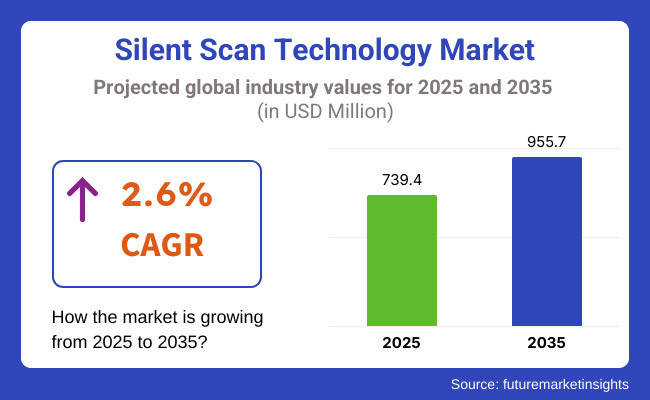

The Silent scan technology market is expected to reach approximately USD 739.4 million in 2025 and expand to around USD 955.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.6% over the forecast period.

Silent scan technology market will be expected to see a robust growth with the growing demand for noise-free imaging in the diagnostic process. It is the first technology implemented mostly on MRI system that is a true quantum leap when it comes to the reduction of the acoustic noise of MRI, enhancing the comfort of the patient without adversely affecting the quality of the image whatsoever.

Output from new, advanced MRI equipment, including optimized gradient coils and new noise-dampening materials, is driving the market. In addition, numerous regulatory bodies are encouraging the use of patient-friendly imaging technologies, thus driving demand for silent scan solutions among healthcare providers. To distinguish themselves, vendors are spending on high-performance, low-noise scanning solutions.

This increasing need for silent scan-capable high-field MRI systems is particularly prevalent in upscale imaging centers and hospitals seeking to differentiate their services. As healthcare providers become more concerned with improving patient satisfaction and operational efficiency, silent scan technology is becoming a key feature in the next generation of medical imaging, further driving market expansion.

The silent scan technology market has experienced consistent growth over the past few years, fueled by growing awareness of patient comfort in medical imaging. Adoption was initially slow as healthcare providers were initially concerned with traditional MRI systems, with noise reduction being a secondary concern. As patient-centered care gained momentum, however, demand for quieter imaging solutions started to increase.

These years, top MRI makers made significant investments to develop and hone silent scan technology, launching sophisticated gradient coil designs and noise-absorbing materials to improve the imaging experience. Hospitals and diagnostics facilities realized the value of decreased patient stress and enhanced scan compliance and began incorporating silent scan-capable MRI systems into their facilities. Market growth accelerated with the growth of upscale diagnostic centers and the drive for imaging service differentiation.

Regulatory agencies and healthcare organizations also started stressing the need for noise reduction in MRI procedures, which resulted in more funding and research in this area. Consequently, silent scan technology progressed from being a specialty feature to an essential element in contemporary MRI systems.

The demand for the silent scan technology market in North America is boosted by regulatory patient comfort norms, high expenditure on cutting-edge medical imaging technologies, and the availability of prominent MRI manufacturers.

The country is the most dominant across the region because of its well-developed diagnostic imaging facilities and hospital budgets that are robust enough to upgrade to noise-free MRI systems. Growing patient awareness regarding silent scanning technologies and growing demand for high-quality imaging experiences are also driving adoption.

Medical doctors are increasingly using silent scan MRI technology to increase patient compliance, especially among pediatric and claustrophobic patients. R&D centers and imaging firms are creating next-generation low-noise MRI systems with improved efficiency. Hospitals and diagnostic imaging centers are also giving refurbished programs high priority to add silent scan features to existing MRI machines to bolster market growth.

An organized public healthcare system, increasing investments in advanced MRI technologies, and robust government programs to increase diagnostic comfort are fueling the European silent scan technology market.

Germany, France, and the UK are leading the adoption of silent scan technology due to their centralized procurement policy and focus on patient-friendly imaging technologies. Budgetary constraints in public healthcare systems, long approval periods for new medical technologies, and the slow rate of MRI system replacement can hamper market growth.

In response to these challenges, health authorities are making more efforts to integrate silent scan MRI in public hospitals, particularly pediatric and geriatric care. Cross-border collaborations among medical institutions and producers are speeding up the development of cost-effective noise-reduction methods.

Asia-Pacific silent scan technology market is growing significantly with the rising demand for advanced medical imaging and growing patient base. Major nations like China, India, and Japan are making hospital modernization a priority, upgrading MRI facilities.

The aggressive growth of private diagnostic centers and the demand for high-quality healthcare services are further driving the silent scan technology adoption. But market penetration remains threatened by high costs of equipment, low rural awareness, and technical limitations in retrofitting existing MRI machines.

The region's healthcare providers, in turn, are collaborating with international imaging equipment makers to bring silent scan solutions to market at affordable prices. Governments are also providing subsidies and tax incentives to promote the uptake of noiseless MRI solutions in government hospitals. Local medical device makers are also investing in region-specific silent scan MRI solutions for wider accessibility and affordability, making Asia-Pacific a growth driver for silent scan technology.

Challenges

Regulatory Barriers and Limited Awareness Hindering Adoption

Silent scan technology must meet the established medical imaging rules, which consequently means approval times can be long before new noise-reducing methods become available for broad use. There is a lot of testing that regulators need to do to verify that these technologies do not impair MRI operation, image quality, or patient safety. Consequently, new silent scan products undergo a lengthy validation process that holds them back from commercialisation and prevents manufacturers from offering innovations in a timely fashion.

Apart from the regulatory challenges, inadequate awareness and radiologist training and MRI technician training can impede its take-off still further. The understanding of silent scan technology advantages is sparse among medical personnel, and several settle for the conventional imaging technologies.

There is little training offered on these systems, prompting skepticism towards accepting noise-free MRI systems and further dampening the growth of the market. Knowledge and expertise shortages also make it harder for smaller hospitals and diagnostic centers-particularly in developing economies with tighter budgets and fewer resources-to invest in newer imaging technologies.

Opportunities

Rising Demand for Patient-Centric Imaging Creating Growth Opportunities

Strong demand for silent scan technology from hospitals and diagnostic centre owing to the growing focus on patient comfort and experience is also generating demand for silent scan technology, thereby defining the market's landscape.

Conventional MRI machines generate high levels of acoustic noise, which may induce stress and discomfort among the patients, especially children, aged patients, patients suffering from anxiety and claustrophobia. Consequently, to provide a more pleasant and collaborative scanning experience, healthcare providers are focusing on noise-free imaging solutions.

This move towards patient-centric diagnostics is compelling manufacturers and hospitals to invest in sophisticated silent scan MRI systems. High-end diagnostic centers, especially, consider silent scanning as a differentiator that raises the level of service and draws more patients.

Government initiatives towards better healthcare experiences are also prompting facilities to add silent scan features, presenting a huge market opportunity. As the need for comfortable, high-quality imaging increases, silent scan technology adoption will grow very fast.

Growing Preference for High-Field MRI Systems with Silent Scan Capabilities

Hospitals and diagnostic centers have a growing preference for high-field MRI equipment, especially 3T and 7T scanners, because they provide better image resolution and shorter scan times. More acoustic noise is created by these systems, but this has fueled demand for effective noise reduction. In reaction, medical imaging companies are incorporating silent scan technology into high-field MRI machines to counterbalance image quality and patient comfort.

Advanced healthcare facilities are increasingly embracing silent scan-capable high-field MRI systems to improve diagnosis accuracy and patient satisfaction. This is particularly high in developed countries, where the focus is on cutting-edge imaging technology. With emerging economies strengthening their advanced healthcare infrastructure, the market for high-field MRI equipment with silent scan capability will increasingly grow, speeding up adoption.

Increasing Focus on Retrofitting Existing MRI Systems with Silent Scan Technology

Rather than buying new MRI systems, imaging centers and hospitals more frequently retro-fit current systems with silent scan technology. Medical imaging companies today provide modular noise-reduction technologies, allowing hospitals to easily adopt silent scan technology into existing systems.

This movement is especially prominent in emerging countries, where new MRI system deployments are restricted due to budget concerns. As retrofitting becomes easier and less expensive, it will be the primary driver for global silent scan technology adoption.

Traditionally, the silent scan technology market developed as a reaction to rising patient discomfort from high-decibel noise in MRI machines. Initial developments addressed passive noise-reducing technologies, including insulation materials and scanning protocol optimization. Adoption was slow at first because hospitals were more concerned with image quality than with patient comfort.

But as patient-centered care picked up momentum, top MRI manufacturers invested in higher-end gradient coil technologies and noise-reduction algorithms, fueling market expansion. Support from regulation for patient-friendly imaging also further spurred adoption, especially in established healthcare markets.

In the future, the market will see tremendous progress with emphasis on small and energy-efficient silent scan MRI systems. The demand for portable and ambulatory MRI solutions will be driven to include silent scan functionality, increasing accessibility beyond hospitals. Further, manufacturers are developing affordable noise-reduction solutions to bring silent scan technology within reach in emerging markets, paving the way for wider adoption in the future.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory agencies validated silent scan technology to meet standards of safety and imaging quality, pushing approvals under patient-focused care programs. |

| Technological Advancements | MRI manufacturers advanced gradient coils and optimized pulse sequences to minimize levels of noise without compromising image acuity. |

| Consumer Demand | Growing patient awareness and patient demand for noise-free imaging, particularly among children, elderly, and anxiety-susceptible patients, have driven higher uptake in upscale healthcare centers. |

| Market Growth Drivers | Increased investment in healthcare infrastructure and rising demand for advanced imaging solutions have stimulated uptake in advanced economies. |

| Sustainability | Initial efforts were aimed at minimizing MRI system power consumption and using noise-reduction materials with low environmental footprint. |

| Supply Chain Dynamics | Hospitals and diagnostic centers purchased MRI systems directly from top manufacturers, but cost constraints restricted adoption in smaller centers. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Authorities are imposing standardized protocols on silent scan MRI systems to push global uptake in balance with affordability and accessibility. |

| Technological Advancements | They are incorporating ultra-low-noise technology, miniaturized design, and power-efficient materials in upcoming MRI devices to enhance accessibility and sustainability. |

| Consumer Demand | Hospitals are adding silent scan technology as an integral feature of MRI systems, focusing on patient-friendly diagnostics to improve overall patient experience and adherence. |

| Market Growth Drivers | Emerging economies growth, healthcare providers' strategic partnerships with MRI suppliers, and government incentives are driving the mass use of silent scan MRI. |

| Sustainability | MRI manufacturers are embracing environmentally friendly production methods, creating recyclable machine parts, and incorporating sustainable power solutions to reduce the carbon footprint of the industry. |

| Supply Chain Dynamics | Better supply chain logistics and affordable silent scan retrofitting solutions are now facilitating higher market penetration, making it accessible in urban as well as rural healthcare environments. |

Market Outlook

In the United States, the silent scan technology market is being vividly supported by ongoing improvements in MRI noise-reduction technique and growing demand for patient-friendly imaging solutions. The continually rising incidence of neurological and musculoskeletal disorders has necessitated more MRI scans, further supporting the development of silent scan technology.

Notably, the regulatory authorities are in favor of developing patient comfort and the top medical imaging firms have been strategically investing to drive market growth. Because of the advanced healthcare infrastructure and great emphasis on enhancing the diagnostic experience, the USA is still the torchbearer of silent scan MRI.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.1% |

Market Outlook

In India, the silent scan technology market is gradually increasing because of the increase in better healthcare infrastructure and investments in sophisticated medical imaging. Diagnostic centers and hospitals are subsequently increasing the installation of additional MRI machines, mainly in urban and semi-urban areas that focus on patient comfort through noise-free imaging.

The simultaneous high pile of neurological ailments, orthopedic ailments, and cancer cases has increased the need for good quality MRI scans. In addition to this, government-generation healthcare moves are driving this thrust for quiet scan MRI systems, motivated by the establishment of private diagnostic pastimes.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.8% |

Market Outlook

China's subdued scan technology market is growing vigorously because the country is pursuing strong investments in the modernization of healthcare and heightened demand for improved diagnostic imaging. With the significant aging population and high incidences of chronic illness, MRI scanning with high-end patient comfort is in demand.

The health reform efforts and increased emphasis of the Chinese government to enhance indigenous manufacture of advanced-level medical equipment also fuel market expansion. Furthermore, top medical imaging companies are increasing their footprint in China, making silent scan MRI systems more widely available.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.9% |

Market Outlook

Germany is the leader of the Europe silent scan technology market, based on the developments in the healthcare sector and focused medical innovation. The country possesses one of the highest prevalence figures of MRI scans in Europe, thus the silent scan technology is a natural step forward in advancing patient care.

The MRI medical imaging technology is being adopted by the diagnostic centers and hospitals of Germany. Top MRI vendors in the country are broadening their investments in silent scan R&D. Simultaneously, high regulatory requirements on comfort and patient safety are forcing some hospitals to introduce noise-free MRI solutions.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.6% |

Market Outlook

The market of Brazilian silent scan technology is in proliferation as the country improves healthcare infrastructures and diagnostic imaging facilities. High investment by both hospitals and diagnostic centers in sophisticated MRI technologies, owing to increasing cases of chronic and neurological ailments, has further accelerated the buildup of silent scan MRI systems.

Adoption is growing mainly in private hospitals and city-centered healthcare institutions, where comfort becomes an increasingly vital concern. However, rural areas within the market are still restrained by cost considerations and healthcare deficiencies.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.7% |

1.5T MRI Scanners Leading the Market Due to Optimal Balance of Cost, Performance, and Accessibility

The market for silent scan technology is gradually dominated by the 1.5T MRI scanners, due to their perfect price, equilibrium between imaging quality and operating efficiency. Their high-resolution images are beneficial for a wide range of clinical applications such as neurology, orthopedics, and cardiovascular imaging, thus making them a favorite among hospitals and diagnostic centers.

Along with increased inherent costs and specialized infrastructure demands for 3T MRI scanners, 1.5T systems are cost-effective and are generally more accessible for performing silent scan technology by urban and semi-urban health centers.

In addition, low power usage, lower maintenance costs, and compatibility with the majority of the contrast agents increased their usage. Additionally, manufacturers keep innovating gradient coil designs and noise-reducing features of 1.5T systems, depicting them as patient-friendly in imaging.

Though, it is due to their versatility, affordability and numerous technological advancements that the 1.5T MRI scanners would continue to be, by far, the dominant segment of the silent scan technology market.

3T MRI Scanners Gaining Traction Due to Superior Image Quality and Advanced Diagnostics

The 3T MRI scanner takes on growing momentum in the silent scan technology through their superior magnetic field strength coupled with Deafening image clarity, faster scan times, and improved accuracy of the diagnosis. These scanners are more effective in handling complicated neuro-trauma musculoskeletal cardiovascular imaging, where ultra-high resolution becomes necessary for the proper perception and subsequent detection of the early tracery of pathologies.

Although more costly than 1.5T systems, the 3T ones are becoming increasingly accepted in specialized hospitals, research centers, and high-end diagnostic facilities with a focus on precision imaging. With advances in gradient coil technology, the noise attenuation built-in, and effective cooling systems, the incorporation of the silent MRI scan in existing versions has become increasingly viable.

In addition, the combination of the 3T MRI with scanning time reduction or the retrieval of an exceptionally high image quality would most probably enhance its uptake among tertiary care hospitals and academic medical centers, thus increasing the presence of the 3T MRI segment into the list of rising segments in premium diagnostics.

Hospitals Driving Market Growth as Primary Adopters of Silent Scan Technology

Diagnostic imaging centers are the prime end users for the silent scan technology market due to growing outpatient MRI service demand. The centers are cost-efficient and provide quality imaging solutions, and therefore, silent scan MRI systems prove to be an excellent addition to their services. Patients seeking a quiet, painless scan, specifically patients with claustrophobia, pediatrics, and the elderly, favor imaging centers with silent scan technology.

Unlike hospitals, which provide all kinds of medical services, such other imaging centers specialize in radiology and imaging only so that they can invest in the latest MRI technology. In order to gain more physician referrals and enhance patient satisfaction, independent imaging centers are moving towards the incorporation of 1.5T and 3T silent scan MRI systems. Moreover, with healthcare moving toward ambulatory and preventive diagnostics, diagnostic centers have an important role to play in making silent scan technology more accessible and prevalent.

The silent scan technology market is experiencing high competitive conditions, boosted by the demand for continued technological progress in this area, increasing demand for patient-centric imaging, and noise-free MRI solutions.

Leading manufacturers of medical imaging systems, healthcare technology companies, and diagnostic equipment firms are continually investing in more advanced gradient coil designs, acoustic shielding, and new scanning algorithms to enable silent MRI.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens Healthineers | 25-30% |

| GE Healthcare | 20-25% |

| Philips Healthcare | 15-20% |

| Canon Medical Systems | 10-15% |

| Fujifilm Healthcare | 5-10% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens Healthineers | Market leader offering advanced silent scan MRI systems with optimized noise reduction and high-resolution imaging. |

| GE Healthcare | Provides Silent Scan technology integrated into both 1.5T and 3T MRI systems to enhance patient comfort and diagnostic accuracy. |

| Philips Healthcare | Focuses on patient-friendly MRI innovations, including Ambient Experience and noise-free scanning techniques. |

| Canon Medical Systems | Develops advanced acoustic noise reduction solutions for MRI machines, ensuring better patient experience and imaging clarity. |

| Fujifilm Healthcare | Expanding presence in silent scan MRI with cost-effective, high-performance imaging solutions for hospitals and diagnostic centers. |

Key Company Insights

Other Key Players Beyond the leading companies, several other manufacturers contribute to the silent scan technology market, enhancing product diversity, noise reduction advancements, and accessibility across various healthcare facilities. These include:

1.5T MRI Scanners and 3T MRI Scanners

Hospitals, Diagnostic Imaging Centres and Ambulatory Surgical Centres

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for silent scan technology market was USD 739.4 million in 2025.

The silent scan technology market is expected to reach USD 955.7 million in 2035.

Rising adoption of silent scan MRI in hospitals and diagnostic centers to improve patient experience and compliance during imaging procedures.

The top key players that drives the development of silent scan technology market are GE Healthcare, Siemens Healthineers, Philips Healthcare and Canon Medical Systems Corporation Fujifilm Healthcare

1.5T MRI scanners is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 3: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 15: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 5: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 9: Global Market Attractiveness by End User, 2023 to 2033

Figure 10: Global Market Attractiveness by Region, 2023 to 2033

Figure 11: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 12: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 13: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 14: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 15: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 16: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 19: North America Market Attractiveness by End User, 2023 to 2033

Figure 20: North America Market Attractiveness by Country, 2023 to 2033

Figure 21: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 22: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 23: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 24: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 27: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 28: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 29: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 30: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 31: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 32: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 33: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 34: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 35: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 36: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 37: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 38: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 39: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 40: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 41: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 42: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 47: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 48: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 49: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 50: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 51: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 55: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 56: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 57: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 58: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 59: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 60: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 61: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 62: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 63: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 64: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 65: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 66: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 70: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 71: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 72: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 73: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 74: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 75: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 76: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 77: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 78: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 79: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 80: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silent Generator Market Analysis by Sound Level, Type, Phase, Power Rating, Fuel, Application, End User, and Region through 2035

Scanning and Migration Software Market

3D Scanning Market Size and Share Forecast Outlook 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

SPECT Scanning Services Market Growth - Trends & Forecast 2025 to 2035

Laser Scanning Microscopes Market

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Vehicle Scanner Market Growth – Trends & Forecast 2024-2034

Thermal Scanner Market Growth – Trends & Forecast 2020-2030

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

Micro-CT Scanners Market

Intraoral Scanner Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Narcotics Scanner Market Size and Share Forecast Outlook 2025 to 2035

Full Body Scanner Market Analysis - Size, Share & Forecast 2025 to 2035

Differential Scanning Calorimetry Market Size and Share Forecast Outlook 2025 to 2035

Mobile Laser Scanning Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mobile LiDAR Scanner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA