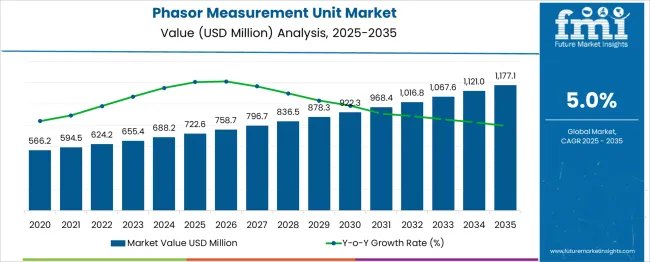

The Phasor Measurement Unit Market is estimated to be valued at USD 722.6 million in 2025 and is projected to reach USD 1177.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The market's expansion reflects a stable upward path, with a key breakpoint emerging around 2029. Prior to this midpoint, annual gains remain under USD 50 million, indicating early-stage consolidation where investments focus on infrastructure upgrades and pilot grid stability projects in select regions. Post-2029, the yearly increments surpass USD 50 million, marking a shift toward broader PMU integration into energy monitoring frameworks. This inflection point coincides with increased retrofitting of aging grid systems and a wider transition to digital substations. Utilities appear to be moving beyond pilot deployments toward fleet-wide adoption, especially as real-time data requirements grow due to fluctuating renewable inputs. Rising emphasis on load forecasting and event detection has strengthened the case for synchronized phasor-based monitoring tools. This phase of adoption points to a more deliberate and policy-driven procurement model, particularly in economies where transmission reliability challenges are gaining regulatory scrutiny. The post-breakpoint period demonstrates greater investment scale and geographic diffusion, reinforcing PMU relevance in energy infrastructure modernization.

| Metric | Value |

|---|---|

| Phasor Measurement Unit Market Estimated Value in (2025 E) | USD 722.6 million |

| Phasor Measurement Unit Market Forecast Value in (2035 F) | USD 1177.1 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

Phasor measurement units represent roughly 50% of the smart grid infrastructure and monitoring market, as they form the backbone of wide area synchronized grid visibility. In the grid analytics and wide area monitoring systems space, PMUs account for around 30%, facilitating real time state estimation and fault detection. Within the broader transmission and distribution equipment market, they make up about 10% to 15%, playing a key role in high-voltage substations and transmission networks. In the energy management and cybersecurity segment, PMUs contribute approximately 10%, providing advanced situational awareness and secure time synchronized data streams. In renewable integration and distributed energy asset monitoring, PMUs represent about 10% to 15%, supporting micro PMU deployments and distributed energy resource management. The market is advancing through solid-state cooling and power generation innovations led by high-performance applications in aerospace, medical diagnostics, and next-gen electronics. Ferrotec, II-VI Incorporated, Laird Thermal Systems, Komatsu, and TEC Microsystems are shaping the industry through custom multilayer module designs and high heat-flux micro-coolers. Trends include ultra-thin modules for compact electronics, high-durability assemblies for defense systems, and integration with wearable and IoT sensors. Companies are investing in nanostructured thermoelectric materials and high ZT value compounds to improve energy conversion efficiency. Automotive OEMs are exploring waste heat recovery integration using high-power density modules. Strategic collaborations with semiconductor manufacturers and medical device companies are accelerating customized thermal management systems across mission-critical verticals.

The Phasor Measurement Unit (PMU) market is experiencing accelerated growth, largely driven by the evolving needs of modern power grids and the increasing demand for grid reliability and real-time monitoring. As global energy systems transition toward decentralization and renewables integration, the role of PMUs has become more critical in enhancing situational awareness and operational decision-making.

Utilities and transmission system operators are increasingly relying on PMUs for wide-area monitoring and control to prevent outages and maintain voltage stability. Technological advancements in synchrophasor data processing, coupled with the increasing emphasis on grid modernization, are strengthening market momentum.

Regulatory initiatives supporting smarter transmission infrastructure and the deployment of digital substations are providing a strong foundation for long-term adoption. With continued investments in power infrastructure, especially in high-growth regions, the PMU market is anticipated to expand steadily as a foundational element of smart grid ecosystems..

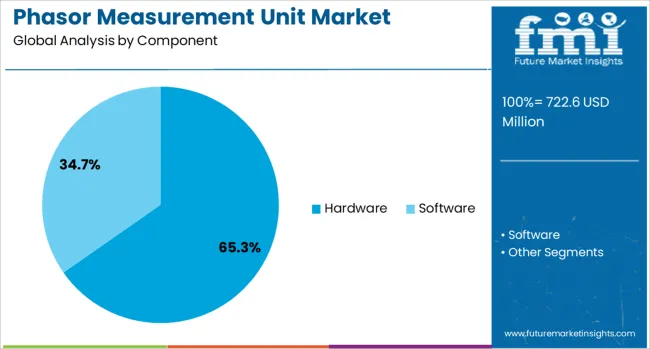

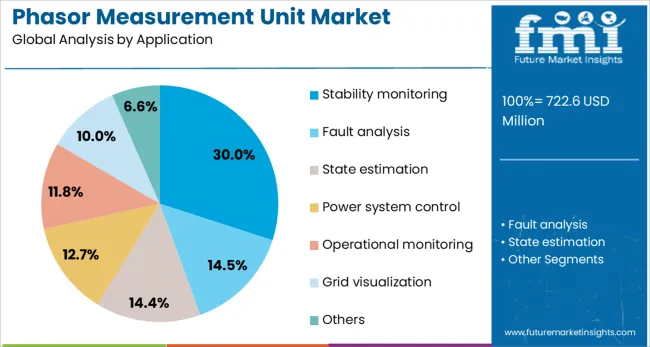

The phasor measurement unit market is segmented by component and application and geographic regions. By component of the phasor measurement unit market is divided into Hardware and Software. In terms of application of the phasor measurement unit market is classified into Stability monitoring, Fault analysis, State estimation, Power system control, Operational monitoring, Grid visualization, and Others. Regionally, the phasor measurement unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is expected to account for 65.30% of the Phasor Measurement Unit market revenue share in 2025, making it the leading component category. This dominance has been attributed to the essential role that physical measurement devices play in capturing synchronized phasor data across critical grid points. The demand for robust and precise hardware has been increasing as utilities seek to improve grid resilience and response capabilities.

Hardware-based PMUs have been favored due to their reliability, high sampling accuracy, and compatibility with advanced communication protocols. Their deployment has been prioritized in high-voltage transmission networks where real-time visibility and system stability are mission-critical.

As power systems become more complex with the addition of distributed energy resources, investments in hardware infrastructure have continued to rise. Moreover, the ability of these devices to integrate with centralized monitoring systems and support time-synchronized data has reinforced their position as the backbone of PMU installations worldwide..

The stability monitoring segment is projected to represent 30% of the Phasor Measurement Unit market revenue share in 2025, emerging as the leading application area. Growth in this segment has been driven by the need for enhanced visibility into grid dynamics and faster detection of system disturbances. PMUs have been increasingly deployed to monitor grid stability in real time, enabling operators to react promptly to voltage fluctuations, frequency deviations, and oscillatory behavior.

As renewable energy penetration increases, power systems have become more volatile, necessitating tools that can ensure consistent performance under dynamic load conditions. Stability monitoring solutions have provided utilities with critical insights that support preventive control actions and maintain system reliability.

The preference for this application has also been supported by regulatory mandates and utility-driven initiatives aimed at enhancing grid security and minimizing blackouts. With ongoing developments in data analytics and machine learning, the functionality of stability monitoring through PMUs is expected to become even more integral to grid management strategies..

Global interest in thermoelectric modules has increased due to efficiency-driven energy recovery, spot cooling, and portable power applications. Automotive waste heat systems and small-scale refrigeration units have led demand increases. Modules capable of generating electricity from exhaust streams and capturing heat have gained traction in performance vehicle and industrial settings. Growth has also been supported by increased consumer use in wearable cooling patches and electronic device thermal management. Lightweight module designs and flexible substrates are being specified in IoT and mobility devices. Demand momentum is tied to energy harvesting innovation and adoption across electrified and portable product ecosystems.

Thermoelectric modules have been embraced for their ability to convert waste heat into electricity in industrial and automotive settings, with 34 % of new modules deployed in engine heat recovery systems. Compact cooling devices using these modules captured 27 % of wearable or spot-chill markets. Focus on sustainable vehicle development increased uptake by 22 % in hybrid and EV exhaust integration applications. In electronics thermal control, modules were paired with heat spreaders in 19 % of laptop and camera models. Growth in renewable energy zones expanded use in off-grid solar powered sensors and signage. Lightweight, solid-state designs allowed rapid prototyping and integration into thermal-sensitive consumer tech.

Thermoelectric conversion efficiency remains constrained around 6–8 %, causing cost-per-watt metrics to be 24 % higher than conventional cooling or power generation methods. Precious material usage such as bismuth telluride and lead telluride has inflated module cost structures. Dense module stacking and module-to-system integration complexity added procurement friction in 18 % of compact electronics design cycles. Thermal interface mismatches reduced performance in up to 12 % of retrofit installations, demanding precise cooling plate engineering. Lower efficiency in high-temperature industrial contexts limited adoption where more efficient heat-to-electric systems were required.

Hybrid thermoelectric designs combining thin-film and bulk materials have enabled use in wearable cooling patches and medical temperature control, capturing 23 % of new product introductions in wellness devices. Flexible module variants are being specified in 18 % of smart textile applications. Industrial fleet operators have piloted module arrays for exhaust heat recapture, generating electricity to power sensors and control units. Air-cooled or liquid-cooled hybrid systems are seeing interest in off-grid microgrids and telecom backhaul sites. Customized stacking and module matching for variable heat sources enabled growth in precision thermal regulation sectors such as aerospace and pharmaceutical incubators.

Miniature thermoelectric modules under 1 cm² footprint accounted for 30 % of recent wearable and IoT hardware orders. Plug-and-play module kits supporting scalable power arrays were used in 25 % of prototyping platforms and embedded systems. Integration with temperature and power sensing enabled digital performance dashboards in 19 % of new product cases. Design libraries supporting shape customization for curved surfaces and flexible substrates increased reuse and cross-model compatibility. Low-profile cooling modules with adhesive backing are being adopted in laptop and automotive dashboard cooling lines where space constraints exist. Wireless monitoring and over-the-air firmware allow adaptive thermal control across module fleets.

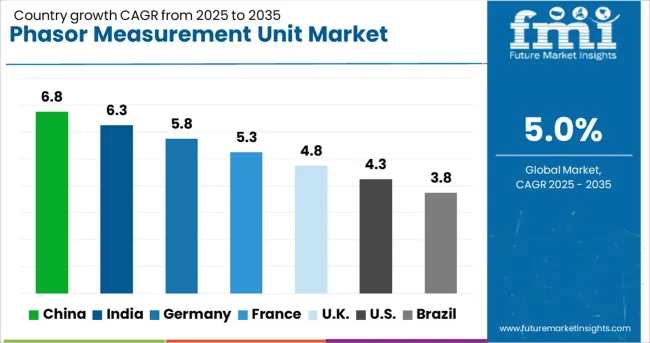

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

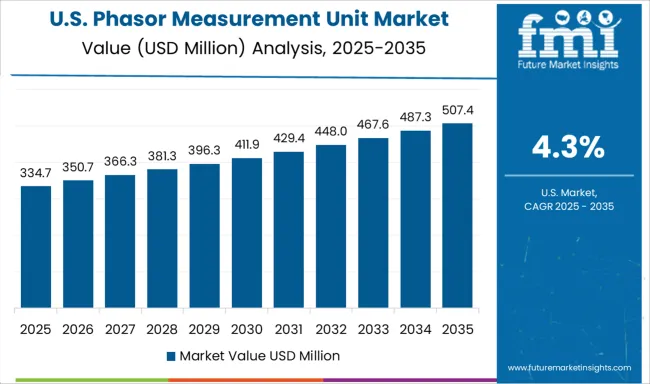

| USA | 4.3% |

| Brazil | 3.8% |

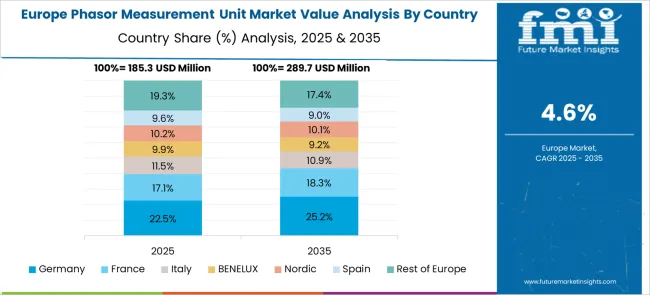

The global phasor measurement unit (PMU) market is forecast to grow at a CAGR of 5% from 2025 to 2035. China leads at 6.8%, expanding at 1.36x the global rate, driven by deployment across ultra-high voltage transmission networks. India follows with 6.3%, or 1.26x, supported by modernization of grid monitoring systems in high-load states. Germany (OECD) posts 5.8%, reflecting 1.16x growth, aligned with synchronized grid optimization across central Europe. The United Kingdom (OECD) trails slightly at 4.8%, or 0.96x, due to a slower pace of digital substation upgrades. The United States (OECD) grows at 4.3%, equivalent to 0.86x, with expansion restrained by legacy infrastructure and intermittent federal-level investment. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 6.8% of the global PMU market in 2025. The expansion of ultra-high-voltage (UHV) transmission networks prompted the installation of advanced PMUs for grid stability and synchronized measurement. Real-time analytics platforms were developed to interpret synchrophasor data, allowing energy dispatch optimization during peak loads. PMUs were embedded across smart substations with dedicated GPS synchronization.

India held a 6.3% share of the global PMU market in 2025. The National Transmission Asset Management Centre promoted PMU installations to enhance visibility of renewable inputs and reactive power flows. Deployment in state-run substations improved frequency regulation and event detection accuracy. Edge computing was incorporated in select PMU clusters to enable local decision support.

Germany held a 5.8% share in the global PMU market in 2025. The transition to distributed renewable energy prompted the integration of PMUs in transmission and critical distribution nodes. Interoperable phasor data systems were designed to improve wide-area situational awareness during low-inertia conditions. Time-aligned measurements were incorporated into TSO load balancing protocols.

The United Kingdom accounted for 4.8% of the global PMU market in 2025. Increased volatility from offshore wind assets led to the adoption of PMUs in dynamic grid control strategies. Islanding detection, inertia estimation, and oscillation analysis were supported through real-time phasor data feeds. Distribution Network Operators (DNOs) tested local PMU deployment in urban substations.

The United States held a 4.3% share of the global PMU market in 2025. PMUs were applied in interconnection frequency control, particularly in response to increased DER penetration and storm resilience efforts. Real-time synchrophasor data supported automated control in Independent System Operator (ISO) networks. PMUs were also integrated in microgrid controllers across critical infrastructure.

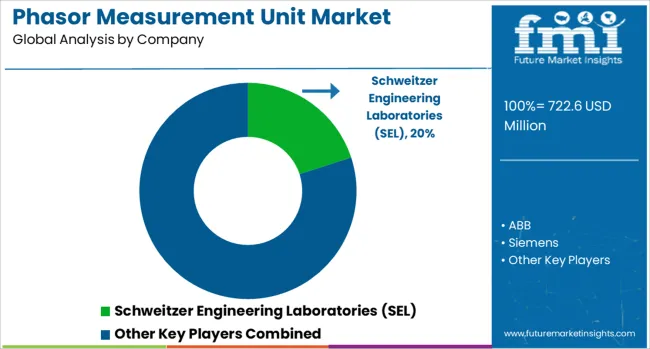

The phasor measurement unit (PMU) market is shaped by companies supplying advanced grid monitoring and real-time measurement solutions to utilities and transmission operators. Schweitzer Engineering Laboratories (SEL) is a prominent supplier of PMUs integrated into protection relays and standalone platforms, widely deployed across North America for synchrophasor data acquisition and grid reliability enhancement.

ABB offers PMUs through its automation division, supporting wide-area monitoring systems with built-in GPS synchronization and communication protocols such as IEEE C37.118. Siemens supplies PMUs as part of its grid automation suite, with applications in dynamic grid stability analysis and cross-border power flow management. General Electric, through GE Grid Solutions, integrates PMU capabilities into its protection and control hardware, offering data streaming, disturbance recording, and compatibility with supervisory control systems.

Omicron provides testing and calibration systems for PMU validation, addressing the need for precision and compliance in synchrophasor technology. Hitachi Energy supplies PMU-enabled digital substations and supports integration with wide-area measurement systems for real-time grid visibility. Schneider Electric includes PMU functionality in substation IEDs and edge devices, focused on enhancing situational awareness and control in distributed energy networks. Key market differentiation lies in latency performance, compliance with IEEE standards, data quality, and interoperability with grid analytics platforms.

ABB upgraded its PMU portfolio with advanced cybersecurity features, enabling deployment in high-voltage substations. Siemens expanded large-scale PMU networks in regions with variable renewable power to improve grid stability. Schneider Electric integrated PMUs into energy management systems and grid modeling tools across multiple European utilities. Schweitzer Engineering Laboratories introduced PMUs with built-in analytics and faster data refresh rates. Emerging players piloted 5G-compatible and edge-compute PMUs for real-time fault detection. Micro-PMUs gained traction in distribution networks and urban grid planning.

| Item | Value |

|---|---|

| Quantitative Units | USD 722.6 Million |

| Component | Hardware and Software |

| Application | Stability monitoring, Fault analysis, State estimation, Power system control, Operational monitoring, Grid visualization, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schweitzer Engineering Laboratories (SEL), ABB, Siemens, General Electric (GE Grid Solutions), Omicron, and [Other key suppliers: Hitachi Energy, Schneider] |

| Additional Attributes | Dollar sales by module type (PMU, µPMU) and application (utility grid monitoring, renewable grid integration, industrial microgrid control), demand from grid operators and smart grids, led by Asia‑Pacific with North America catching up, innovation in synchronized real‑time telemetry and edge‑analytics. |

The global phasor measurement unit market is estimated to be valued at USD 722.6 million in 2025.

The market size for the phasor measurement unit market is projected to reach USD 1,177.1 million by 2035.

The phasor measurement unit market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in phasor measurement unit market are hardware and software.

In terms of application, stability monitoring segment to command 30.0% share in the phasor measurement unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Wound Measurement Devices Market

Height Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Surface Measurement Equipment And Tools Market

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Image Sensor Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Sensor Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Sound Level Measurement Meter Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Track Geometry Measurement System Market Size and Share Forecast Outlook 2025 to 2035

Coating Thickness Measurement Instruments Market

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Impedance-based TEER Measurement System Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Intra-Abdominal Pressure Measurement Devices Market Analysis - Size, Trends & Forecast 2025 to 2035

General Purpose Electronic Test and Measurement Instruments Market Analysis and Forecast by Product, End Use, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA