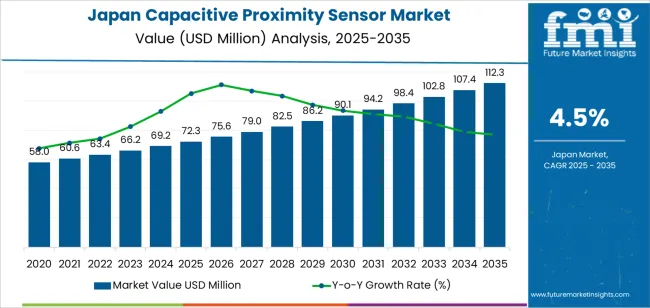

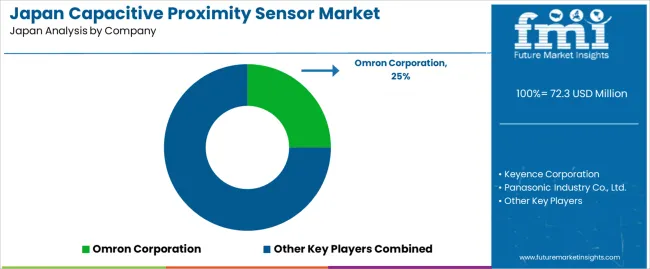

The Japan capacitive proximity sensor demand is valued at USD 72.3 million in 2025 and is projected to reach USD 112.3 million by 2035, reflecting a CAGR of 4.5%. Demand is influenced by increased deployment of non-contact sensing technologies across industrial automation, consumer electronics, building access systems, and smart-manufacturing environments. Broader adoption of robotics, touch-based interfaces, and automated inspection lines also contributes to steady utilization growth.

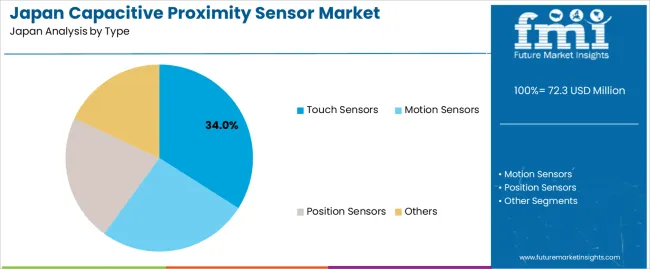

Precision requirements in semiconductor facilities and electronics assembly plants further strengthen procurement volumes. Touch sensors lead the product landscape. These sensors are selected for stable sensitivity, compact form factors, and compatibility with equipment requiring responsive surface-level activation. Their use in control panels, household appliances, medical devices, and automotive interiors reinforces segment leadership. Enhancements in noise immunity, response speed, and multi-surface detection accuracy continue to support integration into automated systems.

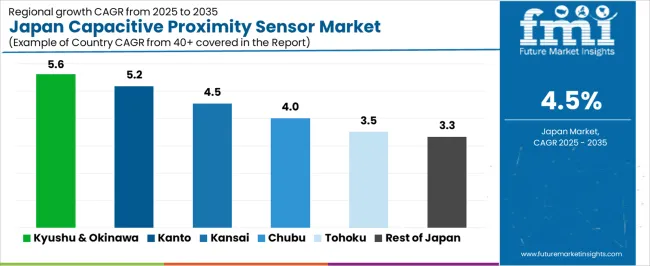

Kyushu & Okinawa, Kanto, and Kinki record the highest utilization due to the strong concentration of electronics manufacturers, industrial automation facilities, and component-assembly clusters. These regions maintain advanced supply networks and benefit from ongoing investments in process optimization and factory digitalization. Key suppliers include Omron Corporation, Keyence Corporation, Panasonic Industry Co., Ltd., Azbil Corporation, and Autonics Japan. These companies provide capacitive sensors for industrial automation, consumer-electronics manufacturing, building-automation systems, and precision equipment used across Japan’s technology and industrial sectors.

A 10-year comparison for Japan’s capacitive-proximity-sensor segment shows a steady expansion pattern shaped by industrial automation, electronics manufacturing, and quality-control applications. In the early years, growth is supported by established use in material detection, level sensing, and non-contact measurement across machinery, packaging lines, and component-assembly plants. Early growth remains consistent because sensors are integrated into long-standing automation architectures, and procurement follows equipment-maintenance and upgrade cycles.

In the later years, growth continues at a measured pace as adoption broadens within semiconductor tools, robotics systems, and precision-assembly environments. Incremental gains reflect improvements in sensitivity, miniaturization, and environmental resistance, which support expanded application in compact production equipment. The rate of increase remains controlled because many factories operate within mature automation frameworks where replacement and optimization contribute more to growth than new installations.

Comparing both periods, early growth reflects stable industrial demand and predictable integration into existing machinery, while late growth is shaped by incremental technological refinement and gradual expansion into higher-precision tasks. The 10-year profile shows consistent, moderate advancement aligned with Japan’s automation intensity and long equipment-lifecycle patterns.

| Metric | Value |

|---|---|

| Japan Capacitive Proximity Sensor Sales Value (2025) | USD 72.3 million |

| Japan Capacitive Proximity Sensor Forecast Value (2035) | USD 112.3 million |

| Japan Capacitive Proximity Sensor Forecast CAGR (2025-2035) | 4.5% |

Demand for capacitive proximity sensors in Japan is increasing because manufacturing plants, automation lines and inspection systems require reliable detection of both metallic and non-metallic materials. These sensors support applications in electronics, automotive components, packaging machinery and semiconductor equipment, all of which depend on accurate object presence detection without physical contact. Japanese factories emphasize precision, miniaturization and high throughput, which strengthens the need for sensors capable of detecting liquids, powders and plastics in environments where inductive sensors are unsuitable.

Growth in robotics, warehouse automation and process-control systems also reinforces adoption, as capacitive sensors help monitor fill levels, detect misalignment and prevent equipment collisions. Constraints include sensitivity to environmental factors such as humidity and contamination, the need for careful calibration to avoid false triggering and higher unit cost in advanced models. Smaller facilities may continue using mechanical or inductive sensors when application requirements are simple, which slows full penetration in low-complexity operations. Integration with legacy equipment can also require adjustments that some operators postpone until broader system upgrades occur.

Demand for capacitive proximity sensors in Japan reflects the country’s established base of automated manufacturing, robotics integration, and precision control systems. These sensors support detection of objects, motion, and positioning across production lines, automotive components, and specialized machinery. Japanese industries use capacitive sensing for applications requiring non-contact measurement, stable performance under variable environmental conditions, and compatibility with diverse materials.

Touch sensors account for 34.0%, supported by their use in operator interfaces, machine panels, and equipment requiring responsive actuation without mechanical switches. Their reliability and simplicity make them suited for industrial environments where repeated use occurs. Motion sensors represent 26.0%, applied in automation systems requiring object detection, conveyor monitoring, and robotic arm coordination.

Position sensors hold 22.0%, supporting alignment, component placement, and equipment calibration tasks in electronics and automotive assembly. Other sensor types represent 18.0%, covering specialized configurations used in niche manufacturing settings. This distribution reflects Japan’s preference for durable, contactless sensing methods compatible with controlled factory conditions and stable equipment interfaces.

Key points:

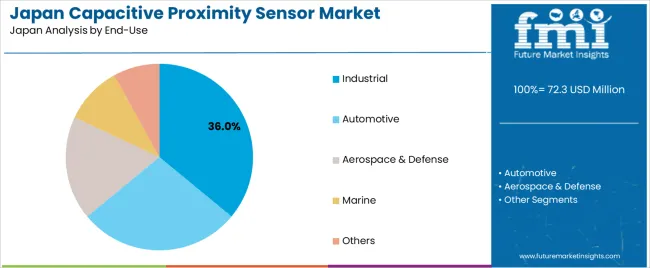

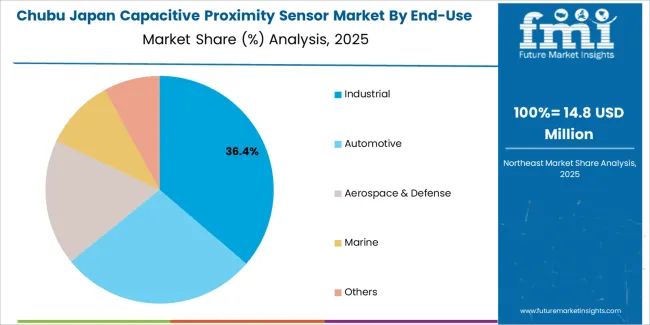

Industrial applications represent 36.0%, reflecting Japan’s extensive use of capacitive sensors in automated assembly, material handling, electronics fabrication, and quality control. Automotive applications account for 28.0%, supported by integration into production lines, component testing, and vehicle assembly systems. Aerospace and defense contribute 18.0%, using sensors in equipment monitoring, component alignment, and specialized manufacturing operations.

Marine applications represent 10.0%, covering navigation equipment, vessel monitoring systems, and corrosion-resistant sensor installations. Other end uses account for 8.0%, spanning laboratory equipment and automated devices in smaller facilities. Distribution reflects Japan’s reliance on precise, stable sensing technologies across high-value industrial and manufacturing environments.

Key points:

Expansion of electronics and precision-equipment manufacturing, increased automation in food and beverage plants and rising adoption in component-handling systems are driving demand.

In Japan, capacitive proximity sensors gain steady demand as electronics manufacturers in regions such as Nagano, Shizuoka and Aichi use them for non-contact detection of circuit boards, resin parts and small components during assembly. Food and beverage plants rely on capacitive sensors to detect packaged items, powder levels and liquid presence in filling and bottling lines, aligning with strict hygiene requirements. Automation growth in automotive and industrial machinery factories strengthens use of sensors for material-positioning, hopper-level monitoring and robotic pick-and-place workflows. These applications support consistent procurement across Japan’s mature industrial ecosystem.

High price sensitivity among smaller factories, limited retrofit feasibility in ageing production lines and cautious adoption in moisture-prone environments restrain demand.

Small and medium-sized manufacturers often prioritize low-cost photoelectric sensors or mechanical switches, reducing broader uptake of capacitive models. Many older factories, especially in regional prefectures, operate legacy equipment with limited mounting space or insufficient control-panel capacity, making sensor upgrades more difficult. Moisture, oil mist and steam common in some Japanese manufacturing environments can affect detection stability unless higher-specification housings are used, causing hesitation in facilities that lack budget for premium variants. These constraints moderate rapid expansion despite clear functional advantages.

Shift toward compact, high-sensitivity models, increased integration in semiconductor automation and rising use in logistics automation define key trends.

Japanese suppliers are developing compact capacitive sensors with adjustable sensitivity to support fine detection tasks in electronics, battery and optical-component assembly. Semiconductor fabs expanding in Kyushu and Hokkaido increasingly deploy capacitive sensors for wafer-handling, chemical-container monitoring and ultra-clean material flows. Logistics centers operated by e-commerce and parcel carriers are adopting capacitive sensors for carton detection, level measurement in automated storage systems and monitoring of plastic tote positioning. These trends reflect growing sophistication in sensor requirements across Japan’s industrial, electronics and logistics sectors.

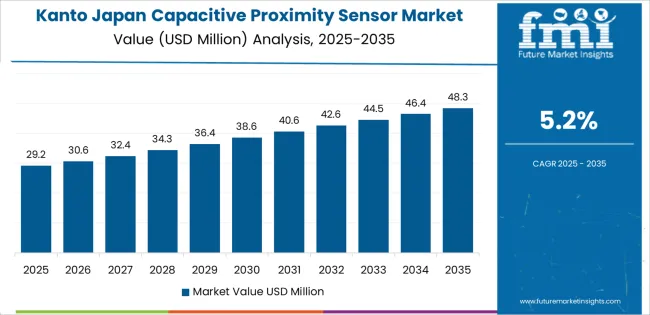

Demand for capacitive proximity sensors in Japan is expanding as manufacturing plants, electronics facilities, automation integrators, and industrial equipment suppliers increase their use of non-contact detection in production lines, quality-control systems, packaging units, robotics, and material-handling processes. Growth reflects regional manufacturing density, factory-automation investments, adoption of sensor-based monitoring, and requirements for precision detection in electronics, automotive, food processing, and logistics. Kyushu & Okinawa leads at 5.6%, followed by Kanto (5.2%), Kinki (4.5%), Chubu (4.0%), Tohoku (3.5%), and Rest of Japan (3.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.6% |

| Kanto | 5.2% |

| Kinki | 4.5% |

| Chubu | 4.0% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

Kyushu & Okinawa grows at 5.6% CAGR, supported by semiconductor production, electronics assembly, and strong automation adoption across Kumamoto, Fukuoka, and Oita. Semiconductor facilities in Kumamoto use capacitive sensors in wafer-handling, clean-room transport, and precision alignment systems. Electronics factories depend on non-contact sensing for component placement, surface detection, conveyor monitoring, and inspection processes.

Automation suppliers across Fukuoka integrate capacitive sensors into robotic arms, packing systems, and smart-factory upgrades used by regional manufacturers. Logistics centers in Kyushu adopt sensors for container-positioning, chute monitoring, and automated sorting. Equipment distributors maintain stable supply networks for industrial sensors, ensuring consistent access for regional plants.

Kanto grows at 5.2% CAGR, driven by dense industrial activity and advanced electronics production across Tokyo, Kanagawa, Saitama, and Chiba. Manufacturing clusters use capacitive sensors in factory-automation lines requiring non-contact detection for packaging control, position sensing, and equipment-safety functions. Electronics firms develop precision modules and assemblies that depend on accurate sensing for alignment and quality verification.

Tokyo-based automation companies integrate capacitive sensors into smart-factory systems, enabling manufacturers to improve process consistency. Logistics operators rely on sensors for presence detection in automated storage and conveyor systems. Industrial-equipment distributors across Kanagawa maintain strong inventories of capacitive sensors to meet continuous procurement needs.

Kinki grows at 4.5% CAGR, supported by diversified manufacturing across Osaka, Kyoto, and Hyogo. Electronics producers in Osaka use capacitive sensors to detect small parts, verify placement accuracy, and monitor inspection lines. Robotics suppliers in Kyoto integrate sensors into articulated robots used for assembly, picking, and automated testing. Industrial plants across Kobe adopt sensors for process-safety monitoring, machine guarding, and automated material movement. Component-manufacturing zones rely on capacitive sensors for surface detection and dimensional verification, supporting consistent output quality. Regional equipment suppliers maintain distribution networks that ensure stable access to industrial-sensor inventory.

Chubu grows at 4.0% CAGR, shaped by automotive, machinery, robotics, and electronics production across Aichi, Shizuoka, and Nagano. Automotive-component factories use capacitive sensors for presence detection, assembly verification, lubricant monitoring, and automated inspection tasks. Machinery producers integrate sensors into CNC systems, packaging units, and industrial equipment requiring accurate surface or level detection. Semiconductor-related firms in Nagano apply capacitive sensors in handling systems and alignment tools. Manufacturing clusters in Aichi use sensors to support automation upgrades across stamping, molding, and painting operations.

Tohoku grows at 3.5% CAGR, supported by electronics assembly, automotive-parts production, and developing automation activity across Miyagi, Fukushima, and Iwate. Electronics factories adopt capacitive sensors for inspection lines, PCB handling, and placement verification. Automotive-parts producers use sensors in casting, machining, and assembly stations requiring surface detection and part-presence monitoring. Regional logistics hubs incorporate capacitive sensors into conveyor-management systems used in distribution centers. Public-sector industrial programs encourage automation in medium-scale factories, increasing sensor usage across production lines.

Rest of Japan grows at 3.3% CAGR, influenced by small and mid-scale manufacturers in electronics, metalworking, food processing, and equipment assembly. Factories use capacitive sensors for package detection, fill-level monitoring, vibration-free sensing, and small-component verification. Automation adoption in local manufacturing plants increases need for non-contact sensors to improve workflow reliability. Food-processing sites adopt sensors for portion control, conveyor spacing, and contamination prevention. Regional distributors supply compact and general-purpose capacitive sensors suited for varied industrial applications.

Demand for capacitive proximity sensors in Japan is shaped by automation manufacturers serving electronics assembly, food processing, materials handling, and general industrial equipment. Omron Corporation holds an estimated 25.0% share, supported by controlled sensor-head design, stable detection repeatability, and broad adoption across Japanese factory-automation platforms. Its sensors provide consistent moisture-resistant performance and compatibility with common PLC environments.

Keyence Corporation maintains strong participation through high-sensitivity capacitive sensors used in electronics and precision-manufacturing applications. Its devices offer reliable micro-level detection, predictable response curves, and wide availability through rapid delivery channels. Panasonic Industry Co., Ltd. contributes significant volume with compact sensors designed for robotics, conveyors, and packaging equipment, emphasizing stable noise-resistance and long operating life.

Azbil Corporation supports domestic industrial sites with sensors engineered for environmental robustness and reliable operation in process-automation settings. Autonics Japan adds depth with cost-efficient capacitive sensors used in OEM applications requiring consistent detection of plastics, powders, and granular materials. Foreign suppliers such as Rockwell Automation Japan and Pepperl+Fuchs Japan serve multinationals and advanced manufacturing plants through sensors designed for specialized detection tasks. Competition in Japan centers on detection stability, environmental resistance, response reliability, mounting flexibility, and strong local technical support as manufacturers require dependable sensing performance for tightly controlled production environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Type | Touch Sensors, Motion Sensors, Position Sensors, Others |

| End-Use | Industrial, Automotive, Aerospace & Defense, Marine, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Omron Corporation, Keyence Corporation, Panasonic Industry Co., Ltd., Azbil Corporation, Autonics Japan (Autonics Corporation) |

| Additional Attributes | Dollar sales by sensor type and end-use industry; regional demand distribution across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; adoption trends driven by industrial automation, robotics, automotive electronics, and defense applications; technological developments in high-precision capacitive sensing, miniaturized sensors, and ruggedized marine/industrial variants; competitive landscape of Japanese and Asia-based sensor manufacturers. |

The demand for capacitive proximity sensor in Japan is estimated to be valued at USD 72.3 million in 2025.

The market size for the capacitive proximity sensor in Japan is projected to reach USD 112.3 million by 2035.

The demand for capacitive proximity sensor in Japan is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in capacitive proximity sensor in Japan are touch sensors, motion sensors, position sensors and others.

In terms of end-use, industrial segment is expected to command 36.0% share in the capacitive proximity sensor in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Proximity Sensor Market Report - Growth, Demand & Forecast 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Inductive Proximity Sensors Market

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA