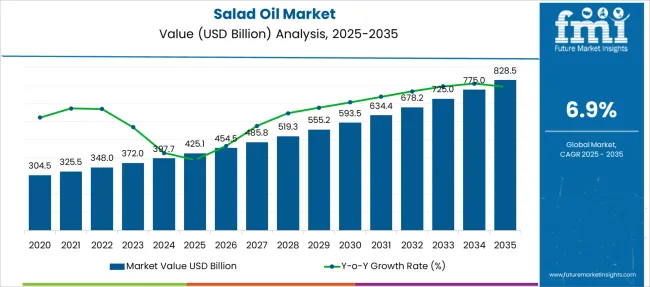

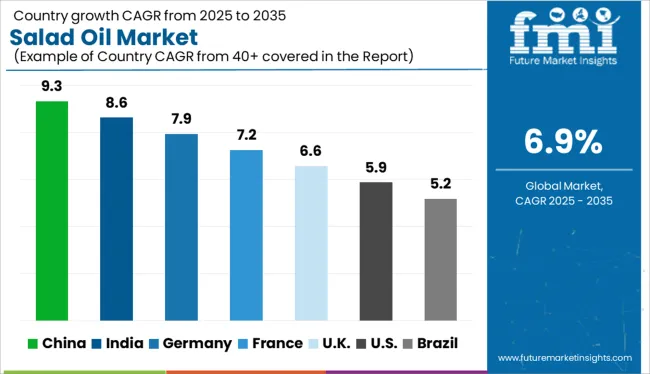

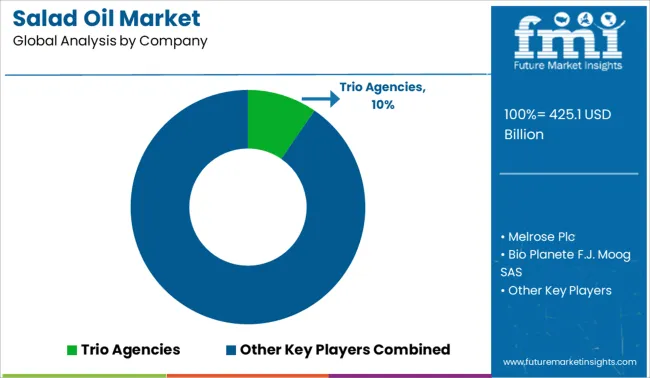

The Salad Oil Market is estimated to be valued at USD 425.1 billion in 2025 and is projected to reach USD 828.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Salad Oil Market Estimated Value in (2025 E) | USD 425.1 billion |

| Salad Oil Market Forecast Value in (2035 F) | USD 828.5 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The salad oil market is experiencing sustained growth due to the increasing global focus on health-conscious eating habits, natural ingredients, and culinary versatility in food preparations. As consumers seek healthier edible oils for cold and raw consumption, demand for light, neutral-tasting oils with high nutritional content has increased. The market is also being influenced by rising awareness regarding the benefits of unsaturated fats, which are prompting shifts away from traditional cooking oils toward specialty salad oils.

Technological improvements in cold-pressing, filtration, and refining processes have improved product quality and shelf stability, further supporting growth. Regulatory alignment on food labeling and the emphasis on organic and non-GMO certifications are boosting premium product segments.

Urbanization and expansion of organized retail and HoReCa (Hotel, Restaurant, Catering) sectors are enabling higher product visibility and consumer experimentation Going forward, sustainability considerations and origin-specific marketing are expected to create new growth opportunities in both established and emerging regions.

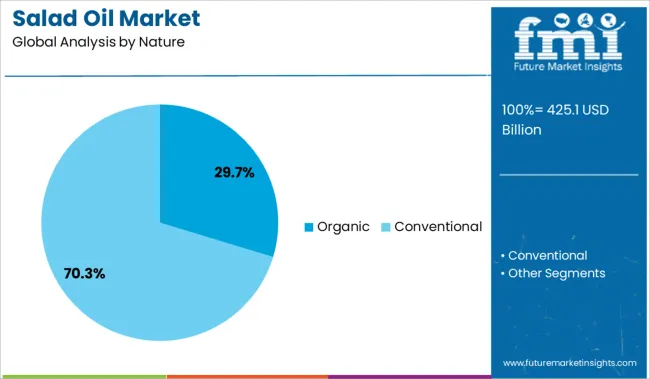

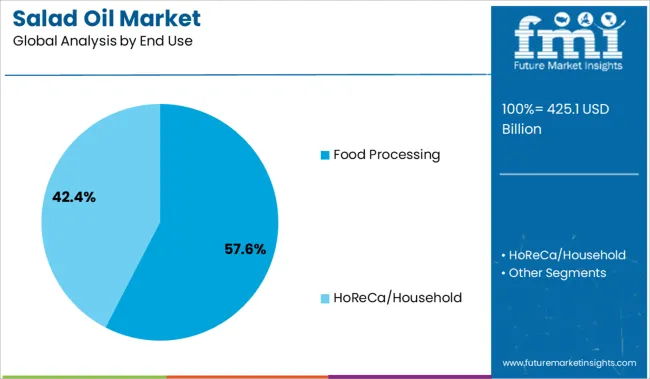

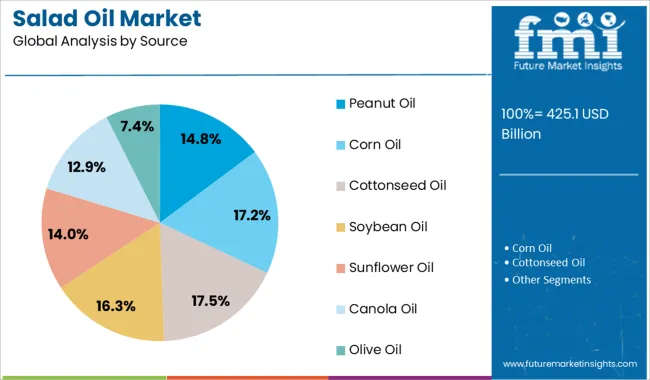

The market is segmented by Nature, End Use, Source, and Distribution Channel and region. By Nature, the market is divided into Organic and Conventional. In terms of End Use, the market is classified into Food Processing and HoReCa/Household. Based on Source, the market is segmented into Peanut Oil, Corn Oil, Cottonseed Oil, Soybean Oil, Sunflower Oil, Canola Oil, and Olive Oil. By Distribution Channel, the market is divided into Online Retail, Specialty Stores, General Grocery Stores, and Online Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic segment is expected to hold 29.7% of the overall revenue share in the salad oil market in 2025, marking a significant shift toward clean-label and traceable ingredient preferences. This segment’s growth is being influenced by consumer trust in organic certification and the perceived health and environmental benefits associated with organically grown oilseed sources.

The absence of synthetic pesticides, genetically modified organisms, and chemical additives has increased demand for organically produced salad oils across both retail and institutional channels. Enhanced availability of organic oilseeds and expansion in certified supply chains have enabled manufacturers to offer a broader range of organic variants.

Policy support for organic agriculture and labeling standards in North America and Europe has contributed to increasing shelf space for organic oils in supermarkets and online platforms Additionally, premium pricing potential and stronger alignment with wellness-focused consumer segments have reinforced the importance of organic salad oils in brand positioning strategies across the edible oil industry.

The food processing segment is projected to account for 57.6% of the total revenue share in the salad oil market by 2025, reflecting its widespread application in large-scale culinary operations. This dominance is being driven by the need for consistent, high-quality oils that support flavor stability and texture in mass-produced food products such as dressings, sauces, ready-to-eat meals, and condiments.

Salad oils are favored in industrial food processing due to their light viscosity, neutral flavor profile, and compatibility with automated dosing and mixing systems. The segment has further benefited from the global shift toward healthier food formulations, where unsaturated and low-cholesterol oil options are increasingly required.

As food manufacturers prioritize ingredient transparency and nutritional value, salad oils with cleaner compositions are being adopted to meet regulatory and consumer demands Extended shelf life, heat resistance during cold fill processes, and ease of blending with other ingredients have solidified the role of salad oil in commercial food production workflows.

Peanut oil is anticipated to hold 14.8% of the overall revenue share in the salad oil market in 2025, owing to its unique blend of flavor stability, nutritional richness, and functionality in cold applications. Its naturally high monounsaturated fat content and antioxidant properties have positioned it as a preferred choice among health-conscious consumers and food service providers.

The mild nutty flavor and higher smoke point make peanut oil suitable for both salad dressings and light sautéing, expanding its application range. Supply chain advancements in peanut cultivation and oil extraction, particularly in Asia Pacific and the United States, have supported consistent availability in both bulk and packaged formats.

The segment has also benefited from consumer inclination toward traditional oils with wellness associations and minimal processing As dietary patterns evolve to incorporate plant-based and allergen-specific considerations, peanut oil continues to find relevance in niche health food brands and artisanal culinary segments that prioritize premium oil quality.

The demand for salad oil is mainly driven by the increasing consumption of processed food products such as mayonnaise, salad dressings, etc.

Mayonnaise and salad dressing products first originated in the European region and are consumed on a large scale in European countries, in turn, spurring the sales of salad oil as well.

And the demand for salad oil as well as sales of salad oil is greatly pushed forward by the growing adoption of European food culture worldwide, such as the consumption of salad and introduction, such as antipasto.

Salad oil from vegetable sources is healthy due to the high content of monounsaturated fats and polyphenols, encouraging many to go for it thereby soaring the sales of salad oil.

The rising sales of salad oil are also on account of the fact that salad oil is low in saturated fat content and is trans-fat free that are unhealthy.

The Benefits associated with salad oil in connection with weight loss, inflammation reduction, and risk of heart disease reduction further augment the demand for salad oil around the world.

The demand for salad oil is likely to go up as polyphenols have antioxidant properties, and have been discussed to reduce the risk of diabetes, cardiovascular problems, and neurodegenerative diseases.

The rise in the health consciousness around the globe is increasing the opportunity for healthy products, including salad oil and the same is expected to greatly aid the global sales of salad oil.

The salad oil market share is likely to expand as manufacturers of salad oil are providing organic, non-GMO, Kosher, Halal, and SQF-certified products.

And considering the current consumer perception and demand for such products, manufacturers offering salad oil with these claims have increased the overall demand for salad oil.

Currently, the global salad oil market share is dominated by the North American and European regions due to the regular consumption of salad and salad dressing products such as salad oil.

In the Asia Pacific and the Middle East and African region, due to the changing food culture and eating habits, demand for salad oil is on the surge.

The increasing middle-class population and middle-class population income are creating a conducive environment for the overall sales of salad oil since the purchasing power of the customer is increasing in these regions.

Some of the key players in the salad oil market include Trio Agencies, Melrose Plc, Bio Planete F.J. Moog SAS, Salad Oils International Corporation, Cargill Inc., PYCO Industries, Avatar Corporation, COFCO Corporation, Sovena Group, Stratas Foods,

A few other key players are Maeva Group International, Archer Daniels Midland Company, California Rice Oil Company, AG Processing Inc., and Columbus Vegetable Oils.

Manufacturers are innovating new products to have improvised properties to consolidate their market position by expanding their salad oil market share.

One such recent development in the salad oil market is the blend of vegetable oil and omega-3 derived from marine sources that have increased health benefits.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2014 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Nature, Source, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Trio Agencies; Melrose Plc; Bio Planete F.J. Moog SAS; Salad Oils International Corporation; Cargill Inc.; PYCO Industries; Avatar Corporation; COFCO Corporation; Sovena Group; Stratas Foods; Maeva Group International; Archer Daniels Midland Company; California Rice Oil Company; AG Processing Inc.; Columbus Vegetable Oils |

| Customization | Available Upon Request |

The global salad oil market is estimated to be valued at USD 425.1 billion in 2025.

The market size for the salad oil market is projected to reach USD 828.5 billion by 2035.

The salad oil market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in salad oil market are organic and conventional.

In terms of end use, food processing segment to command 57.6% share in the salad oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salad Container Market Size and Share Forecast Outlook 2025 to 2035

Vegan Salad Dressing Market - Growth & Demand 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Fat Free Salad Dressings Market

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA