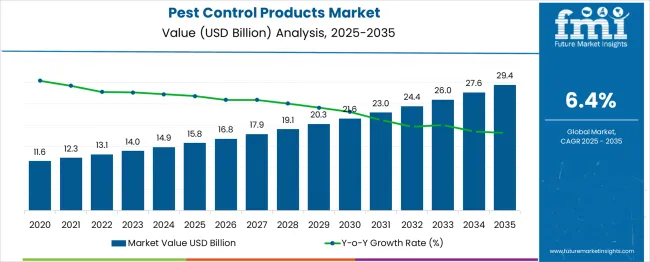

The pest control products market is expected to grow from USD 15.8 billion in 2025 to USD 29.4 billion in 2035, registering a compound annual growth rate (CAGR) of 6%. Expansion from USD 11.6 billion in 2020 reflects steady year-on-year growth, with incremental increases of USD 0.7 billion to USD 1 billion annually. The market reaches USD 16.8 billion in 2026, USD 20.3 billion by 2030, and USD 26 billion in 2034, demonstrating consistent adoption across agricultural, residential, and commercial segments. Growth is driven by rising demand for crop protection solutions, increasing awareness of vector-borne disease prevention, and stricter regulations on sanitation and hygiene standards.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 15.8 billion |

| Forecast Value in (2035F) | USD 29.4 billion |

| Forecast CAGR (2025 to 2035) | 6% |

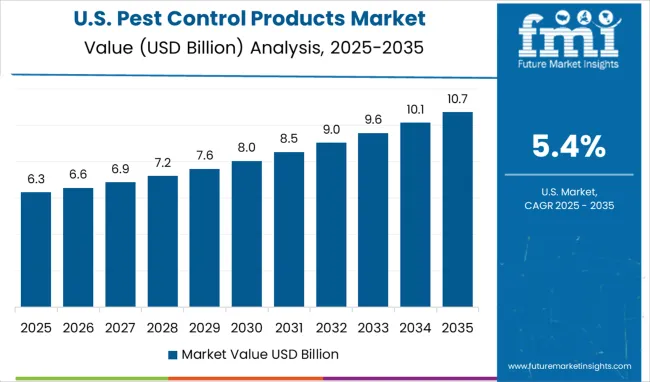

The pest control products market shows steady year-on-year growth from 2020 to 2035, rising from USD 11.6 billion in 2020 to USD 29.4 billion in 2035 at a compound annual growth rate (CAGR) of 6%. Early-year growth from 2020 to 2025 was moderate, with the market increasing from USD 11.6 billion to USD 15.8 billion. Annual increments ranged between USD 0.7 billion and USD 0.9 billion, reflecting gradual adoption across agricultural and residential segments. The market reached USD 14.9 billion in 2024, while 2025 marked a key milestone as broader awareness of vector-borne disease control and stricter regulatory standards began to accelerate adoption. YoY growth rates in this phase averaged around 5–6%, indicating steady momentum.

Post-2025, annual growth strengthens, with values rising from USD 16.8 billion in 2026 to USD 20.3 billion by 2030 and USD 26 billion in 2034. Incremental gains widened to USD 1 billion to USD 1.4 billion per year, reflecting increasing demand for integrated pest management solutions, eco-friendly formulations, and commercial applications. Growth peaks in 2035, driven by strong adoption across emerging markets.

Market expansion is being supported by the increasing awareness about health risks associated with pest infestations and the corresponding demand for effective pest management solutions. Modern consumers and businesses are increasingly focused on maintaining hygienic environments that protect against disease vectors, property damage, and contamination risks. The proven efficacy of professional pest control products in managing various pest species makes them essential components of integrated facility management and public health strategies.

The growing emphasis on food safety regulations and quality standards is driving demand for pest control products in food processing, storage, and retail sectors. Consumer preference for comprehensive pest management solutions that combine multiple control mechanisms is creating opportunities for innovative product formulations. The rising influence of environmental eco-efficiency trends and regulatory requirements is also contributing to increased adoption of eco-friendly and targeted pest control products across different sectors and applications.

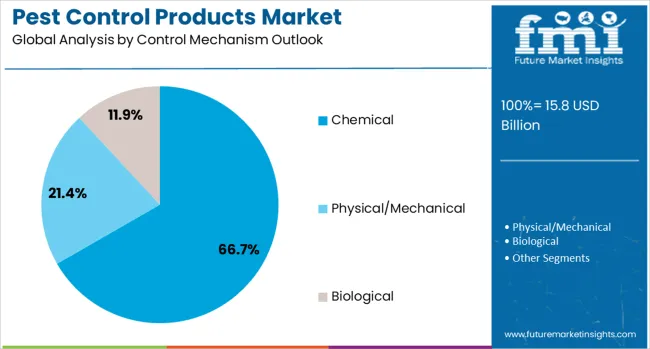

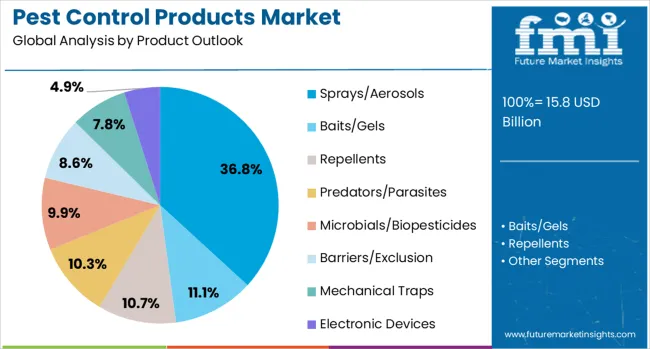

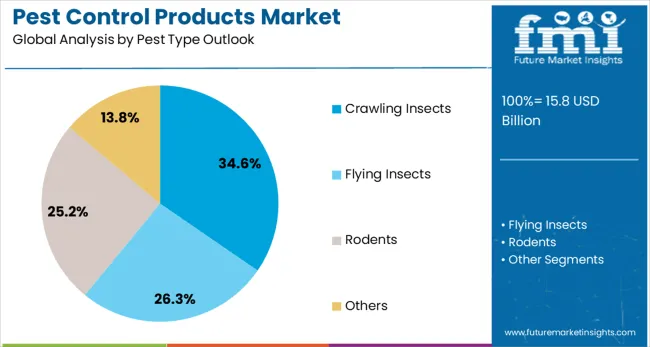

The market is segmented by product outlook, pest type outlook, control mechanism outlook, end use outlook, and region. By product outlook, the market is divided into sprays/aerosols, baits/gels, repellents, predators/parasites, microbials/biopesticides, barriers/exclusion, mechanical traps, and electronic devices. Based on pest type outlook, the market is categorized into crawling insects, flying insects, rodents, and others. In terms of control mechanism outlook, the market is segmented into chemical, physical/mechanical, and biological. By end use outlook, the market is classified into B2B and B2C segments. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Chemical control mechanisms are expected to account for 67% of the pest control products market in 2025, retaining their dominance as the most widely adopted approach. These solutions provide rapid action, broad-spectrum effectiveness, and proven results against multiple pest species, making them the preferred choice for both professionals and end consumers. Chemical control offers immediate suppression while maintaining long-term residual effects, ensuring consistent protection across homes, commercial buildings, and agricultural settings. Increasing pest resistance has driven the development of advanced formulations with multiple active ingredients, reinforcing chemical control as the backbone of pest management programs and the primary driver of market growth.

Sprays and aerosols are projected to represent 37% of the pest control products market in 2025, reflecting their popularity as convenient, ready-to-use formats. Consumers and professionals favor these products for targeted delivery, quick action, and the ability to reach hidden or hard-to-access pest habitats. Sprays and aerosols provide both preventative protection, such as barrier creation, and corrective pest elimination, making them versatile solutions for residential and commercial settings. The segment benefits from ongoing innovation in formulation chemistry, with specialized sprays targeting specific species or combining multiple active ingredients to enhance efficacy. User-friendly designs further support adoption across professional and DIY markets.

The crawling insects segment is expected to account for 35% of the pest control products market in 2025, driven by the high prevalence of ants, cockroaches, termites, and beetles in residential and commercial settings. These pests are persistent, reproduce rapidly, and pose health and structural risks, necessitating targeted control strategies such as residual treatments, baits, and exclusion measures. Ongoing pest management programs ensure continuous demand for products addressing crawling insects. Urbanization, high-density living spaces, and favorable environmental conditions further exacerbate infestations, reinforcing the need for effective and reliable solutions. Crawling insect control remains a critical segment, supporting sustained growth in the overall pest control products market.

The pest control products market is witnessing a noticeable shift toward eco-friendly formulations. Consumers and businesses are increasingly cautious about chemical residues and their long-term effects on human health, pets, and the environment. Manufacturers are responding by introducing products that use natural extracts, essential oils, or biological agents to target pests effectively while minimizing harmful side effects. Eco-conscious buyers, particularly in residential and commercial sectors, prefer products that are safe for indoor use and environmentally responsible. Regulatory bodies in several countries are also encouraging low-toxicity alternatives, further driving demand. This trend reflects how consumer preferences and regulations together are reshaping the direction of product development in pest control markets worldwide.

Another dynamic influencing the pest control products market is the growth of professional pest management services. While do-it-yourself sprays and repellents remain popular, many households and businesses are choosing professional solutions that use advanced products and application techniques. Service providers often partner with product manufacturers to ensure access to high-quality and specialized formulations not available in retail. Demand is particularly strong in sectors such as hospitality, healthcare, and food processing, where consistent pest control is critical to maintaining standards. As urban populations grow and awareness of pest-related health risks increases, professional services are driving steady consumption of pest control products on a large scale.

Consumers increasingly seek pest control products that offer long-lasting protection rather than short-term relief. Frequent reapplication of sprays or repellents is inconvenient, especially in large homes, farms, and commercial facilities. To address this, manufacturers are developing extended-release formulations, advanced baiting systems, and barrier products designed to remain effective for weeks or even months. This demand is strong in both agricultural and urban markets, where consistent protection saves time and reduces overall costs. Long-lasting solutions are also gaining traction in regions with tropical climates, where pests are active year-round. The shift toward durability and efficiency in pest control products reflects a broader consumer preference for convenience and reliability.

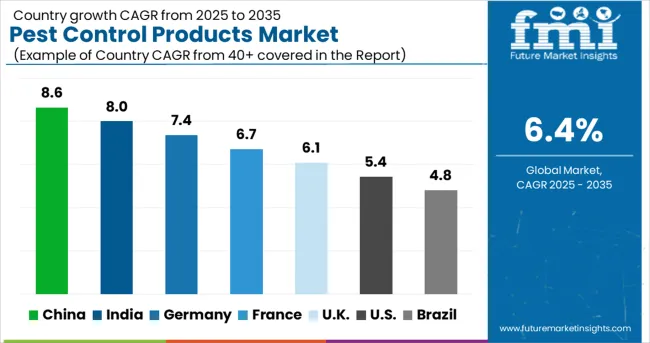

| Country | CAGR (2025-2035) |

|---|---|

| India | 8.% |

| China | 8.6% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The pest control products market is experiencing robust growth globally, with China leading at an 8.6% CAGR through 2035, driven by rapid urbanization, expanding food processing sector, and increasing awareness about hygiene standards. India follows closely at 8%, supported by growing commercial infrastructure, rising health consciousness, and increasing pest infestation challenges in urban areas. Germany shows steady growth at 7.4%, emphasizing eco-efficient pest management solutions and advanced control technologies. France records 6.7%, focusing on agricultural applications and food safety compliance. The UK shows 6.1% growth, prioritizing professional pest management services and regulatory compliance.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Pest control products in China are projected to grow at a CAGR of 8.6% through 2035, driven by expanding commercial infrastructure, rising hygiene awareness, and industrial development. Competition is strong among domestic and international service providers establishing networks to serve commercial, residential, and food-processing sectors across tier-1 and tier-2 cities. Adoption outpaces India and the UK due to high population density and government-backed public health initiatives. Investments in integrated pest management programs, professional service networks, and advanced formulations are enhancing operational coverage. Urban and industrial facilities increasingly rely on effective pest control solutions to maintain hygiene standards, protect food operations, and safeguard public health.

Pest control products in India are expected to expand at a CAGR of 8% through 2035, supported by rising urbanization, expanding commercial infrastructure, and growing awareness of vector-borne diseases. Domestic and international providers are establishing distribution and service networks to meet the increasing demand in urban and semi-urban regions. Compared with China, adoption is slightly slower but shows high potential due to expanding food service, retail, and hospitality sectors. Investments in regulatory compliance, professional services, and structured pest management solutions are improving operational efficiency. Indian businesses and residential complexes are increasingly implementing pest control programs to mitigate health risks and ensure safety across commercial and residential spaces.

Pest control products in the USA are projected to grow at a CAGR of 5.4% through 2035, supported by preference for eco-friendly solutions and professional service delivery. Competition is shaped by providers offering advanced, environmentally responsible formulations for residential and commercial applications. Compared with China and India, adoption emphasizes sustainability, innovation, and integrated approaches. Investments in biological solutions, data-driven service management, and advanced delivery methods are enhancing operational effectiveness. USA businesses and households increasingly rely on environmentally conscious pest control programs to maintain high protection standards while reducing ecological impact across commercial, residential, and food processing sectors.

Pest control products in Germany are expected to grow at a CAGR of 7.4% through 2035, driven by environmental regulations, advanced management technologies, and operational safety requirements. Competition is led by providers delivering compliant, high-performance solutions across commercial, residential, and agricultural sectors. Adoption is more regulated and technologically advanced compared with China and India. Investments in research, eco-efficient formulations, and collaboration with academic institutions are enhancing innovation and service quality. German businesses increasingly implement integrated pest management systems that meet strict regulatory standards while delivering efficient, environmentally responsible control measures across industrial, commercial, and urban environments.

Pest control products in the UK are projected to grow at a CAGR of 6.1% through 2035, supported by demand for professional services and regulatory compliance solutions. Competition is dominated by providers offering integrated programs to commercial, hospitality, and residential clients. Adoption is moderate compared with China and India but emphasizes reliability, compliance, and service quality. Investments in staff training, structured delivery models, and advanced formulations are enhancing program effectiveness. British businesses and property managers are increasingly implementing professional pest management programs to maintain hygiene, meet health regulations, and protect operations across commercial and residential settings.

Pest control products in France are expected to grow at a CAGR of 6.7% through 2035, supported by demand from agriculture, food processing, and commercial industries. Competition involves providers delivering eco-friendly, integrated solutions emphasizing regulatory compliance and operational efficiency. Adoption is moderate compared with Germany and China but focuses on sustainability and operational performance. Investments in professional service networks, advanced formulations, and industry collaborations are supporting market growth. French agricultural producers and food manufacturers increasingly implement pest management programs to protect crop yields, ensure food quality, and maintain environmental compliance, enhancing overall productivity and market confidence.

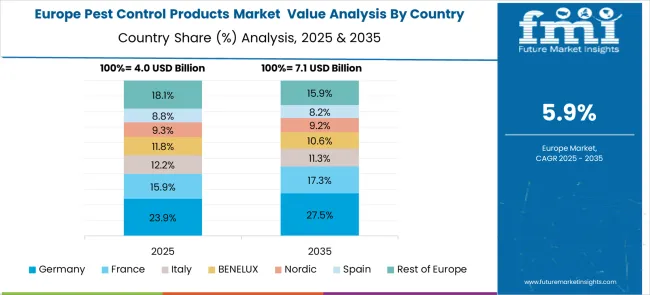

The pest control products market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its stringent regulatory standards and advanced pest management practices, supported by companies leveraging scientific research to develop effective pest control formulations that address diverse infestation challenges while maintaining environmental compliance and worker safety standards.

France represents a significant market driven by its agricultural sector and food processing industry requirements, with companies focusing on integrated pest management solutions that combine traditional chemical controls with biological and mechanical approaches for eco-efficient pest control in agricultural and commercial applications.

The UK exhibits considerable growth through its emphasis on professional pest management services and regulatory compliance, with companies providing comprehensive pest control solutions for commercial properties, food establishments, and residential sectors. Germany and France show expanding demand for eco-friendly pest control products, particularly in organic farming and eco-efficient building management applications. BENELUX countries contribute through their focus on innovative pest control technologies and eco-efficient solutions, while Eastern Europe and Nordic regions display growing potential driven by increasing awareness of pest management importance and expanding commercial sectors requiring professional pest control services across diverse industry applications.

Companies are investing in advanced formulation technologies, eco-efficient product development, digital service platforms, and comprehensive training programs to deliver effective, compliant, and environmentally responsible pest management solutions. Brand positioning, product innovation, and service excellence are central to strengthening market presence and customer relationships.

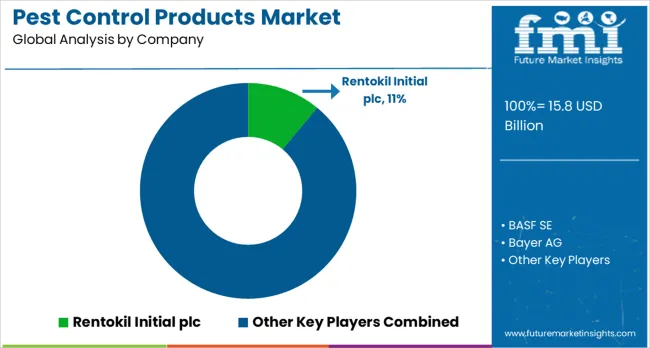

Rentokil Initial plc, UK-based, leads the market with 11% global value share, offering comprehensive pest management solutions with a focus on professional service delivery and innovative control technologies. BASF SE, Germany, provides advanced chemical formulations with emphasis on effectiveness and environmental stewardship. Bayer AG, Germany, delivers science-backed pest control solutions with focus on agricultural and urban applications. FMC Corporation, USA, focuses on specialized formulations that combine multiple active ingredients for enhanced pest control effectiveness.

Control Solutions Inc., Ecolab Inc., and Syngenta Group, operating globally, provide comprehensive pest control product ranges across multiple application sectors and distribution channels. Woodstream Corporation, USA, emphasizes mechanical and electronic pest control solutions with focus on humane and eco-efficient approaches. Bell Laboratories Inc. and Corteva Agriscience provide specialized formulations with focus on specific pest species and professional application requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 15.8 billion |

| Product Outlook | Sprays/Aerosols, Baits/Gels, Repellents, Predators/Parasites, Microbials/Biopesticides, Barriers/Exclusion, Mechanical Traps, Electronic Devices |

| Pest Type Outlook | Crawling Insects, Flying Insects, Rodents, Others |

| Control Mechanism Outlook | Chemical, Physical/Mechanical, Biological |

| End Use Outlook | B2B, B2C |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Rentokil Initial plc, BASF SE, Bayer AG, FMC Corporation, Control Solutions Inc., Ecolab Inc., Syngenta Group, Woodstream Corporation, Bell Laboratories Inc., and Corteva Agriscience |

| Additional Attributes | Dollar sales by product type and application sector, regional demand trends, competitive landscape, buyer preferences for chemical versus biological control methods, integration with eco-efficient pest management practices, innovations in smart monitoring technologies, precision application systems, and eco-friendly formulation development |

The global pest control products market is estimated to be valued at USD 15.8 billion in 2025.

The market size for the pest control products market is projected to reach USD 29.4 billion by 2035.

The pest control products market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in pest control products market are sprays/aerosols, baits/gels, repellents, predators/parasites, microbials/biopesticides, barriers/exclusion, mechanical traps and electronic devices.

In terms of pest type outlook, crawling insects segment to command 34.6% share in the pest control products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pesticide Detection Market Analysis - Size, Share, and Forecast 2025 to 2035

Pesticides Packaging Market Growth & Industry Forecast 2025 to 2035

Pest Resistant Crops Market

Pest Control Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Smart Pest Monitoring Management System Market Size and Share Forecast Outlook 2025 to 2035

Biorational Pesticide Market Size and Share Forecast Outlook 2025 to 2035

Neonicotinoid Pesticide Market Size and Share Forecast Outlook 2025 to 2035

Rodent Control Pesticides Market Size and Share Forecast Outlook 2025 to 2035

Home and Garden Pesticides Market Analysis by Type, Application, and Region from 2025 to 2035

Organophosphate Pesticides Market

Agri Natural Enemy Pest Control Market Analysis – Trends, Growth & Forecast 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA