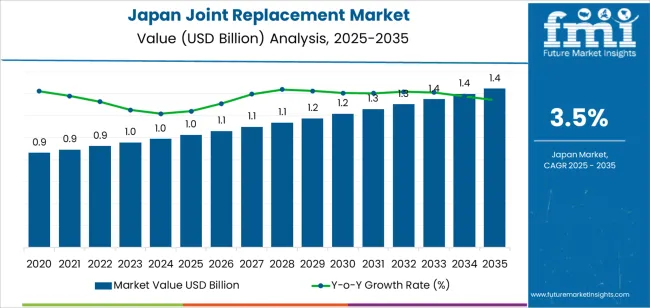

The Japan joint replacement demand is valued at USD 1.0 billion in 2025 and is forecasted to reach USD 1.4 billion by 2035, reflecting a CAGR of 3.5%. Demand is shaped by an ageing population, increased prevalence of osteoarthritis, and broader utilisation of reconstructive procedures in orthopaedic centres. Rising awareness of mobility preservation, expanded access to specialised surgical care, and continued improvements in implant materials also contribute to uptake. Hospitals and rehabilitation facilities emphasise durability, postoperative recovery efficiency, and long-term functional outcomes, which influence implant-selection behaviour.

Knee replacements lead the replacement landscape. These procedures are selected due to high incidence of degenerative knee disorders, improved implant longevity, and refined surgical techniques that support predictable recovery. Advancements in biomaterials, fixation methods, and patient-specific instrumentation strengthen adoption in both high-volume surgical units and regional medical centres.

Kyushu & Okinawa, Kanto, and Kinki record the highest utilisation levels due to concentrated hospital networks, orthopaedic surgery departments, and rehabilitation infrastructure. These regions also maintain strong distribution channels for implant systems and postoperative care services. Key suppliers include Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith+Nephew, and DJO, LLC. These companies provide knee, hip, shoulder, and other reconstructive systems used across primary and revision joint replacement procedures.

Saturation-point analysis shows that demand moves toward a mature utilisation range shaped by demographic stability and established surgical-care pathways. From 2025 to 2029, procedure volumes increase steadily as ageing-related osteoarthritis, mobility impairment, and post-trauma conditions sustain the need for hip and knee implants. Hospitals and orthopaedic centres maintain consistent procurement of standard and premium implant systems, creating a clear early-period rise supported by routine case flow.

Between 2030 and 2035, the segment approaches a controlled saturation phase. Growth becomes more moderate as surgical volumes align with stable population ageing trends and longer implant lifespans reduce replacement frequency. Incremental gains arise from demand for minimally invasive approaches, advanced polyethylene bearings, and lighter alloy components, but these do not produce sharp expansion. The use of robotic-assisted surgery and preoperative planning software supports procedural consistency rather than additional volume. The resulting saturation profile reflects a segment anchored in predictable clinical utilisation, where long implant cycles, stable case-mix patterns, and mature orthopaedic infrastructure shape steady long-term demand across Japan.

| Metric | Value |

|---|---|

| Japan Joint Replacement Sales Value (2025) | USD 1.0 billion |

| Japan Joint Replacement Forecast Value (2035) | USD 1.4 billion |

| Japan Joint Replacement Forecast CAGR (2025-2035) | 3.5% |

Demand for joint replacement surgery in Japan is increasing as the population ages and the prevalence of osteoarthritis, rheumatoid arthritis and joint trauma rises. Hip, knee and shoulder replacements are the most common procedures, and Japanese hospitals expand orthopaedic service capacity to meet growing patient volumes. Advances in implant materials, surgical techniques, robot-assisted surgery and enhanced rehabilitation protocols improve outcomes, reduce hospital stay and encourage earlier intervention.

Increasing patient awareness, higher healthcare access in non-metropolitan areas and government policies supporting musculoskeletal health contribute to demand growth. Constraints include long surgical wait times in some regions, high cost of implants and rehabilitation, and cautious eligibility criteria that may delay surgical intervention. Some rural hospitals may lack specialised orthopaedic surgeons or infrastructure for complex joint-replacement procedures.

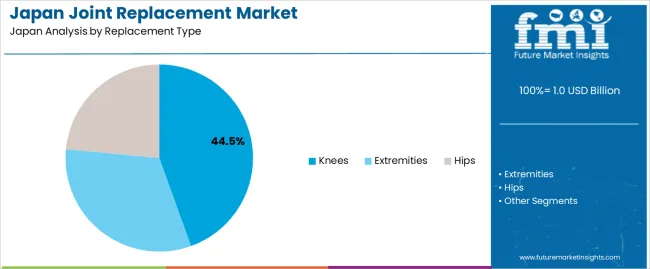

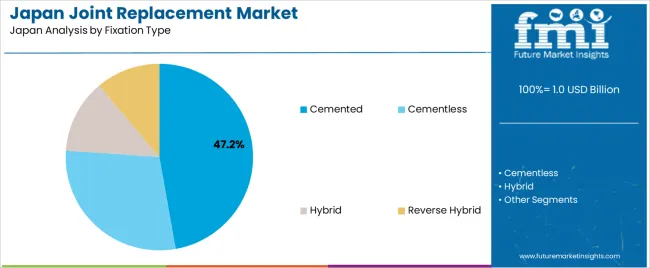

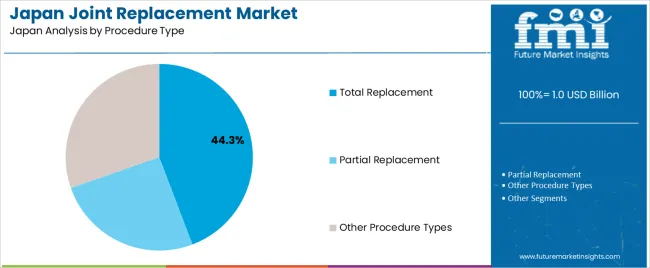

Demand for joint replacement in Japan reflects an ageing population, increased musculoskeletal disorders, and adoption of advanced implant technologies across orthopaedic care. Replacement-type selection depends on joint degeneration patterns, mobility needs, and long-term functional outcomes. Fixation-type preferences relate to bone quality, implant stability, and surgeon familiarity with different anchoring methods. Procedure-type distribution highlights how full and partial joint reconstructions address varying stages of joint deterioration.

Knee replacements hold 44.5% of national demand and represent the leading replacement type. This reflects the high prevalence of knee osteoarthritis and the need for procedures that restore mobility and reduce chronic pain. Extremities account for 32.0%, covering shoulder, ankle, wrist, and elbow replacements used for degenerative or traumatic conditions. Hip replacements represent 23.5%, supporting patients with degenerative hip disease requiring restored joint function and improved stability. Replacement-type distribution aligns with differences in joint load, cartilage wear, and activity levels across Japanese patients, contributing to varied surgical volumes across orthopaedic centres.

Key drivers and attributes:

Cemented fixation holds 47.2% of national demand and represents the dominant fixation method. Cemented implants provide immediate stability and are widely used for older adults with reduced bone density. Cementless fixation represents 28.9%, supporting biological bone ingrowth where long-term stability is preferred, particularly in younger or more active patients. Hybrid fixation accounts for 12.8%, combining cemented and cementless components to balance stability and natural fixation. Reverse-hybrid fixation represents 11.1%, applying reverse component anchoring strategies in specific clinical cases. Fixation-type distribution reflects bone-quality considerations, surgical preferences, and implant performance requirements across Japan’s orthopaedic facilities.

Key drivers and attributes:

Total joint replacement holds 44.3% of national demand and represents the leading procedure category. This approach fully reconstructs damaged joints and supports improved mobility for patients with advanced degeneration. Partial replacement accounts for 25.4%, serving individuals with localised damage where joint preservation remains possible. Other procedure types represent 30.4%, covering resurfacing, revision surgeries, and specialised reconstructions. Procedure-type distribution reflects the severity of joint deterioration, patient functional expectations, and clinical assessments guiding surgical planning across Japanese orthopaedic systems.

Key drivers and attributes:

Japan has one of the highest proportions of older adults globally, and joint degeneration, especially in knees and hips is more frequent in older age. This demographic shift increases the number of patients seeking surgical intervention to restore mobility and reduce pain. Growing awareness of joint health, healthcare access improvements and advances in surgical techniques make joint replacement more acceptable as a treatment option.

Even though joint replacement is well established, some patients and clinicians delay surgery in favour of conservative treatment such as physical therapy or injections. Reimbursement policies may cap or limit speed of expansion in some regions, and hospital resource constraints (for operating theatres or rehabilitation beds) can restrict throughput. These factors moderate near-term growth despite structural demand.

Surgical providers in Japan are adopting minimally invasive joint-replacement techniques and robotic-assisted systems that reduce hospital stay and improve patient outcomes, which makes surgery feasible for older or more frail patients. An ageing implanted-population leads to higher demand for revision procedures in the future. Implant manufacturers are launching advanced materials such as highly cross-linked polyethylene, ceramic bearings and custom anatomies which appeal to Japanese surgeons and patients seeking longer implant life and better functionality. These developments support steady growth in the joint-replacement industry in Japan.

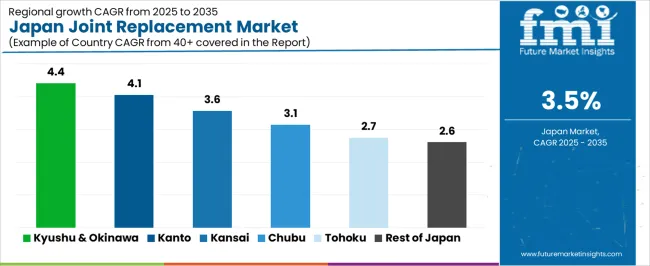

Demand for joint-replacement procedures in Japan is increasing through 2035 as aging demographics, higher osteoarthritis prevalence, and wider access to orthopedic care drive growth across hospitals and specialized surgical centers. Rising mobility impairment among older adults increases the need for hip, knee, and shoulder replacement interventions. Advances in minimally invasive techniques, improved implant materials, and broader reimbursement support also encourage sustained adoption. Regional variation reflects differences in age distribution, healthcare-facility density, and availability of orthopedic specialists. The Kyushu & Okinawa region leads with 4.4%, followed by Kanto (4.1%), Kinki (3.6%), Chubu (3.1%), Tohoku (2.7%), and the Rest of Japan (2.6%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.4% |

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.1% |

| Tohoku | 2.7% |

| Rest of Japan | 2.6% |

Kyushu & Okinawa grows at 4.4% CAGR, influenced by a relatively high share of elderly residents and strong reliance on orthopedic services across Fukuoka, Kumamoto, and Kagoshima. Hospitals and specialized clinics report rising surgical volumes as age-related joint degeneration increases across urban and rural districts. Rehabilitation centers expand capacity to support postoperative therapy, improving access and reducing procedure delays. Regional medical institutions adopt improved implant materials designed for longer service life, supporting demand from active older adults. Expanding diagnostic screening for arthritis and joint deterioration contributes to earlier surgical referrals.

Kanto grows at 4.1% CAGR, supported by the country’s largest concentration of hospitals, orthopedic specialists, and diagnostic centers across Tokyo, Kanagawa, Chiba, and Saitama. High patient inflow from surrounding prefectures sustains steady surgical activity. Facilities adopt robot-assisted and navigation-guided joint-replacement systems that improve precision and shorten recovery times. Growing outpatient surgery programs increase accessibility for knee and shoulder procedures. Aging populations in suburban districts also expand the patient base requiring surgical intervention.

Kinki grows at 3.6% CAGR, driven by established multi-specialty hospitals and regional orthopedic networks across Osaka, Kyoto, Hyogo, and Nara. Joint-replacement demand is supported by strong uptake of minimally invasive techniques, which reduce hospitalization time and improve procedural efficiency. Medical universities in the region support training and development of orthopedic surgeons, strengthening long-term capacity. Rehabilitation providers expand physiotherapy programs tailored for hip and knee recovery, supporting the growing surgical population.

Chubu grows at 3.1% CAGR, supported by a stable elderly population and strong healthcare infrastructure across Aichi, Shizuoka, and Gifu. Hospitals adopt standardized surgical pathways that reduce recovery times and increase procedural throughput. Manufacturers located in Aichi and nearby areas collaborate with hospitals to evaluate new implant materials and fixation technologies. Rural prefectures within Chubu experience rising demand as mobility-related conditions progress among older residents with limited access to conservative treatment options.

Tohoku grows at 2.7% CAGR, influenced by a high elderly share but lower hospital density across Aomori, Miyagi, Iwate, and Akita. Orthopedic departments expand capacity for hip and knee surgeries as degenerative conditions rise. Regional medical centers develop referral networks to handle complex cases requiring joint reconstruction. Rehabilitation-service availability is increasing, allowing more patients to complete postoperative recovery closer to home. The spread of arthritis-screening programs in community clinics drives earlier diagnosis.

The Rest of Japan grows at 2.6% CAGR, shaped by stable aging demographics, moderate hospital capacity, and increased availability of community rehabilitation services. Smaller hospitals perform rising numbers of primary joint-replacement surgeries for hip and knee degeneration. Regional clinics adopt improved imaging for better assessment of joint deterioration. Municipal health programs encourage arthritis management, increasing referrals for surgical evaluation. Although growth is moderate, consistent population aging supports long-term procedural demand.

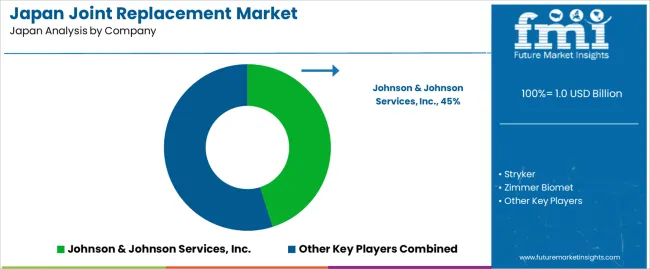

Demand for joint-replacement solutions in Japan is shaped by a concentrated group of orthopedic-device manufacturers supporting hip, knee, shoulder, and extremity reconstruction across hospitals and specialized surgical centres. Johnson & Johnson Services, Inc. holds the leading position with an estimated 45.1% share, supported by controlled implant engineering, consistent material performance, and widespread adoption of established prosthetic systems. Its position is reinforced by predictable fixation behaviour, verified biocompatibility, and dependable integration within Japan’s orthopedic-surgery pathways.

Stryker and Zimmer Biomet follow as significant participants. Stryker provides joint-replacement systems with documented kinematic stability and reliable component precision suited to high-volume knee and hip procedures. Zimmer Biomet supports broad clinical use through implants characterised by controlled wear properties, stable articulation surfaces, and consistent surgeon-preferred instrumentation.

Smith+Nephew maintains a presence through reconstruction systems emphasizing controlled soft-tissue balance and validated implant geometries, supporting both conventional and minimally invasive procedures. DJO, LLC. adds capability with reconstruction products tailored to select joint categories and revision cases, offering steady mechanical reliability and compatibility with diverse patient-anatomy requirements.

Competition across this segment centres on implant-material performance, long-term durability, fixation stability, articulation accuracy, and availability of comprehensive surgical instrumentation. Demand continues to grow as Japan’s ageing population drives procedure volumes and healthcare providers prioritise high-reliability joint-replacement systems that support mobility restoration and consistent postoperative outcomes across varied patient groups.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Replacement Type | Extremities, Knees, Hips |

| Fixation Type | Cemented, Cementless, Hybrid, Reverse Hybrid |

| Procedure Type | Total Replacement, Partial Replacement, Other Procedure Types |

| End User | Hospitals, Orthopedic Clinics, Other End-uses |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith+Nephew, DJO, LLC |

| Additional Attributes | Dollar sales by replacement type, fixation approach, and procedure category; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of joint implant manufacturers; advancements in biocompatible materials, cementless fixation designs, robotic-assisted joint replacement, and minimally invasive surgical techniques; integration with hospital orthopedic departments, specialty joint clinics, and rehabilitation-focused care pathways across Japan. |

The demand for joint replacement in japan is estimated to be valued at USD 1.0 billion in 2025.

The market size for the joint replacement in japan is projected to reach USD 1.4 billion by 2035.

The demand for joint replacement in japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in joint replacement in japan are knees, extremities and hips.

In terms of fixation type, cemented segment is expected to command 47.2% share in the joint replacement in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

Demand for Joint Replacement in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA