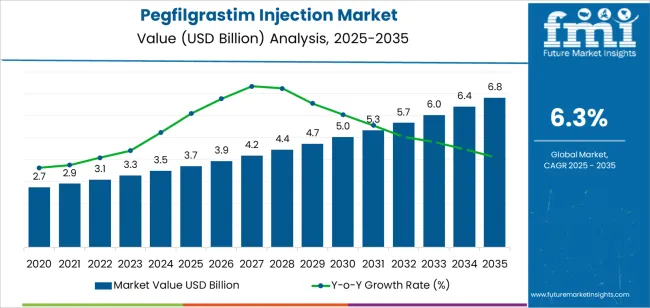

The pegfilgrastim injection market is valued at USD 3.7 billion in 2025 and is expected to reach USD 6.8 billion by 2035, supported by widespread integration of long-acting granulocyte colony-stimulating factor therapies across oncology care protocols worldwide. Pegfilgrastim remains a core component in managing chemotherapy-induced neutropenia, reducing infection risk, and enabling uninterrupted treatment cycles for cancer patients. As oncology caseloads rise and treatment regimens become increasingly complex, hospitals and cancer care networks prioritize reliable therapies that stabilize neutrophil counts with minimal dosing frequency. The expanding use of biosimilar pegfilgrastim further strengthens treatment accessibility, improving affordability for both institutional and outpatient settings.

From 2025 to 2030, the market advances from USD 3.7 billion to approximately USD 5.0 billion, adding USD 1.3 billion in value and accounting for 42 percent of total decade growth. This phase reflects accelerated uptake of biosimilar formulations as patent expirations and pricing pressures reshape prescribing patterns. Oncology centers focus on workflow efficiency, treatment continuity, and reduced adverse event incidence. From 2030 to 2035, growth continues toward USD 6.8 billion, adding USD 1.8 billion or 58 percent of total expansion. Increasing cancer prevalence, expansion of reimbursement support, and rising use of home-based injection protocols fuel this later-stage adoption. Manufacturers offering validated clinical equivalence, patient-friendly delivery systems, and strong supply consistency are positioned to maintain long-term advantage as pegfilgrastim remains a standard supportive care therapy across global oncology treatment pathways.

The latter half (2030-2035) will witness steady growth from USD 5.0 billion to USD 6.8 billion, representing an addition of USD 1.8 billion or 58% of the decade's expansion. This period will be defined by mass market penetration of biosimilar pegfilgrastim products, integration with comprehensive cancer treatment platforms, and seamless compatibility with existing chemotherapy protocols infrastructure. The market trajectory signals fundamental shifts in how healthcare providers approach neutropenia prevention optimization and patient safety management, with participants positioned to benefit from steady demand across multiple drug types and therapeutic application segments.

The market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its biosimilar adoption phase, expanding from USD 3.7 billion to USD 5.0 billion with steady annual increments averaging 6.3% growth. This period showcases the transition from branded pegfilgrastim formulations to advanced generic biosimilar systems with enhanced patient access capabilities and integrated hospital pharmacy systems becoming mainstream features.

The 2025-2030 phase adds USD 1.3 billion to market value, representing 42% of total decade expansion. Market maturation factors include standardization of neutropenia management and oncology supportive care protocols, declining costs for biosimilar formulations, and increasing healthcare provider awareness of pegfilgrastim benefits reaching 85-90% efficacy in chemotherapy-induced neutropenia applications. Competitive landscape evolution during this period features established biopharmaceutical manufacturers like Amgen and Pfizer defending market positions while biosimilar manufacturers focus on cost-effective development and enhanced market penetration capabilities.

From 2030 to 2035, market dynamics shift toward comprehensive biosimilar integration and global healthcare expansion, with growth continuing from USD 5.0 billion to USD 6.8 billion, adding USD 1.8 billion or 58% of total expansion. This phase transition centers on mature biosimilar market systems, integration with automated hospital networks, and deployment across diverse oncology and hematology scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from patent protection to comprehensive patient access optimization systems and integration with cancer care coordination platforms.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.7 billion |

| Market Forecast (2035) | USD 6.8 billion |

| Growth Rate | 6.3% CAGR |

| Leading Technology | Innovative Drugs Type |

| Primary Application | Neoplastic Diseases Therapeutic Segment |

The market demonstrates strong fundamentals with innovative drug systems capturing a dominant share through advanced biopharmaceutical design and patient outcome optimization capabilities. Neoplastic disease applications drive primary demand, supported by increasing chemotherapy utilization and neutropenia management technology requirements. Geographic expansion remains concentrated in developed markets with established oncology infrastructure, while emerging economies show accelerating adoption rates driven by cancer treatment expansion and rising healthcare access standards.

Market expansion rests on three fundamental shifts driving adoption across the oncology, hematology, and chemotherapy support sectors. First, chemotherapy-induced neutropenia management demand creates compelling clinical advantages through pegfilgrastim injections that provide immediate white blood cell recovery and infection prevention without compromising treatment schedules, enabling oncologists to meet stringent patient safety standards while maintaining chemotherapy intensity and reducing hospitalization risks. Second, cancer care modernization accelerates as healthcare systems worldwide seek advanced supportive therapies that complement traditional chemotherapy processes, enabling precise neutrophil count management and infection prophylaxis that align with clinical guidelines and patient safety regulations.

Third, biosimilar availability enhancement drives adoption from hospitals and cancer centers requiring cost-effective treatment solutions that maximize patient access while maintaining therapeutic effectiveness during chemotherapy cycles and intensive treatment protocols. Growth faces headwinds from reimbursement challenges that vary across healthcare systems regarding the coverage of supportive care medications and biosimilar products, which may limit adoption in resource-constrained healthcare environments. Technical limitations also persist regarding patient adherence considerations and injection site reactions that may reduce treatment continuation in certain patient populations and clinical scenarios, which affect therapeutic compliance and patient satisfaction requirements.

The pegfilgrastim injection market represents a specialized yet critical biopharmaceutical opportunity driven by expanding global cancer treatment volumes, supportive care modernization, and the need for superior neutropenia management in diverse oncology applications. As healthcare providers worldwide seek to achieve 85-90% neutropenia prevention effectiveness, reduce febrile complications, and integrate advanced colony-stimulating factor systems with chemotherapy platforms, pegfilgrastim injections are evolving from supportive medications to essential oncology care solutions ensuring patient safety and treatment continuity leadership.

The market's growth trajectory from USD 3.7 billion in 2025 to USD 6.8 billion by 2035 at a 6.3% CAGR reflects fundamental shifts in cancer care requirements and supportive therapy optimization. Geographic expansion opportunities are particularly pronounced in Asia Pacific markets, while the dominance of innovative drug systems and neoplastic disease applications provides clear strategic focus areas.

Strengthening the branded pegfilgrastim segment through enhanced formulation technologies, superior clinical evidence, and patient support programs. This pathway focuses on optimizing drug efficacy, improving injection tolerability, extending market exclusivity through 85-90% neutropenia prevention rates, and developing specialized delivery systems for diverse patient populations. Market leadership consolidation through advanced pharmaceutical engineering and patient adherence integration enables premium positioning while defending competitive advantages against biosimilar alternatives. Expected revenue pool: USD 280-360 million

Rapid cancer treatment growth and healthcare infrastructure expansion across Asia Pacific creates substantial expansion opportunities through local manufacturing capabilities and hospital network partnerships. Growing chemotherapy utilization and government cancer care initiatives drive steady demand for advanced pegfilgrastim systems. Localization strategies reduce treatment costs, enable faster hospital adoption, and position companies advantageously for national healthcare programs while accessing growing patient populations. Expected revenue pool: USD 240-310 million

Expansion within the dominant neoplastic disease segment (78.0% market share) through specialized formulations addressing solid tumor chemotherapy standards and high-dose treatment requirements. This pathway encompasses dose-dense chemotherapy support, myelosuppressive regimen integration, and compatibility with diverse cancer treatment protocols. Premium positioning reflects superior efficacy evidence and comprehensive safety compliance supporting modern oncology practice. Expected revenue pool: USD 210-270 million

Strategic expansion into biosimilar pegfilgrastim segment requires enhanced manufacturing capabilities and regulatory approval strategies addressing cost-effectiveness operational requirements. This pathway addresses formulary positioning, hospital procurement, and value-based contracting with advanced bioequivalence demonstration for demanding regulatory standards. Competitive pricing reflects market access requirements and volume-driven adoption standards. Expected revenue pool: USD 190-250 million

Development of specialized pegfilgrastim applications for blood disorder indications (20.0% share) and other conditions (2.0%), addressing specific hematological requirements and stem cell mobilization demands. This pathway encompasses bone marrow transplant support, aplastic anemia treatment, and cost-effective alternatives for non-oncology neutropenia segments. Therapeutic differentiation through clinical evidence enables diversified revenue streams while reducing dependency on chemotherapy-induced neutropenia platforms. Expected revenue pool: USD 95-130 million

Expansion of patient assistance programs through co-pay support, international pricing strategies, and healthcare system partnerships. This pathway encompasses emerging market access, uninsured patient programs, and government healthcare integration requiring affordable pegfilgrastim solutions. Market development through access optimization enables competitive positioning while reaching underserved patient populations requiring neutropenia management capabilities. Expected revenue pool: USD 85-115 million

Development of comprehensive hospital partnerships addressing formulary inclusion and clinical protocol requirements across oncology and hematology applications. This pathway encompasses evidence-based guidelines, clinical outcome tracking, and comprehensive economic documentation. Premium positioning reflects healthcare system value and clinical excellence while enabling access to value-based procurement programs and integrated delivery network partnerships. Expected revenue pool: USD 75-100 million

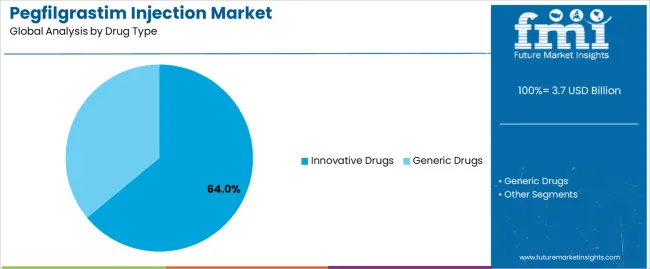

Primary Classification: The market segments by drug type into Innovative Drugs and Generic Drugs categories, representing the evolution from branded biopharmaceutical products to biosimilar alternatives for comprehensive neutropenia management.

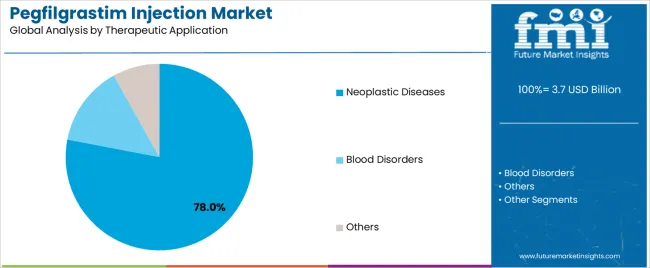

Secondary Classification: Therapeutic application segmentation divides the market into Neoplastic Diseases, Blood Disorders, and Other conditions, reflecting distinct requirements for neutrophil recovery, clinical efficacy, and patient safety standards.

Regional Classification: Geographic distribution covers Asia Pacific, Europe, North America, and other regions, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by cancer care expansion programs.

The segmentation structure reveals therapeutic progression from branded pegfilgrastim formulations toward biosimilar drug systems with enhanced affordability and access capabilities, while application diversity spans from chemotherapy support to specialized hematology indications requiring precise neutropenia management solutions.

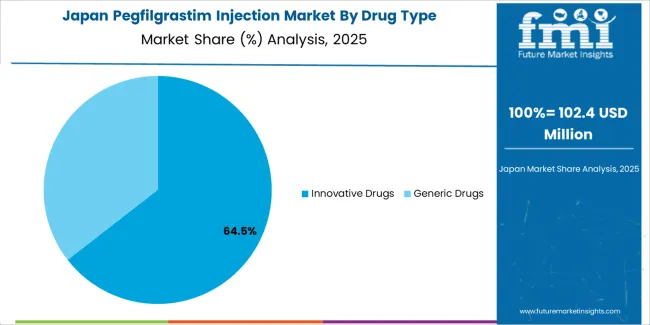

Innovative drug systems command the leading position in the market with approximately 64.0% market share through advanced biopharmaceutical properties, including superior clinical evidence, established efficacy profiles, and brand recognition that enable healthcare providers to achieve optimal neutropenia prevention across diverse oncology and hematology environments. The segment benefits from physician preference for proven pegfilgrastim products that provide consistent therapeutic performance, extensive clinical data, and regulatory approval without requiring significant formulary modification or physician retraining.

Advanced formulation features enable single-dose convenience, predictable pharmacokinetics, and integration with existing chemotherapy protocols, where drug efficacy and safety represent critical clinical requirements. Innovative drug systems differentiate through proven neutrophil recovery characteristics, consistent manufacturing quality, and compatibility with diverse patient populations that enhance therapeutic effectiveness while maintaining optimal safety suitable for high-risk chemotherapy applications.

Key market characteristics include advanced pharmaceutical formulations with optimized pegylation technology and prolonged duration capabilities, extended therapeutic effectiveness enabling 85-90% neutropenia prevention with consistent clinical outcomes, and healthcare system compatibility including established reimbursement pathways, physician familiarity, and evidence-based guideline support for oncology treatment operations.

Generic drug systems maintain cost-effective positioning in the Pegfilgrastim Injection market due to their biosimilar properties and healthcare affordability advantages. These systems appeal to hospitals and healthcare systems requiring therapeutic equivalence with reduced acquisition costs for expanding patient access. Market adoption is driven by biosimilar approval acceleration, focusing comparable efficacy and safety through optimized regulatory pathways while maintaining competitive healthcare economics.

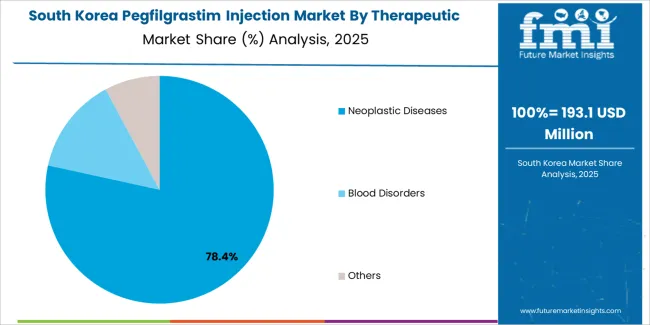

Neoplastic disease applications dominate the market with approximately 78.0% market share due to widespread utilization in chemotherapy support and increasing focus on treatment intensity maintenance, infection prevention, and dose schedule adherence applications that minimize neutropenic complications while maintaining cancer treatment standards. Oncologists prioritize neutropenia management reliability, clinical evidence, and integration with existing chemotherapy regimens that enables coordinated supportive care application across multiple cancer types.

The segment benefits from substantial oncology research investment and clinical guideline programs that emphasize the utilization of colony-stimulating factors for febrile neutropenia prevention and treatment optimization applications. Solid tumor chemotherapy programs incorporate pegfilgrastim injections as standard supportive care for myelosuppressive treatment regimens, while hematologic malignancy protocols increase demand for neutrophil recovery capabilities that comply with clinical standards and minimize treatment delays.

Market dynamics include strong growth in breast cancer and lung cancer chemotherapy requiring neutropenia prophylaxis capabilities, increasing adoption in lymphoma treatment protocols and dose-dense chemotherapy applications for patient safety, and rising integration with clinical pathways for treatment optimization and outcome improvement. Varying cancer types and chemotherapy regimen differences may influence pegfilgrastim utilization patterns across different oncology specialties or treatment scenarios.

Blood disorder applications capture approximately 20.0% market share through specialized therapeutic requirements in stem cell transplantation, bone marrow failure syndromes, and severe congenital neutropenia applications. These conditions demand effective neutrophil recovery systems capable of supporting hematopoietic reconstitution while providing sustained white blood cell production and infection protection capabilities.

Other therapeutic applications account for approximately 2.0% market share, including HIV-related neutropenia, drug-induced neutropenia, and specialty clinical scenarios requiring pegfilgrastim therapy for neutrophil count management and infection prevention.

Growth Accelerators: Cancer incidence expansion drives primary adoption as pegfilgrastim injections provide superior neutropenia prevention capabilities that enable oncologists to maintain chemotherapy dose intensity without excessive hospitalization costs, supporting treatment protocols and patient safety missions that require precise white blood cell management applications. Biosimilar availability infrastructure demand accelerates market expansion as healthcare systems seek cost-effective colony-stimulating factor alternatives that reduce treatment expenses while maintaining therapeutic effectiveness during chemotherapy cycles and intensive treatment scenarios. Healthcare spending increases worldwide, creating steady demand for supportive care medications that complement cancer treatment processes and provide patient outcome differentiation in competitive healthcare markets.

Growth Inhibitors: Reimbursement challenges vary across healthcare systems regarding the coverage of supportive care therapies and biosimilar product pricing, which may limit operational flexibility and market penetration in regions with restrictive formularies or cost-containment healthcare policies. Clinical utilization limitations persist regarding appropriate patient selection and prophylactic versus therapeutic use patterns that may reduce cost-effectiveness in low-risk chemotherapy regimens, standard-dose protocols, or non-myelosuppressive treatment conditions, affecting prescribing patterns and guideline adherence requirements. Market competition across multiple biosimilar manufacturers and originator products creates pricing pressure between different pegfilgrastim suppliers and healthcare system formulary preferences.

Market Evolution Patterns: Adoption accelerates in high-risk chemotherapy and dose-dense treatment protocols where neutropenia prevention justifies medication costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by cancer care expansion and biosimilar availability awareness. Technology development focuses on enhanced delivery devices, improved patient convenience, and compatibility with automated injection systems that optimize adherence and therapeutic effectiveness. The market could face disruption if alternative neutropenia management strategies or longer-acting formulations significantly alter pegfilgrastim utilization patterns in oncology applications, though current product's unique combination of efficacy, convenience, and safety continues to make it preferred in chemotherapy support applications.

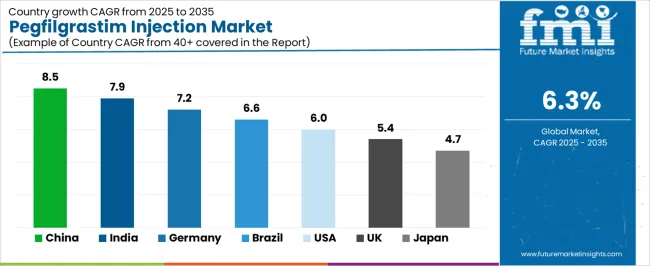

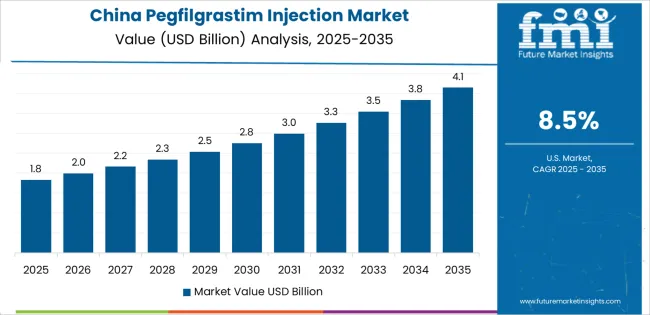

The market demonstrates varied regional dynamics with Growth Leaders including China (8.5% CAGR) and India (7.9% CAGR) driving expansion through cancer treatment capacity additions and healthcare infrastructure programs. Steady Performers encompass Germany (7.2% CAGR), Brazil (6.6% CAGR), and United States (6.0% CAGR), benefiting from established oncology systems and biosimilar adoption advancement. Mature Markets feature United Kingdom (5.4% CAGR) and Japan (4.7% CAGR), where specialized cancer treatment applications and supportive care integration support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| United States | 6.0% |

| United Kingdom | 5.4% |

| Japan | 4.7% |

Regional synthesis reveals Asia Pacific markets leading adoption through cancer treatment expansion and biosimilar manufacturing development, while European countries maintain steady expansion supported by healthcare system advancement and biosimilar integration requirements. North American markets show moderate growth driven by oncology practice applications and supportive care standardization trends.

The Chinese market emphasizes advanced therapeutic features, including neutropenia management optimization and integration with comprehensive cancer treatment platforms that manage chemotherapy protocols, supportive care coordination, and patient safety applications through unified oncology systems. The country demonstrates strong growth at 8.5% CAGR, driven by cancer incidence increases, oncology infrastructure initiatives, and emerging biosimilar manufacturing development that support pegfilgrastim integration. Chinese healthcare providers prioritize therapeutic effectiveness with pegfilgrastim injections delivering consistent neutrophil recovery through advanced formulation capabilities and hospital protocol adaptation features.

Technology deployment channels include major cancer hospitals, specialized oncology pharmacy distributors, and national healthcare procurement programs that support clinical applications for complex chemotherapy regimens and neutropenia management applications. Hospital formulary integration capabilities with established oncology systems expand market appeal across diverse clinical requirements seeking efficacy and affordability benefits. The expanding cancer patient population and accelerating healthcare modernization create steady demand, while innovative applications in targeted therapy combinations and immunotherapy support open new growth avenues.

Performance Metrics:

Germany's advanced healthcare market demonstrates sophisticated pegfilgrastim deployment with documented clinical effectiveness in solid tumor chemotherapy applications and hematologic malignancy treatment through integration with existing hospital pharmacy systems and oncology care infrastructure. The country leverages clinical expertise in supportive oncology and cancer care systems integration to maintain strong growth at 7.2% CAGR. Healthcare centers, including Berlin, Munich, and Hamburg, showcase premium installations where pegfilgrastim systems integrate with comprehensive oncology platforms and clinical pathway systems to optimize patient outcomes and treatment effectiveness.

German oncologists prioritize evidence-based medicine and guideline compliance in supportive care development, creating demand for clinically proven pegfilgrastim products with advanced features, including patient monitoring integration and adverse event management systems. The market benefits from established oncology infrastructure and willingness to invest in supportive care technologies that provide long-term patient benefits and compliance with international cancer treatment and safety standards.

Market Intelligence Brief:

The USA market demonstrates sophisticated deployment across comprehensive cancer centers with documented effectiveness in breast cancer chemotherapy and lymphoma treatment through integration with comprehensive oncology management systems and supportive care infrastructure. The country leverages advanced healthcare capabilities in oncology innovation and biosimilar development technologies to maintain moderate growth at 6.0% CAGR. Healthcare centers, including major academic medical centers, community oncology networks, and integrated delivery systems, showcase premium installations where pegfilgrastim products integrate with comprehensive electronic health record platforms and clinical decision support networks to optimize treatment adherence and patient safety effectiveness.

American oncologists prioritize clinical outcomes and cost-effectiveness in supportive care development, creating demand for innovative pegfilgrastim systems with advanced features, including on-body injector devices and patient adherence tracking integration. The market benefits from established comprehensive cancer care infrastructure and willingness to invest in supportive therapy technologies that provide long-term value benefits and compliance with NCCN guidelines and quality standards.

Market Intelligence Brief:

The UK market demonstrates advanced healthcare system deployment with documented clinical effectiveness in NHS oncology applications and cancer center treatment through integration with existing formulary systems and clinical commissioning infrastructure. The country leverages regulatory expertise in biosimilar adoption and cancer care systems integration to maintain steady growth at 5.4% CAGR. Healthcare centers, including London, Manchester, and Birmingham, showcase premium installations where pegfilgrastim systems integrate with comprehensive NHS platforms and NICE guidance systems to optimize resource utilization and treatment effectiveness.

British oncologists prioritize cost-effectiveness and evidence-based prescribing in supportive care development, creating demand for biosimilar pegfilgrastim products with advanced features, including healthcare economic documentation and patient outcome tracking. The market benefits from established NHS infrastructure and commitment to invest in value-driven supportive care technologies that provide long-term system benefits and compliance with UK clinical guidelines and NICE technology appraisals.

Strategic Market Indicators:

India's market demonstrates rapid expansion deployment with documented clinical effectiveness in private hospital oncology applications and emerging public healthcare cancer treatment through integration with developing healthcare systems and oncology infrastructure development. The country leverages growing pharmaceutical manufacturing capabilities in biosimilar production and healthcare systems integration to achieve high growth at 7.9% CAGR. Healthcare centers, including Mumbai, Delhi, and Bangalore, showcase expanding installations where pegfilgrastim products integrate with comprehensive private hospital platforms and emerging public cancer programs to optimize market penetration and treatment access effectiveness.

Indian healthcare providers prioritize affordability and local manufacturing in supportive care development, creating demand for domestically produced pegfilgrastim biosimilars with advanced features, including competitive pricing and regional distribution networks. The market benefits from expanding cancer treatment infrastructure and willingness to invest in affordable biopharmaceutical technologies that provide patient access and compliance with national healthcare initiatives.

Market Intelligence Brief:

Brazil's market shows strong expansion with documented clinical effectiveness in private oncology clinics and emerging public cancer treatment through integration with developing healthcare systems and SUS infrastructure. The country leverages growing cancer care capacity and healthcare modernization to achieve growth at 6.6% CAGR. Healthcare centers, including São Paulo, Rio de Janeiro, and Brasília, showcase growing installations where pegfilgrastim products integrate with oncology networks and public health programs to optimize treatment access.

Brazilian oncologists prioritize treatment accessibility and biosimilar adoption, creating demand for affordable pegfilgrastim products with features including tropical climate stability and extended distribution networks. The market benefits from expanding cancer care sector and commitment to invest in supportive care technologies supporting universal healthcare access and improved patient outcomes.

Market Intelligence Brief:

Japan's market demonstrates precision deployment with documented clinical effectiveness in comprehensive cancer center applications and university hospital oncology through integration with advanced healthcare quality systems and treatment protocol infrastructure. The country leverages pharmaceutical excellence in biopharmaceutical quality and healthcare systems integration to maintain steady growth at 4.7% CAGR. Healthcare centers, including Tokyo, Osaka, and Nagoya, showcase premium installations where pegfilgrastim products integrate with comprehensive electronic medical record platforms and clinical quality systems to optimize treatment excellence and patient safety effectiveness.

Japanese oncologists prioritize product quality and clinical precision in supportive care development, creating demand for premium pegfilgrastim products with advanced features, including rigorous quality control and comprehensive safety documentation systems. The market benefits from established advanced cancer care infrastructure and commitment to invest in highest-quality biopharmaceutical technologies that provide superior clinical positioning and compliance with stringent Japanese pharmaceutical and healthcare standards.

Strategic Market Indicators:

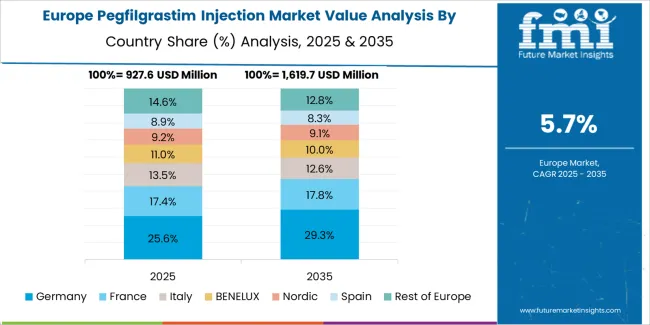

The Pegfilgrastim Injection market in Europe is projected to grow from USD 1156.4 million in 2025 to USD 2128.7 million by 2035, registering a CAGR of 6.3% over the forecast period. Germany is expected to maintain its leadership position with a 24.8% market share in 2025, increasing to 25.6% by 2035, supported by its advanced oncology infrastructure and major cancer centers in Berlin and Munich.

France follows with a 18.4% share in 2025, projected to reach 19.1% by 2035, driven by comprehensive cancer care programs and biosimilar adoption initiatives. The United Kingdom holds a 16.7% share in 2025, expected to maintain 16.4% by 2035 through NHS formulary applications and cost-effectiveness focused procurement. Italy commands a 14.9% share, while Spain accounts for 12.3% in 2025. The Netherlands maintains 6.8% market presence. The Rest of Europe region is anticipated to show steady adoption, expanding its collective share from 6.1% to 6.8% by 2035, reflecting consistent growth in Nordic countries, biosimilar expansion in Central European markets, and oncology modernization across Eastern European healthcare facilities.

In Japan, the Pegfilgrastim Injection market prioritizes innovative drug systems, which capture the dominant share of comprehensive cancer center and university hospital installations due to their advanced features, including proven clinical efficacy optimization and seamless integration with existing chemotherapy protocol infrastructure. Japanese oncologists emphasize quality, evidence, and long-term safety excellence, creating demand for branded pegfilgrastim products that provide consistent therapeutic capabilities and superior clinical performance based on treatment requirements and pharmaceutical standards. Generic drug configurations maintain secondary positions primarily in cost-conscious healthcare settings and biosimilar pilot programs where therapeutic equivalence meets clinical requirements without compromising treatment outcomes.

Market Characteristics:

In South Korea, the market structure favors international biopharmaceutical manufacturers, including Amgen, Pfizer, and Sandoz, which maintain dominant positions through comprehensive product portfolios and established hospital networks supporting both comprehensive cancer centers and community oncology installations. These providers offer integrated solutions combining advanced pegfilgrastim products with professional clinical services and ongoing medical education support that appeal to Korean oncologists seeking reliable neutropenia management systems.

Local pharmaceutical distributors and hospital pharmacy networks capture moderate market share by providing localized service capabilities and competitive pricing for biosimilar pegfilgrastim installations, while domestic manufacturers focus on biosimilar development and cost-effective solutions tailored to Korean healthcare market characteristics.

Channel Insights:

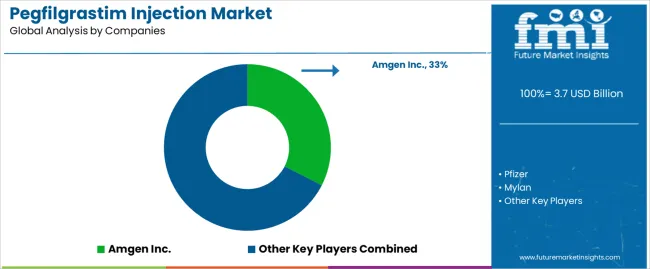

The market operates with moderate concentration, featuring approximately 12-16 meaningful participants, where leading companies control roughly 55-60% of the global market share through established oncology relationships and comprehensive biopharmaceutical portfolios. Competition emphasizes clinical evidence capabilities, biosimilar development, and hospital formulary integration rather than price-based rivalry alone. The leading company, Amgen Inc., commands approximately 32.5% market share through its originator Neulasta product line and global oncology presence.

Market Leaders encompass Amgen Inc., Pfizer, and Mylan, which maintain competitive advantages through extensive biopharmaceutical expertise, global hospital networks, and comprehensive clinical evidence capabilities that create physician loyalty and support premium or competitive pricing. These companies leverage decades of colony-stimulating factor technology experience and ongoing regulatory investments to develop advanced pegfilgrastim systems with proven neutropenia prevention and patient safety features.

Technology Innovators include Sandoz (Novartis), Biocon Biologics Inc., and Coherus BioSciences, Inc., which compete through specialized biosimilar development technology focus and innovative market access capabilities that appeal to healthcare systems seeking cost-effective neutropenia management solutions and formulary optimization. These companies differentiate through rapid biosimilar approval cycles and specialized oncology market access focus.

Regional Specialists feature pharmaceutical manufacturers focusing on specific geographic markets and specialized applications, including emerging market biosimilars and integrated patient support solutions. Market dynamics favor participants that combine reliable therapeutic formulations with advanced clinical evidence, including real-world effectiveness data and comprehensive pharmacoeconomic documentation features. Competitive pressure intensifies as traditional pharmaceutical companies expand into biosimilar pegfilgrastim systems, while specialized oncology biotech companies challenge established players through innovative delivery devices and patient adherence platforms targeting comprehensive cancer centers and community oncology segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 billion |

| Drug Type | Innovative Drugs, Generic Drugs |

| Therapeutic Application | Neoplastic Diseases, Blood Disorders, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 20+ additional countries |

| Key Companies Profiled | Amgen Inc., Pfizer, Mylan, Sandoz (Novartis), Biocon Biologics Inc., Coherus BioSciences, Inc. |

| Additional Attributes | Dollar sales by drug type and therapeutic application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with biopharmaceutical manufacturers and biosimilar suppliers, physician preferences for clinical efficacy and cost-effectiveness, integration with oncology treatment platforms and hospital formulary systems, innovations in biosimilar formulations and delivery device excellence, and development of patient access solutions with enhanced affordability and therapeutic optimization capabilities. |

The global pegfilgrastim injection market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the pegfilgrastim injection market is projected to reach USD 6.8 billion by 2035.

The pegfilgrastim injection market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in pegfilgrastim injection market are innovative drugs and generic drugs.

In terms of therapeutic application, neoplastic diseases segment to command 78.0% share in the pegfilgrastim injection market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Pen Market Insights - Growth, Demand & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Injection Molded Plastic Market Trends – Growth & Forecast 2024-2034

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Micro Injection Molded Plastic Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA