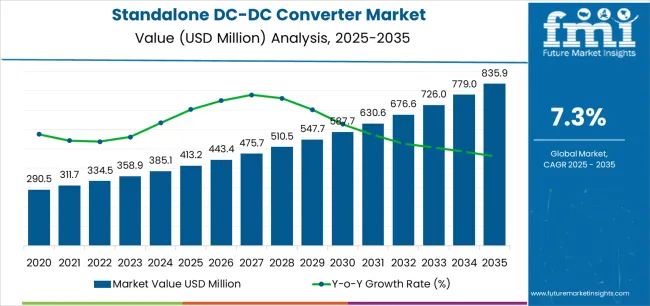

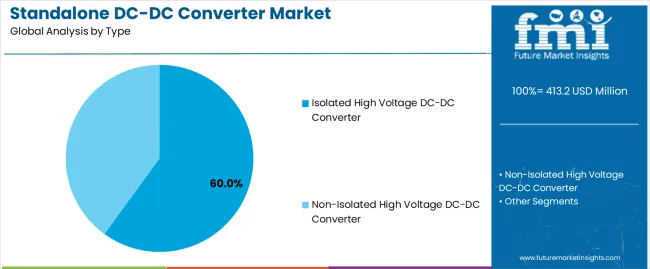

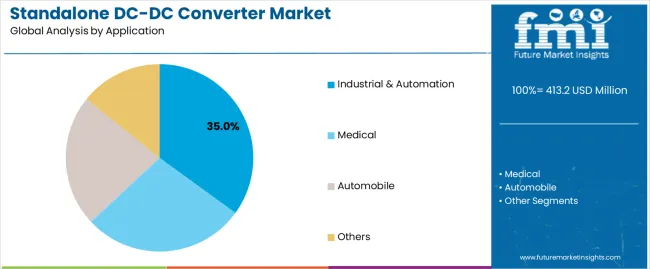

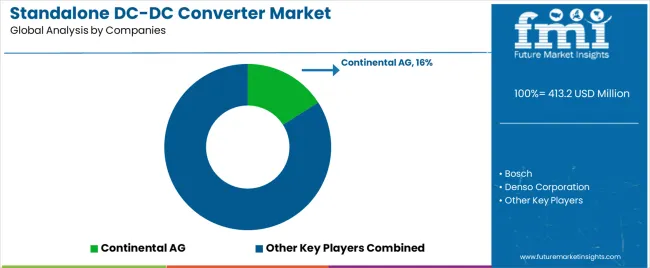

The standalone DC/DC converter market is set to rise from USD 413.2 million in 2025 to USD 835.9 million by 2035, advancing at a 7.3% CAGR and adding USD 422.7 million in new value over the period. Demand strengthens as power electronics become central to electric vehicles, industrial automation, smart medical equipment, and renewable-energy-driven systems. The leading product category, isolated high-voltage DC/DC converters, holds a 60% share, reflecting widespread adoption across EV powertrain architectures, factory automation networks, and regulated medical environments that require safe input-output separation. On the application side, industrial and automation systems account for 35% of demand, supported by robotics, sensor networks, and digitalized production lines.

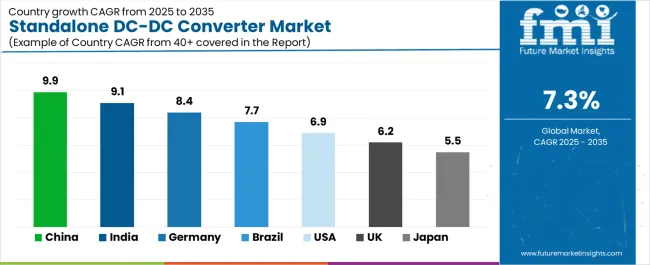

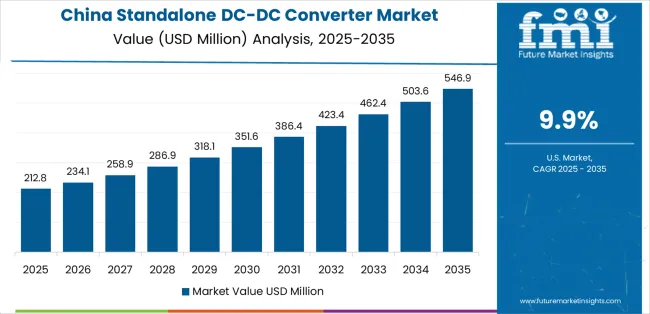

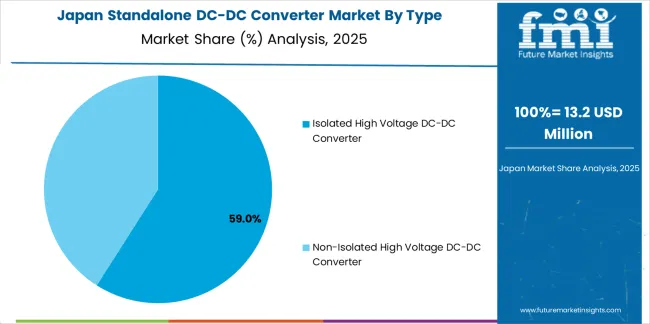

Regionally, China leads with a 9.9% CAGR, followed by India at 9.1% and Germany at 8.4%, driven by large-scale electrification, automation investments, and expanding EV ecosystems. Brazil shows 7.7%, the USA 6.9%, the UK 6.2%, and Japan 5.5%, reflecting mature but steadily advancing adoption. Across all regions, demand is shaped by rising EV penetration, miniaturized power electronics, and the shift toward renewable-integrated power systems. Competitive activity is anchored by Continental AG, Bosch, Denso, Panasonic, Hella, Aptiv, TDK, Valeo, Toyota, Shinry Technologies, and Inovance Technology, with market share influenced by innovations in high-voltage isolation, thermal management, and compact converter design.

From 2025 to 2030, the market is expected to grow from USD 413.2 million to USD 587.7 million, adding USD 174.5 million. This period will see a substantial increase in demand for standalone DC/DC converters, driven by their widespread use in automotive, consumer electronics, and renewable energy systems. With advancements in power conversion technologies and the rise of electric vehicles, the market will benefit from greater adoption of energy-efficient components that contribute to overall system performance.

Between 2030 and 2035, the market will continue to expand from USD 587.7 million to USD 835.9 million, adding USD 248.2 million in value. This phase of growth will be fueled by the increasing need for advanced power management in applications like EVs, smart grids, and telecommunications. As industries place greater emphasis on sustainability, renewable energy systems, and energy efficiency, standalone DC/DC converters will play an integral role in facilitating the transition to more energy-efficient and cost-effective power systems, ensuring continued growth through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 413.2 million |

| Market Forecast Value (2035) | USD 835.9 million |

| Forecast CAGR (2025-2035) | 7.3% |

The Standalone DC/DC Converter market is experiencing significant growth due to the increasing demand for power conversion solutions in various industries, including automotive, medical, and industrial automation. As industries push for efficient energy management and reliable power delivery systems, the adoption of DC/DC converters is rising. The increasing need for high-voltage isolation in applications like electric vehicles (EVs) and industrial machinery is also driving market growth. Additionally, the push toward automation and the integration of smart technologies in industrial sectors are creating new opportunities for Standalone DC/DC Converters.

The growing focus on renewable energy solutions and energy efficiency is another key factor behind the demand for DC/DC converters, as these systems provide a reliable means of power conversion in a variety of renewable energy applications. Furthermore, the expansion of electric vehicles (EVs) and medical equipment is accelerating the need for high-efficiency power conversion systems. With technological advancements in power electronics and battery management systems, DC/DC converters are becoming increasingly essential in modern electrical systems, contributing to the Standalone DC/DC Converter market’s growth.

The standalone DC/DC converter market is segmented by type and application. By type, the market includes isolated high voltage DC-DC converters and non-isolated high voltage DC-DC converters. By application, the market is separated into industrial and automation, medical, automobile, and others. The isolated high voltage DC-DC converter segment leads with 60% share, while the industrial and automation segment leads the application category with 35% share. Growth is particularly strong across China, India, and Germany, where rapid industrialization and electrification are transforming energy and power electronics systems.

The isolated high voltage DC-DC converter segment holds the leading position in the market with a 60% share due to its critical role in ensuring electrical safety, reliability, and performance stability in high-voltage environments. These converters provide input-to-output electrical isolation, which protects components and users from electrical faults, making them essential in sectors where high-voltage equipment is widely utilized. In industrial automation, these converters help maintain stable operations by shielding sensitive control electronics from voltage spikes or system disturbances. In the automotive sector, particularly in electric vehicles, isolated converters manage power distribution between traction batteries, onboard systems, and auxiliary modules, preventing electrical interference and improving vehicle efficiency.

In the medical device industry, isolated converters are necessary to comply with safety standards requiring patient-protective electrical separation between equipment circuitry and external power sources. As hospitals and healthcare facilities adopt more advanced diagnostic and therapeutic machines, the demand for isolated DC-DC converters continues to rise. The increasing shift toward electrification, digital control systems, and renewable energy utilization also reinforces the need for isolated converters in power distribution systems. With industries prioritizing operational safety, efficiency, and long-term durability, the isolated high voltage DC-DC converter segment is expected to remain dominant throughout the forecast period.

The industrial and automation segment leads the standalone DC/DC converter market with 35% share, driven by accelerating adoption of automated manufacturing, robotics, and intelligent production systems across both developed and emerging economies. In these environments, DC/DC converters are essential for powering sensors, controllers, actuators, robotic systems, industrial communication networks, and process control systems. Factories increasingly prioritize consistent voltage regulation to ensure operational continuity, reduce downtime, and prevent equipment failures. Standalone DC/DC converters enable precise and energy-efficient power conversion, supporting smooth and optimized industrial operations.

As industries transition toward Industry 4.0 practices, including AI-driven process optimization, IoT-enabled monitoring, and digitalized machine control, the reliance on compact, efficient, and high-reliability power management devices will continue to grow. Many industrial environments involve fluctuating power loads and exposure to electrical noise, making stable DC power distribution critical. Additionally, the expansion of renewable energy-driven industrial power systems and the modernization of older manufacturing infrastructure are further increasing the need for flexible DC/DC conversion capabilities. The integration of automated warehousing, autonomous production lines, and advanced robotics across China, India, and Germany is particularly notable, positioning the industrial and automation segment as the leading contributor to sustained market expansion.

The Standalone DC/DC Converter market is expanding due to the increasing demand for power conversion systems in industries like automotive, medical, and industrial automation. The shift toward electrification, smart factories, and energy-efficient solutions is accelerating the need for reliable and efficient power management systems. Additionally, the rise of electric vehicles (EVs), renewable energy integration, and smart medical devices is propelling market growth. As industries evolve towards automation and energy optimization, the adoption of DC/DC converters will continue to drive market expansion in the coming years.

What are the key drivers of the Standalone DC/DC Converter market?

The primary drivers of the Standalone DC/DC Converter market include the growing adoption of electric vehicles (EVs) and the increasing demand for energy-efficient solutions in industries like automotive and medical. In electric vehicles, DC/DC converters are crucial for managing power between traction batteries, auxiliary systems, and charging circuits. Additionally, the increasing shift towards industrial automation and smart manufacturing creates a significant demand for reliable and efficient power conversion systems. The growing focus on renewable energy integration, IoT-driven devices, and battery-powered systems is also accelerating the need for standalone DC/DC converters to ensure optimal energy management.

What are the key restraints in the Standalone DC/DC Converter market?

Despite the growth prospects, the Standalone DC/DC Converter market faces several restraints. One of the key challenges is the high cost of advanced DC/DC converters with high-voltage capabilities, which can deter adoption, especially in price-sensitive industries. Additionally, complexity in design and the need for customized solutions for specific applications, such as medical devices or electric vehicles, can increase production costs and lead times. Regulatory challenges and the need for compliance with strict safety standards in various industries may also slow down the market’s growth. Furthermore, environmental concerns related to the electronic waste generated from obsolete converters may affect broader adoption.

What are the key trends in the Standalone DC/DC Converter market?

Key trends in the Standalone DC/DC Converter market include the rise of miniaturization and integration in power management systems. As industries, particularly automotive and medical, demand more compact and efficient solutions, DC/DC converters are becoming increasingly integrated into smaller, more powerful systems. There is also a growing focus on energy efficiency, driven by the increasing demand for sustainable solutions in electric vehicles and smart grids. Moreover, the ongoing adoption of smart factories, AI-powered automation, and IoT devices is driving the need for more intelligent power conversion solutions that provide real-time monitoring and efficient energy distribution across industrial networks.

The standalone DC/DC converter market shows a varied growth outlook across major global economies. Countries such as China, India and Germany exhibit the fastest growth due to rapid industrialization, heavy adoption of automation technologies, and expansion of electric vehicle infrastructure. Regions like the USA, UK and Japan show more moderate growth reflecting mature markets and already high penetration of power conversion technologies. As industrial & automation applications continue to expand, growth in these countries is driven by local manufacturing capability, infrastructure spending and electrification initiatives. The country-wise variance highlights how emerging markets are key growth engines for the converter sector over the forecast period.

| Country | CAGR (%) |

|---|---|

| China | 9.9 |

| India | 9.1 |

| Germany | 8.4 |

| Brazil | 7.7 |

| USA | 6.9 |

| UK | 6.2 |

| Japan | 5.5 |

China is projected to grow at a CAGR of 9.9%, leading the Standalone DC/DC Converter market due to its strong focus on industrial automation, electric vehicles, and renewable energy integration. The country’s electric vehicle (EV) sector is one of the largest in the world, with DC/DC converters playing a crucial role in power conversion between the high-voltage traction batteries and low-voltage auxiliary systems. Additionally, China’s massive infrastructure projects, including smart factories, robotics, and automation technologies, are fueling demand for DC/DC converters in manufacturing environments. As the country continues to expand its electric vehicle fleet, integrate more solar power, and modernize its industrial systems, the market for DC/DC converters is expected to expand rapidly. The combination of government support for green technologies, the adoption of smart grids, and the expansion of automation in industries ensures China will remain a key player in driving DC/DC converter demand in the coming years.

India is forecast to grow at a CAGR of 9.1%, driven by its rapidly expanding industrial base and increasing adoption of electric vehicles (EVs) and automation technologies. India’s automotive sector, including its growing electric vehicle market, is a significant contributor to the demand for DC/DC converters. These converters are critical in managing the energy flow between traction batteries and auxiliary power systems in EVs. Additionally, the push for smart manufacturing in India’s industrial sector has spurred the need for reliable power conversion solutions for sensors, controllers, and robotic systems. As India focuses on infrastructure development, industrial modernization, and renewable energy, DC/DC converters are essential for ensuring efficient energy management in these sectors. Government initiatives like Make in India and policies promoting green energy are further accelerating the demand for DC/DC converters, solidifying India’s position as a key player in the global Standalone DC/DC Converter market.

Germany is projected to grow at a CAGR of 8.4% in the Standalone DC/DC Converter market, driven by its mature automotive industry, focus on renewable energy, and rapid adoption of industrial automation. The country’s robust automotive sector, which includes major manufacturers like Volkswagen, BMW, and Mercedes-Benz, is incorporating DC/DC converters into electric vehicles (EVs) for efficient energy management. The German market is also heavily influenced by the ongoing transition toward smart factories, robotics, and industry 4.0 technologies, all of which rely on DC/DC converters for power conversion and voltage regulation. Furthermore, Germany’s leadership in renewable energy adoption and electric mobility underscores the growing demand for DC/DC converters that support efficient power distribution and battery management. With ongoing investments in clean energy solutions, Germany is expected to continue its strong growth in DC/DC converters, especially as industries move toward green technologies and sustainable practices.

Brazil is forecast to grow at a CAGR of 7.7% in the Standalone DC/DC Converter market, driven by the country’s expanding automotive industry, increasing industrial automation, and rising interest in renewable energy. As Brazil’s automotive industry shifts towards electric vehicles (EVs) and the demand for sustainable energy solutions grows, the need for DC/DC converters to manage power between high-voltage systems and auxiliary power circuits in EVs increases. The expansion of renewable energy installations and battery-based systems in Brazil further boosts the demand for efficient power conversion systems. In industrial applications, DC/DC converters play a crucial role in ensuring reliable power management for machinery and automated systems. As Brazil continues to modernize its infrastructure and increase its industrial capacity, the demand for power conversion solutions will continue to rise, positioning Brazil as a significant player in the global DC/DC converter market.

The USA is projected to grow at a CAGR of 6.9% in the Standalone DC/DC Converter market, with steady demand driven by the automotive sector, industrial automation, and medical technologies. The USA is a leader in electric vehicle adoption, with automakers focusing heavily on DC/DC converters to manage energy flows between traction batteries and auxiliary systems. In industrial automation, DC/DC converters are used in smart factories, robotic systems, and machine tools, where power conversion and regulation are critical. Additionally, the USA healthcare industry’s increasing reliance on medical equipment that requires precise power conversion further contributes to market growth. As the USA continues to push for electric mobility, advanced manufacturing, and energy-efficient solutions, the DC/DC converter market will see sustained growth, supported by continued advancements in power electronics and smart grid technologies.

The UK is expected to grow at a CAGR of 6.2% in the Standalone DC/DC Converter market, driven by the growth of automotive electrification, smart manufacturing, and renewable energy adoption. The shift toward electric vehicles (EVs) in the UK is driving demand for DC/DC converters to support power conversion between high-voltage traction batteries and low-voltage systems. The country’s ongoing transition to Industry 4.0, which includes the adoption of automation and robotics in manufacturing, is also boosting the demand for DC/DC converters in industrial applications. Additionally, the UK’s commitment to reducing carbon emissions through the adoption of renewable energy solutions further increases the demand for DC/DC converters to ensure efficient energy management. As the UK continues to focus on sustainability and advanced manufacturing technologies, the Standalone DC/DC Converter market is expected to continue its steady growth trajectory.

Japan is projected to grow at a CAGR of 5.5% in the Standalone DC/DC Converter market, supported by the country’s strong automotive industry, leadership in robotics, and focus on renewable energy. Japan’s automotive sector, particularly the rise of electric vehicles (EVs), is driving significant demand for DC/DC converters that regulate power between traction batteries and auxiliary systems. In the industrial sector, Japan continues to lead in robotics and automation technologies, where DC/DC converters are essential for controlling energy flow to various machines and processes. Furthermore, Japan’s commitment to clean energy and smart grid solutions creates a growing need for power conversion systems to support renewable energy integration and battery storage systems. While Japan's growth in the DC/DC converter market is more moderate compared to emerging economies, its technological advancements and early adoption of energy-efficient technologies make it a significant contributor to global market trends.

The Standalone DC/DC Converter market is highly competitive, with a mix of established players and new entrants focusing on delivering efficient power conversion solutions. Leading companies like Continental AG, Bosch, and Denso Corporation hold significant market shares, leveraging their advanced technological capabilities in power electronics and automotive systems. These companies provide isolated and non-isolated converters for industries ranging from automotive to industrial automation, enhancing energy efficiency and safety. The continuous development of smarter and more compact converters keeps these companies ahead, providing solutions that meet diverse sector requirements, including electric vehicles, medical devices, and smart factories.

Smaller and emerging players, including Shinry Technologies and Inovance Technology, are also making their mark by offering cost-effective solutions tailored for industrial applications and automotive systems. The market is expected to witness further fragmentation as more players enter, targeting specific niches such as renewable energy, battery management systems, and energy storage solutions. Additionally, partnerships between automotive manufacturers and converter suppliers are strengthening, particularly with the growth of electric vehicle adoption. As technological advancements in power electronics continue, competition will intensify, with companies innovating in digital control and integration technologies to enhance converter efficiency and performance.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | China, India, Germany, Brazil, USA, UK, Japan |

| Type | Isolated High Voltage DC-DC Converter, Non-Isolated High Voltage DC-DC Converter |

| Application | Industrial & Automation, Medical, Automobile, Others |

| Key Companies Profiled | Continental AG, Bosch, Denso Corporation, Panasonic Corporation, Hella GmbH & Co. KGaA, Aptiv PLC, Alps Alpine Co. Ltd, TDK, Valeo Group, Toyota, Shinry Technologies, Inovance Technology |

| Additional Attributes | The market analysis includes dollar sales by type and application categories. It also covers regional adoption trends across major markets such as China, India, Germany, and the USA The competitive landscape features key manufacturers in the DC/DC converter sector, focusing on innovations in high voltage isolation and power conversion technologies. Trends in the demand for DC/DC converters in industrial automation, medical applications, and the automotive sector are explored, along with the rise in electric vehicle and renewable energy applications. |

The global standalone DC-DC converter market is estimated to be valued at USD 413.2 million in 2025.

The market size for the standalone DC-DC converter market is projected to reach USD 835.9 million by 2035.

The standalone DC-DC converter market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in standalone DC-DC converter market are isolated high voltage DC-DC converter and non-isolated high voltage DC-DC converter.

In terms of application, industrial & automation segment to command 35.0% share in the standalone DC-DC converter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standalone PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

Aircraft DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Converter Aluminum Foil Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Converter Aluminum Foil Manufacturers

Converter Transformer Market

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Data Converters Market

Video Converter Software Market

Torque Converters Market Report - Growth, Demand & Forecast 2025 to 2035

Frequency Converter Market Growth – Trends & Forecast 2024-2034

EV Charger Converter Module Market Forecast Outlook 2025 to 2035

Rotating Phase Converter Market

High Speed Data Converters Market

Industrial Media Converter Market Growth – Trends & Forecast 2025 to 2035

Gigabit Interface Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA