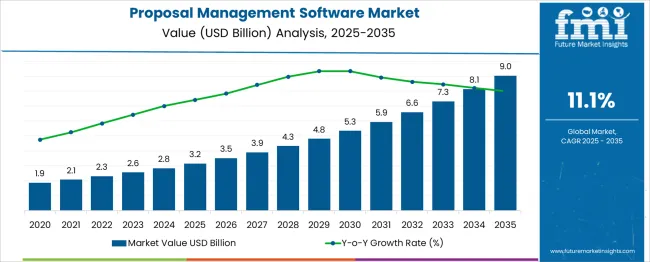

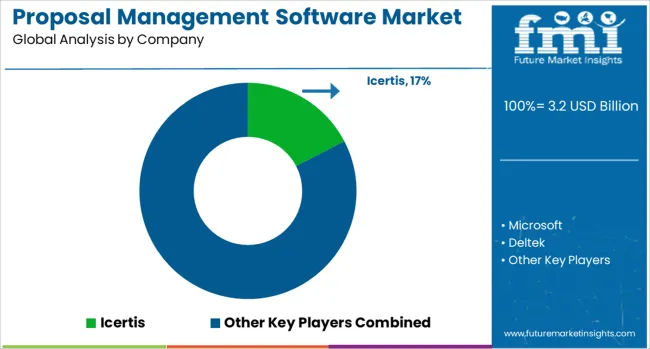

The Proposal Management Software Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period.

| Metric | Value |

|---|---|

| Proposal Management Software Market Estimated Value in (2025 E) | USD 3.2 billion |

| Proposal Management Software Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 11.1% |

The increasing adoption of cloud-based services is anticipated to play a key role in strengthening the global proposal management software market during the forecast period. Also, the growing application of Internet of Things (IoT) services has resulted in the generation of a massive number of data.

The surging adoption of big data and social media platforms has generated a significant need amongst organizations to adopt data analytics software. Integration of modern technologies in organizations helps enterprises to enhance their operations and sustain the rising competition in the market.

The launch of new products in the market is expected to propel the industry expansion in the forecast period. For instance, in August 2024, Frequence, an advertising sales automation leader and workflow software, announced the launch of SmartProposals.

It is a first-of-its-kind technology that uses real-time deal-close and campaign performance data to provide and increase local-market media campaign proposals. It observes millions of data points from an ample number of media campaigns to produce efficient and capable campaign proposals that allow media sellers to generate more revenue. Such product launches are expected to assist the industry expansion during the forecast period.

Other benefits of using an AI-based proposal management software market include increased compatibility, enhanced reliability, and security, among others. Owing to the aforementioned factors, the market is poised to witness notable growth in the assessment tenure.

Growing innovations along with modernization in technology are expected to offer various opportunities for expansion in the coming time. Rapid digitization of BFSI has been identified as the most lucrative opportunity prevailing in the market in the assessment period.

The benefits of using cloud-based software in BFSI are anticipated to drive the market in the forecast period. Innovative customer experiences, efficient collaboration, and better relationships with clients are some of the advantages offered, strengthening the market in the forecast period.

In addition, favorable initiatives taken by players are likely to benefit the market. For instance, in April 2025, Intellect Global Transaction Banking (iGTB) announced that it would integrate Microsoft Cloud for Financial Services to enhance cloud adoption and digital transformation incentives of corporate banks. Such initiatives adopted in the sector are anticipated to propel the industry in the assessment period.

Also, rising financial inclusivity, especially across developing nations is likely to act as a significant opportunity for the market. Favorable initiatives taken by the government are likely to support market growth in the coming time. For instance, the launch of Digital India by the Government of India will benefit the BFSI sector and market in the region during the forecast period.

Concerns regarding data privacy and security concerns are expected to hamper the market growth in the forecast period. Cyber security risks like malware attacks and vulnerabilities in cloud-based applications are projected to have a negative impact on market growth.

As the popularity of IoT and cloud technologies is increasing, enterprises are looking for secure methods to protect themselves from growing vulnerabilities and security breaches. Moreover, such software is deployed on the cloud owing to the proliferation of SaaS-based applications, which also have various security issues since the data on the cloud is a cyber-security concern.

However, the integration of AI for proposal management software can help in tackling such challenges. Also, the launch of products by players is likely to assist organizations in countering such situations.

For instance, in May 2020, Icertis announced the acquisition of a security instrumentation player, called, Verodin. Verodin integrated with FireEye Helix’s security orchestration capabilities to assist its customers to automate and prioritize the improvement of security controls. Such initiatives are anticipated to help the market grow in the coming time.

Based on components, the software segment is anticipated to lead the global proposal management market during the forecast period. The segment is expected to expand at a CAGR of 10.9% during the forecast period.

Expansion of the segment can be attributed to the growing innovations in various sectors, such as; IT & Telecom, and BFSI. With rapid digitization and increasing adoption of cloud-based software, the segment is expected to augment notably in the forthcoming time. Moreover, growing innovation and rising investment in Research and Development are expected to offer various lucrative opportunities to the market in the forecast time.

Based on deployment, the on-premises segment is anticipated to lead the global proposal management market. The segment is expected to witness a growth rate of 10.1% during the forecast period.

The expansion of the segment can be attributed to cost efficiency. Also, the wide adoption of such solutions by SMEs is another factor propelling the segmental growth during the forecast period.

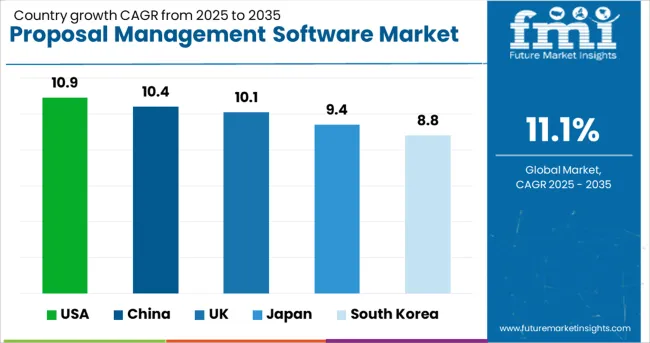

As per the analysis, the global market for proposal management software is anticipated to be dominated by North America during the forecast period. The USA is projected to take the lead in the region while exhibiting a CAGR of 10.9%, garnering a market value of USD 9 Billion by 2035. The growth of the regional market can be attributed to the rapid adoption of modern technologies by established players in the region.

High disposable income and the presence of established players in the region are some of the important factors driving the global proposal management software market in the forecast period. Also, the stable economy, developed infrastructure, and growing initiatives to reduce paper waste are other salient factors strengthening the industry in the region.

In addition, with the growing demand for transparency and visibility, the growth of the proposal management software market is affirmative in North America in the forecast period.

Asia Pacific has been identified as the most lucrative market during the forecast period. As per the analysis, China is expected to dominate the market during the forecast period. The region is likely to procure USD 475.2 Million while expanding at a CAGR of 10.4% by 2035.

Other lucrative regions, Japan and South Korea have been estimated at US$ 383.2 Million and US$ 239.1 Million respectively. The growth of the regional market can be attributed to the increasing deployment of cloud-based software in various organizations. And also, the growing initiatives of digitization by the government of several developing countries such as; India, China, and others are expected to support the market expansion in the forecast tenure.

| Countries | Estimated CAGR |

|---|---|

| USA | 10.9% |

| UK | 10.1% |

| China | 10.4% |

| Japan | 9.4% |

| South Korea | 8.8% |

Key players in the global proposal management software market are Microsoft, WeSuite, Icertis, Deltek, and GetAccept.

Recent developments in the Industry are as follows:

The global proposal management software market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the proposal management software market is projected to reach USD 9.0 billion by 2035.

The proposal management software market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in proposal management software market are software, services, _deployment and integration, _consulting and _support and maintenance.

In terms of vertical, government segment to command 22.8% share in the proposal management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA