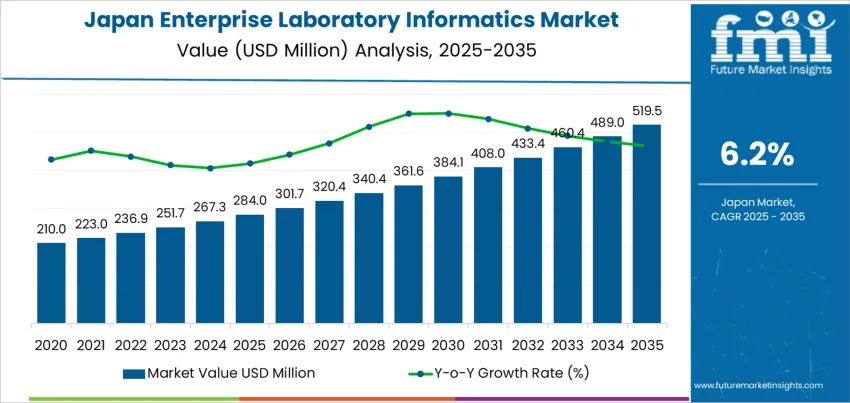

The demand for enterprise laboratory informatics in Japan is expected to grow from USD 284.0 million in 2025 to USD 519.5 million by 2035, driven by a compound annual growth rate (CAGR) of 6.2%. Enterprise laboratory informatics refers to the integrated software solutions used to manage laboratory data and processes, enabling enhanced collaboration, data analysis, and compliance with regulatory standards. As Japan continues to advance in industries such as pharmaceuticals, healthcare, and biotechnology, the adoption of laboratory informatics systems will be critical for streamlining operations, improving efficiency, and ensuring the accuracy and security of laboratory data

The increasing complexity of scientific research and the growing volume of data generated in laboratories are key drivers for the expansion of enterprise laboratory informatics. These systems provide tools for managing large datasets, supporting real-time data analysis, and facilitating data-driven decision-making. Laboratories in various sectors are increasingly relying on these solutions to maintain high levels of accuracy, traceability, and compliance with stringent regulations, especially in sectors like life sciences and pharmaceuticals.

The ongoing digital transformation of Japan's healthcare and research sectors is contributing to the growth of laboratory informatics. With the integration of artificial intelligence (AI) and automation technologies into these systems, laboratories can process and analyze data more efficiently. The shift towards cloud-based solutions and the growing need for remote collaboration will further drive the adoption of enterprise laboratory informatics across various industries.

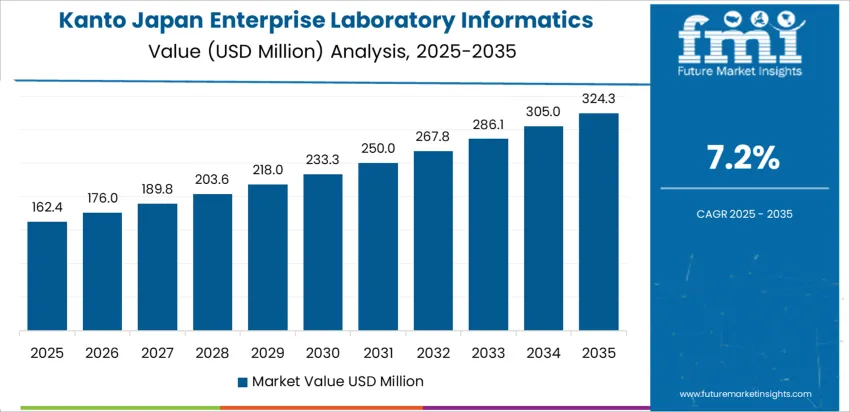

From 2025 to 2030, demand for enterprise laboratory informatics in Japan is expected to grow from USD 284.0 million to USD 361.6 million, adding USD 77.6 million in value. This period will see steady growth, driven by the increasing need for data management and analytics solutions across industries such as healthcare, pharmaceuticals, and biotechnology. As laboratory data management becomes more complex, the demand for integrated informatics solutions will rise, contributing to this growth.

From 2030 to 2035, demand will continue to rise from USD 361.6 million to USD 519.5 million, contributing USD 157.9 million in value. Although the growth rate may slow slightly as the industry matures, the continued advancements in AI, automation, and cloud technology will ensure that enterprise laboratory informatics remain a crucial tool for laboratories across various sectors. The increasing adoption of remote collaboration and data sharing will sustain demand, making laboratory informatics solutions an essential part of Japan's evolving research and healthcare infrastructure.

| Metric | Value |

|---|---|

| Demand for Enterprise Laboratory Informatics in Japan Value (2025) | USD 284.0 million |

| Demand for Enterprise Laboratory Informatics in Japan Forecast Value (2035) | USD 519.5 million |

| Demand for Enterprise Laboratory Informatics in Japan Forecast CAGR (2025-2035) | 6.2% |

The demand for enterprise laboratory informatics in Japan is growing due to the increasing need for efficient data management, collaboration, and automation in laboratories across industries such as pharmaceuticals, healthcare, biotechnology, and manufacturing. Enterprise laboratory informatics systems help streamline data collection, analysis, and reporting, enabling labs to enhance productivity, maintain compliance with regulations, and ensure the accuracy and integrity of their research.

A major driver behind this growth is the rising adoption of data-driven decision-making and the increasing complexity of laboratory operations. As industries like pharmaceuticals and biotechnology continue to advance, the need for robust informatics systems that can handle large volumes of complex data becomes more crucial. These systems enable laboratories to integrate information from different sources, improve workflows, and accelerate the pace of research and product development.

Japan’s strong focus on technological innovation, particularly in the healthcare and life sciences sectors, is contributing to the demand for enterprise laboratory informatics. The need for greater regulatory compliance, real-time data access, and improved collaboration between research teams is pushing organizations to adopt advanced informatics systems. As Japan continues to prioritize healthcare advancements, biotechnology research, and scientific innovation, the demand for enterprise laboratory informatics is expected to grow steadily through 2035, supported by technological advancements and the growing complexity of research data.

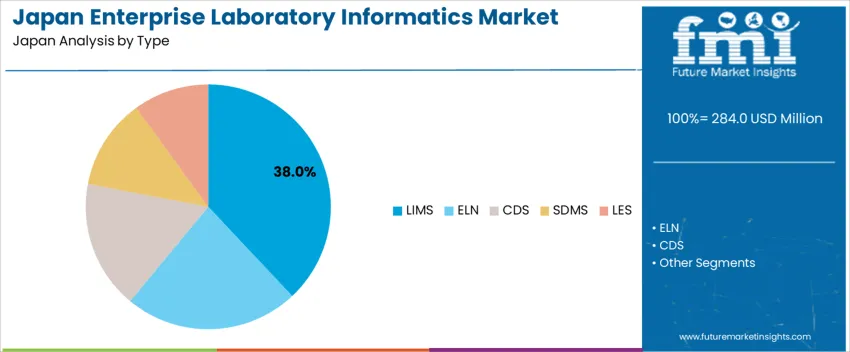

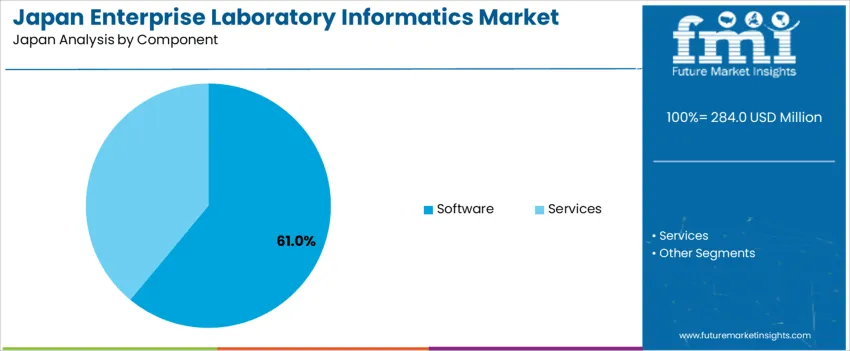

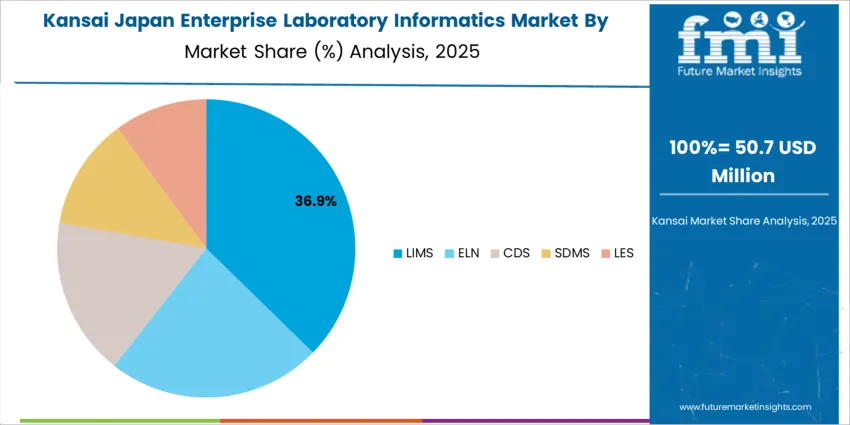

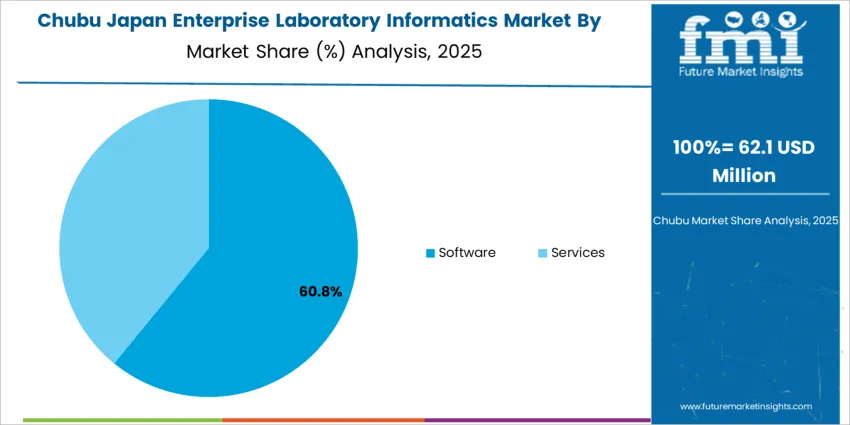

Demand for enterprise laboratory informatics in Japan is segmented by type, component, delivery, industry, and region. By type, demand is divided into LIMS (Laboratory Information Management Systems), ELN (Electronic Lab Notebooks), CDS (Chromatography Data Systems), SDMS (Scientific Data Management Systems), and LES (Laboratory Execution Systems). The demand is also segmented by component, including software and services. In terms of delivery, demand is split between cloud-based and on-premise solutions. Industry-wise, demand spans across pharma, CRO (Contract Research Organizations), biotech, CMO (Contract Manufacturing Organizations), chemical, oil, agriculture, and gas, with pharma leading the demand. Regionally, demand is distributed across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

LIMS (Laboratory Information Management Systems) account for 38% of the demand for enterprise laboratory informatics in Japan, primarily due to their ability to streamline laboratory operations, ensure compliance, and enhance data management. LIMS are widely used in industries like pharma, biotech, and chemical manufacturing for tracking samples, managing workflows, and integrating laboratory instruments with other IT systems. Their capability to automate data capture and improve efficiency in laboratory settings has driven their widespread adoption. LIMS are particularly valued for their ability to manage large volumes of data, enhance reporting accuracy, and ensure data integrity, which is critical for industries that require precise, regulatory-compliant records. As the demand for advanced laboratory automation and data management solutions grows in Japan’s highly regulated industries, LIMS are expected to remain the dominant product type, further driving the adoption of enterprise laboratory informatics solutions.

Software accounts for 61% of the demand for enterprise laboratory informatics in Japan, as it provides the foundation for managing laboratory data, workflows, and operations. Laboratory software, including LIMS, ELNs, and CDS, plays a crucial role in automating data collection, analysis, and reporting, which significantly increases operational efficiency and accuracy. As industries such as pharma, biotech, and chemical manufacturing continue to evolve and become more data-driven, the need for robust software solutions that can handle complex data and regulatory compliance requirements grows. Software solutions enable real-time data access, integration with laboratory instruments, and enhanced decision-making capabilities. The growing focus on digital transformation and automation in laboratory environments further drives the demand for software. As Japanese companies look to optimize operations, reduce costs, and improve productivity, the demand for enterprise laboratory software will continue to dominate the laboratory informatics industry.

Demand for enterprise‑grade laboratory informatics in Japan is rising as laboratories across pharmaceuticals, biotechnology, healthcare, environmental testing, chemicals, and food industries increase reliance on digital systems to manage complex data workflows. Solutions such as laboratory information management systems (LIMS), electronic lab notebooks (ELN), scientific data management systems (SDMS), and related informatics tools are being adopted to improve data integrity, traceability, compliance, and overall R&D productivity. Cloud‑based and web‑hosted deployment models gain traction, offering scalability and remote accessibility. The drive toward automation, higher throughput testing, and regulatory compliance also fuels demand.

Why is Demand for Enterprise Laboratory Informatics Growing in Japan?

Demand is growing because Japanese laboratories and research institutions face increasing data volume and complexity, especially in drug discovery, clinical research, environmental testing, and quality control. Enterprise informatics helps manage large data sets, sample tracking, test results, and regulatory documentation more efficiently while reducing human error and improving reproducibility. Growing adoption of regulatory frameworks that demand traceability and audit‑ready data drives labs to upgrade their informatics infrastructure. The need for faster turnaround, collaboration across teams, and centralized data management supports the shift from manual or legacy systems to integrated informatics solutions. The growing use of automation and digital workflows in labs pushes more organizations to implement enterprise‑wide informatics platforms.

How are Technological & Industry Innovations Driving Enterprise Laboratory Informatics Demand in Japan?

Technological advances such as cloud computing, AI‑driven data analytics, IoT integration with lab equipment, and more powerful software platforms are significantly driving demand for informatics solutions. Cloud‑based LIMS, ELN, and SDMS enable remote access, collaboration across geographies, centralized data storage, and scalable infrastructure without heavy on-premise hardware. Automation of lab processes and data capture reduces manual workload and error rates. Tools that integrate with robotics, high‑throughput screening systems, and automated sample handling enable labs to scale operations. Innovations in data analytics, machine learning, and workflow automation allow researchers to derive insights faster and more reliably. As labs modernize and digitalize, interest in integrated, enterprise‑level informatics platforms continue to grow.

What are the Key Challenges and Risks That Could Limit Enterprise Laboratory Informatics Demand in Japan?

Despite growing interest, several factors may restrain adoption of enterprise laboratory informatics in Japan. High initial costs including software licensing, customization, integration with existing equipment, and training can be prohibitive for small or mid‑sized labs. Technical complexity and the need for skilled IT support or data‑management expertise can pose a barrier. Integration with legacy systems or lab equipment can be difficult. Concerns about data security, privacy, and compliance especially when using cloud‑based systems may deter adoption in sensitive sectors like healthcare or chemicals. For labs with relatively low throughput or simple workflows, the return on investment may not justify the transition, limiting uptake.

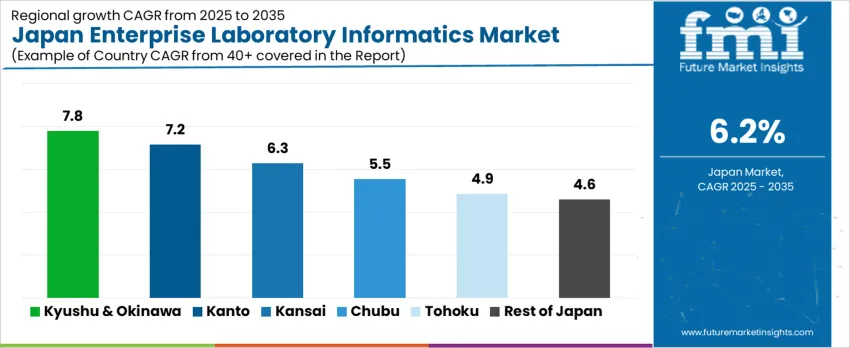

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.8% |

| Kanto | 7.2% |

| Kansai | 6.3% |

| Chubu | 5.5% |

| Tohoku | 4.9% |

| Rest of Japan | 4.6% |

Demand for enterprise laboratory informatics in Japan is growing steadily, with Kyushu & Okinawa leading at a 7.8% CAGR, driven by industrial expansion and digital adoption. Kanto follows at 7.2%, supported by its role as a hub for scientific research and innovation. Kansai shows a 6.3% CAGR, fueled by its focus on life sciences, pharmaceuticals, and healthcare. Chubu experiences a 5.5% CAGR, driven by industrial sectors like automotive and technology. Tohoku and the Rest of Japan show moderate growth at 4.9% and 4.6%, respectively, supported by regional investments in agriculture, clean energy, and industrial innovation. As Japan continues to prioritize digital transformation, demand for laboratory informatics solutions will grow steadily across the country.

Kyushu & Okinawa leads the demand for enterprise laboratory informatics, growing at a 7.8% CAGR. The region’s industrial and scientific sectors, particularly in biotechnology, agriculture, and healthcare, drive the increasing adoption of laboratory informatics solutions. As businesses in Kyushu & Okinawa seek to improve efficiency, accuracy, and data management in laboratory operations, enterprise laboratory informatics systems are becoming increasingly essential. The region’s focus on research and development, particularly in life sciences and agriculture, supports this growth. Kyushu & Okinawa's expanding healthcare sector, with an increasing emphasis on precision medicine and clinical research, contributes to the rise in demand for laboratory informatics systems. As the region’s scientific and industrial sectors continue to innovate, demand for enterprise laboratory informatics will remain strong, further supporting laboratory operations and the management of complex datasets.

Kanto is experiencing steady demand for enterprise laboratory informatics, with a 7.2% CAGR. The region’s leading role in scientific research and industrial development, particularly in biotechnology, pharmaceuticals, and medical technology, contributes to this growth. Kanto is home to a large number of research institutions, universities, and biotech firms that require robust informatics systems to manage laboratory data, streamline workflows, and enhance research capabilities. The rise in personalized medicine and clinical trials in Kanto accelerates the need for advanced informatics solutions. Kanto’s robust healthcare and pharmaceutical sectors are driving the adoption of laboratory informatics, allowing businesses to optimize laboratory operations and improve regulatory compliance. As Kanto continues to innovate in life sciences and healthcare technologies, the demand for enterprise laboratory informatics solutions will remain strong, supporting the region’s scientific and industrial progress.

Kansai is seeing moderate demand for enterprise laboratory informatics, with a 6.3% CAGR. The region’s emphasis on life sciences, pharmaceuticals, and healthcare innovation drives the need for efficient data management and laboratory automation solutions. Kansai’s growing number of research institutions, universities, and pharmaceutical companies are increasingly adopting laboratory informatics to streamline their operations, improve data accuracy, and ensure compliance with regulatory standards. The rise in research projects related to biotechnology, drug discovery, and clinical trials in Kansai contributes to the growing demand for informatics systems. Kansai’s focus on the convergence of technology and healthcare also drives the adoption of informatics solutions to enhance laboratory productivity and facilitate data-driven decision-making. As Kansai continues to grow as a hub for scientific research and development, demand for enterprise laboratory informatics is expected to expand, particularly in the pharmaceutical and healthcare sectors.

Chubu is experiencing steady demand for enterprise laboratory informatics, with a 5.5% CAGR. The region’s industrial base, particularly in automotive, electronics, and materials science, is driving the need for laboratory informatics solutions to manage complex data in research and development. Chubu’s growing focus on technology and industrial innovation, especially in the automotive sector, contributes to the adoption of informatics solutions in laboratory operations. As more companies in Chubu embrace digital transformation, laboratory informatics solutions are being implemented to enhance productivity, ensure data accuracy, and streamline research workflows. Chubu’s investment in health tech and precision manufacturing further drives the demand for enterprise laboratory informatics systems. As industrial and research sectors in Chubu continue to grow and innovate, demand for informatics solutions in laboratories will rise steadily, supporting the region’s technological advancement.

Tohoku is seeing moderate demand for enterprise laboratory informatics, with a 4.9% CAGR. The region’s industrial sectors, particularly in agriculture, manufacturing, and clean energy, are increasingly adopting laboratory informatics solutions to streamline research and improve data management. Tohoku’s emphasis on sustainable technologies and green energy solutions is driving the need for advanced data analytics and laboratory automation. The region’s focus on agriculture and biotechnology research contributes to the growing demand for informatics systems to enhance laboratory efficiency and ensure accurate data analysis. As Tohoku’s research institutions and industrial sectors continue to invest in technology, the demand for enterprise laboratory informatics systems will continue to rise, particularly in areas that rely on data-driven decision-making and innovation in agricultural and environmental sciences.

The Rest of Japan is experiencing steady demand for enterprise laboratory informatics, with a 4.6% CAGR. Although the demand is smaller compared to more industrialized regions, local businesses and research institutions are increasingly adopting informatics solutions to optimize laboratory operations. In rural and suburban areas, industries like agriculture, food processing, and environmental science are driving the need for efficient data management and lab automation. As the Rest of Japan continues to focus on improving industrial efficiency and sustainability, the demand for laboratory informatics systems is expected to rise. Local governments and small enterprises are increasingly adopting digital tools to improve research capabilities and ensure compliance with industry standards. As digital transformation continues to spread across regional industries, the demand for enterprise laboratory informatics solutions in the Rest of Japan will continue to grow steadily.

The demand for enterprise laboratory informatics in Japan is growing as industries like pharmaceuticals, biotechnology, and chemicals seek efficient ways to manage laboratory data, streamline workflows, and ensure compliance with regulatory standards. Enterprise laboratory informatics systems integrate laboratory data management, analysis, and reporting into centralized platforms, enabling organizations to optimize operations, improve decision-making, and accelerate product development. As Japan's technology-driven industries continue to advance, laboratory informatics solutions are becoming essential tools for increasing research efficiency, improving quality control, and ensuring accurate data management.

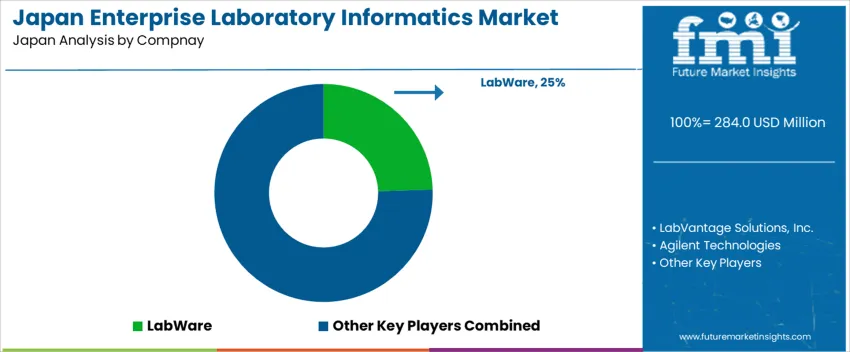

Leading companies in the enterprise laboratory informatics industry in Japan include LabWare, LabVantage Solutions, Inc., Agilent Technologies, Waters, and LabLynx. LabWare dominates the industry with a share of 24.5%, offering a comprehensive laboratory information management system (LIMS) that enhances laboratory operations and compliance. LabVantage Solutions, Inc. provides integrated LIMS and laboratory analytics solutions for industries such as life sciences, food safety, and healthcare. Agilent Technologies offers informatics software designed to integrate seamlessly with laboratory instruments, focusing on analytical data management. Waters specializes in informatics solutions to streamline laboratory data, improving the efficiency of testing and research. LabLynx offers flexible cloud-based LIMS solutions, particularly targeting small to medium-sized laboratories looking for cost-effective solutions.

Competition in this industry is driven by factors such as data integration, automation capabilities, scalability, and regulatory compliance. Companies compete by offering customizable solutions that can seamlessly integrate with existing laboratory systems, handle complex data processes, and meet industry-specific needs. As industries in Japan continue to prioritize digital transformation and research innovation, providers that offer secure, user-friendly, and efficient laboratory informatics solutions will maintain a competitive edge.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | LIMS, ELN, CDS, SDMS, LES |

| Component | Software, Services |

| Delivery | Cloud, On-premise |

| Industry | Pharma, CRO, Biotech, CMO, Chemical, Oil, Agriculture, Gas |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | LabWare, LabVantage Solutions, Inc., Agilent Technologies, Waters, LabLynx |

| Additional Attributes | Dollar sales by type, component, delivery, and industry; regional CAGR and adoption trends; demand trends in enterprise laboratory informatics; growth in pharma, biotech, and agriculture industries; technology adoption for LIMS, ELN, and other informatics solutions; vendor offerings in laboratory informatics services; regulatory influences and industry standards |

The demand for enterprise laboratory informatics in Japan is estimated to be valued at USD 284.0 million in 2025.

The market size for the enterprise laboratory informatics in Japan is projected to reach USD 519.5 million by 2035.

The demand for enterprise laboratory informatics in Japan is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in enterprise laboratory informatics in Japan are lims, eln, cds, sdms and les.

In terms of component, software segment is expected to command 61.0% share in the enterprise laboratory informatics in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Laboratory Informatics Market Analysis by Type of Solution, Component, Delivery, Industry, and Region Through 2035

Demand for Enterprise Laboratory Informatics in USA Size and Share Forecast Outlook 2025 to 2035

Japan Enterprise Internet Reputation Management Market Report – Size, Growth & Forecast 2025-2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA