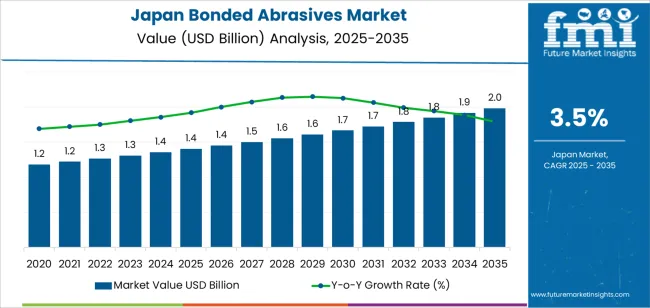

The demand for bonded abrasives in Japan is expected to grow from USD 1.4 billion in 2025 to USD 1.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.5%. Bonded abrasives are integral to various industries, including automotive manufacturing, metalworking, electronics, construction, and machinery, where they are used for grinding, cutting, polishing, and finishing applications. As Japan’s industrial landscape continues to evolve with advancements in technology and manufacturing processes, the demand for bonded abrasives is expected to increase steadily, driven by both traditional sectors and emerging industries.

In the automotive sector, bonded abrasives are widely used in the production of engine components, transmission parts, and bodywork. As the automotive industry increasingly focuses on precision manufacturing and enhanced performance standards, the demand for high-performance abrasives will rise. With Japan’s continued emphasis on advanced manufacturing technologies, bonded abrasives will play a key role in achieving improved material efficiency and quality in production. Similarly, in the electronics sector, the demand for bonded abrasives will be driven by the growing need for precision grinding and polishing in semiconductor manufacturing, electronics assembly, and precision machining.

Between 2025 and 2030, the demand for bonded abrasives in Japan is expected to grow from USD 1.4 billion to USD 1.5 billion. This phase will see steady growth, supported by consistent demand from traditional industries like automotive, construction, and manufacturing. During this period, the industry will experience relatively stable expansion as industries continue to rely on bonded abrasives for their established applications. The inflection point in this phase will likely be driven by technological advancements in abrasives, which will allow for more efficient grinding, polishing, and finishing. As industries seek to improve productivity and manufacturing precision, bonded abrasives will see a gradual increase in adoption, particularly in high-precision applications.

From 2030 to 2035, the demand for bonded abrasives is projected to rise sharply, reaching USD 1.9 billion by 2035. This acceleration will be driven by the continued adoption of advanced manufacturing technologies and the increased demand for high-precision abrasives across industries such as automotive, electronics, and machinery. The inflection point in this period will occur as these industries push for even higher performance and quality standards, particularly in the production of smaller, more complex components. The greater use of robotics and automation in manufacturing processes will also enhance the need for bonded abrasives in precision applications, driving the sharp increase in demand.

| Metric | Value |

|---|---|

| Demand for Bonded Abrasives in Japan Value (2025) | USD 1.4 billion |

| Demand for Bonded Abrasives in Japan Forecast Value (2035) | USD 1.9 billion |

| Demand for Bonded Abrasives in Japan Forecast CAGR (2025-2035) | 3.5% |

The demand for bonded abrasives in Japan is increasing due to their critical role in manufacturing processes that require precise finishing and shaping of materials. Bonded abrasives, which include grinding wheels, honing stones, and other abrasive tools, are essential in industries such as automotive, metalworking, electronics, and construction. These materials are used to improve surface quality, ensure dimensional accuracy, and enhance the overall performance of machinery and products.

The growing automotive and electronics sectors in Japan are significant drivers of this demand. Bonded abrasives are used extensively in the manufacturing of engine components, bearings, and various parts for electronic devices, where high precision is required. Japan's focus on advanced manufacturing technologies, such as automation and robotics, is fueling the demand for more efficient and durable abrasive products.

Technological innovations, such as the development of high-performance abrasives with improved cutting power and longevity, are further supporting industry growth. As Japanese industries continue to focus on precision, productivity, and durability, the demand for bonded abrasives is expected to grow steadily through 2035. Their key role in modern manufacturing processes, combined with advancements in material efficiency, ensures that bonded abrasives remain integral to Japan's industrial development.

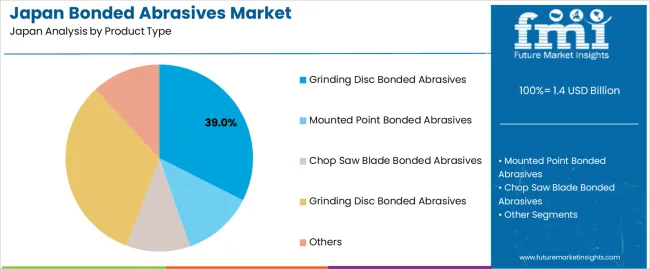

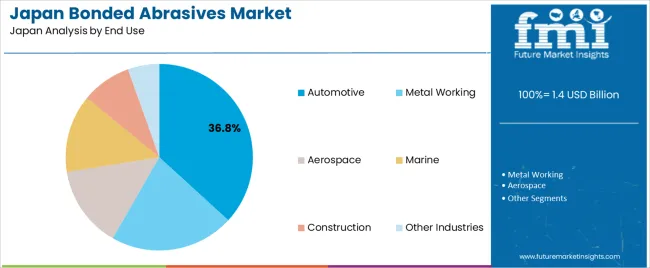

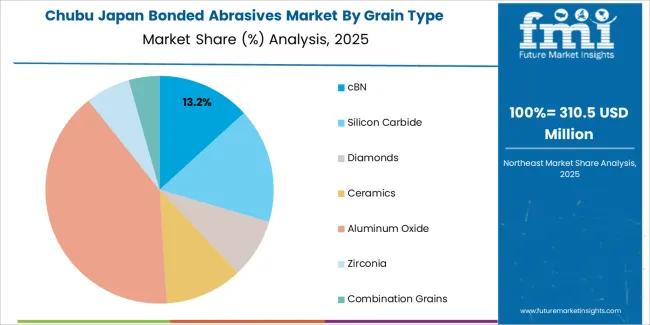

Demand for bonded abrasives in Japan is segmented by product type, end-use industry, grain type, and region. By product type, demand is divided into grinding disc bonded abrasives, mounted point bonded abrasives, chop saw blade bonded abrasives, cone bonded abrasives, and others. The demand is also segmented by end-use industry, including automotive, metal working, aerospace, marine, construction, and other industries. In terms of grain type, demand is divided into cBN (cubic boron nitride), silicon carbide, diamonds, ceramics, aluminum oxide, zirconia, and combination grains. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Grinding disc bonded abrasives account for 39% of the demand for bonded abrasives in Japan. These abrasives are favored for their precision grinding and cutting capabilities, which make them indispensable in various industrial applications. They are especially popular in the automotive and metalworking industries, where they are used for grinding, shaping, and finishing materials such as metals, composites, and ceramics. The versatility of grinding disc bonded abrasives in terms of size, shape, and compatibility with different materials makes them ideal for use in large-scale manufacturing processes. Their durability and effectiveness in handling tough, high-performance materials further solidify their preference in heavy-duty industrial tasks. As industries demand higher precision, efficiency, and more complex manufacturing, grinding disc bonded abrasives remain an essential tool for achieving high-quality finishes in automotive, aerospace, and metalworking sectors. With the growing need for faster, more reliable production, the demand for grinding disc bonded abrasives will continue to dominate the bonded abrasives industry.

The automotive industry accounts for 36.8% of the demand for bonded abrasives in Japan. These abrasives are essential in automotive manufacturing processes, particularly for tasks such as metalworking, surface finishing, and component production. Automotive production requires high precision in cutting, grinding, polishing, and shaping parts to meet strict standards for performance and durability. Grinding disc bonded abrasives, in particular, are extensively used for shaping and finishing engine components, body panels, brake pads, and other parts. As the automotive sector moves towards more advanced materials, such as high-strength alloys and composites, the need for specialized abrasives capable of handling these materials continues to grow. As automakers focus on producing parts with tighter tolerances and improving the overall quality of vehicles, the role of bonded abrasives becomes even more critical. With the increasing demand for innovation and precision in automotive manufacturing, bonded abrasives will remain integral to the sector's development and growth.

In Japan, demand for bonded abrasives is driven by the country’s advanced manufacturing base particularly in automotive, electronics, metal fabrication, and precision machining where grinding, cutting, and finishing operations are critical. Automation and Industry 4.0 practices emphasise consistent, high‑quality surface treatments, boosting the need for bonded abrasive wheels and specialised grinding tools. At the same time, infrastructure refurbishment and construction projects add further end‑use demand. Restraints include competition from coated and super‑abrasive technologies, high raw‑material (abrasive grain, bonding agents) and energy costs, and the mature state of Japan’s manufacturing base, which means replacement rather than rapid expansion is the norm.

Why is Demand for Bonded Abrasives Growing in Japan?

Demand in Japan is rising because manufacturers continue to produce high‑precision components (motors, sensors, automotive parts) and face increasing requirements for surface finish, dimensional accuracy and efficiency. The growing uptake of electric vehicles (EVs) and lightweight materials (aluminium, composites) in Japanese industry drives use of specialized grinding wheels and bonded‑abrasive solutions. The electronics sector and export‑oriented manufacturing demand reliable finishing tools. As factories adopt more automation and tighter quality controls, bonded abrasives become a vital consumable. With Japan’s mature yet innovative industrial environment, steady growth is seen rather than explosive expansion.

How are Technological Innovations Driving Growth of Bonded Abrasives in Japan?

Technological improvements are enhancing bonded abrasives use in Japan by increasing performance, precision, and application‑specific capability. New bonding technologies and grain‑combinations enable better durability, lower heat generation, and finer precision grinding, which is vital for Japanese industries working with hard alloys, ceramics, and composites. Automated grinding systems integrate sophisticated bonded abrasive wheels, helping reduce downtime and scrap. Innovations for durability such as lower‑emission production of wheels or improved recycling also support growth. These technical advances tailor bonded abrasives to Japan’s high‑quality manufacturing norms and enable their adoption in advanced applications.

What are the Key Challenges Limiting Adoption of Bonded Abrasives in Japan?

Despite demand, Japan’s bonded abrasives industry faces several challenges. One issue is cost: high‑performing bonded wheels and consumables carry premium prices, which can discourage substitution from standard abrasives. Another is competition from alternative technologies such as coated abrasives, super‑abrasives (ceramic/diamond), or additive manufacturing finishing which may reduce demand for traditional bonded types. Material input cost volatility (abrasive grains, resins) and energy costs for production hamper margin. Also, because many Japanese factories are well‑established with long‑life equipment, incremental replacements rather than new installations limit rapid growth.

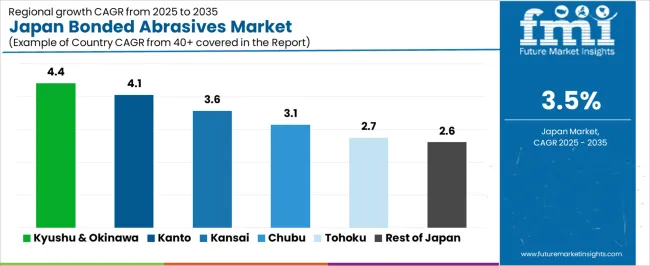

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.4% |

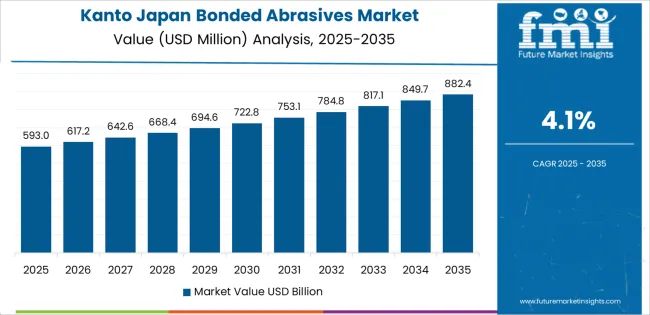

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.1% |

| Tohoku | 2.7% |

| Rest of Japan | 2.6% |

Demand for bonded abrasives in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 4.4% CAGR. Kanto follows with a 4.1% CAGR, supported by its large industrial and technological sectors, including automotive and electronics. Kinki shows a 3.6% CAGR, with demand driven by its well-established manufacturing and automotive industries. Chubu experiences a 3.1% CAGR, with demand primarily from the automotive sector and precision manufacturing. Tohoku shows a 2.7% CAGR, with moderate demand from its manufacturing and agricultural sectors. The Rest of Japan experiences the lowest growth at 2.6%, but consistent demand remains due to smaller-scale industrial applications.

Kyushu & Okinawa are experiencing the highest demand for bonded abrasives in Japan, with a 4.4% CAGR. This growth is driven by the region’s industrial base, particularly in manufacturing, automotive, and metalworking industries. Bonded abrasives are used extensively in precision grinding, cutting, and polishing applications, which are critical in the production of automotive components, machinery, and metal parts. The region's strong manufacturing base, particularly in cities like Fukuoka and Kagoshima, relies on bonded abrasives to achieve high-quality finishes and improve production efficiency. As Kyushu & Okinawa continue to focus on industrial growth and modernization, the demand for bonded abrasives is expected to remain strong, particularly in sectors like automotive and metalworking, where high-precision processes are essential.

Kanto is experiencing steady demand for bonded abrasives in Japan, with a 4.1% CAGR. The region’s demand is primarily driven by its large industrial base, including automotive, electronics, and metalworking industries. Bonded abrasives are critical in applications such as grinding, cutting, and polishing for automotive parts, electronic components, and other precision machinery. Kanto, home to major industrial hubs like Tokyo and Yokohama, has a high concentration of manufacturers that use bonded abrasives to achieve precise finishes in high-performance components. The growing automotive and electronics industries, along with Kanto’s focus on technological innovation, contribute to the increasing adoption of bonded abrasives. As the region continues to prioritize manufacturing efficiency and product quality, demand for bonded abrasives is expected to continue to rise steadily.

Kinki is experiencing moderate demand for bonded abrasives in Japan, with a 3.6% CAGR. The demand in this region is driven by the strong manufacturing sectors, particularly automotive, machinery, and metalworking. Kinki, including cities like Osaka and Kyoto, is a key industrial hub where bonded abrasives are used in precision grinding and cutting applications. The automotive industry, which is a significant part of Kinki’s industrial landscape, relies heavily on bonded abrasives for manufacturing high-quality parts. In addition to automotive applications, the region’s focus on improving manufacturing processes in sectors like machinery and metalworking further supports the demand for bonded abrasives. As Kinki continues to prioritize technological advancements and industrial efficiency, the demand for bonded abrasives is expected to grow steadily, particularly in high-precision industries.

Chubu is seeing moderate demand for bonded abrasives in Japan, with a 3.1% CAGR. The region’s demand is driven by its strong automotive and manufacturing sectors, particularly in cities like Nagoya. Bonded abrasives are crucial in the automotive industry, where they are used in precision grinding, cutting, and polishing of automotive parts. Chubu’s automotive industry, which includes major manufacturers like Toyota, contributes significantly to the demand for bonded abrasives in the production of high-performance and precision components. The region’s manufacturing focus on machinery, electronics, and heavy industries also drives steady demand for bonded abrasives, which are used to enhance product finishes and improve production efficiency. As Chubu continues to expand its industrial and automotive capabilities, the demand for bonded abrasives will remain steady, supported by ongoing technological innovations in manufacturing processes.

Tohoku is experiencing the lowest growth in demand for bonded abrasives in Japan, with a 2.7% CAGR. The demand in this region is primarily driven by its smaller industrial sectors, particularly in manufacturing and metalworking. While Tohoku has a smaller industrial base compared to regions like Kanto or Kyushu, it still relies on bonded abrasives in applications like grinding, cutting, and polishing for machinery and automotive components. The region's agricultural and light manufacturing sectors also use bonded abrasives for various processing tasks. As Tohoku continues to modernize its industrial operations and improve production efficiency, the demand for bonded abrasives will remain steady. The region’s focus on durability and reducing operational costs is also contributing to the growing adoption of bonded abrasives in industrial processes.

The Rest of Japan is seeing the lowest growth in demand for bonded abrasives, with a 2.6% CAGR. The demand in this region is primarily driven by small-scale manufacturing, agricultural processing, and light industries. Bonded abrasives are used in grinding, cutting, and polishing applications, particularly in metalworking and machinery production. The Rest of Japan’s industrial sectors rely on bonded abrasives for precision manufacturing and improving production quality. While the overall industrial scale is smaller compared to regions like Kanto or Kyushu, the consistent demand for bonded abrasives in regional manufacturing, agricultural, and metalworking sectors ensures steady growth. The Rest of Japan’s continued focus on improving industrial processes and efficiency will support moderate growth in the demand for bonded abrasives in the coming years.

In Japan, demand for bonded abrasives is continued by robust industrial sectors including automotive manufacture, metal fabrication, construction, and precision engineering. Bonded abrasives such as grinding wheels and cut-off discs are vital for surface finishing, shaping, and edge preparation in Japan’s high-precision manufacturing environment. Industry growth in this segment remains steady.

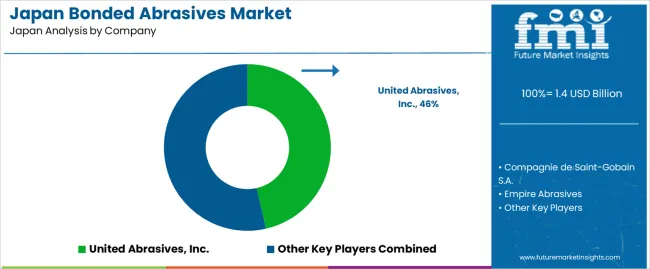

Leading suppliers in this space include United Abrasives, Inc., which holds a share of about 46.4%, followed by Compagnie de Saint-Gobain S.A., Empire Abrasives, Karbosan Abrasive Stone Industry Co., Inc., and SurfacePrep. These companies differentiate themselves by offering a wide product range (resin-bond, vitrified-bond, metal-bond), tailored grit sizes, and technical services suited for Japanese manufacturing and repair operations. United Abrasives’ leading position reflects its strong global presence and supply-chain compatibility with Japanese industrial users.

The competitive dynamics in Japan’s bonded abrasives segment are shaped by several factors. A key driver is the demand from Japan’s automotive, tooling, and metal-fabrication sectors for high-performance abrasives suited to precision parts and surface finishes. Another driver is the shift toward automated grinding systems and the need for abrasives that perform reliably in high-speed, computer-controlled equipment. Challenges include the maturity of Japan’s manufacturing base (which limits ultra-high growth), cost pressure from lower-cost imports, and strict quality and safety standards for abrasives. Suppliers that can combine high product quality, localized technical support, rapid delivery, and cost optimization are best positioned to grow in Japan’s bonded abrasives arena.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Grinding Disc Bonded Abrasives, Mounted Point Bonded Abrasives, Chop Saw Blade Bonded Abrasives, Cone Bonded Abrasives, Others |

| Grain Type | cBN, Silicon Carbide, Diamonds, Ceramics, Aluminum Oxide, Zirconia, Combination Grains |

| End Use | Automotive, Metal Working, Aerospace, Marine, Construction, Other Industries |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | United Abrasives, Inc., Compagnie de Saint-Gobain S.A., Empire Abrasives, Karbosan Abrasive Stone Industry Co., Inc., SurfacePrep |

| Additional Attributes | Dollar sales by product type and grain type; regional CAGR and adoption trends; demand trends in bonded abrasives; growth in automotive, aerospace, and metal working industries; technology adoption for abrasive applications; vendor offerings including abrasives, tools, and equipment; regulatory influences and industry standards |

The demand for bonded abrasives in japan is estimated to be valued at USD 1.4 billion in 2025.

The market size for the bonded abrasives in japan is projected to reach USD 2.0 billion by 2035.

The demand for bonded abrasives in japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in bonded abrasives in japan are grinding disc bonded abrasives, mounted point bonded abrasives, chop saw blade bonded abrasives, grinding disc bonded abrasives and others.

In terms of grain type, cbn segment is expected to command 13.8% share in the bonded abrasives in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bonded Abrasives Market Growth - Trends & Forecast 2025 to 2035

Demand for Bonded Abrasives in USA Size and Share Forecast Outlook 2025 to 2035

Bonded Magnet Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA