The demand for cold insulation in Japan is projected to grow from USD 453.8 million in 2025 to USD 801.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.9%. Cold insulation materials are vital for maintaining temperature control and improving energy efficiency in industries such as construction, refrigeration, HVAC systems, and food processing. As industries focus more on durability and cost reduction, the demand for high-performance cold insulation is expected to rise.

In Japan, the growing emphasis on energy-efficient buildings and industrial processes is driving the need for effective cold insulation. Cold insulation plays a crucial role in applications where precise temperature control is required, such as cold storage, refrigeration systems, and cryogenic applications. The increasing need for refrigeration in the food supply chain and the expansion of energy-efficient buildings will significantly contribute to the growth in demand for cold insulation.

The rising awareness of carbon emissions and the need to reduce energy consumption will further support the adoption of energy-efficient insulation materials. As industries aim to improve energy efficiency and reduce operational costs, the demand for cold insulation solutions will continue to rise, particularly in sectors that prioritize durability and environmental impact.

Between 2025 and 2030, the demand for cold insulation in Japan is expected to grow from USD 453.8 million to USD 480.3 million. During this period, growth will be moderate, driven by the steady demand for cold insulation in industries such as food storage, refrigeration, and construction. The industry will experience stable growth, as the ongoing demand for energy-efficient insulation materials and temperature control solutions aligns with industrial and environmental trends. The gradual increase in demand during this phase is expected to be predictable, based on established industry needs and the focus on durability.

From 2030 to 2035, demand for cold insulation is projected to rise more sharply, increasing from USD 480.3 million to USD 801.2 million. This period will witness accelerated growth, fueled by the increasing demand for energy-efficient solutions in the construction sector, especially in the development of energy-efficient buildings and infrastructure. The growing need for refrigeration and cold storage, particularly due to the expanding food distribution networks and the advancement of cryogenic systems, will drive further industry expansion. During this phase, the adoption of cold insulation solutions will intensify, as stricter energy standards and durability goals push for greater utilization of efficient insulation technologies.

| Metric | Value |

|---|---|

| Demand for Cold Insulation in Japan Value (2025) | USD 453.8 million |

| Demand for Cold Insulation in Japan Forecast Value (2035) | USD 801.2 million |

| Demand for Cold Insulation in Japan Forecast CAGR (2025-2035) | 5.9% |

The demand for cold insulation in Japan is increasing as industries seek energy-efficient solutions to reduce operational costs and minimize energy consumption. Cold insulation plays a critical role in industries such as refrigeration, HVAC systems, and cryogenic applications by reducing heat transfer, maintaining temperature stability, and enhancing overall energy efficiency. With Japan’s emphasis on durability and energy conservation, the adoption of cold insulation is becoming more widespread across both commercial and industrial sectors.

Key drivers include the growth of industries like food and beverage, pharmaceuticals, and chemicals, where precise temperature control is essential. Japan’s push toward energy-efficient buildings and systems is contributing to the rise in demand for cold insulation in construction and facility management. Stringent energy regulations and a strong commitment to reducing carbon emissions are further encouraging the use of cold insulation technologies.

Technological advancements, such as the development of more effective and eco-friendly insulation materials, are also supporting the industry's growth. As businesses strive to meet environmental targets while lowering energy costs, cold insulation is becoming a key component of their strategies. With increasing focus on durability and energy efficiency, the demand for cold insulation in Japan is expected to grow steadily through 2035, driven by its essential role in both industrial and commercial energy-saving initiatives.

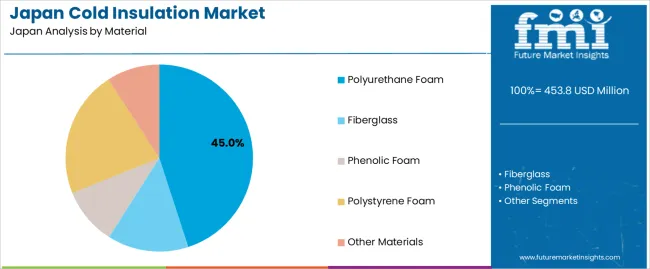

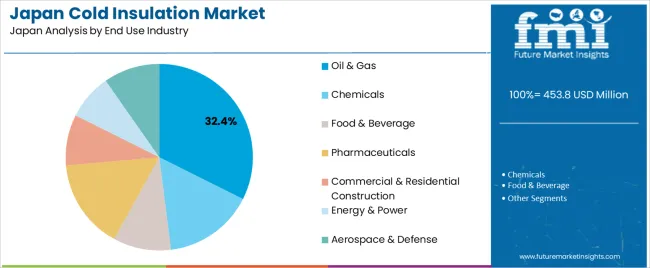

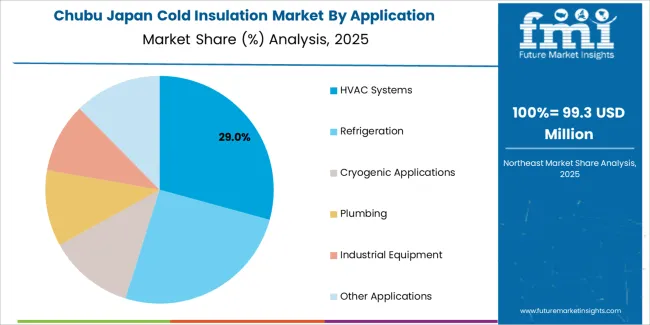

Demand for cold insulation in Japan is segmented by material, end-use industry, application, and region. By material, demand is divided into polyurethane foam, fiberglass, phenolic foam, polystyrene foam, and other materials. The demand is also segmented by end-use industry, including oil & gas, chemicals, food & beverage, pharmaceuticals, commercial & residential construction, energy & power, and aerospace & defense. In terms of application, demand is divided into HVAC systems, refrigeration, cryogenic applications, plumbing, industrial equipment, and other applications. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Polyurethane foam accounts for 45% of the demand for cold insulation in Japan. This material is favored for its superior thermal insulation properties, which are crucial in maintaining temperature control in industries such as oil & gas, food & beverage, and energy. Polyurethane foam offers a high R-value (thermal resistance), ensuring that heat transfer is minimized, making it an efficient choice for cold insulation. It is widely used in refrigeration, HVAC systems, and cryogenic applications due to its ability to resist moisture, maintain its shape, and provide long-lasting performance under varying environmental conditions.

The versatility of polyurethane foam in terms of application, along with its ability to reduce energy consumption and improve operational efficiency, ensures that it remains the leading material for cold insulation in Japan. As industries continue to prioritize energy-efficient and durable insulation solutions, polyurethane foam will maintain its dominant position in the industry.

Oil & gas accounts for 32.4% of the demand for cold insulation in Japan. The oil and gas industry relies heavily on cold insulation to maintain the integrity of pipelines, storage tanks, and offshore structures that transport and store liquids and gases at low temperatures. Effective cold insulation is critical for preventing the loss of thermal energy, protecting materials from temperature fluctuations, and ensuring the safe operation of equipment in extreme environments.

As Japan continues to expand its energy infrastructure and increase its focus on the extraction and transportation of liquefied natural gas (LNG), the demand for cold insulation in the oil and gas sector is expected to grow. Cold insulation also plays a vital role in reducing operational costs by minimizing energy losses, making it an indispensable part of the industry. As a result, oil & gas will continue to lead the demand for cold insulation in Japan.

Key drivers include the expansion of food‑chain logistics and cold‑storage facilities (for frozen foods, pharmaceuticals), growth in process industries (chemicals, LNG, cryogenics) needing insulation at sub‑zero temperatures, and increasing regulatory/energy‑efficiency pressure pushing upgrades of existing insulation systems in industrial and commercial sectors. Restraints include the relatively higher cost of specialised cold‑insulation materials and systems compared to standard thermal insulation, technical complexity of design and installation (vapour barrier, condensation control) especially in older plants, and limited availability of space or suitable infrastructure for retrofits in dense urban or ageing industrial areas.

In Japan, demand for cold insulation is rising because key sectors such as food & beverage manufacturing and storage, pharmaceuticals with cold‑chain requirements, and industrial processing (including cryogenic and LNG applications) are expanding. These end‑users require insulation solutions that reliably maintain low temperatures, prevent heat ingress and reduce energy losses. At the same time, government policies and energy‑efficiency targets are encouraging facility owners to upgrade or replace older insulation systems. The combination of cold‑chain growth, industrial need for low‑temperature performance, and regulatory drivers is pushing adoption of cold insulation materials and systems across Japan’s commercial and industrial landscape.

Technological innovations are supporting growth in Japan’s cold insulation industry by offering improved material performance, easier installation and better maintenance. New insulation materials such as advanced foams and composite panels deliver superior low‑temperature thermal resistance, improved vapour‑barrier control and enhanced durability under chilling conditions. Modular insulation jackets and retrofit systems simplify installation in existing facilities. In addition, smart insulation solutions incorporating sensors for monitoring temperature, moisture and performance help facility managers optimise insulation maintenance and energy use. These advances make cold insulation more efficient and attractive for industrial, storage and logistics applications in Japan, enabling broader uptake.

Despite strong potential, adoption of cold insulation in Japan is challenged by several factors. One major issue is cost: specialised low‑temperature insulation materials and systems come at a premium compared with standard insulation, which can deter price‑sensitive projects. Also, the technical complexity of installing and maintaining insulation for cryogenic or near‑sub‑zero conditions demands specialised skills, rigorous design and high‑quality workmanship often in facilities with constrained space or retrofit limitations. Supply‑chain and material‑availability issues for advanced insulation panels or foams may delay projects in Japan’s mature manufacturing and logistics sectors.

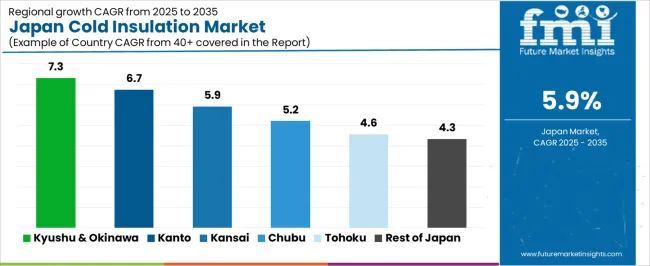

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.3% |

| Kanto | 6.7% |

| Kansai | 5.9% |

| Chubu | 5.2% |

| Tohoku | 4.6% |

| Rest of Japan | 4.3% |

Demand for cold insulation in Japan is growing across all regions, with Kyushu & Okinawa leading at a 7.3% CAGR. This growth is driven by the region’s expanding industrial base and infrastructure development, particularly in energy, manufacturing, and chemical sectors. The Kanto follows with a 6.7% CAGR, supported by its large-scale industrial and petrochemical operations. The Kansai shows a steady 5.9% CAGR, driven by its emphasis on energy-efficient buildings and environmental standards. The Chubu experiences a moderate 5.2% CAGR, with demand primarily from the food processing and manufacturing sectors. The Rest of Japan sees the lowest growth at 4.3%, though steady demand remains, particularly in agricultural and regional industrial applications.

Kyushu & Okinawa are experiencing the highest demand for cold insulation in Japan, with a 7.3% CAGR. This growth is driven by the region’s expanding industrial base, particularly in the petrochemical, manufacturing, and energy sectors. The increasing need for temperature-controlled storage and transportation in industries such as food processing, pharmaceuticals, and chemicals is contributing to the rising demand for cold insulation.

Kyushu & Okinawa's growing construction projects, particularly in the commercial and industrial sectors, further drive the need for insulation in buildings and infrastructure. The region's emphasis on improving energy efficiency and reducing operational costs supports the adoption of cold insulation in various industrial applications. As the region continues to invest in infrastructure and industrial modernization, demand for cold insulation is expected to remain strong.

Kanto is seeing strong demand for cold insulation in Japan, with a 6.7% CAGR. The region’s demand is largely driven by its industrial and manufacturing sectors, including food and beverage, pharmaceuticals, and chemicals. Cold insulation is essential for maintaining temperature control in industrial applications like refrigeration and storage. Major urban centers like Tokyo and Yokohama, with a high concentration of commercial and industrial facilities, contribute to the growing need for insulation solutions.

Kanto’s emphasis on energy efficiency, coupled with the growing demand for environmentally responsible building practices, further supports the need for cold insulation in both residential and commercial buildings. The region’s focus on technological innovation and durability ensures that demand for cold insulation will continue to grow as industries prioritize efficiency and compliance with regulatory standards.

Kinki is experiencing moderate demand for cold insulation in Japan, with a 5.9% CAGR. The region’s demand is primarily driven by its industrial and chemical sectors, which require cold insulation for temperature-sensitive processes. The growing focus on energy efficiency in the region's industrial operations, particularly in chemical manufacturing, is fueling the adoption of cold insulation for process cooling and refrigeration. Kinki’s expanding construction industry, particularly in Osaka and Kyoto, further contributes to demand for cold insulation in new buildings and infrastructure.

The region’s focus on improving building energy efficiency and reducing environmental impact also drives the demand for cold insulation in residential and commercial applications. As the region continues to grow industrially and expand its infrastructure, the need for cold insulation to support energy-efficient practices is expected to rise steadily.

Chubu is seeing steady demand for cold insulation in Japan, with a 5.2% CAGR. The region’s manufacturing base, including automotive and chemical industries, is a significant driver of this demand. Chubu is home to key industrial hubs like Nagoya, where cold insulation is essential in temperature-sensitive processes such as refrigeration, cooling, and transportation. The region's focus on energy-efficient manufacturing and reducing operational costs also supports the growing adoption of cold insulation in industrial applications.

Chubu’s expanding construction and infrastructure projects are contributing to the rising demand for cold insulation in buildings. As the region continues to prioritize green development and energy efficiency in its industrial and residential sectors, the demand for cold insulation is expected to grow at a moderate but steady pace.

Tohoku is experiencing moderate demand for cold insulation in Japan, with a 4.6% CAGR. The region’s demand is driven by its agricultural and manufacturing industries, particularly in food processing, where cold insulation plays a critical role in maintaining product quality during storage and transportation. As Tohoku continues to modernize its industrial infrastructure and focus on improving energy efficiency, the demand for cold insulation in both manufacturing and building applications is expected to increase.

The region’s growing focus on green building practices and energy-efficient solutions also supports the adoption of cold insulation. While the growth rate is slower compared to other regions, the increasing need for energy-efficient systems and temperature control in industrial applications ensures steady demand for cold insulation in Tohoku.

The Rest of Japan is experiencing the lowest growth in demand for cold insulation, with a 4.3% CAGR. While this region does not have the same level of industrial activity as other major hubs, demand remains steady due to the agricultural and light manufacturing sectors. Cold insulation is used in the food processing and storage industries, where temperature control is essential for maintaining product quality. The region's growing focus on green development and energy-efficient manufacturing practices contributes to the adoption of cold insulation in various applications. As local industries continue to expand and modernize, the demand for cold insulation in the Rest of Japan will grow at a moderate pace, particularly in agricultural and industrial processes that require temperature-sensitive solutions.

In Japan the demand for cold insulation systems is gaining traction across sectors such as refrigeration, food & beverage processing, chemical and industrial gas handling, LNG infrastructure, and low temperature logistics. These systems comprising rigid foam panels, cellular glass, spray polyurethane foams, vacuum insulation panels and related accessories are valued for preventing heat ingress, maintaining controlled low temperature environments and improving energy efficiency. Japan’s well developed industrial base and stringent thermal performance standards support steady adoption of high performance cold insulation solutions.

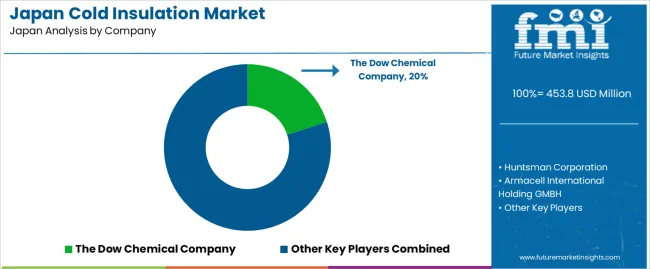

Major suppliers competing in this space include The Dow Chemical Company with a 20.0% share, Huntsman Corporation, Armacell International Holding GMBH, Evonik Industries and Pittsburgh Corning Corporation. These companies differentiate through specialized materials tailored for cold service conditions (e.g., very low thermal conductivity, high moisture and chemical resistance), strong service and technical support in Japan, and supply chain networks capable of serving industrial scale clients. Dow’s leadership stems from its broad insulation materials platform and strong presence in Japanese manufacturing and refrigeration segments.

The competitive dynamics are shaped by several key factors. A driver is the increasing emphasis on energy efficiency, clean process standards and retrofits of aging industrial infrastructure in Japan, which boost demand for advanced cold insulation solutions. A second driver is the rapid growth of cold chain logistics (especially for pharmaceuticals and specialty foods) and expanding cryogenic storage applications that require reliably high performance insulation. Restraints include high upfront material and installation costs, the specialized nature of installation for cold insulation (which may require skilled labour and bespoke systems), and competition from alternative insulation or refrigeration technologies. Suppliers that can combine technical performance, local support and cost effective installation are best placed to win in Japan’s cold insulation arena.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Material | Polyurethane Foam, Fiberglass, Phenolic Foam, Polystyrene Foam, Other Materials |

| Application | HVAC Systems, Refrigeration, Cryogenic Applications, Plumbing, Industrial Equipment, Other Applications |

| End Use Industry | Oil & Gas, Chemicals, Food & Beverage, Pharmaceuticals, Commercial & Residential Construction, Energy & Power, Aerospace & Defense |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | The Dow Chemical Company, Huntsman Corporation, Armacell International Holding GMBH, Evonik Industries, Pittsburgh Corning Corporation |

| Additional Attributes | Dollar sales by material and application; regional CAGR and adoption trends; demand trends in cold insulation; growth in oil & gas, food & beverage, and construction sectors; technology adoption for thermal insulation; vendor offerings including insulation materials, services, and solutions; regulatory influences and industry standards |

The demand for cold insulation in japan is estimated to be valued at USD 453.8 million in 2025.

The market size for the cold insulation in japan is projected to reach USD 801.2 million by 2035.

The demand for cold insulation in japan is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in cold insulation in japan are polyurethane foam, fiberglass, phenolic foam, polystyrene foam and other materials.

In terms of application, hvac systems segment is expected to command 30.0% share in the cold insulation in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Japan Cold Laser Therapy Market Insights – Demand, Size & Industry Trends 2025-2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA