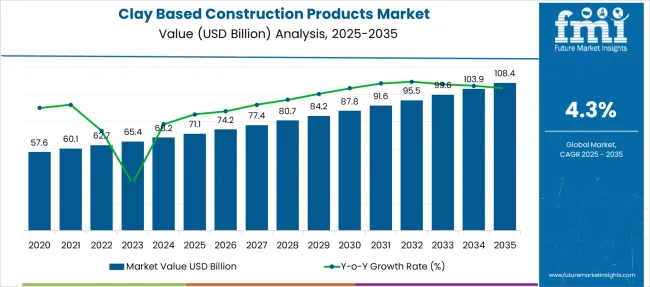

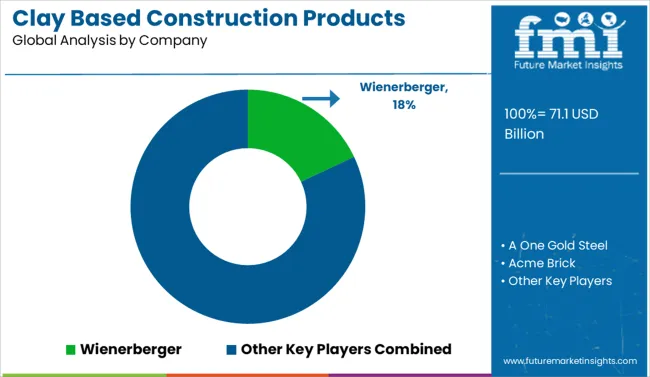

The Clay Based Construction Products Market is estimated to be valued at USD 71.1 billion in 2025 and is projected to reach USD 108.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. Market value increases from USD 65.4 billion in 2023 to USD 108.4 billion by 2035, reflecting a USD 43 billion gain over the decade. CAGR stands at 4.3%, though yearly acceleration is uneven, with notable dips in 2023 before stabilizing from 2025 onward. Volatility in growth rate correlates with supply chain readjustments post-2023, followed by a consistent incline through 2032. This suggests resilience despite commodity-driven price challenges. Long-term, the CAGR indicates the construction boom in urban redevelopment projects, and incremental demand for eco-materials amplifies adoption potential, albeit at a modest pace compared to cement-based alternatives.

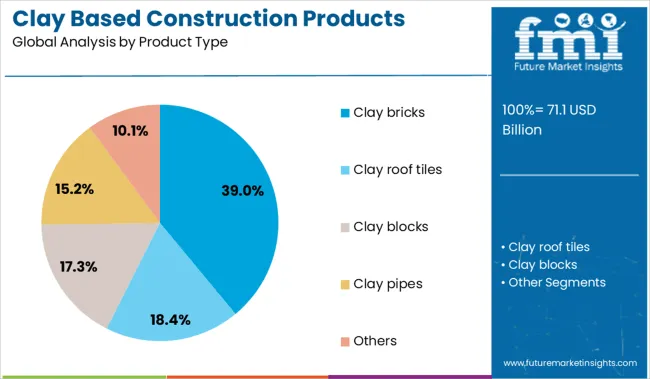

Clay bricks dominate the market with 39.0% share in 2025, primarily due to their structural strength, thermal insulation benefits, and widespread use in residential and commercial projects. Asia-Pacific accounts for the fastest growth, fueled by large-scale housing projects and infrastructure investments, while North America and Europe sustain demand through renovation activity and preference for traditional, durable materials in premium segments.

The market curve is expected to gain additional momentum post-2030 as green building practices favor natural and recyclable materials, with clay products positioned as eco-compliant alternatives to synthetic substitutes. Opportunities lie in advanced manufacturing processes such as 3D extrusion, lightweight clay composites, and digitally engineered façade solutions.

| Metric | Value |

|---|---|

| Clay Based Construction Products Market Estimated Value in (2025 E) | USD 71.1 billion |

| Clay Based Construction Products Market Forecast Value in (2035 F) | USD 108.4 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The clay based construction products market is witnessing consistent demand, driven by increased investments in long-term infrastructure, growing sustainability mandates, and the material's natural thermal and acoustic insulation properties. Rising urbanization and emphasis on affordable housing have intensified the use of clay-based materials, especially in regions focused on low-cost, long-lasting construction methods.

Clay products are being favored for their low embodied energy, ease of recycling, and durability, making them compliant with green building standards. Construction firms are increasingly integrating clay products into new builds as part of passive design strategies to reduce operational energy loads.

Technological improvements in kiln efficiency and material formulation are lowering production emissions and enhancing product performance. Heightened focus on carbon reduction in the construction lifecycle is expected to expand the adoption of clay-based materials across both public and private sector developments.

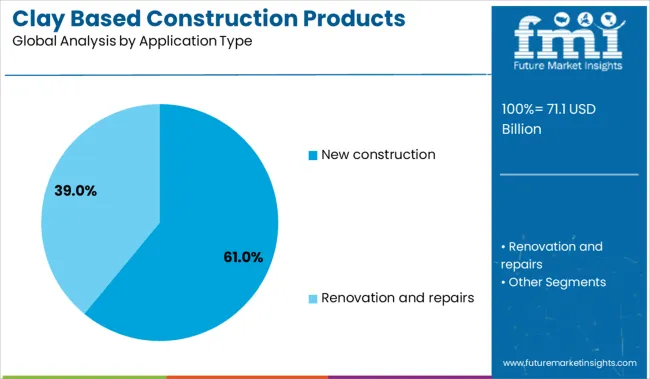

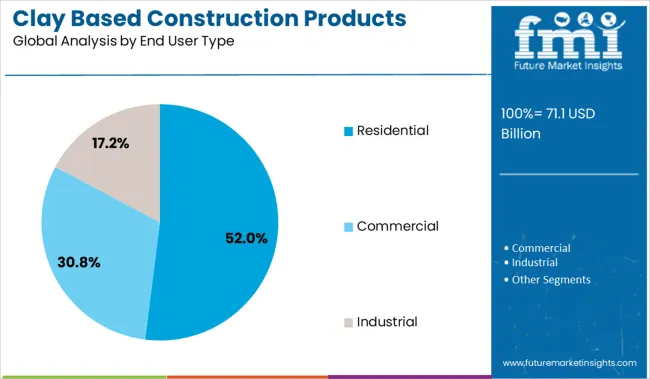

The clay-based construction products market is segmented by product type, application type, end-user type, distribution channel, and region. By product type, it includes clay bricks, clay roof tiles, clay blocks, clay pipes, and other related products widely used in building structures. In terms of application type, the segmentation comprises new construction and renovation and repair activities, indicating demand from both fresh projects and maintenance works. Based on end-user type, the market is classified into residential, commercial, and industrial sectors, reflecting its broad application across infrastructure projects. By distribution channel, it is divided into direct and indirect sales models. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Clay bricks are projected to account for 39.00% of the total market share in 2025, making them the leading product type in the clay based construction segment. This leadership is attributed to their proven performance in structural durability, thermal regulation, and fire resistance.

The segment has remained resilient due to the availability of abundant raw materials and cost-effectiveness in large-scale projects. Clay bricks also support energy efficiency in buildings by enhancing thermal mass and reducing dependency on mechanical cooling.

Continuous advancements in modular brick formats and mechanized manufacturing have improved installation efficiency and reduced labor costs. Their compatibility with green building certifications and circular construction practices has further reinforced their role as the preferred material across both rural and urban development zones.

New construction activities are expected to hold 61.00% of the total revenue share in 2025, establishing this as the dominant application type for clay based construction products. This trend is being driven by increasing demand for urban infrastructure, mass housing projects, and institutional buildings across developing economies.

The long lifespan and structural stability of clay products make them ideal for foundational applications in new projects. Governments and private developers are prioritizing cost-efficient and environmentally compliant building materials, particularly in large-scale township and vertical development programs.

In addition, the need to meet updated energy efficiency codes and local building regulations is encouraging the use of materials that offer superior envelope performance, a requirement that clay products fulfill effectively.

The residential sector is anticipated to contribute 52.00% of the overall market revenue in 2025, marking it as the top end user segment. This dominance is being supported by expanding demand for single and multi-family housing units in both urban and peri-urban locations.

Homeowners and builders are gravitating toward clay materials due to their low maintenance, environmental compatibility, and aesthetic appeal. Regional housing initiatives aimed at promoting sustainable and disaster-resilient construction have further boosted residential adoption. Consumer preferences for energy-efficient homes that reduce long-term operating costs have led to wider incorporation of clay bricks and tiles. As population density rises and governments encourage vertical growth in cities, the residential segment is expected to remain a primary driver of clay-based product demand.

Interlocking clay brick systems are driving faster, more efficient modular construction, especially in thermal and seismic applications. Inconsistent subsoil clay quality and extraction limits are challenging cost-effective regional scalability.

Prefabricated housing firms across Southeast Asia and Eastern Europe have increasingly adopted interlocking clay brick systems to reduce site labor dependencies. By Q2 2025, turnkey modular developers reported a 21% reduction in assembly time when compressed clay blocks were pre-sized at fabrication centers. This workflow has been promoted as a means to boost structural uniformity while meeting seismic zoning codes in mid-rise applications.

Distributors in Poland and Vietnam added 34 new SKU lines of pre-mortared clay tiles as part of rapid-install kits, reflecting the demand for thermally efficient façades. Clay-based prefab kits have also been bundled with carbon-credit consulting, positioning them as climate-aligned without using broad narratives. Builders are now opting for earthen construction materials over aerated concrete in peri-urban zones driven by thermal inertia, acoustic dampening, and durability claims.

Market expansion for fired and unfired clay products has been hindered by uneven subsoil clay quality across Latin America and Sub-Saharan Africa. Processing plants in Ghana and Colombia recorded yield losses of 13%-16% due to high sand content and mineral inconsistencies in locally mined clay deposits. This variability has forced operators to import kaolinite-rich clays from neighboring regions, increasing freight-adjusted costs by 22% per ton.

Brickmakers have relied on third-party lab calibrations to monitor particle gradation, yet batch rejection rates remain above 9% in some facilities. In response, clinker-blend formulas were introduced to standardize shrinkage and firing times, although their adoption has raised cost sensitivity among price-conscious contractors. Regional clay shortages and regulatory limits on open-pit extraction are being viewed as primary constraints on scaling low-cost clay housing initiatives.

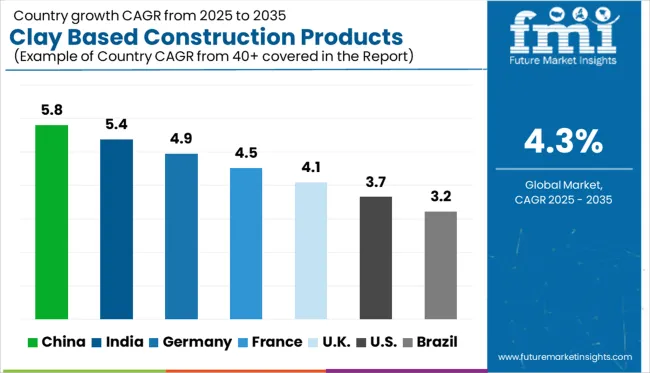

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The global clay based construction products market is advancing at a CAGR of 4.3% from 2025 to 2035, yet several countries, particularly from BRICS and OECD blocs, are outperforming this average. China leads with a CAGR of 5.8%, bolstered by rapid urban development, eco-clay initiatives, and government mandates favoring energy-efficient building materials. India follows at 5.4%, driven by housing growth, green building certifications, and demand for clay roof and wall components across tier-II and III cities aligned with ASEAN flows. Germany, a prominent OECD member, is growing at 4.9% CAGR, supported by stringent energy-efficiency norms and retrofitting projects that emphasize durable clay materials. France, at 4.5%, benefits from the restoration of heritage structures and bio-clay innovation. Meanwhile, the UK and USA record slower growth at 4.1% and 3.7% respectively, reflecting mature construction cycles and moderate new-build demand. The report covers 40+ countries, with the above six highlighted as key growth contributors

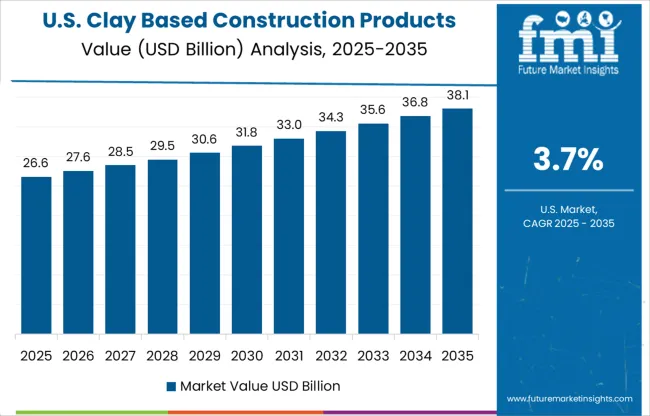

The CAGR for the clay-based construction products market in the United States increased from 2.4% during 2020 to 2024 to approximately 3.7% for the 2025 to 2035 period. This upward shift reflects a moderate resurgence in demand from multi-family residential projects and retrofitting mandates in states with wildfire-prone zones.

The application of fire-rated earthen façades in passive housing standards has driven material substitution in Western regions. The Inflation Reduction Act’s support for energy-efficient materials indirectly improved the outlook for low-emissivity clay bricks in government-funded renovations. Public procurement guidelines now prioritize thermal-mass materials, positioning clay block systems as code-compliant choices for municipal infrastructure.

The CAGR for the United Kingdom's clay-based construction products market moved from 2.9% in 2020 to 2024 to 4.1% over the 2025 to 2035 timeframe, as architectural preferences shifted back toward heritage-compatible materials in urban refurbishments. Demand has risen for reclaimed and handmade clay bricks in conservation zones, especially across Greater London, Manchester, and Bristol. Higher thermal inertia of clay blocks was recognized under the updated Building Regulations Part L (2025), which widened eligibility for clay façades in low-carbon housing prototypes. UK-based artisan brickworks also benefited from "build-local" incentives introduced post-Brexit, reinforcing domestic clay product sales over imports.

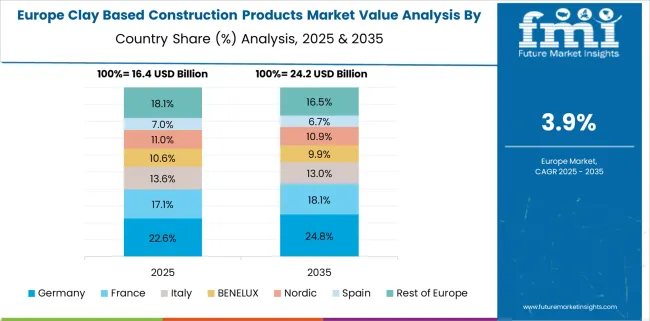

Germany's clay-based construction products market saw a CAGR transition from 3.5% during 2020 to 2024 to about 4.9% for 2025 to 2035. This expansion has been catalyzed by aggressive shifts toward low-carbon construction mandated by the revised Energy Efficiency Building Act (GEG).

Clay block systems with integrated insulation layers have found favor among developers seeking to comply with KfW efficiency standards. Regional municipalities in Bavaria and Baden-Württemberg now prioritize public buildings using mineral-based construction products to align with lifecycle emission targets. Domestic producers scaled up automation lines in 2024 to meet structured B2B tender demand for thermally upgraded brick systems.

China’s clay-based construction products market experienced a CAGR of 4.4% from 2020 to 2024, which has now advanced to approximately 5.8% over 2025 to 2035, powered by strong provincial mandates to utilize thermally massive materials in affordable housing projects.

The Ministry of Housing and Urban-Rural Development (MOHURD) expanded local pilot schemes using unburnt compressed clay blocks, especially in Sichuan, Anhui, and Henan. Standardization of interlocking clay systems accelerated prefabrication compatibility, while rural revitalization schemes encouraged high-durability local clay adoption over cement alternatives. National policies now favor eco-brick systems in carbon-labeled green building projects.

India’s clay-based construction products market shifted from a 3.8% CAGR in 2020 to 2024 to about 5.4% in 2025 to 2035, as both public and private housing schemes moved toward cost-efficient and thermally efficient walling materials. The Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission have incorporated compressed stabilized earth blocks (CSEB) and clay roofing tiles in model projects, particularly across Tamil Nadu, Maharashtra, and Odisha.

Local clay kilns have also received technology upgrades to reduce soot emissions, aligning with regional air quality targets while improving production yield. Developers of mid-income housing clusters are showing preference for earthen wall components to meet cost-per-square-foot benchmarks.

Leading players in the clay-based construction market are enhancing regional manufacturing, modular compatibility, and fire-resistant product lines. Wienerberger, Acme Brick, General Shale, and Ibstock have expanded their product portfolios across roofing tiles, facing bricks, and thermal blocks. CRH and Holcim USA are focusing on vertically integrated distribution and alternative earth materials.

Companies such as Gladding, McBean and Ludowici Roof Tile remain active in heritage restoration and high-end architectural clay solutions, particularly in North America. Emerging manufacturers like Nuvocotto, Prayag Clay Products, and Uganda Clays are scaling capacity in Asia and Africa to serve rising demand in urban housing.

NS Arcus and McNear Brick and Block are innovating in interlocking and pre-mortared systems, while A One Gold Steel and Pulkit TMT are exploring clay-composite hybrids in structural use cases.

Leading companies are expanding globally through strategic mergers and acquisitions, broadening their footprint across regions. They prioritize product innovation, focusing on eco-friendly and high-efficiency clay products. Players are also aggressively entering developing markets and collaborating with contractors and distributors to streamline the supply chain and enhance responsiveness to local demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 71.1 Billion |

| Product Type | Clay bricks, Clay roof tiles, Clay blocks, Clay pipes, and Others |

| Application Type | New construction and Renovation and repairs |

| End User Type | Residential, Commercial, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wienerberger, A One Gold Steel, Acme Brick, CRH, General Shale, Gladding, McBean, Holcim US, Ibstock, Ludowici Roof Tile, McNear Brick and Block, NS Arcus, Nuvocotto, Prayag Clay Products, Pulkit TMT, and Uganda Clays |

| Additional Attributes | Dollar sales, share, regional demand shifts, public infrastructure spend, builder preferences, kiln tech trends, regulatory codes, and pricing benchmarks across applications. |

The global clay based construction products market is estimated to be valued at USD 71.1 billion in 2025.

The market size for the clay based construction products market is projected to reach USD 108.4 billion by 2035.

The clay based construction products market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in clay based construction products market are clay bricks, clay roof tiles, clay blocks, clay pipes and others.

In terms of application type, new construction segment to command 61.0% share in the clay based construction products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clay Coated Recycled Boxboard Market Growth - Demand & Forecast 2024 to 2034

Clay Coated Paper Market Growth & Demand 2024-2034

Clay Desiccant Bag Market

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

China Clay Market Size, Growth, and Forecast for 2025-2035

Bentonite Clay Market Forecast Outlook 2025 to 2035

Automatic Clay Brick Making Machine Market

TerraCotta Clay for Detoxification Market Size and Share Forecast Outlook 2025 to 2035

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA