follows OEM production rhythms rather than retail volatility. Access to upstream chemical feedstocks supports stable formulation activity. Supply flows remain structured around contract manufacturing and long term procurement agreements with large polymer and coatings producers.

Tohoku posts a CAGR of 3.4% through 2035 for arylamide pigment demand, shaped by moderate packaging, agricultural plastics, and construction coatings usage. Regional food packaging and farm equipment components use pigmented polymers at steady volumes. Infrastructure upkeep sustains limited but consistent architectural coatings demand. Manufacturing density remains lower than central regions, keeping overall pigment throughput moderate. Distribution relies on interregional supply from Kanto and Chubu. Demand grows through replacement cycles rather than capacity expansion, with bulk color concentrates preferred for cost control by smaller processors.

The rest of Japan reflects a CAGR of 3.2% through 2035 for arylamide pigment demand, supported by rural packaging, municipal coatings, and small scale plastics manufacturing. Local food processors, consumer goods workshops, and maintenance contractors account for most pigment use. Demand remains tied to repair cycles, seasonal packaging needs, and limited export oriented plastics output. Manufacturing density is dispersed, favoring distributor stocked pigment grades. Growth remains steady rather than rapid due to slower industrial turnover and lower automation intensity in secondary prefectures compared with core industrial regions.

Demand for arylamide pigments in Japan is rising because downstream industries require high performance organic pigments for paints, coatings, plastics, printing inks, textiles, and automotive finishes. As Japanese manufacturers aim for durable colorants with strong tint strength, chemical and heat resistance, and good lightfastness, arylamide pigments meet those needs. Growth in automotive coatings, industrial machinery, plastics goods, and packaging drives demand. The shift toward high quality finishes and stable coloration in coatings and printing inks also increases reliance on pigments whose properties support long term performance and consistent visuals.

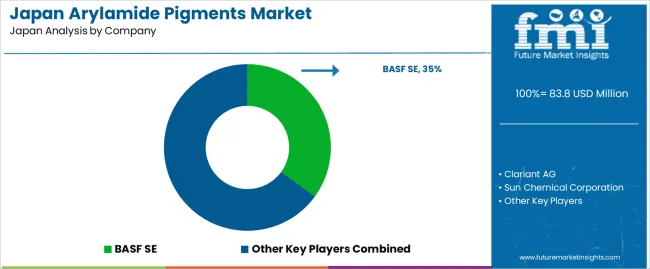

Major suppliers in the Japanese arylamide pigment segment include BASF SE, Clariant AG, Sun Chemical Corporation, DIC Corporation, and Heubach GmbH. BASF (through its pigments business, now integrated with DIC in Japan) offers a broad range of pigment types used in coatings and plastics applications. Clariant supplies organic pigment solutions valued for stable color and performance in coatings, inks, and plastics. Sun Chemical and DIC (which are associated via corporate ownership) provide pigments and colorants tailored to printing inks, packaging, and industrial coatings. Heubach specialises in custom pigment solutions for textile, coatings, and printing applications. These companies influence the market by offering a mix of global pigment expertise and local supply chains to meet Japan’s diverse industrial colorant requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Arylamide Yellow, Arylamide Red, Arylamide Orange, Others |

| End User Industry | Printing Inks, Paints & Coatings, Plastics, Textiles, Paper Industry, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | BASF SE, Clariant AG, Sun Chemical Corporation, DIC Corporation, Heubach GmbH |

| Additional Attributes | Dollar by sales by pigment type and end-user industry; regional CAGR and volume growth projections; breakdown of pigment demand by color type; key end-use trends in automotive coatings, plastics, and printing inks; regulatory compliance impact on pigment selection; lightfastness, heat stability, and chemical resistance requirements; emerging applications in EV coatings, premium plastics, and industrial coatings; innovation in pigment dispersion and high-performance formulations; competition from inorganic and hybrid pigments; local vs global supplier activity and capacity trends. |

The demand for arylamide pigments in Japan is estimated to be valued at USD 83.8 million in 2025.

The market size for the arylamide pigments in Japan is projected to reach USD 128.3 million by 2035.

The demand for arylamide pigments in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in arylamide pigments in Japan are arylamide yellow, arylamide red, arylamide orange and others.

In terms of end user industry, printing inks segment is expected to command 32.0% share in the arylamide pigments in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Demand for Arylamide Pigments in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA