The demand for barcode printers and consumables in the USA is expected to grow from USD 1.8 billion in 2025 to USD 3.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.5%. Barcode printers and consumables, including labels, ribbons, and tags, are essential for inventory management, supply chain operations, and retail tracking. The continued adoption of barcode scanning and labeling systems across industries such as retail, logistics, healthcare, and manufacturing will drive the steady demand for these products. The market’s growth is also supported by increasing automation, the expansion of e-commerce, and the rising need for efficient tracking and data management.

The market will see steady growth over the forecast period, starting at USD 1.8 billion in 2025 and increasing to USD 1.9 billion in 2026, USD 2.0 billion in 2027, and USD 2.1 billion in 2028. By 2029, the market will reach USD 2.2 billion, with continued growth expected through the 2030s. By 2035, the demand for barcode printers and consumables is expected to reach USD 3.1 billion, driven by the growing need for real-time tracking, inventory control, and data management in various industries.

The 10-year growth comparison for barcode printers and consumables shows a steady, predictable upward trend, with the market expected to grow from USD 1.8 billion in 2025 to USD 3.1 billion by 2035. Over the first five years (2025-2029), the market will experience incremental increases in demand, with a steady rise of approximately USD 0.2 billion each year. The growth rate will remain stable as businesses continue to invest in barcode technology for operational efficiency.

In the second half of the forecast period (2029-2035), growth is expected to continue at a similar pace, although the rate of increase may slightly accelerate as automation and data management solutions become more integral across industries. By 2035, the total increase in market value will amount to USD 1.3 billion, reflecting strong and consistent demand for barcode printers and consumables across various sectors. The comparison highlights a smooth, continuous expansion, with no major disruptions or fluctuations expected in the market.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.8 billion |

| Industry Forecast Value (2035) | USD 3.1 billion |

| Industry Forecast CAGR (2025 to 2035) | 5.5% |

Demand for barcode printers and related consumables in the USA is rising as industries across retail, logistics, manufacturing, healthcare and e commerce increasingly rely on automated identification and data capture (AIDC) systems. The surge in online shopping and rapid growth of e commerce have led to expanded distribution, warehousing and fulfilment operations. Companies need efficient ways to print shipping labels, inventory tags, and product barcodes at scale, which drives investment in both barcode printers and consumables such as labels and ribbons. In manufacturing and warehousing, barcode printing supports inventory tracking, asset management, and product traceability — functions that become more important as supply chains grow more complex. As logistics and supply chain operations scale, demand for high volume, reliable barcode printing systems grows in parallel.

At the same time technological advances and evolving regulatory or business process requirements support further uptake. Improvements in printing technology, such as thermal transfer and direct thermal printers, produce labels durable enough for harsh warehouse conditions, cold storage, or long term tracking. Mobile and wireless barcode printers offer flexibility for on the go labelling in warehouses or during delivery, supporting modern logistics models. Barcode printing is also widely adopted in sectors requiring traceability and compliance — for example in healthcare, pharmaceuticals, and food & beverage — where accurate labeling and serialization are critical for safety and regulatory adherence. As companies continue to automate operations, improve traceability and enhance supply chain efficiency, demand for barcode printers and consumables in the USA is likely to grow steadily in coming years.

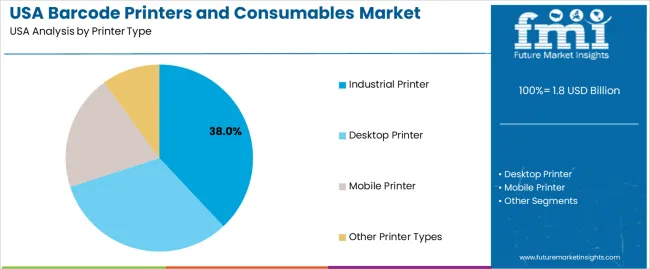

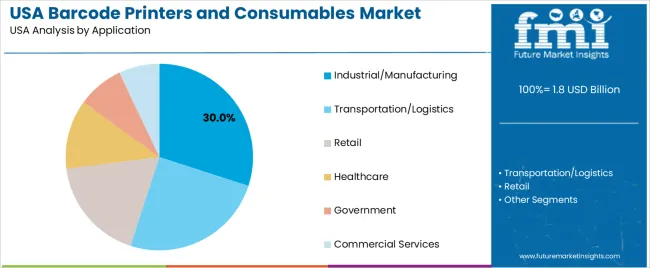

The demand for barcode printers and consumables in the USA is primarily driven by printer type and application. The leading printer type is industrial printer, which accounts for 38% of the market share, while industrial/manufacturing applications dominate, capturing 30% of the demand. Barcode printers are essential for businesses across various industries to generate and print barcode labels for inventory tracking, shipping, and product identification. The growing need for efficient tracking solutions and improved operational efficiency continues to drive the demand for barcode printers and consumables in the USA.

Industrial printers lead the demand for barcode printers in the USA, holding 38% of the market share. Industrial printers are specifically designed for high-volume, high-speed printing in demanding environments such as warehouses, manufacturing facilities, and distribution centers. These printers offer high durability, fast printing speeds, and the ability to print large quantities of barcode labels, making them ideal for industrial and manufacturing applications. Industrial printers are built to handle the rugged conditions of factories and warehouses, offering long-term reliability and consistency in printing.

The demand for industrial barcode printers is driven by the increasing need for efficient labeling and tracking systems in industries that rely on large-scale production and logistics. As businesses continue to focus on inventory management, asset tracking, and shipment accuracy, industrial barcode printers are crucial for maintaining operational efficiency and minimizing errors. With the growing demand for automation and process optimization in manufacturing and logistics sectors, industrial printers are expected to remain the dominant choice in the barcode printing market in the USA.

Industrial/manufacturing applications lead the demand for barcode printers in the USA, capturing 30% of the market share. In the industrial and manufacturing sectors, barcode printers are used for labeling products, packaging, and inventory items to ensure seamless operations across production lines and supply chains. These applications require high-performance, high-volume printing solutions that can handle demanding environments where quick turnaround times and accuracy are critical.

The demand for barcode printers in industrial and manufacturing applications is driven by the need for efficient inventory management, real-time tracking, and improved workflow automation. Barcode labels are vital for tracking products from production to shipping, and the growing focus on operational efficiency has made barcode printers an essential tool in these sectors. As industries continue to embrace automation and data-driven decision-making, the need for reliable barcode printing solutions in manufacturing and industrial environments will continue to grow in the USA.

Demand for barcode printers and consumables in the USA is growing as businesses across industries, including retail, logistics, and healthcare, increase their use of barcode labeling for inventory tracking and shipping. As e-commerce continues to rise, the need for efficient labeling systems becomes more critical. Barcode printers offer accuracy and speed, improving operational efficiency. The rise of automation and digital management systems further fuels demand for these products, as businesses seek reliable solutions for labeling and tracking across supply chains.

What are the Drivers of Demand for Barcode Printers and Consumables in the USA?

The demand for barcode printers and consumables is driven by the growth of e-commerce, as the need for accurate shipping and tracking increases. Retailers and logistics companies rely on barcode printers to label products and manage inventory efficiently. The expansion of automated warehouse and manufacturing systems also drives adoption, as barcode systems are integral to inventory management and product tracking. Additionally, the need for regulatory compliance and product traceability in industries such as pharmaceuticals and food safety encourages the use of barcode printers. The increasing shift toward digital and automated supply chain management also supports growth.

What are the Restraints on Demand for Barcode Printers and Consumables in the USA?

Despite growth, several factors can limit the adoption of barcode printers and consumables. One restraint is the high initial investment required for industrial printers, which may be prohibitive for smaller businesses. Additionally, the ongoing cost of consumables, such as labels and ribbons, can be expensive, especially for high-volume users. The availability of alternative identification technologies, like RFID, could also limit the use of barcode printing in certain industries. Finally, operational challenges such as the need for regular maintenance and potential compatibility issues with existing systems may deter some companies from adopting new barcode solutions.

What are the Key Trends Influencing Demand for Barcode Printers and Consumables in the USA?

Key trends influencing demand include the increasing adoption of mobile and wireless barcode printers for greater flexibility in logistics and warehouse operations. The rise of thermal printing technologies is another trend, offering more durable and cost-effective solutions for labeling. Additionally, the integration of barcode systems with cloud-based software allows businesses to manage inventories and shipments in real-time. Another growing trend is the demand for eco-friendly and sustainable consumables, as businesses seek to reduce their environmental impact while maintaining efficiency and compliance with industry standards.

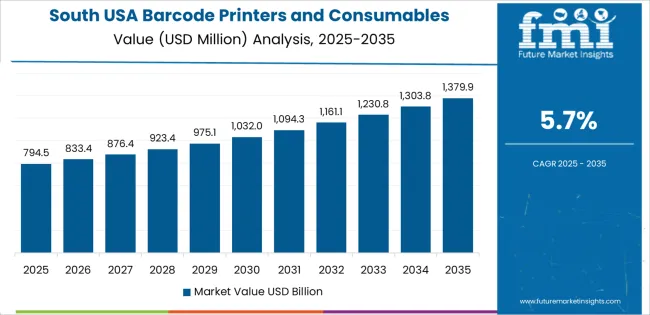

The demand for barcode printers and related consumables in the USA shows consistent growth across all major regions. The highest growth is expected in the West USA at a CAGR of 6.3%. The South USA follows with a CAGR of 5.7%, reflecting strong industrial and logistics demand. The Northeast USA shows a CAGR of 5.1%, driven by manufacturing and retail sectors. The Midwest USA is projected to grow at 4.4%, supported by warehouse automation and supply chain upgrades. These regional differences reflect variations in industrial activity, distribution infrastructure, e commerce penetration, and demand for reliable labeling and tracking solutions across sectors such as retail, logistics, manufacturing, and healthcare.

| Region | CAGR (%) |

|---|---|

| West USA | 6.3 |

| South USA | 5.7 |

| Northeast USA | 5.1 |

| Midwest USA | 4.4 |

In the West USA, the demand for barcode printers and consumables is expected to grow at a CAGR of 6.3%. The region’s strong logistics corridors, ports, warehousing, and distribution centers contribute significantly to demand for labeling and tracking tools. Companies handling large freight volumes, imports and exports, and distribution across the Pacific adjacent supply chain rely on barcode printing to maintain inventory accuracy and regulatory compliance.

In addition, the rise of e commerce and direct to consumer distribution centres in states such as California has increased the need for efficient packaging, shipping, and return labeling systems. The agricultural sector in some Western states also uses barcode enabled packaging and supply chain traceability for perishable produce. As automation continues to spread in warehousing and retail, and as companies seek to reduce human error and improve tracking, adoption of barcode printers and consumables remains strong. The combination of dense industrial activity and a robust logistics framework supports a high growth rate for barcode printing solutions in this region.

In the South USA, projected growth for barcode printers and consumables stands at a CAGR of 5.7%. This region benefits from a growing number of distribution hubs, manufacturing plants, and logistics operations. States in the South host a mix of light manufacturing, food processing, and large scale warehousing that require reliable labeling systems for compliance, shipping, and traceability. The expansion of retail chains and big box distribution networks across southern states also drives demand for barcode printers for inventory management, price tagging, and supply chain operations.

Additionally, the South has seen growth in e commerce fulfillment centres, where efficiency and accuracy in packaging and dispatch are critical. The relatively lower labour costs in the region encourage investments in automation tools to increase throughput and reduce errors. As companies increasingly adopt just in time delivery systems and tighter inventory control, the demand for barcode printing solutions and consumables remains steady and substantial in the South.

In the Northeast USA, the demand for barcode printers and consumables is expected to grow at a CAGR of 5.1%. This region hosts dense networks of retail outlets, manufacturing facilities, pharmaceutical companies, and healthcare providers - all of which depend on accurate inventory management, labeling, and tracking systems. In warehouses and distribution centres near urban hubs, barcode systems streamline order fulfilment, returns processing, and compliance with traceability regulations.

The food and beverage industry in the Northeast also uses barcode labeling for packaging, batch tracking, and expiry date management. Moreover, the strong presence of pharmaceutical and biotech firms requires reliable labeling for drugs, medical devices, and diagnostic kits, which increases demand for high quality printers and consumables. Retailers and wholesalers in urban areas further drive adoption of barcode systems to support point of sale tagging, stock management, and supply chain efficiency. Overall, the combination of commercial, industrial, and regulatory requirements sustains robust demand for barcode printing solutions in the Northeast.

In the Midwest USA, the demand for barcode printers and consumables is projected to grow at a CAGR of 4.4%. This region continues to support manufacturing, automotive parts supply, agriculture processing, and warehousing operations that require labeling and traceability systems. Factories producing goods at scale often employ barcode printers for parts identification, packaging, and quality control. Agricultural processing and distribution centres rely on barcode labeling for tracking produce, seeds, and farm inputs.

Midwestern warehouses and logistics providers manage long distance shipments across the country, making barcode printing necessary for shipping, inventory management, and returns handling. Although growth is more modest compared to coastal regions, gradual modernization of facilities, increased automation, and rising digital adoption in supply chain operations contribute to demand. As companies retrofit older systems and implement better inventory tracking, barcode printers and consumables remain relevant and see steady adoption across the Midwest.

The barcode printers and consumables market in the USA is primarily driven by the needs of sectors such as logistics, retail, healthcare, warehousing, and manufacturing. Zebra Technologies leads with approximately 28.2% of the market share, with other key players including Honeywell International Inc., SATO Holdings Corporation, TSC Auto ID Technology Co., Ltd., and Brother Industries, Ltd. These companies provide a range of barcode printers, including industrial, desktop, and mobile models, as well as consumables like labels, ribbons, and thermal papers. Applications span from e commerce shipping labels and retail price tags to inventory tracking in warehouses, patient record labels in healthcare, and product identification in manufacturing.

Competition in this market is shaped by differences in technology features, reliability, and total cost of ownership. Some suppliers focus on rugged industrial printers designed for high volume production, while others emphasize mobility, compact design, and ease of integration for smaller settings such as retail or healthcare. Consumable offerings, including durable labels and thermal transfer ribbons, also play a critical role, with companies differentiating based on print clarity, adhesion quality, and resistance to environmental factors. As demand for automation and traceability increases, firms continually adapt their product portfolios to meet the evolving needs of industries requiring precise labeling and efficient inventory management.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Printer Type | Industrial Printer, Desktop Printer, Mobile Printer, Other Printer Types |

| Application | Industrial/Manufacturing, Transportation/Logistics, Retail, Healthcare, Government, Commercial Services |

| Printing Technology | Thermal Transfer, Direct Thermal, Inkjet, Laser, Dot Matrix |

| Key Companies Profiled | Zebra Technologies, Honeywell International Inc., SATO Holdings Corporation, TSC Auto ID Technology Co., Ltd., Brother Industries, Ltd. |

| Additional Attributes | Dollar sales by printer type, application, and printing technology highlight strong demand for barcode printers across sectors such as industrial, logistics, and retail. Industrial printers dominate, with thermal transfer and direct thermal technologies leading the market. Key players like Zebra Technologies and Honeywell provide robust solutions for businesses requiring high-volume, durable printing. The market continues to expand, driven by increased demand for inventory management, shipping logistics, and asset tracking across various industries. |

The demand for barcode printers and consumables in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the barcode printers and consumables in USA is projected to reach USD 3.1 billion by 2035.

The demand for barcode printers and consumables in USA is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in barcode printers and consumables in USA are industrial printer, desktop printer, mobile printer and other printer types.

In terms of application, industrial/manufacturing segment is expected to command 30.0% share in the barcode printers and consumables in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Demand for Welding Consumables in USA Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA