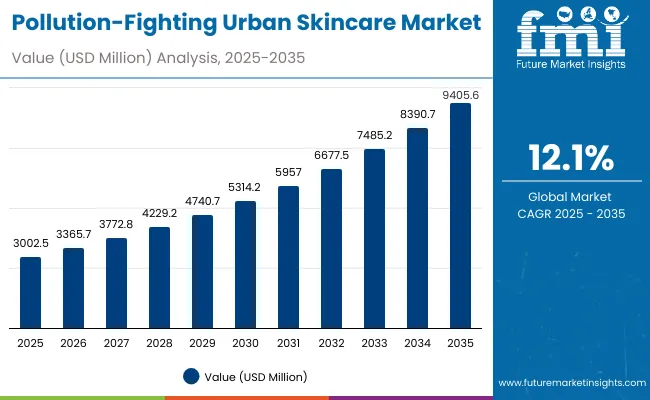

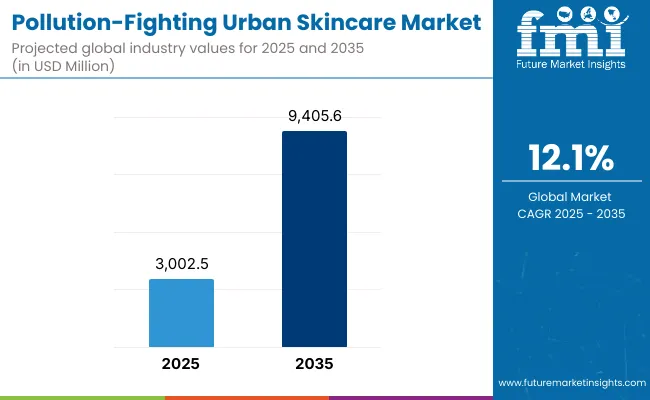

A valuation of USD 3,002.5 million has been projected for the Pollution-Fighting Urban Skincare Market in 2025, while the market is expected to advance to USD 9,405.6 million by 2035. This expansion reflects an increase of USD 6,403.1 million over the decade, equivalent to a threefold rise. A CAGR of 12.1% is anticipated during the period, underscoring the steady pace of adoption as pollution-linked skincare concerns intensify worldwide.

Pollution-Fighting Urban Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Pollution-Fighting Urban Skincare Market Estimated Value In (2025E) | USD 3,002.5 million |

| Pollution-Fighting Urban Skincare Market Forecast Value In (2035F) | USD 9,405.6 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

Between 2025 and 2030, the market is set to grow from USD 3,002.5 million to USD 5,314.2 million, adding USD 2,311.7 million in value. This first half of the forecast period will account for 36% of overall decade growth. Demand will be shaped by rising consumer awareness of pollution-induced skin damage, coupled with regulatory emphasis on protective skincare formulations.

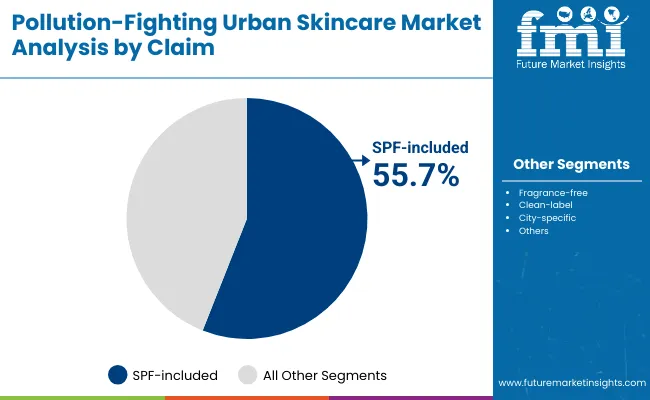

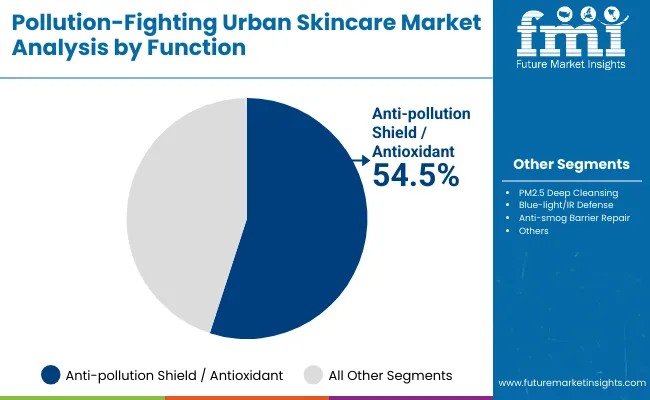

During this phase, SPF-included claims are expected to dominate with a 55.7% share, reflecting the growing appeal of multifunctional protection. Anti-pollution shield and antioxidant-based solutions will also lead by function with a 54.5% share in 2025, setting the tone for functional dominance.

In the second half, from 2030 to 2035, market revenues are forecast to expand further by USD 4,091.4 million, representing 64% of decade growth. The surge will be powered by accelerating demand in Asia-Pacific markets, particularly China and India, where CAGR levels are projected at 20.5% and 23.6% respectively. Expanding e-commerce penetration, premium beauty retail, and increased preference for scientifically validated formulations

From 2020 to 2024, the market expanded steadily as pollution-driven skincare awareness gained momentum across major urban centers. By 2025, demand for multi-protection products is projected to strengthen, with SPF-included claims and anti-pollution antioxidant shields anchoring the largest shares. Between 2025 and 2030, significant acceleration is anticipated in China and India, where CAGRs of 20.5% and 23.6% respectively are forecast, highlighting Asia-Pacific as the fastest-growing region.

By 2035, the market is expected to more than triple, powered by rising disposable incomes, evolving beauty routines, and heightened consumer demand for scientifically validated protective solutions. Competitive intensity will remain high, as established brands enhance portfolios with antioxidant complexes and sustainability-focused claims. The long-term advantage is likely to be defined not just by brand recognition but by innovation in multifunctional actives, digital consumer engagement, and clinical validation.

The growth of the Pollution-Fighting Urban Skincare Market is being fueled by rising awareness of environmental stressors and their adverse impact on skin health. Increasing levels of urban air pollution, combined with heightened concerns over particulate matter such as PM2.5, have elevated consumer demand for preventative skincare solutions.

Advances in active ingredient systems, including antioxidants, vitamin complexes, and bioactive proteins, are being adopted to provide multi-layered defense. Strong preference for SPF-included claims reflects the desire for convenience, as multifunctional products that combine sun and pollution protection are being prioritized.

Rapid expansion in Asia-Pacific, particularly in China and India, is being supported by urbanization, disposable income growth, and higher pollution exposure. E-commerce penetration and digital-first retail channels are further accelerating accessibility and adoption. Continued clinical validation and alignment with clean-label and sustainable formulations are expected to reinforce consumer trust, ensuring long-term momentum for pollution-fighting skincare solutions.

The Pollution-Fighting Urban Skincare Market has been segmented across claim, function, and product type, reflecting how consumer preferences are being shaped by protective efficacy, active formulations, and daily usability. Claim segmentation underscores the rising importance of SPF-backed products, while function classification highlights the demand for antioxidant-rich solutions.

Product type segmentation emphasizes the relevance of moisturizers with SPF and their essential role in everyday skincare. Each dimension of segmentation demonstrates how consumer adoption is influenced by the convergence of environmental awareness, regulatory momentum, and lifestyle-driven choices. The interplay between these segments is expected to define the pace and direction of growth through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| SPF-included | 55.7% |

| Others | 44.3% |

The SPF-included segment is projected to capture 55.7% of market revenues in 2025, reaching USD 1,575.8 million. Its dominance is being reinforced by the growing consumer need for multifunctional skincare that protects against both sun exposure and pollution. The preference for SPF-included claims is expected to remain strong as awareness of UV and pollution synergy deepens.

The “Others” category, with 44.3% share, is anticipated to maintain steady growth through clean-label and fragrance-free claims, appealing to consumers seeking skin compatibility. Across both categories, trust in efficacy and regulatory backing is expected to accelerate adoption, ensuring sustained relevance of claim-driven positioning in the decade ahead.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-pollution shield/antioxidant | 54.5% |

| Others | 45.5% |

Anti-pollution shield and antioxidant formulations are forecasted to lead with 54.5% share in 2025, equivalent to USD 1,636.4 million. Their position is being strengthened by increasing consumer recognition of oxidative stress as a primary contributor to premature aging and skin sensitivity. The adoption of antioxidants and protective actives is anticipated to accelerate as urban exposure intensifies.

The “Others” category, valued at USD 1,367.5 million with a 45.5% share, will remain competitive by addressing skin repair and detoxification needs. Innovation in functional blends, such as bioactive complexes and repair-focused actives, is expected to expand this space. Together, these functions highlight how science-backed efficacy will drive market evolution in the coming decade.

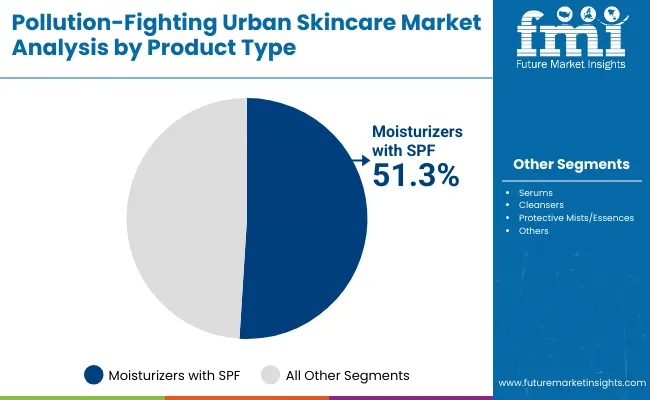

| Segment | Market Value Share, 2025 |

|---|---|

| Moisturizers with SPF | 51.3% |

| Others | 48.7% |

Moisturizers with SPF are projected to dominate with a 51.3% share in 2025, valued at USD 1,484.8 million. Their leadership reflects their role as essential daily-use products that integrate hydration with protective defense against pollution and sun exposure. The demand for lightweight, multifunctional moisturizers is expected to rise significantly among urban consumers.

Other product types, with a 48.7% share worth USD 1,463.6 million, are anticipated to contribute strongly through serums, mists, and cleansers designed for targeted protection and barrier repair. Diversification of skincare routines and innovations in portable, easy-to-apply formats are likely to reinforce their presence. This segmentation highlights the balanced contribution of product formats to overall market expansion.

The market is being influenced by evolving consumer expectations, regulatory pressures, and technological advancements, creating opportunities while also exposing structural limitations that shape the long-term growth trajectory.

Scientific Validation of Pollution-Linked Skin Aging

Market expansion is being accelerated as scientific evidence linking air pollutants and fine particulate matter to skin aging and inflammatory conditions is increasingly validated through clinical research. Dermatological studies highlighting oxidative stress pathways have enhanced consumer awareness and created trust in advanced formulations.

This driver is not only redefining marketing narratives but is also compelling brands to invest in R&D pipelines that integrate antioxidants, vitamins, and bioactives with proven efficacy. As clinical data continues to be disseminated, a stronger alignment between medical dermatology and consumer skincare is expected to emerge, reinforcing demand for pollution-defense products in both mass and premium categories.

High Costs of Innovation in Bioactive Ingredients

The cost of developing next-generation bioactive complexes such as ectoin, moringa seed proteins, and resveratrol-based systems is acting as a restraint. Formulating multi-active blends with sustainable sourcing, clinical trials, and regulatory compliance creates significant price pressures for both manufacturers and end consumers.

Premium positioning often limits accessibility in price-sensitive regions, slowing broader adoption. Unless cost efficiencies are achieved through biotechnological advances and scaled production, the affordability challenge is expected to temper growth in emerging economies, despite rising consumer interest in protective skincare.

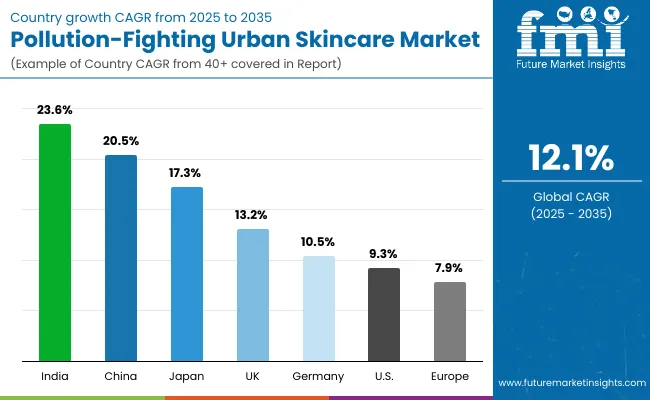

| Country | CAGR |

|---|---|

| China | 20.5% |

| USA | 9.3% |

| India | 23.6% |

| UK | 13.2% |

| Germany | 10.5% |

| Japan | 17.3% |

The Pollution-Fighting Urban Skincare Market is showing distinct country-level growth dynamics, shaped by environmental stress levels, regulatory frameworks, and consumer adoption of advanced skincare routines. India is projected to lead with a CAGR of 23.6% between 2025 and 2035, supported by rising disposable incomes, rapid urbanization, and heightened awareness of pollution-linked skin concerns in highly populated metropolitan areas.

China is expected to follow closely at 20.5% CAGR, where severe air quality challenges, combined with government-backed sustainability initiatives, are creating fertile ground for the adoption of scientifically validated skincare solutions.

Japan, advancing at 17.3% CAGR, is positioned strongly due to consumer inclination toward technology-driven skincare and preference for clinically proven, multifunctional formats. The UK is expected to expand at 13.2%, driven by increasing urban wellness awareness and premium beauty investments. Germany, with a CAGR of 10.5%, is anticipated to grow steadily, supported by dermatology-focused retail channels and rising demand for clean-label claims.

The USA shows moderate growth at 9.3% CAGR, reflecting maturity of the skincare sector but steady adoption of anti-pollution claims in urban centers such as New York and Los Angeles. Collectively, Asia-Pacific markets are expected to set the pace for global adoption, while Europe and North America maintain steady yet differentiated growth trajectories.

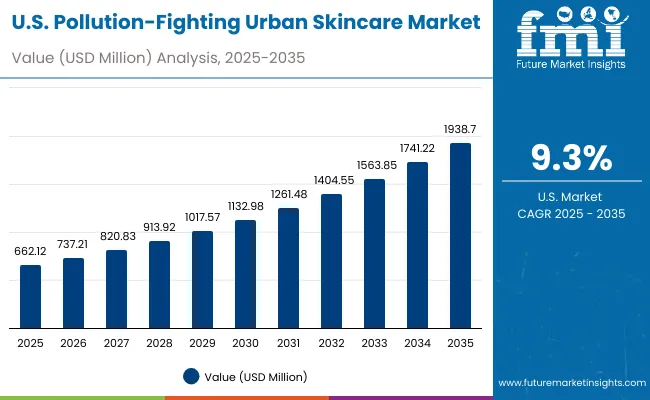

| Year | USA Pollution-Fighting Urban Skincare Market (USD Million) |

|---|---|

| 2025 | 662.12 |

| 2026 | 737.21 |

| 2027 | 820.83 |

| 2028 | 913.92 |

| 2029 | 1,017.57 |

| 2030 | 1,132.98 |

| 2031 | 1,261.48 |

| 2032 | 1,404.55 |

| 2033 | 1,563.85 |

| 2034 | 1,741.22 |

| 2035 | 1,938.70 |

The USA Pollution-Fighting Urban Skincare Market is projected to grow at a CAGR of 11.0% from 2025 to 2035, expanding from USD 662.12 million in 2025 to USD 1,938.70 million by 2035. This threefold rise underscores how demand for multifunctional protection is being accelerated by worsening urban pollution and greater consumer awareness of skin health risks.

Sales are anticipated to strengthen consistently, reaching USD 1,132.98 million by 2030, before further advancing to USD 1,938.70 million in 2035. The decade’s expansion will be shaped by SPF-included products, which are increasingly positioned as daily-use essentials. Premium ranges featuring antioxidants and dermatologist-backed formulations are also expected to capture growing consumer interest.

Digital-first retail strategies, coupled with rising e-commerce penetration, will enhance accessibility and create new engagement models. Clinical skincare channels, including dermatology clinics, are projected to reinforce trust in scientifically validated products. By the end of the forecast period, the USA market will reflect a more balanced mix of premium skincare adoption and mass-market accessibility, driven by sustainability, clean-label claims, and multifunctional innovation.

The UK Pollution-Fighting Urban Skincare Market is projected to grow at a CAGR of 13.2% from 2025 to 2035, reflecting steady expansion driven by rising urban wellness awareness and a preference for premium skincare solutions. Market revenues are expected to increase consistently as pollution-related skin damage becomes a priority among urban populations.

Adoption is anticipated to be influenced strongly by dermatologist-endorsed products and advanced formulations featuring antioxidants and SPF inclusion. Premium retail channels are projected to expand their influence, with e-commerce gaining traction as a key growth driver. Demand for fragrance-free and clean-label claims is expected to strengthen consumer trust, particularly among younger demographics seeking safety and transparency.

The India Pollution-Fighting Urban Skincare Market is projected to grow at a CAGR of 23.6% from 2025 to 2035, marking the fastest growth among major countries. Expansion is expected to be fueled by rapid urbanization, rising disposable incomes, and severe air pollution levels across metropolitan regions.

By 2030, significant adoption is anticipated as skincare routines become increasingly aligned with preventative health and wellness priorities. Demand is expected to be led by multifunctional products combining SPF and antioxidants, with premiumization gaining traction in metropolitan cities. Local and international brands are projected to scale operations rapidly, leveraging e-commerce channels and digital campaigns to reach younger demographics.

The China Pollution-Fighting Urban Skincare Market is projected to grow at a CAGR of 20.5% between 2025 and 2035, underscoring its position as one of the fastest-expanding markets globally. Growth is expected to be driven by severe pollution exposure, strong consumer awareness, and regulatory support for sustainable skincare practices.

China’s urban population is anticipated to embrace multifunctional products such as moisturizers with SPF, while premium beauty retail and e-commerce platforms are expected to fuel distribution. Local innovation, supported by biotechnology and advanced formulation science, is likely to shape the competitive landscape. By 2035, China is forecasted to be among the largest contributors to global market revenues.

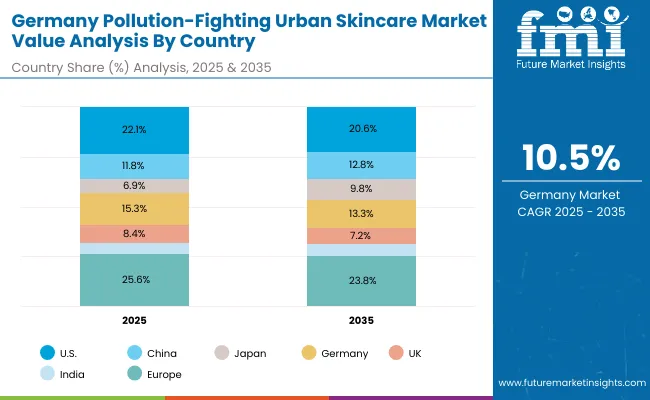

| Country | 2025 |

|---|---|

| USA | 22.1% |

| China | 11.8% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.4% |

| India | 5.2% |

| Country | 2035 |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 9.8% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The Germany Pollution-Fighting Urban Skincare Market is projected to grow at a CAGR of 10.5% from 2025 to 2035, reflecting stable yet significant expansion. Growth is expected to be anchored by high consumer trust in dermatologist-tested products and a strong inclination toward clean-label and fragrance-free claims.

Germany’s premium skincare sector is anticipated to record strong adoption of SPF-included and antioxidant-rich formulations, with pharmacies and dermatology clinics projected to play a central role in distribution. Regulatory emphasis on safety, sustainability, and product validation is expected to further reinforce consumer confidence.

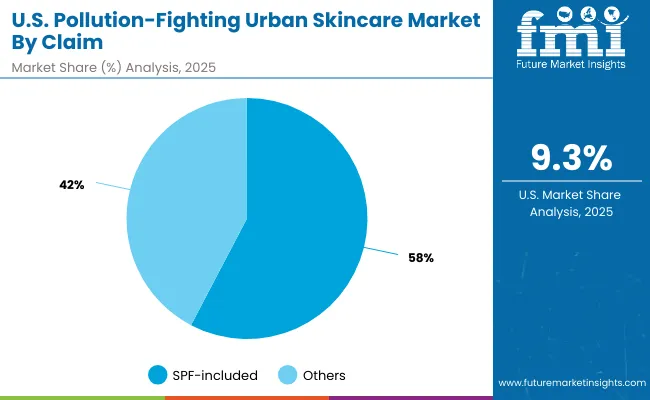

| Segment | Market Value Share, 2025 |

|---|---|

| SPF-included | 57.7% |

| Others | 42.3% |

The Pollution-Fighting Urban Skincare Market in the United States is projected at USD 662.12 million in 2025. SPF-included products contribute 57.7%, valued at USD 381.9 million, while other claims account for 42.3%, valued at USD 280.2 million. This dominance of SPF-included products highlights the consumer preference for multifunctional skincare that combines pollution protection with sun defense. The prioritization of SPF stems from the growing awareness of combined UV and pollution damage, which accelerates skin aging and sensitivity.

A structural shift is expected as USA consumers increasingly demand dermatologist-endorsed and clinically validated solutions, particularly in metropolitan areas with higher pollution exposure. Premium skincare positioned with antioxidant enrichment is also projected to support growth. As sustainability and clean-label formulations gain traction, adoption is anticipated to rise further. The decade ahead will be defined by innovation in lightweight moisturizers, advanced barrier-protection formats, and digital-first retail distribution.

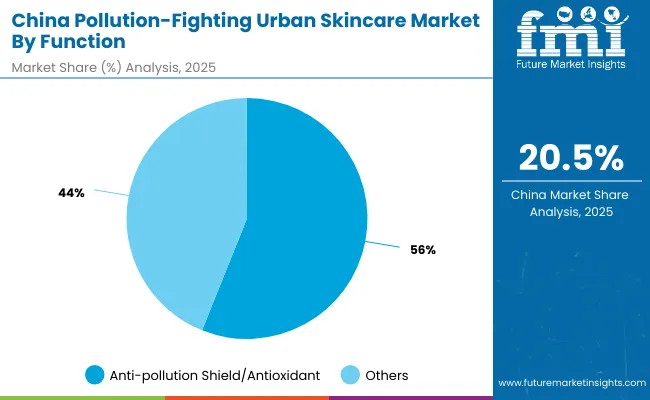

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-pollution shield/antioxidant | 56.1% |

| Others | 43.9% |

The Pollution-Fighting Urban Skincare Market in China is projected at USD 353.20 million in 2025. Anti-pollution shield and antioxidant-based products contribute 56.1%, valued at USD 198.3 million, while other functions account for 43.9%, valued at USD 154.9 million. This functional dominance highlights the strong consumer inclination toward products that counter oxidative stress and strengthen skin barriers against severe pollution exposure.

Growth in China is expected to be accelerated by increasing disposable incomes, widespread urbanization, and heightened public awareness of skin damage linked to particulate matter and smog. Premium skincare formats offering clinically validated antioxidant protection are anticipated to gain wider adoption, while e-commerce platforms and digital-first retail strategies are projected to expand product accessibility nationwide.

The decade ahead will likely be defined by advanced formulation technologies, local R&D investments, and integration of bioactive ingredients tailored to urban Chinese consumers. As sustainability and regulatory compliance gain momentum, trust in protective skincare is expected to solidify further, positioning China as one of the most dynamic markets globally.

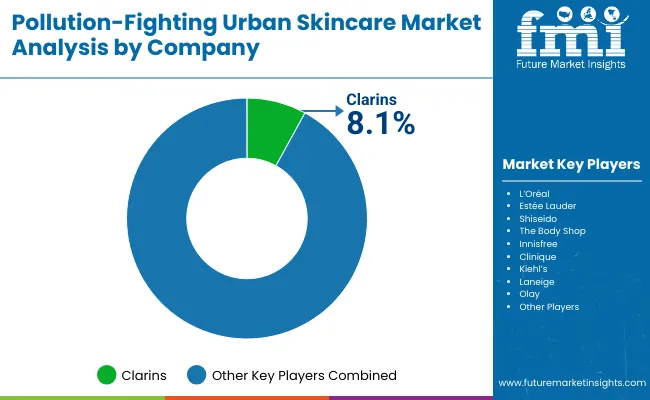

| Company | Global Value Share 2025 |

|---|---|

| Clarins | 8.1% |

| Others | 91.9% |

The Pollution-Fighting Urban Skincare Market is moderately fragmented, with global leaders, mid-sized innovators, and regional specialists competing for share across diverse consumer bases. Global beauty leaders such as Clarins, L’Oréal, Estée Lauder, and Shiseido are positioned strongly due to their extensive R&D pipelines, established distribution networks, and premium brand equity. Their strategies are increasingly centered on integrating antioxidants, multifunctional SPF products, and sustainable formulations, ensuring alignment with consumer expectations for efficacy and clean-label transparency.

Clarins, holding 8.1% of global value share in 2025, has emerged as the leading player, reflecting its early focus on pollution-defense skincare. This leadership is expected to have been consolidated from 2024, when its share was already dominant in the category.

Mid-sized innovators such as The Body Shop, Innisfree, Clinique, and Kiehl’s are addressing the demand for accessible, eco-conscious, and dermatology-backed solutions. Their ability to balance affordability with functional efficacy positions them favorably in both developed and emerging markets.

Niche-focused brands including Laneige and Olay are emphasizing product innovation in lightweight moisturizers and urban-targeted formulations. Their strength lies in regional adaptability, particularly in Asia-Pacific where consumer awareness of pollution-linked skin concerns is expanding rapidly.

Competitive differentiation is expected to shift from brand heritage alone toward evidence-based claims, clinical validation, and digital-first engagement strategies. Ecosystem integration through omni-channel distribution and sustainability-focused packaging will remain decisive in shaping long-term leadership.

Key Developments in Pollution-Fighting Urban Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,002.5 million (2025) - USD 9,405.6 million (2035) |

| By Claim | SPF-included, Others |

| By Function | Anti-pollution shield/antioxidant, Others |

| By Product Type | Moisturizers with SPF, Serums, Cleansers, Protective mists/essences |

| By Active System | Ectoin/moringa seed proteins, Vitamin C + Niacinamide, Algae/charcoal complexes, Resveratrol/ferulic systems |

| By Channel | Pharmacies, E-commerce, Premium beauty retail, Dermatology clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Japan, Germany, United Kingdom, Brazil, South Africa |

| Key Companies Profiled | Clarins, L’Oréal, Estée Lauder, Shiseido, The Body Shop, Innisfree, Clinique, Kiehl’s, Laneige, Olay |

| Additional Attributes | Dollar sales by claim, function, and product type; adoption of SPF-included multifunctional products; rising demand in urban centers with severe pollution exposure; e-commerce and digital-first retail expansion; premiumization trends in Asia-Pacific; clinical validation and dermatologist endorsements; sustainability and clean-label innovation shaping long-term competitive advantage. |

The global Pollution-Fighting Urban Skincare Market is estimated to be valued at USD 3,002.5 million in 2025.

The market size for the Pollution-Fighting Urban Skincare Market is projected to reach USD 9,405.6 million by 2035.

The Pollution-Fighting Urban Skincare Market is expected to grow at a CAGR of 12.1% between 2025 and 2035.

The key product types in the Pollution-Fighting Urban Skincare Market are moisturizers with SPF, serums, cleansers, and protective mists/essences.

In terms of claims, SPF-included products are expected to command 55.7% share in the Pollution-Fighting Urban Skincare Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Smart Urban Infrastructure Deployment Market Insights - Trends & Forecast 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA