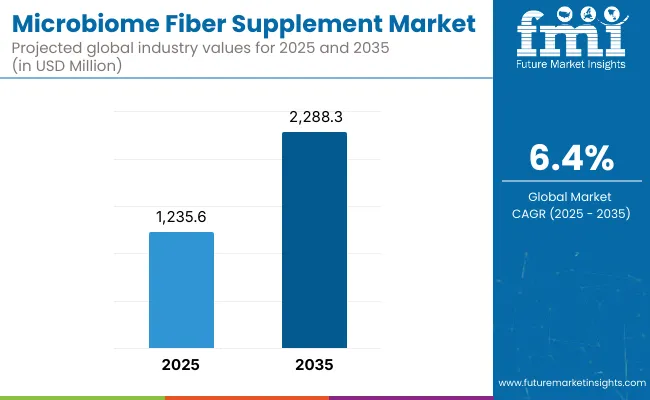

The Microbiome Fiber Supplement Market is projected to be valued at USD 1,235.6 million in 2025 and is forecasted to reach USD 2,288.3 million by 2035. This trajectory represents an incremental gain of USD 1,052.7 million over the decade, reflecting a 6.4% compound annual growth rate (CAGR).

Microbiome Fiber Supplement Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,235.6 million |

| Forecast Value in (2035F) | USD 2,288.3 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

Market size is expected to nearly double within the forecast period, signaling a strong and sustained appetite for gut-health-centric formulations in the global nutraceutical landscape.

From 2025 to 2030, the market is anticipated to expand from USD 1,235.6 million to approximately USD 1,680.8 million, contributing USD 445.2 million accounting for over 42% of the decade's total growth. This early phase is expected to be driven by steady adoption across functional foods, dietary supplements, and clinical nutrition products.

Consumers are projected to increasingly favor microbiome-supportive ingredients, such as resistant starch, due to their documented prebiotic efficacy and broad formulation compatibility. Demand is anticipated to remain strongest in North America and Western Europe, where microbiome awareness is comparatively high and regulatory standards support transparent claims.

During the second half of the forecast period (2030-2035), market momentum is likely to accelerate further, with an additional USD 607.5 million expected to be added. This accounts for nearly 58% of total growth and reflects growing traction in Asia-Pacific and Latin America.

Expansion is projected to be fueled by innovations in synbiotic formulations, improved clinical substantiation, and increased use of microbiome-targeted fibers in personalized wellness protocols. Overall, a robust and credible growth outlook is anticipated, backed by science-led product development and increasing consumer trust in gut-health-linked solution

From 2020 to 2024, the Microbiome Fiber Supplement Market expanded steadily, supported by growing awareness of gut health, prebiotic efficacy, and preventive nutrition. During this period, leadership was maintained by vertically integrated multinationals, with Cargill, Ingredion, and ADM contributing over 40% of total market revenue. Product innovation focused on high-purity inulin, FOS, and resistant starch, while gummies and powder formats gained favor among health-conscious consumers.

As the market enters 2025, demand is expected to reach USD 1.24 billion, driven by expanding digestive health applications, immune support, and gut-brain axis solutions. By 2035, recurring value is projected to emerge from personalized nutrition, synbiotics, and digital health integration.

The competitive advantage is transitioning from commodity fiber supply to holistic ecosystem offerings that combine ingredient science, validated health claims, and consumer-tailored delivery formats. Niche players specializing in gut-brain cognition, metabolic support, and AI-enabled microbiome personalization are expected to gain market traction, reshaping the competitive dynamics beyond fiber type alone.

The Microbiome Fiber Supplement Market is being propelled by increasing scientific validation of the gut microbiome’s role in systemic health, including immunity, metabolism, and mental well-being. Heightened consumer awareness has been cultivated through educational campaigns and functional claims backed by clinical studies. As dietary fiber deficiencies are increasingly linked to chronic health conditions, demand for microbiome-supportive fibers has been strengthened across preventive and therapeutic nutrition sectors.

Growth has been supported by product innovations tailored for diverse consumer groups, including seniors and health-conscious adults. Customizable formats such as powders, gummies, and functional foods have been introduced to meet evolving preferences for convenience and palatability.

In parallel, sales through online retail and D2C channels have been amplified by personalized wellness platforms and targeted marketing strategies. Regulatory recognition of prebiotic fibers and GRAS (Generally Recognized as Safe) status for key ingredients have further facilitated product development and commercialization. Future demand is expected to be driven by synbiotic formulations and personalized gut-health solutions.

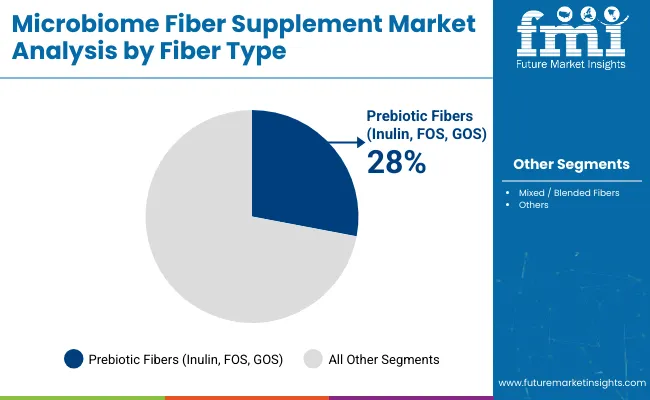

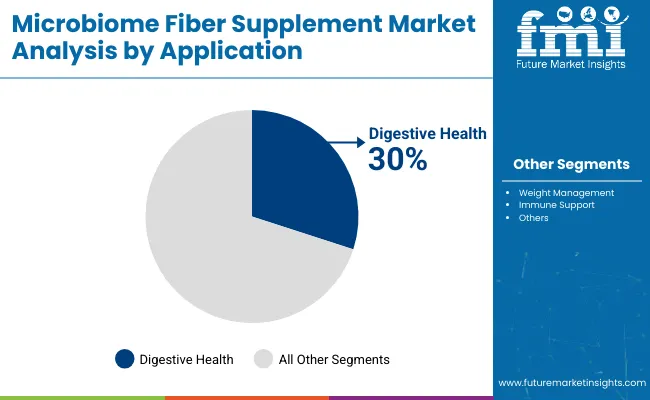

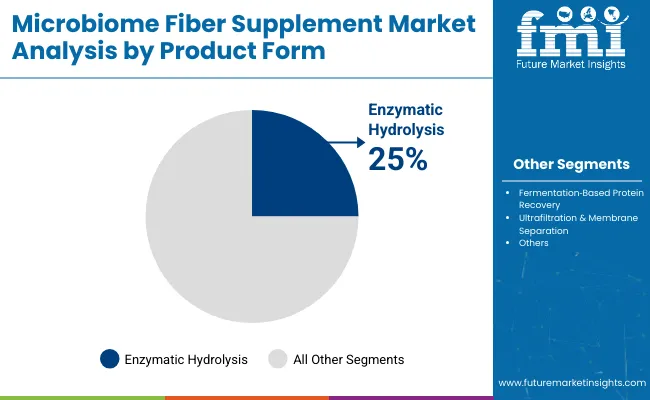

The Microbiome Fiber Supplement Market has been segmented across five key verticals: fiber type, application, product format, sales channel, and end user. This classification allows for a nuanced understanding of how consumer demand, health awareness, and formulation preferences are shaping adoption trends across the microbiome health landscape.By fiber type, segments such as prebiotic fibers, resistant starch, and blended fibers have been positioned as front-runners, driven by clinical efficacy and formulation flexibility.

Application-based segmentation highlights the dominant role of digestive and immune health, while also revealing emerging traction in cognitive and metabolic functions. On the basis of product format, powders, capsules, and gummies are witnessing increased uptake due to convenience, bioavailability, and alignment with personalized nutrition trends. This multi-dimensional segmentation enables market stakeholders to tailor strategies and optimize resource allocation in line with evolving consumer expectations and scientific validation.

| Fiber Type Segment | Market Value Share, 2025 |

|---|---|

| Prebiotic Fibers (Inulin, FOS, GOS) | 28.0% |

| Mixed / Blended Fibers | 15.0% |

The prebiotic fiber segment is projected to contribute 28% of the Microbiome Fiber Supplement Market revenue in 2025, establishing its lead in the category. Growth is being supported by mounting clinical evidence linking inulin, FOS, and GOS with enhanced gut microbiota modulation, improved digestion, and immune support.

Increased use of these fibers in powders and functional foods has been facilitated by their compatibility with diverse matrices and minimal sensory impact. As GRAS recognition and EFSA approvals continue to build regulatory confidence, the segment is expected to benefit from cross-functional applications spanning gut-brain axis support and metabolic health. Demand is likely to rise further through integration into synbiotic and personalized wellness platforms.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Digestive Health | 30.0% |

| Weight Management | 18.0% |

| Immune Support | 15.0% |

Digestive health is anticipated to account for 30% of the market share in 2025, underscoring its status as the leading application segment. Growth in this domain is being reinforced by heightened consumer focus on gastrointestinal well-being, fueled by rising diagnoses of IBS, bloating, and dysbiosis. Microbiome-supportive fibers are being increasingly recognized as frontline solutions for maintaining digestive balance, with product uptake observed across general adult and senior demographics.

Weight management and immune support applications are also experiencing acceleration due to converging consumer needs for holistic, non-pharmacological solutions. Scientific messaging that links fiber intake with enhanced nutrient absorption and inflammation modulation is expected to further elevate the role of digestive health in product positioning.

| Product Form Segment | Market Value Share, 2025 |

|---|---|

| Powders | 35.0% |

| Capsules & Tablets | 20.0% |

| Gummies | 15.0% |

The powder format is expected to represent 35% of market value in 2025, emerging as the most dominant product segment. This leadership is being enabled by high dosing flexibility, ease of integration into daily routines, and suitability for custom nutrient blends. Manufacturers are prioritizing flavor masking and solubility improvements to enhance consumer compliance.

Capsules and tablets remain preferred for standardized dosing and convenience, particularly in pharmaceutical retail channels. Meanwhile, gummies have been positioned as a rapidly expanding format, particularly among younger and health-conscious consumers. Their palatable delivery, combined with evolving clean-label formulations, is projected to strengthen adoption in the wellness and lifestyle nutrition categories.

Regulatory sensitivity and source authenticity concerns continue to challenge wider adoption of Microbiome Fiber Supplement, even as demand accelerates across cognitive health, neurological therapy, and cosmetic formulations. Technological refinement and bioactivity validation remain central to unlocking mainstream integration across global supplement and medical markets.

Rising Demand for Neuroprotective and Nootropic Ingredients in Preventive Healthcare

Growing awareness of neurodegenerative disorders and mental performance optimization has fueled demand for naturally sourced nootropic compounds. Microbiome Fiber Supplement has been increasingly positioned as a valuable source of phosphatidylserine, sphingolipids, and neuroactive peptides compounds known to support cognitive resilience, memory retention, and synaptic repair.

The ingredient’s origin in organ-specific bioactivity has aligned with evolving consumer preferences for targeted, nature-derived solutions in brain health. Supplement manufacturers have responded by launching standardized formulations for daily cognitive support, particularly in aging populations and knowledge-driven workforce segments. As preventive neurology continues to be prioritized in both clinical and wellness sectors, demand for such specialized ingredients is expected to remain resilient.

Ethical, Religious, and Regulatory Scrutiny Over Animal-Derived Neuroextracts

Despite functional efficacy, adoption has been hindered by regulatory ambiguity and consumer hesitancy surrounding animal organ extracts, particularly those sourced from bovine neurological tissue. Concerns related to disease transmission (e.g., prion risks), ethical considerations, and religious dietary laws have led to cautious policy environments in several markets.

Product approvals often require exhaustive traceability, purification, and GMP certification, increasing entry barriers for new players. In religiously sensitive regions, demand remains restricted, and plant-based cognitive alternatives are being preferred. As clean-label and ethical sourcing pressures intensify, only rigorously controlled, transparently labeled bovine extracts are expected to gain regulatory and consumer acceptance.

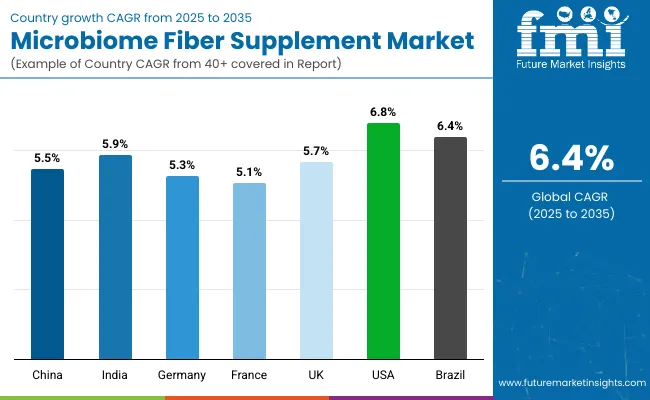

| Countries | CAGR |

|---|---|

| China | 5.5% |

| India | 5.9% |

| Germany | 5.3% |

| France | 5.1% |

| UK | 5.7% |

| USA | 6.8% |

| Brazil | 6.4% |

The global Microbiome Fiber Supplement Market is projected to exhibit differentiated growth patterns across key countries, shaped by regulatory support, public health priorities, and consumer awareness of microbiome-linked wellness. The United States is anticipated to lead growth among developed economies, with a CAGR of 6.8% through 2035. This expansion is expected to be supported by high functional food penetration, established D2C wellness brands, and growing integration of personalized gut health solutions in clinical and lifestyle contexts.

China, with a CAGR of 5.5%, is expected to benefit from expanding middle-class consumption, increasing focus on preventative nutrition, and the progressive localization of prebiotic ingredient production. In India, a stronger CAGR of 5.9% is projected, driven by rising urban health consciousness, government nutrition campaigns, and a shift toward fiber-enriched diets in metabolic health management.

Germany (5.3%), the UK (5.7%), and France (5.1%) are anticipated to maintain consistent growth, supported by EFSA-backed ingredient approvals, gut health education, and the inclusion of microbiome fibers in nutraceutical and functional food portfolios. Meanwhile, Brazil is projected to advance at 6.4% CAGR, attributed to rising prevalence of digestive health disorders and an expanding retail base for natural supplements.

| Years | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USA Microbiome Fiber Supplement | 296.5 | 316.8 | 334.4 | 354.2 | 377.9 | 401.4 | 423.0 | 447.1 | 471.8 | 503.8 | 532.7 |

The Microbiome Fiber Supplement Market in the United States is projected to grow at a CAGR of 6.8% from 2025 to 2035. This expansion is being driven by a convergence of personalized nutrition trends, digital wellness integration, and increased clinical awareness of gut-health interventions. USA consumers are progressively adopting microbiome-supportive fibers not only for digestive health but also for cognitive function, metabolic regulation, and immune resilience.

The healthcare and lifestyle nutrition sectors have been actively integrating microbiome solutions into patient-centric and performance-focused regimens. Growing traction has been observed among aging populations and wellness-oriented millennials, particularly through D2C platforms and personalized supplement subscriptions.

Gummy and powder-based formats have gained visibility due to higher compliance and convenience. Meanwhile, digital health ecosystems have enabled precision fiber recommendations via microbiome testing, further strengthening consumer engagement and repeat purchases.

Continued innovation in formulation and delivery methods is expected to support long-term market maturity and consumer loyalty in the USA market.

The Microbiome Fiber Supplement Market in the United Kingdom is projected to grow at a CAGR of 5.7% between 2025 and 2035. Market expansion is expected to be supported by high consumer awareness, a robust dietary supplement culture, and NHS-backed gut health initiatives. British consumers are becoming more responsive to clinically validated fibers as part of lifestyle interventions for IBS, immunity, and mental health.

The growing interest in the gut-brain axis and mood regulation through microbiome pathways is likely to further reinforce demand. Distribution through pharmacies and nutrition chains is being enhanced by transparent labeling and EFSA-compliant claims.

The Indian Microbiome Fiber Supplement Market is anticipated to expand at a CAGR of 5.9% from 2025 to 2035. Growth is being fueled by rapid urbanization, increasing dietary awareness, and the rising burden of lifestyle disorders like diabetes, obesity, and IBS. Government campaigns on digestive health and fiber-enriched diets have improved public engagement with gut wellness solutions.

Ayurvedic and natural positioning of microbiome-supportive fibers is being promoted by domestic players, enhancing acceptance among traditionally health-conscious consumers. Retail expansion in Tier 2 and Tier 3 cities is also contributing to increased accessibility.

The Microbiome Fiber Supplement Market in China is expected to witness a CAGR of 5.5% from 2025 to 2035, driven by a convergence of preventive healthcare priorities, digital health ecosystems, and middle-class wellness expenditure. National nutrition plans and consumer education on gut health are actively promoting fiber-rich product adoption.

Local innovation in synbiotic supplements, coupled with premium product positioning, is enabling sustained interest in microbiome solutions. Integration into traditional Chinese health frameworks is further legitimizing category growth.

| Countries | 2025 | 2035 |

|---|---|---|

| UK | 19.1% | 19.7% |

| Germany | 21.4% | 20.4% |

| Italy | 9.1% | 11.9% |

| France | 12.7% | 13.4% |

| Spain | 9.4% | 9.8% |

| BENELUX | 6.4% | 5.6% |

| Nordic | 5.8% | 5.1% |

| Rest of Europe | 16.1% | 14.1% |

Germany’s Microbiome Fiber Supplement Market is projected to grow at a CAGR of 5.3% through 2035, backed by high regulatory clarity, functional food penetration, and demand for clean-label health products. German consumers are particularly responsive to EFSA-approved claims and clinical substantiation, positioning the market for quality-led growth.

Adoption is being reinforced through integration into lifestyle wellness regimes and physician-recommended formulations for digestive and cardiovascular support. Sales are expected to remain strong in pharmacy and organic retail channels, with rising online activity.

Growth Outlook for Microbiome Fiber Supplement in Japan

| Fiber Type Segment | Market Value Share, 2025 |

|---|---|

| Prebiotic Fibers (Inulin, FOS, GOS) | 30.0% |

| Resistant Starch | 9.0% |

| Beta Glucan | 12.0% |

| Pectin | 10.0% |

| Psyllium Husk | 7.0% |

| Arabinoxylan | 6.0% |

| Cellulose & Hemicellulose | 11.0% |

| Mixed / Blended Fibers | 15.0% |

The Microbiome Fiber Supplement Market in Japan is projected to witness steady expansion through 2035, supported by the country’s aging population, preventive healthcare culture, and longstanding consumer familiarity with dietary fiber. In 2025, prebiotic fibers are expected to command 30% of market share, followed by mixed/blended fibers at 15% and beta-glucan at 12%, indicating a consumer preference for multi-functional, clinically backed ingredients.

Growth in the Japanese market is anticipated to be driven by demand for immune and metabolic health support, with specific focus on formulations that target digestive balance and cognitive well-being. The cultural alignment with gut-health through traditional dietary practices such as fermented foods has set a favorable foundation for microbiome-focused supplementation.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Digestive Health | 32.0% |

| Immune Support | 16.0% |

| Metabolic Health | 12.0% |

| Weight Management | 17.0% |

| Cardiovascular Health | 14.0% |

| Gut Brain Axis Support | 9.0% |

South Korea’s Microbiome Fiber Supplement Market is projected to experience strong growth through 2035, driven by increasing public interest in gut health, K-wellness trends, and functional food innovation. In 2025, digestive health is expected to dominate with 32% share, followed by weight management at 17%, and immune support at 16%, indicating a broadening of consumer priorities beyond traditional digestive concerns.

South Korean consumers have demonstrated high receptivity to scientifically backed, aesthetically packaged wellness products. Demand for gut-brain axis support, growing at a CAGR of 9.2%, reflects increasing consumer focus on mood, stress resilience, and mental clarity. Integration of fibers into RTD beverages, yogurts, and meal replacements is being supported by domestic brands leveraging functional claims.

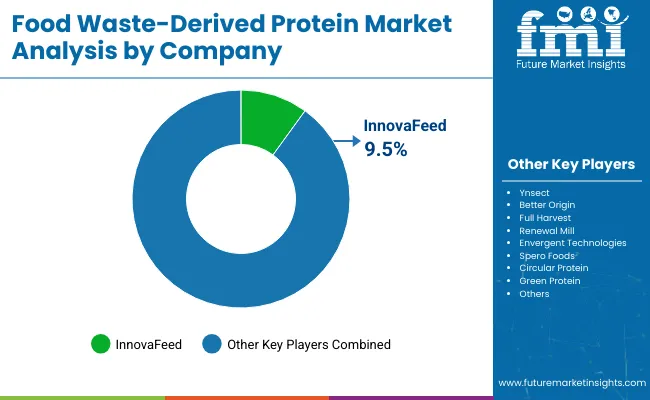

| Giants | Global Value Share 2025 |

|---|---|

| Cargill, Inc. | 9.6% |

| Others | 90.4% |

The Microbiome Fiber Supplement Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused players competing across functional nutrition and health-specific applications. Multinational giants such as Cargill, Ingredion, and ADM hold significant market positions through vertically integrated production, robust global supply chains, and R&D-backed formulation capabilities. Their focus has been placed on clinically validated prebiotic fibers such as inulin, GOS, and resistant starch, tailored for digestive, metabolic, and cognitive health applications.

Companies like Tate & Lyle, Kerry Group, and Roquette are expanding through portfolio diversification and regional customization. Their strategies are being shaped by partnerships with food and nutraceutical brands, allowing for co-developed products in functional beverages, gummies, and powders. These mid-sized players have emphasized clean-label innovation and plant-based sourcing to enhance market credibility.

Specialist suppliers such as Beneo, Cosucra, and Taiyo (Sunfiber) cater to high-purity, application-specific formulations, with growing relevance in gut-brain axis and immune support segments. These players differentiate through traceable sourcing, regional regulatory alignment, and compatibility with synbiotic platforms.

Competitive advantage is now shifting toward integrated ecosystems combining ingredient science, digital personalization, and targeted health positioning. Future leadership will be defined by capacity to scale clinically backed ingredients while adapting to consumer-centric trends like precision nutrition, transparency, and sustainable sourcing.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,235.6 Million |

| Fiber Type | Prebiotic Fibers (Inulin, FOS, GOS), Resistant Starch, Beta ‑ Glucan, Pectin, Psyllium Husk, Arabinoxylan, Cellulose & Hemicellulose, Mixed/Blended Fibers |

| Application | Digestive Health, Immune Support, Metabolic Health, Weight Management, Cardiovascular Health, Gut-Brain Axis Support |

| Product Form | Powders, Capsules & Tablets, Gummies, Ready-to-Drink Beverages, Functional Foods |

| End User | General Adults, Seniors, Patients with Digestive Disorders, Health-Conscious Consumers |

| Sales Channel | Pharmacies & Drugstores, Health & Nutrition Stores, Online Retail, Supermarkets & Hypermarkets, Direct-to-Consumer (D2C) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, Ingredion, DuPont (IFF Health), ADM, Tate & Lyle, Kerry Group, Roquette, Beneo, Cosucra, Taiyo International (Sunfiber) |

| Additional Attributes | Global dollar sales by fiber type and application, shift toward prebiotic blends and gut-brain formulations, expansion in D2C and online retail, increasing role of synbiotics, aging population trends, innovation in fiber combinations, regional regulatory drivers, personaliza tion via microbiome diagnostics |

The global Microbiome Fiber Supplement is estimated to be valued at USD 1,235.6 million in 2025.

The market size for the Microbiome Fiber Supplement is projected to reach USD 2,288.3 million by 2035.

The Microbiome Fiber Supplement is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product format in the Microbiome Fiber Supplement Market are powders, capsules & tablets, gummies, ready-to-drink beverages, and functional foods, with powders leading in market share due to dosage flexibility and high solubility.

In terms of application, the digestive health segment is projected to command the largest share at 30% in 2025, reflecting continued focus on gastrointestinal wellness and fiber-based preventive health interventions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA