The Japan magazine and literature bag demand is valued at USD 6.2 million in 2025 and is expected to reach USD 7.9 million by 2035, reflecting a CAGR of 2.3%. Demand is driven by the continued circulation of printed magazines, catalogues, and retail literature in specialty publishing and subscription channels. Environmental compliance requirements and preferences for recyclable and renewable substrates influence purchasing and procurement in publishing and mailing operations. Paper remains the leading material choice due to alignment with national waste-reduction goals and consumer preference for non-plastic packaging. Bags with 25–30 GSM basis weight dominate usage because they provide sufficient tensile strength for lightweight printed literature while maintaining minimal material consumption and lower disposal impact.

Kyushu & Okinawa and Kanto record the highest usage levels. These regions maintain strong logistics networks for postal distribution, regional publishing hubs, and large-format retail operations that continue to provide physical catalogues for consumer engagement. Key suppliers include Lion Office Products Co., Ltd., PLUS Corporation, KOKUYO Co., Ltd., DAISO Industries Co., Ltd., and ASKUL Corporation. These companies supply standard and custom formats suited for postal processing, retail messaging, and document protection, supporting distribution workflows for commercial print media and promotional communications.

Demand for magazine and literature bags in Japan shows a steady trajectory shaped by both print-media consumption and regulated packaging use. Growth during the first five-year period is influenced by the shift toward lightweight protective materials for publications distributed through bookstores, kiosks, and mail logistics. Value expansion remains incremental because demand depends on the stable but slow-declining print-publishing ecosystem. Early growth reflects operational adoption by postal distributors and subscription channels.

In the second five-year period, growth becomes more dependent on higher-quality protective films and compliance with environmental packaging standards. Online book and magazine sales sustain the category, supporting continued packaging needs despite reduced physical newsstand circulation. The comparative assessment indicates that gains from 2030 to 2035 exceed the earlier period due to wider use in specialty printed formats and increased protective requirements in distribution. Long-term expansion remains moderate but consistent, with a transition from traditional print-volume dependence toward durability, recyclability, and logistics-driven value enhancement.

| Metric | Value |

|---|---|

| Japan Magazine and Literature Bag Sales Value (2025) | USD 6.2 million |

| Japan Magazine and Literature Bag Forecast Value (2035) | USD 7.9 million |

| Japan Magazine and Literature Bag Forecast CAGR (2025-2035) | 2.3% |

Demand for magazine and literature bags in Japan is increasing because publishers, direct mail distributors and retail marketing teams continue to use printed promotional materials that require clean and protected packaging. These bags help prevent moisture, dust and handling damage during postal delivery or courier transport, which is important for maintaining presentation quality. Catalogs, brochures and cultural event programs are widely circulated in Japan, and protective film bags support their distribution through mailboxes, bookstores and kiosks. Tourism offices and municipal agencies also rely on packaged informational materials for visitors at stations and public venues.

Publishers introduce higher quality bags that improve visibility of printed covers and maintain sharp edges during distribution. Custom sizing and clean printing surfaces support branding, which encourages use in targeted marketing campaigns. Growth in educational mailers and membership communications from community groups further supports steady demand. Constraints include digital communication alternatives that reduce print volumes in some sectors and rising material costs for plastic films. Environmental concerns encourage gradual transition to recyclable or reduced-plastic options, which may require adjustments in equipment and procurement planning. Smaller publishers often delay bulk orders until campaign schedules are confirmed.

Demand for magazine and literature bags in Japan is shaped by protective distribution requirements across publishing, e-commerce book delivery, and postal circulation. Buyers prioritize tear resistance, print compatibility, light-weighting, and recycling alignment under Japanese packaging regulations. Publishing houses and logistics operators focus on moisture protection, barcode readability, and adherence to standard parcel handling formats. Rising digital subscriptions reduce bulk volumes, yet physical media distribution maintains steady packaging needs for specialty magazines, collectors’ editions, and direct-mail promotional content.

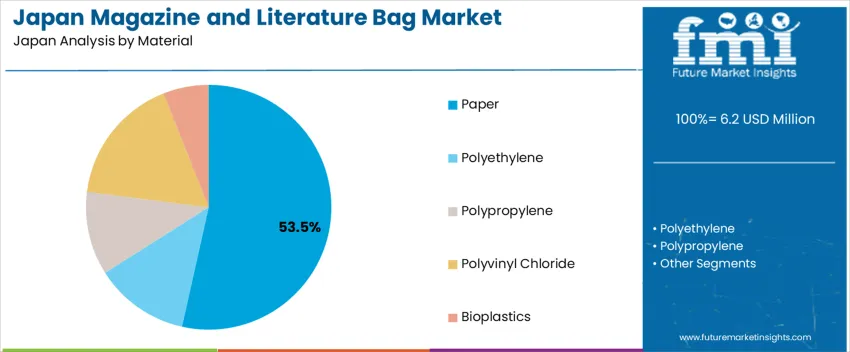

Paper accounts for 53.5%, driven by Japan’s strong paper-recycling infrastructure and preference for renewable packaging formats. Polyvinyl chloride represents 17.0%, selected where enhanced water resistance or clarity requirements apply. Polyethylene accounts for 12.5%, valued for lightweight durability in mass-shipment envelopes. Polypropylene represents 11.0%, supporting improved transparency for visual inspection. Bioplastics hold 6.0%, supported by circular-economy policies yet limited by cost and scale. Material choices align with postal system durability, green certifications, and printing demands for branding or customer-address display.

Key points:

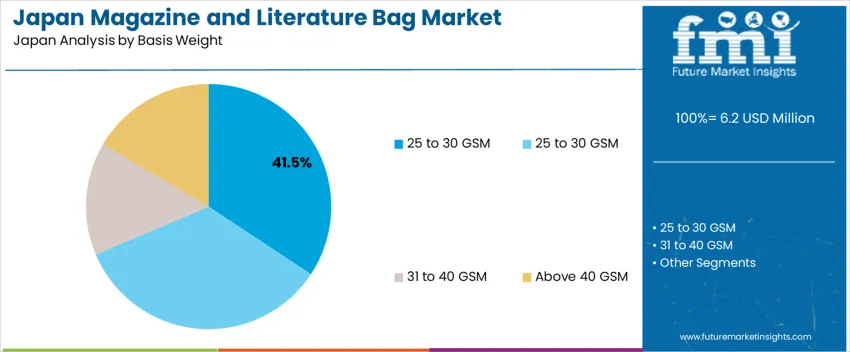

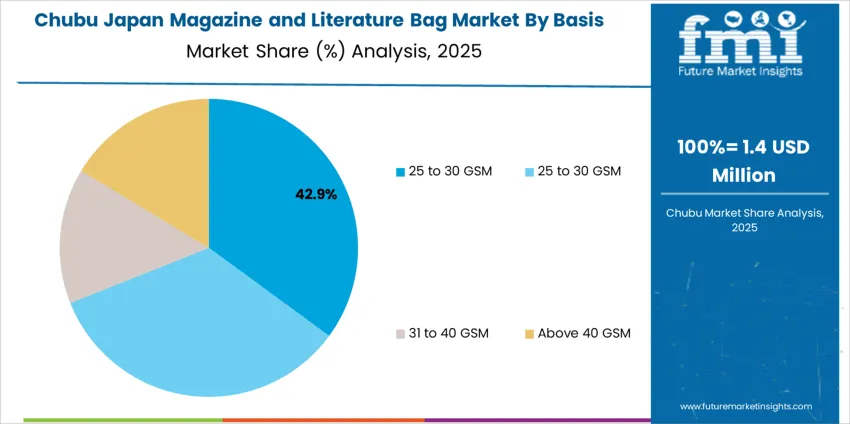

Bags in the 25–30 GSM range represent 41.5%, balancing printability with lightweight protection in large circulation. Another segment listed as 25–30 GSM at 20.5% likely reflects variations in paper grade selection within this weight category. Basis weights from 31–40 GSM hold 18.0%, used for thicker magazines or extended transport handling. Above 40 GSM represents 20.0%, providing reinforced tear resistance for high-value or collector publications. Basis-weight choice is guided by handling stress during automated sorting, moisture exposure in delivery channels, and cost controls across recurring bulk distribution common in Japan’s print fulfillment cycles.

Key points:

Distribution of print promotional materials, continued use of catalog mailings and strong participation in hobby and collector markets are driving demand.

In Japan, magazine and literature bags maintain steady usage as department stores, telecom providers and financial institutions continue to distribute catalogs and promotional brochures by mail. Retailers and travel agencies operating in major rail hubs rely on bagged brochures to support walk-in marketing campaigns. Manga, hobby magazines and collector editions have strong followings in regions such as Tokyo and Osaka, and protective bags help preserve quality during shipment and retail handling. Convention and event organizers distribute printed materials in protective sleeves for attendees, supporting regular demand from printing contractors and packaging firms.

Decline in print media circulation, green pressure on plastic packaging and limited adoption of alternative disposal systems restrain demand.

Circulation for general-interest magazines continues to fall as consumers shift toward digital news and entertainment, reducing large-volume shipments that once depended on literature bags. Municipal policies and consumer expectations encourage reduced plastic use, creating reluctance among publishers to expand plastic packaging unless required for product protection. Recycling pathways for film-based materials remain limited in many prefectures, and disposal confusion reduces acceptance of plastic sleeves among environmentally focused consumers. These influences contribute to a gradual contraction of traditional demand.

Shift toward paper-forward protective wraps, increased focus on collector-grade archival bags and rising customization for branded mailings define key trends.

Packaging suppliers in Japan are expanding paper-forward alternatives that provide similar protection while aligning with household waste-collection rules. Specialty retailers and online sellers of premium manga and collectible print items are adopting thicker, archival-grade bags to support long-term protection for high-value issues. Publishers and event organizers are customizing bags with printed logos and QR codes to support brand recognition and digital engagement during mail campaigns. These trends indicate continued niche demand concentrated in collector markets and targeted promotional distribution across Japan.

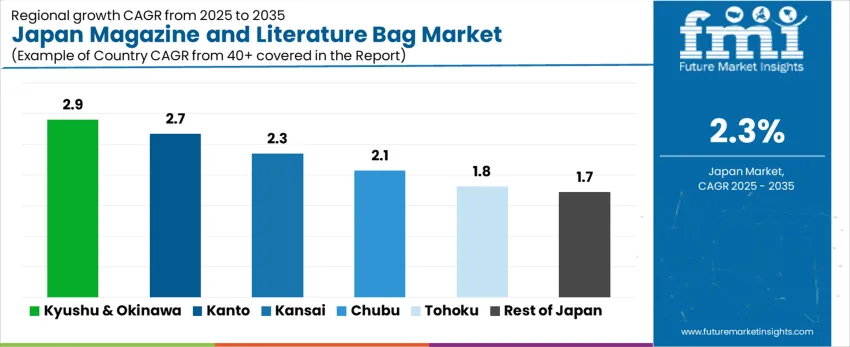

Demand for magazine and literature bags in Japan is shaped by publishing distribution, retail presentation, catalog circulation, and document protection for institutional and commercial use. Consumption patterns follow regional printing activity, logistics networks, and retail advertising cycles. Kyushu & Okinawa leads at 2.9% CAGR, followed by Kanto (2.7%), Kinki (2.3%), Chubu (2.1%), Tohoku (1.8%), and Rest of Japan (1.7%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 2.9% |

| Kanto | 2.7% |

| Kinki | 2.3% |

| Chubu | 2.1% |

| Tohoku | 1.8% |

| Rest of Japan | 1.7% |

Kyushu & Okinawa records 2.9% CAGR, supported by publishing operations and promotional distribution in tourism-influenced retail environments. Airports, travel kiosks, and hospitality venues circulate printed brochures and catalogues protected with lightweight bags designed to prevent folding or moisture exposure in humid climates. Universities and local organizations distribute informational booklets through structured mailing programs that rely on film-based literature bags for reliable delivery. Retailers use clear packaging for product catalogs, allowing consumers to preview content before purchase. Mail-order channels require durable wrap formats to maintain print condition during short-route logistics. Procurement focuses on seal strength and packaging clarity that preserves brand presentation for consumer engagement in physical retail settings.

Kanto grows at 2.7% CAGR, driven by high publishing density in Tokyo and surrounding prefectures where magazines, periodicals, and cultural media maintain wide readership. Commercial printers package new issues in film bags to protect gloss finishes from abrasion during metropolitan transit and store-handling. Mailing campaigns for event promotions and membership communications depend on film bags sized for standardized postal workflows. Retailers evaluate film clarity to preserve visual appeal in bookstores and convenience outlets where magazines are frequently displayed. Media companies align packaging decisions with cost oversight while meeting brand standards for shelf presentation. Disposable material reduction initiatives encourage use of thinner-gauge films that maintain tear resistance while minimizing waste output in municipal systems.

Kinki posts 2.3% CAGR, reflecting regional circulation of consumer magazines, cultural pamphlets, and city guides distributed through Osaka and Kyoto commercial districts. Retailers prefer clear film bags that preserve printed image quality under high-touch display conditions. Cultural institutions distribute printed programs for tourism and events, requiring lightweight protective packaging that prevents moisture intrusion. Logistics operators prioritize bag formats that support rapid sorting and protection against transit scuffing. Procurement teams monitor sealing consistency and slip properties to ensure smooth handling across retail shelving. Cost-sensitive publishers adopt simplified bags without additional label components to maintain affordability across regular issue cycles.

Chubu grows at 2.1% CAGR, tied to printing activities in Aichi and Shizuoka supporting nationwide distribution. Catalogs and promotional brochures require protective wrap during long-haul transport where dust and abrasion risk is higher. Automotive and industrial suppliers distribute product literature in protective bags used during trade visits and warehouse interactions. Packaging buyers evaluate film stiffness and sealing efficiency to maintain product integrity throughout handling. Vertical retail channels demand consistent size control to match inventory storage systems in smaller-format stores.

Tohoku reports 1.8% CAGR, driven by regional circulation of education materials, municipal informational booklets, and seasonal tourism pamphlets. Wider delivery routes increase the need for moisture-resistant and tear-resistant materials that protect content over longer transport windows. Libraries and academic networks distribute printed publications to students and community members, requiring secure bag formats that maintain clean presentation. Procurement aligns with standardized sizes for government and educational communications to support procurement consistency.

Rest of Japan grows at 1.7% CAGR, reflecting limited publishing and smaller local circulation runs. Cultural and retail brochures remain primary applications supported by tourism and community advertising. Buyers assess packaging functionality based on cost, ease of handling, and clarity needed for limited-shelf displays. Gradual adoption of thinner-gauge recyclable films aligns with municipal waste handling goals.

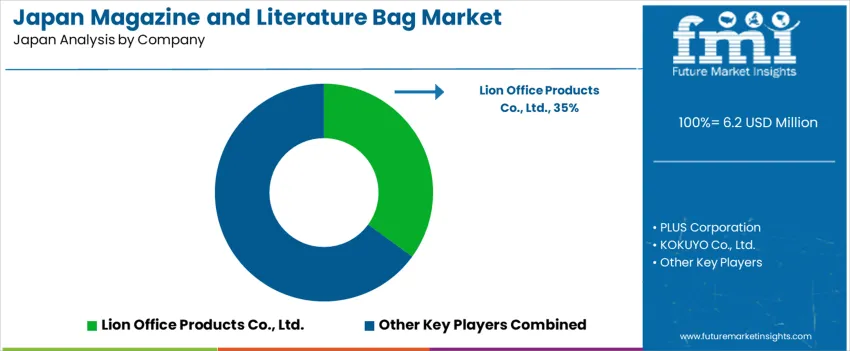

Demand for magazine and literature bags in Japan is supported by domestic suppliers that provide polypropylene and polyethylene sleeves used in publishing distribution, office document handling, and consumer stationery applications. Lion Office Products Co., Ltd. holds about 35.0% share, supported by controlled film-clarity standards, consistent size accuracy, and extensive availability across Japan’s retail and business-supply channels. Its sleeves provide predictable tear resistance needed for books and periodicals in handling and shelving environments. PLUS Corporation maintains strong presence in document-protection supplies distributed through national office-supply networks, delivering sleeves with dependable sealing performance and thickness uniformity. KOKUYO Co., Ltd. participates with product lines tailored to school and business organizations where transparent protection and stable formability support long-term storage.

DAISO Industries Co., Ltd. contributes share through affordable polypropylene sleeves widely accessible in consumer retail, supporting everyday handling of magazines and small catalogues. ASKUL Corporation, through e-commerce distribution, offers steady availability to enterprise users requiring bulk supply and standardized specifications. Competition in Japan centers on film transparency, dimensional consistency, handling durability, and controlled distribution channels. Demand remains steady as publishers, office users, and consumers rely on protective sleeves that maintain printed-media condition in storage, transport, and point-of-sale environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Material | Paper, Polyethylene, Polypropylene, Polyvinyl Chloride, Bioplastics |

| Basis Weight | 25 to 30 GSM, 31 to 40 GSM, Above 40 GSM |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Lion Office Products Co., Ltd., PLUS Corporation, KOKUYO Co., Ltd., DAISO Industries Co., Ltd., ASKUL Corporation |

| Additional Attributes | Demand segmentation based on office document protection, retail distribution, and consumer stationery consumption; rising use of bioplastic-based and recyclable packaging due to eco-friendly compliance; regional distribution influenced by office clusters in Kanto and Kinki; weight-based preferences linked to durability and print transparency needs. |

The demand for magazine and literature bag in Japan is estimated to be valued at USD 6.2 million in 2025.

The market size for the magazine and literature bag in Japan is projected to reach USD 7.9 million by 2035.

The demand for magazine and literature bag in Japan is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in magazine and literature bag in Japan are paper, polyethylene, polypropylene, polyvinyl chloride and bioplastics.

In terms of basis weight, 25 to 30 gsm segment is expected to command 41.5% share in the magazine and literature bag in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magazine and Literature Bag Market Analysis by Material, Basis Weight, Sales Channel, and Region Forecast Through 2035

Demand for Magazine and Literature Bag in USA Size and Share Forecast Outlook 2025 to 2035

Japan Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Demand for Bag in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bag-In-Box in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Toy Bag in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Canvas Bags in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cassava Bags in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Heavy Duty Bag and Sack in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Bagasse Tableware Product in Japan Size and Share Forecast Outlook 2025 to 2035

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Bag in Tube Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA