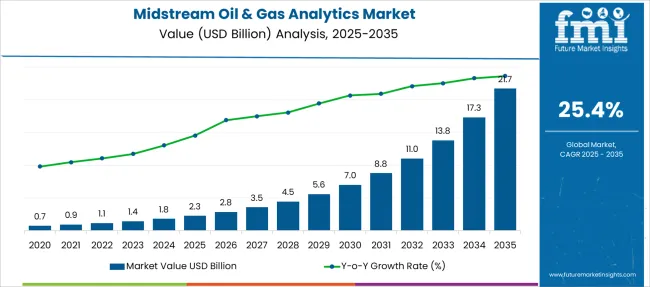

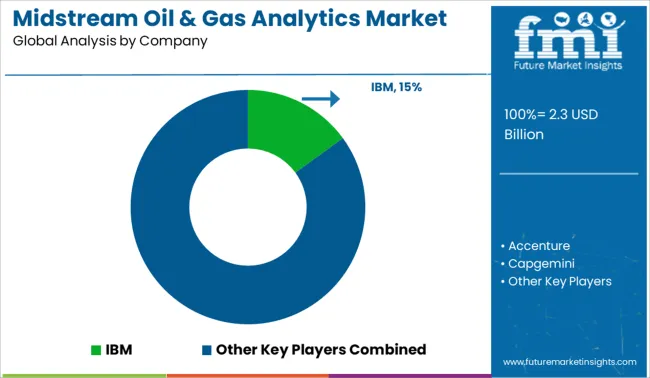

The Midstream Oil & Gas Analytics Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 21.7 billion by 2035, registering a compound annual growth rate (CAGR) of 25.4% over the forecast period.

| Metric | Value |

|---|---|

| Midstream Oil & Gas Analytics Market Estimated Value in (2025E) | USD 2.3 billion |

| Midstream Oil & Gas Analytics Market Forecast Value in (2035F) | USD 21.7 billion |

| Forecast CAGR (2025 to 2035) | 25.4% |

The midstream oil and gas analytics market is advancing steadily as companies prioritize operational efficiency, safety, and regulatory compliance within pipeline and storage infrastructure. Increasing volumes of data generated by sensor networks and SCADA systems have necessitated the adoption of sophisticated analytics solutions to optimize asset performance and prevent disruptions.

The market has been influenced by growing digital transformation initiatives in the energy sector, with a focus on real-time monitoring and predictive maintenance. As aging infrastructure and environmental regulations intensify, analytics are being leveraged to enhance decision-making and minimize risk.

Future opportunities are expected to arise from integration with emerging technologies such as edge computing, AI-driven diagnostics, and cloud platforms, which can deliver scalable and agile analytics capabilities. The convergence of operational technology and information technology is paving the way for innovative solutions that support both reliability and sustainability goals in midstream operations.

The market is segmented by Deployment, Service, and Application and region. By Deployment, the market is divided into on-premises and Hosted. In terms of Service, the market is classified into Professional, Cloud, and Integration. Based on Application, the market is segmented into Pipeline SCADA, Fleet, and Storage optimization. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

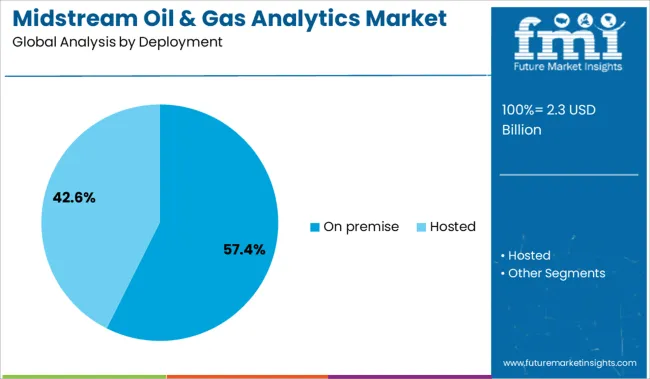

The on premise deployment segment is anticipated to secure 57.40% of the total market revenue in 2025, establishing it as the leading deployment model. This dominance has been driven by the critical need for data security and control within midstream operations, where sensitive infrastructure information demands stringent protection measures.

Organizations have preferred on premise solutions due to their ability to integrate with existing legacy systems and customized infrastructure. Additionally, operational continuity and minimal latency in analytics processing have been factors reinforcing on premise adoption.

Industry leaders have invested heavily in robust IT frameworks to support these deployments, ensuring compliance with regulatory requirements and reducing exposure to cyber risks. The ability to maintain full ownership of data and system management has further contributed to the widespread preference for on premise solutions in this sector.

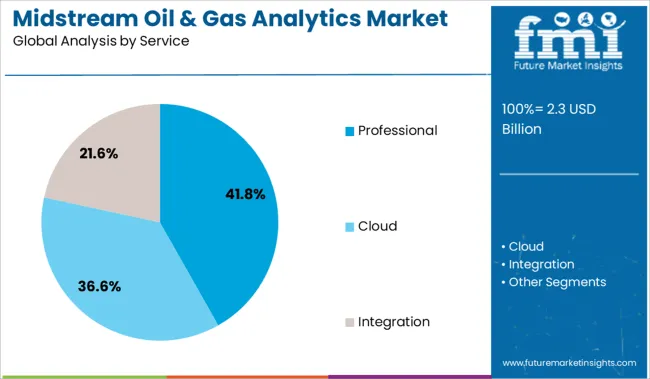

Within the service category, the professional segment is projected to command 41.80% of the market revenue in 2025, making it the foremost service type. The growth of this segment can be attributed to the complexity of deploying and managing analytics solutions across distributed midstream assets.

Expertise in customizing analytics platforms, integration with SCADA systems, and ongoing maintenance is essential to ensure accuracy and reliability. Organizations have increasingly relied on professional services to navigate evolving regulatory landscapes, implement best practices, and train operational personnel.

The specialized knowledge offered by professional service providers has helped reduce implementation risks and accelerate time to value. This dependency on expert support has cemented professional services as a critical component in the successful adoption and sustained operation of midstream analytics technologies.

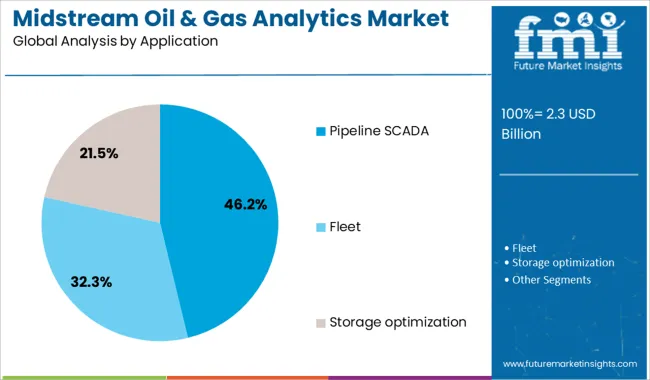

The pipeline SCADA application segment is expected to capture 46.20% of the market revenue in 2025, positioning it as the leading application area. The prominence of this segment stems from the vital role SCADA systems play in monitoring and controlling pipeline infrastructure, which requires continuous data acquisition and real-time analytics.

Analytics applied to SCADA data enable enhanced detection of anomalies, leak prevention, and efficient management of flow and pressure parameters. The criticality of pipeline integrity and safety in midstream operations has driven substantial investments in advanced analytics tailored specifically for SCADA environments.

This has resulted in improved operational visibility and decision-making capabilities, supporting compliance with safety regulations and reducing downtime. The scalability of SCADA-focused analytics solutions has further accelerated their adoption, reinforcing this segment's leadership in the market.

Rising demand for real-time visibility, regulatory compliance, and failure prevention drives analytics adoption. Opportunities emerge in AI-based asset monitoring, cloud-based platforms, and expanding services across pipeline and terminal infrastructures.

The midstream oil and gas analytics market is expanding due to increasing needs for pipeline integrity, storage optimization, and compliance with safety and emission standards. Real-time monitoring tools support better asset utilization and flow control across pipelines, terminals, and compressor stations. Regulatory requirements for emissions and leak detection make analytics essential for accurate reporting and audit readiness.

Predictive maintenance analytics helps detect wear and malfunction signs early, reducing unplanned downtime and equipment replacement costs. Integration of IoT, SCADA, and sensor data enables centralized monitoring and operational forecasting.

On-premise solutions remain vital for critical infrastructure, but cloud-based systems are gaining ground for their scalability. This strong focus on performance, risk mitigation, and cost efficiency continues to drive adoption across midstream operations.

Opportunities in the midstream analytics market are rising through the use of AI-powered solutions that enable anomaly detection, leak prediction, and automated response actions. Cloud-native analytics platforms support remote decision-making by consolidating data from geographically dispersed assets into centralized dashboards.

Vendors are increasingly collaborating with pipeline operators to build tailored modules for scheduling, inventory optimization, and compliance tracking. Subscription-based models make advanced analytics accessible to mid-sized operators with limited IT resources. Emerging markets investing in energy logistics infrastructure present new growth avenues.

Additionally, analytics bundled with digital twin technology, geospatial mapping, and mobile access tools enhances operator control and workforce efficiency. These innovations open scalable, flexible, and secure pathways for modernizing midstream operations and expanding data-driven decision-making.

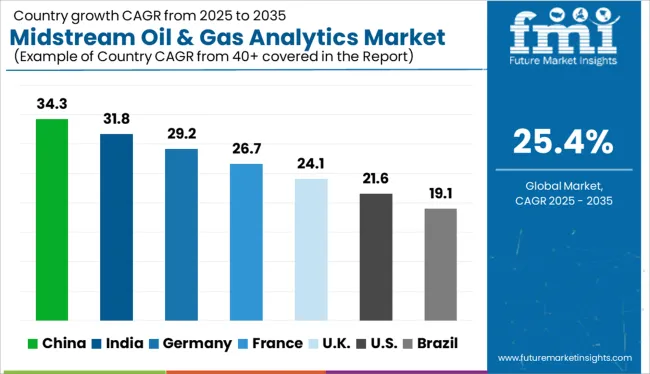

| Countries | CAGR |

|---|---|

| China | 34.3% |

| India | 31.8% |

| Germany | 29.2% |

| France | 26.7% |

| UK | 24.1% |

| USA | 21.6% |

| Brazil | 19.1% |

The global midstream oil & gas analytics market is forecasted to grow at a remarkable CAGR of 25.4% from 2025 to 2035, driven by increasing reliance on data-driven infrastructure optimization, predictive maintenance, and real-time pipeline monitoring. Among BRICS nations, China leads at a striking 34.3% CAGR, powered by the digital transformation of pipeline networks and rapid infrastructure expansion.

India follows at 31.8%, propelled by regulatory digitization initiatives and investment in LNG terminals and inter-regional pipeline connectivity. Within OECD markets, Germany shows strong growth at 29.2%, supported by sustainability targets, data-intensive operations, and integration of hydrogen transport systems.

The United Kingdom (24.1%) reflects a mature but evolving market, while the United States (21.6%) advances analytics adoption through AI-enabled pipeline safety and emissions monitoring. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is expected to lead the global midstream oil and gas analytics market with a projected CAGR of 34.3%, driven by rapid pipeline infrastructure digitization and expanding natural gas transmission networks. National energy security initiatives are boosting investment in real-time asset monitoring, predictive failure analytics, and pipeline optimization tools.

Chinese oil majors are partnering with domestic software providers to deploy AI-driven analytics across pipeline control rooms and LNG storage hubs. Increased demand for cross-border pipeline safety and operational intelligence is fueling adoption in both onshore and offshore terminals.

India is set to grow at a CAGR of 31.8%, supported by large-scale pipeline expansion projects and a government mandate to digitize oil and gas operations. Public sector undertakings (PSUs) are investing in SCADA upgrades, pipeline integrity software, and digital twins for predictive diagnostics.

Real-time analytics is becoming central to optimizing asset lifespans in aging midstream networks. Gas utility firms are adopting sensor-driven monitoring and data fusion to cut costs and reduce methane emissions. With the growth of city gas distribution and LNG terminals, demand for integrated analytics tools is rising across Tier-1 and Tier-2 cities.

Germany is expected to witness a robust CAGR of 29.2%, propelled by energy diversification efforts and strong regulatory oversight on midstream efficiency. The shift from Russian gas imports has increased the importance of secure pipeline tracking and fault prevention systems. Local operators are enhancing flow modeling and real-time pressure analytics to comply with EU emissions directives.

Demand for automated risk detection and pipeline health scoring is growing among independent grid operators and terminal owners. As hydrogen blending becomes more prevalent, analytics systems are being retrofitted to handle new gas compositions and mixed-fuel transport networks.

The United Kingdom is forecast to grow at a CAGR of 24.1%, underpinned by asset decarbonization targets, digital transformation across offshore terminals, and enhanced risk mitigation frameworks. Companies are investing in AI-powered anomaly detection and real-time metering data analytics for subsea pipelines.

Adoption of digital twins and cloud-native platforms is expanding among North Sea operators. Cybersecurity analytics and regulatory reporting compliance are emerging as key buying criteria. Cross-sector collaboration between analytics vendors and engineering firms is enabling smarter pipeline visualization and risk scoring.

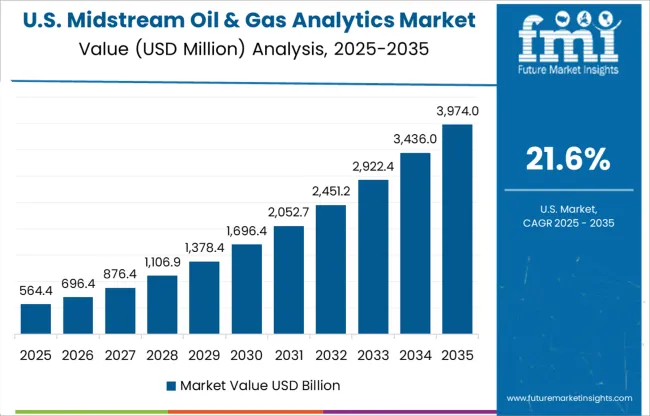

The United States midstream oil and gas analytics market is projected to grow at a CAGR of 21.6%, led by legacy infrastructure upgrades and increased shale gas transmission. Operators are integrating anomaly detection, corrosion tracking, and compressor station analytics into control room workflows.

Data centralization and pipeline condition modeling are helping mitigate risks and improve maintenance scheduling. Companies are increasingly focused on real-time reporting to comply with PHMSA and EPA guidelines. Analytics-backed control systems are being installed in compressor and pumping stations to reduce unplanned downtime and optimize throughput.

The midstream oil & gas analytics market is moderately consolidated, with a mix of global IT firms and industry-focused service providers offering advanced data solutions for pipeline monitoring, asset management, and operational optimization. IBM leads with a 15.0% market share, leveraging AI-driven platforms, real-time data analytics, and IoT integration to enhance midstream efficiency and safety.

Tier 1 players like Microsoft, SAP, and Oracle provide scalable cloud-based solutions for predictive maintenance, regulatory compliance, and logistics optimization. Tier 2 firms such as Accenture, Cognizant, and Capgemini focus on end-to-end digital transformation, combining domain expertise with analytics consulting.

Tier 3 vendors including TIBCO, Tableau, and Teradata deliver specialized visualization and data integration tools. Growth is driven by rising energy demand, the need for operational transparency, and investments in digital infrastructure across pipelines, terminals, and storage facilities.

On January 24, 2025, Kuva Systems announced that it secured a USD 5 million USA Department of Energy contract to deploy its optical gas imaging analytics at 175 oil and gas sites, enhancing midstream emissions monitoring and regulatory compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Deployment | On premise and Hosted |

| Service | Professional, Cloud, and Integration |

| Application | Pipeline SCADA, Fleet, and Storage optimization |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM, Accenture, Capgemini, Cisco Systems, Cognizant, Deloitte, Hewlett Packard Enterprise, Hitachi, Microsoft, Oracle, SAP, SAS Institute, Tableau Software, Teradata, and TIBCO Software |

| Additional Attributes | Dollar sales by analytics type, deployment mode, and end-user segment; regional trends driven by infrastructure expansion and digital transformation; innovation in AI, digital twins, and edge computing; focus on operational efficiency, leak detection, and predictive maintenance; regulatory impact on data reporting; cybersecurity concerns in remote monitoring; and emerging use cases in emissions tracking, carbon intensity analysis, and real-time logistics optimization. |

The global midstream oil & gas analytics market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the midstream oil & gas analytics market is projected to reach USD 21.7 billion by 2035.

The midstream oil & gas analytics market is expected to grow at a 25.4% CAGR between 2025 and 2035.

The key product types in midstream oil & gas analytics market are on premise and hosted.

In terms of service, professional segment to command 41.8% share in the midstream oil & gas analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA