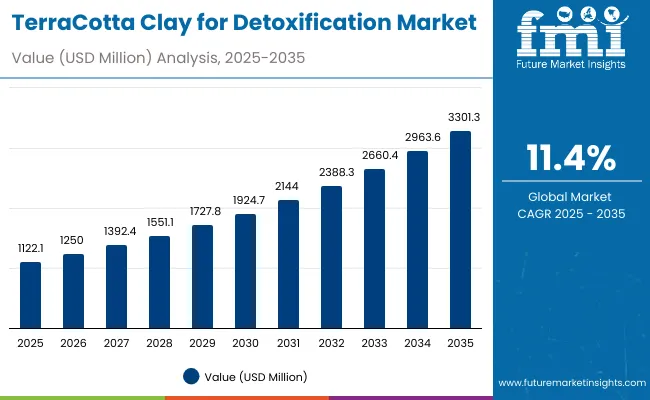

The global TerraCotta Clay for Detoxification Market is expected to record a valuation of USD 1,122.1 million in 2025 and USD 3,301.3 million in 2035, with an increase of USD 2,179.2 million, which equals a growth of nearly 194% over the decade. The overall expansion represents a CAGR of 11.4% and a 2.9X increase in market size.

Global TerraCotta Clay for Detoxification Market Key Takeaways

| Metric | Value |

|---|---|

| Global TerraCotta Clay for Detoxification Market Estimated Value in (2025E) | USD 1,122.1 million |

| Global TerraCotta Clay for Detoxification Market Forecast Value in (2035F) | USD 3,301.3 million |

| Forecast CAGR (2025 to 2035) | 11.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,122.1 million to USD 1,924.7 million, adding USD 802.6 million, which accounts for 36.8% of the total decade growth. This phase records steady adoption across beauty masks, scrubs, and spa-based body wraps, driven by consumer preference for natural detoxifying and pore purifying functions. Wash-off masks dominate this period as they cater to over 49% of beauty and personal care applications requiring deep-cleaning and instant results, making them a staple in both retail and professional skincare routines.

The second half from 2030 to 2035 contributes USD 1,376.6 million, equal to 63.2% of total growth, as the market jumps from USD 1,924.7 million to USD 3,301.3 million. This acceleration is powered by the widespread adoption of clean-label, vegan-certified, and sensitive-skin-friendly formulations. Countries such as China and India, with CAGRs of 16.4% and 18.5% respectively, drive much of this expansion, positioning Asia-Pacific as the global growth hub. Beyond facial skincare, the body masks & wraps segment gains momentum in wellness spas and holistic detoxification therapies. Retail diversification across e-commerce and specialty beauty chains ensures recurring demand, while mineral-origin claims strengthen the brand positioning of leading companies.

From 2020 to 2024, the global TerraCotta Clay for Detoxification Market grew steadily as consumer adoption was primarily driven by hardware-like formulations of traditional clay masks and kaolin-rich blends. During this period, the competitive landscape was dominated by multinational skincare brands controlling nearly 70-75% of global revenue, with leaders such as L’Oréal, Shiseido, and Innisfree focusing on clay-based products marketed under detoxifying and oil-control claims. Competitive differentiation relied on natural authenticity, brand heritage, and mineral sourcing credibility, while newer clean-label formats had minimal traction, contributing less than 15% of the total market value.

Demand for TerraCotta Clay detox products expands to USD 1,122.1 million in 2025, and the revenue mix begins shifting as vegan, fragrance-free, and sensitive-skin claims gain wider appeal. Traditional multinational leaders face rising competition from regional and niche players, especially in Asia, where Cattier, Himalaya, and K-beauty-inspired brands capitalize on heritage positioning. Major incumbents are pivoting towards hybrid models, offering clay-based detoxification products with added botanicals, probiotics, and mineral supplements to retain relevance. Emerging entrants specializing in eco-certified sourcing, clean beauty positioning, and digital-first distribution are gaining share rapidly. The competitive advantage is moving away from brand legacy alone to sustainability, certification, and omnichannel retail strategy.

Advances in clay sourcing and formulation technology have improved detoxification efficiency and skin compatibility, allowing for more effective pore purification and oil control across diverse skin types. Wash-off clay masks have gained popularity due to their instant results, mineral replenishment, and suitability for at-home spa routines. The rise of terracotta-rich kaolinitic clays has contributed to enhanced absorption, smoother texture, and broad application in both mass retail and specialty salons. Consumer industries such as cosmetics, wellness spas, and dermatological care are driving demand for clay detoxification products that can integrate seamlessly into existing skincare and wellness regimens.

Expansion of clean beauty, vegan-certified claims, and digital-first e-commerce strategies has fueled market growth. Innovations in formulation science (blending bentonite with montmorillonite, and iron-oxide clays with antioxidants) are expected to open new application areas. Segment growth is expected to be led by terracotta-rich kaolinitic clays, detoxifying & pore purifying functions, and wash-off masks due to their proven effectiveness and adaptability across both developed and emerging markets.

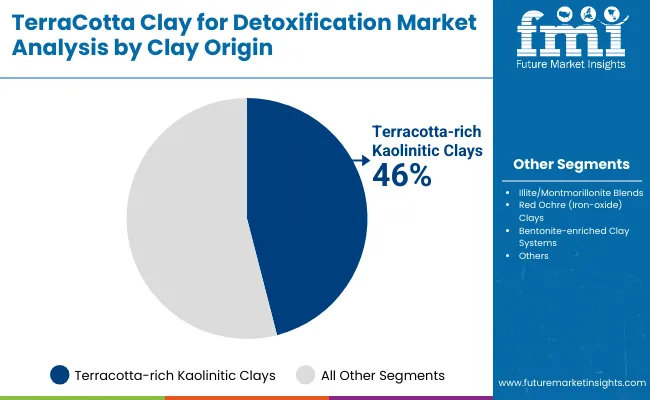

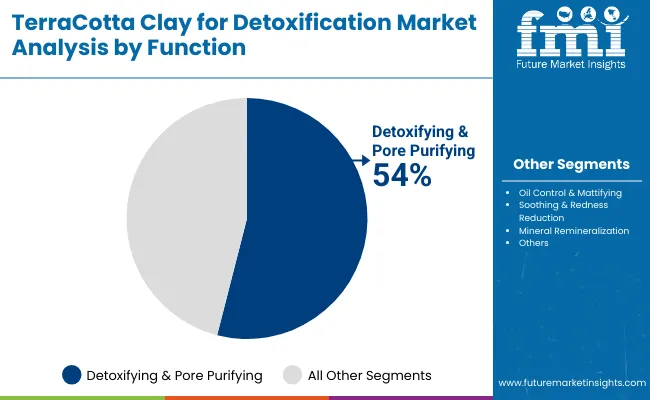

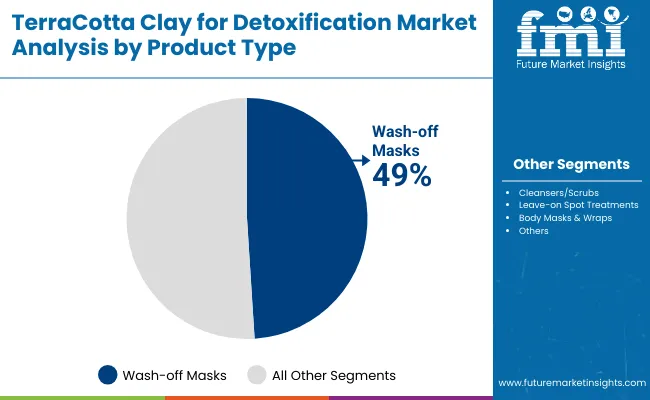

The market is segmented by clay origin, function, product type, channel, claim, and geography. Clay origin includes terracotta-rich kaolinitic clays, illite/montmorillonite blends, red ochre (iron-oxide) clays, and bentonite-enriched clay systems, highlighting the diversity of raw material bases driving adoption. Function classification covers detoxifying & pore purifying, oil control & mattifying, soothing & redness reduction, and mineral remineralization, catering to specific consumer skincare needs. Based on product type, the segmentation includes wash-off masks, cleansers/scrubs, leave-on spot treatments, and body masks & wraps. Distribution channels encompass e-commerce, mass retail, pharmacies/drugstores, specialty beauty retail, and spas/salons. Claims focus on natural/mineral origin, fragrance-free/sensitive-skin, clean-label, and vegan attributes. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa, with China and India emerging as the fastest-growing markets.

| Clay Origin | Value Share% 2025 |

|---|---|

| Terracotta-rich kaolinitic clays | 46% |

| Others | 54.0% |

The terracotta-rich kaolinitic clays segment is projected to contribute 46% of the global TerraCotta Clay for Detoxification Market revenue in 2025, maintaining its lead as the dominant clay origin category. This is driven by the widespread consumer demand for kaolin-based detoxifying masks and cleansers known for their gentle yet powerful ability to remove impurities, absorb excess oil, and purify pores without irritating the skin. Terracotta-rich formulations also appeal to consumers due to their heritage positioning and perception as mineral-rich, natural detoxifiers.

The segment’s growth is further supported by the expansion of clean-label beauty trends, where kaolin-rich terracotta clays are favored as safe, skin-friendly options that can be marketed under sensitive-skin claims. As brands continue to enhance clay formulations by blending terracotta-rich bases with antioxidants, botanicals, and functional additives, this segment is expected to retain its position as the backbone of detoxification-focused skincare products throughout the forecast period.

| Function | Value Share% 2025 |

|---|---|

| Detoxifying & pore purifying | 54% |

| Others | 46.0% |

The detoxifying & pore purifying function segment is forecasted to hold 54% of the market share in 2025, led by its strong consumer adoption across masks, scrubs, and spa-based treatments. These formulations are favored for their high efficacy in clearing clogged pores, removing toxins, and refreshing the skin, making them a universal solution for both oily and combination skin types.

Their versatility across daily skincare routines and premium spa therapies has facilitated widespread adoption globally. The segment’s growth is also reinforced by rising consumer awareness of urban pollution and environmental aggressors, which has heightened demand for deep detoxification solutions. As more consumers seek instant results with visible skin clarity, detoxifying and pore purifying claims are expected to continue their dominance in the global TerraCotta Clay for Detoxification Market.

| Product Type | Value Share% 2025 |

|---|---|

| Wash-off masks | 49% |

| Others | 51.0% |

The wash-off masks segment is projected to account for 49% of the global TerraCotta Clay for Detoxification Market revenue in 2025, establishing it as the leading product type. Wash-off clay masks are preferred for their instant detoxifying action, ease of use, and visible results after a single application, which makes them highly appealing to both young and mature consumer groups.

Their suitability for DIY home treatments, spa-inspired rituals, and mass retail distribution has made them a cornerstone of the clay detox market. Developments in formulation science—such as enhanced spreadability, faster drying times, and added botanical extracts have further improved the consumer experience. Given their strong combination of affordability, efficacy, and global accessibility, wash-off masks are expected to maintain their leading role in the global TerraCotta Clay for Detoxification Market.

Rising Popularity of Mineral-Based Detoxification Products in Asia-Pacific

One of the strongest growth drivers is the cultural and consumer preference for clay and mineral-based skincare in Asia-Pacific, particularly in China and India. Both countries are registering some of the fastest CAGRs globally (China at 16.4%, India at 18.5%). Historically, clay masks and mud packs have deep roots in Ayurvedic, herbal, and Traditional Chinese Medicine practices. This cultural familiarity gives terracotta clay a natural trust advantage, allowing brands to position their products as both modern and heritage-driven. Combined with the rapid growth of e-commerce channels in Asia-Pacific, these products are penetrating younger demographics who seek affordable, effective detox solutions. Global brands are increasingly localizing terracotta clay products for Asian consumers, emphasizing detoxifying, pore-purifying, and mattifying functions, which aligns with regional skin concerns like oiliness and pollution exposure.

Expansion of Multi-Claim Formulations in Premium and Mass Retail

Another major driver is the shift from single-function clay masks to multi-claim detoxification products. Today’s consumers are not only looking for pore cleansing but also for redness reduction, oil control, and mineral replenishment in one product. This has led to the innovation of hybrid terracotta clay products—such as detoxifying masks infused with botanicals, hyaluronic acid, and probiotics. Premium skincare brands are leveraging this by promoting multi-layered benefits in specialty retail and spas, while mass-market players are pushing affordable versions in drugstores and online channels. This multi-claim appeal increases consumer loyalty and repeat purchases, especially as consumers seek value-driven yet multifunctional solutions. The result is higher shelf space allocation for clay detox products in both developed and emerging markets.

Raw Material Quality Variability and Sourcing Challenges

Unlike synthetic skincare ingredients, terracotta clays and their blends (kaolinitic, illite/montmorillonite, red ochre, bentonite) vary significantly depending on their geological source and mineral composition. This leads to inconsistency in product performance such as texture, absorption capacity, and color uniformity. For global brands, ensuring consistent sourcing and quality across multiple countries remains a challenge. Moreover, environmental regulations in Europe and North America around clay mining, sustainability, and traceability are tightening, which increases costs for companies attempting to certify eco-friendly and clean-label clays. This could restrain smaller and mid-sized players that lack diversified supply chains.

Rising Competition from Synthetic and Alternative Detox Ingredients

Although clay detox products are gaining traction, they face competition from synthetic detoxification technologies and alternative natural ingredients like activated charcoal, volcanic ash, and enzyme-based exfoliants. Many of these alternatives are marketed as more lightweight, customizable, or suitable for sensitive skin, which can limit clay’s appeal among specific consumer groups. For example, fragrance-free or ultra-sensitive consumers in Western markets may prefer milder synthetic formulations that avoid the tightening effect of clays. This competitive overlap may restrain clay’s market share in certain premium skincare categories, especially if innovations in synthetic detox formulations outpace advancements in clay-based systems.

Surge in E-commerce and Digital-First Distribution Models

E-commerce has emerged as one of the most powerful trends shaping the global TerraCotta Clay for Detoxification Market. Brands are leveraging direct-to-consumer (D2C) platforms, influencer marketing, and subscription models to push clay detoxification products. In China, cross-border e-commerce platforms such as Tmall Global are enabling international clay-based brands to tap into young Gen Z and millennial buyers with instant access. In the USA and Europe, social media campaigns highlighting before-and-after detox mask results have created viral product demand. This trend not only lowers distribution costs but also enhances data-driven personalization, enabling companies to launch niche SKUs (vegan, fragrance-free, mineral origin) quickly into the market.

Integration of TerraCotta Clay into Body Care and Spa-Based Rituals

A second trend is the extension of terracotta clay detox products beyond facial skincare into body care, wellness rituals, and spa services. While facial masks dominate, clay body wraps and detox scrubs are rapidly gaining momentum in luxury spas and wellness resorts across Europe, North America, and the Middle East. These products emphasize whole-body detoxification, remineralization, and stress relief, aligning with the global wellness movement. Additionally, at-home consumers are adopting body-focused terracotta clay products marketed as part of holistic detox kits, which combine scrubs, wraps, and leave-on treatments. This diversification of application points enhances the premium positioning of clay products and creates new revenue streams beyond the traditional facial skincare category.

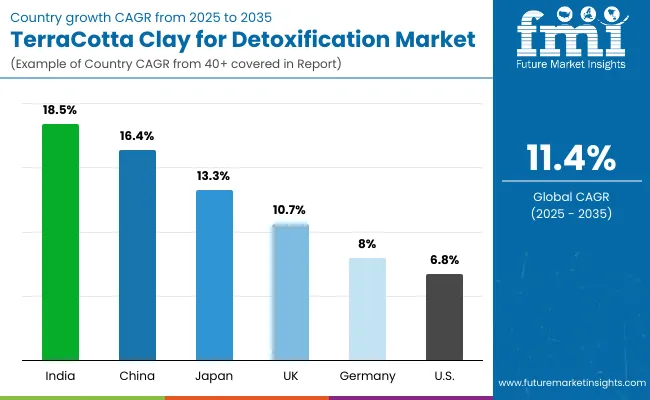

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.4% |

| USA | 6.8% |

| India | 18.5% |

| UK | 10.7% |

| Germany | 8.0% |

| Japan | 13.3% |

The global TerraCotta Clay for Detoxification Market shows strong geographical divergence, with India (18.5%) and China (16.4%) emerging as the fastest-growing markets between 2025 and 2035. Growth in these regions is underpinned by cultural familiarity with clay-based skincare rituals, high levels of urban pollution driving demand for detoxifying solutions, and the affordability of clay products that resonate with mass-market consumers. India in particular benefits from the integration of clay-based detox products into Ayurvedic and herbal beauty systems, while China’s rapid digital retail expansion enables premium and mass brands alike to penetrate younger demographics. Japan, with a CAGR of 13.3%, also stands out as a high-growth market where terracotta clay products align with J-beauty’s focus on minimalist, natural, and functional formulations, ensuring widespread adoption across both premium and everyday skincare categories.

In comparison, developed Western markets such as the USA (6.8%), Germany (8.0%), and the UK (10.7%) are projected to grow at steadier but more moderate rates. In these regions, clay detox products compete with a broader set of synthetic and alternative natural detox solutions, such as charcoal, enzyme-based exfoliants, and probiotic skincare. However, demand is reinforced by clean beauty trends, vegan positioning, and sensitive-skin product launches, particularly in the UK where natural and cruelty-free claims resonate strongly with consumers. Germany’s growth is supported by its well-developed pharmacy and drugstore distribution network, while the USA continues to account for a significant share of the global market due to mass retail adoption and strong brand portfolios from multinational leaders like L’Oréal and Freeman Beauty. This demonstrates that while growth momentum is highest in Asia, Western markets remain critical in maintaining global balance and scale for leading companies.

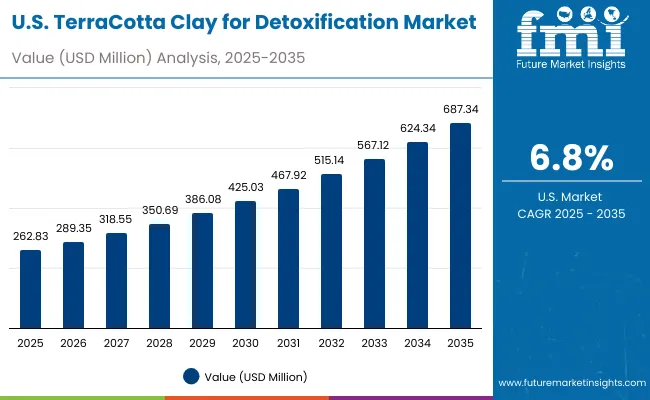

| Year | USA TerraCotta Clay for Detoxification Market (USD Million) |

|---|---|

| 2025 | 262.83 |

| 2026 | 289.35 |

| 2027 | 318.55 |

| 2028 | 350.69 |

| 2029 | 386.08 |

| 2030 | 425.03 |

| 2031 | 467.92 |

| 2032 | 515.14 |

| 2033 | 567.12 |

| 2034 | 624.34 |

| 2035 | 687.34 |

The TerraCotta Clay for Detoxification Market in the United States is projected to grow at a CAGR of 6.8%, supported by rising demand for clean-label, mineral-origin skincare products. Mass retail and pharmacies remain the primary channels, with established players like L’Oréal Garnier, La Roche-Posay, and Freeman Beauty driving growth through affordable, accessible formats. The detoxifying & pore purifying function dominates as urban consumers increasingly seek solutions for environmental stressors and pollution exposure. Premium growth is also observed in sensitive-skin, fragrance-free claims, where dermatology-linked brands play a strong role.

The TerraCotta Clay for Detoxification Market in the United Kingdom is expected to grow at a CAGR of 10.7%, driven by high adoption in vegan, cruelty-free, and clean-label segments. UK consumers are increasingly drawn to brands like The Body Shop, Cattier, and L’Oréal Paris, which emphasize sustainability and eco-friendly sourcing. The market is supported by robust specialty retail channels and pharmacy chains, where terracotta clay detox products are marketed as affordable luxuries with natural positioning. Heritage-inspired and mineral-origin claims resonate strongly with consumers, while spas and salons integrate clay body wraps into wellness rituals.

India is witnessing rapid growth in the TerraCotta Clay for Detoxification Market, which is forecast to expand at a CAGR of 18.5% through 2035, the highest globally. Growth is supported by the integration of clay into Ayurvedic and herbal beauty traditions, where local brands such as Himalaya dominate, alongside global players expanding in tier-2 and tier-3 cities. E-commerce penetration and rising awareness among middle-class consumers are accelerating adoption, particularly for oil-control and mattifying functions suited to Indian skin types and climates. Additionally, body wraps and spa-inspired clay rituals are gaining ground in urban wellness centers, reinforcing both premium and mass-market uptake.

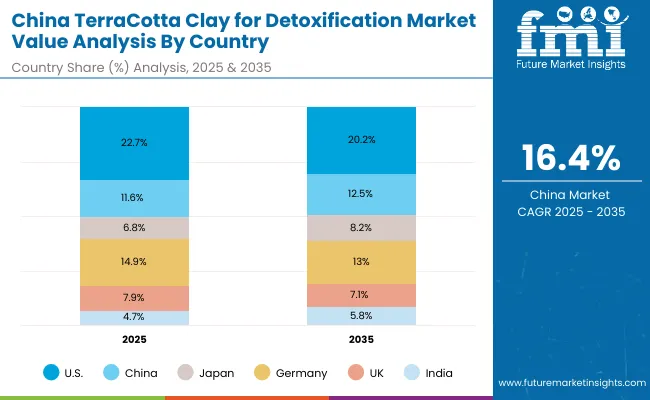

The TerraCotta Clay for Detoxification Market in China is expected to grow at a CAGR of 16.4%, positioning it as one of the fastest-growing markets globally. Growth is led by young millennial and Gen Z consumers who favor K-beauty and C-beauty inspired clay masks for detoxifying and pore-purifying functions. Domestic and international brands alike are leveraging cross-border e-commerce platforms such as Tmall Global to rapidly distribute products. Municipal and urban pollution challenges are also driving consumer preference for deep detoxification masks and scrubs. Affordable SKUs from domestic brands complement premium imports, creating a broad consumption base.

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.7% |

| China | 11.6% |

| Japan | 6.8% |

| Germany | 14.9% |

| UK | 7.9% |

| India | 4.7% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.2% |

| China | 12.5% |

| Japan | 8.2% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 5.8% |

.webp)

| USA By Clay Origin | Value Share% 2025 |

|---|---|

| Terracotta-rich kaolinitic clays | 46% |

| Others | 54.0% |

The TerraCotta Clay for Detoxification Market in the United States is projected at USD 262.8 million in 2025. Terracotta-rich kaolinitic clays contribute 46%, while other clay blends account for 54%, reflecting balanced consumer interest in both kaolin-based detoxification and bentonite-enriched or iron-oxide clay variants. The dominance of kaolinitic clays stems from their gentle exfoliating and detoxifying action, which suits USA consumers with sensitive or combination skin types.

Growth is supported by the integration of clay detox masks into dermatology-linked retail chains and the rising popularity of fragrance-free and sensitive-skin formulations. USA consumers are shifting toward products that not only detoxify but also deliver soothing, redness-reducing, and oil-control benefits. With mass retail and drugstore channels serving as the primary outlets, global leaders such as L’Oréal, Garnier, and La Roche-Posay are leveraging their scale to dominate. Over the decade, the USA market is expected to maintain its global leadership, though growth will be slower compared to Asia-Pacific.

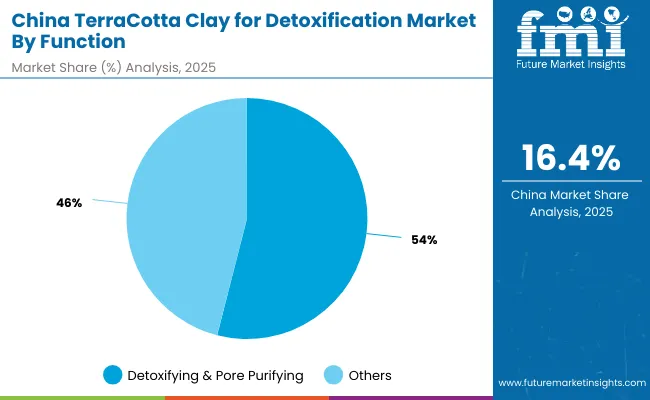

| China By Function | Value Share% 2025 |

|---|---|

| Detoxifying & pore purifying | 54% |

| Others | 46.0% |

The TerraCotta Clay for Detoxification Market in China is valued at USD 130.3 million in 2025, with detoxifying & pore purifying products leading at 54%, followed by other functional claims at 46%. The dominance of detoxifying formulations is a direct outcome of China’s urban consumer base facing high pollution levels, where clay masks and scrubs are positioned as essential solutions for deep cleansing and maintaining skin clarity.

This advantage positions detoxifying clay products as the cornerstone of beauty and wellness routines in China. E-commerce platforms such as Tmall and JD.com amplify adoption by providing fast access to international brands like Innisfree, Shiseido, and L’Oréal Paris, while domestic brands offer competitive pricing to penetrate mass-market categories. Premium adoption is also reinforced by spa-inspired rituals and C-beauty product innovation, where hybrid clays infused with botanicals and vitamins appeal to millennial and Gen Z consumers. With a CAGR of 16.4%, China will be among the strongest global growth drivers, surpassing many developed economies in relative expansion.

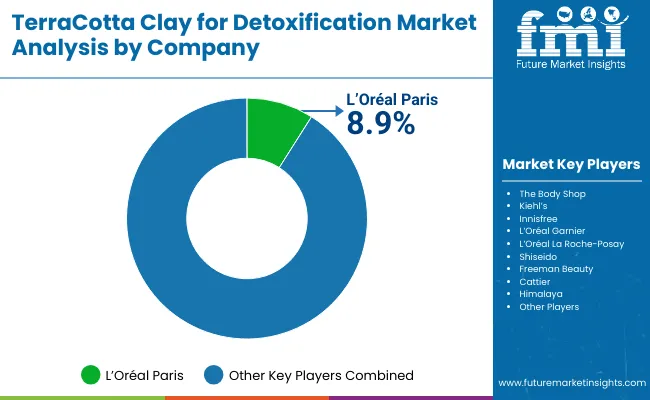

| Company | Global Value Share 2025 |

|---|---|

| L’Oréal Paris | 8.9% |

| Others | 91.1% |

The TerraCotta Clay for Detoxification Market is moderately fragmented, with multinational beauty conglomerates, mid-sized skincare innovators, and niche heritage brands competing across categories. Global leaders such as L’Oréal Paris, Garnier, La Roche-Posay, and Shiseido hold significant market share, driven by their diversified clay mask portfolios, strong retail distribution, and clean-label brand positioning. Their strategies emphasize sensitive-skin claims, vegan certifications, and hybrid formulations that combine clays with botanicals and active ingredients.

Mid-sized players such as The Body Shop, Kiehl’s, and Innisfree are accelerating adoption by leveraging natural and mineral-origin branding, coupled with sustainability and eco-friendly sourcing narratives. These companies appeal strongly to European and East Asian consumers seeking ethical, cruelty-free beauty products. Niche-focused specialists such as Freeman Beauty, Cattier, and Himalaya provide affordable, heritage-driven formulations, resonating in mass-market and Ayurvedic-inspired segments. Their strength lies in regional adaptability, clean beauty positioning, and affordability, rather than global dominance.

Competitive differentiation is increasingly shifting away from brand legacy and product claims alone toward distribution ecosystem strength, omnichannel marketing, and eco-certification credibility. Brands that can blend heritage, sustainability, and digital-first engagement are expected to gain stronger consumer loyalty over the decade.

Key Developments in Global TerraCotta Clay for Detoxification Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,122.1 Million |

| Clay Origin | Terracotta-rich kaolinitic clays, Illite /montmorillonite blends, Red ochre (iron-oxide) clays, and Bentonite-enriched clay systems |

| Function | Detoxifying & pore purifying, Oil control & mattifying, Soothing & redness reduction, and Mineral remineralization |

| Product Type | Wash-off masks, Cleansers/scrubs, Leave-on spot treatments, and Body masks & wraps |

| Channel | E-commerce, Mass retail, Pharmacies/drugstores, Specialty beauty retail, and Spas/salons |

| Claim | Natural/mineral origin, Fragrance-free/sensitive-skin, Clean-label, and Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L’Oréal Paris, The Body Shop, Kiehl’s, Innisfree, L’Oréal Garnier, L’Oréal La Roche- Posay, Shiseido, Freeman Beauty, Cattier, Himalaya |

| Additional Attributes | Dollar sales by clay origin, function, product type, channel, and claim; adoption trends in detoxifying & pore purifying masks; rising demand for wash-off and body clay products; sector-specific growth in e-commerce, specialty retail, and spas; vegan and fragrance-free product innovation; integration of clay-based detox products in holistic wellness routines; regional growth led by Asia-Pacific markets; and innovations in hybrid formulations blending terracotta clays with botanicals and minerals. |

The global TerraCotta Clay for Detoxification Market is estimated to be valued at USD 1,122.1 million in 2025.

The market size for the global TerraCotta Clay for Detoxification Market is projected to reach USD 3,301.3 million by 2035.

The global TerraCotta Clay for Detoxification Market is expected to grow at a CAGR of 11.4% between 2025 and 2035.

The key product types in the global TerraCotta Clay for Detoxification Market are wash-off masks, cleansers/scrubs, leave-on spot treatments, and body masks & wraps.

In terms of clay origin, terracotta-rich kaolinitic clays are expected to command 46% share in the global TerraCotta Clay for Detoxification Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clay Based Construction Products Market Size and Share Forecast Outlook 2025 to 2035

Clay Coated Recycled Boxboard Market Growth - Demand & Forecast 2024 to 2034

Clay Coated Paper Market Growth & Demand 2024-2034

Clay Desiccant Bag Market

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

China Clay Market Size, Growth, and Forecast for 2025-2035

Bentonite Clay Market Forecast Outlook 2025 to 2035

Automatic Clay Brick Making Machine Market

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA