The rotogravure printing machine market is witnessing sustained growth, supported by demand for high-speed, high-quality printing solutions across flexible packaging and industrial printing sectors. Industry journals and manufacturing reports have emphasized the resurgence of rotogravure printing due to its superior consistency in large-volume runs and ability to handle fine image reproduction.

Press releases from leading printing system manufacturers have detailed advancements in automation, registration control, and printhead technologies, which have improved operational efficiency and reduced setup time. Rising consumption of packaged food and consumer goods has also increased the demand for rotogravure machines, particularly in emerging markets where packaging standards are evolving.

Additionally, developments in substrate compatibility and ink formulations are enabling manufacturers to meet both performance and sustainability criteria. As environmental regulations tighten, manufacturers are incorporating energy-efficient components and solvent recovery systems to address emission challenges. Going forward, the market is expected to grow with expansion in the packaging industry, customization trends, and improved hybrid printing system integration.

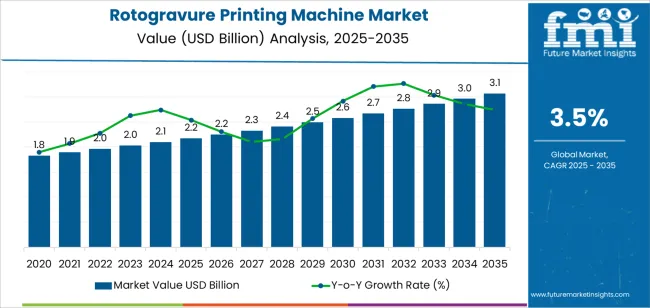

| Metric | Value |

|---|---|

| Rotogravure Printing Machine Market Estimated Value in (2025 E) | USD 2.2 billion |

| Rotogravure Printing Machine Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

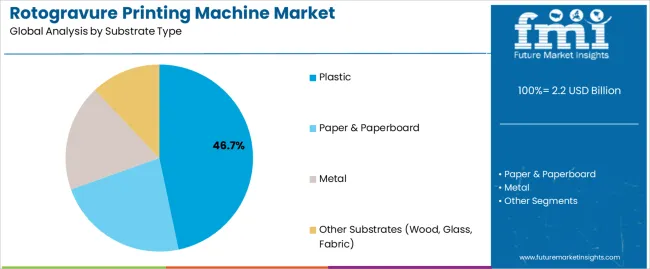

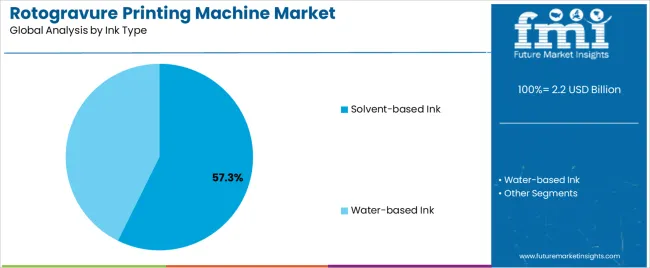

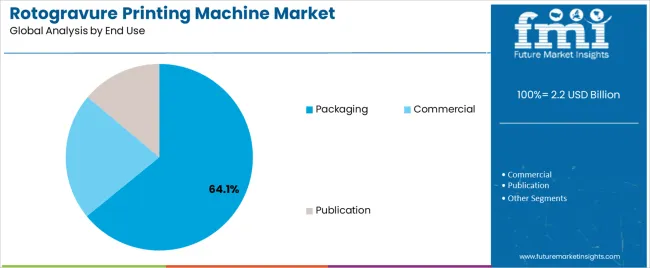

The market is segmented by Substrate Type, Ink Type, and End Use and region. By Substrate Type, the market is divided into Plastic, Paper & Paperboard, Metal, and Other Substrates (Wood, Glass, Fabric). In terms of Ink Type, the market is classified into Solvent-based Ink and Water-based Ink. Based on End Use, the market is segmented into Packaging, Commercial, and Publication. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Plastic segment is projected to account for 46.7% of the rotogravure printing machine market revenue in 2025, sustaining its dominance among substrate types. This segment’s growth has been driven by the widespread use of plastic films in flexible packaging, where clarity, durability, and barrier properties are essential.

Rotogravure machines have been preferred for printing on plastic due to their ability to deliver high-resolution images and maintain ink adhesion across polyethylene, polypropylene, and polyester films. Industry developments have enhanced print repeatability and minimized defects on plastic substrates, supporting brand consistency in consumer goods packaging.

Additionally, the use of plastic has remained strong in sectors such as food, beverages, personal care, and pharmaceuticals due to its lightweight and cost-effective nature. Despite rising environmental concerns, the plastic segment continues to lead due to its scalability, compatibility with solvent-based inks, and print quality advantages in high-volume packaging applications.

The Solvent-based Ink segment is projected to contribute 57.3% of the rotogravure printing machine market revenue in 2025, reflecting its continued preference across industrial-scale printing operations. This dominance has been supported by the ink’s rapid drying properties and strong adhesion capabilities on non-porous substrates such as plastics and metallic films.

Solvent-based inks have remained widely used in packaging applications where durability, water resistance, and vibrant color reproduction are critical. Industry press releases have highlighted enhancements in low-VOC solvent formulations and integrated drying systems that reduce environmental footprint without compromising performance.

Furthermore, solvent-based systems are compatible with high-speed printing environments, supporting faster production cycles and consistent output. Although water-based and UV-curable inks are gaining traction in certain regions, solvent-based inks continue to lead in emerging markets where regulatory pressures are lower and performance reliability is prioritized. The segment’s entrenched infrastructure and proven print quality reinforce its leading role in the ink category.

The Packaging segment is projected to capture 64.1% of the rotogravure printing machine market revenue in 2025, maintaining its position as the largest end-use category. Growth of this segment has been propelled by the global expansion of the packaged food, beverage, personal care, and household goods industries.

Rotogravure printing machines have become integral to packaging operations requiring high-volume, high-definition printing on a variety of substrates. The segment has benefited from demand for aesthetic packaging with consistent branding, legibility, and premium print finishes. Manufacturer briefings and investor presentations have emphasized automation upgrades in packaging lines, which have increased compatibility with rotogravure systems.

Moreover, growth in flexible and multilayer packaging formats has further boosted adoption. As consumer preference shifts toward visual appeal and informative packaging, and brands invest in localization and multilingual labeling, rotogravure’s scalability and versatility continue to meet packaging market requirements. The packaging segment is expected to remain a key driver of market demand for rotogravure printing machines globally.

Analysts predict an accelerated growth rate for the rotogravure printing machine market throughout the forecast period. The positive outlook stems from the inherent advantages rotogravure machines offer. Their high-speed printing capabilities cater perfectly to the demands of mass production, while the detailed engravings on the rotary cylinders ensure exceptional image quality.

As the need for efficient and high-quality printing persists across various industries, the rotogravure printing machine market is well-positioned to capitalize on this momentum, solidifying its role as a cornerstone of the printing landscape.

The growing need for flexible packaging is a major factor in the rotogravure printing machine industry. These flexible packaging options are transforming a number of sectors, and rotogravure printing equipment is ideal for producing them in large quantities. Manufacturers choose rotogravure machines because they can produce excellent print quality on flexible substrates like plastic film. Consider visually appealing food packaging or robust consumer product pouches that are effectively manufactured using rotogravure technology.

The rotogravure printing machine market is expanding significantly, propelled by the growing need for printed packaging in a variety of sectors in addition to flexible packaging. Because these machines can produce beautiful pictures at amazing rates, they are especially good at creating bright magazine covers and high-quality product labels.

Rotogravure printing machines are an essential tool for companies looking to improve the visual appeal of their products because of such capability, which is in line with the expanding need for aesthetically pleasing packaging across a variety of industries.

Customers have more and higher standards for printed goods in a cutthroat industry. This focus on sophistication and aesthetic appeal is one of the main factors propelling the rotogravure printing machine market. For packaging and printed items that are meant to leave a lasting impression, rotogravure machines are the best option due to their remarkable detail and color consistency.

Because of their persistent dedication to producing products of the highest caliber, rotogravure machines are unquestionably valuable resources for companies trying to strengthen and build their brand identity.

Because rotogravure printing machines are becoming more and more affordable, the demand for such devices is expanding significantly. A greater spectrum of organizations may now more easily access these devices thanks to technological improvements. They are, therefore, being viewed as an attractive investment by more businesses.

The simplicity with which rotogravure machines can accommodate enterprises' need for large-scale printing is another factor in their popularity. This pattern is likely to continue as long as there is a need for large-scale, high-quality printing in a variety of businesses. Rotogravure printing machines are a desirable alternative for companies wishing to improve their printing capabilities because of their low cost, great efficiency, and recent technical developments.

The United States is emerging as a particularly attractive demand for the rotogravure printing machine market. The surge in demand stems from the widespread use of rotogravure machines across various industries within the United States.

From high-volume printing needs in the packaging and food sectors to the production of newspapers, magazines, books, and labels, rotogravure machines are a mainstay in American manufacturing.

Such versatility, coupled with the country's robust packaging industry that is projected for further growth, makes the United States a fertile ground for the rotogravure printing machine market. As the demand for high-quality and efficient printing solutions persists, expect the United States' demand to play a significant role in the future of rotogravure technology.

The epidemic has significantly changed China's packaging environment, and this change is driving the demand for rotogravure printing machines. The ever-changing needs of packaging are driving up demand for rotogravure machines in this dynamic industry.

For Chinese enterprises trying to adjust to a shifting market, rotogravure printing offers an attractive alternative because of its remarkable quality and efficiency. Because of this, experts predict that the rotogravure printing machine market in China is anticipated to grow significantly throughout the projection period, with a notable increase in revenue. This pattern emphasizes how rotogravure technology is becoming more and more significant in China's dynamic packaging sector.

For the demand for rotogravure printing machines, India's expanding packaging sector is a major development driver. The cheap access to necessary raw materials, including plastic, paper, and paperboard, is directly related to the packaging industry's notable rise in India.

Considering that India's packaging business presently makes up the fifth biggest portion of the country's GDP, this rise is quite remarkable. Analysts believe that the rotogravure printing machine industry is expected to grow, with a particular emphasis on exports.

High-quality, effective printing solutions are becoming more and more necessary due to the growing need for packaged food and beverages, personal care items, and medications. This demand is fully met by rotogravure printing machines, which provide the right ratio of quality to speed. Expect the rotogravure printing machine industry to grow in the next years because of India's packaging growth.

With the lion's share of the global rotogravure printing machine market, the plastics segment is the dominant player. The many benefits that plastic has to offer as a printing substrate account for its supremacy. Plastic is lightweight, which makes it perfect for high-volume manufacturing using rotogravure machines. Furthermore, printed packaging is assured to survive a variety of climatic conditions due to its inherent durability and moisture resistance.

Beyond these useful advantages, plastic offers a strong financial argument. It is an economical option for companies due to its affordability and the efficiency it adds to the rotogravure printing process. Plastic is the most popular substrate for rotogravure printing machines due to its affordability, adaptability, and durability; this establishes plastic's place in the demand for high-quality and effective printing solutions in the future.

The packaging industry has emerged as the most lucrative segment for the global rotogravure printing machine market. This dominance stems from the perfect synergy between rotogravure technology and the demands of high-volume packaging production.

Rotogravure printing machines are known for their exceptional print quality and versatility, allowing them to print on various substrates like paper, plastic, and metal. These machines cater to the diverse needs of the packaging industry, producing intricate designs on food packaging and crisp brand logos on corrugated boxes.

Rotogravure machines are ideal for large-format packaging solutions like cartons and boxes due to their ability to print on both sides of the substrate. This two-sided printing allows for maximum information dissemination and brand messaging, offering growth opportunities in the packaging industry. The efficiency, quality, and versatility of rotogravure technology make it a crucial tool for businesses seeking to improve their packaging game.

A dynamic transition is occurring in the rotogravure printing machine industry as major firms work to strengthen their positions. Manufacturers are aggressively seeking expansion by employing many strategies. Increasing their capacity to fulfill the soaring demand for rotogravure printing equipment is one tactic. This might entail launching fresh features or capabilities tailored to certain sector demands.

The rotogravure printing machine market is changing as a result of mergers and acquisitions, which enable major firms to expand their footprint. They are fortifying their position by pooling resources and knowledge. Research and development expenditures are continuously producing cutting-edge rotogravure equipment.

They are also modernizing their production facilities in order to satisfy consumer demand. They may successfully negotiate the competitive environment and ensure long-term success in the rotogravure printing machine industry owing to these calculated actions.

In terms of substrate, the market encompasses plastic, paper and paperboard, metal and other such as wood, glass, fabric.

The industry is bifurcated into water-based ink and solvent-based ink, based on the product type.

Based on the end use of the machines, the industry is forked into packaging, commercial, and publication sector.

As per region, the industry is divided into North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa.

The global rotogravure printing machine market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the rotogravure printing machine market is projected to reach USD 3.1 billion by 2035.

The rotogravure printing machine market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in rotogravure printing machine market are plastic, paper & paperboard, metal and other substrates (wood, glass, fabric).

In terms of ink type, solvent-based ink segment to command 57.3% share in the rotogravure printing machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

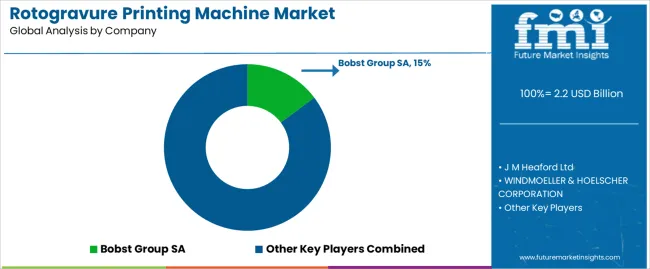

Competitive Overview of Rotogravure Printing Machine Companies

Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Printing Toners Market Size and Share Forecast Outlook 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Printing Plate Market

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Market Positioning & Share in the 3D Printing Metal Industry

Evaluating 3D Printing Filament Market Share & Provider Insights

4D Printing Market

Pad Printing Machine Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA