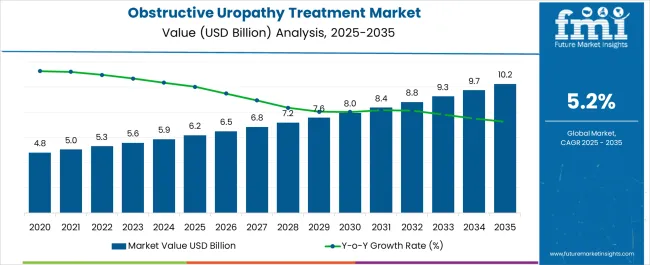

The Obstructive Uropathy Treatment Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Obstructive Uropathy Treatment Market Estimated Value in (2025 E) | USD 6.2 billion |

| Obstructive Uropathy Treatment Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Obstructive Uropathy Treatment market is being influenced by increasing prevalence of urinary tract obstructions, aging populations, and rising incidences of comorbid conditions such as kidney stones, tumors, and infections. The current scenario reflects significant demand for minimally invasive and catheter-based interventions that offer faster recovery and reduced procedural complications. Technological advancements in catheter designs and improved surgical techniques have expanded treatment options, enabling better patient outcomes.

The growing awareness among healthcare providers regarding early diagnosis and management has further supported market expansion. In addition, the rising investments in healthcare infrastructure and increased access to hospital-based services are accelerating the adoption of advanced treatment options. Looking ahead, the market is expected to grow steadily as personalized treatment protocols and outpatient care models are developed.

The combination of improved diagnostic imaging, device innovation, and healthcare accessibility is expected to open new avenues for treatment, especially in regions experiencing a rise in age-related urological disorders These factors are projected to create robust demand for catheter-based solutions and hospital interventions.

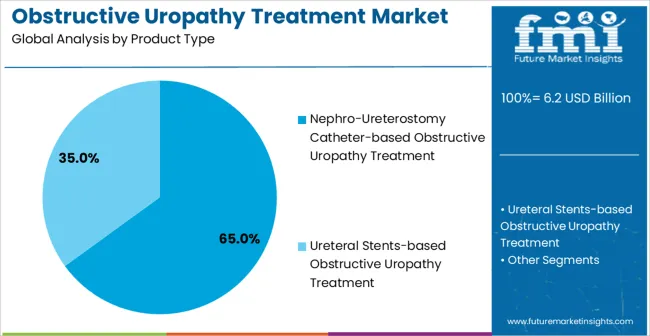

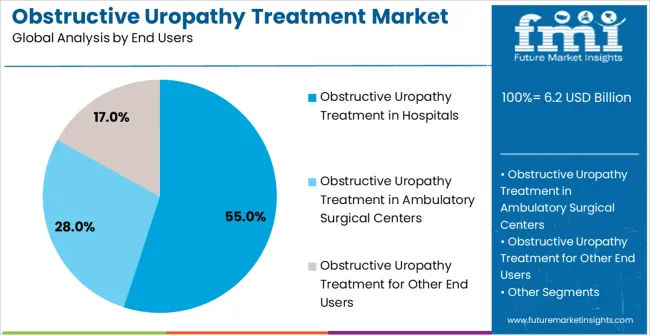

The obstructive uropathy treatment market is segmented by product type, end users, and geographic regions. By product type, obstructive uropathy treatment market is divided into Nephro-Ureterostomy Catheter-based Obstructive Uropathy Treatment and Ureteral Stents-based Obstructive Uropathy Treatment. In terms of end users, obstructive uropathy treatment market is classified into Obstructive Uropathy Treatment in Hospitals, Obstructive Uropathy Treatment in Ambulatory Surgical Centers, and Obstructive Uropathy Treatment for Other End Users. Regionally, the obstructive uropathy treatment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Nephro-Ureterostomy catheter-based obstructive uropathy treatment segment is expected to account for 65.00% of the product type share in the Obstructive Uropathy Treatment market in 2025, positioning it as the largest segment. This prominence is being attributed to the widespread preference for minimally invasive procedures that ensure rapid relief from urinary obstructions while reducing hospitalization duration.

The segment has been supported by improvements in catheter design, which offer better drainage, reduced risk of infection, and ease of insertion in complex cases. The high adoption rate is also being linked to its effectiveness in managing both acute and chronic conditions where temporary or long-term drainage is required.

As outpatient interventions gain traction and healthcare systems focus on cost containment, catheter-based therapies are being favored over traditional surgical approaches The growth of this segment is expected to be reinforced by the rising elderly population, increasing diagnostic rates, and the availability of advanced imaging tools that aid in accurate catheter placement.

The obstructive uropathy treatment in hospitals segment is projected to hold 55.00% of the end-use share in the Obstructive Uropathy Treatment market in 2025, making it the leading end-use category. This position is being supported by hospitals offering specialized care, access to multidisciplinary teams, and the availability of advanced therapeutic procedures that ensure improved patient management. The segment’s growth has been driven by the rising demand for early diagnosis, continuous monitoring, and intervention in complex cases that require expert care and follow-up.

Additionally, hospitals are increasingly adopting structured treatment protocols that integrate imaging, catheter placement, and post-procedure monitoring, thereby improving recovery outcomes. The availability of trained healthcare professionals and investment in modern healthcare infrastructure have further contributed to the segment’s expansion.

As healthcare systems adapt to the growing burden of urinary disorders, hospitals are being viewed as preferred centers for comprehensive obstructive uropathy management The segment is expected to sustain its growth as patient preference for structured and technologically advanced treatment environments continues to rise.

Obstructive uropathy is an obstruction and hindrance in the urinal tract that causes complete or partial obstructions to the normal flow of urine. Obstructive uropathy is caused by a structural or functional malfunction that prevents urine drainage and can lead to serious complications if not treated. Obstructive uropathy can be either acute or chronic.

Obstructive uropathy treatment is appropriate for people of all ages because it can affect anyone at any age. Obstructive uropathy accounts for 10% of the causes of acute renal failure and 4% of cases of chronic end-stage renal failure. Obstructive uropathy can be caused by a neoplastic condition, inflammation, or it can be inherited.

Treatment for obstructive uropathy entails inserting catheters or stents into the kidney or ureter to restore normal urine flow. The treatment for obstructive uropathy is minimally invasive and has a high success rate. The nephron-ureterostomy catheter is inserted through the skin and allows urine to flow from the bladder to the renal pelvis.

A ureteral stent is a tube that is implanted in the ureter and allows urine to flow from the kidney to the bladder. Hydronephrosis is a condition in which there is an excess of fluid in the kidney that is treated with obstructive uropathy. Prompt obstruction relief by the obstructive uropathy treatment market usually results in the preservation of kidney function.

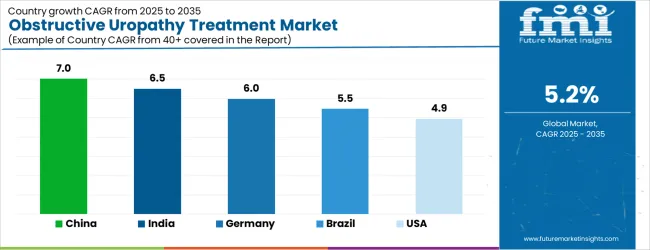

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The Obstructive Uropathy Treatment Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Obstructive Uropathy Treatment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Obstructive Uropathy Treatment Market is estimated to be valued at USD 2.1 billion in 2025 and is anticipated to reach a valuation of USD 2.1 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 313.5 million and USD 196.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Product Type | Nephro-Ureterostomy Catheter-based Obstructive Uropathy Treatment and Ureteral Stents-based Obstructive Uropathy Treatment |

| End Users | Obstructive Uropathy Treatment in Hospitals, Obstructive Uropathy Treatment in Ambulatory Surgical Centers, and Obstructive Uropathy Treatment for Other End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

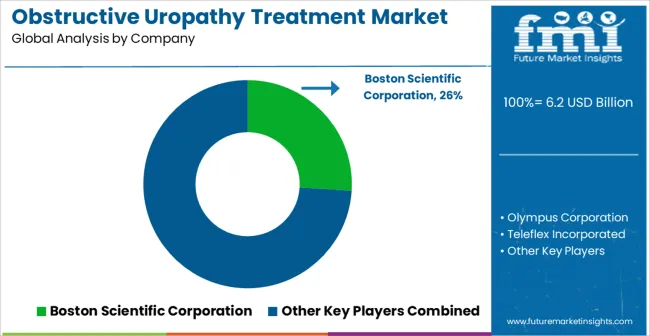

| Key Companies Profiled | Boston Scientific Corporation, Olympus Corporation, Teleflex Incorporated, B. Braun Melsungen AG, Applied Medical, AngioDynamics, Merit Medical Systems, Argon Medical DevicesInc., optimed, Cook Medical, and C. R. Bard |

The global obstructive uropathy treatment market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the obstructive uropathy treatment market is projected to reach USD 10.2 billion by 2035.

The obstructive uropathy treatment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in obstructive uropathy treatment market are nephro-ureterostomy catheter-based obstructive uropathy treatment, ureteral stents-based obstructive uropathy treatment, _open-end stents, _closed-end stents, _double pigtail stents and _multi-loop stents.

In terms of end users, obstructive uropathy treatment in hospitals segment to command 55.0% share in the obstructive uropathy treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Optic Neuropathy Management Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA