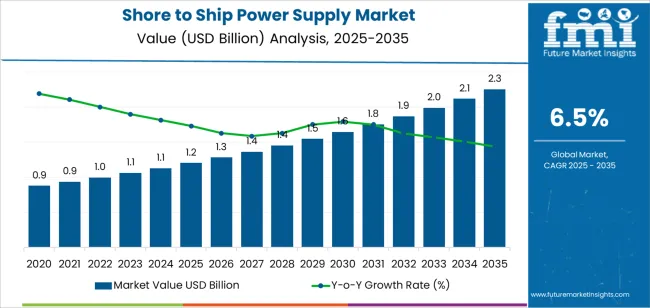

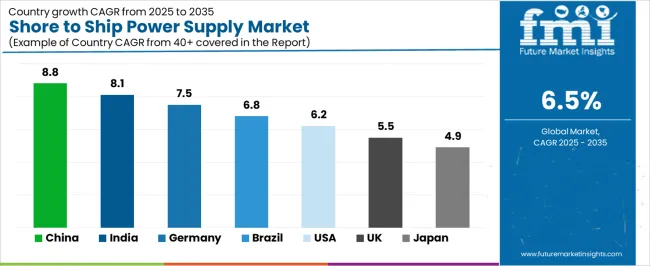

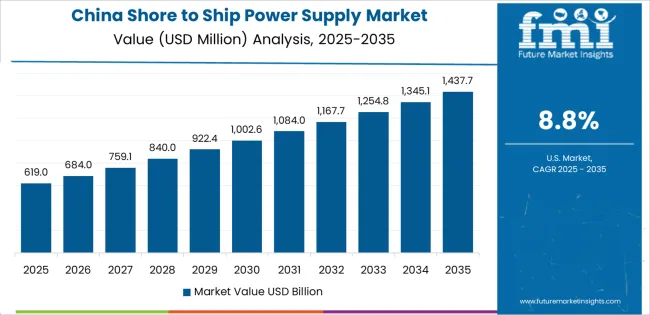

The shore to ship power supply market is projected to increase from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, expanding at a CAGR of 6.5% and adding USD 1.0 billion in absolute value over the forecast period. The market is forecast to grow 1.9 times due to the surge in green port development, strict maritime emission regulations, and accelerating electrification of vessel berthing operations. Port authorities across Asia Pacific, Europe, and North America are adopting shore power systems to replace auxiliary engine operations, reducing noise and cutting emissions by up to 100% during docking. The growing integration of smart grid networks, renewable energy coupling, and automated connection technologies is defining the next generation of eco-friendly maritime infrastructure. China leads the global expansion with an 8.8% CAGR, supported by large-scale port electrification programs in Shanghai, Shenzhen, and Ningbo, alongside 20–30% infrastructure subsidies under its Green Port initiative. India, recording an 8.1% CAGR, follows closely through the Sagarmala initiative and modernization of Mumbai and Chennai ports, where shore power adoption improves air quality and regulatory compliance. Germany, growing at a 7.5% CAGR, maintains Europe’s leadership through high-reliability systems implemented in Hamburg, Bremerhaven, and Kiel, backed by extensive renewable integration and technical workforce expertise.

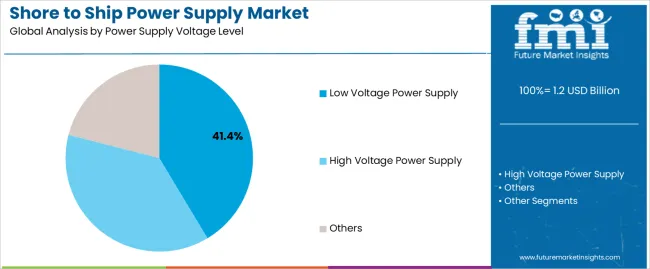

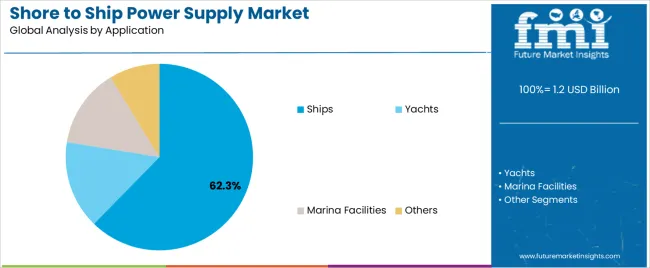

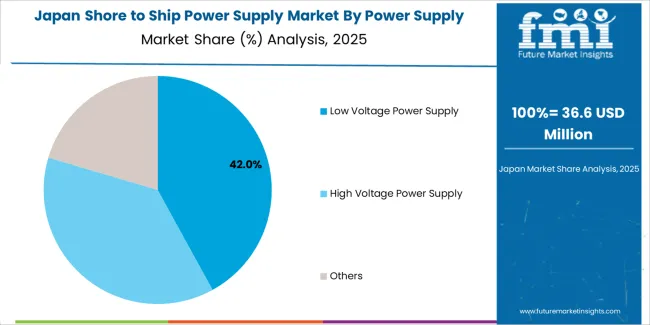

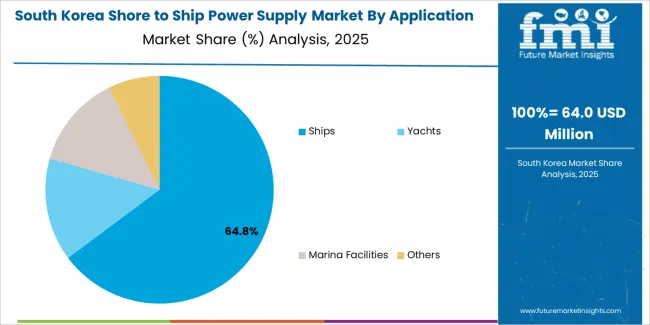

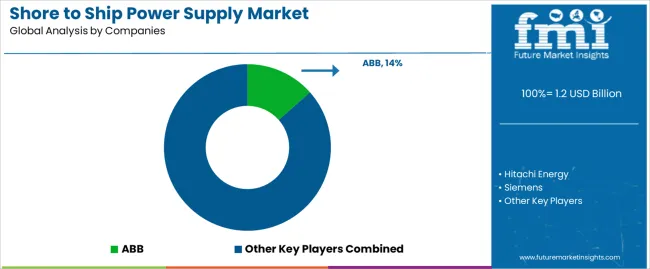

Brazil, expanding at a 6.8% CAGR, benefits from environmental policy adoption in Santos and Rio de Janeiro ports, where shore power installations are promoted to enhance cruise tourism sustainability. The United States, with 6.2% CAGR, focuses on emission-free berthing in California and Washington under stringent state-level air quality programs, while the United Kingdom (5.5% CAGR) invests in Southampton and London port retrofits to meet IMO emission benchmarks. Japan, recording 4.9% CAGR, demonstrates high system reliability through advanced port electrification in Tokyo and Yokohama, combining grid stability with clean power adoption in its port modernization framework. The low voltage power supply segment, commanding 41.4% share, remains the dominant configuration due to cost-effectiveness and cross-vessel compatibility, while ship applications represent 62.3% share, reflecting widespread use in container and cargo vessel berthing operations. Port electrification momentum is supported by technology leaders such as ABB, Siemens, Hitachi Energy, and Schneider Electric, which together control over 50% of the market through turnkey power conversion and automation systems. Regional firms like Cavotec, NR Electric, and Wärtsilä specialize in modular system deployment and grid-integrated marine interfaces.

The maritime industry shift toward eco-friendly mandates and green port initiatives creates steady demand for shore power solutions capable of providing reliable electrical supply with minimal environmental impact and consistent power quality across diverse vessel types. Port operators are adopting shore to ship power systems for emission-sensitive berthing locations where environmental compliance directly impacts operational licensing and community relations requirements.

Port authorities and terminal operators are investing in shore to ship power supply systems to enhance environmental positioning through improved air quality metrics and expanded regulatory compliance capabilities. The integration of advanced power conversion equipment and automated connection systems enables these installations to achieve power delivery performance exceeding vessel auxiliary generators while maintaining electrical safety standards. The initial infrastructure investment requirements for port-side electrical installations and technical compatibility challenges for diverse vessel configurations may pose barriers to market expansion in budget-constrained port facilities and regions with limited access to electrical grid capacity and technical implementation expertise.

Between 2025 and 2030, the market is projected to expand from USD 1.2 billion to USD 1.5 billion, resulting in a value increase of USD 0.3 billion, which represents 32.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for environmental compliance solutions in port operations, product innovation in power conversion technology and connection systems, as well as expanding integration with renewable energy sources and smart grid infrastructure. Companies are establishing competitive positions through investment in high-efficiency power equipment, automated connection technologies, and strategic market expansion across container terminals, cruise ports, and commercial harbor facilities.

From 2030 to 2035, the market is forecast to grow from USD 1.5 billion to USD 2.3 billion, adding another USD 0.7 billion, which constitutes 67.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced shore power systems, including high-capacity installations and intelligent grid-integrated configurations tailored for specific vessel types and port requirements, strategic collaborations between port authorities and electrical equipment manufacturers, and an enhanced focus on renewable energy integration and carbon footprint reduction. The growing focus on maritime sustainability and environmental stewardship will drive demand for advanced, high-performance shore to ship power supply solutions across diverse port and harbor applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast Value (2035) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The shore to ship power supply market grows by enabling port operators to achieve superior environmental performance and regulatory compliance while reducing vessel emissions during berthing operations. Port facilities face mounting pressure to improve air quality and reduce carbon footprints, with shore power systems typically eliminating 95-100% of local emissions compared to auxiliary engine operations, making these specialized installations essential for eco-friendly port operations. The maritime shipping and cruise industries need for emission-free berthing creates demand for reliable shore power solutions that can maintain vessel electrical requirements, achieve zero-emission operations, and ensure consistent power quality across diverse vessel configurations and operational scenarios.

Environmental regulation initiatives promoting clean port operations and emission reduction targets drive adoption in container terminals, cruise ports, and commercial harbors, where local air quality has a direct impact on community health and regulatory compliance. The global shift toward maritime eco-friendly principles and International Maritime Organization implementation accelerates shore to ship power supply demand as port facilities seek electrification solutions that eliminate berthing emissions and minimize environmental impacts. Limited electrical grid capacity in existing port infrastructure and higher initial installation costs compared to vessel auxiliary systems may limit adoption rates among smaller port facilities and regions with aging electrical infrastructure and limited capital investment budgets and technical implementation resources.

The market is segmented by power supply voltage level, application, and region. By power supply voltage level, the market is divided into low voltage power supply, high voltage power supply, and others. Based on application, the market is categorized into ships, yachts, marina facilities, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The low voltage power supply segment represents the dominant force in the market, capturing approximately 41.4% of total market share in 2025. This category encompasses standard voltage configurations optimized for general maritime vessel requirements, delivering reliable electrical supply and proven operational performance across diverse port applications. The low voltage power supply segment market leadership stems from its widespread vessel compatibility, established installation standards, and cost-effective infrastructure requirements across container terminals and commercial port facilities.

The high voltage power supply segment maintains a substantial 38.0% market share, serving port operators who require higher capacity electrical supply through advanced voltage configurations and specialized power delivery systems that accommodate large vessels and high electrical demand applications.

Key advantages driving the low voltage power supply segment include:

Ships applications dominate the market with approximately 62.3% market share in 2025, reflecting the extensive utilization of shore power systems across container vessels, cargo ships, and commercial maritime operations. The ships segment market leadership is reinforced by widespread implementation in major container terminals, bulk cargo ports, and commercial shipping facilities, which provide essential emission reduction advantages and regulatory compliance benefits in high-volume port environments.

The yachts segment represents 18.0% market share through specialized applications including luxury yacht marinas, private yacht facilities, and recreational boating harbors requiring premium power quality and service reliability. Marina facilities account for 12.0% market share, driven by adoption in recreational boating complexes, small craft harbors, and waterfront developments where shore power supports facility amenities and environmental standards.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to environmental compliance and operational efficiency. First, maritime environmental regulation expansion creates increasing requirements for emission-free berthing solutions, with global port authorities implementing air quality standards requiring reliable shore to ship power supply systems for vessel berthing operations, emission elimination, and environmental compliance management. Second, port eco-friendly initiatives and green harbor programs drive adoption of shore power technology, with shore to ship power systems eliminating local emissions while reducing noise pollution in port areas and surrounding communities. Third, international shipping regulation implementation and emission control area requirements accelerate deployment across port facilities, with shore to ship power supply systems integrating effectively into port infrastructure and enabling compliance with evolving maritime environmental standards.

Market restraints include infrastructure investment barriers affecting port facilities in resource-limited regions and budget-constrained harbor operations, particularly where conventional auxiliary power remains adequate for non-regulated berthing scenarios and where electrical grid capacity constraints limit shore power installation viability. Technical compatibility requirements for diverse vessel configurations pose adoption challenges for ports lacking standardized equipment, as shore to ship power effectiveness depends heavily on proper electrical interface design, power conversion configuration, and vessel-specific connection protocols that vary significantly across maritime vessel classes. Limited availability of electrical grid capacity in existing port infrastructure creates additional barriers, as shore power installations require substantial electrical supply capabilities and grid reinforcement that may exceed available utility infrastructure in older port facilities.

Key trends indicate accelerated adoption in Asian maritime hubs, particularly China and India, where port infrastructure modernization and environmental regulation implementation are expanding rapidly through government maritime development programs and international shipping compliance requirements. Technology advancement trends toward renewable energy integration with wind and solar power sources, intelligent power management systems for optimized grid utilization, and modular shore power configurations enabling scalable deployment are driving next-generation infrastructure development. The market thesis could face disruption if alternative vessel power technologies including battery systems achieve breakthrough capabilities in zero-emission berthing operations, potentially reducing demand for shore-based electrical supply in specific port scenarios.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

The market is gaining momentum worldwide, with China taking the leads to aggressive port infrastructure expansion and maritime environmental regulation programs. Close behind, India benefits from growing port modernization initiatives and government eco-friendly programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding port facilities and environmental compliance development strengthen its role in South American maritime operations.

The USA demonstrates robust growth through advanced emission control programs and port green initiatives, signaling continued adoption in environmental compliance applications. Meanwhile, Japan stands out for its port technology expertise and environmental management integration, while UK and Germany continue to record consistent progress driven by maritime sustainability leadership and port modernization programs. Together, China and India anchor the global expansion story, while established markets build stability and environmental leadership into the market growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the market with a CAGR of 8.8% through 2035. The country leadership position stems from comprehensive port infrastructure expansion, intensive maritime sector development programs, and aggressive environmental regulation targets driving adoption of shore power technologies. Growth is concentrated in major port regions, including Shanghai, Shenzhen, Ningbo, and Qingdao, where container terminals, commercial harbors, and cruise ports are implementing shore to ship power supply systems for emission reduction and environmental compliance.

Distribution channels through electrical equipment suppliers, marine infrastructure specialists, and direct manufacturer relationships expand deployment across port clusters, maritime terminals, and harbor facility networks. The country Green Port initiatives provide policy support for shore power technology adoption, including subsidies for infrastructure implementation and environmental compliance programs.

Key market factors:

In major port regions including Mumbai, Chennai, Kolkata, and Kandla maritime zones, the adoption of shore to ship power supply systems is accelerating across container terminals, commercial ports, and harbor facilities, driven by Sagarmala initiatives and increasing focus on environmental compliance. The market demonstrates strong growth momentum with a CAGR of 8.1% through 2035, linked to comprehensive port sector expansion and increasing investment in green infrastructure capabilities.

Indian port authorities are implementing shore to ship power supply technology and environmental management systems to improve air quality while meeting international maritime standards in port operations serving domestic and international shipping routes. The country maritime development policies create steady demand for shore power solutions, while increasing focus on environmental stewardship drives adoption of emission-free berthing systems that enhance port competitiveness.

Germany advanced maritime sector demonstrates sophisticated implementation of shore to ship power supply systems, with documented case studies showing significant emission reductions in port operations through optimized shore power strategies.

The country port infrastructure in major maritime regions, including Hamburg, Bremerhaven, Rostock, and Kiel, showcases integration of advanced shore power technologies with existing harbor facilities, leveraging expertise in electrical engineering and environmental management. German port operators emphasize eco-friendly standards and environmental performance, creating demand for reliable shore power solutions that support climate commitments and stringent air quality requirements. The market maintains strong growth through focus on maritime sustainability and port innovation, with a CAGR of 7.5% through 2035.

Key development areas:

The Brazilian market leads in Latin American shore to ship power supply adoption based on expanding port infrastructure and growing environmental compliance in major maritime centers. The country shows solid potential with a CAGR of 6.8% through 2035, driven by port sector investment and increasing demand for eco-friendly maritime operations across container ports, cruise terminals, and commercial harbor sectors.

Brazilian port authorities are adopting shore to ship power supply technology for alignment with international environmental standards, particularly in major commercial ports requiring emission control and in cruise terminals where air quality impacts tourism appeal. Technology deployment channels through electrical equipment distributors, marine infrastructure specialists, and port procurement programs expand coverage across maritime networks and harbor facilities.

Leading market segments:

The U.S. market leads in advanced shore to ship power supply applications based on integration with emission control regulations and comprehensive port environmental programs for enhanced air quality. The country shows solid potential with a CAGR of 6.2% through 2035, driven by maritime environmental leadership and increasing adoption of shore power technologies across major ports, cruise terminals, and naval facilities.

American port authorities are implementing shore to ship power supply systems for regulatory compliance requirements, particularly in California ports with stringent emission standards and in East Coast terminals where community air quality impacts operational licenses. Technology deployment channels through specialized electrical contractors, port engineering firms, and direct equipment relationships expand coverage across diverse maritime operations.

Leading market segments:

The U.K. market demonstrates consistent implementation focused on maritime sustainability and port environmental management, with documented shore power integration achieving emission improvements in harbor operations. The country maintains steady growth momentum with a CAGR of 5.5% through 2035, driven by maritime environmental commitments and port modernization requirements in major harbor facilities. Major maritime regions, including London, Southampton, Liverpool, and Scotland ports, showcase deployment of shore power technologies that integrate with existing port infrastructure and support environmental requirements in maritime operations.

Key market characteristics:

Japan market demonstrates sophisticated implementation focused on port environmental management and maritime sustainability, with documented integration of advanced shore power systems achieving emission reduction in port operations. The country maintains steady growth momentum with a CAGR of 4.9% through 2035, driven by environmental excellence culture and focus on eco-friendly principles aligned with maritime industry standards. Major port regions, including Tokyo, Yokohama, Osaka, and Nagoya, showcase advanced deployment of shore power technologies that integrate seamlessly with port electrical systems and comprehensive environmental management frameworks.

Key market characteristics:

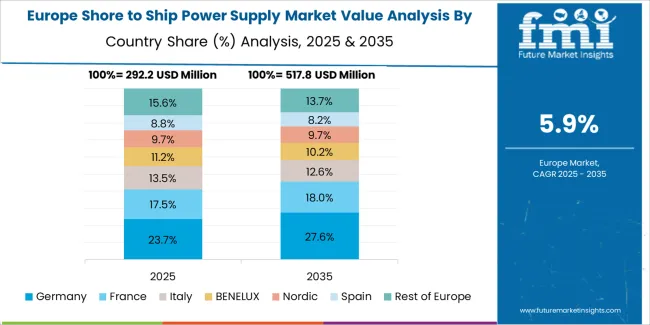

The shore to ship power supply market in Europe is projected to grow from USD 310.5 million in 2025 to USD 640.7 million by 2035, registering a CAGR of 7.5% over the forecast period. Germany is expected to maintain its leadership position with a 29.8% market share in 2025, declining slightly to 29.1% by 2035, supported by its extensive port infrastructure and major maritime centers, including Hamburg, Bremerhaven, and Rostock port regions.

France follows with a 23.4% share in 2025, projected to reach 23.8% by 2035, driven by comprehensive port modernization programs and environmental initiatives in major maritime regions. The United Kingdom holds a 19.2% share in 2025, expected to reach 19.5% by 2035 through major port facilities and cruise terminal operations. Italy commands a 14.6% share in both 2025 and 2035, backed by maritime infrastructure development and port eco-friendly programs. Spain accounts for 6.5% in 2025, rising to 6.7% by 2035 on port expansion operations and environmental compliance growth. The Rest of Europe region is anticipated to hold 6.5% in 2025, expanding to 7.3% by 2035, attributed to increasing shore to ship power supply adoption in Nordic countries and emerging Baltic maritime operations.

The Japanese market demonstrates a mature and environmentally-focused landscape, characterized by sophisticated integration of advanced shore power systems with existing port infrastructure across container terminals, commercial harbors, and cruise facilities. Japan focus on environmental excellence and operational efficiency drives demand for reliable shore power equipment that supports eco-friendly commitments and air quality targets in competitive maritime environments. The market benefits from strong partnerships between international electrical equipment providers and domestic port operators including major harbor authorities, creating comprehensive service ecosystems that prioritize technical support and environmental management programs. Port facilities in Tokyo, Yokohama, Osaka, and other major maritime areas showcase advanced infrastructure implementations where shore to ship power supply systems achieve high reliability compliance through optimized electrical design and comprehensive maintenance protocols.

The South Korean market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and installation capabilities for port operations and maritime facility applications. The market demonstrates increasing focus on port modernization and environmental compliance, as Korean port authorities increasingly demand advanced shore power solutions that integrate with domestic electrical infrastructure and sophisticated port management systems deployed across major maritime complexes. Regional electrical contractors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including installation programs and application-specific power solutions for container and cruise terminal operations. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean maritime specialists, creating hybrid service models that combine international product development expertise with local technical support capabilities and rapid response systems.

The market features approximately 20-25 meaningful players with moderate fragmentation, where leading companies control market share through established project execution networks and comprehensive product portfolios. Competition centers on system reliability consistency, technical performance, and project support capabilities rather than price competition alone. Market leaders maintain competitive advantages through proven electrical engineering expertise and established relationships with port authorities and terminal operators.

Market leaders include major electrical equipment manufacturers with global reach and comprehensive power system capabilities, which maintain competitive advantages through technical expertise, project execution capabilities, and deep maritime infrastructure knowledge across multiple regions, creating trust and reliability advantages with port development operations and harbor facility projects. These companies leverage research and development capabilities in power conversion optimization, grid integration technology advancement, and ongoing technical support relationships to defend market positions while expanding into emerging maritime markets and specialized application segments.

Challengers encompass specialized marine electrical equipment manufacturers and shore power specialists, which compete through differentiated product offerings and strong regional presence in key maritime markets. Product specialists focus on specific voltage configurations or application segments, offering specialized capabilities in custom system solutions, rapid deployment services, and competitive pricing structures for standard installations.

Regional players and emerging electrical infrastructure companies create competitive pressure through localized engineering advantages and project responsiveness capabilities, particularly in high-growth markets including China and India, where proximity to port development projects provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven electrical performance with comprehensive project management offerings that address the complete installation cycle from system design through commissioning and operational support.

Shore to ship power supply systems represent advanced electrical infrastructure solutions that enable port operators to achieve zero-emission berthing and regulatory compliance while eliminating vessel auxiliary engine operations, delivering superior environmental benefits and operational efficiency with enhanced air quality and noise reduction in demanding port environments. With the market projected to grow from USD 1.2 billion in 2025 to USD 2.2 billion by 2035 at a 6.5% CAGR, these specialized electrical installations offer compelling advantages - emission elimination, environmental compliance, and community benefit - making them essential for ships applications (62.3% market share), yachts operations (18.0% share), and port facilities seeking alternatives to auxiliary engine power that compromises air quality through local emissions and operational noise. Scaling market adoption and technology deployment requires coordinated action across maritime policy, port infrastructure development, equipment manufacturers, port authorities, and infrastructure investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Power Supply Voltage Level | Low Voltage Power Supply, High Voltage Power Supply, Others |

| Application | Ships, Yachts, Marina Facilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | ABB, Hitachi Energy, Siemens, Schneider Electric, Wärtsilä, Comeca Group, Nidec Conversion, eCap Marine, GEPowerCon, Igus, Cavotec, NR Electric, Wabtec, Hareid Group, TERASAKI, TEC Container |

| Additional Attributes | Dollar sales by power supply voltage level and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with electrical equipment manufacturers and port infrastructure networks, port facility requirements and technical specifications, integration with electrical grid systems and renewable energy sources, innovations in power conversion technology and automated connection platforms, and development of specialized shore power solutions with enhanced environmental performance and operational reliability capabilities. |

The global shore to ship power supply market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the shore to ship power supply market is projected to reach USD 2.3 billion by 2035.

The shore to ship power supply market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in shore to ship power supply market are low voltage power supply, high voltage power supply and others.

In terms of application, ships segment to command 62.3% share in the shore to ship power supply market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Onshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Energy Infrastructure Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA