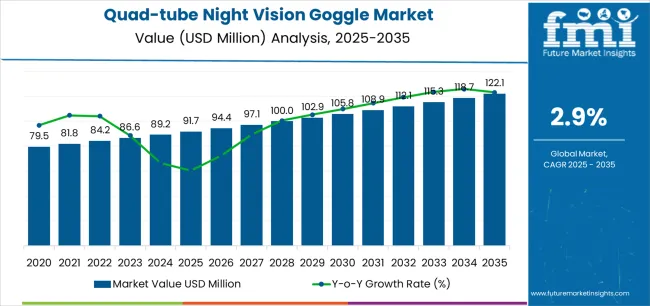

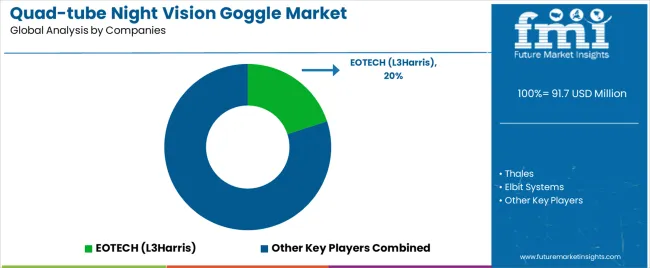

The global quad-tube night vision goggle market is valued at USD 91.7 million in 2025 and is projected to reach USD 122.1 million by 2035, advancing at a CAGR of 2.9%. Analysis shows gradual and stable growth, supported by the continued adoption of multi-tube night vision systems in defense, law enforcement, and tactical surveillance operations. The shift from dual-tube to quad-tube configurations provides wider field coverage and improved depth perception, enhancing situational awareness during low-light missions.

Manufacturers are focusing on compact housing, lightweight composite materials, and power-efficient image intensifier technology to optimize field performance. Integration of digital imaging enhancements, including auto-gating and infrared compatibility, is broadening usability in both military and specialized civilian applications. Modular assembly designs also facilitate maintenance and component replacement, extending operational life and reducing field downtime.

North America remains the primary market due to sustained defense procurement and modernization programs. Europe follows with a consistent replacement cycle across special operations and border patrol units. Asia Pacific exhibits moderate but rising demand linked to increased defense spending and tactical training initiatives. Through 2035, component durability, optical clarity, and supply chain coordination will remain central to maintaining consistent production and deployment efficiency.

Between 2025 and 2030, the Quad-Tube Night Vision Goggle Market is projected to rise from USD 91.7 million to USD 105.8 million, reflecting a 15.4% increase and accounting for 45.9% of the decade’s total expansion. Growth during this period will be supported by rising defense modernization initiatives, increased tactical operations requiring enhanced situational awareness, and the growing use of advanced imaging technologies. The quad-tube configuration provides a wider field of view and superior depth perception compared to traditional dual-tube systems, making it the preferred choice for elite military and law enforcement units. Manufacturers are focusing on weight reduction, power efficiency, and image clarity improvements to enhance operational performance.

From 2030 to 2035, the market is forecast to expand from USD 105.8 million to USD 122.1 million, marking a 15.4% increase and contributing 54.1% of the total decade’s growth. This phase will be characterized by technological innovation in sensor miniaturization, low-light amplification, and digital night vision capabilities. Increasing adoption in homeland security, border surveillance, and special operations will continue to propel demand. Strategic collaborations between optical technology developers and defense contractors will enable the integration of augmented reality overlays, advanced infrared systems, and lightweight composite housings, ensuring the next generation of night vision goggles meets evolving mission and operational standards.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 91.7 million |

| Market Forecast Value (2035) | USD 122.1 million |

| Forecast CAGR (2025 to 2035) | 2.9% |

The quad-tube night vision goggle market is advancing as military and law enforcement organizations prioritize expanded field awareness and improved low-light visual performance. Unlike dual-tube systems, quad-tube configurations provide a panoramic view with minimal blind zones, enabling operators to detect movement and navigate terrain more effectively during night missions. This wider field of vision offers tactical advantages in surveillance, reconnaissance, and close-quarter engagements where spatial perception directly influences operational safety and coordination.

Defense procurement programs in the United States, Europe, and Asia-Pacific regions increasingly specify quad-tube designs to enhance situational awareness for infantry and special operations units. Manufacturers focus on reducing weight, improving battery efficiency, and integrating image intensifier tubes with higher signal-to-noise ratios for clearer imaging in starlight or overcast conditions. The combination of advanced optics, ruggedized housings, and mounting compatibility with modern helmets supports field versatility. Expanding applications in border security, counter-terrorism, and search-and-rescue operations also contribute to market growth. However, high production costs and stringent export controls restrict broader civilian and commercial adoption. Ongoing research into digital-fusion night vision and thermal overlay technologies continues to define next-generation quad-tube systems, reinforcing their role in precision night-time operations worldwide.

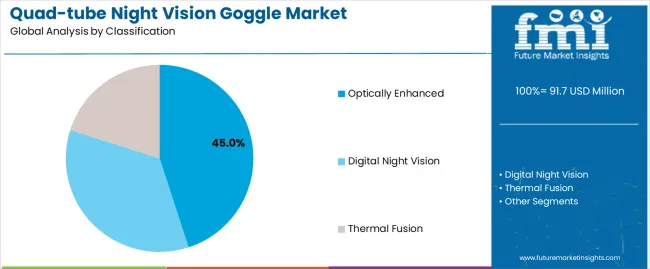

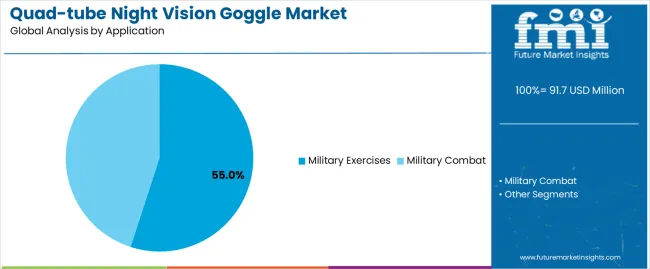

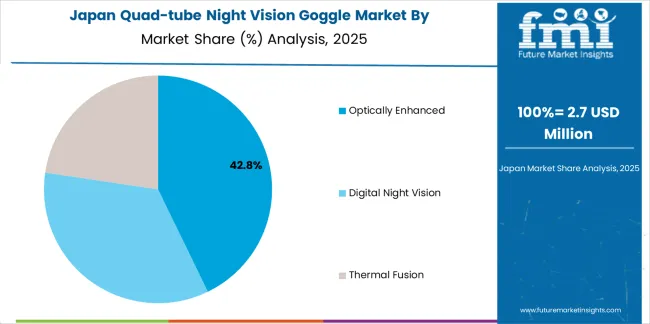

The quad-tube night vision goggle market is segmented by classification, application, and region. By classification, the market is divided into optically enhanced, digital night vision, and thermal fusion systems. Based on application, it is categorized into military exercises and military combat. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments collectively outline product differentiation, operational environments, and regional defense procurement patterns defining market distribution worldwide.

The optically enhanced segment accounts for approximately 45.0% of the global quad-tube night vision goggle market in 2025, representing the leading classification category. This dominance is driven by the segment’s widespread adoption within defense and tactical operations where image intensification remains the standard technology for low-light visibility. Optically enhanced goggles utilize advanced image intensifier tubes to amplify ambient light, providing high-resolution night vision with minimal latency and superior depth perception.

These systems are favored for their reliability, optical clarity, and independence from digital processing delays, making them suitable for complex mission environments. Their four-tube design enhances field of view, improving situational awareness in coordinated movement and surveillance operations. Continuous improvements in image tube sensitivity and power efficiency have extended operational endurance and image contrast. The segment maintains strong market presence in military and law enforcement procurement programs prioritizing proven optical performance under varying light conditions. While digital and thermal fusion systems are advancing, optically enhanced models continue to dominate due to their established operational record, compatibility with existing helmet mounts, and maintenance simplicity within field-deployed environments.

The military exercises segment represents about 55.0% of the total quad-tube night vision goggle market in 2025, making it the largest application category. Its leadership reflects ongoing demand for training and simulation systems supporting large-scale defense readiness operations. Night vision goggles are routinely used during tactical exercises, field maneuvers, and joint operations to simulate combat conditions, allowing personnel to build proficiency in night-time situational awareness and coordination.

This segment’s growth is supported by regular procurement cycles from defense organizations seeking durable, field-ready optical systems for repeated use. Military training programs prioritize optically enhanced and digital models for familiarization with mission-grade night vision technology. The segment’s demand is particularly strong in North America and Europe, where structured night training forms a key component of tactical preparedness programs. Advances in ruggedized design, optical calibration accuracy, and battery performance have further strengthened product reliability in extended training conditions. The military exercises segment continues to dominate overall market demand, as global armed forces emphasize realistic simulation environments and consistent optical training tools to maintain operational readiness and visual performance across diverse low-light scenarios.

The quad-tube night vision goggle market is growing as defense and security forces seek wider field-of-view and enhanced situational awareness during low-light operations. These systems, featuring four image-intensifier tubes, provide greater peripheral vision and depth perception compared to conventional binocular or monocular night vision devices. Expansion in modernization programs, tactical missions, and border surveillance operations supports market growth. However, high procurement cost, limited commercial application, and export restrictions constrain broader adoption. The market is trending toward lighter designs, integrated digital features, and improved ergonomic performance to enhance comfort, efficiency, and adaptability for military users.

Market growth is driven by increased investment in defense modernization and the growing demand for advanced night-vision capabilities among special operations units. The wider field of view and improved spatial orientation provided by quad-tube systems enhance operational safety and mission efficiency. Rising global security challenges, night-time reconnaissance activities, and counter-terrorism missions are expanding demand for high-precision optical systems. Additionally, technological improvements in sensor quality, power efficiency, and mounting systems encourage adoption among elite forces seeking enhanced visual awareness in complex operational environments.

High acquisition cost and technical complexity remain key barriers to widespread use of quad-tube night vision goggles. The production of multi-tube optical assemblies requires advanced manufacturing processes, which increase overall system cost. Weight and power-consumption issues also affect long-term operational comfort and mobility. Many defense organizations continue to rely on dual-tube or monocular systems that provide sufficient capability at lower cost. Export regulations, supply chain dependencies, and maintenance challenges further limit adoption, particularly among smaller or budget-constrained defense forces seeking cost-effective alternatives.

The market is shifting toward more compact, lightweight, and digitally integrated quad-tube systems that improve comfort and performance. Manufacturers are developing models with enhanced image intensification, modular configurations, and hybrid optical-digital processing. Integration of thermal imaging and augmented-reality overlays is gaining prominence, creating multifunctional visual systems suited to diverse mission profiles. Regional diversification is accelerating as defense procurement programs expand in Asia-Pacific and Europe. Increased collaboration between optics manufacturers and defense research agencies is promoting innovation, ensuring future quad-tube designs align with evolving tactical and environmental requirements.

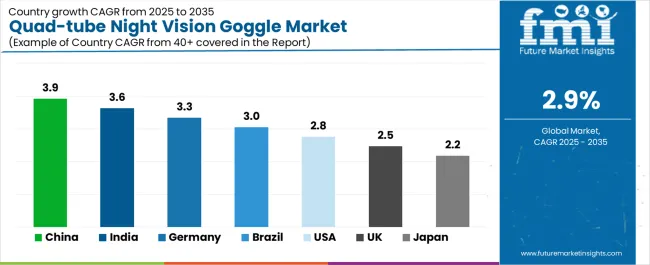

| Country | CAGR (%) |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| Brazil | 3.0% |

| USA | 2.8% |

| UK | 2.5% |

| Japan | 2.2% |

The quad-tube night vision goggle market is expanding at a moderate pace globally, with China leading at a 3.9% CAGR through 2035, driven by defense modernization, domestic manufacturing capabilities, and technological integration in surveillance systems. India follows at 3.6%, supported by increased defense procurement and research initiatives focused on tactical vision equipment. Germany records 3.3%, benefiting from advanced optics engineering and precision component development. Brazil grows at 3.0%, propelled by security upgrades and law enforcement applications. The USA, at 2.8%, maintains a mature market emphasizing product innovation and military-grade upgrades, while the UK (2.5%) and Japan (2.2%) experience steady growth through R&D collaboration, miniaturization, and focus on performance optimization in low-light operational technologies.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from quad-tube night vision goggles in China is projected to grow at a CAGR of 3.9% through 2035, supported by ongoing defense modernization and investment in advanced night vision technologies. The country’s focus on improving ground troop situational awareness and surveillance capabilities is driving procurement of multi-tube optical systems. Domestic manufacturers are developing image intensifier tubes and digital fusion optics to strengthen tactical performance. Increased integration of night vision systems across armored and infantry units continues to sustain market demand.

Revenue from quad-tube night vision goggles in India is increasing at a CAGR of 3.6%, supported by indigenous defense manufacturing and modernization programs. The government’s focus on equipping special forces and infantry units with advanced imaging systems promotes steady procurement. Partnerships between public defense organizations and private optics firms are enhancing local production capabilities. Import substitution efforts under national defense initiatives continue to drive development of electro-optical components.

Revenue from quad-tube night vision goggles in Germany is advancing at a CAGR of 3.3%, supported by established expertise in optical engineering and production of high-performance imaging systems. Defense contractors and security agencies are adopting quad-tube designs for enhanced field coverage and low-light accuracy. Manufacturers emphasize image clarity, ergonomic balance, and integration with digital targeting systems. Adherence to NATO and EU defense standards ensures product reliability and export compatibility.

Revenue from quad-tube night vision goggles in Brazil is projected to grow at a CAGR of 3.0%, supported by expanding defense procurement and modernization of surveillance operations. Military and law enforcement agencies are incorporating night vision systems into reconnaissance and border control activities. Collaboration with international suppliers facilitates access to advanced optical systems. Steady investment in tactical equipment modernization sustains procurement cycles.

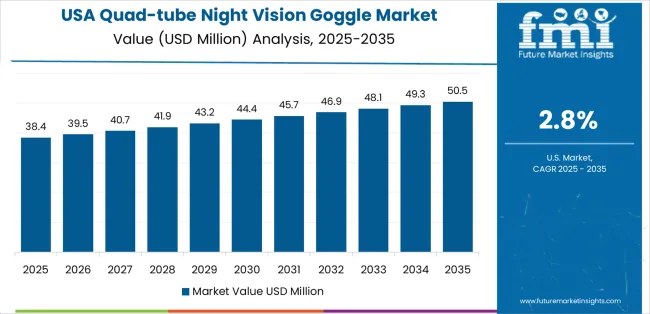

Revenue from quad-tube night vision goggles in the United States is increasing at a CAGR of 2.8%, supported by the country’s continuous defense technology renewal and focus on special operations capability. The USA military’s adoption of panoramic night vision systems enhances situational awareness in complex environments. Manufacturers are improving sensor resolution, image fusion, and ergonomic efficiency. Continuous procurement for training and operational readiness sustains stable market activity.

Revenue from quad-tube night vision goggles in the United Kingdom is advancing at a CAGR of 2.5%, supported by standardization in defense equipment and modernization of special forces technology. Procurement programs emphasizing interoperability and field adaptability are promoting steady adoption. Local manufacturers and defense contractors focus on lightweight designs and digital interface improvements. Collaboration with allied nations ensures product compatibility across joint operations.

Revenue from quad-tube night vision goggles in Japan is projected to grow at a CAGR of 2.2%, supported by precision optics engineering, defense modernization, and homeland security enhancement. Demand is concentrated within self-defense and maritime security operations. Domestic optical manufacturers focus on compact system design, image stability, and integration with helmet-mounted platforms. Long-term defense procurement strategies maintain steady utilization across specialized units.

The global quad-tube night vision goggle market is moderately concentrated, shaped by defense technology integrators and optical device manufacturers specializing in low-light imaging systems. EOTECH (L3Harris) leads with an estimated 20% market share, supported by extensive experience in image intensification technology and integration of ruggedized quad-tube systems for military and tactical applications. Thales and Elbit Systems hold strong positions through advanced night vision platforms incorporating multispectral sensors and digital fusion technologies tailored for defense forces in Europe and the Middle East.

Rosoboronexport maintains regional influence as a key exporter of optical and night vision systems for Eastern and Central Asian defense markets. BEL contributes within India’s defense sector through localized production and modernization programs for surveillance and infantry equipment. Photonis Defense and Newcon Optik focus on high-performance image intensifiers and optical modules designed for special operations and border surveillance. Tonbo Imaging emphasizes sensor fusion and lightweight optical systems for tactical mobility. Shenzhen Detyl Optoelectronics, Tianjin Argus Technology Development, and Yunnan Innovatech represent China’s expanding industrial capacity, producing cost-competitive quad-tube goggles for domestic and export demand. Beijing LSJ Technology Development, Qingdao Yizhuo Optoelectronic Technology, Zhongshang Dingsheng Investment Group, Nanyang Lindu Optics Tech, and Yunnan Yuanjin Optical strengthen the regional supply network through contract manufacturing and optical assembly. Competitive advantage in this market is defined by image clarity, power efficiency, and ergonomic integration, while sustained differentiation relies on digital enhancement, sensor miniaturization, and system interoperability with modern battlefield platforms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Classification) | Optically Enhanced, Digital Night Vision, Thermal Fusion |

| Application | Military Exercises, Military Combat |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | EOTECH (L3Harris), Thales, Elbit Systems, Rosoboronexport, BEL, Photonis Defense, Newcon Optik, Tonbo Imaging, Shenzhen Detyl, Tianjin Argus, Yunnan Innovatech |

| Additional Attributes | Dollar sales by classification and application; field-of-view vs. weight trade-offs; image intensifier tube performance; battery life and power management; helmet-mount compatibility and ergonomics; export controls and defense procurement cycles; integration with thermal/AR fusion; maintenance/sustainment networks; domestic production initiatives and certification standards. |

The global quad-tube night vision goggle market is estimated to be valued at USD 91.7 million in 2025.

The market size for the quad-tube night vision goggle market is projected to reach USD 122.1 million by 2035.

The quad-tube night vision goggle market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in quad-tube night vision goggle market are optically enhanced, digital night vision and thermal fusion.

In terms of application, military exercises segment to command 55.0% share in the quad-tube night vision goggle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision System Market Growth - Trends & Forecast 2024 to 2034

Night Vision Device Market

Over-night Hair Treatment Products Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Market

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Retinoid-Infused Night Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Protective Goggles Market

Vision Screener Market Size and Share Forecast Outlook 2025 to 2035

Vision Care Market Size and Share Forecast Outlook 2025 to 2035

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Vision Sensor Market by Type, Application, End user and Region through 2035

Revision Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

Television Broadcasting Services Market Insights – Growth & Forecast 2023-2033

Television Services Market

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA