The NLP in education market is expanding rapidly as artificial intelligence and language processing technologies transform teaching, assessment, and content delivery. The growing adoption of digital learning platforms and the need for personalized learning experiences are driving demand for NLP-enabled solutions.

These tools assist in automating grading, evaluating student sentiment, and improving accessibility for diverse learners. The current market is supported by the proliferation of e-learning applications, chatbots, and intelligent tutoring systems that leverage NLP for real-time interaction and feedback.

Institutions are increasingly adopting AI-based analytics to enhance academic performance and student engagement. With ongoing advancements in language models and integration into mainstream educational systems, the market outlook remains highly favorable, characterized by continuous innovation and increasing investment in EdTech infrastructure.

| Metric | Value |

|---|---|

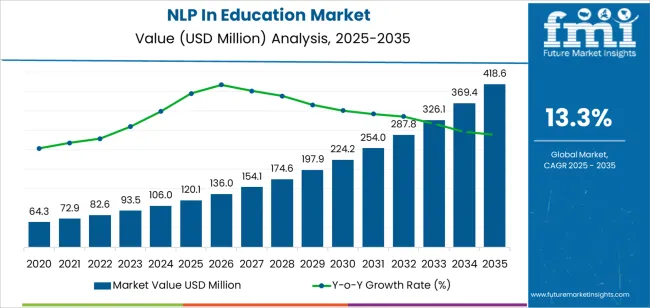

| NLP In Education Market Estimated Value in (2025 E) | USD 120.1 million |

| NLP In Education Market Forecast Value in (2035 F) | USD 418.6 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

The market is segmented by Offering, Model Type, Application, and End-User and region. By Offering, the market is divided into Solution and Services. In terms of Model Type, the market is classified into Rule-based NLP, Statistical NLP, and Hybrid NLP. Based on Application, the market is segmented into Sentiment Analysis and Data Extraction, Risk and Threat Detection, Content Management and Automatic Summarization, Intelligent Tutoring and Language Learning, Corporate Training, and Others. By End-User, the market is divided into EdTech Provider and Academic User. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment leads the offering category with approximately 45.40% share, reflecting strong adoption of NLP-based platforms and software that streamline administrative and academic functions. These solutions automate grading, plagiarism detection, and student support, reducing the burden on educators.

The segment benefits from the growing use of cloud-based learning management systems and digital classrooms that integrate NLP capabilities for real-time feedback and adaptive learning. Continuous enhancements in AI-driven content analytics and multilingual processing have improved system efficiency and scalability.

With educational institutions prioritizing digital transformation, the solution segment is expected to sustain its leadership through the forecast period.

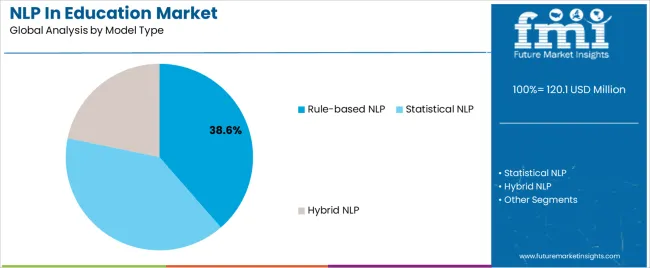

The rule-based NLP segment accounts for approximately 38.60% share of the model type category, attributed to its interpretability, reliability, and ease of implementation in structured educational data systems. Rule-based models are widely utilized in grammar correction, keyword extraction, and predefined question-answer frameworks within e-learning tools.

The segment remains prominent due to its lower computational requirements and predictable performance compared to deep learning models. Continued improvements in hybrid NLP frameworks combining rule-based and statistical techniques are expanding functionality across educational applications.

As institutions focus on cost-effective and transparent AI adoption, the rule-based NLP segment is projected to maintain its strong presence.

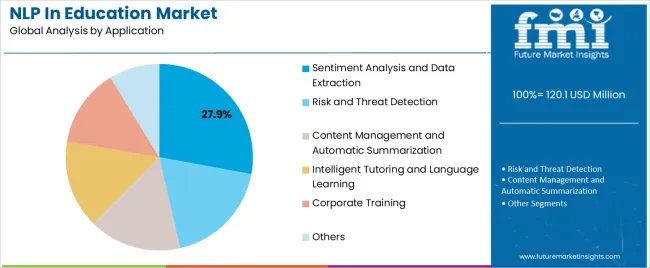

The sentiment analysis and data extraction segment represents approximately 27.90% share in the application category, driven by the growing importance of understanding learner engagement and content effectiveness. NLP-powered tools analyze feedback, discussion forums, and assignments to assess emotional tone and identify learning gaps.

Educational institutions and EdTech providers utilize these insights to tailor curricula and improve student retention. The segment’s growth is reinforced by the rising use of analytics dashboards and predictive models in education management systems.

As data-driven decision-making becomes integral to educational operations, sentiment analysis and data extraction are expected to remain vital application areas within the NLP in education market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 37.4 million |

| Market Value for 2025 | USD 83.7 million |

| Market CAGR from 2020 to 2025 | 22.3% |

In the following section, we ought to look in depth at the NLP in education market analysis. Comprehensive studies demonstrate that solution offerings dominate the market, establishing a definite shift towards practical implementations.

Rule-based NLP models have emerged as the leading model types, showing widespread acceptance and success in educational settings.

| Attributes | Details |

|---|---|

| Top Offering | Solution |

| CAGR % 2020 to 2025 | 22.1% |

| CAGR % 2025 to End of Forecast (2035) | 18.0% |

| Attributes | Details |

|---|---|

| Top Model Type | Rule-based NLP |

| CAGR % 2020 to 2025 | 21.9% |

| CAGR % 2025 to End of Forecast (2035) | 17.8% |

The following tables exhibit major economies, including China, South Korea, Japan, the United States, and the United Kingdom, focusing on NLP in education market.

A detailed analysis reveals that South Korea sets itself apart, providing an opportunity for expansion and demonstrating the country's capacity for the significant advancement and adoption of Natural Language Processing (NLP) technology in the educational system.

| Nation | South Korea |

|---|---|

| HCAGR (2020 to 2025) | 29.4% |

| CAGR (2025 to 2035) | 20.1% |

| Country | Japan |

|---|---|

| HCAGR (2020 to 2025) | 25.7% |

| CAGR (2025 to 2035) | 19.4% |

| Nation | United Kingdom |

|---|---|

| HCAGR (2020 to 2025) | 25.7% |

| CAGR (2025 to 2035) | 19.3% |

| Nation | China |

|---|---|

| HCAGR (2020 to 2025) | 24.7% |

| CAGR (2025 to 2035) | 18.6% |

| Nation | United States |

|---|---|

| HCAGR (2020 to 2025) | 23.2% |

| CAGR (2025 to 2035) | 18.5% |

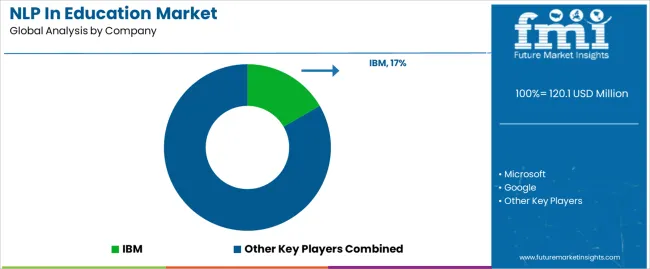

The landscape of NLP in education market includes various major players promoting innovation and revolution. IBM, Microsoft, and Google stand out as prominent innovators, harnessing their massive resources and experience to determine the trajectory of natural language processing in education.

SAS Institute and AWS bring significant educational technology expertise to the table, providing advanced solutions to address the changing needs of educational institutions. Welocalize, Automated Insights, and Primer.ai contribute to the competitive field by providing specialized services and specialist capabilities that address specific areas of NLP in education market.

As NLP vendors in education continue to collaborate and compete, the market has the potential for tremendous development and innovation. Advances in language understanding, educational content generation, and individualized learning experiences propel the developments in the NLP in education.

Noteworthy Breakthroughs

| Company | Details |

|---|---|

| Yellow.ai | Yellow.ai announced Salem, a new Al-powered educational chatbot for WhatsApp, in March 2025. |

| Microsoft | Microsoft launched Automated ML Supports NLP in February 2025, allowing ML specialists and data scientists to leverage text data to develop unique models for tasks such as named entity recognition (NER), multi-class text classification, and multi-label text classification. |

| IBM Partner Plus | IBM Partner Plus launched for the first time in January 2025. This new program reimagines how IBM engages with its business partners to increase technical knowledge and accelerate time to market by providing unprecedented access to IBM resources, incentives, and specialist assistance. |

| NICE | In December 2025, NICE revealed ElevateAl, a brand-new AlaaS service that gives the developer community access to the capabilities of Enlighten Al, its purpose-built customer experience AI in education technology trends. |

| In November 2025, Google announced an ambitious new plan to develop a single Al language model that can handle the top 1,000 languages spoken worldwide. | |

| Askdata | Askdata, a data engagement and collaboration platform, was bought by SAP SE in July 2025. The acquisition's primary goal is to aid consumers in making informed decisions using AI-driven natural language searches. |

| Apple Inc. | Apple Inc. purchased Inductiv Inc., a machine learning firm, in May 2024. The acquisition is intended to improve the performance of Apple's virtual assistant, Siri. |

The global nlp in education market is estimated to be valued at USD 120.1 million in 2025.

The market size for the nlp in education market is projected to reach USD 418.6 million by 2035.

The nlp in education market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in nlp in education market are solution, _text-based nlp solution, _video-based nlp solution, _image-based nlp solution, _audio-based nlp solution, services, _professional services and _managed services.

In terms of model type, rule-based nlp segment to command 38.6% share in the nlp in education market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Natural Language Processing (NLP) Market Insights – Trends & Growth Forecast 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA