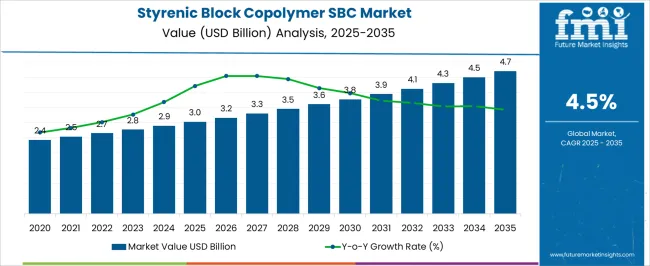

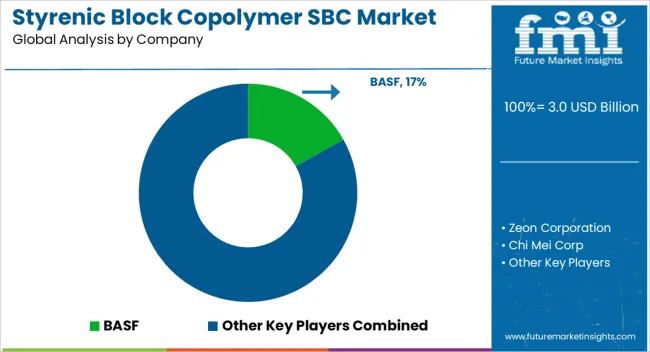

The Styrenic Block Copolymer SBC Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Between 2025 and 2030, the market grows from USD 3.0 billion to USD 3.9 billion, contributing USD 0.9 billion in growth, with a CAGR of 5.6%.

This early-phase growth is driven by increasing demand for SBC in industries like automotive, adhesives, sealants, and consumer goods, where SBC provides key benefits such as flexibility, durability, and processing advantages. As the trend toward lightweight materials and sustainable solutions continues to grow, SBC demand is expected to rise across various sectors.

From 2030 to 2035, the market continues its upward trajectory, expanding from USD 3.9 billion to USD 4.7 billion, contributing USD 0.8 billion in growth, with a slightly lower CAGR of 3.7%. This deceleration reflects the market maturing, with a more stable demand driven by well-established applications of SBC, especially in established industries.

Despite this, new applications and technological advancements in SBC production continue to drive incremental growth. The overall CAGR of 4.5% reflects a consistent market expansion fueled by the growing adoption of SBC in various industrial sectors.

| Metric | Value |

|---|---|

| Styrenic Block Copolymer SBC Market Estimated Value in (2025 E) | USD 3.0 billion |

| Styrenic Block Copolymer SBC Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Styrenic Block Copolymer market is showing consistent growth, driven by the increasing demand for high-performance polymers in construction and industrial applications. These materials are valued for their flexibility, durability, and ease of processing, which makes them ideal for use in various sectors.

The growth in infrastructure projects and the need for advanced materials that can withstand harsh environmental conditions have contributed significantly to the market expansion. Product innovation has led to enhanced polymer blends that improve mechanical strength and weather resistance.

Moreover, growing urbanization and the expansion of road networks and building projects have fueled demand for materials used in paving and roofing. The market outlook remains positive as applications continue to diversify and manufacturers focus on sustainable production methods. Segmental growth is anticipated to be led by the SBS product segment and paving & roofing as the primary application area.

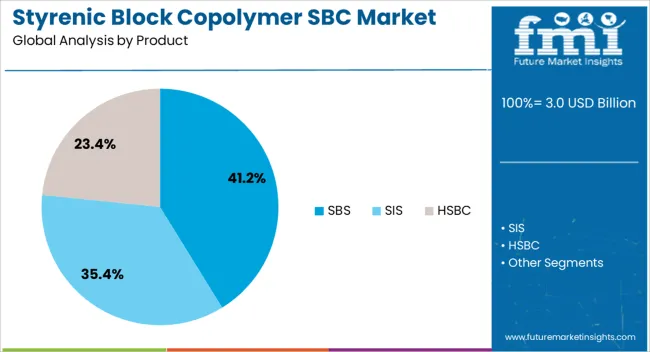

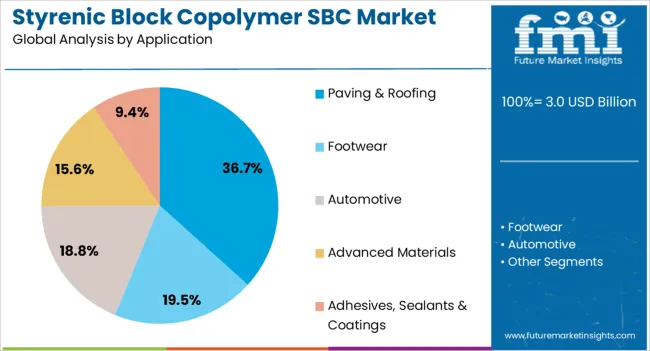

The styrenic block copolymer SBC market is segmented by product, application, and geographic regions. By product, the styrenic block copolymer SBC market is divided into SBS, SIS, and HSBC. In terms of application of the styrenic block copolymer, the SBC market is classified into Paving & Roofing, Footwear, Automotive, Advanced Materials, and Adhesives, Sealants & Coatings.

Regionally, the styrenic block copolymer SBC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The SBS segment is projected to account for 41.2% of the SBC market revenue in 2025, maintaining its position as the leading product type. SBS is favored due to its superior elasticity, toughness, and compatibility with asphalt, making it widely used in modifying paving materials.

Its ability to enhance the durability and performance of pavements under extreme weather and heavy traffic conditions has driven adoption. Additionally, SBS offers excellent adhesion and resistance to aging, which extends the lifespan of roofing membranes and paving surfaces.

The versatility of SBS in formulation and processing has enabled its use in a wide range of construction materials. As infrastructure projects continue to demand materials with improved mechanical properties, the SBS segment is expected to retain its leadership.

The paving & roofing segment is projected to hold 36.7% of the SBC market revenue in 2025, positioning it as the dominant application area. The growth of this segment is fueled by expanding construction activities and the need for durable materials that can resist thermal degradation and mechanical stress.

SBCs are used extensively to improve asphalt performance in road paving which helps in reducing maintenance costs and increasing road lifespan. In roofing, SBCs contribute to waterproofing and the flexibility of membranes, ensuring better protection against weather elements.

Increasing government infrastructure investments and the replacement of aging pavements have further driven demand. The segment is expected to maintain its leading position as the construction sector continues to prioritize high-performance polymer materials.

The styrenic block copolymer (SBC) market is witnessing substantial growth due to its increasing applications across various industries such as automotive, construction, packaging, and medical. SBCs are widely used for their excellent elasticity, high strength, and versatile performance characteristics. These properties make SBCs ideal for use in adhesives, sealants, and coatings. The growing demand for lightweight, high-performance materials, along with advancements in SBC formulations, is driving market expansion. Despite challenges like volatile raw material costs and competition from alternative materials, SBCs continue to offer significant opportunities in diverse industrial applications.

The primary driver of the SBC market is the rising demand for lightweight and high-performance materials across various industries. As manufacturers aim to reduce the weight and increase the strength of materials used in automotive, packaging, and construction, SBCs offer a unique combination of properties such as elasticity, durability, and processing ease. The shift toward more energy-efficient and fuel-efficient vehicles is contributing to SBC’s growing use in automotive components like bumpers, dashboards, and seals. The expanding demand for adhesives, coatings, and sealants in construction and packaging applications is boosting SBC consumption, as it provides excellent bonding properties and resistance to weathering. These applications are key factors in driving the market growth of SBCs.

A major challenge in the SBC market is the volatility of raw material prices. Styrene, a key component in SBC production, is subject to price fluctuations due to its dependence on petrochemical derivatives. These fluctuations can lead to increased production costs and pricing instability, affecting manufacturers' ability to maintain competitive pricing. Another challenge is the growing environmental concerns regarding the use of petrochemical-based products. As industries increasingly focus on sustainability and reducing their environmental footprint, the demand for eco-friendly alternatives may create pressure on SBC manufacturers to innovate and offer products with less environmental impact. The need for regulatory compliance regarding the environmental effects of SBC products could further complicate market dynamics.

The SBC market presents significant growth opportunities driven by technological advancements and expanding applications. Innovations in SBC formulations are improving performance, processing capabilities, and compatibility with various substrates. This has resulted in increased adoption in high-performance applications such as adhesives, coatings, and sealants. The demand for SBCs in the automotive and packaging industries is expected to rise due to their lightweight properties and enhanced functionality. The growing emphasis on recycling and circular economy practices in the plastics industry also presents opportunities for SBC manufacturers to develop more sustainable products, providing further market growth prospects. Emerging markets in Asia-Pacific, where industrial development and consumer goods manufacturing are growing rapidly, offer substantial opportunities for SBC market expansion.

A key trend in the SBC market is the integration of SBCs with smart technologies and the development of advanced formulations. The increasing adoption of smart sensors and coatings is driving the demand for SBCs in industries such as electronics, automotive, and medical devices, where precision and performance are critical. Advances in formulation techniques are also allowing manufacturers to produce SBCs that offer higher levels of durability, flexibility, and performance, meeting the needs of more demanding applications. The trend toward advanced, multifunctional SBCs is shaping the future of the market, as manufacturers focus on creating products that provide greater efficiency and superior performance in various industrial sectors.

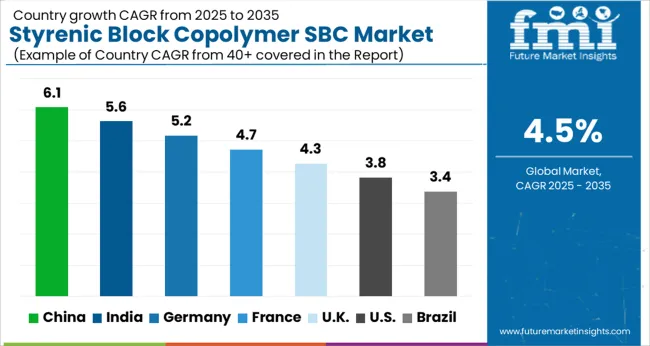

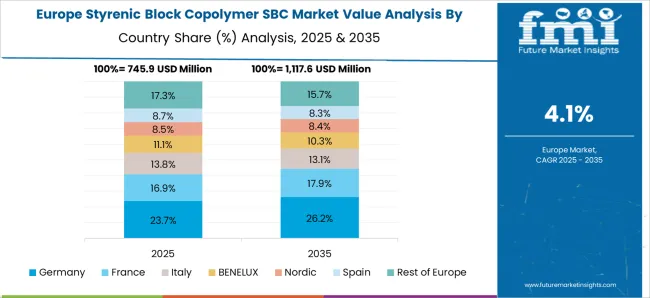

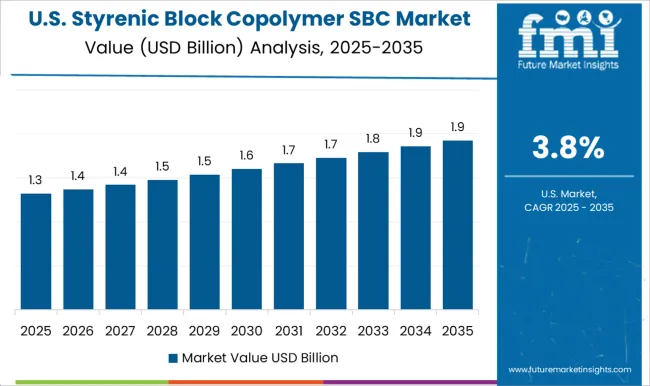

The styrenic block copolymer (SBC) market is expected to grow at a CAGR of 4.5% globally from 2025 to 2035. China leads with 6.1%, followed by India at 5.6%, and Germany at 5.2%. France records a growth rate of 4.7%, while the UK shows 4.3%, and the USA stands at 3.8%. Growth in China and India is driven by expanding demand in automotive, packaging, and consumer goods industries, especially due to the rising need for lightweight and durable materials. Developed markets like France, the UK, and the USA show steady growth, supported by advancements in the automotive and packaging sectors and increasing demand for eco-friendly materials. With technological innovations and growing awareness, the SBC market is anticipated to continue expanding globally. The analysis includes over 40 countries, with the top countries detailed below.

China is projected to grow at a CAGR of 6.1% through 2035, driven by robust growth in the automotive and packaging industries. The country’s automotive industry is adopting SBCs for their lightweight and durable properties, which contribute to better fuel efficiency and overall vehicle performance. The packaging sector in China is also growing rapidly, particularly in food and beverage packaging, where SBCs are increasingly used due to their flexibility, cost-effectiveness, and durability. As the industrial base expands and urbanization progresses, the demand for SBCs in China will continue to rise.

India is expected to grow at a CAGR of 5.6% through 2035, supported by rising demand from the automotive, packaging, and consumer goods industries. The automotive sector in India is expanding rapidly, particularly due to the growing focus on lightweight materials for improved fuel efficiency. SBCs are increasingly being adopted in automotive applications due to their lightweight, flexible, and durable nature. In packaging, the push for cost-effective and eco-friendly solutions is contributing to SBC adoption. As India continues to industrialize and urbanize, demand for high-performance materials such as SBCs in various sectors is set to increase.

Germany is projected to grow at a CAGR of 5.2% through 2035, driven by the demand for SBCs in the automotive and packaging industries. As the European leader in automotive manufacturing, Germany’s demand for SBCs is fueled by the need for lightweight materials that improve vehicle performance and energy efficiency. SBCs are being increasingly used in the packaging industry, particularly in food and beverage packaging, as they offer excellent durability and flexibility. The push for green solutions and innovations in manufacturing processes will continue to support the growth of SBC adoption in Germany.

The United Kingdom is expected to grow at a CAGR of 4.3% through 2035, driven by the demand for SBCs in the automotive and packaging industries. The automotive sector in the UK is focusing on reducing vehicle weight, which is driving the use of SBCs in vehicle components. In the packaging industry, SBCs are increasingly adopted for their durability, flexibility, and cost-efficiency. As consumer demand for efficient and eco-friendly packaging grows, SBCs are becoming a preferred choice. The UK’s emphasis on improving vehicle efficiency and developing cost-effective packaging solutions is expected to continue driving market demand.

The United States is projected to grow at a CAGR of 3.8% through 2035, driven by demand in the automotive and packaging sectors. As the automotive industry in the USA focuses on fuel efficiency and vehicle performance, SBCs are increasingly used for their lightweight and durable properties. The packaging industry’s growing demand for efficient, cost-effective solutions is also fueling SBC adoption. With the emphasis on green technologies and efficient manufacturing processes, SBCs are becoming a key material in various industries. As the need for advanced materials continues to grow, SBC adoption in the USA is set to rise.

Competition is shaped by global giants and regional players focusing on sustainability, specialty product innovation, and supply chain strength. Kraton Corporation has positioned itself strongly with investments in renewable SBC offerings, launching bio-based product lines under its CirKular+ ReNew series and modernizing production facilities to boost output efficiency. INEOS Styrolution leverages its large manufacturing footprint across Europe, Asia, and the Americas, supplying a wide portfolio of styrenics while catering to industries such as packaging, consumer electronics, and automotive. Versalis and Asahi Kasei differentiate by advancing research and development in hydrogenated grades like SEBS, known for their enhanced heat and UV resistance, making them suitable for high-performance sectors including electronics and cables.

JSR Corporation and LG Chem emphasize regional production agility, customer-specific formulations, and tailored service models across Asia, ensuring flexibility and faster market responsiveness. Sinopec and Dynasol Group capitalize on integrated petrochemical operations to offer competitive pricing and supply reliability, especially for bulk applications such as asphalt, roofing, and infrastructure. Zeon Corporation remains focused on specialized elastomer solutions, adding differentiation through unique performance properties in premium segments. Overall, companies are pursuing strategies centered on sustainability initiatives, wide manufacturing networks, specialty product innovation, and feedstock integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Product | SBS, SIS, and HSBC |

| Application | Paving & Roofing, Footwear, Automotive, Advanced Materials, and Adhesives, Sealants & Coatings |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Zeon Corporation, Chi Mei Corp, Versalis, Styrolution, TSRC, Denki Kagaku Kogyo Kabushiki Kaisha, Momentive Specialty Chemicals, LG Chemicals, Chevron Phillips, En Chuan, Asahi Kasei, JSR Corporation, Kumho Petrochemicals, and JX Nippon Oil & Energy Corporation |

| Additional Attributes | Dollar sales by product type (styrene-butadiene-styrene (SBS), styrene-isoprene-styrene (SIS), styrene-ethylene-butadiene-styrene (SEBS)) and end-use segments (automotive, adhesives, footwear, medical devices, consumer goods). Demand dynamics are influenced by the growing adoption of SBC in automotive and footwear industries, the increasing demand for high-performance materials in construction, and the shift towards eco-friendly elastomer solutions. |

The global styrenic block copolymer SBC market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the styrenic block copolymer SBC market is projected to reach USD 4.7 billion by 2035.

The styrenic block copolymer SBC market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in styrenic block copolymer SBC market are sbs, sis and hSBC.

In terms of application, paving & roofing segment to command 36.7% share in the styrenic block copolymer SBC market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Styrene-Butadiene-Styrene (SBS) Block Copolymer Market Size, Growth, and Forecast 2025 to 2035

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Block Sack Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Block Pallets Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Styrenics Market Analysis by Polymer Type, Application, and Region 2025 to 2035

Market Share Breakdown of Block Pallets Industry

Blockchain in Banking Market

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Block Margarine Market

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA