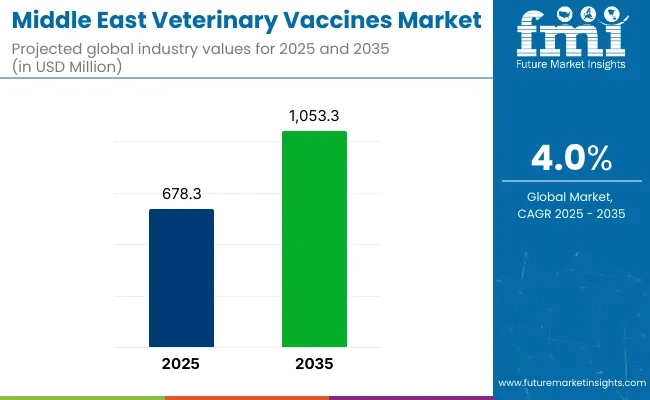

The middle east veterinary vaccines market is projected to reach USD 678.3 million in 2025 and expand to around USD 1,053.3 million by 2035, reflecting a CAGR of 4% during the forecast period. This growth is largely driven by an increasing focus on animal health, food safety, and the prevention of zoonotic diseases.

The livestock and poultry industries, which are central to the region's domestic food supply and export economies, are seeing rising demand for vaccines to enhance productivity, reduce animal mortality, and control infectious outbreaks. The need for efficient vaccination solutions is therefore becoming more critical in safeguarding these industries.

Governments across the region are supporting the veterinary vaccines market by implementing national animal health plans to coordinate mass vaccination programs, improve biosecurity measures, and upgrade veterinary services. This support is boosting the demand for vaccines across various sectors, including livestock (cattle, sheep, goats), poultry, aquaculture, and even companion animals.

As urban populations grow, there is an increase in pet ownership, which is driving the need for vaccines in companion animals as well. This trend of expanding vaccination efforts is crucial for mitigating health risks and enhancing the overall welfare of animals, particularly in densely populated urban centers.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 678.3 million |

| Market Size in 2035 | USD 1,053.3 million |

| CAGR (2025 to 2035) | 4% |

Over the last decade, the Middle East veterinary vaccines market has experienced a shift from reliance on imported vaccines to a focus on local production, supported by government initiatives and regional manufacturing. Intensive farming practices, coupled with diseases like foot-and-mouth disease and avian flu, have acted as major catalysts for market growth.

Regulatory interventions focused on improving animal health standards and ensuring higher vaccine efficacy have also contributed to the market's expansion. Collaborations between international companies and local producers, combined with the growth of innovative vaccine technologies such as recombinant vaccines, are driving the region's future progress. The increasing adoption of these advanced solutions is enhancing disease control and promoting sustainable practices in animal health management.

The middle east veterinary vaccines market is expected to experience steady growth, driven by key segments such as live attenuated vaccines and veterinary hospitals as the leading end user. Live attenuated vaccines are projected to dominate the market, while veterinary hospitals will continue to lead the adoption of veterinary vaccines for animal healthcare.

Live attenuated vaccines are expected to capture 45% of the Middle East veterinary vaccines market share by 2025. These vaccines, which contain live pathogens that have been weakened but are still capable of inducing an immune response, are widely used in veterinary practices due to their effectiveness in providing long-lasting immunity.

Live attenuated vaccines are commonly used to prevent diseases in animals such as rabies, foot-and-mouth disease, and avian influenza. Companies like Zoetis, Merck Animal Health, and Bayer Animal Health are key players in the development and distribution of these vaccines.

Live attenuated vaccines are favored in both small and large animal care for their proven efficacy in disease prevention and relatively low cost. As the demand for improved animal health, particularly in livestock and poultry, continues to rise in the Middle East, live attenuated vaccines are expected to remain the preferred choice for disease prevention, making them the dominant segment in the veterinary vaccines market.

Veterinary hospitals are projected to account for 42% of the veterinary vaccines market share in the Middle East by 2025. These hospitals are major consumers of veterinary vaccines, as they play a critical role in diagnosing and treating animal diseases, as well as in preventive care through vaccination.

The rising demand for pet healthcare, alongside the growing livestock and poultry industries in the region, is driving the need for veterinary vaccines. Veterinary hospitals are increasingly adopting advanced vaccines, including live attenuated and inactivated vaccines, to improve animal health and control the spread of diseases.

Companies such as Elanco, Vetoquinol, and Virbac are working with veterinary hospitals to provide vaccines and other healthcare products for animals. As veterinary care continues to advance, with increasing focus on both companion animals and livestock, veterinary hospitals will remain a key end user in the market, driving the continued demand for vaccines and improving overall animal health outcomes across the region.

A Lack of Trained Veterinarians Impacts the Effective Administration of Vaccines and Disease Management Programs.

The various challenges being faced by the Middle East veterinary vaccine industry are structural and operational. Various regulatory environments for different countries prevent vaccines from being timely approved and harmonized, limiting their cross-border distribution and trade. Other focused issues include poor standards in cold chain logistics, which affect vaccine stability and efficacy, particularly in remote or rural situations. Many areas also have shortages of trained veterinary professionals, which also affects vaccine administration and monitoring.

Even with government and donor efforts, vaccines remain unaffordable to most in low-income and conflict-affected areas. On top of that, smallholder farmers sometimes hesitate to vaccinate animals due to a lack of knowledge about the vaccines, perceived costs, or mistrust of government programs. In addition, it limits tracking and response capabilities in real time because of the absence of consolidated animal disease surveillance networks.

Expansion of Veterinary Clinics in Major Cities Strengthens the Availability of Vaccines and Advanced Veterinary Treatment Options.

Though there are challenges, the Middle East veterinary vaccine market is creating many opportunities that can quicken growth in this area. The growing trend of regional manufacturing of vaccines, particularly in the Gulf Cooperation Council (GCC), as governments look at pharmaceutical sovereignty by reducing dependency on imports, is a critical opportunity through which they can bring down prices, accelerate distribution, and improve response during outbreaks.

Urbanization, as well as rising disposable income, is a growing niche for pet ownership that is demanding increasing scopes of companion animal mammalian vaccines for diseases such as rabies and canine distemper. Further, awareness of zoonotic diseases has increased post-COVID-19, which has galvanized support for One Health initiatives combining human, animal, and environmental health strategies.

Such frameworks would provide suitable platforms upon which to expand veterinary vaccination programs and gather multi-sectoral funding. The increasing embrace of digital health tools, one such example being mobile-based applications for livestock management and vaccination reminder enhancement, is promoting better adherence and farmer engagement.

Poultry Vaccine Demand

The poultry sector represents the most dynamic component of the veterinary vaccine market in the Middle East. Poultry meat and eggs form a significant part of the regional diet, and countries such as Saudi Arabia, Egypt, and Iran are among the largest producers in the region. Diseases like Newcastle disease, infectious bronchitis, avian influenza, and Marek’s disease are endemic threats that prompt consistent vaccination protocols.

Layer and broiler farms, particularly in the GCC, operate on intensive farming models that rely on strict biosecurity and scheduled immunization. The rise of vertically integrated poultry businesses has improved compliance with best practices and facilitated the adoption of thermostable and multivalent vaccines. Moreover, demand is shifting toward recombinant and vector-based poultry vaccines that offer improved protection and administration convenience.

Emerging Zoonotic Threats

The presence of zoonotic diseases like the Middle East Respiratory Syndrome Coronavirus (MERS-CoV), Rift Valley fever, and brucellosis has made the case for considerable veterinary vaccination systems across the Middle East more imminent. The underlying diseases interfere with livestock productivity and also possess direct public health threats to some measure, and hence they have an area of concern globally.

One Health is a paradigm that recognizes the interrelationship among human health, animal health, and environmental health, and this has become a unifying science behind vaccine-oriented surveillance and control programs. Hence, governments are now including veterinary immunization within the frameworks of epidemic preparedness plans. For instance, vaccine campaigns for Rift Valley fever are being coordinated with vector control and restrictions on livestock movements.

As the rising needs of livestock products, growing awareness for the health of animals, and governmental initiatives for improvement of veterinary healthcare structure have matured well to trigger a steady growth for the veterinary vaccine industry in Middle East countries between 2020 to 2024, which is approximately valued at USD 652.2 million in 2024 and projected to exceed USD 1,053.3 million by 2035, it translates to a compound-anonal growth rate (CAGR) of about 4% for the forecast period.

The key factors propelling this growth include region-specific vaccines for diseases targeting camels and collaborative programs for disease control in line with regional standards.

Market Outlook

The Veterinary Vaccines market in the UAE is primarily driven by the strong horse racing culture and elite endurance riding events that the country has to offer in addition to robust government support for sport. The country is known for maximum investments in sophisticated equine medical care, owning expensive stables, hiring specialized veterinary hospitals, etc., focusing on the best treatments.

This increased activity, in conjunction with international equestrian events such as the Dubai World Cup, drives the demand for regenerative medicine, joint health solutions and performance-enhancing therapeutics. Rich owners propel the adoption of advanced diagnostics, biologics, and preventative care, rendering the UAE a premium market for equine therapeutics.

Factors Driving Market Growth

Market Forecast

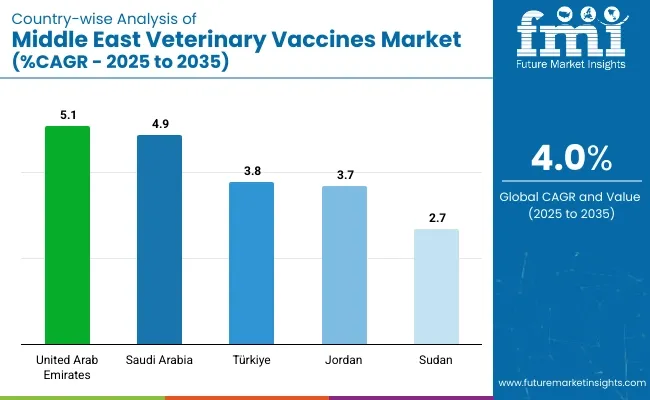

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.1% |

Market Outlook

Royal patronage, high-volume investments in equestrian sports, and a budding breeding industry characterize the Saudi Arabian Veterinary Vaccines market, which is poised for accelerated growth. The Kingdom is home to prominent horse racing and show-jumping events such as the Saudi Cup, which has helped grow the demand for lameness treatments, regenerative therapies and specialty veterinary care.

An expansion in veterinary infrastructure, government support for equine welfare, and an increasing number of private equestrian centers drive sustained growth in the market. Well, good quality equine healthcare services, such as the adoption of biologics, NSAIDs, and advanced diagnostic tools, continue to be key contributors to services.

Factors Driving Market Growth

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.9% |

Market Outlook

Türkiye’s Developing Veterinary Vaccines Market-Horse Racing Industry, Equestrian Culture, and Government-Supported Breeding Programs. The country’s expansive racing sector, spearheaded by the Jockey Club of Turkey, also drives demand for joint health solutions, anti-inflammatory drugs and lameness therapies.

Improvements in diagnostics, surgical techniques, and regenerative medicine are also enhancing treatment outcomes. Increasing horse ownership, as well as a significant rise in recreational riding trends, are further fueling growth in the market, along with growing investments in developing effective equine health solutions.

Factors Driving Market Growth

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.8% |

Market Outlook

Jordan’s Veterinary Vaccines market is profiting from a longstanding Arabian horse breeding tradition and growing equestrian tourism, and it is underpinned by support from royalty for the industry. Regional events for endurance riding and show-jumping are also held in the country, creating a need for joint care, pain management and preventive healthcare.

Investment in veterinarian education, specialty clinics, and equine welfare initiatives are helping to increase access to advanced treatments. Rising demands for biologics, NSAIDs and vaccines are driven by greater awareness of equine health management.

Factors Driving Market Growth

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.7% |

Market Outlook

The Sudan Veterinary Vaccines market is stimulated by the role of horses in agriculture, transport and traditional sports, but not racing or recreation. The high demand for vaccines, antiparasitic treatments, and anti-inflammatory drugs is attributed to the widespread prevalence of infectious diseases and harsh climatic conditions.

Challenges include limited access to specialized equine health-care infrastructure and veterinary expertise, but international aid and veterinary training programs are enhancing the market. Ongoing efforts to improve disease control and preventive care are slowly strengthening the nation’s equine health infrastructure.

Factors Driving Market Growth

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.7% |

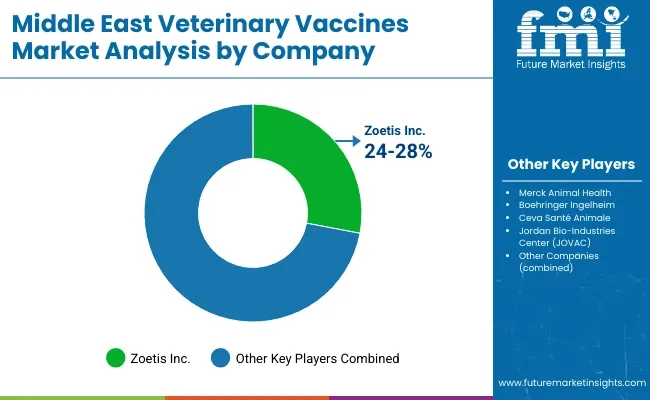

The Middle East veterinary vaccine market is rapidly progressing due to the growing concern about animal health, investments to enhance production in livestock, and initiatives undertaken by governments to control zoonotic diseases. There is an increase in demand for vaccines among companion animals and livestock for the prevention of foot and mouth disease, avian influenza, rabies and infectious diseases.

Key players in the market, alongside multinational animal health companies currently ramping up their regional presence through strategic alliances, acquisitions, and launches of novel vaccines, are serious contenders entrenching local producers on the ground with government support in terms of subsidies, research grants, and regulatory assistance to boost domestic production capacity.

Other Key Players

Additional companies supporting the Middle East veterinary vaccine market include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 678.3 million |

| Projected Market Size (2035) | USD 1,053.3 million |

| CAGR (2025 to 2035) | 4.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand doses for volume |

| Vaccines Analyzed (Segment 1) | Attenuated Live Vaccines, Inactivated Vaccines, Toxoid Vaccines, DNA Vaccines, Recombinant Vaccines, Others |

| Animal Types Analyzed (Segment 2) | Companion Animals, Livestock Animals, Equine |

| Disease Indications Analyzed (Segment 3) | Foot and Mouth Disease, Newcastle Disease, PPRS, Canine Parvovirus, Brucellosis, Avian Influenza, Others |

| End Users Analyzed (Segment 4) | Hospital Pharmacies, Veterinary Clinics, Private Veterinary Pharmacies, Others |

| Regions Covered | Middle East |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain, Jordan, Israel, Egypt, Lebanon |

| Key Players influencing the Middle East Veterinary Vaccine Market | Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Ceva Santé Animale, Jordan Bio-Industries Center (JOVAC), Vaxxinova, Biovet JSC, Indian Immunologicals Ltd., Elanco Animal Health, HIPRA |

| Additional Attributes | Share of live vs recombinant vaccine usage, Vaccination trends in poultry and ruminants, Government procurement and immunization campaign strategies, Emerging threats from zoonotic and endemic diseases in the region, Role of private veterinary clinics in vaccine distribution |

| Customization and Pricing | Customization and Pricing Available on Request |

Attenuated Live Vaccines, Inactivated Vaccines, Toxoid Vaccines, DNA Vaccines, Recombinant Vaccines and Others.

Companion Animals, Livestock Animals and Equine.

Foot and Mouth Disease, Newcastle Disease, PPRS, Canine Parvovirus, Brucellosis, Avian Influenza and Others.

Hospital Pharmacies, Veterinary Clinics, Private Veterinary Pharmacies and Others.

United Arab Emirates, Saudi Arabia, Türkiye, Jordan, Sudan, Egypt and Rest of Middle East.

The Middle East Veterinary Vaccine industry is projected to witness CAGR of 4.0% between 2025 and 2035.

The Middle East Veterinary Vaccine industry stood at USD 652.2 million in 2024.

The Middle East Veterinary Vaccine industry is anticipated to reach USD 1,053.3 million by 2035 end.

China is expected to show a CAGR of 4.9% in the assessment period.

The key players operating in the Middle East Veterinary Vaccine industry are Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Ceva Santé Animale, Jordan Bio-Industries Center (JOVAC), Vaxxinova, Biovet JSC, Indian Immunologicals Ltd., Elanco Animal Health, HIPRA and Others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Bio-Stimulants Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Data Storage Market Report – Trends & Industry Forecast 2025–2035

Middle East and Africa Rough Terrain Cranes Market Growth - Trends & Forecast 2025 to 2035

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

Middle East Conveyor Belts Market - Growth & Demand 2025 to 2035

Analysis and Growth Projections for Middle East and Mediterranean Tahini Business

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

Middle East Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Middle East Wood Flooring Market Growth – Trends & Forecast 2024-2034

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

Middle East 3D Printing Materials Market Trends 2022 to 2032

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

B2B Middleware Market Size and Share Forecast Outlook 2025 to 2035

Low and Middle Income Countries Opioid Substitution Therapy Market Analysis by Drug Class, Indication, Distribution Channel, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA