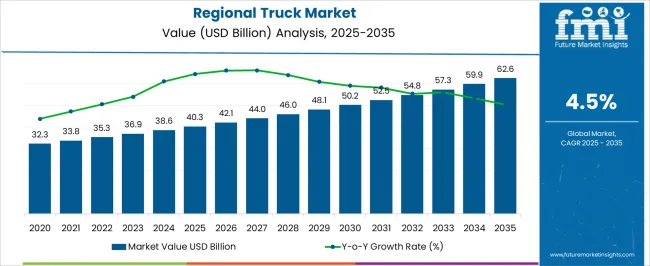

The regional truck market is projected to expand consistently, moving from USD 32.3 billion in 2025 to nearly USD 62.6 billion by 2040, registering a compound annual growth rate (CAGR) of 4.8%. In the first growth phase from 2025 to 2030, the market advances from USD 32.3 billion to USD 40.3 billion, supported by rising freight transportation demand across short- and medium-haul routes, coupled with infrastructure upgrades in key regions. Strong growth in e-commerce and logistics operations also boosts adoption of regional trucks, as companies seek efficient and reliable fleet options for timely delivery. Between 2031 and 2035, the market value climbs from USD 42.1 billion to USD 52.5 billion, propelled by stricter emission standards, fleet modernization programs, and the transition towards alternative fuel-powered trucks that improve operational efficiency while reducing costs. Advanced driver assistance systems and digital fleet management solutions further accelerate market adoption during this period. By 2040, the regional truck market achieves USD 62.6 billion, reflecting continued expansion in domestic trade, rising investments in connected transport networks, and an increasing focus on electrification and hybridization of truck fleets. Growing preference for regional trucks as a cost-effective transport mode, especially in emerging economies, ensures their strong position across industries such as retail, manufacturing, and agriculture. This growth trajectory positions the regional truck segment as an essential driver of goods movement and logistics efficiency worldwide.

| Metric | Value |

|---|---|

| Regional Truck Market Estimated Value in (2025 E) | USD 40.3 billion |

| Regional Truck Market Forecast Value in (2035 F) | USD 62.6 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The regional truck market is witnessing steady expansion, largely influenced by the surge in regional logistics, e-commerce distribution, and infrastructure development. As fleet operators seek cost-effective, durable, and efficient transport solutions, regional trucks are increasingly preferred for their operational balance between heavy-duty capacity and short-haul efficiency.

This market is being driven by increasing freight movement within urban and peri-urban corridors, rising fleet replacement cycles, and heightened attention to total cost of ownership. Diesel and alternative fuel adoption strategies are shaping procurement choices, particularly as regional policies around emissions and fuel efficiency evolve.

Advanced telematics, vehicle diagnostics, and fleet management systems are being integrated to enhance operational visibility and driver productivity Over the next several years, the market is anticipated to grow steadily with greater emphasis on modular chassis design, hybrid fuel configurations, and connected vehicle technologies that improve uptime and reduce lifecycle costs, positioning regional trucks as a critical asset in modern supply chain ecosystems.

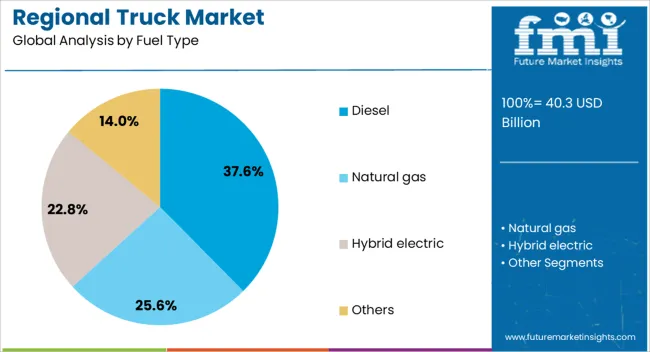

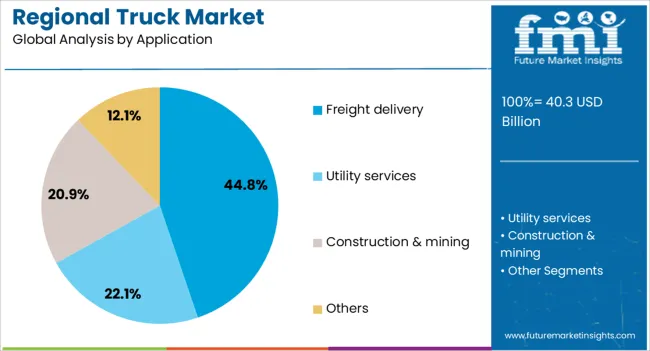

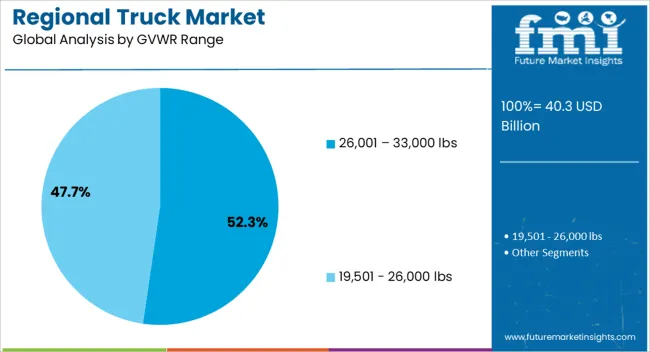

The regional truck market is segmented by fuel type, application, gvwr range, axle configuration, and geographic regions. By fuel type, regional truck market is divided into Diesel, Natural gas, Hybrid electric, and Others. In terms of application, regional truck market is classified into Freight delivery, Utility services, Construction & mining, and Others. Based on gvwr range, regional truck market is segmented into 26,001 – 33,000 lbs and 19,501 - 26,000 lbs. By axle configuration, regional truck market is segmented into 6X4, 4X2, and 6X6. Regionally, the regional truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The diesel fuel type segment is projected to hold 37.6% of the regional truck market revenue share in 2025, maintaining a substantial role in powering regional fleets. This segment's dominance is driven by the superior energy density, fueling infrastructure maturity, and torque delivery characteristics offered by diesel engines, which remain critical for medium-duty logistics operations.

Diesel regional trucks continue to serve a key function in long-duration, high-load applications where alternative fuel options may face range limitations or lack of fueling support. Additionally, recent advancements in emission control technologies, including selective catalytic reduction and diesel particulate filters, have allowed diesel trucks to comply with stringent environmental regulations without compromising performance.

The integration of electronic control modules and predictive maintenance capabilities in diesel-powered models has further enhanced fuel economy and reliability, supporting their sustained use in freight-intensive corridors With fleet operators prioritizing operational efficiency and fuel accessibility, diesel remains a practical and cost-effective solution in regional transport networks.

The freight delivery segment is expected to capture 44.8% of the total revenue share in the regional truck market by 2025, reinforcing its leading role in demand generation. This segment’s strength has been influenced by the explosive growth of regional distribution hubs, last-mile delivery expansion, and warehouse-to-retail logistics.

Regional trucks configured for freight delivery are being prioritized for their optimal payload capacity, maneuverability in mixed urban environments, and regulatory compliance with regional weight classifications. The increase in e-commerce fulfillment and just-in-time delivery models has intensified the demand for medium-duty trucks capable of frequent stops, route adaptability, and enhanced cargo security.

Technological upgrades such as GPS-enabled routing, load tracking systems, and automated braking have been instrumental in improving operational efficiency and delivery precision As retailers and logistics providers restructure supply chains around decentralized fulfillment models, regional freight delivery trucks are positioned to meet the growing expectations of speed, scalability, and cost-efficiency.

The gross vehicle weight rating range of 26,001 to 33,000 lbs is forecast to account for 52.3% of the regional truck market revenue in 2025, highlighting its position as the preferred weight class for regional haulage. This segment has gained traction due to its capacity to strike a balance between payload volume, fuel efficiency, and regulatory compliance, particularly in markets with distinct weight-based taxation or access regulations.

Trucks in this range are widely adopted by fleet operators for their versatility across freight delivery, construction supply, and utility services, providing the power needed for heavier regional loads while remaining operable under commercial driver licensing standards. This GVWR category supports optimal axle distribution, load management, and route planning for regional hauls that involve both highway and urban driving.

The ability to integrate advanced driver-assistance systems and telematics within this class has further improved safety, route optimization, and maintenance scheduling, reinforcing its value across dynamic fleet operations.

Regional trucks are gaining momentum as essential assets in freight distribution, infrastructure projects, and e-commerce. Their role in balancing efficiency, compliance, and flexible operations ensures steady growth across global logistics networks.

Regional trucks have become central to freight distribution, connecting production hubs, warehouses, and retail centers within short- to medium-haul routes. Their adoption is supported by rising e-commerce activity, increased FMCG distribution, and the growing need for reliable logistics between cities. These vehicles are optimized for frequent stops and shorter travel cycles, making them indispensable for businesses that rely on timely and high-volume delivery. Fleet operators are upgrading to more fuel-efficient and compliant models to handle higher load volumes. With supply chains becoming increasingly fragmented, regional trucks ensure continuity in logistics by bridging gaps where heavy-duty long-haul vehicles and lighter vans are less efficient.

Infrastructure projects have accelerated demand for regional trucks, as these vehicles serve construction, mining, and utility sectors that require dependable mid-capacity hauling solutions. Their flexibility to operate within city limits and across regional boundaries makes them preferred for transporting aggregates, equipment, and construction materials. Governments investing heavily in road construction and housing projects have reinforced the segment’s growth. Specialized configurations with tippers and flatbeds are also expanding adoption. Construction contractors and leasing companies increasingly favor regional trucks for their balance of payload capacity and maneuverability. This trend highlights how infrastructure expansion continues to sustain long-term demand for regional trucks globally.

Regional truck fleets are gradually shifting toward more fuel-efficient, hybrid, and electric models to reduce operating costs and comply with emissions regulations. Fleet owners are investing in modern powertrains that provide higher efficiency and longer service intervals, which improves overall productivity. Leasing models have also gained momentum, offering operators flexible access to advanced vehicles without high upfront costs. Adoption of connected fleet management solutions is improving route optimization, reducing idle time, and ensuring regulatory compliance. These factors are helping operators maintain profitability in competitive logistics markets. The growing pressure on logistics firms to balance efficiency and compliance has created a clear shift in vehicle procurement strategies.

The surge in e-commerce has strengthened the demand for regional trucks, particularly for fast-moving goods and perishable items that require time-sensitive delivery. Retailers and online platforms are relying on regional fleets to handle distribution between warehouses, fulfillment centers, and urban delivery hubs. This trend is not limited to developed economies but is also expanding across emerging markets, where online shopping adoption is rising rapidly. Regional trucks are favored for their payload flexibility and ability to complete multiple delivery cycles in a single day. With rising consumer expectations for quicker deliveries, logistics players are expanding fleet sizes and diversifying vehicle specifications to meet this demand.

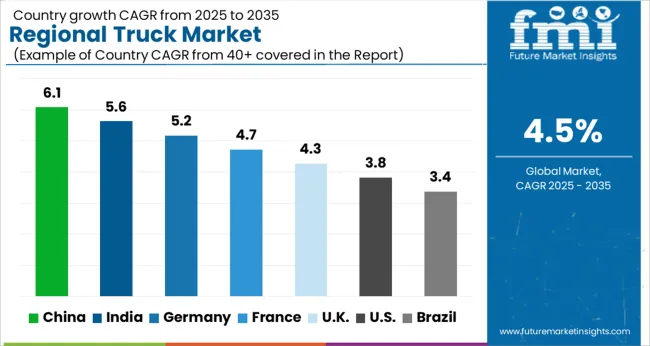

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

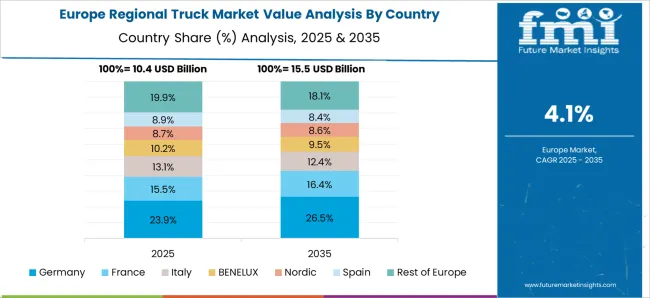

The regional truck market is projected to expand globally at a CAGR of 4.5% from 2025 to 2035, supported by rising demand for efficient short-haul logistics, infrastructure expansion, and e-commerce distribution. China leads with a CAGR of 6.1%, driven by rapid industrial output, large-scale logistics networks, and continued investment in road freight capacity. India follows at 5.6%, backed by FMCG growth, government infrastructure projects, and increased need for regional fleet modernization.France records 4.7%, supported by steady activity in construction, agriculture, and food distribution networks. The United Kingdom grows at 4.3%, driven by demand for e-commerce fulfillment and cold-chain transport, while the United States records 3.8%, reflecting a mature market where growth is linked to replacement demand and fleet electrification. This comparative assessment highlights Asia as the fastest-expanding regional truck market, while Europe shows balanced growth from industrial logistics, and the United States maintains steady but slower gains.

China is projected to post a 6.1% CAGR during 2025–2035, well above the global 4.5% path. Momentum has been supported by dense manufacturing clusters, deep warehousing footprints, and rapid hub to spoke distribution between inland factories and coastal gateways. Regional fleets have expanded to serve perishables, parcel delivery, and components shuttling for automotive and electronics value chains. Financing availability for mid tonnage fleets has improved renewal cycles, which encourages migration to cleaner and more efficient powertrains. Upgrades in provincial highways and intermodal nodes have shortened turn times, lifting asset utilization. Cold chain operators have scaled multi temperature routes that suit day range trucks. In this setting, body builders, telematics vendors, and dealers are capturing steady parts and services revenue from higher duty cycles and more frequent maintenance windows.

India is expected to grow at a 5.6% CAGR for 2025–2035, outpacing the global 4.5% average. Distribution intensity has risen across FMCG, pharmaceuticals, building materials, and white goods, which favors short to medium haul assets with quick loading features. Dedicated freight corridors and new state highways have reduced transit uncertainty, enabling higher daily kilometers within driver hour norms. Tax and e invoicing compliance have promoted organized fleet growth, improving contract tenures and credit access. Leasing and rental models are gaining acceptance among MSME shippers and regional 3PLs, which widens access to newer vehicles with better uptime. The parcel and express segment continues to add cross docking nodes that require frequent replenishment by medium duty trucks. With city restrictions on larger rigs, regional trucks remain the practical choice for feeder routes into urban consolidation centers.

France is positioned to advance at a 4.7% CAGR during 2025–2035, close to the global 4.5% baseline. Distribution patterns across food, pharmaceuticals, and specialty retail favor multi stop day trips that suit 7.5 to 19 ton trucks. The construction cycle has kept steady demand for tippers and flatbeds serving urban worksites where maneuverability matters. Regional carriers have adopted route planning and load pooling to protect margins against fuel price swings, which improves backhaul ratios and lift factors. Cold chain operators serving dairy, meat, and bakery flows have refreshed bodies and refrigeration units to improve temperature stability on short runs. Vehicle makers and dealers are offering service contracts that bundle uptime guarantees with parts availability, keeping fleets on the road. The mix is expected to tilt toward higher payload and liftgate equipped configurations as omnichannel retail places pressure on punctual store replenishment.

The United Kingdom is projected at 4.3% CAGR for 2025–2035, a touch below the global 4.5% rate yet stronger than the earlier period. Growth has been shaped by parcel and grocery chains expanding regional cross docks that require frequent replenishment runs. Cold chain duties for fresh foods and pharmaceuticals have widened, favoring liftgate bodies and multi compartment boxes. Retailers have refined hub to store schedules to maintain shelf availability, which increases day range trips and favors reliable mid tonnage platforms. Fleet buyers have focused on total cost per kilometer, selecting powertrains and gear ratios tuned for mixed urban and A road profiles. With parts and service networks extending coverage, operators are achieving better uptime and higher first time fix rates across regions.

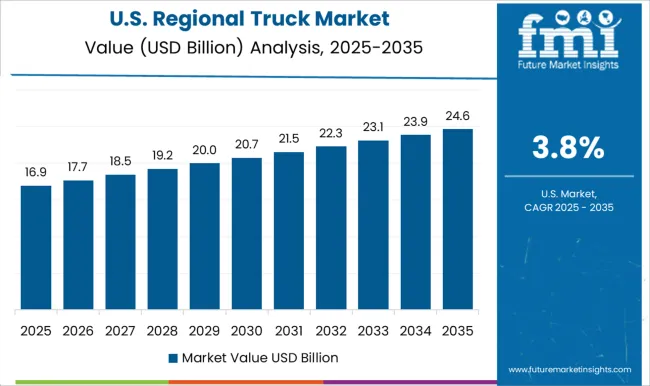

The United States is slated to grow at a 3.8% CAGR during 2025–2035, below the global 4.5% pace but backed by stable replacement cycles and regional distribution tied to big box retail, food processors, and industrial suppliers. Networks have continued to rely on day cabs for warehouse to store and plant to DC moves within 300 to 500 kilometer ranges. Driver availability and wage inflation have encouraged tighter scheduling and higher tractor utilization on daylight turns. Fleet managers have prioritized tire programs, aero kits, and idle control to protect cost per mile on frequent stop routes. Urban restrictions on larger rigs in select metros have nudged shippers toward regional trucks for final leg replenishment. Parts distribution centers have strengthened same day availability, which supports high uptime targets and predictable service intervals across large fleets.

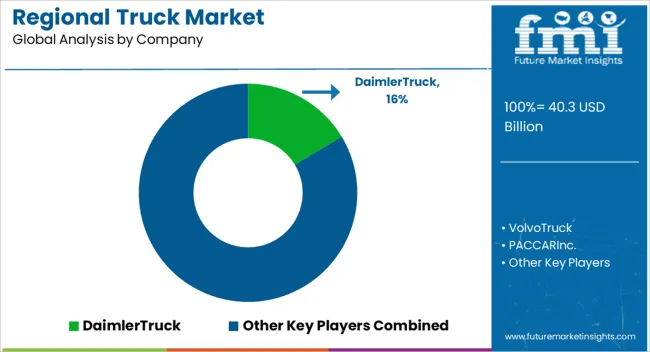

The regional truck market is led by globally established OEMs and specialized truck manufacturers, each competing on efficiency, payload flexibility, regional connectivity, and fleet service networks. Daimler Truck maintains a leadership position with its Freightliner and Mercedes-Benz brands, offering a strong mix of medium and heavy-duty regional trucks optimized for short-haul logistics and distribution. Volvo Truck emphasizes fuel efficiency, advanced safety systems, and electrified models designed for regional freight and construction segments. PACCAR Inc., through Kenworth and Peterbilt, delivers high-reliability trucks with advanced telematics, supported by robust dealer service networks across North America.

Scania AB, under the TRATON GROUP, focuses on modular designs and alternative powertrains suited for regional operations in Europe. Ford Motor is enhancing its position through light and medium regional trucks tailored for high-frequency distribution. TRATON GROUP leverages its MAN and Scania brands to dominate in Europe, particularly in short-haul fleet applications. MAN SE continues to develop efficient drivetrains and integrated fleet management tools, strengthening its reach among European operators. Navistar, integrated into TRATON, contributes with its International brand, supporting regional freight and vocational truck applications in the Americas. Hino Truck, backed by Toyota, expands in Asia with reliable medium-duty offerings for regional logistics. Volkswagen, through its truck and bus division, targets Latin America and emerging markets, offering cost-competitive yet durable regional trucks.

Competitive strategies in this market revolve around fleet electrification, lifecycle service contracts, digital fleet optimization, and modular configurations designed for regional payload versatility. Strategic alliances, localized production, and financing solutions are shaping OEM approaches to capture rising demand for efficient and compliant regional trucks across both developed and emerging economies.

Daimler Truck

Volvo Truck

PACCAR Inc.

Scania AB

Ford Motor

TRATON GROUP

MAN SE

Hino Truck

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Fuel Type | Diesel, Natural gas, Hybrid electric, and Others |

| Application | Freight delivery, Utility services, Construction & mining, and Others |

| GVWR Range | 26,001 – 33,000 lbs and 19,501 - 26,000 lbs |

| Axle Configuration | 6X4, 4X2, and 6X6 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler Truck, Volvo Trucks, PACCAR Inc. (Kenworth, Peterbilt), TRATON GROUP (Scania, MAN, Navistar, Volkswagen Truck & Bus – Latin America), Ford Trucks / Ford Motor Company, Hino Motors |

| Additional Attributes | Dollar sales, share, demand by fleet size, growth in e-commerce logistics, infrastructure-led adoption, competitive landscape, regional regulations, fuel transition trends, and aftersales opportunities. |

The global regional truck market is estimated to be valued at USD 40.3 billion in 2025.

The market size for the regional truck market is projected to reach USD 62.6 billion by 2035.

The regional truck market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in regional truck market are diesel, natural gas, hybrid electric and others.

In terms of application, freight delivery segment to command 44.8% share in the regional truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Complex Regional Pain Syndrome (CRPS) Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA