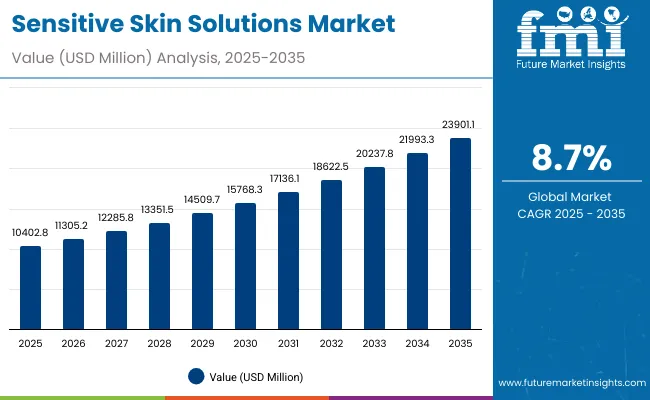

The global Sensitive Skin Solutions Market has been projected to begin at USD 10,402.80 million in 2025, expanding to USD 23,901.10 million by 2035.The increase of USD 13,498.30 million during this period reflects more than a doubling in value, translating into a robust CAGR of 8.70%. Momentum is expected to remain consistent as demand for barrier-supportive and fragrance-free solutions continues to rise in line with shifting consumer priorities toward dermatologically safe products.

Sensitive Skin Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Sensitive Skin Solutions Market Estimated Value in (2025E) | USD 10,402.80 million |

| Sensitive Skin Solutions Market Forecast Value in (2035F) | USD 23,901.10 million |

| Forecast CAGR (2025 to 2035) | 8.70% |

Over the first half of the forecast period, from 2025 to 2030, the market is set to grow from USD 10,402.80 million to USD 15,768.30 million, generating USD 5,365.50 million in incremental revenue.This stage is likely to account for nearly 40% of the decade’s total expansion, supported by increasing adoption of sensitive skin routines among adults, product innovation in barrier-strengthening categories, and wider availability through e-commerce and pharmacy retail.Demand during this phase is expected to remain anchored in developed markets, particularly the U.S. and Europe, where fragrance-free claims will drive early gains.

From 2030 to 2035, growth is forecast to accelerate with an additional USD 8,132.80 million contributed, equal to nearly 60% of the overall rise.The market is anticipated to climb from USD 15,768.30 million to USD 23,901.10 million in this stage, driven by strong penetration in high-growth geographies such as China and India, alongside premiumization trends that emphasize hypoallergenic, dermatologist-tested, and clinically validated claims.

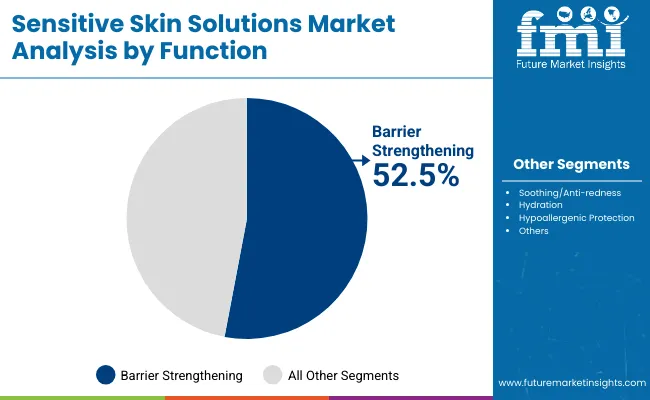

By 2035, barrier-strengthening products are projected to maintain leadership with a 52.50% share, while fragrance-free claims are set to capture 57.60% of the market, reinforcing consumer trust in safe and irritation-free solutions.

Between 2020 and 2024, the Sensitive Skin Solutions Market advanced steadily as consumer awareness of irritation-free and dermatologist-tested products increased. This early phase was shaped by strong adoption of fragrance-free solutions, which accounted for a dominant share by 2025.

Competitive dynamics were influenced by global dermatology-backed brands, with leaders securing nearly all market share through trust-driven positioning and science-based claims. During this period, product portfolios were expanded toward barrier-strengthening and hypoallergenic ranges, while services such as digital dermatology consultations gained relevance as complementary enablers.

Looking ahead to 2025 and beyond, the market is expected to progress toward USD 23,901.10 million by 2035, with significant acceleration in Asia, particularly China and India, where double-digit CAGR levels are anticipated.

Market leadership is projected to remain concentrated among established skincare brands, yet competition will intensify as premiumization, transparent ingredient labeling, and AI-enabled dermatology tools reshape the consumer landscape. Differentiation is expected to shift toward clinically validated efficacy, skin compatibility testing, and seamless retail integration, ensuring that future growth will be captured by those aligning with evolving sensitivity needs and digital-first care models.

Growth in the Sensitive Skin Solutions Market is being propelled by rising awareness of skin sensitivity and the shift toward dermatologist-endorsed, irritation-free formulations.The demand is being fueled by consumers seeking fragrance-free and hypoallergenic solutions that address barrier repair and long-term skin health.

As ingredient transparency becomes a central expectation, brands are being pushed to reformulate portfolios with clean-label and minimal-allergen compositions.This trend is reinforced by clinical validation and dermatologist testing, which are strengthening consumer trust and accelerating adoption.

Expansion is also being driven by the surge of e-commerce platforms and digital dermatology consultations, which are improving accessibility and personalized product recommendations.High-growth regions such as China and India are expected to record double-digit CAGR due to increased awareness, premiumization, and adoption by urban populations.

Adult-sensitive skin users continue to anchor demand, while innovations targeting younger demographics are opening incremental growth opportunities.Collectively, these factors are ensuring strong momentum through 2035.

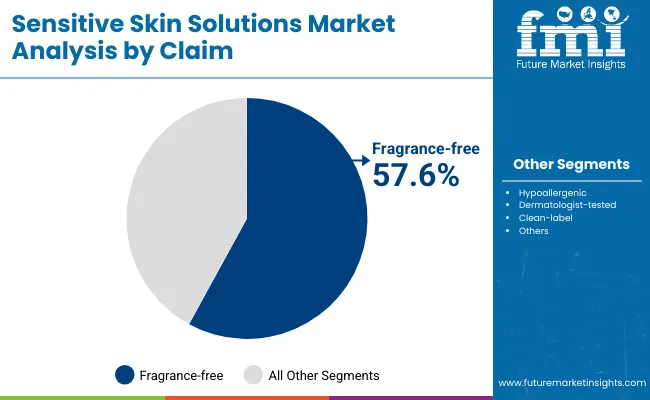

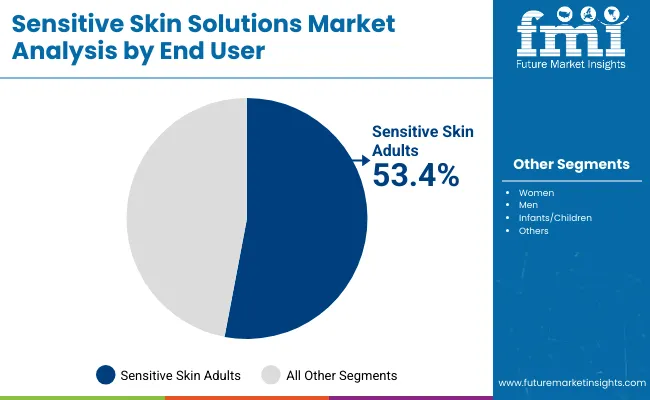

The Sensitive Skin Solutions Market has been segmented across key dimensions such as claim, end user, and function, each highlighting consumer priorities and product positioning. Fragrance-free claims dominate as the leading trust signal, reflecting rising demand for formulations free from irritants.

In terms of end users, adults with sensitive skin represent the largest consumer group, driven by heightened awareness and lifestyle-driven routines. From a functional perspective, barrier-strengthening products hold the highest share, underlining the emphasis on repairing and protecting skin health. Each of these segments showcases how evolving consumer expectations, dermatologist guidance, and regulatory support are shaping long-term market growth.

| Claim | Market Value Share, 2025 |

|---|---|

| Fragrance-free | 57.6% |

| Others | 42.4% |

The claim segment is dominated by fragrance-free solutions, holding 57.60% share in 2025 with USD 5,987.90 million in sales. Growth is being driven by consumer sensitivity toward artificial fragrances and allergens, which are widely associated with irritation. Increased dermatological guidance and regulatory support for allergen-free products are strengthening trust in this category.

The adoption of fragrance-free ranges is expected to expand further as minimal formulations and clean-label ingredients are emphasized by leading brands. This segment is projected to remain the cornerstone of consumer preference, reinforcing its dominant position through 2035.

| End User | Market Value Share, 2025 |

|---|---|

| Sensitive skin adults | 53.4% |

| Others | 46.6% |

Adults with sensitive skin are anticipated to account for 53.40% of the market in 2025, equating to USD 5,567.70 million. This segment is expanding as awareness of adult skin concerns, including barrier weakness and redness, continues to grow.

Premiumization trends and broader access through e-commerce and pharmacies are contributing to sustained demand. With more men and aging demographics entering the category, the base of sensitive skin adults is expected to expand further. As consumer education and lifestyle-driven routines become more prevalent, this segment is forecast to remain the leading end-user group.

| Function | Market Value Share, 2025 |

|---|---|

| Barrier strengthening | 52.5% |

| Others | 47.5% |

Barrier-strengthening functions are projected to lead with 52.50% share in 2025, generating USD 5,462.60 million. The focus on maintaining and repairing skin barrier integrity has gained momentum as consumers become more aware of the link between barrier health and sensitivity prevention.

Dermatologists have emphasized barrier care as a foundational approach, reinforcing consumer trust in this function. Product pipelines are increasingly centered on actives like ceramides and lipids that restore barrier performance. As global consumers move toward preventive rather than reactive care, barrier-strengthening solutions are expected to sustain their dominance, positioning them as a central driver of long-term growth.

Growing consumer awareness and clinical validation are reshaping the Sensitive Skin Solutions Market, even as challenges around affordability and regulatory scrutiny temper progress. A forward-looking balance between scientific innovation and cost-efficient accessibility will define market evolution through 2035.

Dermatology Integration into Mainstream Retail

The market is being influenced by the integration of dermatologist-driven expertise into mainstream retail formats. Pharmacies and digital platforms are increasingly embedding diagnostic tools and tele-dermatology consultations alongside product sales. This trend is allowing personalized recommendations to be delivered at the point of purchase, improving trust and conversion rates.

The driver reflects a broader shift where skincare is positioned not only as a beauty product but as a quasi-healthcare solution. Over time, this integration is anticipated to elevate premium product adoption and enhance the visibility of clinically validated claims, ensuring that sensitivity care solutions evolve into a central pillar of preventive dermatology.

Cost-Intensive Clinical Validation Protocols

A major restraint emerges from the high costs associated with clinical validation and hypoallergenic testing. As regulatory authorities tighten standards and consumers demand transparent proof of safety, significant investments are required to demonstrate efficacy and tolerability. Smaller brands often face barriers entering the market, leading to concentration of power among established players with larger R&D budgets.

While this enhances consumer safety, it also reduces competitive diversity, limiting innovation from niche entrants. The capital intensity of repeated trials, long approval timelines, and certification expenses is expected to restrict faster commercialization, creating disparities between global and local market players.

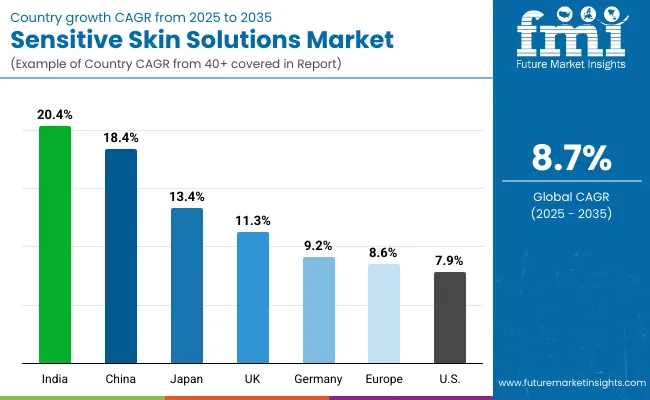

| Country | CAGR |

|---|---|

| China | 18.4% |

| USA | 7.9% |

| India | 20.4% |

| UK | 11.3% |

| Germany | 9.2% |

| Japan | 13.4% |

The global Sensitive Skin Solutions Market is projected to display distinct country-level variations in adoption, shaped by consumer awareness, regulatory stringency, and evolving retail dynamics. Asia emerges as the fastest-growing region, with India expected to lead at a 20.40% CAGR, followed closely by China at 18.40%. In both nations, rapid urbanization, expanding middle-class income levels, and rising dermatology awareness are anticipated to accelerate adoption of sensitive skin care products. The integration of e-commerce platforms and tele-dermatology services is also projected to widen accessibility, particularly among younger consumers in Tier-1 and Tier-2 cities.

Japan, growing at 13.40% CAGR, is forecast to benefit from aging demographics, where sensitive skin prevalence is higher, reinforcing demand for dermatologist-tested and premium formulations. In contrast, Europe is expected to expand more moderately at 8.60%, with Germany at 9.20% and the UK at 11.30%. Growth in these regions will continue to be supported by strict ingredient regulations, consumer inclination toward fragrance-free claims, and premium pharmacy-led distribution models.

The USA, projected to grow at 7.90% CAGR, reflects market maturity where adoption is already widespread, though innovation around hypoallergenic and barrier-strengthening claims will sustain steady gains. Collectively, these dynamics position Asia as the leading growth hub, while Europe and North America are expected to retain influence through regulatory rigor and brand-driven trust.

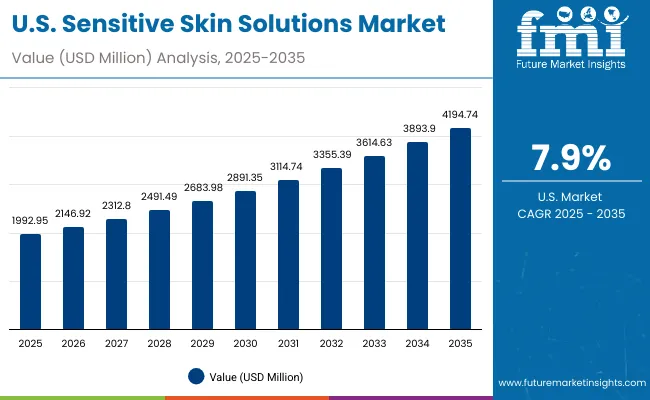

| Year | USA Sensitive Skin Solutions Market (USD Million) |

|---|---|

| 2025 | 1,992.95 |

| 2026 | 2,146.92 |

| 2027 | 2,312.80 |

| 2028 | 2,491.49 |

| 2029 | 2,683.98 |

| 2030 | 2,891.35 |

| 2031 | 3,114.74 |

| 2032 | 3,355.39 |

| 2033 | 3,614.63 |

| 2034 | 3,893.90 |

| 2035 | 4,194.74 |

The Sensitive Skin Solutions Market in the United States is projected to grow at a CAGR of 7.9% from 2025 to 2035, expanding from USD 1,992.95 million to USD 4,194.74 million.The outlook is supported by strong consumer awareness, dermatologist-driven product validation, and increasing demand for fragrance-free and barrier-strengthening formulations. Premium positioning of safe and hypoallergenic solutions is expected to sustain market leadership throughout the forecast horizon.

E-commerce and pharmacy channels are anticipated to reinforce accessibility, while digital dermatology services are forecast to create higher personalization in recommendations. Growth will also be anchored by rising adult adoption and preventive skincare regimens, which are projected to accelerate premium uptake.

The Sensitive Skin Solutions Market in the UK is projected to grow at a CAGR of 11.3% between 2025 and 2035, supported by consumer awareness, regulatory stringency, and premium pharmacy-led retailing.The market is expected to expand steadily as clean-label, fragrance-free, and dermatologist-tested products gain wider traction.

Rising influence of digital platforms is anticipated to provide access to sensitive skin solutions for a broader demographic, including men and aging consumers. Growing pressure for ingredient transparency is expected to reshape product positioning, with brands aligning to compliance-driven safety standards.

The Sensitive Skin Solutions Market in India is expected to record the fastest expansion globally at a CAGR of 20.4% from 2025 to 2035, reflecting rapid urbanization, higher disposable incomes, and rising skincare awareness.

The market is projected to accelerate as sensitive skin care becomes a mainstream consumer priority, particularly among younger populations. E-commerce platforms are anticipated to dominate discovery and distribution, aided by influencer-driven marketing and dermatologist partnerships. Premium adoption is forecast to intensify in Tier-1 and Tier-2 cities, while mass-market brands are expected to expand affordability.

The Sensitive Skin Solutions Market in China is forecast to grow at a CAGR of 18.4% through 2035, driven by increasing dermatology awareness and strong penetration of digital retail ecosystems.The country is expected to emerge as one of the largest contributors to global revenue growth, supported by urban lifestyles and rising health-conscious consumer segments.

Dermatologist-tested and fragrance-free solutions are anticipated to gain dominance as consumers demand clinically validated safety. Integration of sensitive skin care into broader wellness and self-care routines is expected to further support premiumization.

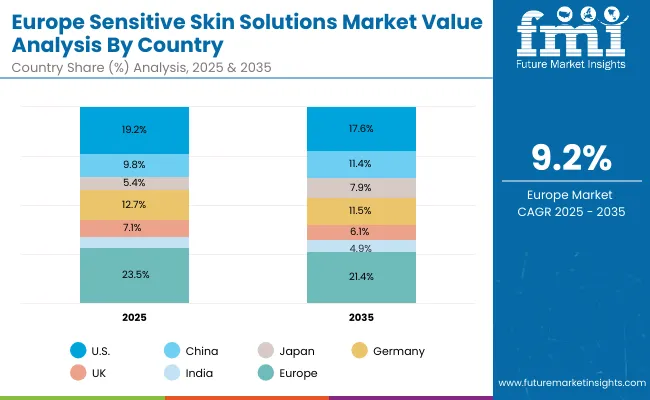

| Country | 2025 |

|---|---|

| USA | 19.2% |

| China | 9.8% |

| Japan | 5.4% |

| Germany | 12.7% |

| UK | 7.1% |

| India | 4.4% |

| Country | 2035 |

|---|---|

| USA | 17.6% |

| China | 11.4% |

| Japan | 7.9% |

| Germany | 11.5% |

| UK | 6.1% |

| India | 4.9% |

The Sensitive Skin Solutions Market in Germany is projected to expand at a CAGR of 9.2% between 2025 and 2035, supported by strong regulatory frameworks and consumer preference for dermatologist-backed solutions.The market outlook is defined by demand for fragrance-free and hypoallergenic formulations that comply with stringent EU regulations.

Pharmacy-led distribution is expected to dominate, while e-commerce channels will steadily expand, offering personalized product recommendations. Rising demand among aging consumers and men’s skincare adoption is projected to diversify the market base.

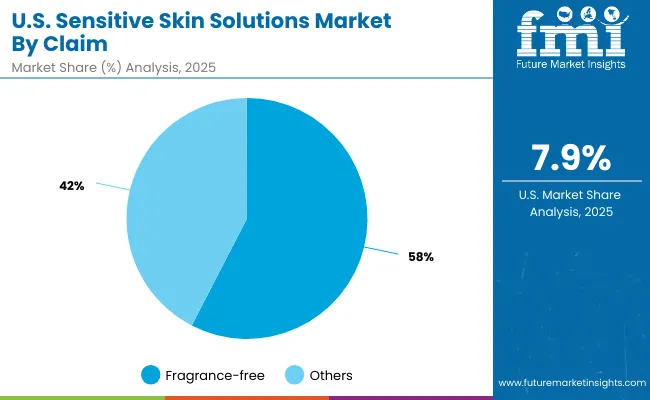

| USA by Claim | Market Value Share, 2025 |

|---|---|

| Fragrance-free | 57.6% |

| Others | 42.4% |

The Sensitive Skin Solutions Market in the United States is projected at USD 1,992.95 million in 2025. Fragrance-free solutions contribute 57.6% with USD 1,147.50 million, while other claims hold 42.4% with USD 845.49 million, highlighting the continued dominance of allergen-free positioning.

This leadership reflects a market dynamic where trust in dermatologist-tested and clinically validated fragrance-free solutions is shaping consumer preference. The rising prevalence of sensitivity concerns across adults and aging populations is accelerating the adoption of formulations designed to minimize irritation risk.

Fragrance-free formulations are also being reinforced by regulatory guidance and increasing consumer literacy around allergens, pushing manufacturers to highlight “no added fragrance” as a core differentiator. Other claims continue to serve niche preferences, but their share remains secondary compared to fragrance-free’s central role. Looking forward, the claim mix is expected to evolve with layering of hypoallergenic and clean-label assurances, yet fragrance-free will remain the baseline expectation in the USA market.

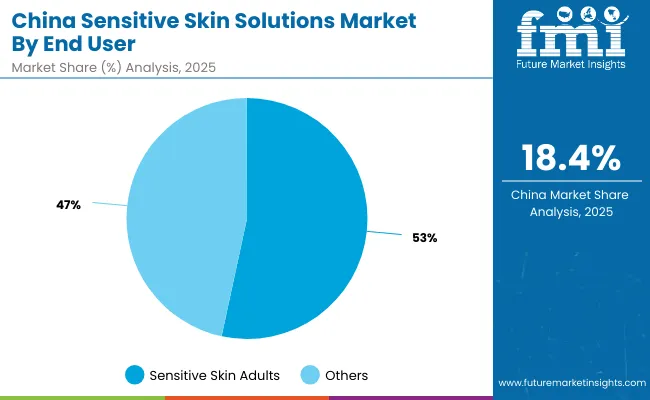

| China by End User | Market Value Share, 2025 |

|---|---|

| Sensitive skin adults | 53.4% |

| Others | 46.6% |

The Sensitive Skin Solutions Market in China is projected at USD 1,021.22 million in 2025. Sensitive skin adults contribute 53.4% with USD 544.90 million, while others account for 46.6% with USD 476.37 million. The dominance of adult consumers reflects rising dermatological awareness, urban lifestyle shifts, and heightened demand for safe, irritation-free solutions. As younger demographics increasingly prioritize preventive skincare, this segment is expected to remain the growth engine of the market.

The adult-focused segment is being supported by rapid expansion of e-commerce platforms, live-streaming sales, and dermatologist-driven content that highlight the importance of barrier care and fragrance-free formulations. The “others” category, while smaller, continues to serve children and niche groups, offering opportunities for specialized innovations. Looking ahead, the adult segment is projected to sustain leadership as premiumization intensifies, while niche consumer groups are expected to diversify adoption patterns.

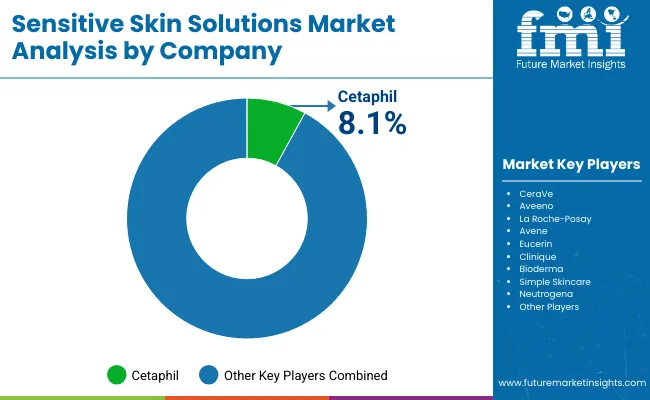

| Company | Global Value Share 2025 |

|---|---|

| Cetaphil | 8.1% |

| Others | 91.9% |

The Sensitive Skin Solutions Market is moderately fragmented, with global leaders, dermatologist-endorsed brands, and regional specialists competing across diverse product categories. Leading brands such as Cetaphil, which holds an 8.1% global market share in 2024, dominate by leveraging dermatologist trust, clinical validation, and wide retail presence. Cetaphil’s positioning is anchored in fragrance-free, hypoallergenic, and barrier-strengthening solutions, making it a benchmark brand for sensitive skin care.

Other prominent international players-including CeraVe, Aveeno, La Roche-Posay, Eucerin, Avene, Clinique, Bioderma, Simple Skincare, and Neutrogena-are strengthening adoption through pharmacist recommendations, digital dermatologist engagement, and innovation in clean-label formulations. These companies are investing in hypoallergenic pipelines, transparency-driven marketing, and digital-first strategies to expand penetration across both developed and emerging markets.

Smaller regional specialists and mass-market entrants contribute to the remaining 91.9% of share, where competitive intensity is high. Many focus on affordability, niche demographics such as infants or men, or localized distribution through pharmacy and e-commerce ecosystems. Their strength lies in pricing flexibility and adaptability to local consumer needs, though they often lack the clinical authority of global leaders.

Competitive differentiation is shifting from basic skincare claims toward integrated ecosystems of safety validation, barrier restoration, and digital consultation models. With consumers increasingly demanding scientifically proven, dermatologist-approved products, market leadership is expected to remain concentrated among a few global dermatology-driven brands, while regional players sustain growth through targeted affordability strategies.

Key Developments in Sensitive Skin Solutions Market

| Item | Value |

|---|---|

| Quantitative Units | USD 10,402.80 million (2025) - USD 23,901.10 million (2035) |

| Claim | Fragrance-free, Hypoallergenic, Dermatologist-tested, Clean-label, Others |

| Function | Barrier strengthening, Soothing/anti-redness, Hydration, Hypoallergenic protection, Others |

| Product Type | Creams/lotions, Serums, Cleansers, Masks, Others |

| Channel | Pharmacies/drugstores, E-commerce, Specialty beauty retail, Mass retail |

| End User | Women, Men, Infants/children, Sensitive skin adults, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, China, Japan, India, France, Brazil, South Africa |

| Key Companies Profiled | Cetaphil, CeraVe, Aveeno, La Roche-Posay, Avene, Eucerin, Clinique, Bioderma, Simple Skincare, Neutrogena |

| Additional Attributes | Dollar sales by claim, function, and end-user; premiumization in fragrance-free and hypoallergenic products; expansion of pharmacy and e-commerce distribution; dermatologist-tested validation as a core differentiator; regional growth led by Asia; digital dermatology and tele-consultation integration; innovation in barrier-supportive formulations and clean-label strategies |

The global Sensitive Skin Solutions Market is estimated to be valued at USD 10,402.80 million in 2025.

The market size for the Sensitive Skin Solutions Market is projected to reach USD 23,901.10 million by 2035.

The Sensitive Skin Solutions Market is expected to grow at a CAGR of 8.70% between 2025 and 2035.

The key product types in the Sensitive Skin Solutions Market are creams/lotions, serums, cleansers, masks, and other skincare formulations.

In terms of claim, the fragrance-free segment is expected to dominate with a 57.6% share in the Sensitive Skin Solutions Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensitive Stomach Cat Food Market

Sensitive Skin Body Lotion Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Photosensitive Alignment Film Market Size and Share Forecast Outlook 2025 to 2035

Photosensitive Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Time Sensitive Networking TSN Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat-Sensitive Cups Market is segmented by material type, capacity, and end-use from 2025 to 2035

Hormone Sensitive Advanced Prostate Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hormone Sensitive Prostate Cancer Market – Trends & Forecast 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Electronic Pressure Sensitive Tape Dispenser Market

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA