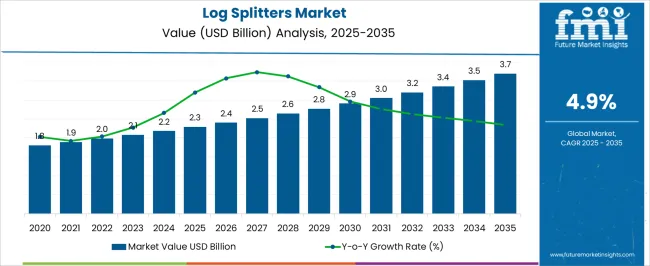

In 2025, the global log splitters market is valued at USD 2.3 billion and is projected to reach USD 3.7 billion by 2035, reflecting a CAGR of 4.9%. The absolute dollar opportunity over this period can be calculated as the difference between the market sizes in 2035 and 2025, resulting in USD 1.4 billion. This growth indicates a steady expansion in demand for log splitters, driven by consistent needs in residential, commercial, and industrial applications.

Companies entering or operating in this market can capture significant revenue gains by addressing both current and emerging customer requirements. From a strategic perspective, the absolute dollar opportunity of USD 1.4 billion represents a tangible financial potential for stakeholders. With a gradual annual increase in market value from 2.3 billion in 2025 to 3.7 billion in 2035, businesses can plan investments, production, and distribution to maximize returns. The CAGR of 4.9% highlights a stable growth trajectory, allowing firms to forecast revenue generation and scale operations accordingly. By targeting key markets and optimizing pricing and distribution channels, players can leverage this market expansion to achieve measurable business outcomes.

| Metric | Value |

|---|---|

| Log Splitters Market Estimated Value in (2025 E) | USD 2.3 billion |

| Log Splitters Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

A breakpoint analysis for the log splitters market highlights critical thresholds where market growth or investment returns shift significantly. Considering the market value of USD 2.3 billion in 2025 and USD 3.7 billion by 2035 at a CAGR of 4.9%, breakpoints can be identified around key annual increments where cumulative growth accelerates. For example, reaching USD 2.8–3.0 billion marks a midpoint in market expansion, signaling increased adoption and revenue potential. Recognizing these breakpoints allows companies to allocate resources efficiently, prioritize production capacity, and adjust marketing strategies to capture high-growth periods, minimizing risk while maximizing returns. Strategically, breakpoints also guide financial planning and operational scaling. As the market progresses toward USD 3.7 billion in 2035, surpassing USD 3.2–3.4 billion may represent a tipping point where competition intensifies and market saturation begins to influence pricing. Companies can use this insight to adjust investment timing, optimize supply chains, and expand distribution selectively. Understanding these thresholds ensures better preparedness for fluctuations and enables businesses to leverage periods of robust demand while avoiding overextension, ultimately strengthening market positioning over the decade-long growth period.

The Log Splitters market is exhibiting strong growth driven by increasing demand for efficient wood processing tools in both residential and commercial applications. The current landscape is shaped by rising interest in sustainable fuel sources such as firewood for heating, coupled with growing outdoor recreational activities that utilize wood-based energy.

Advancements in splitter design, including improved safety features and enhanced splitting power, are encouraging consumer adoption. The market outlook is further supported by expanding awareness about eco-friendly energy alternatives and a steady rise in home improvement projects involving landscaping and wood maintenance.

Increasing disposable incomes in emerging economies and the proliferation of easy-to-use, portable log splitters are also contributing to market expansion Future growth is expected to be underpinned by innovation in power mechanisms, improved durability, and better ergonomics, which together make log splitters more accessible to a broader user base.

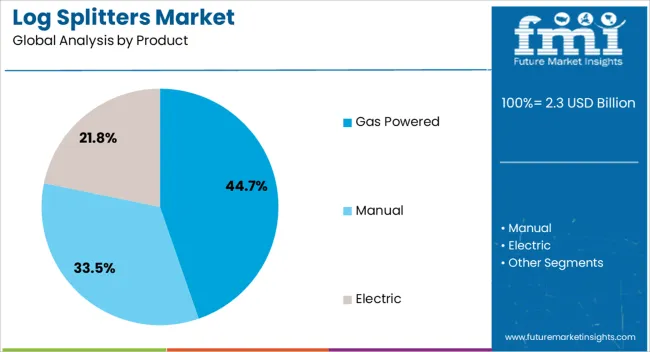

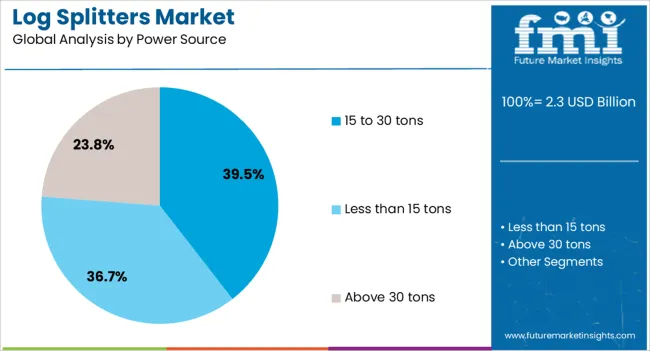

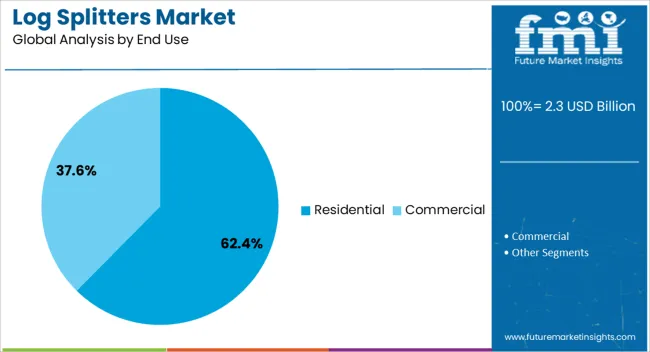

The log splitters market is segmented by product, power source, end use, distribution channel, and geographic regions. By product, log splitters market is divided into Gas Powered, Manual, and Electric. In terms of power source, log splitters market is classified into 15 to 30 tons, Less than 15 tons, and Above 30 tons. Based on end use, log splitters market is segmented into Residential and Commercial. By distribution channel, log splitters market is segmented into Indirect Sales and Direct Sales. Regionally, the log splitters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Gas powered log splitters are expected to hold 44.7% of the market revenue share in 2025, positioning this product type as the leading segment. This prominence is attributed to the higher power output and portability offered by gas engines, which make these splitters suitable for heavy-duty tasks and outdoor use where electricity access may be limited.

The segment's growth has been fostered by the demand for durable equipment capable of handling large volumes of wood efficiently. Additionally, gas powered models tend to provide greater operational flexibility, supporting longer continuous use without dependency on electrical sources.

These factors have made gas powered log splitters the preferred choice for both professional users and serious residential consumers who require reliable, high-capacity machinery.

Log splitters with a splitting force in the range of 15 to 30 tons are projected to account for 39.5% of the market revenue share in 2025, making this the dominant power source segment. This segment has grown due to its ability to handle a wide variety of wood sizes and hardness levels, offering a balance between power and maneuverability.

The capacity to split larger logs efficiently without sacrificing ease of use has appealed to users seeking versatile equipment for residential and light commercial applications. The increased adoption of these medium-tonnage splitters is also supported by their comparatively moderate price points and lower maintenance requirements relative to higher capacity models.

As the demand for flexible and effective wood processing tools grows, the 15 to 30 tons segment is expected to maintain its leadership position.

The residential end-use segment is anticipated to capture 62.4% of the Log Splitters market revenue in 2025, making it the largest application area. This dominance is being driven by growing homeowner interest in self-sufficiency and cost-effective heating solutions using firewood.

Residential users prioritize safety, ease of operation, and compact designs, which have been increasingly incorporated into market offerings. The rise of home improvement trends, including landscaping and outdoor living enhancements, has further propelled the uptake of log splitters for personal use.

Moreover, the segment benefits from expanding consumer education on the benefits of renewable energy sources and the economic advantages of processing firewood at home. As these factors continue to influence consumer behavior, the residential segment is expected to sustain its leading market share.

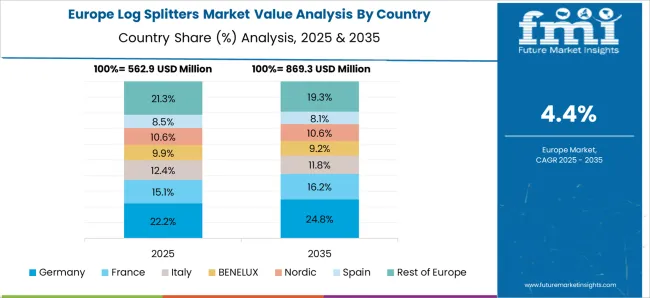

The log splitters market is growing due to increasing residential and commercial demand for firewood, rising awareness of efficient wood processing, and growth in forestry-based industries. North America and Europe lead in adoption of hydraulic and electric log splitters for professional and residential use, emphasizing safety, power, and durability. Asia-Pacific shows rapid growth driven by rising rural electrification, affordable gas-powered units, and expanding small-scale timber operations.

Manufacturers differentiate through splitting capacity, safety features, portability, and automation. Market expansion is supported by the increasing popularity of renewable energy solutions, home heating using firewood, and the trend of backyard landscaping and small-scale wood-processing businesses. Leading suppliers investing in high-capacity, user-friendly, and durable splitters gain competitive advantages, while regional players focusing on cost-effective models capture emerging rural markets.

Log splitters differ by power source hydraulic, electric, or gas-powered and splitting capacity. Europe and North America favor high-capacity hydraulic splitters with electric options for residential and commercial use, ensuring efficiency and safety. Asia-Pacific markets often adopt lower-cost gas-powered or manually assisted splitters suitable for small-scale operations. Differences in power type and output directly impact productivity, ease of use, and maintenance requirements. Leading manufacturers maintain consistent high-quality performance across premium units, whereas regional producers focus on affordable solutions for high-volume or rural use. These contrasts influence adoption trends, buyer decisions, and supplier competitiveness in professional versus cost-sensitive markets, shaping regional growth and market positioning.

Ergonomic design, safety mechanisms, and user-friendly operation are key differentiators. North America and Europe emphasize automatic safety locks, anti-kickback mechanisms, and adjustable heights for professional and home users. Asia-Pacific adoption often prioritizes affordability over advanced safety features, with simpler, manually operated designs. Differences in ergonomics affect user fatigue, operational safety, and task efficiency. Suppliers offering ergonomic, compliant, and high-safety models gain preference among premium buyers, while regional producers target volume-driven, cost-sensitive segments. Variations in safety and usability shape regional adoption, brand perception, and competitive positioning in professional and residential markets.

Sales of log splitters rely on specialized retailers, online channels, and equipment distributors. North America and Europe utilize a mix of e-commerce platforms, specialty hardware stores, and direct sales to professional users. Asia-Pacific markets rely heavily on local machinery distributors and wholesale suppliers to reach rural and semi-urban consumers. Differences in distribution affect market access, pricing, and brand visibility. Global suppliers leverage multi-channel approaches and after-sales service to ensure customer loyalty, whereas smaller regional producers compete primarily on cost through local networks. Distribution contrasts significantly impact market adoption, supplier reach, and long-term growth in diverse regional markets.

Regional demand for log splitters varies by application. North America and Europe focus on residential firewood, landscaping, and commercial forestry operations requiring high-performance, durable machines. Asia-Pacific adoption is driven by small-scale timber processing, rural heating, and urban landscaping projects, often using simpler, cost-efficient splitters. Differences in end-use affect design specifications, power requirements, and supplier strategies. Manufacturers offering tailored solutions for professional forestry, backyard use, and commercial timber enterprises capture high-value contracts, while regional producers supply volume-driven, basic models. Understanding these contrasts enables suppliers to optimize production, marketing, and inventory management to meet the distinct needs of professional and residential users across mature and emerging markets.

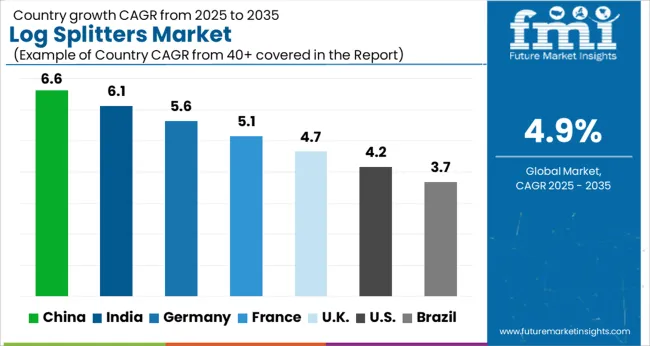

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global log splitters market was projected to grow at a 4.9% CAGR through 2035, driven by demand in residential, commercial, and forestry applications. Among BRICS nations, China recorded 6.6% growth as large-scale production facilities were commissioned and compliance with machinery quality and safety standards was enforced, while India at 6.1% growth saw expansion of manufacturing units to meet rising regional consumption.

In the OECD region, Germany, at 5.6% maintained substantial output under strict industrial and safety regulations, while the United Kingdom, at 4.7% relied on moderate-scale operations for forestry, landscaping, and residential use. The USA, expanding at 4.2%, remained a mature market with steady demand in residential, commercial, and industrial segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Log splitters market in China is growing at a CAGR of 6.6%. Between 2020 and 2024, growth was driven by rising demand for residential heating, commercial forestry, and industrial wood processing applications. Urbanization, rural housing expansion, and adoption of biomass heating systems supported sales. Manufacturers focused on hydraulic, electric, and gas-powered log splitters designed for efficiency, durability, and safety. Distribution through e-commerce and industrial suppliers expanded reach. In the forecast period 2025 to 2035, growth is expected to accelerate with the adoption of automated and eco-friendly systems, advanced safety features, and high-capacity splitters. Increasing awareness of sustainable energy solutions, expansion of commercial timber processing, and demand for ergonomic designs will further drive growth. China remains a leading market due to large industrial base, forestry activities, and residential energy requirements.

Log splitters market in India is growing at a CAGR of 6.1%. The historical period from 2020 to 2024 saw growth fueled by rural heating demand, small-scale timber processing, and agricultural biomass usage. Manufacturers focused on durable, cost-effective, and easy-to-use hydraulic and electric log splitters for commercial and household applications. Infrastructure development, expansion of rural energy systems, and increasing interest in sustainable heating also supported growth. In the forecast period 2025 to 2035, growth is expected to continue with adoption of automated, high-capacity, and energy-efficient splitters. Government programs promoting renewable energy and safety standards, along with growth of commercial timber and biomass sectors, will further boost market demand. India is projected to maintain strong momentum due to rising industrial and residential energy requirements and adoption of modern forestry techniques.

Log splitters market in Germany is growing at a CAGR of 5.6%. Between 2020 and 2024, growth was supported by increasing demand from residential heating, industrial wood processing, and commercial forestry. Manufacturers focused on high performance, hydraulic systems, and safety-enhanced equipment. Residential users, small-scale forestry companies, and commercial operations contributed to steady demand. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of electric, automated, and eco-friendly splitters. Rising consumer awareness of renewable energy, technological innovation, and stringent environmental regulations will further support adoption. Germany remains a key European market due to advanced industrial sector, robust forestry industry, and strong focus on energy efficiency, safety, and sustainable heating solutions.

Log splitters market in the United Kingdom is growing at a CAGR of 4.7%. During 2020 to 2024, adoption was driven by residential heating, small-scale timber processing, and DIY applications. Manufacturers focused on user-friendly, reliable, and durable splitters that meet safety standards. Growth was also supported by expansion of rural homes, fireplaces, and biomass heating installations. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of electric, hydraulic, and automated systems. Rising consumer interest in renewable energy, safe equipment operation, and energy-efficient solutions will further support market expansion. The United Kingdom market reflects stable growth, emphasizing safety, efficiency, and convenience for residential, commercial, and small-scale industrial users.

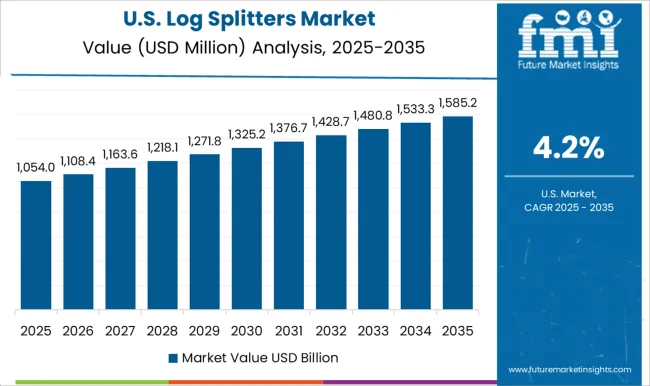

Log splitters market in the United States is growing at a CAGR of 4.2%. Historical period 2020 to 2024 saw growth fueled by residential heating, forestry operations, and industrial wood processing. Manufacturers focused on hydraulic, gas-powered, and electric splitters that ensure durability, safety, and efficiency. Expansion of rural homes, demand for biomass heating, and DIY applications contributed to steady growth. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of automated, high-capacity, and energy-efficient splitters. Increasing demand for sustainable energy solutions, growth in commercial forestry, and innovation in ergonomic and smart designs will further support market expansion. The United States market demonstrates consistent growth with emphasis on safety, reliability, and advanced technological solutions.

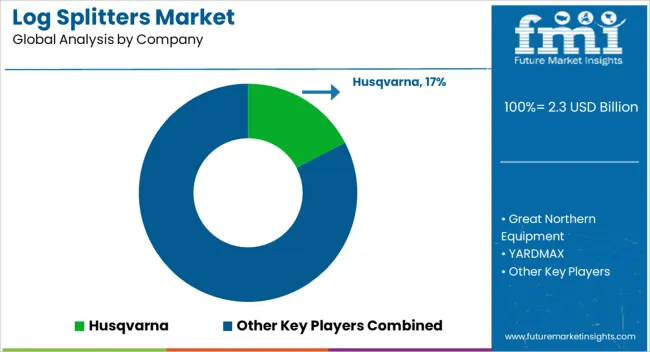

The log splitters market is supplied by Husqvarna, Great Northern Equipment, YARDMAX, Ariens, Champion Power Equipment, Swisher, Power King, Dirty Hand Tools, WEN, Sun Joe, Ltd, Boss Industrial, and POSCH GmbH. Competition is shaped by splitting capacity, engine type, portability, and safety features. Husqvarna and Ariens brochures highlight hydraulic and electric models with optimized splitting force for residential and professional use. Great Northern Equipment and YARDMAX focus on heavy-duty, high-tonnage hydraulic splitters, emphasizing durability and ease of use. Champion Power Equipment and Swisher datasheets specify engine performance, cycle time, and wedge design for consistent splitting efficiency. Observed market patterns indicate rising interest in electric-powered, low-maintenance, and eco-friendly models for small-scale and urban users. Strategies among suppliers focus on product diversification, distribution reach, and performance guarantees. Husqvarna and Ariens prioritize dealer networks and after-sales service to ensure operational reliability.

Great Northern Equipment and YARDMAX invest in robust steel construction and modular designs for professional landscapers and timber operations. Champion Power Equipment and Power King emphasize portability, foldable designs, and rapid deployment features. POSCH GmbH highlights European-engineered log splitters for high-capacity industrial applications. Sun Joe, WEN, and Dirty Hand Tools focus on lightweight, residential models with electric power, ease of assembly, and storage convenience. Observed practices show targeted product segmentation to meet both commercial and home-use requirements while balancing power, weight, and cost. Product brochures specify hydraulic tonnage, engine displacement, cycle time, wedge design, operational modes, and safety features. Husqvarna and Ariens detail hydraulic pump specifications, oil capacities, and operator safety guards. Great Northern Equipment and Champion Power Equipment datasheets highlight engine type, maintenance intervals, and splitting efficiency metrics. YARDMAX and Swisher provide technical guidance on adjustable wedge heights, dual-action splitting, and vertical versus horizontal operation.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Product | Gas Powered, Manual, and Electric |

| Power Source | 15 to 30 tons, Less than 15 tons, and Above 30 tons |

| End Use | Residential and Commercial |

| Distribution Channel | Indirect Sales and Direct Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Husqvarna, Great Northern Equipment, YARDMAX, Ariens, Champion Power Equipment, Swisher, Power King, Dirty Hand Tools, WEN, Sun Joe, Ltd Boss Industrial, and POSCH GmbH |

| Additional Attributes | Dollar sales vary by type, including hydraulic, electric, and gas-powered log splitters; by capacity, spanning light-duty, medium-duty, and heavy-duty; by application, such as residential, commercial, and industrial firewood processing; by end-use, covering households, landscaping services, and forestry operations; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for firewood, outdoor heating, and efficient wood processing equipment. |

The global log splitters market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the log splitters market is projected to reach USD 3.7 billion by 2035.

The log splitters market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in log splitters market are gas powered, manual and electric.

In terms of power source, 15 to 30 tons segment to command 39.5% share in the log splitters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logic Analyzer Market

Logistics Visualization System Market

Logistics Automation Market

Blogger Outreach Software Market Size and Share Forecast Outlook 2025 to 2035

Holographic Blister Foil Market Forecast Outlook 2025 to 2035

Holographic Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Holographic Labels Market Size and Share Forecast Outlook 2025 to 2035

Halogen Biocides Market Size and Share Forecast Outlook 2025 to 2035

Holographic Display Market Size and Share Forecast Outlook 2025 to 2035

Holography in Medical Imaging Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Allogeneic T Cell Therapies Market - Trends, Growth & Forecast 2025 to 2035

Holographic Tear Tape Market

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Biologics Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Urology Lasers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA