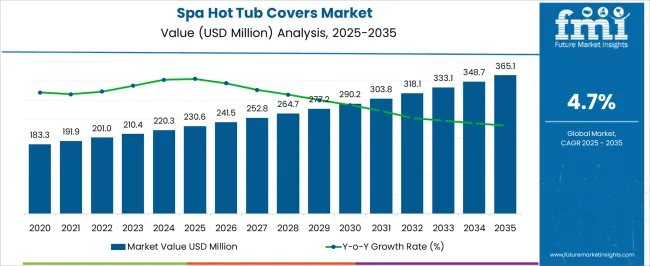

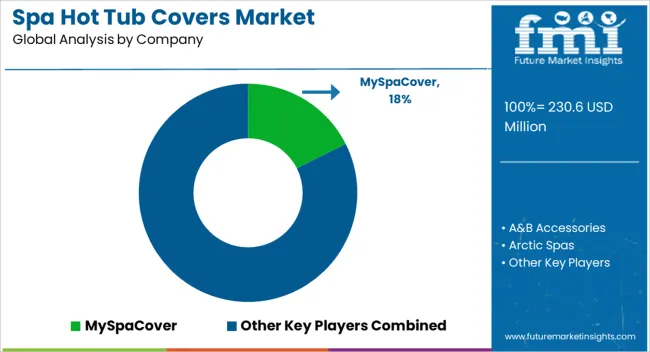

The spa hot tub covers market is projected to grow from USD 230.6 million in 2025 to USD 365.1 million by 2035, reflecting a CAGR of 4.7%, offering a clear year-on-year growth trajectory. In 2025, the market stands at USD 230.6 million, and incremental annual increases gradually rise from USD 191.9 million in 2021 to USD 241.5 million in 2026. Each year records a steady growth of roughly 4–5 percent, highlighting consistent demand in residential and commercial applications. This steady YoY expansion allows manufacturers and distributors to plan production, optimize inventory, and secure annual revenue streams effectively. By 2035, the market is expected to reach USD 365.1 million, representing an absolute increase of USD 134.5 million from 2025, supported by the 4.7 percent CAGR. Year-on-year, the market grows steadily with values rising from USD 252.8 million in 2027 to USD 365.1 million in 2035.

This predictable growth pattern enables stakeholders to anticipate market demand, adjust pricing strategies, and scale operations incrementally. The consistent YoY expansion underscores stable adoption and provides a reliable outlook for revenue planning and long-term market engagement.

| Metric | Value |

|---|---|

| Spa Hot Tub Covers Market Estimated Value in (2025 E) | USD 230.6 million |

| Spa Hot Tub Covers Market Forecast Value in (2035 F) | USD 365.1 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The global spa and hot tub accessories market, of which spa hot tub covers are a key segment, is projected to grow steadily over the next decade. In 2025, spa hot tub covers account for USD 230.6 million, representing approximately 18% of the total parent market. By 2035, the segment is expected to reach USD 365.1 million, maintaining a share of around 17–18% of the overall market. This indicates that covers will continue to be a major contributor to revenue within the spa accessories ecosystem, driven by ongoing demand, replacement cycles, and consistent adoption across residential and commercial applications. Year-on-year, the parent market shows steady growth, with spa hot tub covers increasing at a CAGR of 4.7% from USD 230.6 million in 2025 to USD 365.1 million in 2035.

The segment’s contribution as a percentage of the overall market remains stable, reflecting its sustained importance. Maintaining an 18% share over the decade underscores the covers’ strategic value in product portfolios, offering manufacturers and distributors a predictable revenue stream and highlighting opportunities to capture incremental market value within a growing parent market.

The spa hot tub covers market is witnessing stable growth, driven by the rising adoption of hot tubs in residential and hospitality sectors, combined with a growing emphasis on energy efficiency and water hygiene. Consumers are becoming increasingly aware of the role covers play in maintaining temperature, reducing evaporation, and preventing contamination, especially in seasonal and outdoor installations.

Product innovations such as lockable lids, smart sensors, and UV-resistant coatings are helping differentiate offerings in an otherwise commoditized space. Additionally, sustainability concerns have prompted the development of recyclable and durable cover materials.

Rising disposable incomes, urban wellness trends, and demand for low-maintenance outdoor solutions continue to fuel long-term demand for premium hot tub accessories.

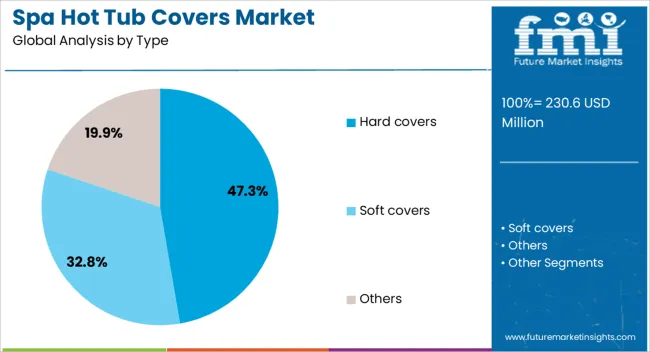

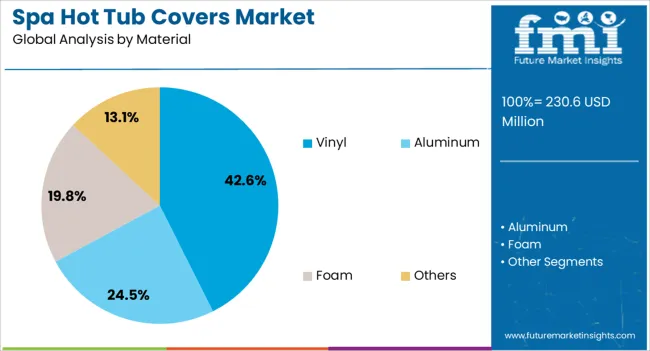

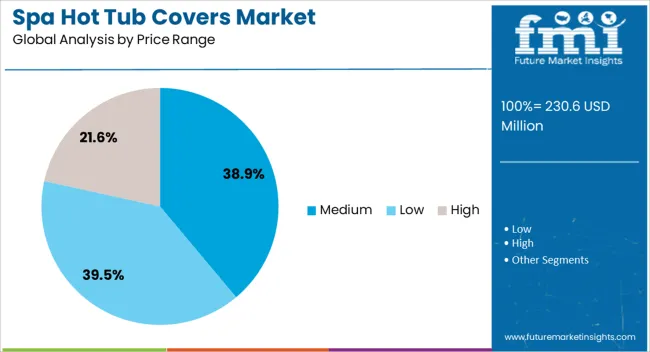

The spa hot tub covers market is segmented by type, material, price range, shape, distribution channel, and geographic regions. By type, spa hot tub covers market is divided into Hard covers, Soft covers, and Others. In terms of material, spa hot tub covers market is classified into Vinyl, Aluminum, Foam, and Others. Based on price range, spa hot tub covers market is segmented into Medium, Low, and High.

By shape, spa hot tub covers market is segmented into Rectangular/square, Round, Oval, and Custom. By distribution channel, spa hot tub covers market is segmented into Indirect and Direct. Regionally, the spa hot tub covers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hard covers are projected to hold the highest market share at 47.30% in 2025, driven by their superior durability, insulation properties, and safety features. These covers are widely preferred in colder climates and commercial installations due to their ability to retain heat and reduce energy consumption.

Their rigid structure also provides added security, minimizing accidental access by children or pets. Demand is also rising among consumers seeking long-term value, as hard covers tend to outlast their soft or inflatable counterparts.

Manufacturers are introducing lightweight composite materials and customizable aesthetics to enhance their appeal in residential wellness setups.

Vinyl-based spa hot tub covers are expected to dominate the material segment with a 42.60% market share by 2025. Vinyl’s widespread adoption is attributed to its water resistance, flexibility, and affordability.

It provides an ideal balance between performance and cost, making it suitable for mid-range and value-conscious consumer segments. Advances in UV protection, mildew resistance, and layered insulation have extended the lifespan of vinyl products, increasing their desirability in outdoor spa environments.

Vinyl’s ease of cleaning and compatibility with various foam inserts also contribute to its leadership across both standard and custom cover applications.

The medium price range is forecast to account for 38.90% of total market share in 2025, leading the price segmentation. This segment benefits from being the most accessible option that still meets performance expectations in terms of insulation, weather protection, and lifespan.

Consumers in this bracket are typically looking for reliability without the added cost of smart features or luxury materials. Medium-priced covers often use improved vinyl or hybrid constructions that balance durability and design.

As cost-conscious buyers prioritize value over brand prestige, this segment remains crucial for volume-driven manufacturers.

The spa hot tub covers market is growing as consumers increasingly seek energy-efficient, safe, and durable solutions for residential and commercial hot tubs. Covers help retain heat, reduce energy costs, prevent water evaporation, and provide safety for households with children or pets. Rising disposable incomes, wellness trends, and home leisure investments are driving adoption. Technological innovations in materials, insulation, and design, along with customization options, are enhancing product durability, aesthetics, and user convenience. Companies offering high-quality, weather-resistant, and energy-efficient spa covers are well-positioned to capitalize on growth in the home improvement, hospitality, and leisure sectors.

The spa hot tub covers market faces challenges related to material durability, weather resistance, and maintenance requirements. Covers are exposed to sunlight, rain, snow, and humidity, which can degrade foam cores, fabrics, and stitching over time. Poor quality materials can lead to sagging, water absorption, or color fading, reducing performance and lifespan. Regular cleaning, proper handling, and storage are essential to maintain insulation and structural integrity. In addition, customers may find replacement or repair challenging if high-quality or customized covers are not readily available. Manufacturers must invest in high-grade fabrics, UV-resistant coatings, reinforced foam cores, and quality assurance protocols to ensure longevity and customer satisfaction.

The spa hot tub covers market is trending toward lightweight materials, enhanced energy efficiency, and customizable designs. Modern covers use high-density foam cores, marine-grade fabrics, and reinforced stitching to reduce weight while improving thermal retention. Insulated designs enhance energy savings by reducing heat loss and evaporation. Customization options in shape, color, and thickness allow consumers to match covers with spa designs and personal preferences. Innovative folding and hinge mechanisms improve user convenience and handling. Some manufacturers are integrating smart features such as sensors for water temperature or cover alignment. These trends reflect a growing focus on combining functionality, aesthetics, and sustainability to enhance user experience and efficiency.

The spa hot tub covers market offers opportunities in residential, commercial, and wellness applications. Increased investment in home leisure, backyard pools, and wellness-focused amenities is driving demand for reliable and energy-efficient covers. Hotels, resorts, and spas are upgrading their facilities with durable, customizable covers to improve maintenance efficiency and guest satisfaction. Emerging markets with rising disposable incomes and wellness awareness present additional growth potential. Collaborations with spa and hot tub manufacturers, retailers, and e-commerce platforms can enhance market reach. Companies that focus on high-quality materials, energy-saving designs, and aesthetically appealing products are positioned to capture growth opportunities across both consumer and professional segments.

Market growth for spa hot tub covers is restrained by high product costs, competitive alternatives, and limited consumer awareness. Premium covers with advanced insulation and durable materials can be expensive, deterring adoption in price-sensitive households. Competition from lower-cost covers or DIY solutions affects market penetration. Additionally, some consumers may underestimate the energy-saving and safety benefits of high-quality covers, reducing perceived value. Variations in cover sizes and spa models can complicate purchasing and replacement decisions. Until costs decrease, awareness increases, and standardized sizing options become more prevalent, adoption may remain concentrated in premium residential and commercial segments where energy efficiency, safety, and durability are highly valued.

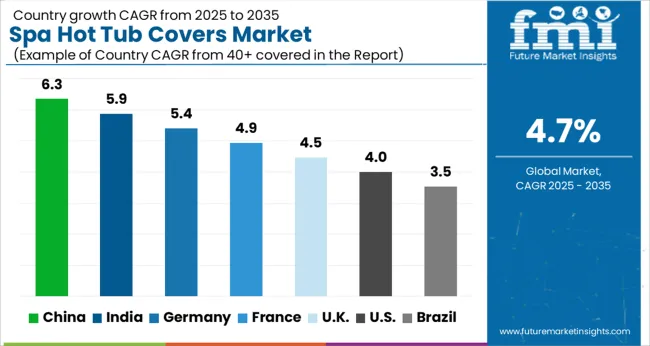

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global spa hot tub covers market is projected to grow at a CAGR of 4.7% through 2035, supported by increasing demand across residential, hospitality, and wellness applications. Among BRICS nations, China has been recorded with 6.3% growth, driven by large-scale production and deployment in leisure and wellness facilities, while India has been observed at 5.9%, supported by rising adoption in hotels, resorts, and private residences. In the OECD region, Germany has been measured at 5.4%, where production and adoption for wellness centers, spas, and residential hot tubs have been steadily maintained. The United Kingdom has been noted at 4.5%, reflecting consistent use in residential and commercial spa facilities, while the USA has been recorded at 4.0%, with production and utilization across hospitality, wellness, and residential sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is experiencing accelerated demand for spa hot tub covers, driven by rising disposable income, luxury home developments, and growing wellness culture, with a CAGR of 6.3%. Manufacturers are focusing on durable, weather-resistant, and energy-efficient covers that improve heat retention and enhance safety. Government initiatives promoting domestic wellness infrastructure and residential property modernization are supporting market growth. Pilot projects in residential complexes, resorts, and wellness centers demonstrate operational benefits such as reduced energy consumption, extended spa longevity, and improved user convenience. Collaborations between local manufacturers and international suppliers are enhancing product quality, design variety, and production efficiency. The trend toward luxury wellness products and growing awareness of spa maintenance continues to fuel adoption across China’s market.

Spa hot tub covers market in India is growing at a CAGR of 5.9%, spurred by increased interest in home wellness, hospitality upgrades, and luxury residential developments. Manufacturers are introducing weather-resistant, insulating, and lightweight covers to enhance usability and safety. Government programs promoting tourism, hospitality, and residential wellness facilities are accelerating market adoption. Pilot installations in hotels, resorts, and high-end residential complexes demonstrate operational benefits such as energy savings, extended product life, and reduced maintenance costs. Collaborations between local suppliers and international technology providers are advancing cover design, material quality, and production efficiency. Rising awareness of spa maintenance, wellness trends, and energy-efficient solutions is expected to continue driving growth across India’s spa hot tub covers market.

Spa hot tub covers market in Germany is witnessing steady growth at a CAGR of 5.4%, supported by widespread adoption in wellness centers, residential spas, and luxury resorts. Manufacturers are focusing on durable, energy-efficient, and weather-resistant covers that meet strict quality and environmental standards. Government initiatives promoting energy efficiency, building safety, and wellness infrastructure are encouraging adoption. Pilot projects in private homes, hotels, and spa facilities demonstrate operational benefits such as improved heat retention, extended equipment life, and enhanced safety. Collaborations between research institutes and manufacturers are advancing material innovation, UV resistance, and energy efficiency. Rising consumer preference for high-quality wellness products and compliance with energy regulations continue to support Germany’s spa hot tub covers market growth.

The United Kingdom is experiencing a CAGR of 4.5% in its spa hot tub covers market, driven by increasing adoption in home wellness, luxury resorts, and spa facilities. Manufacturers are developing weather-resistant, energy-efficient, and easy-to-use covers to improve safety and heat retention. Government programs promoting sustainable energy use, building safety, and tourism infrastructure are supporting market adoption. Pilot projects in residential spas, hotels, and wellness centers demonstrate operational benefits such as energy savings, improved user convenience, and enhanced durability. Collaborations between domestic suppliers and international material experts are advancing product quality, design, and manufacturing efficiency. Rising interest in home wellness and sustainable energy practices continues to encourage market growth in the UK.

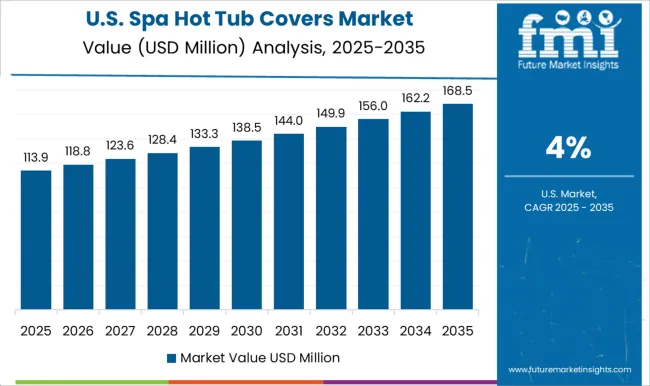

The United States spa hot tub covers market is growing at a CAGR of 4.0%, fueled by high adoption in residential homes, wellness facilities, and luxury resorts. Manufacturers are focusing on energy-efficient, durable, and weather-resistant covers that improve heat retention and reduce maintenance. Government programs promoting energy efficiency, residential safety standards, and wellness infrastructure are supporting market growth. Pilot projects in private homes, hotels, and spa resorts demonstrate operational benefits such as energy savings, product longevity, and improved user experience. Collaborations between manufacturers, material technology providers, and wellness facility operators are enhancing product design, durability, and cost efficiency. Rising consumer interest in home wellness, spa maintenance, and energy savings continues to drive adoption across the USA spa hot tub covers market.

The spa hot tub covers market is highly competitive, with specialized manufacturers and regional suppliers competing on product quality, material performance, and customization. MySpaCover is positioned as a leading provider, with brochures emphasizing foam density, vinyl thickness, insulation values, and precise fit for a variety of hot tub brands. A&B Accessories competes by offering both standard and custom covers, with technical literature highlighting UV resistance, waterproofing, and hinge configurations for ease of use. Arctic Spas and BeyondNice provide OEM and aftermarket options, with brochures detailing thermal retention, structural reinforcements, and weatherproof performance. Blue Wave Products and Caldera Spas promote covers designed for durability and seasonal resilience, with literature presenting foam compression ratings, attachment mechanisms, and recommended maintenance.

Canadian Spa Company and Core Covers focus on customizable covers with attention to fit, weight, and cover shape, while Cover Valet and Hot Spring Spas emphasize ease of handling, protective layering, and safety features in their brochures. Leisure Concepts, Rhino Spa Covers, Spa Depot, Sunstar Spa Covers, and The Cover Guy provide both standard and tailored solutions, with brochures detailing material specifications, insulation properties, and recommended environmental tolerances. Other regional players compete with niche offerings, emphasizing local availability, rapid delivery, and cost-effective customization.

Market strategies are focused on product differentiation, service support, and customer guidance. R&D and engineering efforts are directed toward foam density optimization, vinyl reinforcement, hinge design, and corrosion resistance. Partnerships with spa manufacturers, retailers, and distributors are leveraged to expand reach. Observed industry patterns indicate an emphasis on weight reduction without compromising insulation, ease of removal, and compatibility with a wide variety of spa models.

| Item | Value |

|---|---|

| Quantitative Units | USD 230.6 Million |

| Type | Hard covers, Soft covers, and Others |

| Material | Vinyl, Aluminum, Foam, and Others |

| Price Range | Medium, Low, and High |

| Shape | Rectangular/square, Round, Oval, and Custom |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MySpaCover, A&B Accessories, Arctic Spas, BeyondNice, Blue Wave Products, Caldera Spas, Canadian Spa Company, Core Covers, Cover Valet, Hot Spring Spas, Leisure Concepts, Rhino Spa Covers, Spa Depot, Sunstar Spa Covers, and The Cover Guy |

| Additional Attributes | Dollar sales vary by cover type, including standard, custom-fit, and thermal/spa insulation covers; by material, spanning vinyl, polyethylene, and foam-core composites; by application, such as residential spas, commercial spas, and wellness centers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising spa adoption, energy efficiency demand, and durability-focused consumer preferences. |

The global spa hot tub covers market is estimated to be valued at USD 230.6 million in 2025.

The market size for the spa hot tub covers market is projected to reach USD 365.1 million by 2035.

The spa hot tub covers market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in spa hot tub covers market are hard covers, soft covers and others.

In terms of material, vinyl segment to command 42.6% share in the spa hot tub covers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spain Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Spark Detection System Market Forecast and Outlook 2025 to 2035

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Spasticity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Spatial Computing Market Size and Share Forecast Outlook 2025 to 2035

Space Situational Awareness Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Space Militarization Market Size and Share Forecast Outlook 2025 to 2035

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Spatial Mass Spectrometry Market Size and Share Forecast Outlook 2025 to 2035

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Spackling Paste Market Size and Share Forecast Outlook 2025 to 2035

Spay and Neuter Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA