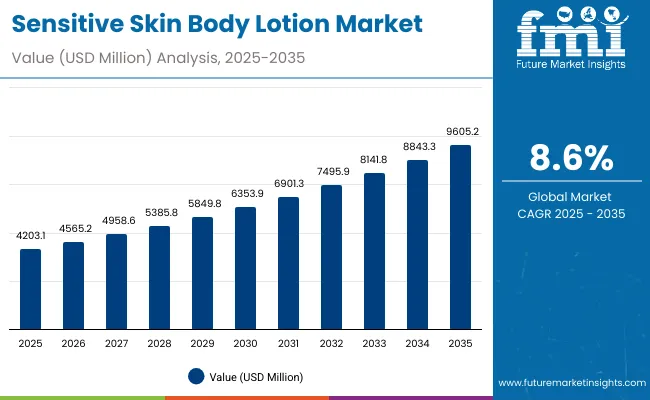

The Sensitive Skin Body Lotion Market is expected to record a valuation of USD 4,203.1 million in 2025 and USD 9,605.2 million in 2035, with an increase of USD 5,402.1 million, which equals a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.6% and a more than 2X increase in market size.

Quick Stats for Sensitive Skin Body Lotion Market

Sensitive Skin Body Lotion Market Key Takeaways

| Metric | Value |

|---|---|

| Sensitive Skin Body Lotion Market Estimated Value in (2025E) | USD 4,203.1 million |

| Sensitive Skin Body Lotion Market Forecast Value in (2035F) | USD 9,605.2 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 4,203.1 million to USD 6,353.9 million, adding USD 2,150.8 million, which accounts for about 39.8% of the total decade growth. This phase records steady adoption of dermatologist-tested and hypoallergenic formulations, particularly in North America and Europe. Short-term momentum is largely supported by the demand for hydration & soothing lotions, which cater to nearly half of the global sensitive skin population, addressing dryness, discomfort, and irritation. Fragrance-free products lead in this phase, gaining consumer trust by avoiding common irritants. Pharmacies and drugstores remain the key distribution channels, backed by professional recommendations and high brand credibility.

The second half from 2030 to 2035 contributes USD 3,251.3 million, equal to 60.2% of total growth, as the market jumps from USD 6,353.9 million to USD 9,605.2 million. This acceleration is powered by rising demand in Asia-Pacific, especially China, India, and Japan, where CAGR rates exceed global averages. E-commerce channels and clean-label claims gain prominence, supported by rising consumer awareness of ingredient transparency and regulatory backing for safe formulations. During this phase, barrier repair, redness relief, and anti-itch lotions experience higher growth, as consumers prioritize products addressing chronic sensitive skin issues. Ingredient innovation with ceramides, oat extract, and niacinamide reinforces brand positioning and widens adoption across new demographics, including men and children.

From 2020 to 2024, the Sensitive Skin Body Lotion Market experienced steady momentum, expanding with consumer demand for dermatologist-approved, fragrance-free, and hypoallergenic solutions. During this period, the competitive landscape was dominated by multinational personal care brands controlling nearly 70-75% of revenues, with Aveeno, Cetaphil, and CeraVe standing out in mass-market pharmacy channels. Differentiation relied on ingredient credibility, clinical testing, and accessibility through trusted distribution outlets such as drugstores and dermatology clinics. Clean-label and botanical ingredient-based ranges gained traction, while services or subscription-driven models had minimal contribution, accounting for less than 10% of the market.

Demand is projected to scale further to USD 4,203.1 million in 2025, as e-commerce penetration, personalized formulations, and regulatory scrutiny reshape the industry. The revenue mix will gradually shift as claim-based categories such as fragrance-free, hypoallergenic, and clean-label capture more than half of the total sales. Traditional leaders face growing competition from dermatology-endorsed challengers emphasizing barrier repair and redness relief.

Market incumbents are increasingly pivoting to hybrid models that combine dermatologist-tested efficacy with sustainability-driven clean-label promises. Emerging players focusing on digital engagement, ingredient transparency, and pediatric-friendly solutions are expanding their share. Competitive advantage is evolving from mere distribution strength to holistic consumer trust, brand ethos, and regulatory compliance.

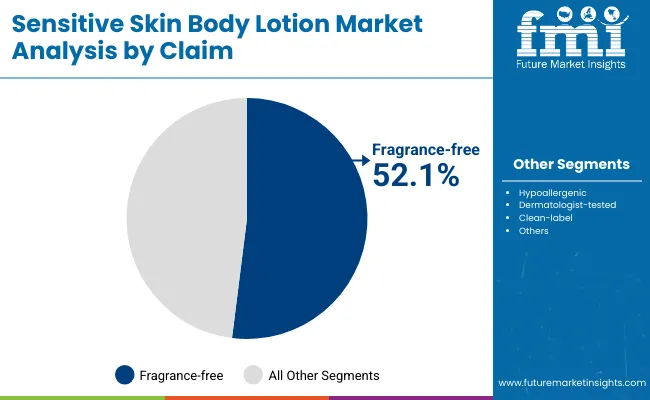

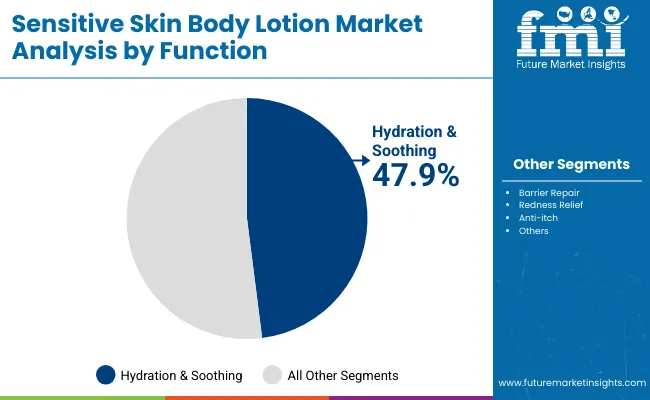

The global market is expanding as more consumers worldwide report sensitive skin conditions linked to pollution, stress, lifestyle changes, and heightened cosmetic use. Advances in dermatological research and ingredient formulations have enhanced the safety and efficacy of lotions, making them accessible to a broader demographic. Hydration & soothing lotions dominate due to their ability to tackle daily dryness and discomfort, while barrier repair and redness relief products are gaining traction for their clinical benefits. Fragrance-free claims resonate strongly with users who want to avoid irritants, explaining their dominance with more than half of global sales.

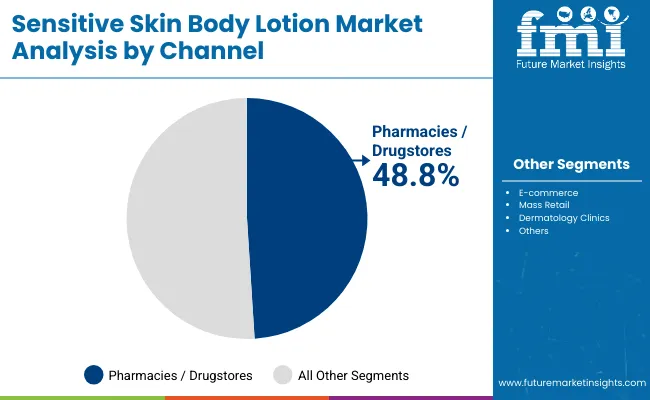

The growth is also linked to rising demand from emerging regions. China and India, with double-digit CAGR rates of 19.8% and 22.7% respectively, represent the fastest-growing markets. Pharmacies and drugstores remain the most trusted distribution channel, capturing nearly half of the value share, but e-commerce is growing rapidly due to convenience and expanded reach. Among end users, women account for the largest share, but products targeted at men, children, and sensitive-skin prone adults are expanding adoption. Ingredient-based innovations such as ceramides for barrier repair, oat extract for soothing, and niacinamide for anti-inflammatory support are central to differentiation.

The market is segmented by function, active ingredient, product type, claim, channel, end user, and region. Hydration & soothing dominates the function category with 47.90% share in 2025, while ceramides lead among active ingredients due to their barrier-repair efficacy. Lotions remain the preferred product type for daily use, supported by consumer preference for lightweight textures. Fragrance-free products hold the largest claim share at 52.10%, reflecting strong trust among sensitive-skin users.

Pharmacies and drugstores lead distribution with 48.80% share, while e-commerce is expanding rapidly. Women account for the majority of demand, with pediatric and men’s segments gaining traction. Regionally, Asia-Pacific drives the fastest growth led by India, China, and Japan, while Europe and North America maintain steady expansion underpinned by regulatory compliance and established skincare awareness.

| Claim | Value Share% 2025 |

|---|---|

| Fragrance-free | 52.1% |

| Others | 47.9% |

Fragrance-free products are projected to contribute 52.10% of the Sensitive Skin Body Lotion Market revenue in 2025 (USD 2,206.1 million), maintaining their lead as the dominant claim category. Leadership is driven by avoidance of potential irritants, tighter scrutiny of allergen lists, and dermatologist recommendations that position fragrance-free as the safest everyday choice for sensitive skin. Momentum is reinforced by clear on-pack communication, pediatric-friendly ranges, and brand strategies that pair fragrance-free with barrier-supporting actives (ceramides, oat, niacinamide). As clean-label and hypoallergenic messaging scale within the "Others" bucket, fragrance-free remains the backbone claim anchoring trust, repurchase, and pharmacy shelf visibility.

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 48.8% |

| Others | 51.2% |

Pharmacies/drugstores are set to contribute 48.80% of 2025 revenue (USD 2,036.4 million), making them the largest single structured channel even as the aggregated "Others" (e-commerce, mass retail, clinics) totals 51.20% (USD 2,149.95 million). Their strength stems from medical credibility, dermatologist endorsement, and tight assortment curation that favors fragrance-free and clinically validated formulas. As e-commerce accelerates discovery and replenishment, pharmacies preserve their role at diagnosis-adjacent touchpoints, where pharmacist guidance, pediatric trust, and OTC derm brands convert at premium price points. Expect omnichannel strategies to deepen click-and-collect, targeted sampling, and in-aisle education to defend share while leveraging digital dermatology to expand reach.

| Function | Value Share% 2025 |

|---|---|

| Hydration & soothing | 47.9% |

| Others | 52.1% |

Hydration & soothing is poised to contribute 47.90% of 2025 revenue (USD 1,993.9 million), the largest single function despite "Others" (barrier repair, redness relief, anti-itch) aggregating to 52.10% (USD 2,190.34 million). Its leadership reflects universal daily needs relief from dryness, tightness, and discomfort where lightweight, non-irritating textures win routine compliance. Clinical positioning around instant comfort and 24-hour moisturization, often paired with ceramides and oat, underpins repeat purchase and broad demographic appeal (women, men, pediatrics). As chronic sensitivity management grows, Hydration & soothing acts as the entry platform that ladders shoppers into targeted sub-functions for barrier rebuilding and flare-up control.

Rising Prevalence of Dermatological Sensitivities Across Age Groups

Increasing cases of sensitive skin conditions caused by pollution, changing climate patterns, and higher cosmetic usage are fueling demand for dermatologist-tested body lotions. In countries such as the USA, Japan, and Germany, awareness of contact dermatitis, eczema, and dryness-driven irritation has surged, making fragrance-free and hypoallergenic products mainstream rather than niche. Children and babies represent a high-growth sub-segment due to heightened parental concern over skin safety, driving consistent adoption in pharmacies and pediatric dermatology clinics.

Ingredient-Led Innovation and Consumer Demand for Transparency

Ceramides, oat extract, and niacinamide-based formulations are becoming central to brand strategies, not just as functional ingredients but as core marketing claims. Consumers increasingly scrutinize ingredient lists, pushing companies to highlight efficacy, origin, and clinical validation. The shift from opaque formulations toward clean-label and science-backed transparency is generating loyalty in developed markets and unlocking new premium niches in Asia-Pacific. This driver is particularly strong in China and India, where CAGR rates of 19.8% and 22.7% respectively highlight how ingredient awareness accelerates adoption.

Regulatory Complexities Across Regional Markets

Unlike standardized pharmaceutical products, body lotions fall under diverse regulatory categories across geographies. For instance, Europe enforces stringent safety assessments under its Cosmetic Regulation, while the USA FDA operates under looser "cosmetic" definitions, creating inconsistencies in labeling, testing, and claims. This fragmented compliance landscape increases cost, delays product launches, and can reduce consumer trust when claims such as "hypoallergenic" or "clean-label" are perceived differently in different regions.

High Price Sensitivity in Emerging Markets

While premium sensitive-skin products dominate in the West, consumers in high-growth regions such as India, China, and parts of Southeast Asia often face affordability barriers. Imported or dermatologist-endorsed brands command a high price premium, limiting penetration beyond affluent urban populations. Local players offering low-cost formulations challenge global incumbents by undercutting on price, which makes scaling premium products difficult in volume-driven markets.

E-commerce Acceleration Coupled with Digital Dermatology

E-commerce is rapidly reshaping distribution, especially in Asia-Pacific where pharmacies traditionally dominated. Online platforms not only expand product reach but also integrate dermatology-driven personalization tools. For example, AI-powered skin analysis apps are recommending fragrance-free or barrier-repair lotions tailored to users’ conditions, boosting conversion rates. This integration of tele-dermatology with online retail is emerging as a competitive differentiator, especially for multinational brands targeting Gen Z and millennial consumers.

Expansion of Men’s and Children’s Sensitive Skin Care Portfolios

Although women remain the largest end-user group, brands are deliberately building sub-portfolios for men and children. Men’s lines are marketed around irritation from shaving and environmental aggressors, while pediatric ranges focus on hypoallergenic and clinically tested safety. Mustela and Aveeno Baby are gaining traction in the pediatric space, while CeraVe and La Roche-Posay have expanded men’s skincare solutions. This diversification helps brands capture untapped segments and move beyond the traditional female-dominated base.

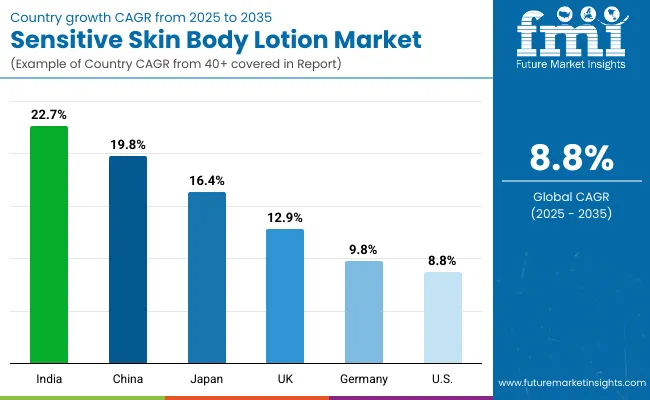

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

The Sensitive Skin Body Lotion Market shows a pronounced regional disparity in adoption speed, strongly influenced by dermatological awareness, ingredient innovation, and channel accessibility. Asia-Pacific emerges as the fastest-growing region, anchored by India at 22.70% CAGR and China at 19.80%. India’s rapid trajectory reflects rising disposable incomes, growing middle-class adoption of dermatologist-tested skincare, and heightened parental awareness of sensitive skin in infants and children.

Pharmacies and e-commerce platforms are increasingly bridging affordability gaps, making premium formulations accessible beyond metro cities. China’s momentum is supported by strong pharmacy and drugstore penetration, consumer demand for dermatologist-endorsed and fragrance-free products, and a growing appetite for clean-label formulations. Rapid digital adoption through e-commerce platforms like Tmall and JD.com is further expanding reach across tier-2 and tier-3 markets.

Japan records a robust CAGR of 16.40%, driven by cultural emphasis on preventive skincare and consumer preference for lightweight, clinically validated formulations. The market is characterized by early adoption of ceramide- and niacinamide-enriched products, reflecting trust in science-backed solutions. Europe maintains a steady growth profile, led by the UK at 12.90% and Germany at 9.80%. Growth in this region is supported by strict cosmetic regulations under the EU framework, rising demand for hypoallergenic products, and strong consumer trust in dermatologist-tested claims.

Sustainability and clean-label positioning are critical differentiators, with established brands reinforcing loyalty through ingredient transparency and eco-friendly packaging. North America shows moderate expansion, with the USA projected at 8.80% CAGR. While growth is slower than Asia-Pacific and Europe, it is anchored by a mature consumer base that prioritizes fragrance-free and hypoallergenic formulations. Expansion here is more claim-driven than volume-driven, with e-commerce-led personalization, digital dermatology consultations, and pediatric-focused portfolios gaining traction over the decade.

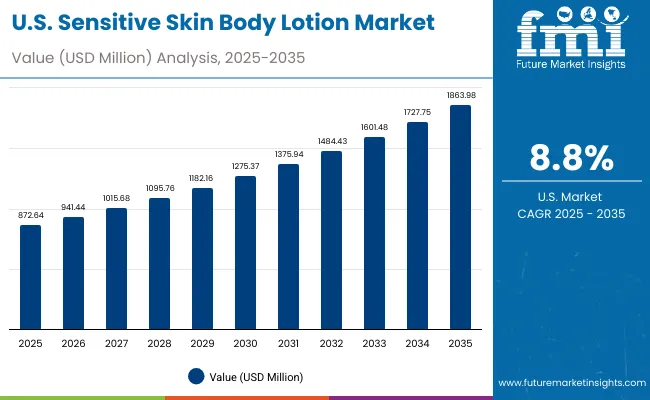

| Year | USA Sensitive Skin Body Lotion Market (USD Million) |

|---|---|

| 2025 | 872.64 |

| 2026 | 941.44 |

| 2027 | 1,015.68 |

| 2028 | 1,095.76 |

| 2029 | 1,182.16 |

| 2030 | 1,275.37 |

| 2031 | 1,375.94 |

| 2032 | 1,484.43 |

| 2033 | 1,601.48 |

| 2034 | 1,727.75 |

| 2035 | 1,863.98 |

The Sensitive Skin Body Lotion Market in the United States is projected to grow at a CAGR of 8.8% between 2025 and 2035, driven by the rising prevalence of sensitive skin conditions, high demand for fragrance-free products, and strong brand positioning through pharmacies and e-commerce. Dermatologist endorsements and pediatric-focused ranges are key accelerators of adoption, while digital dermatology consultations are boosting online recommendations. Growth is balanced between premium dermatologist-tested offerings and mid-priced mass retail products that meet broad consumer needs.

The Sensitive Skin Body Lotion Market in the United Kingdom is expected to grow at a CAGR of 12.9% from 2025 to 2035, supported by demand for dermatologist-tested and clean-label products. Consumer behavior is shaped by regulatory compliance under EU standards, ensuring safety and transparency in formulations. Hypoallergenic and fragrance-free claims resonate strongly, while e-commerce adoption continues to rise through digital-first retailers. Skincare adoption is reinforced by the UK’s strong awareness culture, particularly among women and millennials prioritizing sustainability.

India is witnessing rapid growth in the Sensitive Skin Body Lotion Market, forecasted to expand at a CAGR of 22.7% through 2035. Rising middle-class consumption, increased awareness of sensitive skin issues, and heightened concern for infant and child skincare are fueling adoption. Tier-2 and tier-3 city penetration is improving due to affordability of localized offerings, while global brands are capitalizing on demand for premium dermatologist-endorsed products. Pharmacies and e-commerce platforms are pivotal in expanding reach, supported by aggressive marketing campaigns from multinational and domestic players.

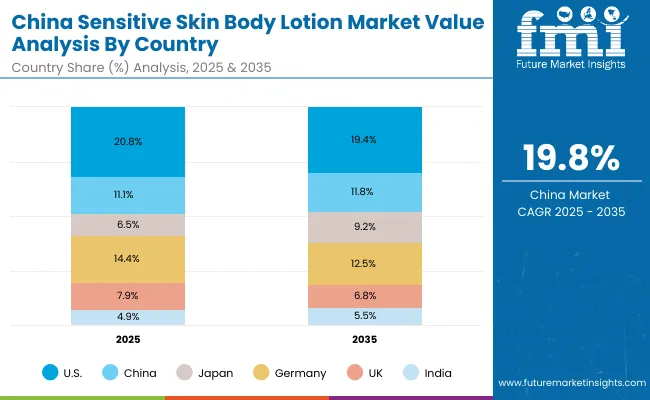

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.4% |

| China | 11.8% |

| Japan | 9.2% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

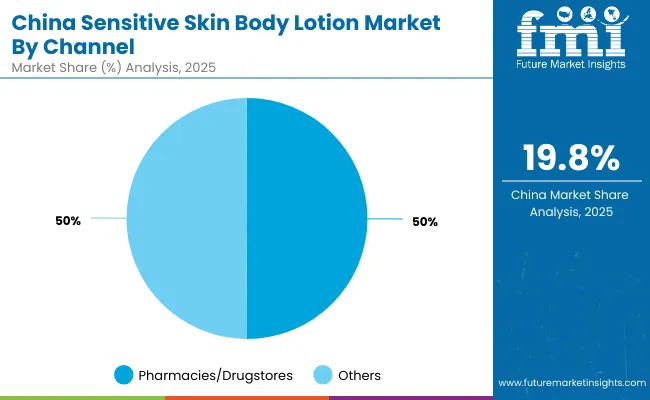

The Sensitive Skin Body Lotion Market in China is expected to grow at a CAGR of 19.8%, one of the highest globally. This momentum is driven by a robust pharmacy and drugstore network, which accounts for 50.10% of national sales in 2025 (USD 233.3 million). E-commerce penetration is accelerating adoption, particularly in lower-tier cities, where online dermatology consultations and promotions influence consumer preferences. Domestic and international brands alike are leveraging clean-label claims and dermatologist-tested endorsements to capture market share.

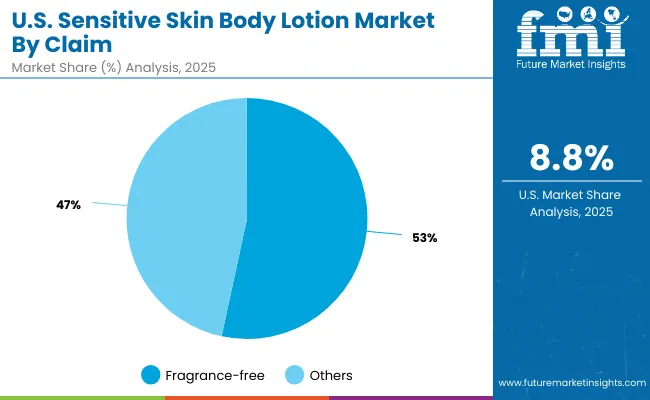

| USA by Claim | Value Share% 2025 |

|---|---|

| Fragrance-free | 53.4% |

| Others | 46.6% |

The Sensitive Skin Body Lotion Market in the United States is valued at USD 872.6 million in 2025, with fragrance-free products leading at 53.40% (USD 466.1 million). The dominance of this claim reflects heightened consumer awareness of potential irritants in skincare, making fragrance-free the most trusted choice for sensitive-skin users. Dermatologist endorsements, pediatric-specific launches, and a strong retail presence in pharmacies and drugstores reinforce the appeal of fragrance-free lotions.

This leadership is supported by the maturity of the USA market, where preventive skincare routines are well established, and consumers actively seek hypoallergenic, dermatologist-tested solutions. Growth is also shaped by digital channels, with e-commerce platforms offering claim-driven product recommendations and expanding reach beyond urban markets. The trend positions fragrance-free lotions as a cornerstone of the USA sensitive skin category.

| China by Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 50.1% |

| Others | 49.9% |

The Sensitive Skin Body Lotion Market in China is valued at USD 465.5 million in 2025, with pharmacies and drugstores leading at 50.10% (USD 233.3 million). The strength of this channel reflects consumer reliance on trusted pharmacy chains for skincare, where dermatologist-approved and medically aligned products dominate. Professional credibility and established distribution systems make this channel indispensable for international and domestic brands targeting sensitive skin consumers.

China’s market momentum is further reinforced by e-commerce platforms such as Tmall and JD.com, which are enabling rapid penetration into tier-2 and tier-3 cities. Ingredient transparency, clean-label positioning, and pediatric formulations are gaining strong traction, supported by rising disposable incomes and growing awareness of chronic skin sensitivity. Pharmacies remain the anchor of trust, while digital channels expand the breadth of consumer engagement.

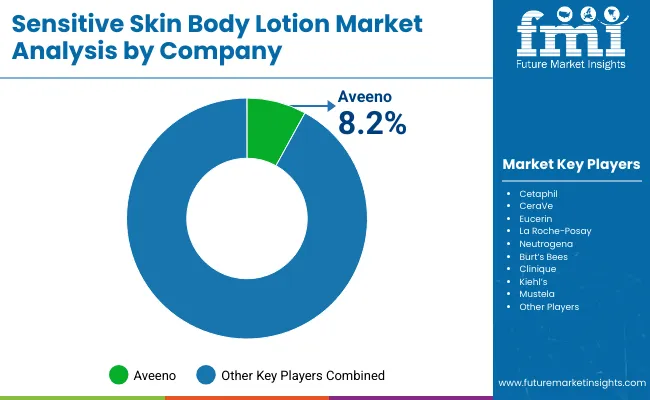

The Sensitive Skin Body Lotion Market is moderately fragmented, with multinational personal care leaders, dermatologist-endorsed brands, and niche players competing for share. Aveeno leads with an 8.20% global value share in 2025, leveraging its heritage in oat extract-based soothing formulations and strong penetration in both pharmacies and pediatric care. Established global players such as Cetaphil, CeraVe, Eucerin, La Roche-Posay, and Neutrogena dominate through dermatologist-tested, fragrance-free, and hypoallergenic portfolios.

Their strategies focus on reinforcing trust via clinical trials, expanding digital-first marketing, and strengthening e-commerce distribution to capture millennial and Gen Z consumers. Niche and natural brands, including Burt’s Bees, Clinique, Kiehl’s, and Mustela, differentiate by offering clean-label, botanical, and baby-care focused solutions.

These companies are gaining traction in specialty channels and among ingredient-conscious buyers who prioritize transparency and sustainability. Competitive differentiation is shifting from price and product format toward claim-based trust, ingredient authenticity, and omni-channel visibility. Companies investing in pediatric care, men’s skincare, and digital dermatology ecosystems are expected to strengthen their market positioning in the coming decade.

Key Developments in Sensitive Skin Body Lotion Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Function | Hydration & soothing, Barrier repair, Redness relief, Anti-itch |

| Active Ingredient | Ceramides, Oat extract, Shea butter, Aloe vera, Niacinamide |

| Product Type | Creams, Lotions, Balms, Gels |

| Claim | Fragrance-free, Hypoallergenic, Dermatologist-tested, Clean-label |

| Channel | Pharmacies/drugstores, E-commerce, Mass retail, Dermatology clinics |

| End User | Women, Men, Children/babies, Sensitive-skin prone adults |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aveeno, Cetaphil, CeraVe, Eucerin, La Roche-Posay, Neutrogena, Burt’s Bees, Clinique, Kiehl’s, Mustela |

| Additional Attributes | Dollar sales by function, ingredient, and claim; adoption trends in fragrance-free and hypoallergenic skincare; rising demand for pediatric and men’s sensitive skin products; growth of pharmacies and e-commerce distribution; software-driven personalization in digital dermatology; regional trends influenced by skin sensitivity prevalence and regulatory frameworks; innovations in ceramide, oat extract, and niacinamide formulations. |

The Sensitive Skin Body Lotion Market is estimated to be valued at USD 4,203.1 million in 2025.

The market size for the Sensitive Skin Body Lotion Market is projected to reach USD 9,605.2 million by 2035.

The Sensitive Skin Body Lotion Market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

The key product types in the Sensitive Skin Body Lotion Market are creams, lotions, balms, and gels.

In terms of claim, fragrance-free products will command 52.10% share in the Sensitive Skin Body Lotion Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensitive Stomach Cat Food Market

Sensitive Skin Solutions Market Size and Share Forecast Outlook 2025 to 2035

Photosensitive Alignment Film Market Size and Share Forecast Outlook 2025 to 2035

Photosensitive Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Time Sensitive Networking TSN Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat-Sensitive Cups Market is segmented by material type, capacity, and end-use from 2025 to 2035

Hormone Sensitive Advanced Prostate Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hormone Sensitive Prostate Cancer Market – Trends & Forecast 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Electronic Pressure Sensitive Tape Dispenser Market

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA