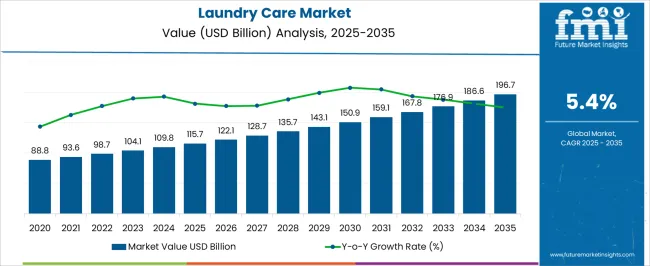

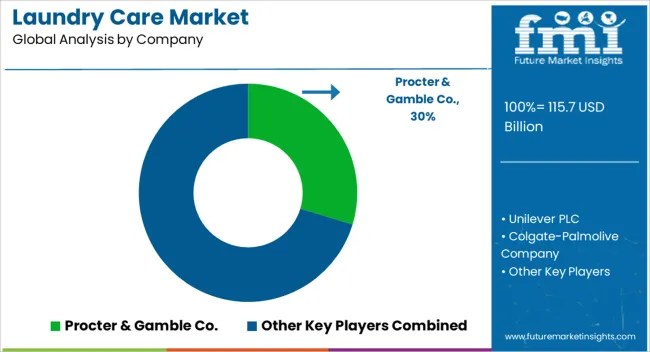

The Laundry Care Market is estimated to be valued at USD 115.7 billion in 2025 and is projected to reach USD 196.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Laundry Care Market Estimated Value in (2025 E) | USD 115.7 billion |

| Laundry Care Market Forecast Value in (2035 F) | USD 196.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The laundry care market is witnessing consistent growth fueled by rising urbanization, evolving consumer lifestyles, and the increased demand for convenient and premium home care solutions. Growing awareness of hygiene and fabric care is influencing product innovation, with manufacturers investing in advanced formulations that provide fragrance, softness, and long lasting freshness.

Expansion of e commerce platforms and organized retail has improved product accessibility across diverse consumer groups. Additionally, sustainability driven innovation such as biodegradable detergents and recyclable packaging is attracting environmentally conscious consumers.

With regulatory support encouraging eco friendly practices and brand strategies focusing on premiumization and specialized laundry solutions, the market outlook is set to remain robust. Continued investment in research and development along with strong distribution networks will further shape growth opportunities in this segment.

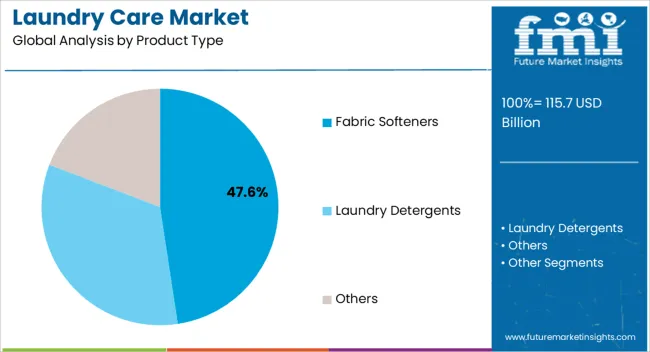

The fabric softeners segment is projected to represent 47.60% of total market revenue by 2025 within the product type category, making it the most dominant. Growth is being driven by consumer demand for added fabric softness, fragrance retention, and protection of textile fibers.

Increasing awareness about the benefits of fabric conditioners in maintaining garment longevity has supported wider adoption. In addition, premium positioning through concentrated liquid formats and eco friendly variants has reinforced demand.

As consumers seek value added laundry products that enhance overall washing experience, fabric softeners continue to lead within the product type category.

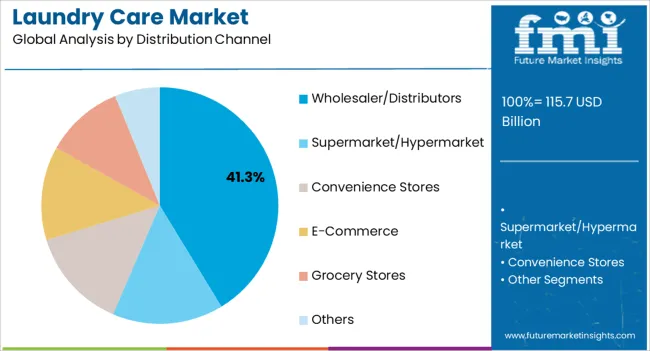

The wholesaler and distributors segment is expected to hold 41.30% of total market revenue by 2025 in the distribution channel category. This dominance is attributed to their extensive reach across urban and rural markets, ensuring widespread product availability.

Wholesalers and distributors play a pivotal role in bridging manufacturers with retailers and smaller outlets, thereby driving consistent supply chain efficiency. Their ability to offer bulk purchasing options and competitive pricing further strengthens their importance in the market.

As laundry care brands continue to expand into emerging markets, the reliance on wholesalers and distributors remains a cornerstone of market growth.

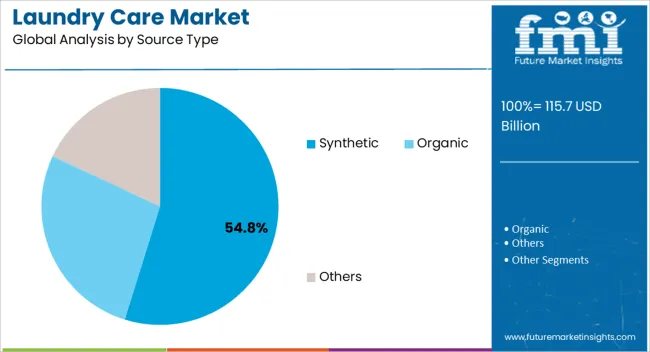

The synthetic segment is projected to account for 54.80% of total market revenue by 2025 within the source type category, positioning it as the leading contributor. This is supported by the wide availability, cost effectiveness, and strong performance of synthetic based laundry care formulations.

Their ability to deliver consistent cleaning results across varying water conditions and fabric types has reinforced adoption. Synthetic products also offer extended shelf life and compatibility with additives such as brighteners and conditioners, enhancing consumer appeal.

Despite rising interest in natural alternatives, the dominance of synthetic formulations continues due to affordability, scalability, and reliable performance in mass market applications.

According to the study, the global laundry care market is expected to register 5.7% CAGR in terms of value between 2025 and 2035. Growth in the market is attributable to the growing awareness among consumers regarding personal hygiene and surging demand for organic home care products. The outbreak of COVID-19 had a moderate impact on the laundry care market.

Sales of laundry care grew at 5.4% CAGR between 2020 and 2025. Sales uptick was reported in the laundry care market during the FQ-20 as consumers grew hyper-aware about infection and harmful effects of unhygienic clothes amidst pandemic.

With increasing awareness, the sales of organic and biodegradable detergents and fabric softeners have surged among consumers. Demand for organic laundry detergents has increased at a higher pace as synthetic laundry detergents have harmful chemicals that have hazardous effect on environment as well as on skin.

Stringent regulations were imposed on the use of certain chemicals has which compelled manufacturers to introduce plant-based laundry care products. As per International Association for Soaps, Detergents, and Maintenance Products (AISE), use of surfactants such as phosphates, strong bleach, and alkyl was prohibited in 2020.

Certain guidelines were imposed to encourage sustainability and biodegradability through eco-friendly packaging and development of phosphates-free formulations. Key manufacturers are shifting their focus towards introducing sustainable alternatives to gain competitive edge in the laundry care industry.

Launch of liquid detergent and capsules made from plant-based ingredients is expected to increase the sales of laundry detergent and fabric softeners. This, in turn, is expected to propel the growth in the market.

Against this backdrop, Future Market Insights projects the demand in the laundry care market to grow at a high rate between 2025 and 2035.

Transformation in FMCG Industry Affecting Sales of Laundry Care Products

Fast-moving consumer goods (FMCG) is one of the largest sectors across the globe, aiding growth of various industries and brand. With growing disposable income and need for essential and basic necessities, sales of home care products such as laundry care, sanitizers, and soaps are increasing.

Following the outbreak of COVID-19, consumers have become hyper conscious regarding their personal hygiene. Amidst the mass hysteria due to the outbreak of this disease, sales of disinfectants, sanitizers, and laundry detergent shot up exponentially.

Key players collaborated with e-commerce giants and retail stores to expand their customer base and strengthen global presence in order to capitalize on this opportunity. While some of the leading manufacturing facilities were disrupted and top brands were struggling to sustain amid the global lockdown, numerous home-grown and local brands introduced organic laundry detergents and collaborated with online grocery and retail stores to augment sales.

With increasing penetration of social media and growing demand for sustainability, especially among millennials, sales of bio-based, organic, and eco-friendly packaged laundry care products surged.

FMCG companies are now relying on digital marketing strategies and online platforms to strengthen their footprint. For instance, Hindustan Unilever announced the launch of e-commerce website, UShop, which will scale up the online reach of several premium brands.

Laundry pod pioneer, Dropps, in August 2024, moved from retail to e-commerce to strengthen its responsiveness to consumers and advance in sustainable packaging efforts.

Innovation in Sustainable Packaging to Drive Laundry Care Products Sales?

Key players are focusing on innovative packaging of laundry care products to improve the safety and enhance sustainability. Threat of consumption by children is high as laundry care products contain certain chemicals.

Key players are focusing on innovative ways to improve the safety of laundry care products. Introduction of sustainable packaging is therefore expected to increase the sales of laundry care products.

For instance, Dropps is one of the leading laundry care products brands, which introduced plastic-free laundry detergent pods packaged in recyclable and compostable box. Brands such as Mamaearth and Ariel have introduced plant-based and safe PODs package to improve the safety of laundry care products.

Demand for Fabric Softeners to Gain Traction during the Forecast Period

Demand for fabric softeners is expected to increase at nearly 5.6% CAGR through 2035, registering highest growth in the segment. The fabric softeners segments gained an estimated market share of 23% in 2025.

Demand for organic fabric softener is expected to grow as consumers are now becoming increasingly aware about their hygiene and quality of their clothes. Sales of fabric softener is expected to increase as fabric softener improves the quality of clothes and enhances the shelf life.

Key companies are introducing biodegradable and organic fabric softener to attract the consumers and gain competitive edge. For instance, leading textile innovator Devan Chemicals announced the launch of bio-based softener, derived from vegetable oils to support circulatory programs.

The Organic Segment might Spur the Global Demand

The organic source type segment is expected to reach USD 115.7 Billion, expanding at 5.5% CAGR through 2025, estimates Future Market Insights. Synthetic laundry care products contain harmful surfactants such as alkyl phenol ethoxylates, which are harmful for aquatic life and environment.

These surfactants are not biodegradable and causes high toxicity to environment and water resources. Regulatory bodies such as Environmental Protection Agency has banned the use of such chemicals.

Artificial colorants used in synthetic detergents are sometimes made from petroleum products, which are harmful for skin, as it can cause skin cancer, and they have hazardous effect on environment as well.

Consumers are opting for organic laundry care products as they are better for skin as well as environment and are also good for clothes due to such factors. Key companies are introducing organic laundry detergents that are better for clothes and are good for sensitive skin.

For instance, in September 2024, Novozymes announced the launch of natural and biodegradable detergent ingredient Pristine, to address consumer challenges such as discoloration and malodor.

Advantages such as longer shelf-life, improved efficiency of washing machine, and biodegradability are the factors favoring the growth in the segment.

Liquid Laundry Care Products are More Preferred by the Consumers

In terms of form type, liquid form segment is expected to dominate the laundry care market. The segment is poised to expand at over 5.5% CAGR, registering an incremental opportunity of USD 58.4 Billion through 2025.

Growth in the segment is attributable to the innovation of liquid detergent and its quick effect on cleaning supported by effective results on the clothes.

The liquid detergents dissolve quickly, and are suitable for delicate fabrics as well, consumers are opting for them over powdered laundry care as liquid detergents are easy to use. Use of liquid laundry care also helps save water as powder detergent requires more water as compared to the liquid detergent.

Increasing adoption of advanced and automatic washing machine among consumers has also compelled key manufacturers to introduce liquid detergent as they are more compatible. This is also expected to drive the sales of liquid laundry care products.

For instance, leading brand Whirlpool introduced super concentrated liquid laundry detergent, Squash, in November 2024, for 83 standard washing-machine loads, making it four times concentrated than ordinary detergent for enhanced cleaning performance.

The Dominant portion of Sales is Anticipated to be Taken Over by the E-commerce channels

As per FMI, e-commerce segment is expected to register highest growth during the forecast period. Sales of laundry care products are expected to surge at 6% CAGR through e-commerce platforms through 2025 & beyond.

Following the outbreak of COVID-19, consumers shifted their preference towards e-commerce platforms for purchasing consumer products. Manufacturers were compelled to collaborate with e-commerce giants and promote their products through social media platforms to sustain in the competition.

Demand for home care and laundry care products surged during the FQ-20 as consumers started hoarding the goods as governments across the globe imposed global lockdown. Home care and laundry care products were considered as essential goods and wide availability of them on online channels improved the sales.

E-commerce giants such as Amazon, Flipkart, eBay, and others availed discounts and attractive offers to attract large consumer base. On the back of this, sales of laundry care products surged in 2024 and the trend is likely to continue over the coming years.

Door-step delivery, and no-contact delivery, consumers are preferring e-commerce platforms for the purchase of home care and laundry care products as these e-commerce platforms offer a plethora of features such as attractive discounts.

Increasing Use of Home Care Products is Propelling the Market Growth

Home care and personal care products accounts for 50% of the sales in India, as per India Brand Equity Foundation (IBEF). Fast-moving consumer goods (FMCG) is the fourth-largest industry in India, contributing 10% to the GDP of country.

Increasing awareness regarding personal hygiene and strong presence of leading laundry care brands in the country is the primary factor propelling the growth in the market. The Indian market for laundry care products will garner a 5.8% CAGR from 2025 to 2035. Laundry care market registered moderate growth in the country with the onset of the novel COVID-19 during the FQ-20.

With emergence of e-commerce platforms and paranoia of unavailability of essential products led to resurgence in the sales of smaller packs of laundry detergents.

Some of the leading key companies such as Reckitt Benckiser and Hindustan Unilever capitalized on the gradual shift to e-commerce purchasing and launched new laundry sanitizers amid COVID-19.

A slew of such product launches have aided the growth in the market and the trend is likely to continue over the coming years. Sales of laundry care products such as detergent have burgeoned as consumers in India have become hyper-aware about the harmful effects of unhygienic clothes.

Emergence of detergent pods in the country also escalated the sales of laundry care product in India. For instance, in November 2024, Ariel, one of the leading detergent brand, announced the launch of single-use tablets called PODS, as pre-dosed washing capsules, filled with concentrate liquid.

Consumers are now more into sustainability hence key manufacturers are focusing on developing sustainable laundry care products and packaging to gain competitive edge in the industry.

China Laundry Care Market to Remain Dominant in East Asia

As per Future Market Insights, Asia Pacific excluding Japan is expected to register highest growth, surpassing a valuation of USD 115.7 billion through 2025, along with a steady CAGR of 6.2% from 2025 to 2035. Growth in the region is attributed to the increasing shift of manufacturing industries to China.

China is home to one of the largest manufacturing industries in the world. Growing production of washing machine and integration of advanced technology in home care products is expected to positively impact the growth in the laundry care market.

Unprecedented outbreak of COVID-19 dampened the sales prospects as manufacturing facilities registered slight disruption. With growing consciousness among consumers regarding the safety and personal hygiene, sales of laundry care products are expected to gain traction through 2024 & beyond.

Increasing demand for organic and biodegradable detergents in the country has spurred the sales of laundry care products. Key manufacturers are investing in research and development activities to develop sustainable and innovative packaging to attract consumers.

Emergence of e-commerce platforms also is expected to increase the sales as vendors are collaborating with online retail stores to increase their revenue generation. Demand for laundry care products is expected to witness incremental opportunity on the back of these aforementioned factors.

Rising Awareness regarding Personal Care and Hygiene to Boost the Demand

According to FMI, United States is estimated to account for over 17.6% of total sales in the global laundry care market and gain 25 BPS through 2025. Growth in the region is attributed to the increasing adoption of liquid and tablet detergents in the United States.

Factors favoring the growth in the United States laundry care market include awareness regarding personal hygiene and high demand for sustainable and organic home care products. They are also now more aware regarding the hazardous effect of chemicals used in the traditional detergent on environment and skin as consumers continue to shop for laundry products. Key manufacturers are capitalizing on this existing trend and introducing sustainable and biodegradable laundry care products.

For instance, Reckitt Benckiser Group PLC, in August 2024, announced the launch of a plant-based cleansing brand, Botanical Origin, which included a range of laundry detergent and fabric softener.

Key players in the country are also focusing on attractive and sustainable packaging targeting vegan consumers to establish their brand presence. Such factors are expected to spur the sales of laundry care products in the United States over the forthcoming decade.

As per Future Market Insights, laundry care market is highly lucrative which is characterized by the presence of many local and international players. To gain competitive edge in the market, key players are adopting strategies such as launch of laundry care products with multi-functional features.

Some of the laundry care market players are introducing organic and natural products with eco-friendly packaging to gain competitive edge.

Meanwhile, some of the players are targeting emerging economies such as India, China, and South Korea due to the untapped opportunities present in these countries. They are also collaborating with local vendors, e-commerce platforms, and grocery stores to gain dominance in these regions and maintain the lead in the market.

Some of the products being launched by the key players are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.4% from 2025 to 2035 |

| Market value in 2025 | USD 115.7 billion |

| Market value in 2035 | USD 196.7 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Source Type, Form Type, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Mexico, Brazil, Germany, United Kingdom, France, Spain, Italy, Japan, China, Singapore, Thailand, Indonesia, Israel, GCC countries, South Africa, Australia, New Zealand |

| Key Companies Profiled | Procter & Gamble Co.; Unilever PLC; Colgate-Palmolive Company; Henkel AG & Co. KGaA; Reckitt Benckiser Group PLC; Amway Corporation; Kao Corporation; S.C. Johnson & Son Inc.; LG Household & Health Care Ltd; Golrang Industrial Group; Lion Corporation; Church & Dwight Co.; Alicorp S.A.A. |

| Customization & Pricing | Available on Request |

The global laundry care market is estimated to be valued at USD 115.7 billion in 2025.

The market size for the laundry care market is projected to reach USD 196.7 billion by 2035.

The laundry care market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in laundry care market are fabric softeners, laundry detergents and others.

In terms of distribution channel, wholesaler/distributors segment to command 41.3% share in the laundry care market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA