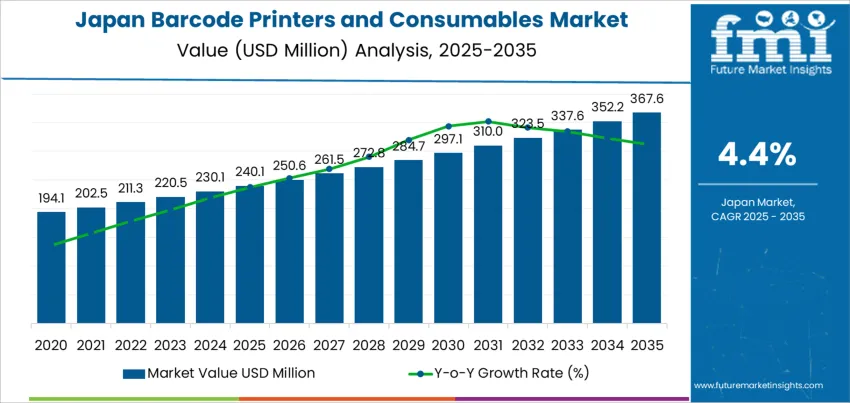

The Japan barcode printers and consumables demand is valued at USD 240.1 million in 2025 and is projected to reach USD 367.6 million by 2035, reflecting a CAGR of 4.4%. Growth is shaped by continued digitalization of warehousing, logistics tracking upgrades, and increasing compliance requirements in healthcare, food, and retail supply chains. Automated barcode identification enables faster throughput, reliable product traceability, and improved inventory visibility across distribution environments.

Industrial printers lead usage due to their durability, high print volumes, and compatibility with diverse label materials including synthetic and heat-resistant substrates. These systems support permanent identification in manufacturing plants, transport hubs, and cold-chain facilities while ensuring scannability across the product lifecycle. Rising demand for thermal transfer ribbons, adhesive labels, and printheads reinforces recurring consumables expenditure.

Kyushu & Okinawa, Kanto, and Kansai exhibit the highest adoption due to concentrated logistics zones, major manufacturing clusters, and retail distribution networks deploying automated labelling standards. Investments in smart supply chain infrastructure and e-commerce fulfilment centers further drive consumption. Key suppliers include SATO Holdings Corporation, Zebra Technologies, Honeywell International Inc., TSC Auto ID Technology Co., Ltd., and Brother Industries, Ltd. Their solutions focus on system uptime, print clarity, seamless device integration, and compliance support for regulated product ecosystems.

Demand for barcode printers and consumables in Japan shows moderate volatility linked to technology-upgrade cycles and sector-specific purchasing rhythms. Retail and logistics operations form the primary demand base, with e-commerce fulfillment sustaining steady requirements for labels and thermal ribbons. These segments help reduce the depth of trough phases because consumables maintain regular turnover regardless of capital-expenditure timing.

Volatility becomes more visible during replacement cycles for hardware printers. Organizations often evaluate upgrades only when print resolution, connectivity, or security features provide clear operational benefits. This can delay procurement during periods of cost control or when existing hardware remains functional. Manufacturing adoption adds periodic spikes when traceability standards tighten, but these increases are not continuous.

Healthcare digitization further contributes incremental lift, though project timelines vary by institution, generating uneven year-to-year growth. Overall, the Growth Rate Volatility Index reflects a stable consumables foundation balanced against cyclical hardware investment. Long-term progression remains positive, yet short-interval fluctuations emerge from procurement deferrals and asynchronous automation initiatives across Japan’s retail, logistics, and industrial environments.

| Metric | Value |

|---|---|

| Japan Barcode Printers and Consumables Sales Value (2025) | USD 240.1 million |

| Japan Barcode Printers and Consumables Forecast Value (2035) | USD 367.6 million |

| Japan Barcode Printers and Consumables Forecast CAGR (2025-2035) | 4.4% |

Demand for barcode printers and consumables in Japan is increasing because retail, logistics and manufacturing sectors depend on accurate product identification and traceability throughout supply chains. Barcode systems support efficient checkout operations in convenience stores and supermarkets, which remain major distribution channels in Japan. E commerce expansion strengthens demand for shipping labels and warehouse identification tags that automate sorting and delivery tracking.

Manufacturers adopt barcode printing to support component-level traceability in automotive, electronics and pharmaceutical production. This allows faster quality checks, recall management and inventory control. Healthcare facilities rely on barcode labels for patient identification, medication tracking and specimen management to enhance safety and reduce administrative errors. Consumables such as thermal labels and ribbons are required for continuous printing in high throughput environments, ensuring stable recurring demand.

Constraints include the rising availability of RFID and digital alternatives for advanced traceability, which may reduce reliance on traditional labeling in some applications. Smaller businesses may delay equipment upgrades due to cost sensitivity or workflow changes needed during integration. Sustainability goals also influence material selection, leading companies to seek recyclable label formats while managing cost and compatibility with existing printers.

Demand for barcode printers and consumables in Japan is driven by digital inventory systems, automated retail checkout, and traceability enforcement in industrial supply chains. Manufacturing hubs, cold-chain logistics, and pharmaceutical distribution rely on high-durability label printing for compliance and accurate product tracking. Expanding e-commerce fulfillment centers and last-mile delivery operations continue to adopt compact and mobile printing solutions. Operational efficiency, cost-per-label optimization, and compatibility with RFID-integrated workflows support sustained adoption across Japanese business sectors.

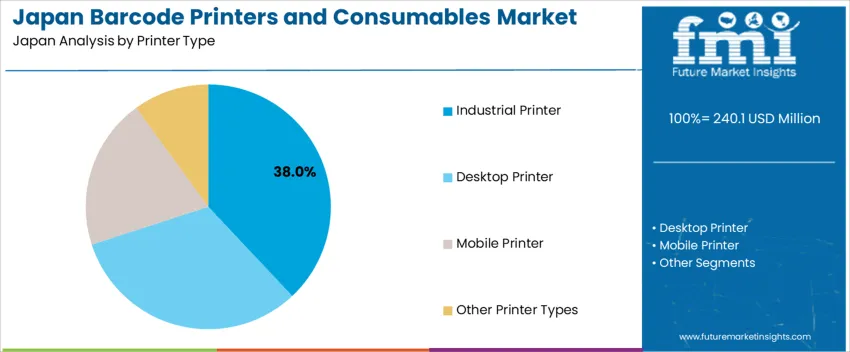

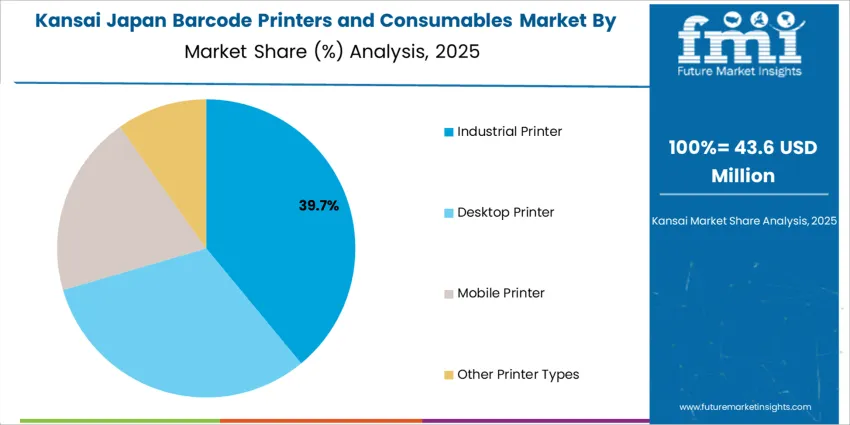

Industrial barcode printers represent 38.0%, driven by heavy-duty labeling requirements in automotive, electronics, and factory automation environments. These models offer rugged construction, high throughput, and long print cycles required for 24/7 operations in Japan’s industrial networks. Desktop printers follow with 32.0%, widely used in retail counters, back-office labeling, and SMEs prioritizing small-footprint devices. Mobile printers account for 20.0%, supporting logistics field teams, warehouse pickers, and healthcare staff requiring on-the-go printing. Other printer types hold 10.0%, including specialty devices for high-resolution or color labeling. Printer selection trends emphasize durability, compact usability, and integration with digital asset-tracking platforms across Japan.

Key Points:

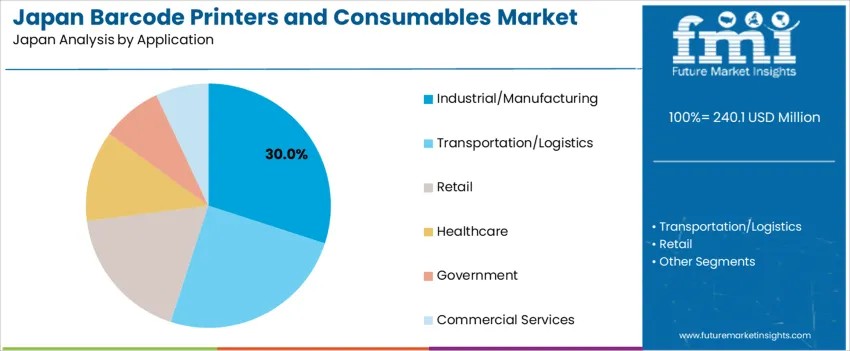

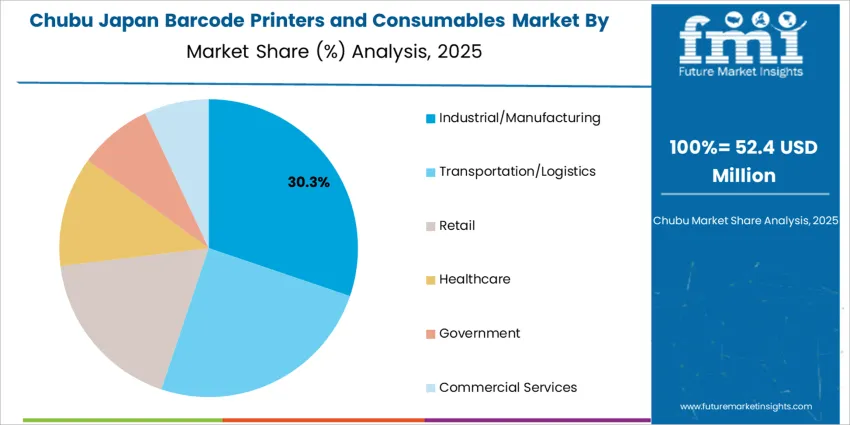

Industrial/manufacturing applications hold 30.0%, driven by traceability needs in automotive, semiconductor packaging, and regulated production lines. Transportation and logistics represent 25.0%, where barcode printing supports parcel identification, route tracking, and warehouse operations. Retail accounts for 18.0%, aligned with point-of-sale scanning and inventory labeling. Healthcare usage stands at 12.0%, enabling patient wristbands, medication labeling, and sterile supply tracking. Government (8.0%) and commercial services (7.0%) support administrative tagging and document management. Growth reflects Japan’s automation strategy requiring error-free workflows, data transparency, and integration with barcode-enabled enterprise software.

Key Points:

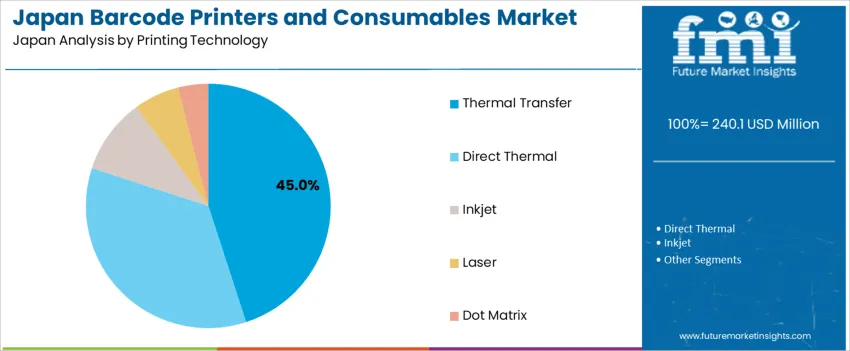

Thermal transfer printing holds 45.0%, preferred for durable, long-lasting barcodes used in manufacturing, cold chain, and outdoor logistics. Direct thermal technology accounts for 35.0%, serving short-lifecycle retail receipts and shipping labels due to lower consumable dependency. Inkjet printers represent 10.0%, used in color coding and branded labels. Laser technology holds 6.0%, applied in high-precision office environments. Dot matrix accounts for 4.0%, retained in legacy industrial setups requiring impact printing. Printing technology choices reflect durability needs, environmental exposure conditions, and total cost of ownership within Japan’s operational labeling systems.

Key Points:

Growth of logistics automation, increased traceability requirements in healthcare and strong reliance on labeling in retail and manufacturing are driving demand.

In Japan, barcode printer usage expands as e-commerce operators in Kanto and Kansai automate parcel handling and require large volumes of shipping labels printed at fulfillment centers. Hospitals and pharmacies adopt barcode systems to enhance medication tracking and reduce dispensing errors in environments with nationwide insurance documentation rules. Supermarkets and convenience stores rely on barcode labels for daily price changes and expiration management across fresh foods. Automotive and electronics manufacturers need durable labels for parts traceability within just-in-time production systems. These industry practices sustain consistent procurement of thermal printers and ribbons that support variable data and high-frequency printing.

High hardware costs for industrial printers, long replacement cycles and sustainability concerns about label materials restrain demand.

Industrial barcode printers involve significant upfront investment, making smaller businesses cautious about automation if manual labeling remains functional. Established printers often operate reliably for many years through maintenance contracts, which slows frequent hardware upgrades. Consumables such as synthetic labels and resin ribbons create plastic waste that conflicts with sustainability goals promoted by major retailers. These economic and environmental factors contribute to selective adoption across lower-volume user groups despite growing automation needs.

Shift toward liner-free label technologies, increased cloud connectivity for distributed printing and rising demand for heat-resistant and chemical-durable consumables define key trends.

Japanese distributors are testing liner-free labels to reduce waste and improve throughput, particularly in convenience-store supply chains. Cloud-linked printers support mobile scanning and print-on-demand workflows in retail shop floors, hospitals and factory lines where space and labor are limited. Heat-resistant and solvent-resistant labels gain importance in automotive and semiconductor sectors where high-temperature processing requires long-term readability. Compact desktop and handheld printers see demand growth among last-mile delivery workers who require real-time printing during pickup and drop-off. These trends indicate steady modernization of barcode printing systems aligned with Japan’s advanced logistics and manufacturing environments.

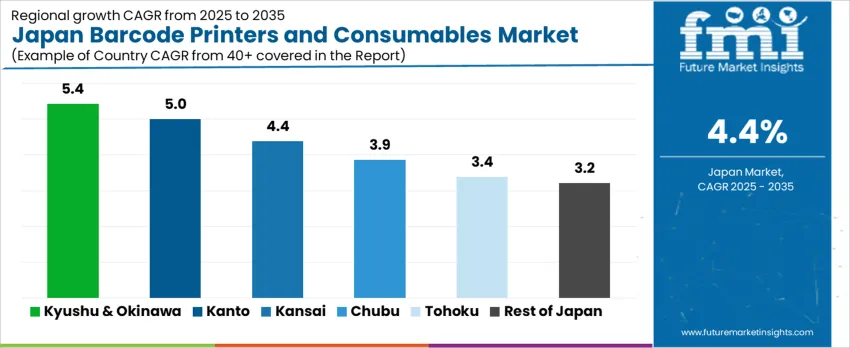

Demand for barcode printers and consumables in Japan is driven by warehousing automation, hospital inventory tracking, and retail checkout efficiency. Many facilities are digitizing traceability systems to support compliance and reduce inventory losses. Growth is strongest in Kyushu & Okinawa (5.4%), followed by Kanto (5.0%), Kansai (4.4%), Chubu (3.9%), Tohoku (3.4%), and the Rest of Japan (3.2%), reflecting differences in logistics activity and digital readiness.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.4% |

| Kanto | 5.0% |

| Kansai | 4.4% |

| Chubu | 3.9% |

| Tohoku | 3.4% |

| Rest of Japan | 3.2% |

Kyushu & Okinawa demonstrates a 5.4% CAGR in barcode label printing and scanning infrastructure as distribution centers support rising e-commerce volumes across Fukuoka and nearby prefectures. Retailers expand point-of-sale printing capacity in large commercial hubs where item-level traceability improves checkout speed and prevents pricing discrepancies. Pharmaceutical laboratories and hospitals increasingly deploy label printers for patient wristbands, medication identification, and sterile-packaged device tracking aligned with national safety requirements.

Manufacturing operations value durable thermal transfer ribbons that withstand chemical exposure and supply-chain handling. Buyers focus on print resolution that ensures scan reliability through the full product lifecycle. Regional logistics operators reinforce demand for label rolls compatible with cold-chain environments and rapid pallet movement. Growth remains linked to digital system adoption, staff familiarity with labeling workflows, and periodic upgrades to maintain alignment with scanning standards across ports, road freight hubs, and healthcare institutions.

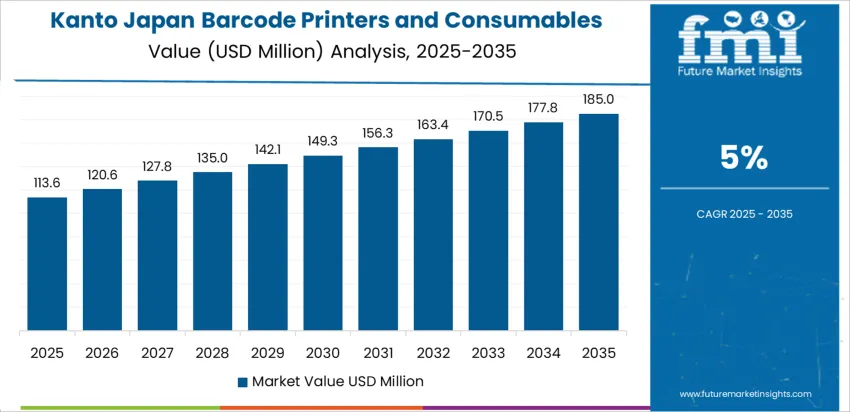

In Kanto, barcode printing demand is rising about 5.0% annually, supported by Tokyo-area logistics consolidation and widespread retail automation. Large distribution centers require high-volume label printing to manage SKU-intensive product categories flowing through metropolitan supply chains. Hospitals in Kanagawa and Saitama integrate barcode technologies into medication administration and lab sample handling to reduce manual transcription and ensure accurate clinical routing. Retail operators adopt compact printers that fit within checkout counters and self-service kiosks installed in dense commercial districts.

Procurement teams prioritize fast-replacement consumables that match installed printer fleets and meet adhesive durability standards across refrigerated and ambient stocking areas. Professional services expand requirements for asset-tagging solutions covering IT hardware and document management. Upgrades focus on connectivity compatibility with scanning systems and enterprise resource planning tools. Kanto’s scale and technical readiness maintain high baseline consumption of labels, ribbons, and thermal printheads.

Kansai’s demand is increasing at around 4.4% CAGR, supported by Osaka and Kobe’s industrial and healthcare networks. Factories track production batches using thermal printing to maintain identification accuracy for automotive, electronics, and machinery components moving through multi-stage assembly operations. Retailers adopt updated point-of-sale printing to manage varied product assortments in consumer goods outlets. Hospital facilities appreciate labels that maintain legibility under frequent disinfection and moisture exposure. Procurement departments evaluate print quality consistency, ribbon lifespan, and error-free scan rates during inbound inspection.

Regulations around product recall traceability encourage investment in reliable barcode application across shipment documentation and storage areas. Compact mobile printers assist warehouse workers in restocking and order-picking tasks, reducing travel time. Kansai’s growth reflects a push toward standardized identification tools that ensure accuracy and workflow continuity within mixed industrial and service environments, helping maintain productivity across regional supply chains.

Chubu maintains a 3.9% annual growth trend, influenced by Nagoya-area logistics servicing automotive and equipment suppliers. Manufacturing plants require barcode labels for parts tracking and inventory audits that support lean production scheduling. Labels must withstand vibration, oils, and handling pressure in distribution channels linked to heavy industrial output. Retailers in Aichi rely on consistent label supplies for pricing accuracy across supermarket formats, supporting fast shelf revisions for promotional cycles.

Hospitals integrate barcode systems for patient records and equipment tagging, guiding maintenance and sterilization workflows. Procurement groups evaluate supply continuity, adhesive performance, and print readability throughout the full product path from receipt to consumption. Chubu’s broad industrial base generates steady demand, with periodic upgrades as connectivity protocols evolve in enterprise planning systems. The region benefits from its central logistics position, improving print-and-apply equipment utilization in outbound shipping operations.

Barcode label adoption in Tohoku grows at approximately 3.4% CAGR, driven by continued hospital modernization, agricultural supply tracking, and expansion in regional retail chains. Healthcare systems utilize barcoded labels for patient identification and specimen transport across networks serving dispersed communities. Food processors install label printers that handle cold storage conditions and conform with packaging traceability standards. Retail outlets incorporate barcode upgrades in inventory control to limit manual counts and reduce stockouts.

Procurement decisions prioritise print durability given longer transportation distances and variations in temperature across rural delivery routes. Staff training programs reinforce correct printing and scanning procedures to sustain reliability during peak operational periods. While volumes remain lower than major metropolitan regions, rising adoption rates reflect structured digital improvement strategies focusing on accuracy and continuity of goods movement within Tohoku’s mixed economy.

Across the remaining prefectures, demand continues to rise at about 3.2% per year, reflecting standardization of barcode labeling across small and medium-sized enterprises. Clinics and municipalities rely on printers for inbound item logging and internal asset management. Local retail operators use barcode systems to speed checkout and support price compliance across frequent SKU shifts. Small warehouses adopt economical print-and-apply units that support basic tracking requirements without complex IT integrations.

Consumable selection emphasizes reliable scanning rather than advanced material features, but adhesive strength must tolerate varied store and storage conditions. Procurement groups value long-term fleet consistency to reduce training time and spare-part complexity. Growth remains steady as digital record-keeping evolves in supply networks operating outside major industrial corridors, supporting foundational barcode capabilities where modernization progresses methodically.

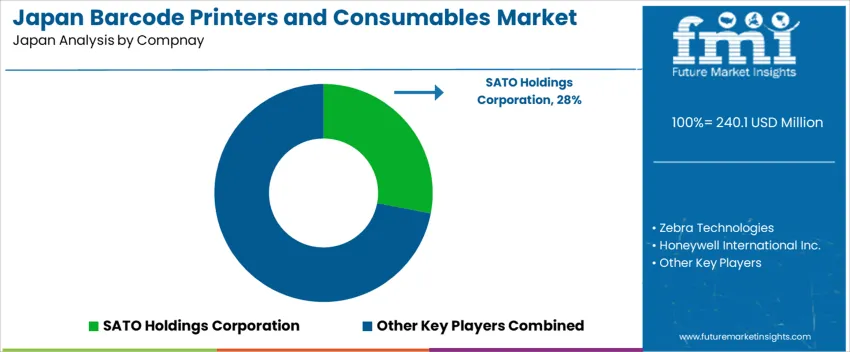

Demand for barcode printers and consumables in Japan is supported by sectors requiring label accuracy, print permanence, and reliable device uptime, including retail, logistics, manufacturing, and healthcare. SATO Holdings Corporation holds an estimated 28.0% share, aligned with established relationships in Japanese supply chains and strong servicing capability across distribution centres and industrial facilities. Its printers offer stable thermal-printing performance and integration alignment with warehouse automation systems.

Zebra Technologies maintains participation through rugged mobile printers and industrial models positioned for large retail networks and advanced logistics workflows requiring durable label materials. Honeywell International Inc. supports demand where scan-print functionality and long-cycle durability are required in field-service and transportation settings. TSC Auto ID Technology Co., Ltd. contributes presence in light-industrial and SME usage, offering cost-reliable printers with acceptable label throughput. Brother Industries, Ltd. supplies compact and desktop formats for retail counters and administrative environments where footprint efficiency and simple consumable replacement are priorities.

Competition focuses on print-head reliability, consumable compatibility, service accessibility, network connectivity, and lifecycle cost. Demand continues as Japanese users expand adoption of track-and-trace solutions supporting accuracy, efficiency, and compliance across domestic logistics and inventory-management systems.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Printer Type | Industrial Printer, Desktop Printer, Mobile Printer, Other Printer Types |

| Application | Industrial/Manufacturing, Transportation/Logistics, Retail, Healthcare, Government, Commercial Services |

| Printing Technology | Thermal Transfer, Direct Thermal, Inkjet, Laser, Dot Matrix |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | SATO Holdings Corporation, Zebra Technologies, Honeywell International Inc., TSC Auto ID Technology Co., Ltd., Brother Industries, Ltd. |

| Additional Attributes | Dollar sales by printer category, printing technology type, and application segments; consumables demand including ribbons, labels, and cartridges; adoption driven by logistics automation, inventory tracking, and healthcare traceability; retail digitalization and mobility solutions expansion; compliance with Japan-specific labeling regulations and cold-chain labeling; reliability, print durability, and integration with warehouse management, RFID, and smart factory systems. |

The demand for barcode printers and consumables in Japan is estimated to be valued at USD 240.1 million in 2025.

The market size for the barcode printers and consumables in Japan is projected to reach USD 367.6 million by 2035.

The demand for barcode printers and consumables in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in barcode printers and consumables in Japan are industrial printer, desktop printer, mobile printer and other printer types.

In terms of application, industrial/manufacturing segment is expected to command 30.0% share in the barcode printers and consumables in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Demand for Barcode Printers and Consumables in USA Size and Share Forecast Outlook 2025 to 2035

Japan Barcode Printer Market Growth – Innovations, Trends & Forecast 2025-2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Demand for Welding Consumables in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA