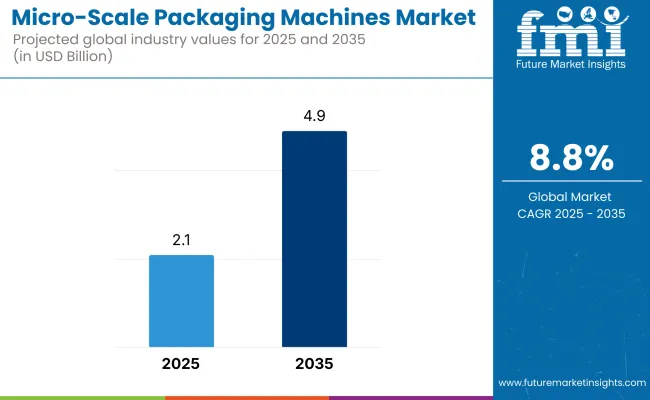

The micro-scale packaging machines market is projected to rise from USD 2.1 billion in 2025 to USD 4.9 billion by 2035, resulting in a total increase of USD 2.8 billion over the decade. This reflects a 133.3% overall market expansion, with a compound annual growth rate (CAGR) of 8.8%. The market will experience a 2.3 increase in size across the forecast period.

| Metric | Values |

|---|---|

| Industry Size (2025E) | USD 2.1 billion |

| Industry Value (2035F) | USD 4.9 billion |

| CAGR (2025 to 2035) | 8.8% |

In the first five years (2025–2030), the market expands from USD 2.1 billion to USD 3.2 billion, contributing USD 1.1 billion, or 39.3% of the decade’s growth. Growth in this phase is driven by rapid adoption in start-up manufacturing units, laboratory-scale production, and personalized/clinical packaging. Compact formats, plug-and-play functionality, and reduced capital costs position these machines favorably in R&D-intensive industries, nutraceuticals, and emerging regional brands.

In the second half (2030–2035), the market surges from USD 3.2 billion to USD 4.9 billion, generating USD 1.7 billion, or 60.7% of the total growth. Technological advancements such as AI-driven changeovers, modular multi-functionality, and smart HMI interfaces bolster demand for highly agile micro-packaging systems. Their application widens across pharma trials, specialty foods, diagnostics, and on-demand packaging, where customization, traceability, and micro-batch production become essential.

From 2020 to 2024, the micro-scale packaging machines market grew from USD 1.3 billion to USD 1.9 billion, driven by hardware-centric adoption across craft producers, nutraceuticals, diagnostics, and contract manufacturing sectors prioritizing small-batch agility. During this period, the competitive landscape was dominated by compact equipment manufacturers controlling nearly 70% of revenue, with leaders such as Shanghai Ingram Micro Packaging Technology Co., Ltd., E-PAK Machinery, Inc., and MaruhoHatsujyo Innovations delivering high-speed, modular solutions for pouches, vials, ampoules, and specialty formats. Competitive differentiation relied on format flexibility, tool-less changeovers, and GMP compliance, while software integration was typically bundled as part of machine functionality rather than as a standalone monetizable feature.

Demand for micro-scale packaging machines will expand to USD 4.9 billion in 2035, and the revenue mix will shift as SaaS platforms, remote analytics, and design-as-a-service tools grow to over 40% share. Traditional OEMs face competition from automation-native players offering AI-based fill accuracy, cloud-tethered diagnostics, and rapid deployment models. Major equipment vendors are pivoting to hybrid systems that incorporate portable HMI panels, remote configuration interfaces, and small-footprint robotics. Emerging players such as Pack’R, Ishida Co., Ltd., Mespack, Pouch Packing Machines Equipment Co., Ltd., IMA S.p.A., and Promarksvac Corporation are gaining share by specializing in industry-specific packaging cells, subscription-enabled platforms, and modular engineering for scalable micro-production lines.

Growing demand from small-batch producers, startups, and specialty product manufacturers is driving the growth of the micro-scale packaging machines market. These compact systems are designed to handle low to medium output while offering precision, cost-efficiency, and flexibility making them ideal for niche applications in food, cosmetics, nutraceuticals, and artisanal products. The rise of localized production and personalized product formats is encouraging adoption of space-saving, modular packaging equipment.

Tabletop fillers, small-form vertical form-fill-seal (VFFS) machines, and benchtop cappers have gained popularity due to their affordability, ease of operation, and suitability for frequent changeovers. These machines support packaging of powders, liquids, pastes, and solids in pouches, bottles, sachets, and jars with minimal footprint and energy use. The growing presence of e-commerce and direct-to-consumer (DTC) brands has further fueled the need for scalable packaging solutions tailored to small production runs.

Industries such as organic food, beauty & wellness, CBD products, and dietary supplements are driving demand for machines that offer batch flexibility, hygienic contact surfaces, and minimal material wastage. These systems enhance packaging control while lowering barriers for market entry in regulated or artisanal sectors.

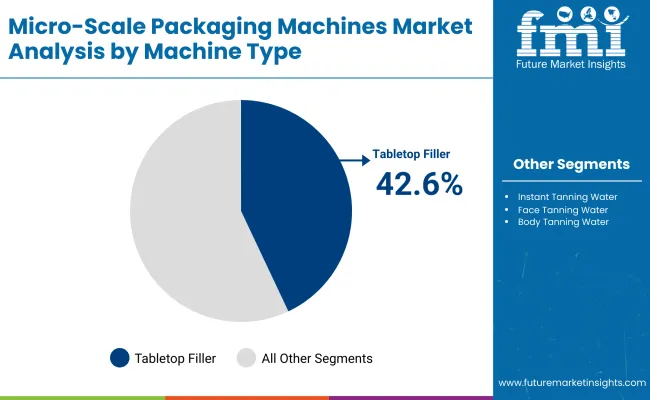

The market is segmented by machine type, product type, automation level, packaging format, end-use industry, and region. Machine type includes tabletop fillers, mini flow wrappers, and small-scale vertical form fill seal (VFFS) machines, designed for compact operations with space and volume constraints. Product type segmentation comprises powders, liquids, creams, and solids, addressing diverse handling and dosing requirements across product categories.

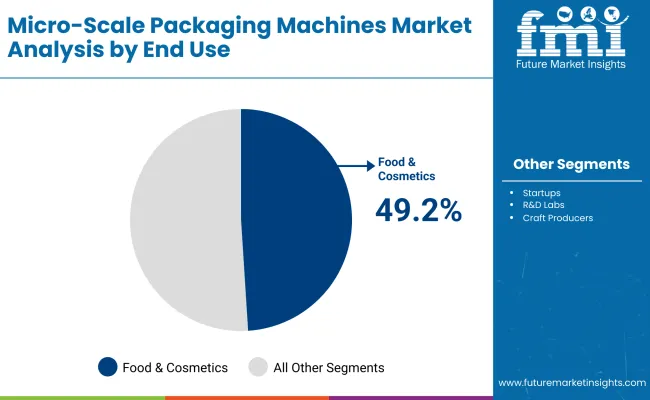

Based on automation level, the market includes manual, semi-automatic, and fully automatic systems, enabling varying levels of operational control, efficiency, and investment. Packaging format is categorized into sachets, blisters, tubes, and micro-pouches, offering flexible formats for precise, small-batch packaging needs. End-use industries include startups, R&D labs, specialty food & cosmetics, and craft producers, where scalability, affordability, and product differentiation are key drivers. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The tabletop fillers segment is expected to account for the highest share of 42.6% in 2025 within the Micro-Scale Packaging Machines Market. This dominance is largely driven by their compact footprint, user-friendly operation, and adaptability across a variety of viscous and non-viscous product types. These machines are especially favored by artisanal producers and small-batch manufacturers seeking precise fill volumes without investing in large industrial systems.

Ideal for startups and pilot lines, tabletop fillers offer consistent fill accuracy and require minimal maintenance. Their modularity and ease of cleaning further appeal to users in regulated sectors such as food and cosmetics. As the demand for flexible packaging formats grows in tandem with shorter production runs and seasonal variants, tabletop fillers are expected to remain a preferred choice among micro and niche producers aiming to scale efficiently.

The specialty food & cosmetics segment is projected to lead the end-use industry category with a 49.2% share in 2025. The shift toward organic, artisanal, and personalized products is driving demand for compact packaging solutions that support agile production environments. Micro-scale packaging machines, including tabletop fillers, enable small brands to meet the rising consumer demand for clean-label goods in attractive, retail-ready formats.

In the cosmetics segment, these machines are essential for producing limited-edition skincare, serums, and fragrance units with precise volume and hygienic filling. Similarly, for specialty food producers such as sauce makers, honey producers, or gourmet oil brands these machines offer a cost-effective way to package products in varied sizes for direct-to-consumer and niche retail distribution. As more brands focus on high-margin, small-batch offerings, the segment is likely to drive continued innovation and machine customization in this space.

The powders segment is projected to capture the highest share of 33.2% in 2025 within the micro-scale packaging machines market. This dominance is largely attributed to the increasing consumption of powdered formulations across nutraceuticals, dietary supplements, instant mixes, and specialty health products. These powders often require accurate dosing, contamination-free environments, and compact packaging needs effectively addressed by micro-scale machines.

Compact fillers and volumetric dosing systems integrated into these machines offer precision and consistency essential for packaging protein powders, herbal mixes, and functional foods.

The semi-automatic segment is expected to dominate the automation level category with a 48.1% share in 2025. These machines strike a balance between manual labor and automation, making them ideal for small and medium-sized enterprises (SMEs) with budget limitations but growing production needs. Semi-automatic units are particularly favored in artisan food, specialty cosmetics, and nutraceutical packaging.

They offer precision dosing, reduced labor dependency, and consistent sealing capabilities without the high upfront investment of fully automated systems.

The sachets segment is forecasted to account for the largest share of 36.2% in 2025 in the micro-scale packaging machines market. This prominence stems from sachets' versatility in offering single-use, hygienic, and low-cost packaging across food, cosmetic, pharmaceutical, and personal care applications. They are widely adopted for trial packs, sample distribution, and travel-size products.

Micro-scale machines configured for sachet packaging offer precision form-fill-seal technology, quick changeover, and adaptable sealing mechanisms making them ideal for dynamic SKUs.

Operational throughput limitations and material handling precision restrict scalability, even as demand grows across nutraceuticals, luxury cosmetics, and specialty foods for compact, space-efficient packaging machines that enable high-quality, low-volume, and SKU-diverse product formats.

Growing Demand for Small-batch Flexibility and Niche Product Customization

Micro-scale packaging machines are gaining significant traction in industries where product differentiation, minimal batch runs, and space efficiency are top priorities. In sectors such as premium cosmetics, herbal supplements, diagnostics kits, and gourmet food packaging, brands rely on small-scale machinery for flexible and precise dispensing, filling, and sealing operations.

These machines support highly customized packaging formats such as sample sachets, single-dose vials, or gift-ready pouches that enhance branding and consumer convenience. Their compact design is ideal for pilot production, R&D labs, or startups with limited floor space. As personalization and SKU proliferation increase across global markets, micro-scale packaging machines offer the adaptability required for short-run, high-margin product lines.

Throughput Constraints and Material Handling Challenges

Despite their benefits, micro-scale packaging machines face barriers related to productivity and material compatibility. These systems typically operate at lower speeds and with limited automation features, which can hinder throughput in time-sensitive operations. Their compact size often limits integration of advanced sensors, robotic arms, or inline inspection modules.

Additionally, handling ultra-thin films, biodegradable laminates, or irregular micro-containers requires precise alignment and calibration raising technical demands. Maintenance and changeovers can also be more frequent due to tighter mechanical tolerances. These limitations make them unsuitable for large-scale manufacturing and may deter firms that require high-speed, continuous output or multi-format packaging versatility.

Rise of Plug-and-Play Models and Digital Integration in Compact Designs

A key trend driving innovation in this market is the emergence of plug-and-play micro packaging units equipped with digital interfaces, IoT connectivity, and recipe-based programming. These next-generation machines are tailored for agile manufacturing environments, enabling seamless line integration, remote monitoring, and data logging.

Equipment providers are also focusing on tool-less changeovers, modular component swaps, and built-in self-cleaning to reduce downtime and improve hygiene compliance. Compact machines designed with servo-driven actuators and touch-enabled HMIs are now capable of maintaining precision while offering format flexibility. As the global shift toward localized production, e-commerce sampling, and small-batch launches accelerates, micro-scale packaging machines are poised to become essential tools for innovation-driven brands.

The global micro-scale packaging machines market is witnessing rapid acceleration, driven by rising adoption among startups, small-batch producers, and niche FMCG brands prioritizing space-efficient, low-cost automation. These compact machines cater to flexible, high-mix, low-volume production needs in cosmetics, nutraceuticals, condiments, pharmaceuticals, and D2C retail.

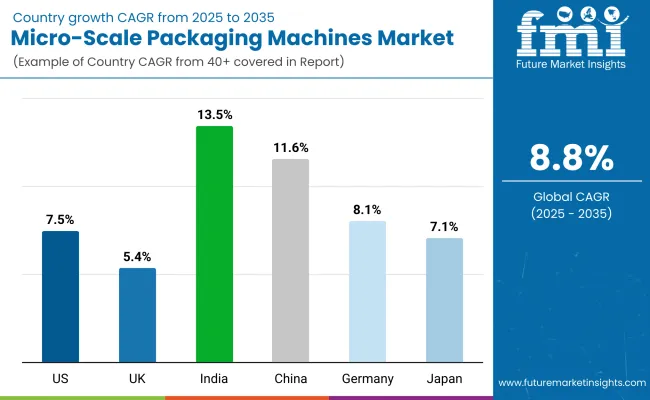

India and China are leading global growth due to MSME digitization, plug-and-play machine demand, and decentralized manufacturing. Germany and the USA are fueling innovation through modular automation and lab-scale packaging for R&D and specialty production. Japan and the UK are focused on personalization, refillables, and compact pharma lines. South Korea remains a niche but stable growth market, with K-beauty and wellness brands driving adoption for portable filling and sealing units.

The micro-scale packaging machines market in the United States is expected to grow at a CAGR of 7.5%, driven by demand from small-batch manufacturers, craft brands, and decentralized packaging facilities. Portable filling, pouching, and sealing equipment is being widely adopted across nutraceuticals, personal care, and artisan food categories. R&D labs and test marketing departments are also deploying benchtop machines for pre-commercial product runs.

The micro-scale packaging machines market in the United Kingdom is forecast to grow at a CAGR of 5.4%, supported by growing artisanal and D2C packaging needs. Small-scale manufacturers across skincare, sauces, and beverage shots are adopting compact, plug-and-play units to minimize floor space and capital expenditure. Regulatory-compliant micro lines are gaining traction in pharmacy and nutraceutical use cases.

India is projected to lead globally in the micro-scale packaging machines market, with a CAGR of 13.5% between 2025 and 2035. The surge is fueled by MSME sector automation, rural production hubs, and government-backed programs for decentralized health and nutrition packaging. Compact pouch fillers, tube sealers, and cap applicators are being deployed in small-footprint spaces for Ayurvedic, dairy, personal care, and oral care applications.

The micro-scale packaging machines market in China is projected to grow at a CAGR of 11.6%, driven by booming e-commerce brands, community food processors, and wellness product manufacturers. Small-footprint automation is being embedded in vertical startups across skincare, herbal products, and meal-prep services. Domestic OEMs are launching pre-configured, entry-level packaging lines with modular upgrades.

Germany’s micro-scale packaging machines market is forecast to grow at a CAGR of 8.1%, led by demand in pharma R&D, batch-specific nutraceuticals, and personalized medical nutrition. Modular machine architectures and GMP compliance are key drivers in hospital compounding and laboratory packaging. German OEMs are producing ultra-compact sealing, de-blistering, and powder dosing systems tailored for high-precision environments.

Japan’s micro-scale packaging machines market is projected to grow at a CAGR of 7.1%, driven by strong interest in high-end personalization, OTC compounding, and refillable cosmetics. Minimalist, low-noise, and hygienic benchtop machines are being adopted in specialty wellness stores, boutique skincare outlets, and homeopathic clinics.

The micro-scale packaging machines market in South Korea is forecast to grow at a CAGR of 3.3%, supported by innovations in refill culture, on-demand beauty blending, and functional food startups. K-beauty brands are adopting compact sachet fillers and stick pack units for influencer lines and travel packs. However, wider adoption is moderated by high land cost and central manufacturing preference.

The micro-scale packaging machines market is moderately fragmented, featuring compact equipment manufacturers, automation system integrators, and multi-format packaging specialists serving niche and small-batch applications across food, pharma, and personal care sectors. Global leaders such as IMA S.p.A., Ishida Co., Ltd., and Mespack hold significant market share, driven by precision dosing systems, cleanroom-ready designs, and compliance with GMP, CE, and FDA guidelines. Their strategies increasingly emphasize digital integration, robotic handling for microformats, and scalable platforms tailored for clinical trials, nutraceuticals, and premium cosmetics.

Established mid-sized players including E-PAK Machinery, Inc., Pack’R, and MaruhoHatsujyo Innovations are addressing demand for low-volume, high-accuracy packaging solutions with servo-driven fillers, flexible pouch handling, and modular cartoning systems. These companies are accelerating adoption in pilot-scale production through hybrid fill-seal designs, intuitive HMIs, and compatibility with various viscosity profiles and dose sizes.

Specialized providers such as Shanghai Ingram Micro Packaging Technology Co., Ltd., Pouch Packing Machines Equipment Co., Ltd., and Promarksvac Corporation focus on cost-effective, application-specific machinery for sachets, stick-packs, and compact liquid or powder formats.

Key Development of Micro-Scale Packaging Machines

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| By Machine Type | Tabletop Fillers, Mini Flow Wrappers, and Small-scale Vertical Form Fill Seal (VFFS) |

| By Product Type | Powders, Liquids, Creams, and Solids |

| By Automation Level | Manual, Semi-Automatic, and Fully Automatic |

| By Packaging Format | Sachets, Blisters, Tubes, and Micro-Pouches |

| By End-Use Industry | Startups, R&D Labs, Specialty Food & Cosmetics, and Craft Producers |

| Key Companies Profiled | Shanghai Ingram Micro Packaging Technology Co., Ltd., E-PAK Machinery, Inc., Maruho Hatsujyo Innovations, Pack’R , Ishida Co., Ltd., Mespack , Pouch Packing Machines Equipment Co., Ltd., IMA S.p.A., Promarksvac Corporation |

| Additional Attributes | Rising demand for ultra-compact machinery in lab and pilot-scale settings, increased preference for modular tabletop units in startup ecosystems, flexible automation for limited-batch production, growing market for artisan and specialty packaging formats, regulatory support for micro-dose pharma testing, integration of cleanroom-friendly designs, adoption in cosmetics sampling and personalized wellness packs, demand for flexible formats like sachets and micro-pouches, use of IoT for precision control in micro-pack lines, and regional growth driven by Asia-Pacific and North American incubator manufacturing hubs |

The global micro-scale packaging machines market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the micro-scale packaging machines market is projected to reach USD 4.9 billion by 2035.

The micro-scale packaging machines market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the micro-scale packaging machines market include tabletop fillers, manual sealers, semi-automatic pouch fillers, and mini blister packers.

In terms of equipment, the tabletop fillers segment is expected to account for the highest share of 42.6% in the micro-scale packaging machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA