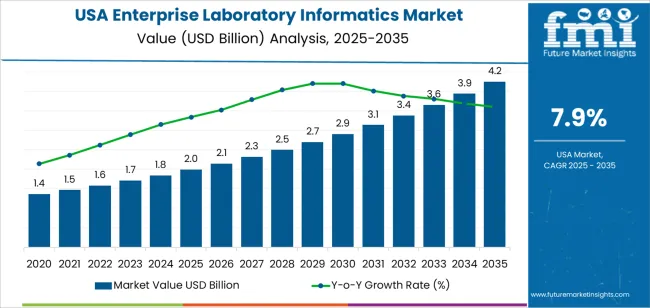

Demand for enterprise laboratory informatics in the USA is estimated at USD 2.0 billion in 2025 and is projected to reach USD 4.2 billion by 2035 at a CAGR of 7.9%. Early growth is anchored in the modernization of data workflows across pharmaceutical R&D, clinical diagnostics, and contract research organizations. Laboratories continue to replace fragmented legacy systems with unified platforms that combine LIMS, ELN, and scientific data management under centralized governance. Integration with regulatory reporting, quality control, and audit traceability remains a primary driver in highly regulated environments. Biopharma manufacturing sites and reference laboratories are the largest early adopters, as they require high data throughput while adhering to validation and documentation standards.

Beyond 2030, market expansion reflects a shift from system deployment toward enterprise-wide data orchestration. Demand rises from about USD 2.9 billion in 2030 toward USD 4.2 billion by 2035 as informatics platforms become core infrastructure for multi-site laboratory networks. Advanced analytics, workflow automation, and direct connectivity with manufacturing execution and ERP systems raise platform dependency across drug development and diagnostics chains. Academic medical centers and public health laboratories also increase adoption to support large-scale genomic and epidemiological data programs. Value growth in this phase is shaped more by higher software spend per institution than by new customer entry, as users expand module depth, data retention capacity, and cross-lab interoperability across the USA research ecosystem.

Unlike consumer-facing digital systems, enterprise laboratory informatics expands from the core of regulated scientific operations where data integrity, traceability, and audit control shape every purchasing decision. Demand in USA increases from USD 2.0 billion in 2025 to USD 2.9 billion by 2030, adding USD 0.9 billion in absolute value. This phase reflects structural modernization across pharmaceutical labs, clinical diagnostics, CROs, environmental testing, and industrial quality control. Growth is driven by replacement of fragmented legacy systems with unified LIMS, ELN, LES, and SDMS platforms. Regulatory pressure around data compliance, validation workflows, and inspection readiness makes informatics spending non-discretionary rather than optional during this period.

From 2030 to 2035, the market expands from USD 2.9 billion to USD 4.2 billion, adding a larger USD 1.3 billion within five years. This back weighted acceleration reflects the transition of laboratory informatics from record-keeping infrastructure into real-time execution and decision orchestration platforms. Advanced analytics, AI-assisted experiment design, automated compliance reporting, and direct integration with manufacturing execution systems raise value per deployment. Informatics shifts from passive data storage to active control of laboratory productivity and regulatory risk. As multi-site global trials, personalized medicine, and high-throughput testing expand, enterprise laboratory informatics becomes a core digital backbone rather than a supporting IT layer.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 2.0 billion |

| Forecast Value (2035) | USD 4.2 billion |

| Forecast CAGR (2025–2035) | 7.9% |

The enterprise laboratory informatics sector in the USA expanded as laboratories across life sciences, diagnostics, environmental testing, and food and chemical industries sought to manage growing volumes of scientific data, regulatory paperwork, and workflow complexity. As laboratories scaled up testing throughput and diversified assays, traditional manual record-keeping and disparate spreadsheets became inadequate. Informatics platforms including laboratory information management systems (LIMS), electronic lab notebooks (ELN), scientific data management systems (SDMS), and laboratory execution systems (LES) offered unified data handling, audit trails, sample tracking, and instrument integration. Adoption rose sharply among pharmaceutical firms, contract research organizations, academic labs, and diagnostics providers, who needed to standardize processes, improve reproducibility, and ensure compliance across multiple studies and sites. Data integration from instruments, traceability of sample provenance, and digital documentation replaced paper logs, reducing error risk and accelerating throughput.

Looking ahead, demand for enterprise-grade laboratory informatics in the USA will be shaped by increasing complexity of R&D pipelines, regulatory scrutiny, and technological convergence. Growth in biologics, personalized medicine, genomic and proteomic research, and high-throughput screening requires systems capable of handling large datasets, cross-functional collaboration, and real-time analytics. Cloud-based informatics, AI-driven data analytics, and interconnectivity with ERP or manufacturing systems will expand use beyond pure research to quality control, environmental monitoring, and industrial applications. Regulatory tightening on data integrity, electronic signatures, and auditability will push labs toward validated informatics platforms. However, adoption may be constrained by costs of implementation, integration challenges with legacy systems, data security concerns, and shortage of skilled lab IT professionals. Market evolution will depend on balancing compliance, cost, and flexibility while managing scale and data complexity in scientific workflows.

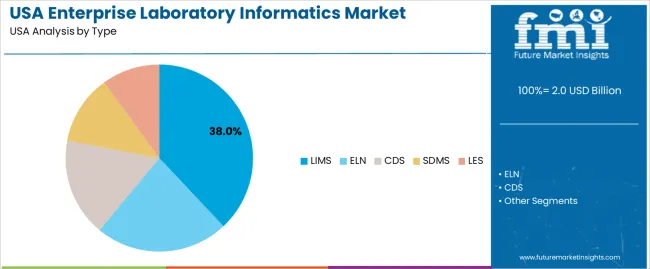

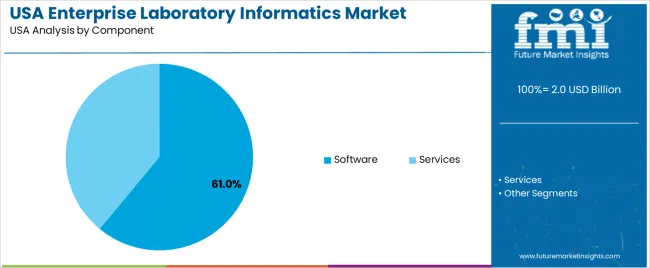

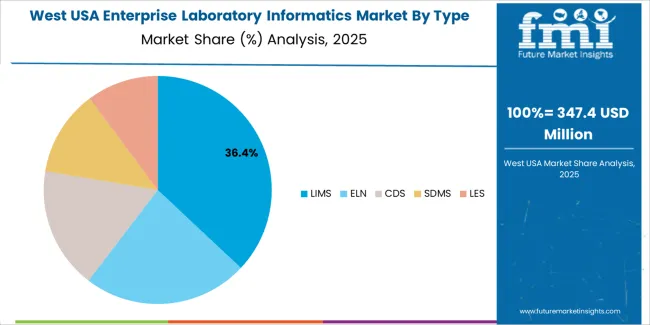

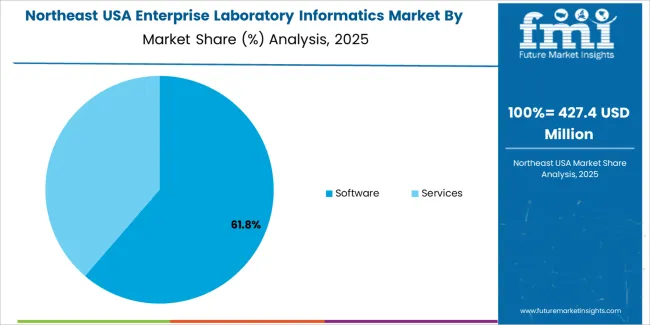

The demand for enterprise laboratory informatics in the USA is structured by system type and component. Laboratory information management systems account for 38% of total demand, followed by electronic lab notebooks, chromatography data systems, scientific data management systems, and laboratory execution systems. By component, software represents 61.0% of total spending, followed by services focused on implementation, integration, validation, and support. Demand behavior is shaped by regulatory compliance pressure, rising data volumes, automation needs, and system interoperability requirements. These segments reflect how digital laboratory operations and data governance priorities define informatics investment across research, pharmaceutical, diagnostics, and industrial laboratories in the USA.

LIMS accounts for 38% of total enterprise laboratory informatics demand in the USA due to its central role in sample tracking, workflow control, and compliance documentation. Laboratories rely on LIMS to manage accessioning, testing workflows, result validation, and audit trails under regulated operating conditions. Pharmaceutical quality control labs, diagnostics centers, environmental testing facilities, and food safety laboratories depend on LIMS for standardized process execution and traceability across large sample volumes.

LIMS platforms also serve as the integration backbone between instruments, data repositories, and enterprise systems such as ERP and quality management platforms. Configuration flexibility allows adaptation to evolving testing protocols and regulatory updates. Replacement demand remains steady as legacy systems face end of support and cybersecurity risks. These compliance, integration, and operational control factors position LIMS as the leading system type in the USA enterprise laboratory informatics landscape.

Software accounts for 61.0% of total enterprise laboratory informatics demand in the USA due to direct investment in licenses, subscriptions, and platform upgrades. Laboratories prioritize core informatics software to support data capture, workflow automation, compliance reporting, and analytics. Software spend increases with the expansion of instrument connectivity, cloud deployment, and cybersecurity safeguards embedded within informatics architectures.

Software platforms also require periodic upgrading to maintain regulatory alignment, security patching, and performance optimization. Multi-site organizations expand license volumes as laboratory networks grow through acquisition and capacity expansion. While services remain essential for validation and integration, software represents the primary recurring investment over the system lifecycle. These license driven revenue models, upgrade cycles, and scalability requirements position software as the dominant component within the USA enterprise laboratory informatics ecosystem.

Demand for enterprise laboratory informatics in the USA is driven by the scale, complexity, and compliance burden of modern laboratory operations across pharmaceuticals, clinical diagnostics, biotechnology, and contract research. Laboratories manage rising data volumes from high-throughput instruments, multi-site testing networks, and regulated workflows. Manual data handling creates audit risk, processing delays, and reproducibility concerns. Consolidation of healthcare systems and life science research networks also increases the need for unified data control. These operational pressures position enterprise informatics as infrastructure for data governance rather than optional productivity software.

In clinical diagnostics, informatics platforms manage specimen tracking, result validation, billing linkage, and regulatory reporting across high sample volumes. Pharmaceutical research uses these systems to control experimental workflows, compound libraries, and analytical data integrity. Contract research organizations depend on informatics to coordinate multi-sponsor studies, maintain chain of custody, and ensure audit-ready documentation. Centralized data environments also support collaboration between internal teams and external partners. These regulated, data-intensive environments require traceability, permission control, and structured workflows that drive sustained enterprise informatics demand.

Enterprise laboratory informatics adoption in the USA is restrained by high implementation cost, complex system integration, and organizational resistance to workflow change. Legacy instruments often use proprietary data formats that complicate platform integration. Migration from paper or fragmented digital tools requires extensive data validation and staff retraining. Smaller laboratories struggle to justify investment against near-term budget constraints. Cybersecurity and patient data protection requirements also raise infrastructure cost. These financial and operational barriers slow uniform adoption across mid-tier labs despite clear efficiency and compliance advantages.

Enterprise laboratory informatics in the USA is shifting toward cloud-based architectures that allow multi-site access, elastic data storage, and faster system updates. Automation links informatics platforms with robotic sample handling, digital imaging, and real-time instrument feeds. Interoperability layers now connect laboratory data with hospital EHR systems and pharmaceutical analytics platforms. Advanced audit trails, role-based security, and predictive quality alerts strengthen compliance control. These trends show enterprise informatics evolving from standalone lab software into connected digital backbone systems for regulated scientific operations.

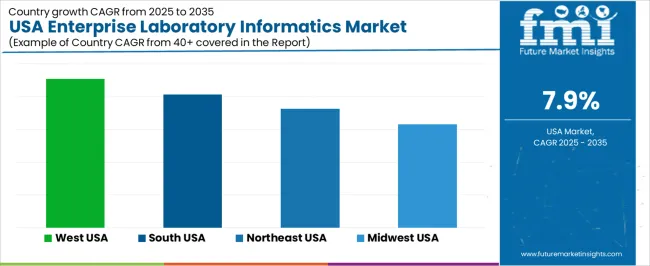

| Region | CAGR (%) |

|---|---|

| West | 9.1% |

| South | 8.1% |

| Northeast | 7.3% |

| Midwest | 6.3% |

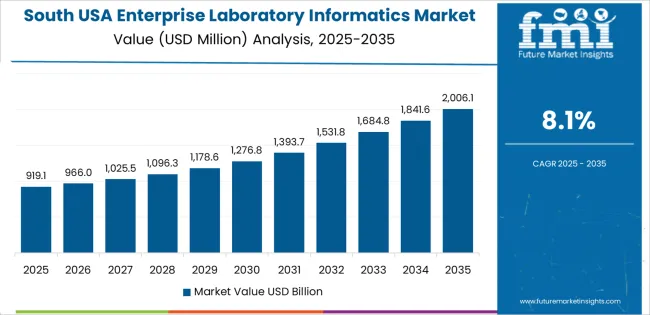

The demand for enterprise laboratory informatics in the USA is growing steadily across all regions, with the West leading at a 9.1% CAGR. This growth is supported by strong presence of biotechnology firms, pharmaceutical R&D centers, and advanced clinical laboratories that rely on integrated data management systems. The South follows at 8.1%, driven by expanding healthcare networks, contract research organizations, and diagnostic laboratories seeking workflow automation. The Northeast records 7.3% growth, supported by dense concentration of academic research institutions, hospitals, and regulated laboratory environments. The Midwest shows comparatively moderate growth at 6.3%, reflecting steady adoption among manufacturing quality labs, food testing facilities, and regional healthcare providers transitioning toward digital laboratory management platforms.

What Is Driving Enterprise Laboratory Informatics Demand in the West Region of USA?

Expansion in the West reflects a CAGR of 9.1% through 2035 for enterprise laboratory informatics demand, supported by strong concentration of biotechnology firms, pharmaceutical research centers, and diagnostics laboratories. Genomics, proteomics, and clinical trial data management require integrated informatics platforms for workflow control and regulatory documentation. Digital health startups and contract research organizations continue to expand laboratory automation scope. Cloud deployment supports multi site data access across collaborative research networks. Demand remains research workflow driven rather than routine testing driven, with emphasis on data integrity, audit readiness, and real time analytical reporting across advanced life science clusters.

How Is the South Supporting Enterprise Laboratory Informatics Demand in USA?

The South advances at a CAGR of 8.1% through 2035 for enterprise laboratory informatics demand, driven by growth in hospital laboratories, public health testing facilities, and pharmaceutical manufacturing quality control operations. Clinical diagnostics networks expand laboratory information systems to manage rising patient testing volumes. Vaccine production, biologics manufacturing, and environmental testing contribute steady industrial demand. Health system consolidation increases the need for unified laboratory data platforms. Demand remains operations driven, aligned with testing throughput growth and regulatory reporting requirements across healthcare, manufacturing, and public sector laboratory environments.

Why Is Enterprise Laboratory Informatics Demand Rising Steadily in the Northeast Region of USA?

The Northeast records a CAGR of 7.3% through 2035 for enterprise laboratory informatics demand, shaped by academic medical centers, pharmaceutical research hubs, and clinical diagnostics networks. Teaching hospitals and university laboratories deploy informatics systems for research data governance and patient sample tracking. Drug discovery programs require structured laboratory execution systems for compliance documentation. Urban diagnostic service providers maintain high transaction volumes. Demand remains compliance and data governance driven, with upgrades focused on validation, cybersecurity, and interoperability across multi-vendor laboratory instrument environments.

What Is Influencing Enterprise Laboratory Informatics Demand in the Midwest Region of USA?

The Midwest expands at a CAGR of 6.3% through 2035 for enterprise laboratory informatics demand, supported by manufacturing quality laboratories, agricultural testing centers, and regional hospital networks. Food safety testing, materials analysis, and environmental monitoring require structured sample tracking and reporting platforms. Industrial laboratories adopt informatics to support certification and compliance documentation. Cost sensitivity influences preference for modular system deployments. Demand remains function driven and predictable, aligned with steady industrial testing volumes, agricultural quality programs, and regional healthcare diagnostic operations rather than advanced research intensity.

Demand for enterprise laboratory informatics in the USA is rising as laboratories confront growing volumes of data, increasing regulatory requirements, and the need for greater efficiency in research and quality control workflows. Laboratories in pharmaceuticals, biotech, environmental testing, and food and beverage sectors require robust systems to manage sample tracking, data integrity, reporting, and compliance. The expansion of high throughput screening, genomics, personalized medicine, and environmental regulation intensifies reliance on informatics platforms. Cloud native deployment, automation, and integration of lab equipment contribute to rising adoption. Facilities seek solutions that unify data across instruments, support audit trails, and enable remote access driving demand for comprehensive informatics suites.

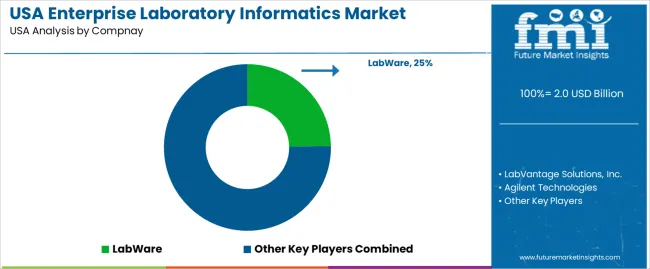

Principal providers shaping the US market include LabWare, LabVantage Solutions, Inc., Agilent Technologies, Waters Corporation, and LabLynx. LabWare offers scalable Laboratory Information Management Systems (LIMS) used by pharmaceutical firms, environmental labs, and testing services. LabVantage supplies integrated LIMS, electronic lab notebook (ELN), scientific data management and analytics capabilities, appealing to biotech, CROs, and quality control operations. Agilent and Waters provide informatics linked to analytical and instrumentation platforms useful for analytical chemistry, quality control, and R&D labs. LabLynx serves smaller and specialized labs with flexible, cloud based LIMS solutions. Together these firms deliver a mix of enterprise grade, scalable, and modular solutions, shaping the informatics landscape across research, industrial, and regulatory laboratories.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | LIMS, ELN, CDS, SDMS, LES |

| Component | Software, Services |

| Delivery | Cloud, On-premise |

| Industry | Pharma, CRO, Biotech, CMO, Chemical, Oil, Agriculture, Gas |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | LabWare, LabVantage Solutions, Agilent Technologies, Waters, LabLynx |

| Additional Attributes | Dollar by sales by type, Dollar by sales by component, Dollar by sales by delivery, Dollar by sales by industry, Regional CAGR, Cloud adoption trends, Regulatory compliance impact, Workflow automation integration, Multi-site deployment and scalability |

The demand for enterprise laboratory informatics in USA is estimated to be valued at USD 2.0 billion in 2025.

The market size for the enterprise laboratory informatics in USA is projected to reach USD 4.2 billion by 2035.

The demand for enterprise laboratory informatics in USA is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in enterprise laboratory informatics in USA are lims, eln, cds, sdms and les.

In terms of component, software segment is expected to command 61.0% share in the enterprise laboratory informatics in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Laboratory Informatics Market Analysis by Type of Solution, Component, Delivery, Industry, and Region Through 2035

USA Enterprise Internet Reputation Management Market Analysis – Size, Share & Innovations 2025-2035

Enterprise Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA