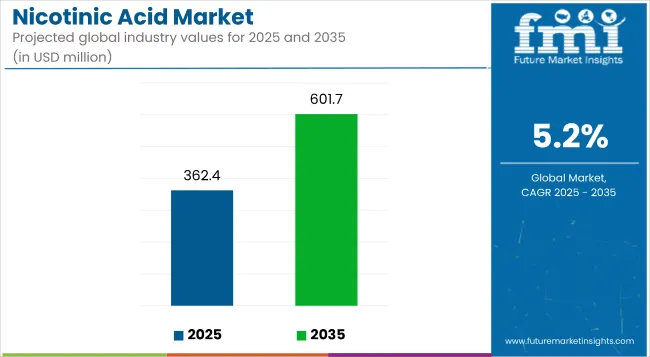

The global nicotinic acid market is projected to grow from USD 362.4 million in 2025 to USD 601.7 million by 2035, registering a CAGR of 5.2%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 362.4 million |

| Industry Value (2035F) | USD 601.7 million |

| CAGR (2025 to 2035) | 5.2% |

This growth is driven by rising awareness of vitamin B3 (niacin) benefits in managing metabolic disorders, skin health, and nervous system regulation. Increased consumption of functional foods, fortified beverages, and dietary supplements featuring nicotinic acid and nicotinamide is accelerating market uptake. Additionally, the pharmaceutical industry's rising use of nicotinic derivatives in anti-inflammatory and cardiovascular applications contributes to the expanding demand.

The market holds an 8.4% share, largely through niacin-based supplements. In the pharmaceutical ingredients market, the share is around 3.2%, due to use in lipid-lowering formulations and skin therapies. Within the personal care ingredients market, the share remains modest at 1.5%, primarily in anti-aging creams. In the fortified food and beverage segment, nicotinic compounds contribute about 2.6%, especially in energy drinks, cereals, and protein bars.

Government and health regulations play a critical role in shaping the market. The USA FDA, EFSA, and FSSAI set fortification limits and health claim regulations for niacin in supplements and foods. In India, the Prevention of Food Adulteration Act and guidelines from ICMR ensure controlled usage in functional food products. These regulatory frameworks encourage safe and effective nicotinic usage in both pharmaceuticals and consumer health products, supporting long-term market growth.

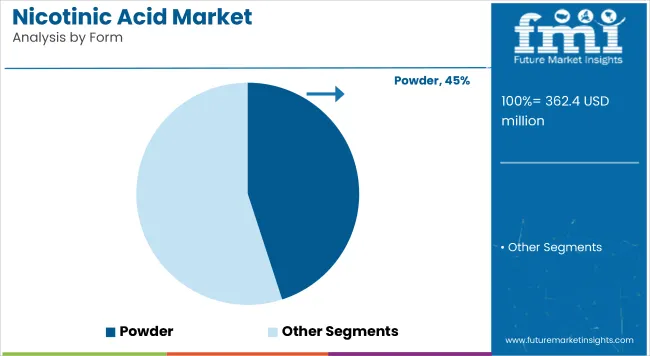

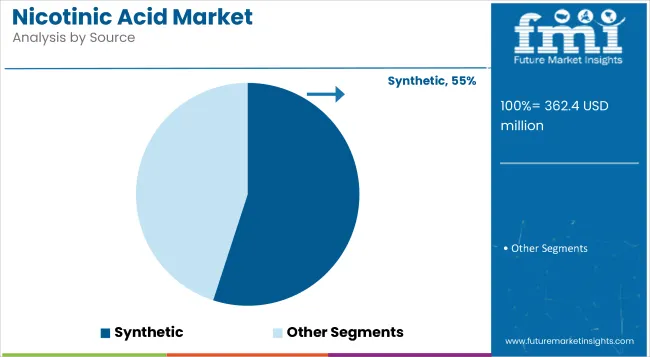

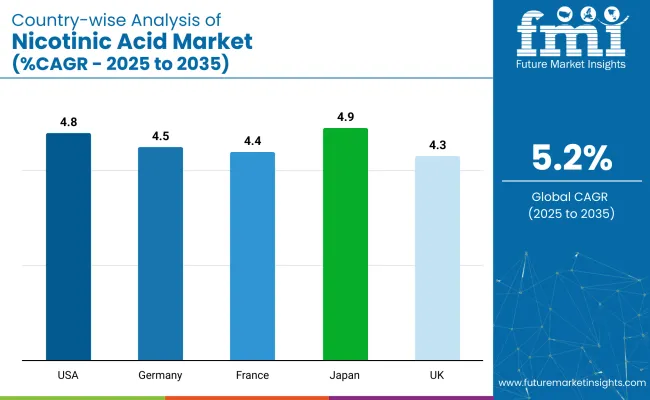

Japan is projected to be the fastest-growing market, expected to expandat a CAGR of 4.9% from 2025 to 2035. Synthetic will lead the source segment with a 55% share, while powder will dominate the form segment with a 45% share. The USA and Germany are also expected to grow steadily at CAGRs of 4.8% and 4.5%, respectively.

The market is segmented by form, grade, source, end-use industry, and region. By form, the market is divided into powder, liquid, and tablets/capsules. In terms of grade, the market is classified into feed grade, food grade, and pharmaceutical grade. Based on source, the market is bifurcated into natural and synthetic.

By the end-use industry, the market is segmented into dietary supplements, functional foods &beverages, infant food, animal feed, personal care, pharmaceuticals, and others (sports nutrition blends, veterinary health tonics, senior wellness formulas, and functional confectionery).

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Powderis projected to hold the highest market share among all forms, accounting for 45% of global demand in 2025. This form is widely used in supplements, functional beverages, and pharmaceutical blends due to its compatibility, long shelf life, and ease of transportation. Its granular nature also makes it ideal for bulk packaging and efficient downstream formulation.

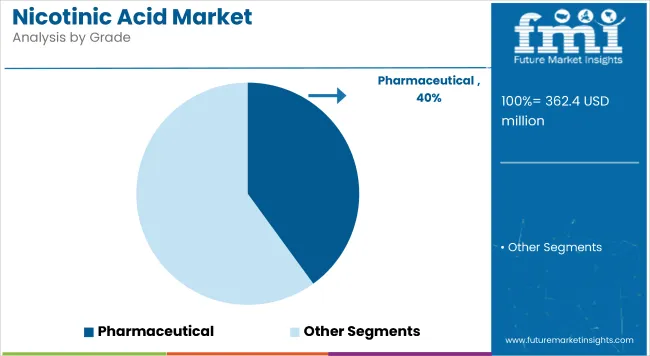

Pharmaceuticalgrade is projected to leadthe grade segment in 2025, capturing a 40% market share globally. Its dominance stems from extensive use in treating hypercholesterolemia, niacin deficiency, and neurodegenerative disorders. High purity and regulatory compliance also favor this grade across prescription-based channels.

Synthetic is expected to dominate the source category, capturinga 55% global market share in 2025. The growth is driven by its cost efficiency, batch-to-batch consistency, and high scalability. Its purity and processing speed make it ideal for contract manufacturing and fortified food applications.

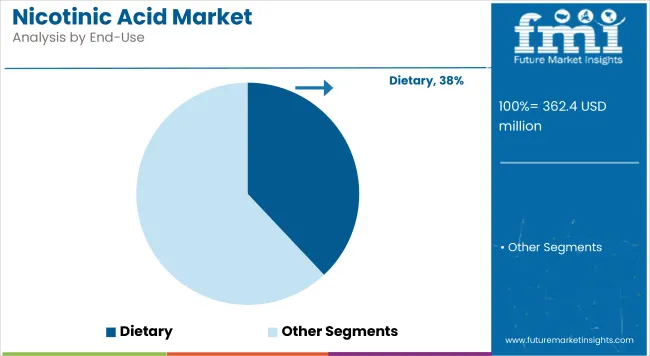

Dietary supplements are projected to remain the leading end-use industry, holding a 38% share of the global market in 2025. Rising awareness about vitamin B3’s role in energy metabolism, skin care, and heart health has made niacin a staple in both standalone supplements and complex multivitamin products.

The global nicotinic acid market is experiencing steady growth, driven by increasing awareness around preventive health, skin nourishment, and energy metabolism. Nicotinic acid (niacin) plays a vital role in cardiovascular support and neurological health, making it a key ingredient across supplements, fortified foods, and pharmaceutical formulations. Expanding use in the beauty and personal care industry also adds to its demand.

Recent Trends in the Nicotinic Acid Market

Challenges in the Nicotinic Acid Market

Japan’s momentum in the nicotinic acid market is driven by functional foods, clinical-grade skincare, and therapeutic vitamins. Germany and France maintain strong demand due to pharmaceutical-grade niacin usage and EU-backed wellness campaigns. The USA, UK, and Japan are growing at a steady 0.97-1.00x of the global CAGR of 4.9%.

The nicotinic acid market is expected to expandat most rapidly in Japan, growing at 4.9% CAGR from 2025 to 2035, followed by Germany (4.5%), France (4.4%), USA (4.8%), and UK (4.3%). Japan leads due to ultra-premium skincare formulations and advanced supplement formats. Western countries focus on regulated therapeutic dosing and preventive healthcare programs.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan nicotinic acid market is projected to grow at a CAGR of 4.9% from 2025 to 2035.Growth is driven by innovations in dermaceuticals, nutricosmetics, and functional beverages. The popularity of niacinamide-based skin brightening serums and oral beauty supplements drives strong demand in urban centers.

The Germany nicotinic acid revenueis expected to expandat a CAGR of 4.5% during the forecast period.Pharmaceutical-grade nicotinic acid is widely used for cholesterol control and neuropathy. EU compliance for supplement labeling and purity enhances trust. Germany also sees rising use of niacinamide in organic-certified skincare and clean nutrition.

The Frenchnicotinic acid market is growing at a CAGR of 4.4% from 2025 to 2035.France focuses on wellness and clinical nutrition, with niacin supplementation increasingly common among seniors and women.

The demand for nicotinic acid in the USA is projected to grow at a CAGR of 4.8%.Clinical-grade extended-release niacin is widely used for hyperlipidemia, with demand supported by rising obesity and metabolic disorder rates.

The UK nicotinic acid revenueis forecast to grow at a CAGR of 4.3% between 2025 and 2035. Usage is centered on nutritional support, cosmetic formulations, and preventive healthcare. The National Health Service (NHS) supports nicotinic supplementation for pregnancy and postnatal care.

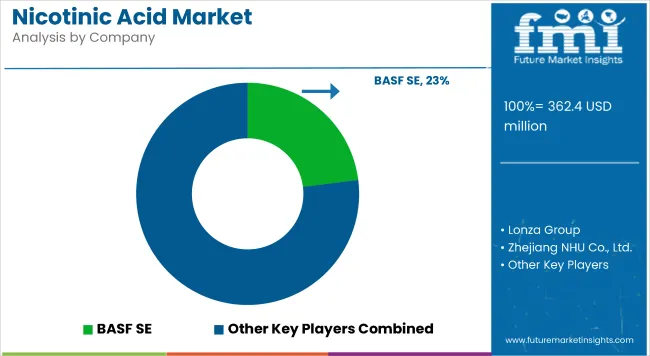

The market is moderately consolidated, with key players including Lonza Group, BASF SE, Zhejiang NHU Co., Ltd., Vertellus Holdings LLC, and Brother Enterprises leading the supply chain. These companies focus on high-purity niacin (nicotinic acid) and niacinamide production for use in pharmaceuticals, personal care, and dietary supplements.

Lonza Group is known for pharmaceutical-grade nicotinic acid production, catering to clinical therapies. BASF SE offers a wide vitamin portfolio including niacinamide for food fortification and personal care. Zhejiang NHU Co., Ltd. and Brother Enterprises lead in large-scale industrial synthesis of niacin for fortified foods and feed additives. Vertellus specializes in customized niacinamide derivatives for cosmetics and functional beverages.

Recent Nicotinic Acid Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 362.4 million |

| Projected Market Size (2035) | USD 601.7 million |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/Volume in metric tons |

| Form Analyzed | Powder, Liquid, and Tablets/Capsules |

| Grade Analyzed | Feed Grade, Food Grade, and Pharmaceutical Grade |

| Source Analyzed | Natural and Synthetic |

| End-use Industry Analyzed | Dietary Supplements, Functional Foods & Beverages, Infant Food, Animal Feed, Personal Care, Pharmaceuticals, and Others (Sports Nutrition Blends, Veterinary Health Tonics, Senior Wellness Formulas, a nd Functional Confectioner y) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Graham Chemical, Glanbia plc, Lonza Group AG, Jubilant Life Sciences Ltd., NutraScience Labs, DSM, BASF SE, Western Drugs Ltd., Spectrum Chemical Mfg. Corp, Fengchen Group Co., Ltd |

| Additional Attributes | Dollar sales by form and grade, share by source, regional demand growth, regulatory influence, pharmaceutical adoption trends, competitive benchmarking |

As per form, the industry has been categorized into Powder, Liquid, and Tablets/Capsules.

This segment is further categorized into Feed Grade, Food Grade, and Pharmaceutical Grade.

This segment is further categorized into Natural and Synthetic.

This segment is further categorized into Dietary Supplements, Functional Foods and Beverages, Infant Food, Animal Feed, Personal Care, Pharmaceuticals, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 362.4 million in 2025.

The market is forecasted to reach USD 601.7 million by 2035, reflecting a CAGR of 5.2%.

Powder will lead the form segment, accounting for 45% of the global market share in 2025.

Synthetic will dominate the source segment with a 55% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 4.9% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA