Scratch-resistant Glass Market Size and Share Forecast Outlook From 2025 to 2035

The scratch-resistant glass market is witnessing robust growth, primarily driven by increasing demand for durable and aesthetically enhanced surfaces in consumer electronics, automotive displays, and architectural applications. Rising smartphone penetration and growing screen size trends have significantly boosted adoption in display protection solutions. Manufacturers are investing in chemical strengthening techniques and surface coating technologies to enhance durability while maintaining optical clarity.

The market also benefits from continuous innovations in aluminosilicate glass compositions, enabling improved hardness and flexibility. Expanding use of smart devices in industrial and outdoor environments has further elevated performance requirements.

With sustainability and recyclability becoming key considerations, the industry is focusing on eco-friendly glass formulations. Overall, the outlook remains positive as demand continues to rise across consumer and industrial product lines requiring long-term scratch resistance.

Quick Stats for Scratch-resistant Glass Market

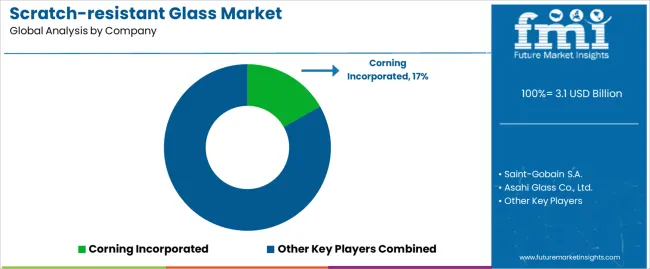

- Scratch-resistant Glass Market Industry Value (2025): USD 3.1 billion

- Scratch-resistant Glass Market Forecast Value (2035): USD 7.8 billion

- Scratch-resistant Glass Market Forecast CAGR: 9.7%

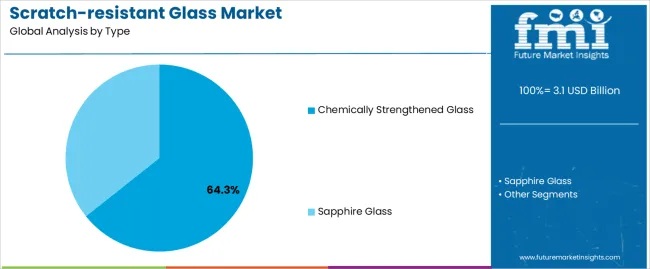

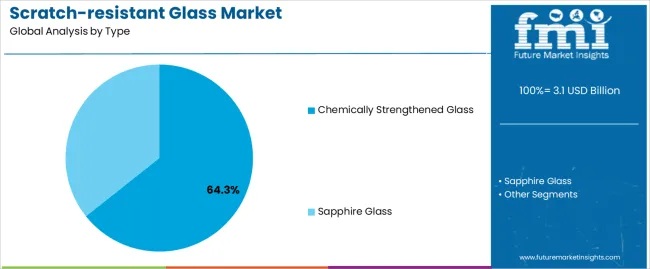

- Leading Segment in Scratch-resistant Glass Market in 2025: Chemically Strengthened Glass (64.3%)

- Key Growth Region in Scratch-resistant Glass Market: North America, Asia-Pacific, Europe

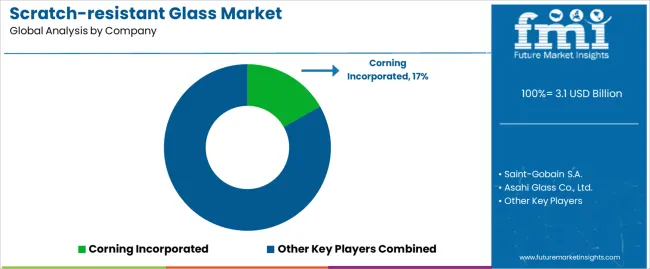

- Top Key Players in Scratch-resistant Glass Market: Corning Incorporated, Saint-Gobain S.A., Asahi Glass Co., Ltd., Nippon Electric Glass Co., Ltd., Schott AG, Guardian Industries, Kyocera Corporation, Murata Manufacturing Co., Ltd., Rubicon Technology, Crystalwise Technology Inc.

| Metric |

Value |

| Scratch-resistant Glass Market Estimated Value in (2025 E) |

USD 3.1 billion |

| Scratch-resistant Glass Market Forecast Value in (2035 F) |

USD 7.8 billion |

| Forecast CAGR (2025 to 2035) |

9.7% |

Segmental Analysis

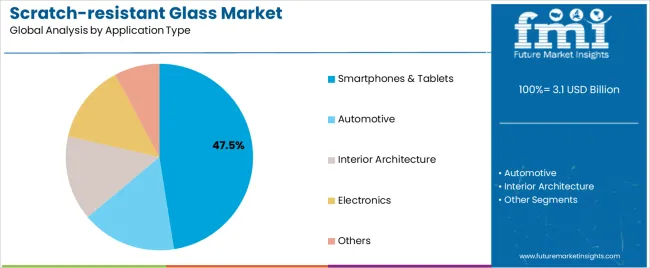

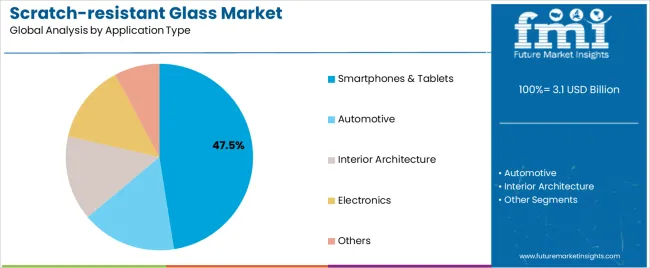

The market is segmented by Type and Application Type and region. By Type, the market is divided into Chemically Strengthened Glass and Sapphire Glass. In terms of Application Type, the market is classified into Smartphones & Tablets, Automotive, Interior Architecture, Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Chemically Strengthened Glass Segment

The chemically strengthened glass segment dominates the type category with approximately 64.30% share, driven by its superior mechanical strength and resistance to surface abrasions. The segment’s growth is underpinned by advancements in ion-exchange processes that enhance structural integrity without compromising optical transparency.

This glass type is extensively used in high-end smartphones, tablets, wearables, and automotive displays, where durability and design aesthetics are critical. Manufacturers are focusing on thin, lightweight variants to support next-generation device architectures.

The segment also benefits from scalability in production and compatibility with existing manufacturing infrastructure. With sustained consumer preference for durable, premium-quality devices, chemically strengthened glass is expected to maintain its leadership across major application segments.

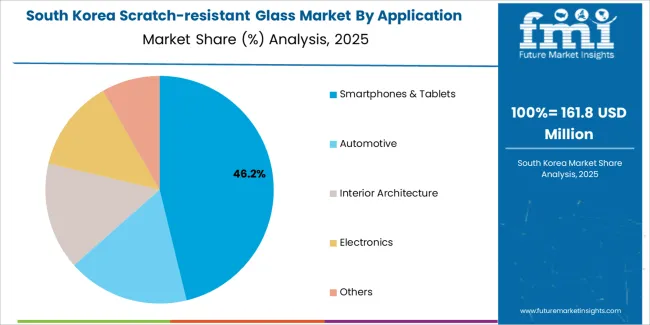

Insights into the Smartphones & Tablets Segment

The smartphones and tablets segment holds approximately 47.50% share in the application type category, reflecting its central role in driving scratch-resistant glass demand. The segment’s dominance is driven by increasing global smartphone shipments and the growing preference for bezel-less and foldable displays that require advanced protection.

Rising consumer expectations for longevity and visual clarity have reinforced the use of high-strength glass coatings. The segment benefits from continuous design evolution in mobile devices, including higher screen-to-body ratios and integration of touch-sensitive layers.

With leading device manufacturers adopting premium protection solutions as a standard feature, demand from this segment is projected to remain strong, sustaining overall market growth.

Emerging Opportunities Driving Growth in the Scratch-resistant Glass Market

- The increasing adoption of smartphones, tablets, and other electronic devices is expected to create lucrative opportunities for manufacturers in the scratch-resistant glass market.

- The electronics sector is expected to see a rise in demand for scratch-resistant glass due to the increasing need for high-quality materials. This glass provides protection for screens against scratches, cracks, and other damages, thereby enhancing device durability and longevity.

- The growing demand for high-performance glass products in the automotive sector is also expected to drive the growth of the scratch-resistant glass industry. The application of scratch-resistant glass in automotive contexts safeguards windshields and windows against damage, bolstering vehicle safety and longevity. This aspect appeals to consumers, contributing to its attractiveness in the market.

- The increasing focus on sustainable and eco-friendly products is driving the market. With the growing awareness about environmental concerns, consumers are increasingly inclined toward products that are environmentally friendly and have a low carbon footprint. In this regard, scratch-resistant glass is considered to be a sustainable and eco-friendly alternative to traditional glass products like scratch-resistant plastic. This is expected to drive its demand in the coming years.

Factors Restraining the Demand for Scratch-resistant Glass

- The intricate manufacturing process of scratch-resistant glass contributes to a high production cost, potentially resulting in elevated prices for these products. This could make them less appealing to consumers who are budget-conscious.

- Competition from alternative materials such as plastic and polycarbonate is expected to hamper the market during the anticipated period. These materials are often cheaper and lighter than glass, making them more attractive for some applications, such as smartphone screens.

- Plastic and polycarbonate are more flexible and shatter-resistant than glass, making them a preferred choice for some consumers.

Despite these challenges, companies in the scratch-resistant glass industry have an opportunity to overcome them and grow their business by providing innovative and sustainable solutions .

Scratch-resistant Glass Industry Analysis by Top Investment Segments

The Chemically Strengthened Glass Segment Dominates the Market by Product Type

| Attributes |

Details |

| Product Type |

Chemically Strengthened Glass |

| Forecasted Market CAGR from 2025 to 2035 |

9.5% |

- The chemically strengthened glass segment dominates the scratch-resistant glass market due to its superior scratch resistance, durability, and strength compared to other types of glass. Chemically strengthened glass is made by dipping the glass into a salt bath, where the sodium ions replace the smaller potassium ions on the glass surface.

- In the smartphone and tablet industry, chemically strengthened glass is the preferred choice due to its superior properties. For example, Corning's Gorilla Glass is a popular choice for smartphone manufacturers because of its ability to withstand scratches, impact, and drops.

- The use of chemically strengthened glass in automotive and architectural applications is also increasing, as it provides better protection and strength compared to traditional glass.

The Smartphones & Tablets Segment Dominates the Market by Top Application Type

| Attributes |

Details |

| Application Type |

Smartphones & Tablets |

| Forecasted Market CAGR from 2025 to 2035 |

9.3% |

- The segment of smartphones and tablets holds dominance in the scratch-resistant glass market. This is mainly because these devices experience higher usage frequencies and face a greater risk of damage from accidental drops or impacts. As a result, consumers prioritize the purchase of devices with durable and scratch-resistant glass to protect their investment.

- The increasing demand for high-end smartphones and tablets with advanced features and larger screens further drives the demand for scratch-resistant glass.

- The expansion of the eCommerce sector and the proliferation of online platforms and retail outlets have simplified the purchasing process for consumers. Consequently, this has fueled the growth of the scratch-resistant glass market within the smartphones and tablets segment.

Analysis of Top Countries, Producing, Adopting, and Exporting Scratch-resistant Glass

| Countries |

Forecasted CAGR through 2025 to 2035 |

| United States |

9.9% |

| United Kingdom |

10.9% |

| China |

10.7% |

| Japan |

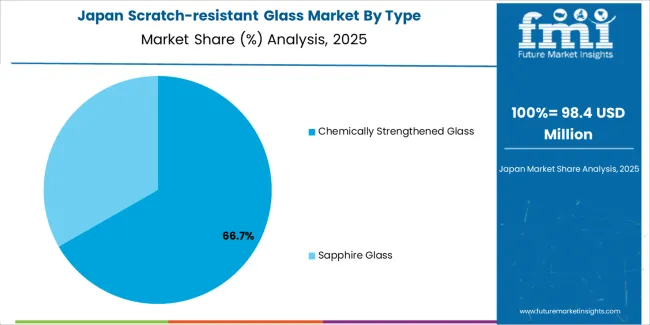

11.0% |

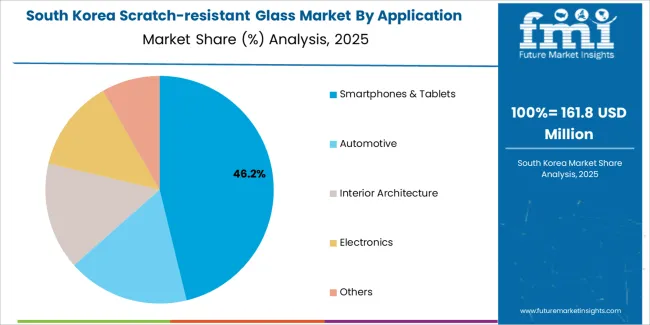

| South Korea |

11.1% |

Increasing Need for Cost-effective Solutions in the United States for Electronics Devices Drives Product Demand

- The widespread use of smartphones and other electronic devices in the United States has led consumers to seek ways to protect their investments as these devices become more advanced and expensive.

- The need for durable and long-lasting products is driving demand for scratch-resistant glass, which offers a cost-effective solution that can significantly extend the lifespan of electronics.

- With consumers becoming more environmentally conscious, they are seeking products that will last longer and reduce waste. Scratch-resistant glass offers a durable and sustainable solution that can withstand wear and tear, reducing the need for replacements and repairs.

- The desire for enhanced aesthetics is driving consumer preferences. With the increasing popularity of sleek and modern designs, consumers are looking for products that not only perform well but also look great.

Rising Penetration of Smartphones in the United Kingdom Drives Scratch-resistant Glass Market Growth

- In the automotive industry, tempered glass is used for windshields and other windows due to its durability and resistance to shattering.

- In the construction industry, tempered glass is used for windows, doors, and other applications where safety and durability are top priorities.

- With the widespread use of smartphones, tablets, and other mobile devices, consumers are increasingly seeking products that can withstand wear and tear.

- Scratch-resistant glass, also known as tempered glass, offers a high level of protection against scratches and other types of damage, making it an attractive option for consumers.

- The growing concern over environmental sustainability in the United Kingdom has led to tempered glass being viewed as a more environmentally friendly alternative to other types of glass, as it is made using a process that requires less energy and produces less waste.

Growing Need for High Quality Electronics Products in China is Fuelling Scratch-resistant Glass Market Expansion

- The growing popularity of smartphones and other electronic devices has led to a surge in demand for scratch-resistant glass in China. These devices are becoming increasingly prevalent in China, which is the world's largest smartphone market.

- Consumers are seeking high-quality products that offer protection against scratches and other forms of damage, and scratch-resistant glass is an ideal solution.

- The rise of the automotive industry in China has also contributed to the growth of the scratch-resistant glass market. As more and more people are purchasing cars, the demand for high-quality windshields and other components has increased. Scratch-resistant glass is a key component in these products, as it offers superior durability and protection against damage.

- The country's booming construction industry has also fueled demand. As more buildings are constructed, the demand for high-quality glass products has increased. Scratch-resistant glass is a popular choice for windows and other building components because it offers superior strength and durability.

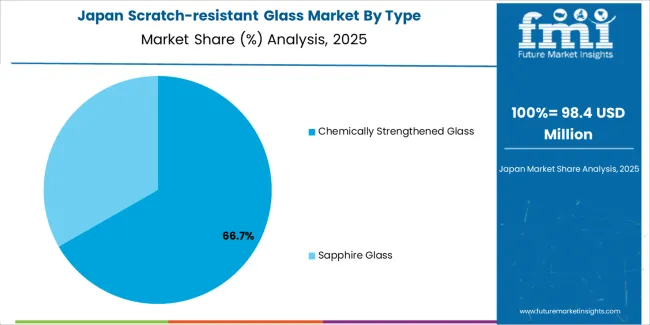

Rising Consumer Awareness Drives Scratch-resistant Glass Adoption for Expensive Electronics in Japan

- The growing awareness and concern among consumers in Japan about the importance of protecting their expensive electronic devices from scratches and other forms of damage have led to an increased demand for scratch-resistant coatings. With the rise in mobile phone and tablet usage, the need for scratch-resistant coatings has become more pressing.

- Consumers in Japan are willing to pay a premium for products that offer this added protection, and manufacturers are responding with a wide range of options.

- As Japan is home to several key electronics companies, it has a highly competitive market for electronic devices. This means that manufacturers are constantly looking for ways to differentiate their products from those of their competitors and to offer consumers added value. Scratch-resistant coatings have become one of the key ways in which manufacturers are achieving this.

Growing Construction Industry in South Korea Simultaneously Fuels the Scratch-resistant Glass Market Growth

- South Korea is a highly developed country where people are always on the lookout for innovative and high-quality products. As a result, they are keen to pay an exceptional price for such products.

- The rise of the smartphone industry in South Korea has played a key role in increasing the demand for scratch-resistant products. Smartphones are an integral part of daily life in South Korea, and people are always looking for ways to protect their expensive devices.

- The growth of the construction industry in South Korea is notable. With the country being densely populated and space-limited, many buildings are constructed vertically. With people living close to each other, there is a higher chance of scratches and damage to walls, floors, and other surfaces. Therefore, people are investing in scratch-resistant coatings and materials to protect their homes and offices.

Key Players and Market Concentration in the Scratch-resistant Glass Industry

The scratch-resistant market seems to be quite diverse, with a variety of players offering different solutions. Some companies offer coatings or films that can be applied to surfaces to provide scratch resistance, while others are developing new materials with scratch-resistant properties.

Additionally, some companies offer repair services for scratched surfaces. Overall, it appears that the market is growing and evolving rapidly, with new innovations and advancements being introduced regularly.

Recent Developments

- In 2024, Corning Incorporated introduced a new line of robust and resilient glass composite products called Corning Gorilla Glass with DX and Corning Gorilla Glass with DX+.

- In 2025, AvanStrate Inc. (ASI) added the AvanRhino Cover Glass to its product portfolio. This new cover glass boasts exceptional drop and scratch resistance, making it ideal for use in a variety of devices, including smartphones, laptops, tablets, and automobile monitors.

- In 2025, WinDoor, PGT Innovations' product line in the premium window, door, and garage door industry, included Diamond Glass as its standard glass. This laminated glass features Corning Architectural Technical Glass and is ultra-lightweight, up to 45% lighter than traditional laminated glass, and more than three times more scratch-resistant.

Leading Suppliers of Scratch-resistant Glass Technologies

- Saint-Gobain S.A.

- Corning Incorporated

- Asahi Glass Co., Ltd.

- Nippon Electric Glass Co., Ltd.

- Schott AG

- Guardian Industries

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Rubicon Technology

- Crystalwise Technology Inc.

Key Shifting Preferences Covered in the Scratch-resistant Glass Market Report

- Innovations in Scratch Resistant Lenses in the Scratch-resistant Glass Market

- Competitive Analysis of Scratch Proof vs Scratch Resistant Glass

- Strategies for Scratch-resistant Gorilla Glass Manufacturers

- Opportunity Breakdown of Spectacle Lenses With Scratch Resistance

- Information About Best Scratch Resistant Glass in the Market

- Top Companies Offering Scratch Resistant Glass for Mobile Phones

Top Segments Studied in the Scratch-resistant Glass Market

By Product:

- Chemically Strengthened Glass

- Sapphire Glass

By Application Type:

- Smartphones & Tablets

- Automotive

- Interior Architecture

- Electronics

- Others

By Region:

- North America

- Latin America

- East Asia

- South Asia

- Europe

- Oceania

- MEA

Frequently Asked Questions

How big is the scratch-resistant glass market in 2025?

The global scratch-resistant glass market is estimated to be valued at USD 3.1 billion in 2025.

What will be the size of scratch-resistant glass market in 2035?

The market size for the scratch-resistant glass market is projected to reach USD 7.8 billion by 2035.

How much will be the scratch-resistant glass market growth between 2025 and 2035?

The scratch-resistant glass market is expected to grow at a 9.7% CAGR between 2025 and 2035.

What are the key product types in the scratch-resistant glass market?

The key product types in scratch-resistant glass market are chemically strengthened glass and sapphire glass.

Which application type segment to contribute significant share in the scratch-resistant glass market in 2025?

In terms of application type, smartphones & tablets segment to command 47.5% share in the scratch-resistant glass market in 2025.