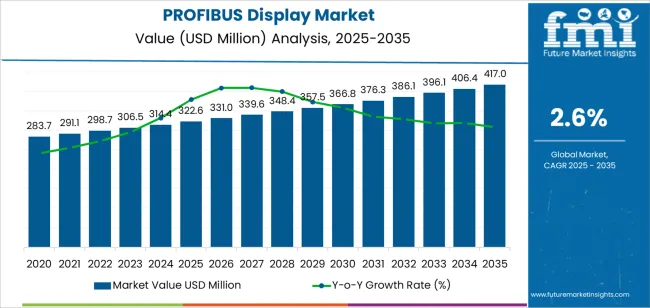

The PROFIBUS display market is forecast to grow from USD 322.6 million in 2025 to USD 417 million by 2035, reflecting a CAGR of 4.3%. Demand growth is primarily driven by the increasing adoption of industrial automation and the rising demand for advanced display solutions in manufacturing and process control environments. PROFIBUS, a widely used communication protocol for automation systems, relies on reliable and efficient display systems for real-time monitoring and control of industrial processes. As industries focus on enhancing operational efficiency, productivity, and safety, the need for high-quality, real-time displays integrated with PROFIBUS systems will continue to grow.

Technological advancements in display technologies and human-machine interfaces (HMIs), as well as the increasing shift towards smart factories, will further support market growth. The development of touchscreen displays, graphical user interfaces (GUIs), and wireless communication solutions will enhance the functionality and flexibility of PROFIBUS display systems. As the global manufacturing sector continues to digitize and automate, the demand for integrated display systems that offer seamless communication with PROFIBUS networks will drive the expansion of the market. Additionally, the increasing adoption of Industry 4.0 and smart manufacturing solutions will further fuel demand for reliable display systems in automated environments.

From 2025 to 2030, the market is expected to grow from USD 322.6 million to USD 366.8 million, an increase of USD 44.2 million. This growth will be driven by the continued digitalization of industries and the increased reliance on automated systems. As smart manufacturing and Industry 4.0 initiatives gain momentum, the need for reliable, real-time data visualization and control systems will continue to rise. The integration of PROFIBUS display systems with advanced HMIs and IoT devices will further accelerate market growth.

Between 2030 and 2035, the market will expand from USD 366.8 million to USD 417 million, adding USD 50.2 million in value. This phase will see an increase in the adoption of wireless and cloud-based display solutions as industries continue to evolve toward connected and intelligent systems. The push for greater operational efficiency and real-time monitoring will be key drivers in this period, ensuring sustained growth in the PROFIBUS display market through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 322.6 million |

| Market Forecast Value (2035) | USD 417 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The PROFIBUS display market is driven by the growing need for automation and real-time monitoring across industrial sectors such as factory automation, energy management, and smart buildings. As industries increasingly adopt Industrial Internet of Things (IIoT) and smart systems, the demand for visual displays that integrate seamlessly with industrial networks is expanding. PROFIBUS displays allow for efficient communication between devices and real-time data visualization, making them essential for monitoring machine performance, energy usage, and process control.

Additionally, industries are focusing on enhancing operational efficiency, and sustainability, leading to widespread adoption of PROFIBUS display solutions. The factory automation sector, in particular, is a major driver, with digital tube displays playing a critical role in process visualization. The demand for these displays is especially prominent in Asia-Pacific and Europe, where industrial automation and smart building technologies are growing rapidly. As IIoT continues to advance, the PROFIBUS display market is poised for steady growth, with increasing demand across various industrial applications, including warehousing and logistics.

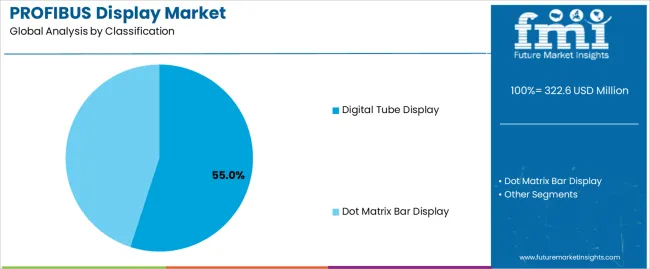

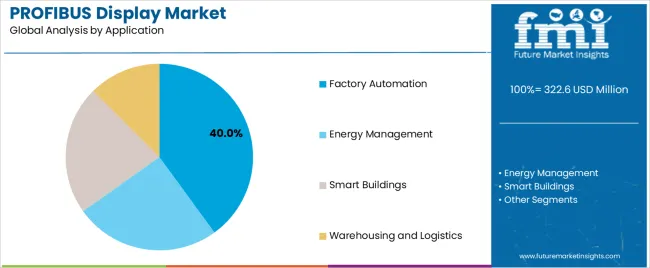

The PROFIBUS display market is segmented into machine type and application, with each segment reflecting unique demands across global industries. By machine type, the market is divided into digital tube displays and dot matrix bar displays, with digital tube displays leading the market share due to their superior visibility and clarity in industrial environments. By application, the market includes factory automation, energy management, smart buildings, and warehousing and logistics, with factory automation leading the market due to the increasing demand for real-time data visualization in industrial processes. The growth of these segments is seen in regions such as China, Germany, and India, where industrial automation is rapidly expanding.

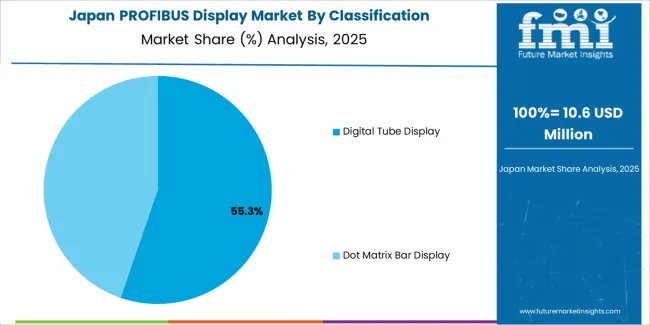

The digital tube display segment leads the PROFIBUS display market, commanding around 55% of the market share. This segment's dominance can be attributed to the clarity, brightness, and reliability of digital tube displays in industrial environments. Digital tube displays are particularly popular in sectors like factory automation, energy management, and smart buildings due to their high performance and versatility. In factory automation, these displays are used for monitoring critical processes and providing real-time feedback on machine performance, making them ideal for automated systems that require constant, reliable data visualization.

These displays also offer high energy efficiency, a key factor as industries seek solutions that reduce their operational costs and environmental footprint. In addition, digital tube displays are preferred for their durability under extreme conditions such as high temperatures, vibrations, and exposure to industrial pollutants, which is crucial for operations in manufacturing and industrial plants. As automation and industrial IoT continue to grow, the demand for digital tube displays will remain strong, maintaining their leadership in the PROFIBUS display market for years to come.

The factory automation segment is the leading application in the PROFIBUS display market, accounting for 40% of the total market share. This dominance is driven by the increasing demand for advanced control systems and real-time data monitoring in manufacturing environments. As industries around the world continue to adopt automation technologies to enhance operational efficiency, the demand for visual display systems that can provide immediate, accurate feedback on industrial processes is growing rapidly. PROFIBUS displays are integral to factory automation because they offer a reliable, easily readable interface for monitoring complex industrial systems, including production lines, machine health, and energy consumption.

These displays help operators detect issues early, improving uptime and preventing costly production delays. Additionally, digital tube displays are particularly valued in factory automation applications because of their brightness, clarity, and long lifespan, which are necessary for the demanding conditions of industrial settings. With the increasing trend of smart manufacturing and the adoption of Industrial Internet of Things (IIoT), the factory automation segment will continue to be the dominant driver of the PROFIBUS display market as industries invest in more automated systems that rely on efficient and reliable data visualization.

The PROFIBUS display market is driven by increasing demand for industrial automation, real-time data visualization, and smart manufacturing solutions. The widespread adoption of PROFIBUS displays in sectors like factory automation, energy management, and smart buildings is further fueled by the need for energy-efficient systems and cost-effective packaging. As industries embrace IIoT technologies and automation, PROFIBUS displays are becoming an essential component of modern industrial networks, providing businesses with enhanced process monitoring and data-driven insights.

What are the key drivers of the PROFIBUS display market?

The primary drivers of the PROFIBUS display market include the rapid adoption of automation and real-time monitoring systems in industrial settings. The need for advanced control systems in factory automation and energy management is pushing the demand for PROFIBUS display solutions, as they provide clear, immediate feedback and data visualization. Additionally, the growing trend toward smart buildings and the increasing implementation of IoT devices in industrial systems are contributing to the market’s expansion. Furthermore, the demand for eco-friendly and sustainable solutions that improve operational efficiency is driving the adoption of energy-efficient displays in industrial processes.

What are the key restraints in the PROFIBUS display market?

Despite the growth prospects, the PROFIBUS display market faces several restraints. The high initial cost of PROFIBUS display systems can deter smaller manufacturers from adopting these solutions. Additionally, the integration complexity with existing industrial systems and the need for skilled labor to operate and maintain these systems can be barriers to entry, particularly in developing markets. Furthermore, while digital tube displays are widely used, dot matrix bar displays still face competition from alternative visual display technologies, potentially limiting their growth within specific industries.

What are the key trends in the PROFIBUS display market?

Key trends in the PROFIBUS display market include the growing integration of IIoT and smart technologies into industrial display systems. As industries become more connected and data-driven, the need for real-time data visualization in automated control systems continues to grow. Another trend is the increasing adoption of eco-friendly and energy-efficient display technologies, with a focus on sustainability. Additionally, there is a rise in demand for customizable and flexible displays, particularly in smart buildings and warehouse management, where visual systems must adapt to varying environmental conditions and business needs.

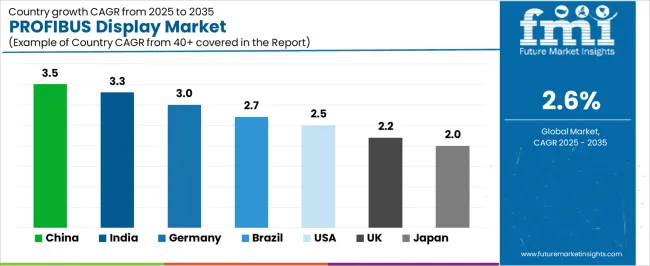

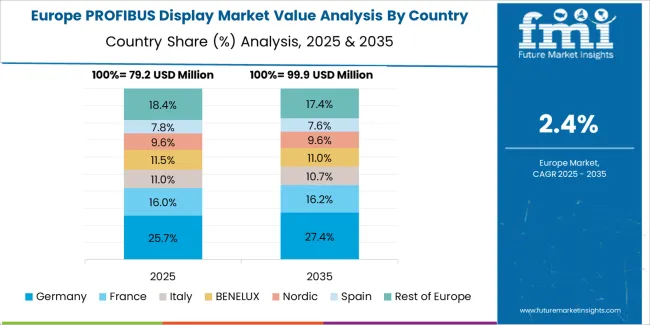

The PROFIBUS display market is experiencing varied growth across countries, with each nation showing distinct trends based on its industrial automation needs, manufacturing sector development, and technological advancements. Understanding the compound annual growth rates (CAGR) for the PROFIBUS display market in different countries helps identify key markets and provides valuable insights for investors, manufacturers, and stakeholders. This analysis highlights how each country's industrial base, commitment to automation, and adoption of smart technologies influence the market for PROFIBUS displays. Countries like China and India are experiencing significant growth due to their expanding industrial sectors, while developed markets like the USA and Germany show steady growth fueled by innovation and digital transformation.

| Country | CAGR (%) |

|---|---|

| China | 3.5% |

| India | 3.3% |

| Germany | 3% |

| Brazil | 2.7% |

| USA | 2.5% |

| United Kingdom | 2.2% |

| Japan | 2% |

China is leading the PROFIBUS display market with a CAGR of 3.5%. The country’s rapid industrialization and significant investments in automation are the primary drivers of this growth. China’s manufacturing sectors, such as automotive, electronics, and chemicals, are increasingly adopting PROFIBUS systems to streamline communication within automated environments. As the country moves towards Industry 4.0, the demand for efficient, high-speed communication systems, like PROFIBUS, has risen substantially. Additionally, the increasing adoption of smart factory technologies and the Internet of Things (IoT) in Chinese industries are fueling this trend. With robust government support for industrial modernization and sustainable growth, China is expected to maintain its dominant position in the global PROFIBUS display market, driving consistent demand for automation solutions and related technologies.

India’s PROFIBUS display market is growing at a CAGR of 3.3%, reflecting the country’s ongoing industrial growth and increased adoption of automation technologies. India’s manufacturing sector, especially in industries such as pharmaceuticals, automotive, and food processing, is rapidly modernizing and adopting smart factory solutions, creating significant demand for PROFIBUS systems. The country’s focus on infrastructure development and digital transformation is accelerating the demand for communication technologies that can facilitate seamless data exchange across automated systems. With the increasing need for efficiency, cost reduction, and real-time data analytics, industries in India are looking toward advanced communication protocols like PROFIBUS to drive productivity. The market is expected to continue expanding as India prioritizes automation and innovation across its industrial sectors.

Germany’s PROFIBUS display market is expected to grow at a CAGR of 3%, supported by its strong industrial base and commitment to automation. As one of the world’s leading manufacturing hubs, Germany’s sectors like automotive, machinery, and chemicals require robust communication systems to enable seamless data exchange in highly automated environments. The country’s push towards digitalization, particularly within Industry 4.0 initiatives, is a significant driver of demand for PROFIBUS systems. Moreover, Germany’s dedication to technological innovation and sustainable manufacturing processes ensures that industries continue to invest in advanced automation solutions. Despite a relatively lower growth rate compared to emerging economies, Germany’s sophisticated industrial landscape, strong R&D focus, and leadership in automation will continue to support steady demand for PROFIBUS displays in the long term.

Brazil’s PROFIBUS display market is projected to grow at a CAGR of 2.7%. The country’s growing industrial automation needs, particularly in manufacturing and energy sectors, are driving the demand for PROFIBUS systems. As Brazil continues to modernize its industrial base, companies are increasingly seeking efficient and cost-effective automation solutions to enhance productivity and operational efficiency. The rise of smart factories and IoT technologies in Brazil is accelerating the adoption of communication protocols like PROFIBUS, which enable real-time data exchange between automated systems. Despite economic challenges, Brazil’s focus on infrastructure development and industrial growth presents a promising opportunity for automation technologies, including PROFIBUS displays, to play a crucial role in supporting the country’s industrial evolution.

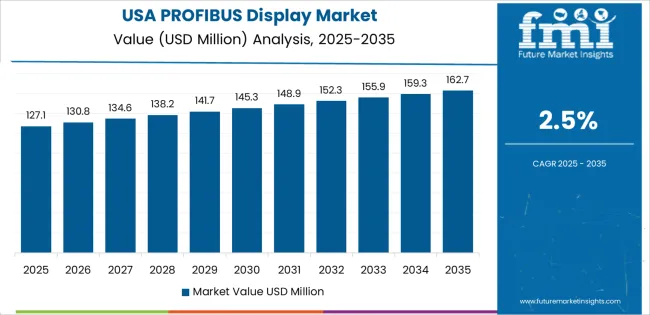

The United States has a projected CAGR of 2.5% for the PROFIBUS display market. As one of the leaders in industrial automation, the USA is home to a large and diverse manufacturing sector, including automotive, aerospace, and energy, which relies heavily on automation technologies. The demand for PROFIBUS displays in the USA is driven by the need for efficient and reliable communication systems that enable seamless integration of automated systems. The country’s emphasis on smart manufacturing, digital transformation, and Industry 4.0 initiatives is fostering the growth of communication technologies like PROFIBUS. Though the USA market may not grow as rapidly as some emerging economies, its established infrastructure and continued focus on innovation will drive steady demand for PROFIBUS systems, particularly in high-tech manufacturing sectors.

In the United Kingdom, the PROFIBUS display market is growing at a CAGR of 2.2%. The UK’s industrial base, particularly in manufacturing and energy, continues to adopt automation solutions, driving demand for advanced communication systems. Despite the challenges posed by Brexit, the UK’s commitment to digital transformation and smart manufacturing has spurred interest in PROFIBUS displays, which enable efficient data exchange in automated systems. The demand for PROFIBUS systems is also supported by the country’s ongoing push toward sustainability and energy-efficient manufacturing. As the UK works to modernize its industries and remain competitive on the global stage, the PROFIBUS display market is expected to experience steady, albeit moderate, growth in the coming years.

Japan’s PROFIBUS display market is projected to grow at a slower pace with a CAGR of 2%. Japan’s advanced manufacturing sector, particularly in robotics, automotive, and electronics, continues to drive demand for automation technologies. While Japan is known for its sophisticated industrial systems, the growth rate for PROFIBUS displays is relatively slow due to the country’s preference for localized automation technologies and communication protocols. Nonetheless, Japan’s emphasis on automation, IoT integration, and digital transformation will continue to support steady demand for PROFIBUS systems. As industries in Japan focus on increasing efficiency and reducing operational costs, the demand for high-performance communication systems like PROFIBUS will remain a key element of the country's industrial strategy.

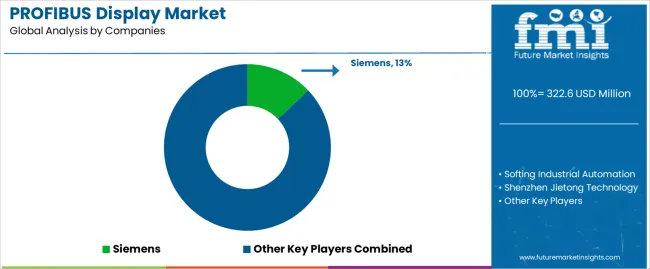

The PROFIBUS display market is competitive, with several global leaders vying for market share. Key players such as Siemens, which holds around 13% of the market, dominate the industry by offering high-quality, customizable PROFIBUS displays tailored for industries like factory automation, energy management, and smart buildings. Siemens has a strong foothold in the market due to its robust product portfolio, cutting-edge technology, and its global presence. Other companies such as Softing Industrial Automation, Shenzhen Jietong Technology, and BAUER KOMPRESSOREN also play significant roles in this market, focusing on innovation and regional expansion. These companies leverage their extensive research and development capabilities to create cost-effective, high-performance solutions that cater to the increasing demand for automated control systems.

Smaller regional players, like DITEL, microSYST Systemelectronic, and MTL INSTRUMENT, also contribute to the market’s growth by focusing on specific applications and providing specialized solutions to niche sectors. These companies often prioritize affordability, customization, and local service support, allowing them to cater to both emerging markets and highly specialized industries. The market is seeing increased mergers, partnerships, and collaborations as companies look to enhance their market share through technological advancements and regional expansion. As industries worldwide continue to embrace digital transformation and smart systems, the competitive landscape will evolve, driven by innovation and differentiation in PROFIBUS display solutions.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | China, India, Germany, Brazil, USA, UK, Japan |

| Classification | Digital Tube Display, Dot Matrix Bar Display |

| Application | Factory Automation, Energy Management, Smart Buildings, Warehousing and Logistics |

| Key Companies Profiled | Siemens, Softing Industrial Automation, Shenzhen Jietong Technology, BAUER KOMPRESSOREN, BEKA, DITEL, microSYST Systemelectronic, MTL INSTRUMENT, Orbit Merret, SENSY S.A., Shanghai Nanhua Electronics Company, Siebert Industrieelektronik, UTICOR Automation, VISUAL ELECTRONIC, WIBOND Informationssysteme GmbH |

| Additional Attributes | The market analysis includes dollar sales by classification and application categories. It also covers regional adoption trends across major markets like China, India, Germany, and the USA. The competitive landscape features key manufacturers in the PROFIBUS display industry, focusing on innovations in digital tube and dot matrix bar displays. Trends in factory automation, energy management, and smart buildings are explored, with a focus on advancements in display technologies and integration with industrial communication systems. |

The global profibus display market is estimated to be valued at USD 322.6 million in 2025.

The market size for the profibus display market is projected to reach USD 417.0 million by 2035.

The profibus display market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in profibus display market are digital tube display and dot matrix bar display.

In terms of application, factory automation segment to command 40.0% share in the profibus display market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Shelf Display Trays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA