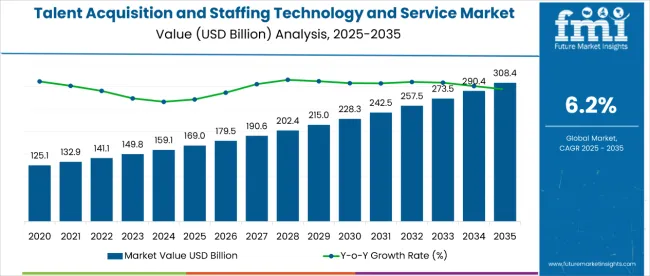

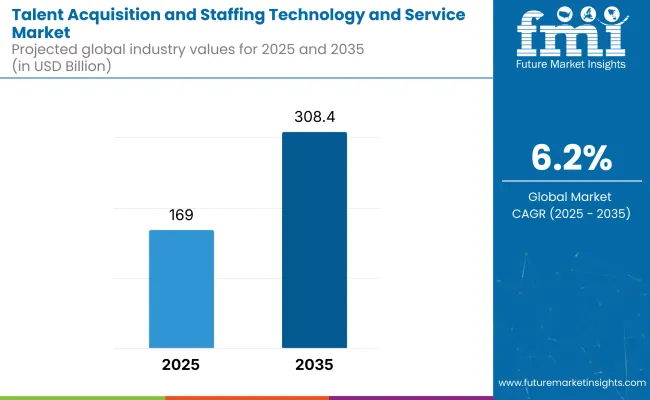

The talent acquisition and staffing technology and service market is estimated to be valued at USD 169 billion in 2025 and is projected to reach USD 308.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 138.5 billion during this period. This reflects a 1.82 times growth at a compound annual growth rate of 6.2%. The market evolution is expected to be driven by increasing adoption of AI-driven hiring platforms, predictive analytics, digital workforce solutions, and the growing need for efficient, automated, and scalable recruitment processes.

By 2030, the market is likely to reach USD 228.6 billion, generating USD 59.6 billion in incremental value during the first half of the decade. The remaining USD 78.9 billion is expected between 2030 and 2035, suggesting a balanced growth pattern supported by global digitization of HR functions, rise of the gig economy, workforce upskilling initiatives, and demand for specialized recruitment in IT, healthcare, and professional services.

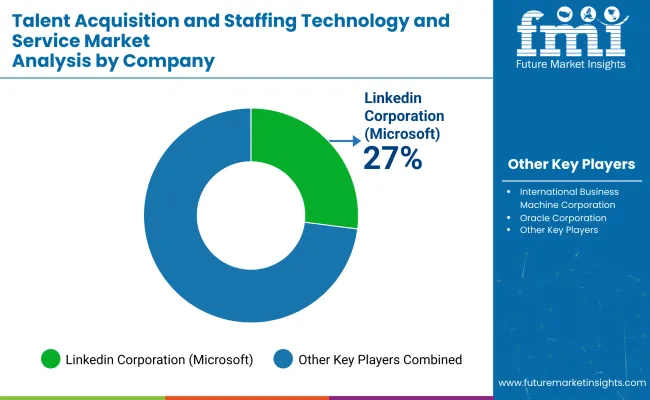

Companies such as International Business Machine Corporation, Oracle Corporation, SAP SE, Randstad Holding NV, LinkedIn Corporation, People Fluent, CareerBuilder, Corner Stone On Demand, Saba Software, Paycom Software, The Adecco Group, Workday, Ultimate Software Group, Skillsoft Corporation, and BambooHR are strengthening their competitive positions through AI-powered talent acquisition platforms, integration of end-to-end HR solutions, and investments in data-driven recruitment technologies. Strategic emphasis on workforce diversity, compliance automation, and SaaS-based scalable hiring solutions will continue to define the market’s trajectory and competitive dynamics across both developed and emerging economies.

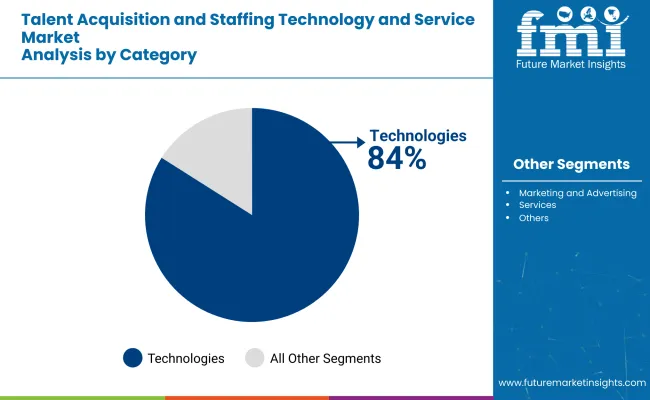

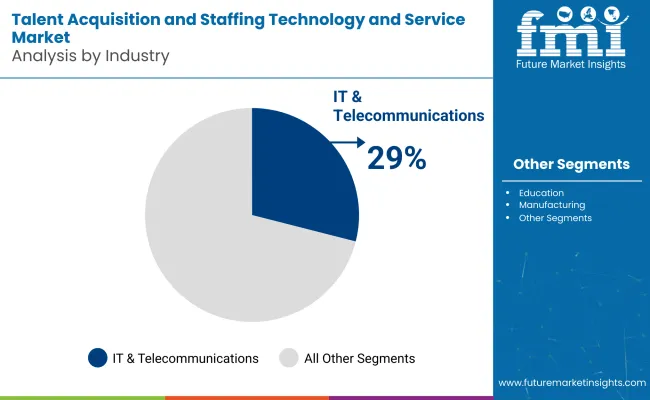

The market holds a strong position within the HR technology and professional services landscape, reflecting its rising adoption across large enterprises, SMEs, and staffing agencies. Within the technology segment, AI-driven recruitment platforms and analytics-based solutions are contributing the largest share, accounting for 84% in 2025, supported by automation of candidate sourcing, assessment, and onboarding. In the services segment, managed staffing solutions and workforce outsourcing continue to expand, driven by globalized hiring needs and hybrid work trends. Within industry applications, IT & Telecommunication leads with 29% share, reflecting its high demand for specialized skills, rapid talent churn, and continuous digital transformation initiatives. Healthcare and professional services are also emerging as significant contributors, propelled by skill shortages and demand for scalable workforce solutions.

The market is driven by the digitalization of HR ecosystems, rising adoption of SaaS-based hiring platforms, and the growing importance of workforce agility in dynamic business environments. Innovations are observed in AI-powered candidate matching, predictive analytics, applicant tracking systems (ATS), and end-to-end cloud HR solutions. Developments include strategic partnerships, mergers, and product innovations by leading players in North America, Europe, and Asia-Pacific to strengthen recruitment automation and global workforce coverage. Trends indicate a strong shift toward data-driven decision-making, diversity and inclusion hiring tools, and integrated talent management platforms, while efficiency, compliance, and scalability continue to define competitive advantage in the market.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 169 billion |

| Projected Value (2035F) | USD 308.4 billion |

| CAGR (2025 to 2035) | 6.2% |

Talent acquisition and staffing technologies’ ability to deliver efficient, automated, and data-driven hiring solutions across multiple industries is driving their adoption. Their functional advantages make them indispensable for enterprises, staffing agencies, and SMEs, where speed, accuracy, and workforce scalability are critical to business outcomes.

Rising skill shortages, increasing employee turnover, and digital transformation initiatives are further propelling market growth, supported by growing demand for hybrid work models, global workforce mobility, and specialized recruitment in IT, healthcare, and professional services. Technological advancements in AI-powered candidate matching, predictive analytics, applicant tracking systems (ATS), and end-to-end cloud HR platforms are enhancing operational efficiency, compliance, and workforce engagement.

Expanding enterprise adoption, strategic partnerships, and product portfolio innovations by key players are strengthening the market outlook. As organizations and recruiters increasingly prioritize efficiency, agility, and cost-effectiveness, talent acquisition and staffing solutions continue to gain traction. With companies focusing on digital integration, workforce analytics, and scalable HR ecosystems, the market is expected to witness steady growth across North America, Europe, and Asia-Pacific.

The market is segmented by category, industry, platform, and region. By category, the market is categorized into marketing and advertising (job posting, employer branding, and recruitment marketing), technologies (integrated ATS, standalone ATS, and point solution & sourcing tools), and services (recruitment process outsourcing services, contingent staffing services, background screening services, and others). Based onindustry, the market is divided intoeducation, manufacturing, BFSI, healthcare, IT & telecommunication, energy, retail, transportation, and others. In terms ofplatform, the market is segmented into internal referrals, social platforms, and others. Regionally, the market spans across North America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Latin America, and Middle East & Africa.

The technologies segment dominates the category landscape, accounting for 84% of the market share in 2025. This segment includes integrated applicant tracking systems (ATS), standalone ATS platforms, and point solution & sourcing tools that streamline recruitment workflows. Organizations increasingly adopt these technologies to automate candidate sourcing, enhance screening accuracy, and improve time-to-hire efficiency.

The segment’s strength is driven by rising adoption of AI-powered recruitment tools, predictive analytics, and cloud-based HR solutions. Employers favor these systems for their scalability, compliance management, and ability to deliver a superior candidate experience. Integration with payroll, onboarding, and workforce management platforms further enhances operational efficiency, positioning technologies as the backbone of modern talent acquisition strategies.

With growing demand for end-to-end digital hiring ecosystems and global workforce mobility, the technologies segment is expected to retain its leadership. Continuous investments in machine learning, social recruiting, and mobile-first hiring platforms will accelerate adoption across North America, Europe, and emerging Asia-Pacific markets.

The IT & telecommunication sector leads the market by industry, holding a 29% share in 2025. This dominance reflects the sector’s ongoing demand for digital talent, specialized technical skills, and high workforce turnover rates, making recruitment solutions essential for business continuity and innovation.

Rapid advancements in cloud computing, 5G deployment, cybersecurity, and software development are creating constant demand for skilled professionals, pushing companies to rely on advanced staffing technologies and recruitment outsourcing services. Platforms such as AI-driven candidate matching, skill assessments, and virtual interview tools are heavily leveraged to secure top talent quickly.

The IT & Telecommunication industry also favors flexible workforce solutions, including contingent staffing and managed services, to address project-based and remote work requirements. With global digitization accelerating, this sector is expected to remain a key revenue driver for the market, particularly in North America, Europe, and rapidly expanding technology hubs in Asia-Pacific.

In 2025, the global talent acquisition and staffing technology and service market continues to witness strong growth, with North America accounting for the largest share, followed by Europe and Asia-Pacific, where rapid digital transformation and workforce globalization are driving adoption. Applications span recruitment marketing, employer branding, job posting, applicant tracking systems (ATS), background screening, and contingent staffing solutions. Enterprises, SMEs, and staffing agencies are increasingly integrating AI-driven recruitment platforms, predictive analytics, and cloud-based HR ecosystems to improve efficiency, workforce scalability, and compliance management. The combination of automation, precision, and scalability positions these solutions as essential tools across IT, healthcare, education, BFSI, and manufacturing industries.

Rising Skill Shortages and Digitalization Drive Adoption

Growing skill gaps, increasing employee turnover, and the need for faster, data-driven hiring processes are major drivers for the market. Organizations prefer AI-powered sourcing, automated onboarding, and integrated HR platforms to streamline recruitment and enhance workforce agility. Growth is further supported by the rise of hybrid work models, gig economy expansion, and digital-first hiring strategies. Technological innovations such as talent analytics, social recruiting, mobile-first hiring apps, and SaaS-based platforms are enabling recruiters to improve engagement, reduce costs, and accelerate time-to-hire. Strategic investments, partnerships, and HR digitalization initiatives also strengthen adoption globally.

Operational Complexities and Compliance Issues Restrain Growth

Despite strong growth, the market faces challenges from regulatory compliance, data privacy laws, and high integration costs. Varying labor regulations, talent shortages in niche domains, and complexities in cross-border hiring slow expansion. Additionally, resistance to change within traditional HR structures, along with cost pressures for SMEs, can restrain adoption. Maintaining compliance, workforce diversity, and operational efficiency while scaling digital platforms requires significant investment. These restraints push companies to focus on innovation, workforce analytics, and compliance-driven solutions to balance efficiency, scalability, and long-term sustainability.

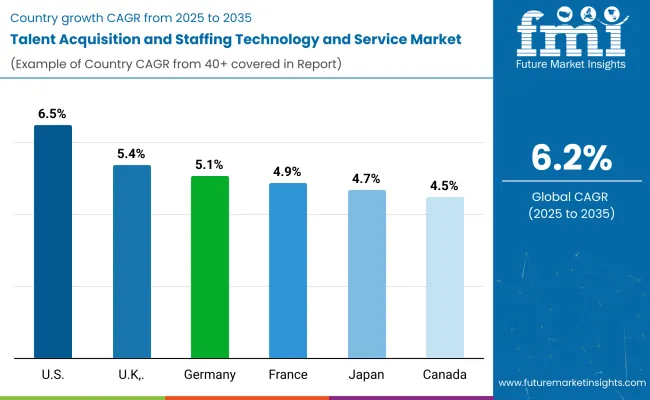

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 5.4% |

| Germany | 5.1% |

| France | 4.9% |

| Japan | 4.7% |

| Canada | 4.5% |

The market shows varied growth trajectories across the top six countries. The USA leads with the highest projected CAGR of 6.5% from 2025 to 2035, driven by widespread adoption of AI-powered recruitment platforms, integrated ATS systems, and cloud-based workforce management solutions across IT, healthcare, and BFSI sectors. The UK follows at 5.4%, supported by digital transformation initiatives, talent shortages, and increasing reliance on recruitment process outsourcing and social platform-based hiring solutions. Germany (5.1%) and France (4.9%) exhibit steady growth due to robust IT and manufacturing sectors, workforce digitization, and compliance-driven adoption of standardized HR technologies. Japan (4.7%) shows moderate expansion, fueled by automation in hiring processes, aging workforce challenges, and integration of analytics-driven talent management systems. Canada (4.5%)also demonstrates measured growth, influenced by gradual adoption of end-to-end recruitment solutions, contingent staffing services, and workforce mobility programs.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

The USA talent acquisition and staffing technology and service market is projected to expand at a CAGR of 6.5% from 2025 to 2035, driven by rapid adoption of AI-powered recruitment platforms, integrated ATS systems, and cloud-based HR solutions across IT, healthcare, and BFSI sectors. Companies are leveraging predictive analytics, automated onboarding, and talent analytics to improve hiring efficiency and workforce scalability. Growth is supported by ongoing skill shortages, high employee turnover, and increasing demand for specialized talent.

Key Statistics:

Revenue from talent acquisition and staffing technology and service in the UK is expected to grow at a CAGR of 5.4% from 2025 to 2035, supported by government programs encouraging workforce digitalization, hybrid work, and talent reskilling initiatives. Enterprises are adopting cloud-based recruitment platforms, social recruiting tools, and RPO services to enhance operational efficiency and candidate engagement. Strategic partnerships between staffing firms and technology providers are accelerating adoption of end-to-end recruitment solutions.

Key Statistics:

Sales of the talent acquisition and staffing technology and service market in Germany are projected to grow at a CAGR of 5.1% from 2025 to 2035, driven by adoption of standardized HR technologies, integrated ATS systems, and workforce analytics tools across IT, manufacturing, and professional services. Companies increasingly use AI and automated sourcing solutions to fill niche and highly skilled roles.

Key Statistics:

Revenue from talent acquisition and staffing technology and service market in France is expected to grow at a CAGR of 4.9% from 2025 to 2035, fueled by adoption of digital recruitment platforms, contingent staffing solutions, and employer branding technologies. Organizations focus on improving candidate experience, operational efficiency, and compliance with labor regulations.

Key Statistics:

Demand for talent acquisition and staffing technology and service is projected to grow at a CAGR of 4.7% from 2025 to 2035, driven by automation in hiring processes, AI-based candidate matching, and workforce analytics solutions. Aging population, talent shortages, and adoption of mobile-first recruitment platforms are boosting demand.

Key Statistics:

The talent acquisition and staffing technology and service market is expected to expand at a CAGR of 4.5% from 2025 to 2035, fueled by demand for flexible staffing solutions, cloud-based recruitment platforms, and predictive talent analytics. Companies are adopting integrated HR systems to optimize hiring and improve workforce planning.

Key Statistics:

The Talent Acquisition and Staffing Technology and Service Market is expanding rapidly, fueled by digital transformation in human resource management, the rise of hybrid work models, and growing reliance on data-driven hiring solutions. Organizations are increasingly adopting AI-powered platforms, cloud-based HR systems, and predictive analytics to streamline recruitment, enhance candidate experience, and optimize workforce planning. The market’s growth is driven by the global competition for skilled professionals, evolving workforce expectations, and the integration of automation and analytics into end-to-end talent management.

Global technology leaders such as International Business Machines Corporation (IBM), Oracle Corporation, and SAP SE are shaping the future of digital staffing with intelligent HR ecosystems. IBM leverages artificial intelligence and machine learning through its Watson Talent solutions to enable bias-free, skills-based hiring and workforce analytics. Oracle’s Fusion Cloud HCM and SAP SE’s SuccessFactors platforms lead the enterprise recruitment segment, offering comprehensive, cloud-based solutions that integrate talent acquisition, employee engagement, and retention analytics.

Workforce management giants such as Randstad Holding NV and The Adecco Group combine advanced staffing services with digital platforms that utilize automation and predictive analytics to match talent efficiently with job opportunities. LinkedIn Corporation, a major disruptor in professional networking, continues to drive global hiring trends through data-driven recruiting tools, AI-enabled job matching, and talent insights for employers worldwide. Workday Inc. strengthens its position with unified HCM systems that integrate workforce analytics, recruitment automation, and performance optimization into a single digital framework.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 169 billion |

| Category | Marketing & Advertising (Job Posting, Employer Branding, and Recruitment Marketing), Technologies (Integrated ATS, Standalone ATS, and Point Solution & Sourcing Tools), and Services (Recruitment Process Outsourcing Services, Contingent Staffing Services, Background Screening Services, and Others) |

| Industry | Education, Manufacturing, BFSI, Healthcare, IT & Telecommunication, Energy, Retail, Transportation, and Others |

| Platform | Internal Referrals, Social Platforms, and Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled |

International Business Machines Corporation (IBM), Oracle Corporation, SAP SE, Randstad Holding NV, LinkedIn Corporation, Workday Inc., The Adecco Group |

| Additional Attributes | Dollar sales by category, industry, and platform; regional demand trends; competitive landscape; AI, predictive analytics, and cloud-based ATS adoption; digital HR integration; recruitment outsourcing; contingent staffing; HR technology innovations |

The global talent acquisition and staffing technology and service market is estimated to be valued at USD 169 billion in 2025.

The market size for talent acquisition and staffing technology and service is projected to reach USD 308.4 billion by 2035.

The talent acquisition and staffing technology and service market is expected to grow at a 6.2% CAGR between 2025 and 2035.

Technologies are projected to lead in the talent acquisition and staffing technology and service market with 84% market share in 2025.

In terms of industry, IT & telecommunication is projected to command 29% share in the talent acquisition and staffing technology and service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Talent Management Software Market Report – Trends & Forecast 2023-2033

Talent as a Service Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA