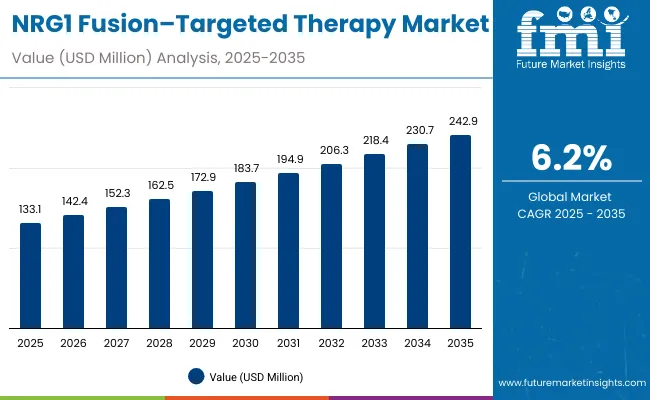

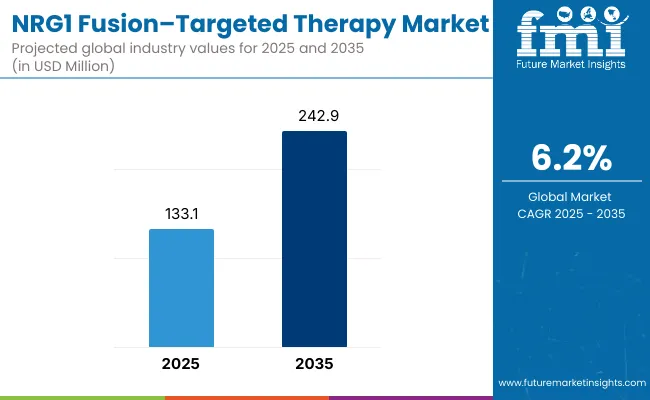

The global NRG1 fusion-targeted therapy market is projected to grow from USD 133.1 million in 2025 to approximately USD 242.9 million by 2035, recording an absolute increase of USD 109.8 million over the forecast period. This translates into a total growth of 82.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035.

NRG1 Fusion-Targeted Therapy Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 133.1 million |

| Forecast Value in (2035F) | USD 242.9 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing prevalence of NRG1 fusion-positive cancers, rising demand for targeted therapy approaches, and growing focus on precision oncology treatments.

Between 2025 and 2030, the NRG1 fusion-targeted therapy market is projected to expand from USD 133.1 million to USD 179.8 million, resulting in a value increase of USD 46.7 million, which represents 42.5% of the total forecast growth for the decade.

This phase of growth will be shaped by rising awareness about NRG1 fusion biomarkers, increasing demand for personalized oncology approaches, and growing penetration of targeted therapies in emerging markets. Pharmaceutical companies are expanding their NRG1 fusion-targeted therapy portfolios to address the growing demand for effective treatment solutions for rare fusion-positive cancers.

From 2030 to 2035, the market is forecast to grow from USD 179.8 million to USD 242.9 million, adding another USD 63.1 million, which constitutes 57.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized oncology channels, integration of companion diagnostic platforms with targeted therapy management, and development of personalized treatment protocols

. The growing adoption of precision medicine and oncologist recommendations will drive demand for clinically proven NRG1 fusion-targeted therapies with enhanced efficacy and safety profiles.

Between 2020 and 2025, the NRG1 fusion-targeted therapy market experienced steady expansion, driven by increasing recognition of NRG1 fusion biomarkers and growing acceptance of targeted therapy approaches. The market developed as healthcare providers recognized the need for specialized treatment solutions to address rare fusion-positive cancers. Clinical research and regulatory approvals began emphasizing the importance of biomarker-driven therapies in achieving better patient outcomes for challenging oncology indications.

Market expansion is being supported by the increasing identification of NRG1 fusion-positive cancers and the corresponding demand for more effective targeted therapeutic approaches. Modern healthcare providers are increasingly focused on precision oncology that can address specific genetic alterations, improve treatment response rates, and reduce the burden of conventional chemotherapy.

The proven efficacy of NRG1 fusion-targeted therapies in treating rare conditions like fusion-positive non-small cell lung cancer and pancreatic adenocarcinoma makes them essential components of comprehensive oncology treatment plans.

The growing emphasis on companion diagnostics and precision medicine is driving demand for tailored targeted therapies that address individual patient genetic profiles and tumor characteristics. Healthcare provider preference for biomarker-driven treatment regimens that target specific fusion proteins is creating opportunities for innovative drug development.

The rising influence of clinical guidelines and evidence-based treatment protocols is also contributing to increased adoption of proven NRG1 fusion-targeted therapies across different patient populations and therapeutic areas.

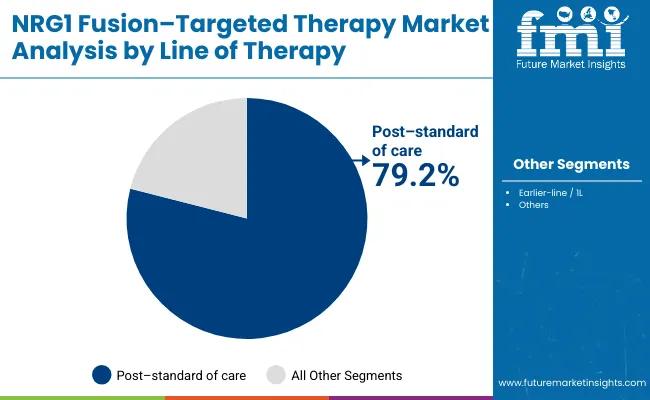

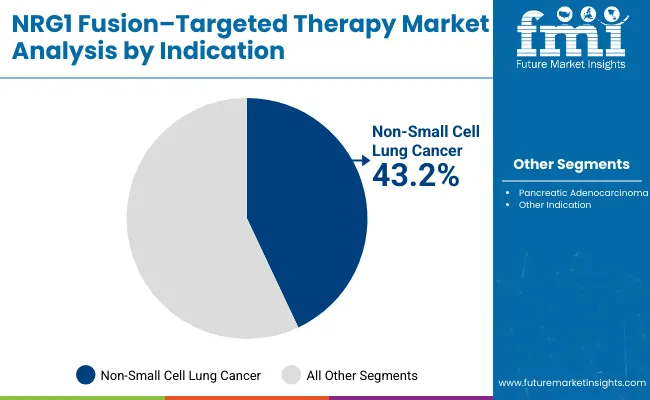

The market is segmented by line of therapy, indication, sales channel, and region. By line of therapy, the market is divided into post-standard of care and earlier-line/1L treatments. Based on indication, the market is categorized into non-small cell lung cancer, pancreatic adenocarcinoma, and other indications.

In terms of sales channel, the market is segmented into hospital pharmacies, specialty pharmacies, community oncology clinics, and online pharmacies. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The post-standard of care treatment segment is projected to account for 79.2% of the NRG1 fusion-targeted therapy market in 2025, reaffirming its position as the category's dominant treatment approach. Healthcare providers increasingly recognize the benefits of NRG1 fusion-targeted medications for treating patients who have exhausted conventional treatment options, particularly those with rare fusion-positive cancers requiring specialized therapeutic interventions. This treatment approach addresses critical unmet medical needs in late-line therapy settings, providing new hope for patients with limited alternatives.

This segment forms the foundation of most treatment protocols for NRG1 fusion-positive cancers, as it represents the most clinically validated and widely accepted targeted approach in precision oncology. Regulatory approvals and extensive clinical research continue to strengthen confidence in these formulations for post-standard care applications.

With increasing recognition of the complexity of fusion-positive cancers requiring specialized approaches, post-standard of care NRG1 fusion-targeted therapies align with both salvage treatment and long-term management goals. Their therapeutic utility in advanced disease settings ensures sustained market dominance, making them the central growth driver of NRG1 fusion-targeted therapy demand.

Non-small cell lung cancer is projected to represent 43.2% of NRG1 fusion-targeted therapy demand in 2025, underscoring its role as the primary indication driving targeted therapy adoption. Healthcare providers recognize that NRG1 fusion-positive NSCLC represents a distinct molecular subset requiring specialized treatment approaches that conventional chemotherapy cannot adequately address. Targeted therapies offer enhanced efficacy in managing these rare fusion-positive cases and improving overall survival outcomes.

The segment is supported by the high prevalence of lung cancer and the growing recognition that NRG1 fusion-targeted approaches can improve patient outcomes and quality of life. Additionally, healthcare systems are increasingly adopting biomarker-driven treatment guidelines that recommend specific targeted therapies for optimal outcomes. As clinical understanding of NRG1 fusion biology advances, targeted therapies will continue to play a crucial role in precision oncology strategies, reinforcing their essential position within the therapeutic market.

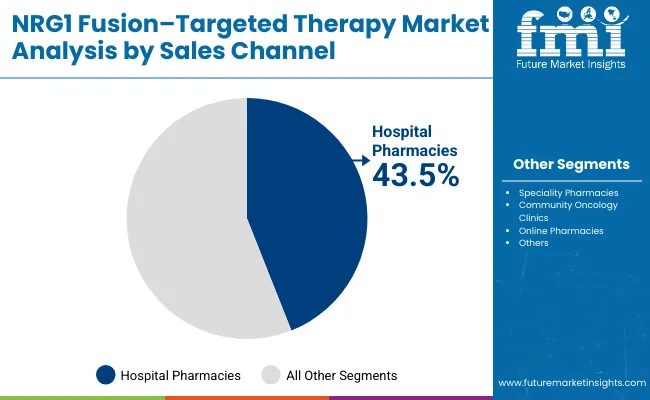

The hospital pharmacies channel is forecasted to contribute 43.5% of the NRG1 fusion-targeted therapy market in 2025, reflecting the primary role of hospital-based oncology services in targeted therapy administration and patient care.

Patients with rare fusion-positive cancers rely on specialized hospital facilities for comprehensive cancer care, making hospital pharmacies the cornerstone of NRG1 fusion-targeted therapy distribution. This channel provides essential services including specialized medication handling, infusion management, and coordination with oncology specialists.

The segment benefits from established relationships between cancer centers and specialized pharmacies that provide continuity of care and medication management support. Hospital pharmacies also offer advantages in terms of specialized storage requirements, complex dosing protocols, and patient monitoring capabilities. With growing emphasis on precision oncology and specialized cancer care, hospital pharmacies serve as critical access points for NRG1 fusion-targeted therapies, making them fundamental drivers of market accessibility and growth.

The NRG1 fusion-targeted therapy market is advancing steadily due to increasing identification of NRG1 fusion biomarkers and growing demand for precision oncology approaches. However, the market faces challenges including complex companion diagnostic requirements, high treatment costs, and limited patient populations. Innovation in targeted therapy formulations and biomarker identification protocols continue to influence product development and market expansion patterns.

Expansion of Specialty Pharmacies and Precision Oncology Channels

The growing adoption of specialized oncology care facilities is enabling more sophisticated targeted therapy management and monitoring. Specialty pharmacies offer comprehensive medication management services, including biomarker testing coordination and adverse event management, that are particularly important for targeted therapy regimens. Precision oncology channels provide access to oncology specialists who can optimize targeted therapy selection and patient monitoring.

Integration of Companion Diagnostics and Biomarker Testing Platforms

Modern pharmaceutical companies are incorporating companion diagnostic technologies such as next-generation sequencing, biomarker identification systems, and molecular profiling integration to enhance targeted therapy selection. These technologies improve treatment precision, enable real-time monitoring of therapeutic outcomes, and provide better coordination between diagnostic laboratories and healthcare providers. Advanced diagnostic platforms also enable personalized treatment recommendations and early identification of potential resistance mechanisms.

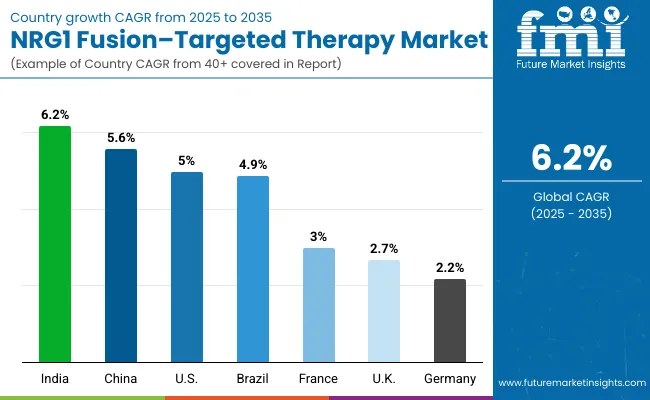

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.2% |

| China | 5.6% |

| USA | 5.0% |

| Brazil | 4.9% |

| Japan | 4.5% |

| France | 3.0% |

| UK | 2.7% |

| Germany | 2.2% |

The NRG1 fusion-targeted therapy market is experiencing varied growth globally, with India leading at a 6.2% CAGR through 2035, driven by expanding oncology infrastructure, increasing cancer awareness, and growing access to targeted therapies. China follows at 5.6%, supported by healthcare system reforms, increasing recognition of precision medicine importance, and expanding pharmaceutical coverage.

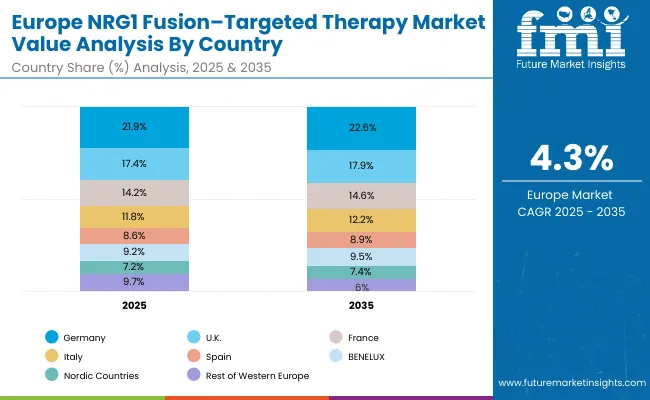

The USA shows growth at 5.0%, emphasizing advanced precision oncology adoption and targeted therapy utilization. Brazil demonstrates growth at 4.9%, focusing on improved access to oncology care and targeted therapy adoption. Europe records 4.3% growth, focusing on evidence-based treatment protocols and comprehensive cancer care systems.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from NRG1 fusion-targeted therapies in China is projected to exhibit steady growth with a CAGR of 5.6% through 2035, driven by ongoing healthcare system reforms and increasing recognition of precision medicine as a priority in cancer care. The country's expanding oncology infrastructure and growing availability of specialized cancer services are creating significant opportunities for targeted therapy adoption. Major international and domestic pharmaceutical companies are establishing comprehensive distribution networks to serve the growing population of patients requiring specialized oncology treatment across urban and developing regions.

Revenue from NRG1 fusion-targeted therapies in India is expanding at a CAGR of 6.2%, supported by increasing healthcare accessibility, growing cancer awareness, and expanding pharmaceutical market presence. The country's large patient population and increasing recognition of precision medicine are driving demand for effective targeted therapy solutions. International pharmaceutical companies and domestic manufacturers are establishing distribution channels to serve the growing demand for quality oncology medications.

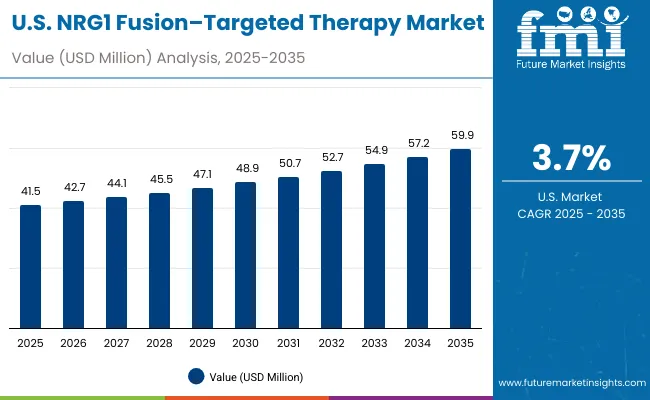

Demand for NRG1 fusion-targeted therapies in the USA is projected to grow at a CAGR of 5.0%, supported by well-established oncology care systems and evidence-based treatment guidelines. American healthcare providers consistently utilize targeted therapies for rare fusion-positive cancers and complex oncology presentations. The market is characterized by mature treatment protocols, comprehensive insurance coverage, and established relationships between healthcare providers and pharmaceutical companies.

Revenue from NRG1 fusion-targeted therapies in Brazil is projected to grow at a CAGR of 4.9% through 2035, driven by healthcare system development, increasing access to oncology care, and growing recognition of precision medicine importance. Brazilian healthcare providers are increasingly adopting targeted therapy approaches for rare fusion-positive cancers, supported by expanding pharmaceutical market presence and improved treatment accessibility.

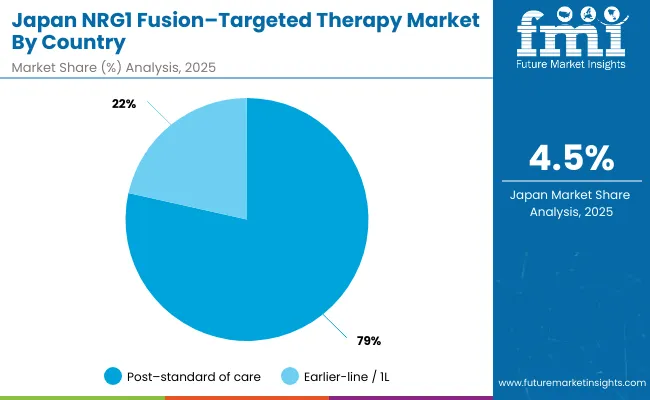

Revenue from NRG1 fusion-targeted therapies in Japan is projected to grow at a CAGR of 4.5% through 2035, supported by the country's advanced oncology care infrastructure, comprehensive healthcare coverage, and systematic approach to precision medicine. Japanese healthcare providers emphasize evidence-based targeted therapy utilization within structured healthcare frameworks that prioritize clinical effectiveness and patient safety.

The NRG1 fusion-targeted therapy market in Europe is projected to expand steadily through 2035, supported by increasing adoption of precision oncology, rising prevalence of fusion-positive cancers, and ongoing clinical innovation in targeted therapies.

Germany will continue to lead the regional market, accounting for 21.9% in 2025 and rising to 22.6% by 2035, supported by a strong clinical research base, reimbursement pathways, and robust oncology care infrastructure. The United Kingdom follows with 17.4% in 2025, increasing to 17.9% by 2035, driven by NHS adoption of advanced treatment guidelines, precision medicine integration, and broadening specialist networks.

France holds 14.2% in 2025, edging up to 14.6% by 2035 as cancer centers expand targeted therapy protocols and demand grows for personalized treatment regimens. Italy contributes 11.8% in 2025, rising to 12.2% by 2035, supported by strong regional oncology programs and growing clinical trial participation. Spain represents 8.6% in 2025, increasing to 8.9% by 2035, underpinned by strengthening access to oncology services and patient support programs.

BENELUX markets together account for 9.2% in 2025, moving to 9.5% by 2035, supported by innovation-friendly regulatory frameworks and academic-industry collaboration. The Nordic countries represent 7.2% in 2025, increasing to 7.4% by 2035, with demand fueled by progressive healthcare systems and early adoption of evidence-based cancer care. The Rest of Western Europe moderates from 9.7% in 2025 to 6.9% by 2035, as larger core markets capture a greater share of investment, clinical trials, and adoption of targeted therapy protocols.

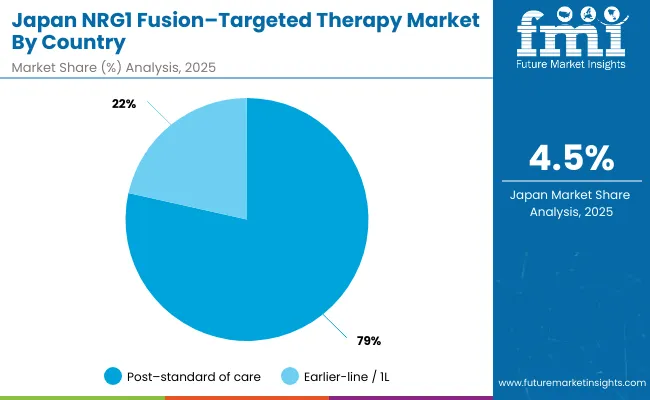

The NRG1 fusion-targeted therapy market in Japan is set to remain focused on advanced-line treatments in 2025, reflecting clinical preferences in oncology practice and evolving prescribing patterns. Post-standard of care treatments dominate with a 78.5% share in 2025, supported by their central role in managing patients who have exhausted conventional treatment options and require specialized targeted approaches for fusion-positive cancers.

Earlier-line/1L treatments represent 21.5% in 2025, gaining traction from pipeline approvals and expanding clinical evidence supporting earlier intervention with targeted therapies. This segment reflects the growing recognition that targeted approaches may provide better outcomes when used earlier in the treatment sequence, particularly for patients with confirmed NRG1 fusion-positive tumors.

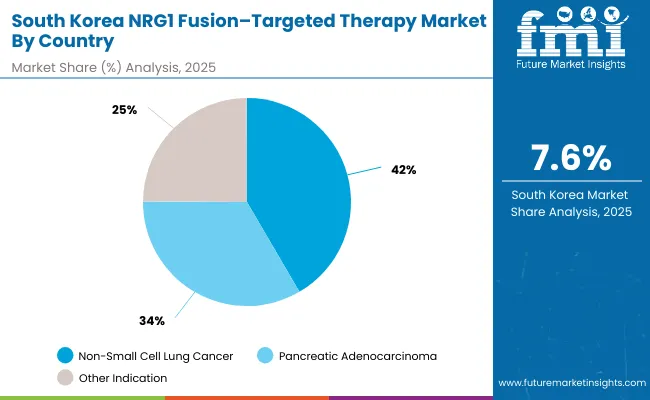

The NRG1 fusion-targeted therapy market in South Korea in 2025 is shaped by strong demand across core oncology indications, reflecting both clinical prevalence and treatment guidelines. Non-small cell lung cancer accounts for the largest share at 41.6%, supported by high rates of lung cancer incidence, comprehensive biomarker testing adoption, and increasing integration of targeted therapies to address fusion-positive disease.

Pancreatic adenocarcinoma follows with 33.5%, driven by the rising burden of pancreatic cancer, heightened awareness about molecular profiling, and wider recognition of NRG1 fusion-targeted therapy protocols for this challenging indication. Other indications contribute 24.9%, supported by the expanding use of targeted therapies across various fusion-positive cancer types and emerging applications in multiple tumorhistologies.

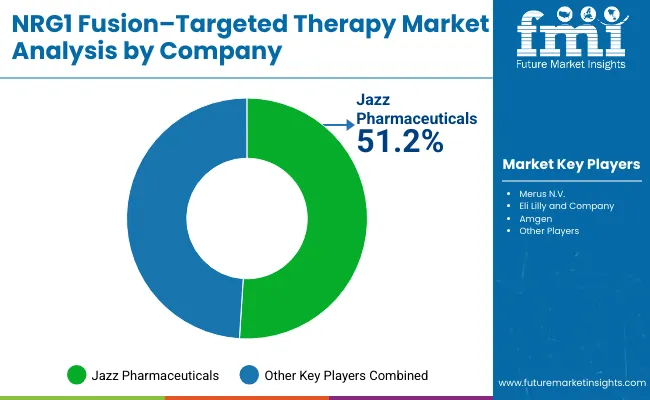

The NRG1 fusion-targeted therapy market is characterized by competition among specialized biotechnology companies, established pharmaceutical firms, and precision medicine focused organizations. Companies are investing in clinical research, biomarker identification, strategic partnerships, and healthcare provider education to deliver effective, safe, and accessible targeted therapy solutions. Drug development, clinical validation, and market access strategies are central to strengthening product portfolios and market presence.

Jazz Pharmaceuticals leads the market with 51.2% global value share, offering clinically-proven NRG1 fusion-targeted therapies with a focus on rare oncology indications and specialized patient populations. Other players collectively account for 48.8% of the market share, including Merus N.V., which focuses on innovative antibody technologies and multispecific therapeutic approaches. Eli Lilly and Company provides comprehensive oncology medication portfolios including targeted products across multiple therapeutic areas. Amgen delivers established targeted therapy products with strong clinical evidence and healthcare provider acceptance in precision oncology settings.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 133.1 Million |

| Line of Therapy | Post-standard of care, Earlier-line/1L |

| Indication | Non-Small Cell Lung Cancer, Pancreatic Adenocarcinoma, Other Indication |

| Sales Channel | Hospital Pharmacies, Specialty Pharmacies, Community Oncology Clinics, Online Pharmacies |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Jazz Pharmaceuticals, Merus N.V., Eli Lilly and Company, Amgen , Zai Lab, Merck & Co., Remedy Repack Inc., Dr. Reddy’s Laboratories, Sun Pharma, Micro Labs, Shine Pharmaceuticals |

| Additional Attributes | Dollar sales by line of therapy and therapeutic indication, regional demand trends, competitive landscape, healthcare provider preferences for specific targeted therapies, integration with specialty oncology channels, innovations in precision medicine approaches, patient access programs, and clinical outcome optimization |

The global NRG1 fusion-targeted therapy market is valued at USD 133.1 million in 2025.

The size for the NRG1 fusion-targeted therapy market is projected to reach USD 242.9 million by 2035.

The NRG1 fusion-targeted therapy market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key treatment line segments in the NRG1 fusion-targeted therapy market are post-standard of care treatments, first-line treatments, and second-line treatments.

In terms of treatment line, post-standard of care treatments segment is set to command 79.2% share in the NRG1 fusion-targeted therapy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rare NRG1 Fusion Market Size and Share Forecast Outlook 2025 to 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Mesotherapy Market Size and Share Forecast Outlook 2025 to 2035

Cryotherapy Market Growth - Demand, Trends & Emerging Applications 2025 to 2035

Aromatherapy Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Heat Therapy Units Market Analysis - Size, Share, and Forecast 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Radiotherapy Patient Positioning Accessories Market Trends – Forecast 2025 to 2035

Phototherapy Lamps Market Growth - Trends & Forecast 2025 to 2035

Gene Therapy in CNS Disorder Market Analysis by Indication, Type, End User, and Region through 2035

Radiotherapy Device Market is segmented by External Beam Radiation Therapy Device and Internal Beam Radiation Therapy Device from 2025 to 2035

Chemotherapy-Induced Oral Mucositis Market – Growth & Forecast 2025 to 2035

Chemotherapy-Induced Myelosuppression Treatment Market Growth - Forecast 2025 to 2035

Back Therapy Kit Market Trends – Demand & Future Outlook 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA