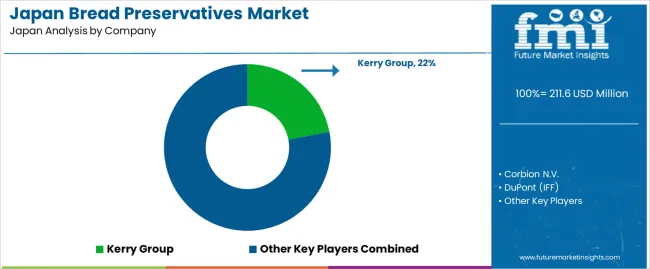

The demand for bread preservatives in Japan is valued at USD 211.6 million in 2025 and is projected to reach USD 328.5 million by 2035, reflecting a compound annual growth rate of 4.5%. Growth is shaped by steady production volumes across commercial bakeries, convenience stores and packaged bread manufacturers that rely on preservatives to maintain shelf stability and prevent spoilage. As distribution networks expand and packaged bread consumption remains strong, producers continue to procure solutions that support mold inhibition and freshness retention. Both traditional and newer preservative blends remain in circulation as manufacturers balance formulation consistency, product handling and storage conditions. These factors contribute to a gradual, predictable rise in demand across Japan’s bakery supply chain.

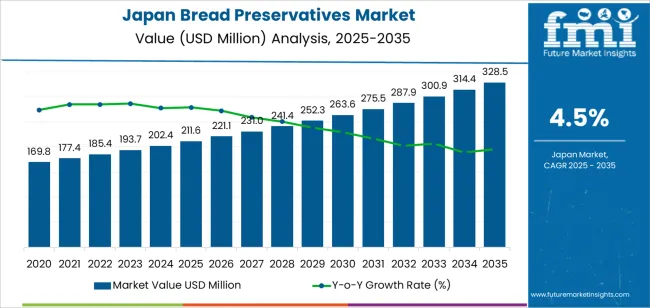

The growth curve shows a smooth upward path beginning at USD 169.8 million in earlier years and rising to USD 211.6 million in 2025 before progressing toward USD 328.5 million by 2035. Yearly increases follow consistent spacing, advancing from USD 221.1 million in 2026 to USD 231.0 million in 2027 and continuing through USD 263.6 million in 2031 and USD 300.9 million in 2033. This pattern reflects a mature but steadily expanding ingredient segment driven by routine production needs and long-standing consumer habits. As bakeries refine recipes and extend distribution reach, preservatives maintain a stable role in ensuring product reliability. The curve highlights dependable growth sustained by ongoing packaged bread demand rather than short-term fluctuations across Japan’s bakery market.

Demand in Japan for bread preservatives is projected to grow from USD 211.6 million in 2025 to USD 328.5 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.5%. Starting at USD 169.8 million in 2020, demand rises each year USD 202.4 million in 2024 and reaches USD 211.6 million in 2025. From 2025 to 2030 the value continues upward to about USD 252.3 million, and by 2035 it is forecast to reach USD 328.5 million. Growth is driven by ongoing demand for packaged and ready to eat bread products, extending shelf life requirements, and the adoption of advanced preservative technologies to meet clean label and functional standards.

Over the forecast period the total value uplift is USD 116.9 million (from USD 211.6 million to USD 328.5 million). Early years are dominated by volume growth as increased bread consumption and packaged bakery production carry demand. In later years value growth contributes more significantly through premium preservative solutions, higher efficacy formulations, and adoption of multifunctional additives (antimould, antistaling, antioxidant) which raise average spending per unit. Suppliers focussing on clean label credentials, multifunctionality and regulatory compliance are best positioned to capture the incremental value toward USD 328.5 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 211.6 million |

| Forecast Value (2035) | USD 328.5 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The demand for bread preservatives in Japan is rooted in distinct historical factors and evolving future dynamics. Historically, the market expanded as packaged breads became widespread and bakeries sought to extend shelf life, reduce mould, and minimise waste in a country with high consumption of sliced loaves and prepared bread products. Low growth in household baking and strong retail distribution of baked goods reinforced consistent demand for preservative technologies. Over time regulatory attention to food safety and convenience-oriented consumption patterns strengthened uptake of bread preservatives for industrial bread manufacturers.

Future growth is expected to hinge on newer drivers such as consumer pressure for clean-label ingredients and plant-based or natural preservatives, together with expansion of frozen and ambient bread formats. Japanese bakeries are embracing enzyme-based systems and plant extracts in place of conventional chemicals, responding to wellness trends and ingredient transparency demands. Growth in online grocery sales, longer delivery chains and smaller household sizes further underscore the need for better preservative solutions. While cost-pressure from raw materials and reformulation challenges remain constraints, the alignment of clean-label demand, broader distribution formats and food-waste reduction goals supports steady growth in the demand for bread preservatives in Japan.

The demand for bread preservatives in Japan is shaped by the types of preservatives used in bakery production and the forms selected for ease of handling and consistent incorporation. Type categories include artificial and natural bread preservatives, each supporting different shelf-life expectations, formulation needs and production volumes. Form categories consist of powder and liquid formats, which vary in dosing accuracy, storage stability and compatibility with automated mixing systems. As bakeries focus on predictable product freshness, microbial control and efficient processing, the combination of preservative type and delivery form guides overall purchasing patterns across Japan’s commercial and industrial bakery operations.

Artificial bread preservatives account for 61% of total demand across preservative types in Japan. This leading share reflects their ability to deliver consistent shelf-life extension and reliable mold inhibition under varied storage conditions. Commercial bakeries value their predictable performance, straightforward dosing and compatibility with high-volume production lines. Artificial preservatives help maintain product uniformity while supporting distribution cycles that require stable freshness across retail networks. Their well-defined functional properties assist bakers in controlling spoilage risks during transportation and display, reinforcing steady adoption within Japan’s bread and bakery sector.

Demand for artificial preservatives continues to rise as large bakeries manage broad distribution areas and require materials that maintain product stability over extended periods. These preservatives support efficient production planning and reduce waste by slowing microbial growth. Their compatibility with both packaged and unpackaged bread formats allows consistent integration with established recipes. Bakeries appreciate the reduced variability in performance, which helps maintain dependable outcomes across daily production schedules. As producers prioritize shelf stability and controlled processing, artificial preservatives remain central to preservative selection in Japan.

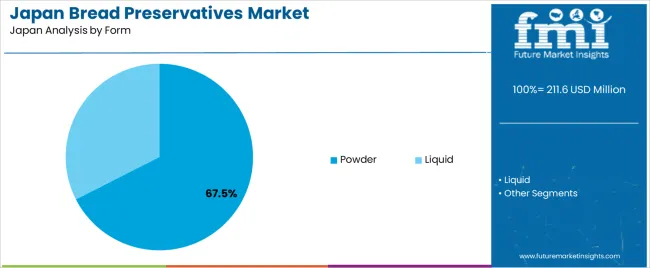

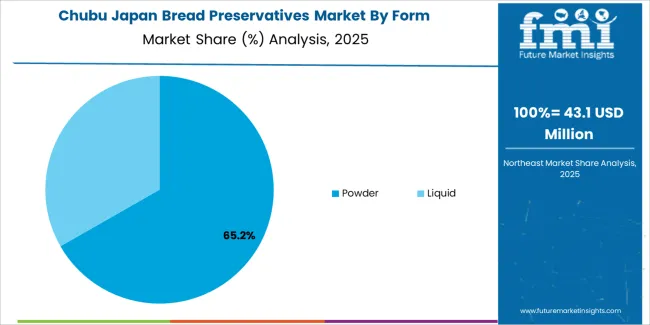

Powder form preservatives account for 67.5% of total demand across form categories in Japan. Their leading position reflects the advantage of long storage stability, ease of transport and predictable blending during dough preparation. Powdered preservatives disperse uniformly through dry mixes, supporting consistent functional performance across large production batches. Industrial bakeries value the accuracy of dry dosing, which helps maintain stable outcomes across varied product types. These characteristics support use in high-throughput facilities where precise ingredient control is essential.

Demand for powder forms also grows as bakeries streamline workflows that rely on dry ingredient batching. Powdered preservatives integrate smoothly with automated mixers and bulk handling systems, supporting efficient operations. Their shelf stability reduces concerns about temperature control during storage, helping facilities maintain uninterrupted production. Powder forms also support flexible recipe development, as adjustments can be made without altering liquid ratios. As bakeries continue prioritizing efficiency and consistency, powder preservatives remain the dominant format across Japan’s bread production environment.

Demand for bread preservatives in Japan is influenced by the country’s strong convenience-store bakery culture, strict food-safety expectations and preference for soft-textured bakery products with longer shelf life. High urban density and reliance on daily packaged bakery items reinforce demand for microbial-control solutions that prevent mould in humid climates. At the same time, consumer awareness of ingredient labels pushes manufacturers to balance freshness with clean-label expectations. These conditions guide how preservative choices evolve in Japan’s bakery supply chain.

How Is Japan’s Convenience-Store Bakery Culture Driving New Trends in Bread Preservatives?

Japan’s extensive konbini bakery ecosystem, supported by chains in Tokyo, Osaka and regional hubs, creates steady demand for bread with consistent softness and freshness throughout long distribution hours. High humidity levels amplify mould risk, pushing bakeries to consider preservatives that stabilise quality without altering flavour. The rise of premium shokupan and specialty breads reinforces interest in solutions that maintain softness over multiple days. These Japan-specific consumption habits shape preservative innovation and selection across commercial bakeries.

Where Are New Opportunities Emerging for Bread-Preservative Suppliers in Japan?

Opportunity emerges from Japan’s growing shift toward “clean-label but stable” bakery products, where manufacturers seek preservative systems with simpler ingredient declarations while maintaining protection under humid conditions. Reformulation efforts in regional bakeries and private-label brands create demand for blends that work with local wheat types and sweet-bread formulations. Growth in frozen-to-bake channels and automated bakeries also expands space for functional preservatives that support long shelf-life without compromising the soft, airy textures preferred by Japanese consumers.

What Constraints Are Limiting Broader Adoption of Bread Preservatives in Japan?

Restraints include Japan’s heightened sensitivity to food-additive perception, where consumers closely examine labels and may reject products with unfamiliar chemical names. Regulatory scrutiny and retailer policies requiring shorter ingredient lists limit use of traditional preservative systems. Smaller regional bakeries often rely on production timing rather than additives to maintain freshness, reducing uptake. Additionally, taste and aroma integrity is critical in Japan’s bakery market, so any preservative that subtly alters flavour faces strong resistance from both buyers and retailers.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.6% |

| Kanto | 5.2% |

| Kinki | 4.5% |

| Chubu | 4.0% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

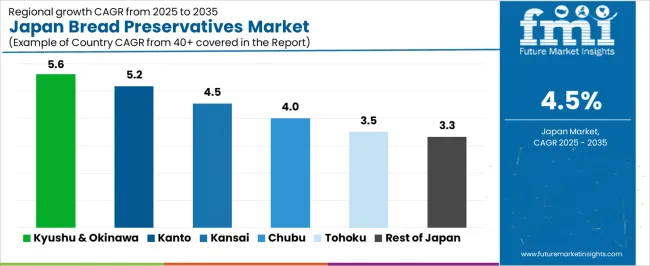

Demand for bread preservatives in Japan is rising steadily across regions, with Kyushu and Okinawa leading at 5.6%. Growth in this region reflects active bakery production and consistent use of preservation agents to extend shelf life in warm climates. Kanto follows at 5.2%, supported by dense consumer markets and strong demand from industrial bakeries supplying packaged bread. Kinki records 4.5%, shaped by urban consumption patterns and regular production of fresh and packaged bakery items. Chubu grows at 4.0%, influenced by regional food manufacturers and stable retail distribution. Tohoku reaches 3.5% as bakeries expand packaged offerings. The rest of Japan posts 3.3%, indicating gradual adoption across smaller commercial markets.

Kyushu & Okinawa is projected to grow at a CAGR of 5.6% through 2035 in demand for bread preservatives. Fukuoka and surrounding bakery operations are increasingly adopting preservatives to extend shelf life, maintain freshness, and prevent microbial growth. Rising demand for packaged bread, convenience products, and food safety drives adoption. Manufacturers provide natural and synthetic preservatives suitable for various bread types. Distributors ensure accessibility across urban, semi-urban, and rural bakeries. Growth in packaged bread consumption, bakery production, and supply chain efficiency supports steady adoption of bread preservatives in Kyushu & Okinawa.

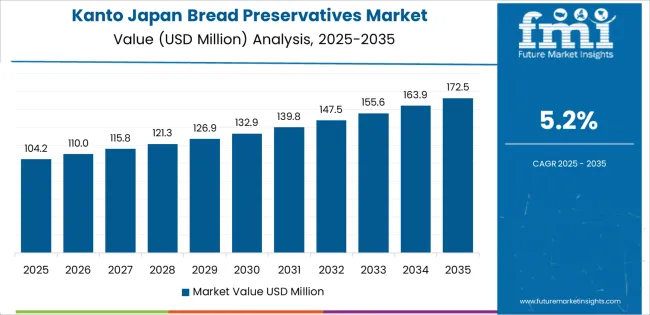

Kanto is projected to grow at a CAGR of 5.2% through 2035 in demand for bread preservatives. Tokyo and surrounding prefectures are increasingly adopting preservatives to maintain freshness, extend shelf life, and prevent microbial spoilage in bakeries and packaged bread production. Rising focus on food safety, product quality, and convenience drives adoption. Manufacturers supply preservatives compatible with white, whole grain, and specialty bread varieties. Distributors ensure accessibility across urban, semi-urban, and industrial bakery facilities. Expansion in packaged bread production, food safety regulations, and consumer convenience supports steady adoption of bread preservatives across Kanto.

Kinki is projected to grow at a CAGR of 4.5% through 2035 in demand for bread preservatives. Osaka, Kyoto, and surrounding bakeries are gradually adopting preservatives to maintain product freshness, prevent microbial growth, and extend shelf life. Rising demand for packaged bread, convenience products, and quality maintenance drives adoption. Manufacturers provide preservatives suitable for different bread types and baking processes. Distributors ensure availability across urban and semi-urban bakery operations. Growth in bakery production, packaged bread consumption, and food safety initiatives supports steady adoption of bread preservatives across Kinki.

Chubu is projected to grow at a CAGR of 4.0% through 2035 in demand for bread preservatives. Nagoya and surrounding areas are increasingly adopting preservatives to maintain freshness, extend shelf life, and prevent spoilage in bakeries and packaged bread production. Rising focus on quality maintenance, food safety, and convenience drives adoption. Manufacturers supply preservatives compatible with multiple bread types and production processes. Distributors ensure accessibility across urban and semi-urban bakeries. Growth in packaged bread production, bakery expansion, and consumer awareness supports steady adoption of bread preservatives across Chubu.

Tohoku is projected to grow at a CAGR of 3.5% through 2035 in demand for bread preservatives. Sendai and surrounding bakeries are gradually adopting preservatives to extend shelf life, maintain freshness, and prevent microbial spoilage. Rising demand for packaged bread, convenience, and quality drives adoption. Manufacturers provide natural and synthetic preservatives suitable for various bread types. Distributors ensure accessibility across urban, semi-urban, and rural bakeries. Bakery production growth, packaged bread consumption, and food safety awareness support steady adoption of bread preservatives across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 3.3% through 2035 in demand for bread preservatives. Smaller towns and rural bakeries gradually adopt preservatives to maintain freshness, prevent microbial growth, and extend shelf life. Rising focus on food safety, convenience, and product quality drives adoption. Manufacturers supply preservatives compatible with white, whole grain, and specialty bread. Distributors ensure accessibility across urban, semi-urban, and rural bakery facilities. Bakery production growth, packaged bread consumption, and safety initiatives support steady adoption of bread preservatives across the Rest of Japan.

The demand for bread preservatives in Japan is driven by rising consumption of packaged and convenience bakery products and the need to maintain freshness during distribution and retail display. Japanese consumers increasingly expect longer shelf life and consistent quality in bread formats such as loaves, rolls and snack breads. At the same time, clean-label trends are gaining traction, prompting formulators to shift toward enzyme-based or natural preservation technologies while complying with strict food-additive regulations. The broader adoption of e-commerce and home delivery for bakery goods also supports the use of preservative systems that secure texture and flavour until the point of consumption.

Key companies shaping the bread-preservative segment in Japan include global ingredient suppliers such as Kerry Group, Corbion N.V. and DuPont (IFF) offering enzyme- or bio-based preservation solutions. In addition, localised formulators and distributors play a critical role in adapting these solutions to Japanese bakery requirements and regulatory conditions. For example, domestic technical partners provide custom preservative blends and registry support suited to Japanese food-sanitation standards. The combination of global innovation and region-specific service strengthens how bread-preservative solutions are selected and implemented across Japanese bakeries and packaged-bread manufacturers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Artificial Bread Preservatives, Natural Bread Preservatives |

| Form | Powder, Liquid |

| Function | Reducing Agents, Enzymes, Oxidants |

| End-Use Industry | Commercial Bakeries, Convenience Stores, Packaged Bread Manufacturers |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Kerry Group, Corbion N.V., DuPont (IFF), Kemin Industries, Puratos Group |

| Additional Attributes | Dollar by sales by preservative type, form, and function; regional CAGR and adoption patterns; volume vs. value contribution across forecast period; clean-label adoption trends; integration into automated bakery production lines; growth in enzyme-based, natural, and multifunctional preservatives; shelf-life extension, freshness retention, and microbial inhibition as key performance criteria; regulatory compliance and food-safety adherence; innovation in frozen-to-bake and packaged bread systems; urban vs. rural bakery adoption trends. |

The demand for bread preservatives in japan is estimated to be valued at USD 211.6 million in 2025.

The market size for the bread preservatives in japan is projected to reach USD 328.5 million by 2035.

The demand for bread preservatives in japan is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in bread preservatives in japan are artificial bread preservatives and natural bread preservatives.

In terms of form, powder segment is expected to command 67.5% share in the bread preservatives in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bread Preservatives Market Insights – Trends & Forecast 2025 to 2035

Demand for Bread Crumbs in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA