The demand for joint replacement in USA is valued at USD 7.1 billion in 2025 and is projected to reach USD 11.0 billion by 2035, reflecting a compound annual growth rate of 4.5%. Growth is shaped by increasing procedural volumes across hip, knee and shoulder replacements, driven by aging demographics and rising prevalence of degenerative joint conditions. Steady clinical adoption continues across hospitals and orthopedic centers where improved implant materials and surgical workflows support predictable outcomes. As rehabilitation programs expand and surgical waiting lists stabilize, demand remains consistent across primary and revision procedures. These factors reinforce a gradual upward path for joint replacement utilization across USA’s healthcare system.

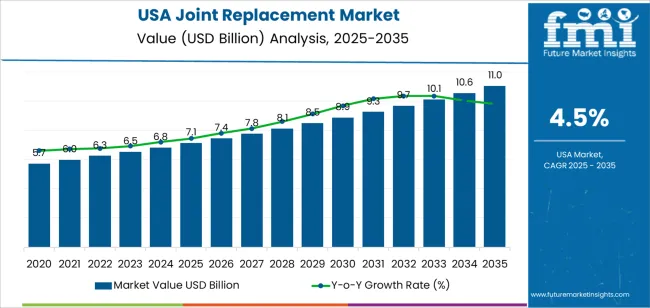

The growth curve exhibits a smooth upward pattern, beginning at USD 5.7 billion in earlier years and rising to USD 7.1 billion in 2025 before progressing toward USD 11.0 billion by 2035. Yearly increases follow regular spacing, with values advancing from USD 7.4 billion in 2026 to USD 7.8 billion in 2027 and continuing with similar increments throughout the timeline. This progression reflects stable procedural demand anchored in established clinical protocols and consistent orthopedic caseloads. As surgical centers expand capacity and patient populations age, joint replacement demand maintains predictable momentum without sharp accelerations or decelerations. The curve’s shape highlights a mature but steadily advancing segment driven by continual need for mobility restoration across USA.

Demand in USA for joint replacement is expected to rise from USD 7.1 billion in 2025 to USD 11.0 billion by 2035, representing a compound annual growth rate (CAGR) of approximately 4.5%. Starting at USD 5.7 billion in 2020, the value increases gradually to USD 6.8 billion in 2024 and hits USD 7.1 billion in 2025. Over the subsequent decade the value climbs steadily passing USD 8.5 billion by 2030 and ultimately reaches USD 11.0 billion by 2035. Growth is driven by ageing demographics, rising prevalence of osteoarthritis and other joint disorders, broader adoption of minimally invasive procedures, and technological innovation in implants and surgical techniques.

From 2025 to 2035 the overall value uplift is USD 3.9 billion. Early in the decade the increase is largely volume led as more procedures are performed and more healthcare providers adopt joint replacement solutions. In the later years, value growth becomes increasingly significant due to adoption of premium implants, revision surgeries, and advanced surgical systems (such as robotics and custom implants) that allow higher per procedure spend. Suppliers who focus on differentiated technologies, enhanced clinical outcomes and broader access will be best positioned to capture the incremental growth toward USD 11.0 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 7.1 billion |

| Forecast Value (2035) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The demand for joint replacement in USA is rising as more individual’s experience chronic joint conditions linked to aging, obesity and long-term mechanical strain. Hip, knee and shoulder replacements are common in older adults seeking improved mobility and pain relief, but demand is also increasing among younger, active patients who want to maintain functional lifestyles. Hospitals and orthopedic centres perform growing numbers of primary joint replacements as diagnostic pathways identify conditions earlier and treatment expectations shift toward restoring quality of life. Outpatient and ambulatory surgical settings support this trend by offering shorter stays and structured rehabilitation programmes, which encourage more patients to pursue surgical solutions. Rising awareness of treatment options and improved preoperative screening also expand candidate pools for joint replacement procedures.

Growth is also shaped by system-wide efforts to manage disability and reduce long-term healthcare burdens. Employers, insurers and care networks recognise the impact of untreated joint disorders on productivity and overall health, which reinforces support for timely surgical intervention. Many facilities have dedicated joint replacement programmes that standardise workflows to deliver predictable outcomes and reduce complications. Enhanced recovery approaches and improved implant reliability allow patients to return to daily activities sooner, reinforcing confidence in joint replacement as an effective treatment pathway. Cost pressures, surgical capacity and revision risks remain challenges, yet the broad need for improved joint function ensures steady demand for joint replacement in USA.

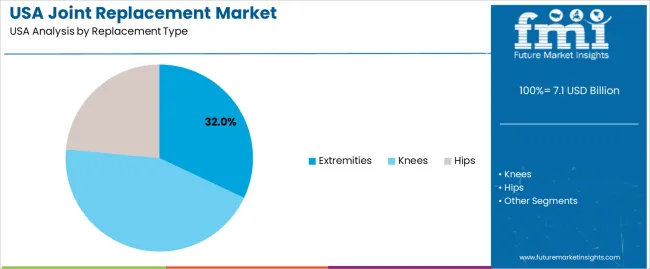

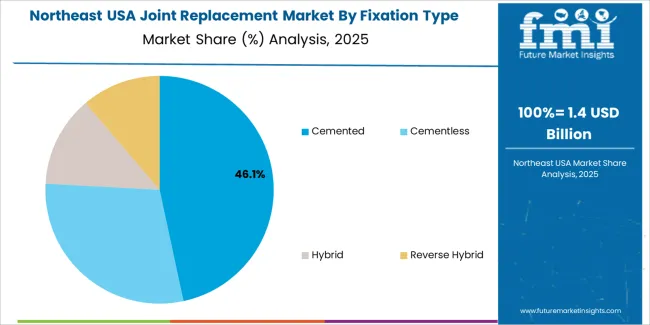

The demand for joint replacement in USA is shaped by the replacement types used across orthopedic procedures and the fixation methods selected for implant stability. Replacement types include extremities, knees and hips, each reflecting different patient needs and clinical priorities. Fixation categories such as cemented, cementless, hybrid and reverse hybrid support varied bone conditions, healing patterns and surgical approaches. As orthopedic care emphasizes predictable outcomes, mobility restoration and long-term implant performance, the combination of anatomical replacement area and fixation technique guides overall demand across surgical centers and hospitals in USA.

Extremities account for 32% of total demand within the replacement type categories. This leading position reflects ongoing need for procedures involving shoulders, ankles, elbows and small joints affected by injury, degeneration or chronic conditions. These replacements help restore functional movement and support daily tasks. Providers value the ability to address localized joint impairment, which often requires smaller implants and refined surgical techniques. Extremity procedures suit a wide range of patients, including those seeking targeted mobility improvement without larger reconstructive surgeries. These characteristics sustain steady reliance on extremity replacements across orthopedic practices.

Demand for extremity replacements continues to expand as diagnostic practices identify joint issues earlier and patients pursue interventions that preserve mobility. The procedures support predictable recovery timelines and suit individuals aiming to maintain activity levels. Improvements in implant geometry and surface finishes reinforce stable performance across varied joint types. As outpatient orthopedic care grows and clinicians refine minimally invasive approaches, extremity replacements remain an important segment shaping overall demand for joint replacement services in USA.

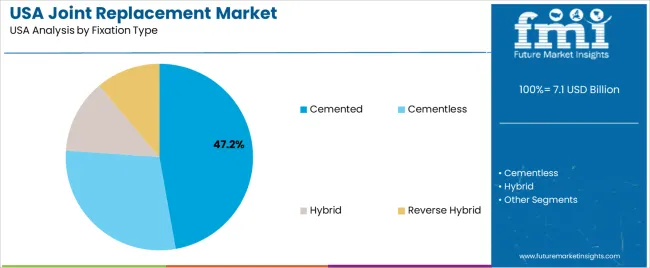

Cemented fixation accounts for 47.2% of total demand within fixation categories. Its leading share reflects dependable implant stability and suitability for patients with reduced bone density or limited remodeling capacity. Surgeons rely on cemented fixation to achieve immediate anchoring, which supports early weight-bearing and predictable postoperative outcomes. The technique offers controlled placement and consistent performance across varied patient profiles, contributing to its steady use in multiple joint replacement procedures.

Demand for cemented fixation rises as orthopedic teams treat older populations who benefit from secure implant seating. The technique supports reliable integration without depending heavily on bone growth, which assists in managing complex cases. Facilities value the predictable handling characteristics of cemented systems and their compatibility with established surgical workflows. As many joint replacements require dependable fixation under diverse anatomical conditions, cemented fixation maintains its position as the most widely used approach across USA.

Demand for joint replacement procedures in the USA is being driven by an ageing population, rising incidence of osteoarthritis and joint degeneration, and growing preference for restoring mobility and quality of life with surgical interventions. Technological advances in implant design, minimally invasive approaches and outpatient settings support adoption. At the same time, barriers include cost pressures, surgical workforce availability, reimbursement limits and concerns about revision rates. These factors together determine how rapidly joint replacement procedures expand across different patient segments in the USA.

Shifting demographics particularly the growing number of older adults and increasing prevalence of obesity and chronic joint disease create higher volumes of patients eligible for hip, knee or other joint replacements. Meanwhile clinical practice is evolving: more procedures are being done in ambulatory surgical centres, implants are tailored and technologies like robotics or navigation assist surgery, and patients expect shorter recovery. These shifts combine to raise demand for joint replacement services in the USA as both primary and revision surgeries grow.

Growth opportunities exist in segments such as younger patients undergoing joint replacement, outpatient surgery settings, minimally invasive implant options and extremity joints (shoulder, ankle, wrist) beyond hip and knee. Also, the revision replacement segment is expanding as earlier replacements reach end-of-life and newer implants become available. Device manufacturers and service providers who can offer advanced implants, modular systems and comprehensive perioperative care packages may capture increased demand in these growth niches within the USA market.

Despite strong demand drivers, several obstacles temper rapid expansion of joint replacement in the United States. High costs of implants and surgical services especially for newer technologies may deter some patients or payers. Access to care in rural or underserved regions, patient comorbidities (such as obesity or cardiac risk) and the need for revision surgeries all add complexity. In addition, outcome expectations and implant longevity concerns influence decision-making by both surgeons and patients. These elements moderate how broadly and how quickly joint replacement services expand across the USA.

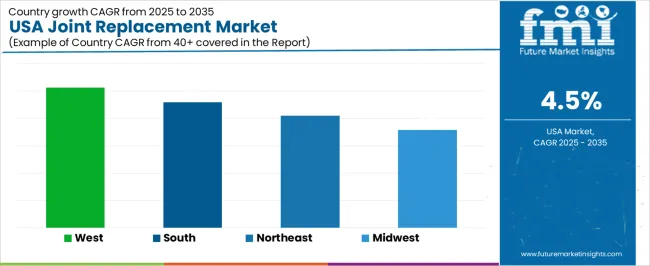

| Region | CAGR (%) |

|---|---|

| West | 5.1% |

| South | 4.6% |

| Northeast | 4.1% |

| Midwest | 3.6% |

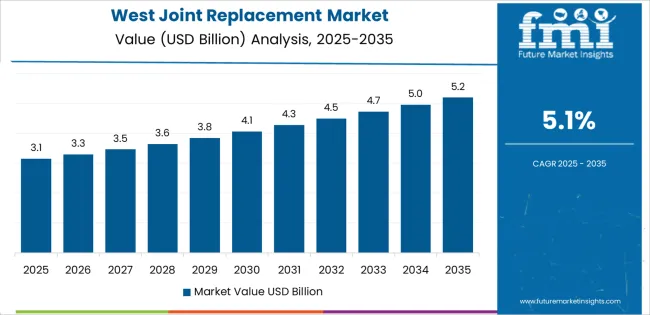

Demand for joint replacement in the USA is increasing steadily, and the West leads at 5.1%. Growth in this region reflects strong orthopedic service availability, higher surgical volumes, and a large aging population seeking treatment for mobility-related conditions. The South follows at 4.6%, supported by expanding hospital networks and rising prevalence of degenerative joint issues across its growing population. The Northeast records 4.1%, shaped by established medical centers and consistent use of replacement procedures for chronic joint conditions. The Midwest grows at 3.6%, where regional hospitals maintain steady demand as patients seek reliable treatment options for knee, hip, and shoulder replacement procedures. These patterns indicate broad national reliance on surgical intervention for long-term joint health.

West USA is projected to grow at a CAGR of 5.1% through 2035 in demand for joint replacement. California and neighboring states are increasingly adopting knee, hip, and shoulder replacement procedures in hospitals and orthopedic clinics. Rising prevalence of osteoarthritis, aging population, and demand for improved mobility drive adoption. Manufacturers supply implants, surgical instruments, and robotic-assisted systems suitable for joint replacement surgeries. Distributors ensure accessibility across hospitals, clinics, and surgical centers. Growth in orthopedic procedures, healthcare infrastructure, and patient awareness supports steady adoption of joint replacement procedures in West USA.

South USA is projected to grow at a CAGR of 4.6% through 2035 in demand for joint replacement. Texas, Florida, and Georgia are increasingly adopting knee, hip, and shoulder replacement procedures in hospitals and orthopedic centers. Rising demand for mobility restoration, surgical efficiency, and patient quality of life drives adoption. Manufacturers provide implants, instruments, and robotic-assisted equipment suitable for multiple procedures. Distributors ensure availability across hospitals, clinics, and surgical facilities. Growth in orthopedic procedures, healthcare infrastructure, and patient awareness supports steady adoption of joint replacement procedures across South USA.

Northeast USA is projected to grow at a CAGR of 4.1% through 2035 in demand for joint replacement. New York, Boston, and Philadelphia are increasingly adopting knee, hip, and shoulder replacement procedures in hospitals and orthopedic clinics. Rising demand for surgical precision, patient mobility, and improved outcomes drives adoption. Manufacturers provide high-quality implants, surgical instruments, and robotic-assisted systems for joint replacement. Distributors ensure accessibility across urban hospitals and clinics. Growth in orthopedic procedures, patient awareness, and healthcare infrastructure supports steady adoption of joint replacement procedures in Northeast USA.

Midwest USA is projected to grow at a CAGR of 3.6% through 2035 in demand for joint replacement. Chicago, Detroit, and Minneapolis are gradually adopting knee, hip, and shoulder replacement procedures in hospitals and orthopedic centers. Rising prevalence of joint disorders, demand for mobility restoration, and surgical efficiency drives adoption. Manufacturers provide implants, instruments, and robotic-assisted systems suitable for multiple procedures. Distributors expand access across urban and semi-urban hospitals and clinics. Orthopedic procedure growth, healthcare infrastructure development, and patient mobility initiatives ensure steady adoption of joint replacement procedures across Midwest USA.

The demand for joint replacement procedures in the USA is driven by a combination of demographic, clinical and technological factors. The ageing population, combined with rising prevalence of osteoarthritis, obesity and injury-related joint damage, leads to increased need for hip, knee and shoulder replacements. Patients are seeking minimally invasive surgeries and faster recovery times, prompting hospitals and surgeons to adopt advanced implant designs, robotic-assisted systems and outpatient surgical models. The shift toward value-based care and enhanced recovery protocols also supports procedural volume growth as healthcare providers aim to improve outcomes and reduce costs. These elements together fuel steady expansion in joint replacement across the USA healthcare system.

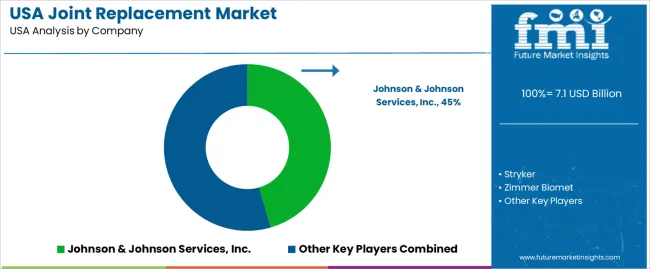

Key companies shaping the joint replacement segment in the USA include Johnson & Johnson Services, Inc., Stryker Corporation, Zimmer Biomet Holdings, Smith & Nephew plc and DJO, LLC. These companies offer a broad range of joint replacement implants, surgical instruments, navigation and robotic systems and post-operative rehabilitation devices tailored to USA clinical workflows. Their strategies emphasise physician training, hospital-system partnerships, and continuous innovation in implant materials and design. Through strong distribution networks, clinical support services and regulatory experience, these firms influence how joint-replacement solutions are selected and adopted across orthopedic practices in the United States.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Replacement Type | Extremities, Knees, Hips |

| Fixation Type | Cemented, Cementless, Hybrid, Reverse Hybrid |

| Procedure Type | Total Replacement, Partial Replacement, Other Procedure Types |

| End User | Hospitals, Orthopedic Clinics, Other End-uses |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Johnson & Johnson Services, Inc., Stryker Corporation, Zimmer Biomet Holdings, Smith & Nephew plc, DJO, LLC. |

| Additional Attributes | Dollar by sales by replacement type, fixation type, and procedure type; regional CAGR and adoption patterns; demand across primary and revision procedures; adoption of minimally invasive procedures and robotic-assisted systems; impact of aging population, degenerative joint conditions, and obesity on procedure volume; average implant price trends; outpatient and ambulatory surgical growth; patient awareness and quality-of-life considerations; projected value uplift and incremental growth through 2035. |

The demand for joint replacement in usa is estimated to be valued at USD 7.1 billion in 2025.

The market size for the joint replacement in usa is projected to reach USD 11.0 billion by 2035.

The demand for joint replacement in usa is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in joint replacement in usa are extremities, knees and hips.

In terms of fixation type, cemented segment is expected to command 47.2% share in the joint replacement in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Demand for Joint Replacement in Japan Size and Share Forecast Outlook 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA