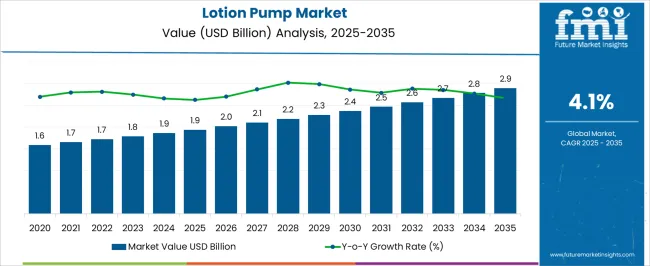

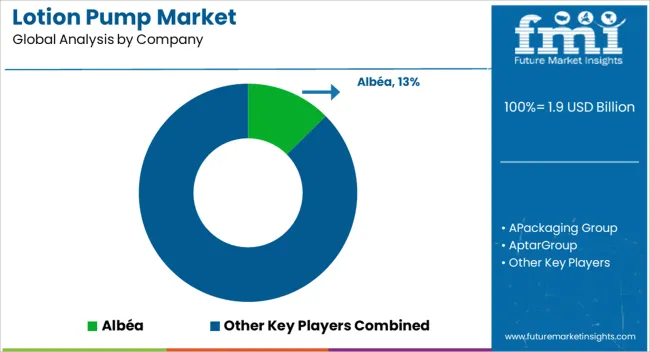

The lotion pump market, estimated at USD 1.9 billion in 2025 and projected to reach USD 2.9 billion by 2035 with a CAGR of 4.1%, exhibits characteristics consistent with a mature market in the adoption lifecycle. The incremental annual growth from USD 1.9 billion to USD 2.9 billion reflects steady expansion rather than exponential acceleration, indicating that early mass adoption phases have largely stabilized and the market is moving toward saturation in conventional segments.

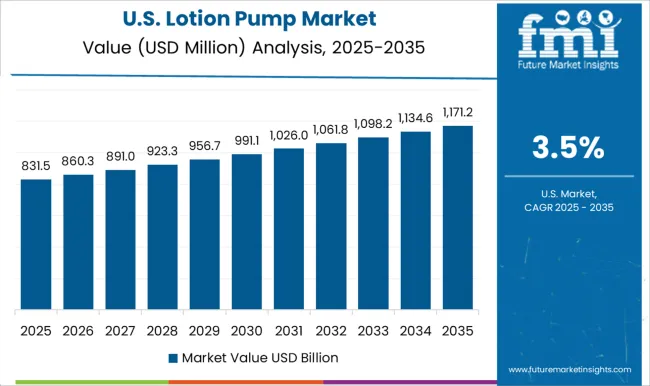

During the early years, between 2025 and 2028, modest growth is observed, rising from USD 1.9 billion to USD 2.1 billion, representing gradual technology penetration and incremental improvements in pump design, dispensing accuracy, and material compatibility. This period corresponds to the late growth phase of the adoption lifecycle, where product refinements and minor innovations drive incremental uptake rather than broad market disruption. From 2029 onward, growth continues at a steady rate, reaching USD 2.9 billion by 2035, reflecting characteristics of the maturity stage. Market expansion during this period is supported primarily by replacement demand, incremental design improvements for enhanced ergonomics and durability, and gradual adoption in emerging geographies.

The market demonstrates a classic mature market profile with a slow, steady growth trajectory, a high penetration of standard technologies, and limited scope for disruptive expansion. Innovation is likely to be incremental, focusing on efficiency, material sustainability, and customization for premium applications, while mass adoption has already stabilized across major regions and consumer segments.

| Metric | Value |

|---|---|

| Lotion Pump Market Estimated Value in (2025 E) | USD 1.9 billion |

| Lotion Pump Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The lotion pump market represents a specialized segment within the global personal care packaging and dispensing industry, emphasizing convenience, hygiene, and controlled dosing. Within the broader cosmetic and personal care packaging market, it accounts for about 4.8%, driven by demand from skincare, haircare, and hand hygiene products. In the beauty and personal care products sector, it holds nearly 5.2%, reflecting adoption for premium and travel size packaging formats. Across the packaging machinery and dispensing solutions segment, the market captures 4.1%, supporting automated filling and precision dosing. Within the eco-friendly and sustainable packaging category, it represents 3.7%, highlighting lightweight, refillable, and recyclable designs.

In the household and personal hygiene packaging sector, it secures 3.9%, emphasizing user convenience, product protection, and enhanced consumer experience. Recent developments in this market have focused on ergonomic design, material innovation, and sustainability. Innovations include airless lotion pumps, adjustable dosing mechanisms, and chemically resistant plastics for long-term product stability. Key players are collaborating with cosmetic brands, packaging manufacturers, and sustainability specialists to improve refillable designs, reduce material usage, and enhance user experience.

Adoption of recyclable and biodegradable plastics, along with compact and travel-friendly formats, is gaining traction. The anti-leak, tamper-proof, and pump-locking mechanisms are being integrated to increase product safety and consumer confidence.

The lotion pump market is experiencing consistent expansion, driven by the rising demand for convenient and hygienic dispensing solutions across personal care, cosmetics, and household product segments. Industry news and packaging sector updates have highlighted the increasing influence of premiumization trends, where brands are investing in innovative pump designs to enhance product aesthetics and user experience.

Growth in e-commerce has also boosted demand for packaging that ensures product safety during transit while maintaining functionality. Advancements in pump technology, such as improved dosage accuracy and clog-resistant mechanisms, have further increased adoption.

Additionally, sustainability considerations are shaping material choices and design innovations, with manufacturers exploring recyclable and refillable pump systems to meet regulatory and consumer expectations. Market prospects remain positive, supported by expanding personal care consumption in emerging economies, greater brand focus on differentiated packaging, and the growing use of multi-material pump systems for performance and branding purposes.

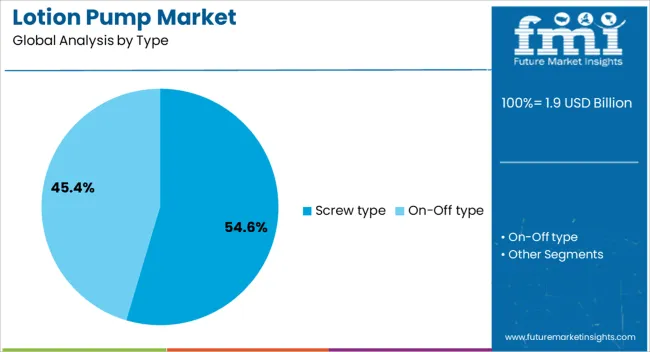

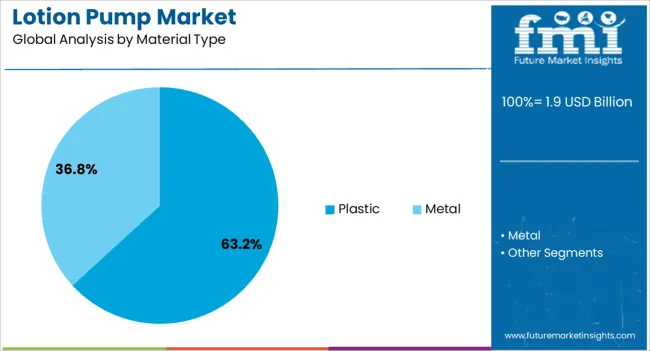

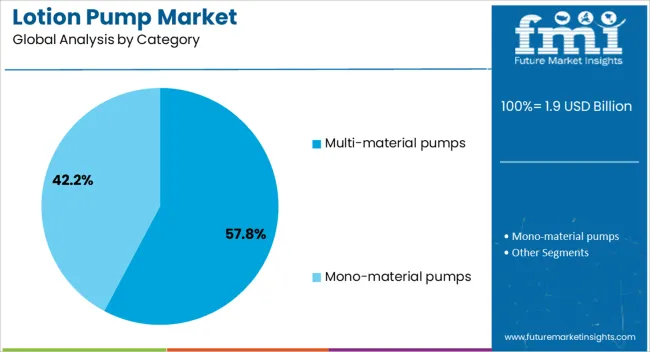

The lotion pump market is segmented by type, material type, category, neck size, pump output, application, distribution channel, and geographic regions. By type, lotion pump market is divided into Screw type and On-Off type. In terms of material type, lotion pump market is classified into Plastic and Metal. Based on category, lotion pump market is segmented into Multi-material pumps and Mono-material pumps.

By neck size, lotion pump market is segmented into 24 mm - 28 mm, Below 24 mm, and Above 28 mm. By pump output, lotion pump market is segmented into 2 – 4 ml per stroke, Up to 2 ml per stroke, and Above 4 ml per stroke. By application, lotion pump market is segmented into Body Care, Hair Care, Skin Care, Baby Care, and Others. By distribution channel, lotion pump market is segmented into Indirect and Direct. Regionally, the lotion pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The screw type segment is projected to account for 54.6% of the lotion pump market revenue in 2025, securing its lead due to its widespread compatibility with a variety of bottle designs and product viscosities. This segment’s growth has been driven by its reliable sealing properties, which prevent leakage and maintain product integrity during storage and transportation.

Manufacturers have favored screw type pumps for their ease of assembly on production lines and compatibility with automated filling processes. Consumer convenience has also been a contributing factor, as screw type mechanisms allow for secure closure and straightforward reusability.

Packaging industry developments have enhanced the ergonomic design and dispensing precision of screw type pumps, supporting their adoption across personal care, cosmetics, and healthcare products. With continued advancements in sealing efficiency and design versatility, the screw type segment is expected to retain its strong market position.

The plastic segment is projected to contribute 63.2% of the lotion pump market revenue in 2025, maintaining its dominance due to the material’s versatility, cost-effectiveness, and adaptability to high-volume manufacturing. Plastic pumps offer lightweight construction, resistance to breakage, and compatibility with a wide range of liquid formulations, making them the preferred choice for mass-market products.

Packaging manufacturers have continued to innovate in recyclable and bio-based plastic options to address environmental concerns, while retaining the performance benefits of traditional polymers. The ability to mold plastic into varied shapes and finishes has also supported brand differentiation and customization in packaging design.

Additionally, the lower transportation and production costs associated with plastic pumps have strengthened their position in both developed and emerging markets. As sustainable material innovations mature, the plastic segment is expected to remain the primary material choice in the lotion pump industry.

The multi-material pumps segment is projected to hold 57.8% of the lotion pump market revenue in 2025, leading the category segment due to its ability to combine functionality, durability, and enhanced aesthetics. This segment’s growth has been fueled by demand for premium packaging solutions that integrate components such as metal springs, elastomer seals, and decorative finishes with plastic or glass bodies.

Multi-material designs have enabled pumps to deliver improved dispensing accuracy, extended product lifespan, and unique tactile experiences for consumers. High-end cosmetic and skincare brands have particularly favored multi-material pumps to differentiate their products in a competitive retail environment.

Furthermore, advances in manufacturing have made it possible to integrate diverse materials without compromising recyclability or structural integrity. With increasing brand focus on packaging as a core element of product identity, the multi-material pumps segment is expected to sustain its market leadership.

The market has expanded significantly as personal care, cosmetics, and pharmaceutical sectors increasingly adopt convenient, hygienic, and precise dispensing solutions. Lotion pumps are widely used for skincare products, hand sanitizers, hair care formulations, and topical medications, providing controlled dosage while improving product shelf life and user experience.

Rising consumer preference for premium personal care products, coupled with increased awareness of hygiene and cosmetic efficacy, has driven demand. Technological advancements in pump mechanisms, materials, and compatibility with various formulations have enhanced performance. Despite challenges such as packaging costs, material sustainability, and supply chain complexities, lotion pumps remain critical for modern product presentation, dosage accuracy, and consumer convenience in both emerging and mature markets worldwide.

The personal care and cosmetics sector has been a major driver for the lotion pump market, as products like moisturizers, sunscreens, and serums require precise and hygienic dispensing. Lotion pumps reduce contamination risk, enhance user convenience, and maintain formulation stability by minimizing exposure to air and microbes. Manufacturers increasingly design pumps with smooth actuation, adjustable flow rates, and aesthetically pleasing appearances to meet consumer expectations. Rising demand for premium skincare products in North America, Europe, and Asia-Pacific has prompted brands to adopt innovative packaging solutions. Multi-component pumps, airless designs, and visually appealing finishes are being integrated into product lines to enhance user experience, improve brand differentiation, and ensure consistent dosage delivery, reinforcing market growth across personal care segments.

Pharmaceutical and healthcare sectors contribute to the adoption of lotion pumps by incorporating them in topical drug delivery, hand sanitizers, and wound care products. Controlled dispensing ensures precise dosage, compliance with hygiene standards, and reduced product wastage. Pumps are designed with chemical-resistant materials compatible with medicinal formulations, maintaining efficacy and stability over time. Hospitals, clinics, and pharmacies increasingly demand user-friendly, safe, and tamper-evident dispensing mechanisms for liquid and semi-liquid preparations. Stringent hygiene regulations, increased healthcare awareness, and rising adoption of preventive and home-based care products support growth.

Technological innovations have improved the functionality, durability, and versatility of lotion pumps. Airless pump designs prevent oxidation and contamination, extending product shelf life and maintaining formulation integrity. Advanced materials, including biodegradable plastics and chemical-resistant polymers, increase compatibility with diverse product types while addressing sustainability concerns.

Adjustable flow mechanisms, smooth actuation, and ergonomic designs enhance user experience and precision dosing. Automation in assembly, quality control, and testing ensures consistency and reliability. Integration with tamper-evident caps, decorative finishes, and customizable packaging solutions allows brands to differentiate products in a competitive market. Continuous research and development in pump mechanisms and materials strengthen market growth by combining performance, safety, and aesthetics in lotion dispensing solutions.

Despite robust growth, the lotion pump market faces challenges related to packaging complexity, raw material costs, and supply chain management. High-quality pumps require precision engineering, specialized plastics or metals, and intricate assembly processes, increasing production costs. Sustainability requirements and recycling regulations add further complexity to material selection and disposal. Supply chain disruptions, transportation delays, and global material shortages can affect manufacturing timelines and product availability. The compatibility testing with diverse formulations is required to prevent leaks, clogging, or chemical degradation. Market players address these challenges through strategic sourcing, modular designs, and investment in automation and quality assurance.

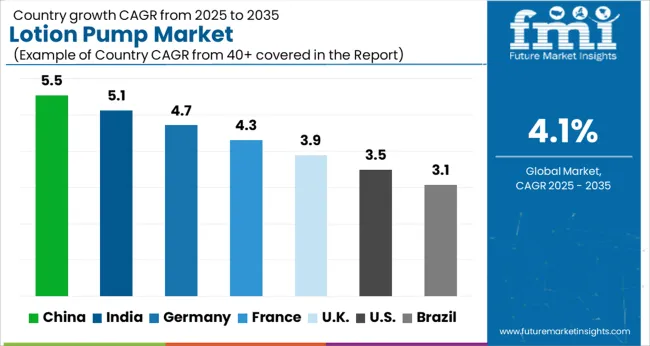

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The market shows steady progress across major regions. Germany expands at 4.7%, supported by growing cosmetic and personal care manufacturing. India records 5.1% growth, driven by increasing domestic demand and rising production capacities. China leads with 5.5% growth, bolstered by large-scale adoption in personal care and hygiene products. The United Kingdom grows at 3.9%, aided by innovations in sustainable and ergonomic pump designs. The United States maintains 3.5% growth, sustained by modernization in packaging and dispensing technologies. These countries highlight a combination of production scale, technological advancement, and market adoption shaping global trends. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to grow at a CAGR of 5.5%, driven by the expansion of personal care, skincare, and cosmetic sectors. Rising consumer awareness regarding hygiene and convenience has increased the adoption of lotion pumps for daily use products. Manufacturers are focusing on innovative designs, durable materials, and aesthetic packaging to cater to premium and mass-market segments. Growth in e-commerce and retail distribution channels further enhances accessibility of lotion pump products. Strategic collaborations between packaging suppliers and cosmetic brands strengthen market penetration. The urban populations’ preference for easy-to-use and refillable packaging solutions supports steady growth in China’s lotion pump market.

India’s market is projected to grow at a CAGR of 5.1%, supported by increasing demand in skincare, cosmetic, and personal hygiene segments. Rising consumer preference for convenient and hygienic packaging solutions drives adoption. Cosmetic and pharmaceutical companies are innovating with ergonomic and eco-friendly lotion pump designs to meet urban and semi-urban consumer expectations. Expansion of retail outlets, online marketplaces, and modern trade channels improves product availability and reach. Strategic partnerships between packaging manufacturers and cosmetic brands enhance product development and distribution efficiency. Government initiatives promoting personal hygiene awareness and quality packaging standards further support market growth in India, positioning the lotion pump market for steady expansion.

The market in Germany is expected to grow at a CAGR of 4.7%, driven by consumer demand for premium and sustainable packaging solutions in personal care and cosmetic segments. Focus on eco-friendly, recyclable, and refillable packaging aligns with environmental regulations and consumer expectations. Cosmetic and pharmaceutical brands are innovating with functional and aesthetic lotion pump designs to enhance user experience. Strong distribution networks through retail chains, online platforms, and specialty stores improve accessibility. Germany’s established personal care industry, emphasis on quality standards, and sustainability-focused policies create favorable conditions for the adoption of advanced lotion pump solutions across multiple sectors.

The market in the United Kingdom is projected to grow at a CAGR of 3.9%, fueled by increasing adoption in skincare, cosmetic, and pharmaceutical products. Consumer preference for hygienic, convenient, and refillable packaging solutions drives product innovation. Brands are focusing on lightweight, durable, and aesthetically appealing lotion pump designs to attract urban consumers. Expansion of modern retail, pharmacy chains, and e-commerce channels facilitates widespread distribution. Additionally, the UK market benefits from regulatory standards emphasizing packaging quality, safety, and sustainability. These factors collectively contribute to steady growth in lotion pump adoption across various personal care and health-related product categories.

The United States is expected to grow at a CAGR of 3.5%, driven by demand in skincare, cosmetics, and personal hygiene products. Increasing consumer awareness of convenience and hygiene encourages adoption of lotion pump packaging. Companies are innovating with sustainable, refillable, and ergonomic designs to enhance usability and reduce environmental impact. Strong presence of retail chains, online stores, and cosmetic specialty outlets supports extensive market penetration. Regulatory frameworks emphasizing product safety and quality standards further encourage high-quality packaging solutions. The combination of consumer preference, technological innovation, and robust distribution networks positions the US lotion pump market for steady, long-term growth.

The market is expanding rapidly, driven by growing demand from personal care, cosmetic, and pharmaceutical industries. Albéa leads with innovative and high-quality dispensing solutions, emphasizing ergonomic designs and consistent performance for lotions, creams, and liquid products. AptarGroup offers advanced pump technologies, focusing on sustainability and precision dosing, catering to global personal care brands. Berry Global Group provides a wide portfolio of lotion pumps with customizable features, integrating material efficiency and functional design to meet varied product requirements. Other prominent players such as APackaging Group, BodyPak, Coster Group, Frapak Packaging, and Silgan Holdings contribute with regional and specialized offerings, emphasizing reliability, ease of use, and compatibility with diverse formulations.

Companies like Rieke, Taplast, and Yuyao WellPack Sprayer are recognized for providing cost-effective and compact solutions suitable for small- and medium-sized brands. The market continues to evolve with advancements in airless pump technology, anti-clog features, recyclable materials, and enhanced dispensing accuracy.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Screw type and On-Off type |

| Material Type | Plastic and Metal |

| Category | Multi-material pumps and Mono-material pumps |

| Neck Size | 24 mm - 28 mm, Below 24 mm, and Above 28 mm |

| Pump Output | 2 – 4 ml per stroke, Up to 2 ml per stroke, and Above 4 ml per stroke |

| Application | Body Care, Hair Care, Skin Care, Baby Care, and Others |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Albéa, APackaging Group, AptarGroup, Berry Global Group, BodyPak, Coster Group, Frapak Packaging, Lompak, OnePlus Packaging, Richmond Containers, Rieke, Silgan Holdings, Taixing K.K. Plastic, Taplast, and Yuyao WellPack Sprayer |

| Additional Attributes | Dollar sales by pump type and application, demand dynamics across skincare, personal care, and cosmetic sectors, regional trends in packaging adoption, innovation in dispensing accuracy, durability, and material sustainability, environmental impact of plastic use and recycling, and emerging use cases in travel-size products, luxury formulations, and hygiene-focused packaging solutions. |

The global lotion pump market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the lotion pump market is projected to reach USD 2.9 billion by 2035.

The lotion pump market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in lotion pump market are screw type and on-off type.

In terms of material type, plastic segment to command 63.2% share in the lotion pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lotion Tubes Market Size and Share Forecast Outlook 2025 to 2035

Dry Skin Cream, Lotion, and Ointment Market - Trends & Forecast 2025 to 2035

Itchy Skin Relief Lotions Market Size and Share Forecast Outlook 2025 to 2035

Sensitive Skin Body Lotion Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Emulsifying Skincare Lotions Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA