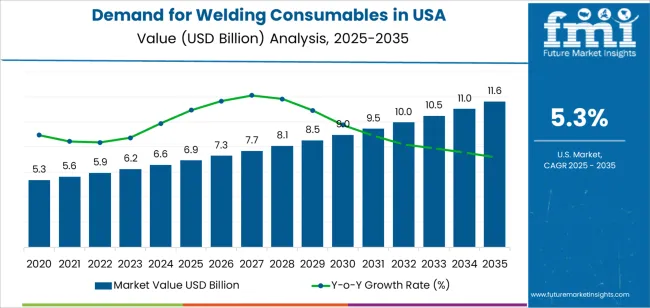

The demand for welding consumables in the USA is valued at USD 6.9 billion in 2025 and is projected to reach USD 11.6 billion by 2035, reflecting a CAGR of 5.3%. Early growth is driven by the expansion of key industries that rely heavily on welding, such as automotive manufacturing, construction, infrastructure development, and oil and gas. Increased demand for high-performance, durable materials and the rise in automation and robotic welding applications further contribute to market growth. As new technologies in welding processes emerge, the need for more specialized and efficient consumables, such as filler metals, fluxes, and welding wires, continues to rise.

As the market progresses toward 2035, demand remains steady, supported by ongoing investments in infrastructure and industrial projects, as well as an increasing focus on repair and maintenance services in various sectors. The later years of the forecast period may see moderate growth, driven by improvements in consumable performance, such as higher quality and longer-lasting products. Innovations in welding techniques and materials, alongside a growing trend toward sustainability and energy-efficient production, will continue to support long-term demand for welding consumables in the USA.

What is the Growth Forecast for Demand for Welding Consumables in USA through 2035?

Demand in USA for welding consumables is projected to increase from USD 6.9 billion in 2025 to USD 11.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.3%. Starting from USD 5.3 billion in 2020, demand is expected to rise steadily year-on-year, reaching USD 6.9 billion in 2025 and continuing through USD 7.3 billion in 2026 up to USD 11.6 billion in 2035. Growth will be driven by infrastructure investment, expansion in manufacturing and automotive sectors, and increasing use of advanced welding technologies.

In addition to volume growth, product mix evolution and technological enhancements are contributing meaningfully to value. As fabrication moves toward higher-specification materials such as high-strength steels and specialty alloys the welding consumables used (electrodes, wires, fluxes) will command higher prices and complexity. The shift toward automated and robotic welding systems further raises requirements for quality and performance of consumables, which increases per-unit spend.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 6.9 billion |

| Forecast Value (2035) | USD 11.6 billion |

| Forecast CAGR (2025–2035) | 5.3% |

Demand for welding consumables in the USA is rising as manufacturing, construction, and repair sectors expand in response to infrastructure investments and reshoring initiatives. Consumables such as welding electrodes, wires, fluxes, and filler rods are essential for joining metals in heavy fabrication, shipbuilding, automotive, and pipeline applications. Fabricators require consistent quality and compatibility with modern welding processes (MIG, TIG, FCAW) to maintain productivity and comply with industry standards. Manufacturers focus on improved alloy chemistry, enhanced flux coatings, and advanced packaging to support mechanized and automated welding setups.

Growth is also supported by heightened demand for infrastructure projects, including bridges, rail systems, and energy facilities, which require high-integrity welds and corresponding consumables certified under ASME and AWS standards. Additionally, the repair and maintenance of industrial equipment and heavy machinery in the oil & gas, mining, and aerospace sectors drives stable aftermarket demand. Although raw-material cost fluctuations and labor skills gaps pose challenges, strong project pipelines and ongoing capital investment in fabrication infrastructure sustain robust demand for welding consumables across the USA.

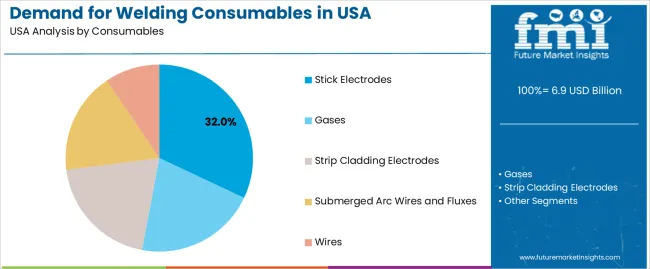

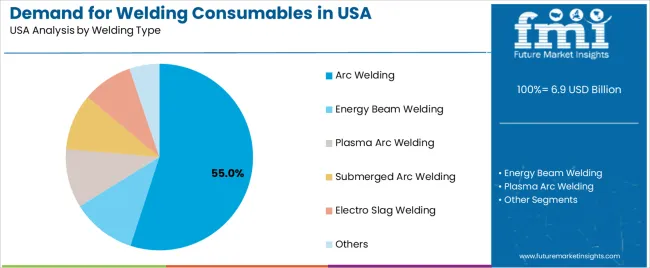

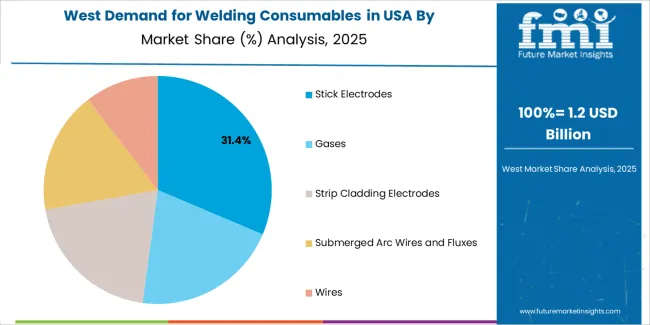

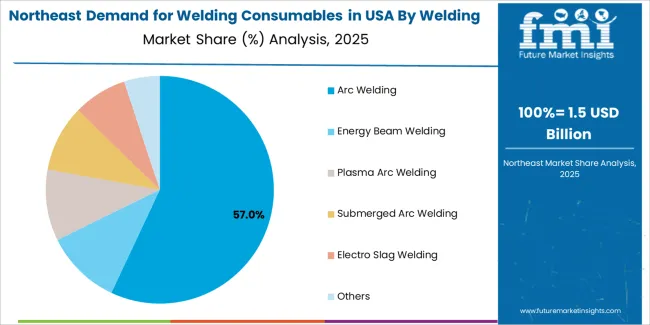

The demand for welding consumables in the USA is segmented by consumables and welding type. By consumables, the demand is divided into stick electrodes, gases, strip cladding electrodes, submerged arc wires and fluxes, wires, and others. Based on welding type, it is categorized into arc welding, energy beam welding, plasma arc welding, submerged arc welding, electro slag welding, and others. These segments reflect varying application needs, technological advancements, and specific requirements across industries that rely on welding processes.

The stick electrodes segment accounts for approximately 32% of the total demand for welding consumables in the USA in 2025, making it the leading consumable category. This position is driven by the versatility and widespread use of stick electrodes in a variety of welding applications, particularly for general purpose and heavy-duty welding in construction, manufacturing, and repair industries. Stick electrodes are favored for their simplicity, cost-effectiveness, and ability to perform in various environments, including outdoor and less controlled settings.

The demand for stick electrodes remains strong due to their compatibility with arc welding, a widely used welding technique. Additionally, stick electrodes are suitable for welding on a range of metals and alloys, which increases their appeal in industries such as construction, automotive repair, and maintenance. The segment maintains its lead due to the broad adoption of arc welding processes that continue to drive the need for stick electrodes across diverse industrial applications.

The arc welding segment represents about 55.0% of the total demand for welding consumables in the USA in 2025, making it the dominant welding type category. This position is supported by the widespread use of arc welding techniques across various industries, including automotive, construction, and shipbuilding. Arc welding is preferred for its flexibility, efficiency, and ability to produce strong, reliable welds across a wide range of metals and thicknesses.

Adoption is particularly high in the manufacturing, infrastructure, and metal fabrication sectors, where welding is critical for producing large components and structures. Arc welding’s ability to operate in diverse environmental conditions, including outdoor and heavy-duty applications, further strengthens its dominance. The segment maintains its leading share because arc welding is a fundamental process used in countless industrial applications, driving consistent demand for consumables like stick electrodes, wires, and fluxes that are essential for the welding process.

The demand for welding consumables in USA is influenced by the health of fabrication, construction and manufacturing sectors that rely on electrodes, wires, fluxes and filler metals. Demand rises as industrial investment and infrastructure upgrades drive welding activity for pipelines, heavy equipment, shipbuilding and steel construction. The expansion of repair and maintenance work also supports continuous consumption of consumables. However, factors such as volatile raw material prices, import competition and automation of welding processes moderate demand growth. Suppliers are responding with improved alloy compatible products, lower fume fluxes and wire types that support robotic welding systems to meet evolving customer needs.

Demand increases as U.S. construction and infrastructure programmes expand and manufacturing plants refurbish existing assets. Projects in oil & gas, utilities, bridges and structural steel require significant welding output, which in turn boosts electrode, wire and flux consumption. Furthermore, the maintenance and overhaul of industrial equipment generate continuous demand for consumables even when new build cycles slow. These factors contribute to sustained consumption of welding materials across sectors.

Several factors limit stronger expansion. Raw material price fluctuations especially for nickel, chromium and copper raise cost of consumables and make buyers more cautious. Automation and robotic welding reduce human weld labor and may shift demand patterns toward fewer but higher quality consumables suited for mechanised systems. Foreign competition imports offering lower cost alternatives also moderate domestic demand. In mature sectors, slowdowns or delays in major capital projects can suppress consumption spikes and shorten demand cycles.

Key trends include rising use of consumables designed for automated and robotic welding systems such as spool wires and flux cored wire compatible with mechanised setups and development of low fume, eco efficient fluxes that meet stricter workplace air and sustainability standards. Specialty consumables targeting high strength, corrosion resistant steels (e.g., for offshore or defence applications) are gaining premium share. Suppliers are also offering bundled solutions (filler material + monitoring + service) and digital tracking systems to optimise consumables USAge and reduce waste.

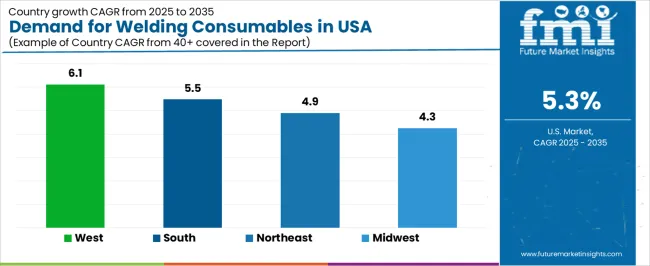

| Region | CAGR (%) |

|---|---|

| West | 6.1% |

| South | 5.5% |

| Northeast | 4.9% |

| Midwest | 4.3% |

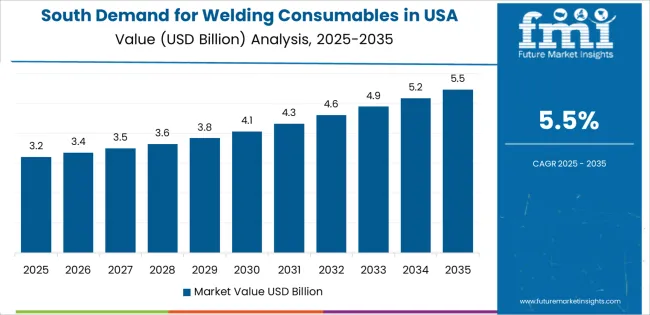

The demand for welding consumables in the USA is growing across regions, with the West leading at a 6.1% CAGR, driven by booming industries like construction, automotive, and renewable energy, alongside expanding infrastructure projects. The South follows at 5.5%, supported by strong manufacturing and industrial sectors, including a rise in shipbuilding and aerospace industries. The Northeast records 4.9%, reflecting consistent demand from advanced manufacturing, automotive repair, and infrastructure upgrades. The Midwest grows at 4.3%, with demand driven by the region's strong industrial base, particularly in heavy machinery, automotive manufacturing, and construction sectors, all requiring robust welding consumables for fabrication and repairs.

The West region of the USA is projected to grow at a CAGR of 6.1% through 2035 in demand for welding consumables. The region’s robust manufacturing sector, including aerospace, automotive, and construction industries, drives the need for high-quality welding materials. California, with its significant automotive and tech industries, plays a key role in this growth. Additionally, the push for renewable energy solutions, such as wind and solar power, further stimulates demand for welding consumables in the energy sector. These trends contribute to the increased adoption of advanced welding techniques and materials in the region.

The South region of the USA is projected to grow at a CAGR of 5.5% through 2035 in demand for welding consumables. The region’s expanding automotive, oil and gas, and manufacturing industries contribute significantly to the demand for welding materials. States like Texas, known for its oil industry, and Tennessee, a hub for automotive manufacturing, continue to fuel the need for high-quality consumables. Additionally, the region’s infrastructure development and construction projects further increase the requirement for welding materials. The growth of energy and manufacturing sectors in the South drives continued demand for consumables.

The Northeast region of the USA is projected to grow at a CAGR of 4.9% through 2035 in demand for welding consumables. The region’s strong industrial base, including manufacturing, shipbuilding, and infrastructure projects, contributes to the steady demand for welding materials. New York, Pennsylvania, and Massachusetts continue to see growth in industries that require welding consumables, such as automotive and construction. The region’s focus on infrastructure repair, industrial renovation, and advanced manufacturing processes further supports the adoption of welding technologies and consumables for a variety of applications.

The Midwest region of the USA is projected to grow at a CAGR of 4.3% through 2035 in demand for welding consumables. With its strong presence in manufacturing, agriculture, and automotive industries, the Midwest sees steady demand for welding materials. States like Michigan, Ohio, and Indiana are central to automotive and industrial manufacturing, contributing to the growing need for welding consumables. Additionally, the region’s expanding infrastructure projects, including highways and bridges, further stimulate demand for welding materials. As the manufacturing sector continues to advance, the demand for consumables is expected to rise.

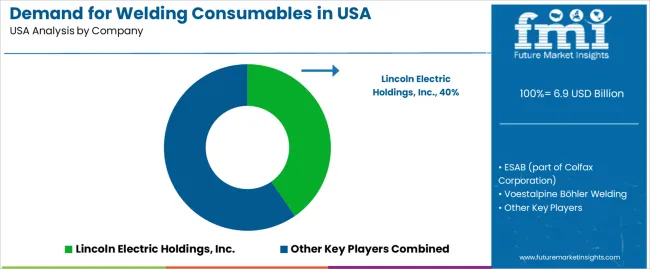

The demand for welding consumables in the USA is growing due to the expanding manufacturing, automotive, and construction industries, as well as increasing infrastructure development. Lincoln Electric Holdings, Inc. leads the market with its wide range of high-quality welding consumables, including electrodes, filler metals, and wires, serving both industrial and commercial applications. ESAB (part of Colfax Corporation) follows closely, offering advanced consumable solutions that focus on performance and reliability for heavy-duty welding and fabrication industries. Voestalpine Böhler Welding strengthens its market presence with innovative welding materials and consumables designed for demanding applications, including energy, automotive, and aerospace sectors. ITW Welding (Illinois Tool Works Inc.) contributes with a broad portfolio of consumables aimed at improving welding productivity and quality across various industries. Kobe Steel, Ltd. further expands the competitive landscape by providing high-performance welding rods, wires, and electrodes that cater to heavy industry and construction applications.

Key factors driving the growth of the welding consumables market in the USA include rising demand for advanced welding techniques, increased manufacturing activity, and the need for efficient, high-quality welding materials in critical applications. As industries such as automotive, aerospace, and construction grow, the need for strong, durable, and cost-effective welding solutions continues to rise. Competition in this market is shaped by product innovation, material quality, and the ability to provide consumables that enhance the efficiency and durability of welded joints. Companies that offer reliable, high-performance consumables with a focus on sustainability and efficiency are well-positioned to lead the market in the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Types | Stick Electrodes, Gases, Strip Cladding Electrodes, Submerged Arc Wires and Fluxes, Wires, Others |

| Welding Types | Arc Welding, Energy Beam Welding, Plasma Arc Welding, Submerged Arc Welding, Electro Slag Welding |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Lincoln Electric Holdings, Inc., ESAB (part of Colfax Corporation), Voestalpine Böhler Welding, ITW Welding (Illinois Tool Works Inc.), Kobe Steel, Ltd. |

| Additional Attributes | Dollar sales by product type, welding type demand, regional growth trends, technological innovations, infrastructure development, and sustainability initiatives in welding materials. |

The global demand for welding consumables in USA is estimated to be valued at USD 6.9 billion in 2025.

The market size for the demand for welding consumables in USA is projected to reach USD 11.6 billion by 2035.

The demand for welding consumables in USA is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for welding consumables in USA are stick electrodes, gases, strip cladding electrodes, submerged arc wires and fluxes and wires.

In terms of welding type, arc welding segment to command 55.0% share in the demand for welding consumables in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA