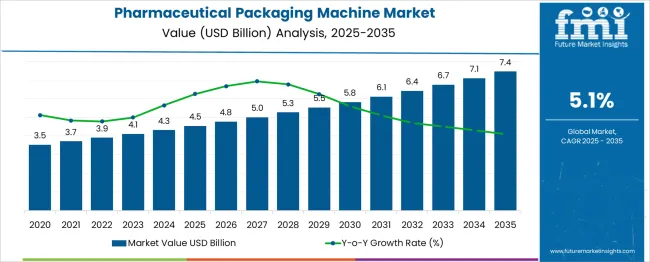

The Pharmaceutical Packaging Machine Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 4.5 billion to USD 5.8 billion, driven by increasing demand for advanced packaging solutions to ensure product safety, quality, and compliance in the pharmaceutical industry.

Year-on-year analysis shows steady growth, with values reaching USD 4.8 billion in 2026 and USD 5.0 billion in 2027, supported by the rising need for automation, serialization, and traceability in packaging. By 2028, the market is forecasted to hit USD 5.3 billion, advancing to USD 5.5 billion in 2029 and USD 5.8 billion by 2030. Innovations in eco-friendly packaging, high-speed machinery, and the adoption of smart packaging technologies will further fuel growth. As regulatory requirements continue to evolve and consumer preferences shift toward sustainable solutions, the pharmaceutical packaging machine market is set to witness continued expansion, providing opportunities for manufacturers to innovate in packaging formats and efficiency.

| Metric | Value |

|---|---|

| Pharmaceutical Packaging Machine Market Estimated Value in (2025 E) | USD 4.5 billion |

| Pharmaceutical Packaging Machine Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The market is progressing steadily, propelled by the escalating demand for precision, speed, and hygiene in drug packaging processes. Increasing production volumes, rising global demand for medicines, and stricter regulatory guidelines have created a strong need for efficient and compliant packaging solutions. The evolution toward serialization, anti-counterfeit packaging, and traceability has necessitated technologically advanced machinery that ensures accuracy and quality assurance across the production line.

Automation and digital integration are being prioritized to meet high throughput expectations while maintaining consistent output. The surge in pharmaceutical exports, the expansion of contract manufacturing organizations, and the rise in biopharmaceuticals are shaping future opportunities in the packaging equipment landscape.

As the pharmaceutical industry focuses more on cost-efficiency, speed-to-market, and patient safety, the demand for intelligent, high-capacity packaging machines is expected to continue its upward trajectory. This is further reinforced by strategic investments in smart factories and Industry 4.0 capabilities that are aligning production with real-time quality monitoring and regulatory compliance..

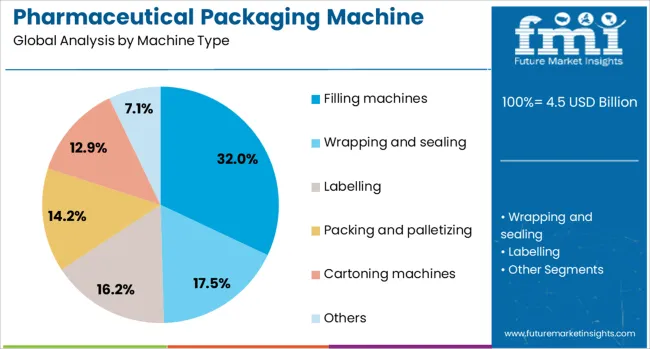

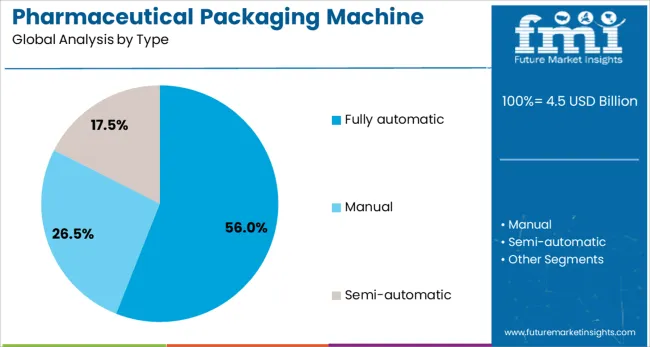

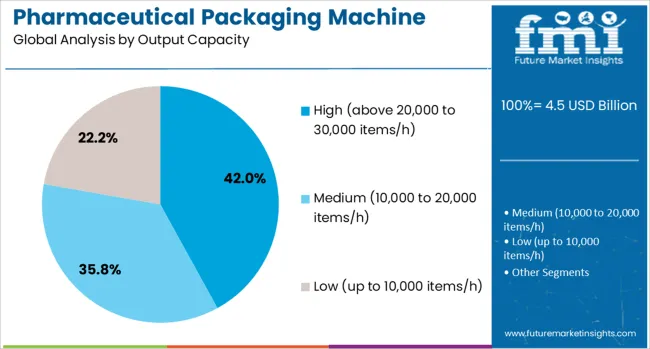

The pharmaceutical packaging machine market is segmented by machine type, type, output capacity, packaging material, formulation type, applicationdistribution channel, and geographic regions. By machine type of the pharmaceutical packaging machine market is divided into Filling machines, Wrapping and sealing, Labelling, Packing and palletizing, Cartoning machinesOthers. In terms of type of the pharmaceutical packaging machine market is classified into Fully automatic, ManualSemi-automatic. Based on output capacity of the pharmaceutical packaging machine market is segmented into High (above 20,000 to 30,000 items/h), Medium (10,000 to 20,000 items/h)Low (up to 10,000 items/h). By packaging material of the pharmaceutical packaging machine market is segmented into Plastic, Glass, PaperOthers. By formulation type of the pharmaceutical packaging machine market is segmented into Liquid, SolidSemisolid. By application of the pharmaceutical packaging machine market is segmented into Blister, Bottle, Vial, Sachet, StripOthers. By distribution channel of the pharmaceutical packaging machine market is segmented into Direct salesIndirect sale. Regionally, the pharmaceutical packaging machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The filling machines segment is expected to account for 32% of the Pharmaceutical Packaging Machine market revenue in 2025, making it the leading machine type. This dominance has been influenced by the critical role these machines play in maintaining dosage precision, sterility, and efficiency during liquid and solid dosage packaging. Filling machines have been integrated into a wide range of pharmaceutical formats, offering adaptability for various container sizes and product viscosities.

Their popularity has been reinforced by growing adoption in aseptic and high-speed production environments where contamination control and minimal waste are essential. Software-driven calibration features and programmable controls have enhanced operational flexibility, making filling machines a cornerstone in automated production lines.

Additionally, regulatory mandates emphasizing accurate dosing and batch traceability have encouraged pharmaceutical manufacturers to invest in high-performance filling technologies. As demand increases for vaccines, injectables, and personalized drug formats, filling machines are expected to remain at the center of pharmaceutical packaging strategies..

The fully automatic segment is projected to represent 56% of the Pharmaceutical Packaging Machine market revenue in 2025, establishing it as the leading type. This growth has been supported by the industry's shift toward end-to-end automation to streamline operations, reduce manual errors, and meet high output standards. Fully automatic machines have been widely adopted due to their ability to manage complex packaging tasks with minimal human intervention, thereby ensuring consistent quality and regulatory compliance.

These machines have also facilitated integration with real-time monitoring systems, which enable predictive maintenance and continuous quality assurance. The preference for fully automatic systems has been amplified by their scalability and compatibility with different packaging lines, including vials, ampoules, blister packs, and sachets.

Labor shortages, production cost pressures, and the need for rapid market entry have further motivated pharmaceutical companies to transition to fully automatic packaging setups. Their efficiency in handling large-scale batches with precision has solidified their position as the preferred choice in modern pharmaceutical manufacturing environments..

The high output capacity segment, defined as machines processing above 20000 to 30000 items per hour, is projected to hold 42% of the Pharmaceutical Packaging Machine market revenue share in 2025, leading in terms of output capacity. This leadership has been driven by the pharmaceutical sector's increasing need for rapid production cycles, especially in high-demand therapeutic categories such as vaccines, analgesics, and antibiotics. Machines with high output capacity have been selected for their ability to sustain large-volume manufacturing while ensuring packaging uniformity and compliance with global standards.

The integration of advanced automation technologies has enabled these machines to maintain high-speed operations without compromising accuracy or sterility. Their suitability for centralized manufacturing hubs and contract manufacturing organizations has also contributed to widespread deployment.

Furthermore, the rise in chronic disease prevalence and demand for over-the-counter medications have placed greater emphasis on machines capable of delivering high throughput. The operational efficiency and long-term cost advantages of high output systems have made them essential in meeting the scalability requirements of large pharmaceutical producers..

The pharmaceutical packaging machine market is driven by the increasing demand for efficient and secure packaging solutions, fueled by the growth of the pharmaceutical industry. Opportunities in the production of generics and biologics are expected to expand market prospects. Trends towards automation and customizable systems are reshaping the market, while challenges related to cost and complexity may slow down adoption. By 2025, addressing these challenges with affordable and efficient solutions will be crucial for continued market success.

The pharmaceutical packaging machine market is growing due to increasing demand for efficient, high-quality packaging solutions that ensure product safety, compliance, and ease of distribution. With pharmaceutical products becoming more complex, manufacturers require specialized machines for different packaging formats such as blister packs, bottles, and vials. Regulatory requirements around product protection, especially in drug packaging, continue to drive the adoption of automated packaging systems. By 2025, this demand for precision and efficiency in pharmaceutical packaging will fuel the market’s expansion.

Opportunities in the pharmaceutical packaging machine market are rising as the global pharmaceutical industry continues to expand. The increasing production of pharmaceuticals, particularly generics and over-the-counter drugs, has spurred demand for packaging solutions that ensure product integrity and safety. The rise in biologics and specialty drugs further drives this demand, as these require specific packaging types. By 2025, the market is expected to benefit from the growing production volumes in emerging pharmaceutical markets.

Emerging trends in the pharmaceutical packaging machine market include the growing demand for automation and customizable packaging systems. Automated machines that streamline production processes are becoming increasingly popular in pharmaceutical manufacturing, offering higher efficiency and reduced labor costs. Additionally, the ability to customize packaging machines for specific products, including variable sizes and shapes, is gaining traction. By 2025, these trends will shape the market, with automated and flexible machines expected to dominate.

Despite the market’s growth, challenges related to high costs and the complexity of pharmaceutical packaging machines persist. Advanced machines that meet regulatory standards and provide customization options often come with high upfront costs. The complexity of maintaining these machines, along with the need for skilled operators, adds to the operational costs. These barriers may slow adoption, especially among smaller manufacturers with limited budgets. By 2025, overcoming these financial and operational challenges will be essential for sustained growth in the market.

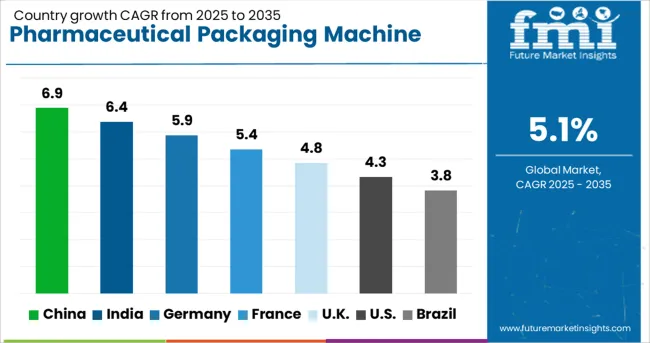

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global pharmaceutical packaging machine market is projected to grow at a 5.1% CAGR from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and France at 5.4%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These variations in growth rates are driven by factors such as increasing demand for packaged pharmaceutical products, the rise in pharmaceutical manufacturing, and advancements in packaging technologies. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, expanding healthcare sectors, and increased production capacities, while more mature markets like the USA and the UK experience steady growth driven by established pharmaceutical industries and regulatory requirements. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pharmaceutical packaging machine market in China is growing at a strong pace, with a projected CAGR of 6.9%. China’s rapidly expanding pharmaceutical industry, along with increasing demand for packaged medicines, is driving the market for pharmaceutical packaging machines. The country’s focus on improving pharmaceutical manufacturing capacity, compliance with international packaging standards, and the push for automation in production lines further contribute to market growth. Additionally, China’s large pharmaceutical export sector, combined with growing consumer health awareness and healthcare investments, provides significant opportunities for the adoption of advanced packaging technologies.

The pharmaceutical packaging machine market in India is projected to grow at a CAGR of 6.4%. India’s rapidly growing pharmaceutical sector, driven by increasing domestic demand and its role as a global supplier of generic medicines, is fueling the demand for advanced packaging machines. The shift towards higher-quality packaging solutions for both domestic and export markets is driving market growth. Furthermore, India’s investments in pharmaceutical manufacturing infrastructure, adherence to global regulatory standards, and the growing emphasis on automation and efficiency in production processes are further boosting demand for pharmaceutical packaging machines.

The pharmaceutical packaging machine market in France is projected to grow at a CAGR of 5.4%. France’s established pharmaceutical industry and strong focus on high-quality production standards are driving demand for packaging machines. The country’s increasing regulatory requirements for packaging safety and environmental impact, combined with the rise of e-commerce and demand for personalized medicine, further contribute to market growth. France’s emphasis on innovation in packaging technologies, including sustainable solutions, and its investments in automation and digitalization in pharmaceutical manufacturing ensure continued market expansion.

The pharmaceutical packaging machine market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK’s established pharmaceutical market, coupled with its focus on innovation and regulatory compliance, supports steady demand for packaging machines. The shift towards more efficient, sustainable, and automated packaging solutions in the UK is contributing to the growth of the market. Additionally, the growing trend of personalized medicine, stricter packaging regulations, and the demand for high-quality packaging solutions in the healthcare and pharmaceutical sectors ensure continued market demand despite slower growth compared to emerging markets.

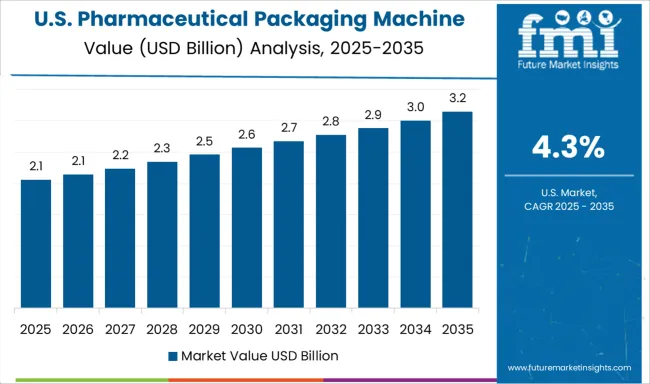

The pharmaceutical packaging machine market in the United States is expected to grow at a CAGR of 4.3%. Despite the maturity of the USA pharmaceutical market, there is steady demand for pharmaceutical packaging machines driven by the increasing need for efficiency, regulatory compliance, and innovations in packaging technologies. The country’s focus on maintaining high safety and quality standards in pharmaceutical packaging, coupled with the growing need for sustainable and eco-friendly packaging solutions, ensures consistent demand. Furthermore, the growing adoption of digital and automated packaging solutions in pharmaceutical production is contributing to the market’s stability.

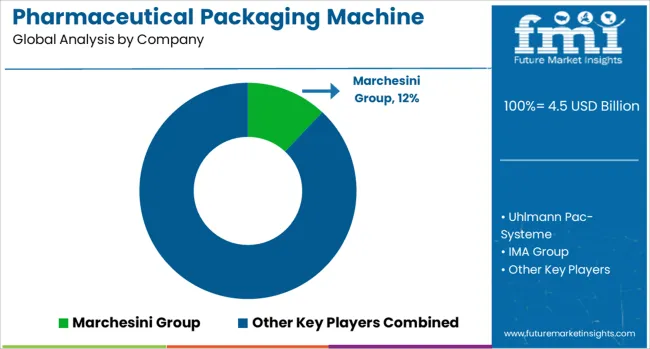

The pharmaceutical packaging machine market is dominated by Marchesini Group, which leads with its comprehensive range of high-quality packaging machinery designed for the pharmaceutical industry. Marchesini’s dominance is supported by its advanced technology, customizability, and strong market presence, offering packaging solutions for tablets, capsules, vials, and syringes. Key players such as Uhlmann Pac-Systeme, IMA Group, and Korber Pharma Packaging maintain significant market shares by providing innovative, high-performance packaging machines designed for efficiency, reliability, and compliance with stringent regulatory standards. These companies focus on automating and optimizing the packaging process, improving production speeds, and ensuring product integrity during packaging.

Emerging players like Romaco Group and Bosch Packaging (Syntegon) are expanding their market presence by offering specialized packaging machines for niche applications, including sterile packaging, blister packaging, and high-speed filling systems. Their strategies include integrating digital technologies, enhancing user interfaces, and improving flexibility in machine designs for evolving pharmaceutical packaging needs. Market growth is driven by the increasing demand for pharmaceutical products, the rise of biologics and generics, and regulatory pressures on packaging safety and sustainability. Innovations in machine intelligence, automation, and eco-friendly packaging solutions are expected to continue shaping competitive dynamics and drive growth in the global pharmaceutical packaging machine market.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Machine Type | Filling machines, Wrapping and sealing, Labelling, Packing and palletizing, Cartoning machines, and Others |

| Type | Fully automatic, Manual, and Semi-automatic |

| Output Capacity | High (above 20,000 to 30,000 items/h), Medium (10,000 to 20,000 items/h), and Low (up to 10,000 items/h) |

| Packaging Material | Plastic, Glass, Paper, and Others |

| Formulation Type | Liquid, Solid, and Semisolid |

| Application | Blister, Bottle, Vial, Sachet, Strip, and Others |

| Distribution Channel | Direct sales and Indirect sale |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Marchesini Group, Uhlmann Pac-Systeme, IMA Group, Korber Pharma Packaging, Romaco Group, and Bosch Packaging (Syntegon) |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across solid, liquid, and injectable drug packaging, regional trends in pharmaceutical packaging machine adoption, innovation in automation, serialization, and eco-friendly materials, impact of regulatory standards on compliance and safety, and emerging use cases in personalized medicine and sustainable packaging solutions. |

The global pharmaceutical packaging machine market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the pharmaceutical packaging machine market is projected to reach USD 7.4 billion by 2035.

The pharmaceutical packaging machine market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pharmaceutical packaging machine market are filling machines, wrapping and sealing, labelling, packing and palletizing, cartoning machines, others and _tablet counting machine etc..

In terms of type, fully automatic segment to command 56.0% share in the pharmaceutical packaging machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Machine Heaters Market Growth – Trends & Forecast 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Equipment Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Pharmaceutical Packaging Companies

Pharmaceuticals Machinery Market Size and Share Forecast Outlook 2025 to 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Snack Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pharmaceutical Plastic Packaging

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Premix Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA