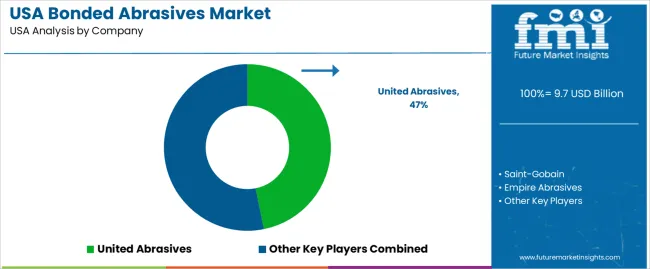

The demand for bonded abrasives in USA is valued at USD 9.7 billion in 2025 and is projected to reach USD 14.9 billion by 2035, reflecting a compound annual growth rate of 4.5%. Steady requirements across metal fabrication, automotive component production, machinery maintenance and construction activities shape growth. Bonded abrasives remain central to grinding, cutting, sharpening and surface preparation tasks where durability and consistent material removal are essential.

As industrial operations expand throughput and refine finishing processes, facilities rely on predictable procurement cycles for wheels, segments and mounted points. These wide-ranging applications support a stable rise in demand as manufacturers emphasize productivity and consistent surface performance across production and maintenance workflows.

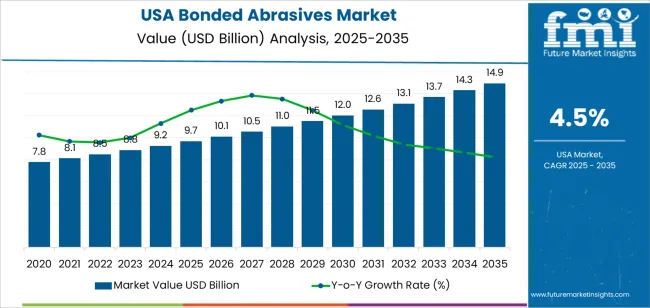

The growth curve shows a smooth upward progression beginning at USD 7.8 billion in earlier years and rising to USD 9.7 billion in 2025 before advancing toward USD 14.9 billion by 2035. Yearly values increase in regular steps, moving from USD 10.1 billion in 2026 to USD 10.5 billion in 2027 and continuing through USD 12.6 billion in 2031 and USD 13.7 billion in 2033. This progression reflects a mature but steadily expanding category driven by routine industrial consumption and continuous use in machinery-intensive environments. As manufacturers adopt improved abrasive formulations and integrate updated finishing systems, demand maintains consistent momentum supported by stable workloads and widespread applications across USA’s industrial landscape.

Demand in USA for bonded abrasives is expected to increase from USD 9.7 billion in 2025 to USD 14.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.5%. Starting at USD 7.8 billion in 2020, demand rises steadily USD 9.2 billion in 2024 and USD 9.7 billion in 2025. Between 2025 and 2030 the value climbs to roughly USD 12.0 billion, while by 2035 it reaches USD 14.9 billion. Growth is driven by ongoing demand from automotive, metalworking, aerospace and industrial manufacturing sectors for cutting, grinding and finishing tools especially as materials become more advanced and precision machining requirements escalate.

Over the forecast period the total uplift of USD 5.2 billion (from USD 9.7 billion to USD 14.9 billion) is supported by both volume growth and per unit value increases. In the early years the trend is primarily volume led as higher production and maintenance demand across manufacturing drives more usage of bonded abrasives. In the latter part of the decade value growth gains importance as bond technology advances, materials shift toward higher performance grains (e.g., cBN, diamond reinforced), and automated finishing systems require higher specification abrasives allowing higher average selling prices. Suppliers focusing on premium, high performance and precision grinding solutions are best positioned to capture the incremental demand growth toward USD 14.9 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 9.7 billion |

| Forecast Value (2035) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

Historical demand for bonded abrasives in USA has been shaped by the strength of automotive production, metal fabrication and construction-related grinding tasks. Manufacturers producing engines, transmissions and structural metal parts relied on bonded wheels for cutting, shaping and finishing, which maintained steady consumption for decades. Repair shops and aftermarket service networks added recurring demand as older vehicles required frequent resurfacing and component preparation. Construction and infrastructure maintenance also contributed as contractors used bonded abrasives for concrete work, metal framing and refurbishment. These long-established industrial activities created predictable usage patterns, supported by widespread availability of standard abrasive formulations and mature distribution channels across the country.

Future demand is influenced by shifts in material use, precision requirements and automation within USA manufacturing. As electric vehicles and lightweight components become more common, producers require abrasives that can handle aluminium alloys, hardened steels and composite materials with higher accuracy. Aerospace, defence and semiconductor fabrication continue to expand their need for abrasive processes that support tight tolerances and controlled surface characteristics. Automated machining centres demand wheels that maintain consistent geometry across extended production cycles, which pushes interest in advanced bonded formulations. Although volatile raw-material prices and competition from coated or super-abrasives present challenges, the combination of material transitions and increased precision needs positions bonded abrasives for sustained demand in USA.

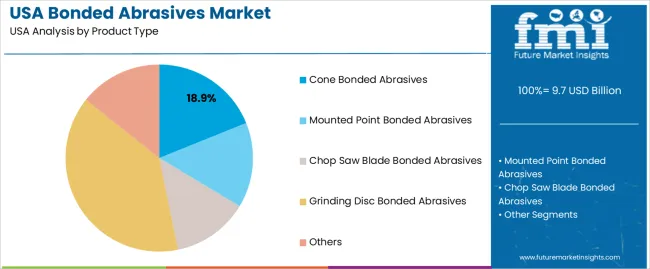

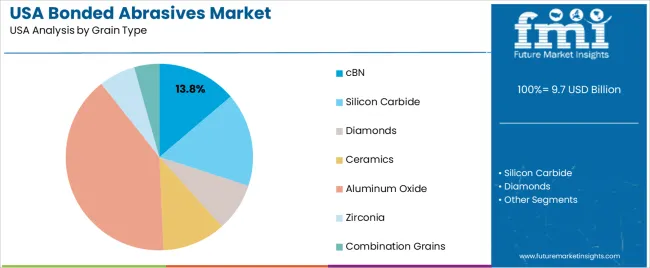

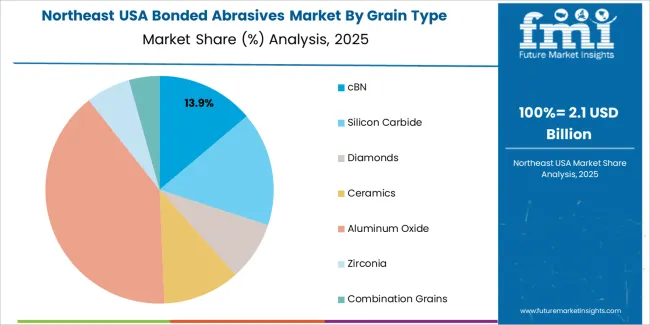

The demand for bonded abrasives in USA is shaped by product type differences that support varied cutting, grinding and shaping tasks, and by grain types that determine removal rate, durability and surface finish. Product categories include cone bonded abrasives, mounted point tools, chop saw blades, grinding discs and other specialized formats used across metalworking, fabrication and maintenance. Grain types such as cBN, silicon carbide, diamonds, ceramics, aluminum oxide, zirconia and combination grains provide distinct performance characteristics. As industrial users emphasize precision, consistent wear behavior and efficient processing, the combination of product form and abrasive grain influences selection across USA.

Cone bonded abrasives account for 19% of total demand across product type categories in USA. Their leading share reflects their suitability for contour work, internal grinding and applications requiring targeted material removal. These tools provide stable shaping performance in areas where flat surfaces or large discs cannot reach. Fabrication shops value the controlled geometry of cone shapes, which supports access to tight spaces and improves accuracy in detailed work. Their compatibility with handheld tools and flexible machinery setups strengthens routine use across repair, maintenance and precision grinding tasks.

Demand for cone bonded abrasives also grows as users seek tools that balance durability with predictable removal rates. The cone shape supports steady contact with irregular surfaces, helping maintain control during intricate operations. Workshops rely on cones for deburring, edge refinement and controlled finishing across metals and composites. Their manageable size supports quick tool changes in high-mix environments. As industries continue requiring abrasives suited to complex geometries, cone bonded products maintain a clear role across USA.

cBN accounts for 13.8% of total demand across grain type categories in USA. This leading share reflects the grain’s ability to deliver strong performance in high-temperature and high-hardness grinding tasks. cBN maintains cutting efficiency when working with hardened steels, superalloys and other difficult materials. Industrial users appreciate its predictable wear characteristics, which support consistent surface finish and reduced tool change frequency. These traits make cBN valuable for production environments that rely on steady precision under demanding operating conditions.

Demand for cBN increases as manufacturing sectors adopt processes requiring fine tolerances and repeatable finish quality. The grain’s thermal stability reduces the risk of workpiece damage during extended grinding cycles. Facilities value cBN for tasks such as tool sharpening, die maintenance and finishing of hardened components. Its compatibility with bonded structures enhances durability in both high-speed and controlled grinding operations. As industries continue emphasizing efficiency and long tool life, cBN remains a preferred grain type across USA’s bonded abrasive applications.

Demand for bonded abrasives in USA is shaped by sector-specific activity in metal fabrication, construction, transportation equipment and maintenance operations. Growth aligns with expansion of domestic manufacturing, upgrades in automotive and aerospace machining, and the ongoing shift toward precision finishing in industrial workshops. At the same time, adoption is moderated by fluctuating industrial output, cost sensitivity in fabrication shops and competition from coated abrasives or superabrasives. These factors collectively influence how widely bonded abrasives are specified across USA industrial, repair and refurbishing environments.

USA manufacturers are investing in machinery upgrades, CNC machining cells and productivity improvements, leading to greater use of consistent, high-tolerance grinding wheels and mounted points. Growth in sectors such as aerospace machining, heavy equipment refurbishment and custom metal fabrication drives interest in bonded abrasives that maintain shape, durability and edge retention across long production runs. Increased reshoring activity also expands domestic machining workloads, creating sustained demand. These local industrial patterns position bonded abrasives as essential tools in USA precision finishing workflows.

Opportunities arise in advanced machining operations tied to electric vehicle component production, stainless-steel fabrication for food-processing plants and expanded metalworking in regional industrial corridors such as the Midwest and Southeast. Repair and overhaul operations in aerospace and rail also provide demand for specialised grinding formulations. Growth in small and mid-sized fabrication shops using automated grinding and robotic finishing systems further creates room for bonded abrasives that support stable performance under continuous duty. These shifts open targeted expansion avenues in the USA industrial base.

Adoption is limited by cost pressures in fabrication shops, where operators may choose lower-priced alternatives during periods of subdued industrial activity. Some manufacturers shift toward coated abrasives or superabrasives for flexibility or longevity, reducing reliance on traditional bonds. Safety requirements, equipment compatibility and training gaps can also slow conversion to newer wheel types. Supply-chain variability for raw materials and inventory constraints across distribution networks add further friction. These restraints moderate how quickly bonded abrasives achieve broader, consistent use across USA machining and maintenance settings.

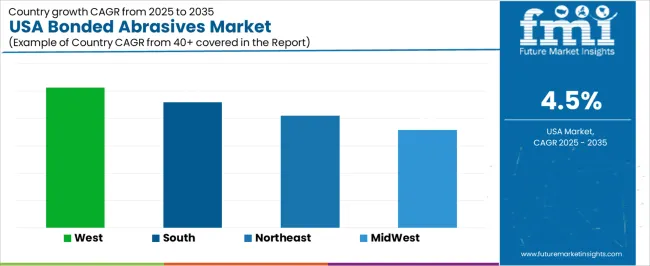

| Region | CAGR (%) |

|---|---|

| West USA | 5.1% |

| South USA | 4.6% |

| Northeast USA | 4.1% |

| Midwest USA | 3.6% |

Demand for bonded abrasives in the USA is increasing across regions, with the West leading at 5.1%. Growth in this region reflects strong activity in metal fabrication, construction, and machinery maintenance, where bonded abrasives support cutting, grinding, and finishing work. The South follows at 4.6%, supported by expanding manufacturing hubs and steady use of abrasive tools across automotive and industrial facilities. The Northeast records 4.1%, shaped by established metalworking sectors and consistent demand from small and mid-sized workshops. The Midwest grows at 3.6%, where manufacturers and equipment service providers maintain regular consumption of bonded abrasives for production and repair tasks. These trends show stable national reliance on abrasive products across industrial applications.

West USA is projected to grow at a CAGR of 5.1% through 2035 in demand for bonded abrasives. California, Washington, and surrounding industrial regions are increasingly using abrasives for metalworking, automotive, and construction applications. Rising focus on surface finishing, precision grinding, and efficiency drives adoption. Manufacturers provide high-performance bonded abrasives suitable for cutting, grinding, and polishing operations. Distributors ensure accessibility across industrial facilities, workshops, and manufacturing plants. Growth in automotive, metal fabrication, and construction sectors supports steady adoption of bonded abrasives across West USA.

South USA is projected to grow at a CAGR of 4.6% through 2035 in demand for bonded abrasives. Texas, Florida, and surrounding industrial hubs are increasingly adopting abrasives for metalworking, construction, and automotive applications. Rising focus on operational efficiency, precision finishing, and material quality drives adoption. Manufacturers supply high-quality bonded abrasives compatible with cutting, grinding, and polishing tasks. Distributors ensure availability across workshops, manufacturing plants, and industrial facilities. Expansion in automotive manufacturing, metal fabrication, and construction projects supports steady adoption of bonded abrasives across South USA.

Northeast USA is projected to grow at a CAGR of 4.1% through 2035 in demand for bonded abrasives. New York, Pennsylvania, and surrounding regions are increasingly adopting abrasives for automotive, metal fabrication, and construction industries. Rising focus on surface quality, operational efficiency, and precision grinding drives adoption. Manufacturers provide high-performance bonded abrasives suitable for cutting, grinding, and polishing operations. Distributors ensure accessibility across manufacturing plants, workshops, and industrial facilities. Industrial production, automotive manufacturing, and construction projects support steady adoption of bonded abrasives across Northeast USA.

Midwest USA is projected to grow at a CAGR of 3.6% through 2035 in demand for bonded abrasives. Illinois, Ohio, and surrounding industrial regions are gradually adopting abrasives for automotive, metalworking, and construction applications. Rising demand for precision grinding, surface finishing, and operational efficiency drives adoption. Manufacturers supply bonded abrasives suitable for cutting, grinding, and polishing tasks. Distributors ensure accessibility across workshops, industrial facilities, and manufacturing plants. Expansion in automotive production, metal fabrication, and construction supports steady adoption of bonded abrasives across Midwest USA.

The demand for bonded abrasives in the USA is driven by sustained activity in automotive, aerospace and general manufacturing sectors. Producers require consistent grinding, cutting and finishing performance to meet tight tolerances and surface specifications. Infrastructure maintenance and repair work elevates need for high durability abrasive components. At the same time, adoption of automation and robotic grinding cells increases demand for precision bonded wheels compatible with CNC machines.

Material shifts toward high strength alloys and composites also require specialized abrasive formulations to preserve tool life and part integrity. Environmental and workplace safety regulations encourage suppliers to offer lower dust, longer lasting products that reduce operator exposure and line downtime, supporting greater procurement of bonded abrasive solutions. Supply chain resilience and localised distribution networks further influence buyer selection and inventory strategies.

Leading suppliers in the USA bonded abrasives segment include United Abrasives, Saint-Gobain, Empire Abrasives, Karbosan and SurfacePrep Corporation. United Abrasives serves diverse industrial users with a focus on engineered solutions and aftermarket support. Saint Gobain brings global materials expertise and broad product families that address high-volume OEM needs. Empire Abrasives specialises in specialty bonded wheels and regional service for manufacturing clients.

Karbosan provides advanced ceramic and resin bonded products with growing distribution in North America. SurfacePrep Corporation focuses on surface preparation and finishing systems that complement bonded abrasive offerings. Competition centres on product performance, on-site technical support and supply reliability. Companies that combine material science, flexible manufacturing and localised service networks are positioned to capture share as industrial demand evolves. Dealer partnerships and customised inventory programs further differentiate supplier propositions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Cone Bonded Abrasives, Mounted Point Bonded Abrasives, Chop Saw Blade Bonded Abrasives, Grinding Disc Bonded Abrasives, Others |

| Grain Type | cBN, Silicon Carbide, Diamonds, Ceramics, Aluminum Oxide, Zirconia, Combination Grains |

| End Use Industry | Automotive, Metalworking, Aerospace, Marine, Construction, Other Industries |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | United Abrasives, Saint Gobain, Empire Abrasives, Karbosan, SurfacePrep Corporation |

| Additional Attributes | Dollar by sales by product type and grain type; regional CAGR and adoption trends; volume vs. value contributions across forecast period; growth in automotive, aerospace, metalworking, construction and marine sectors; integration of bonded abrasives with automated and CNC machining cells; adoption of high-performance grains such as cBN and diamond; trends in safety, low-dust and long-life abrasives; constraints from raw-material costs and competition from coated abrasives; opportunities in advanced and precision grinding applications; presence of localized suppliers and distribution networks. |

The demand for bonded abrasives in usa is estimated to be valued at USD 9.7 billion in 2025.

The market size for the bonded abrasives in usa is projected to reach USD 14.9 billion by 2035.

The demand for bonded abrasives in usa is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in bonded abrasives in usa are cone bonded abrasives, mounted point bonded abrasives, chop saw blade bonded abrasives, grinding disc bonded abrasives and others.

In terms of grain type, cbn segment is expected to command 13.8% share in the bonded abrasives in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bonded Abrasives Market Growth - Trends & Forecast 2025 to 2035

Demand for Bonded Abrasives in Japan Size and Share Forecast Outlook 2025 to 2035

Bonded Magnet Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA