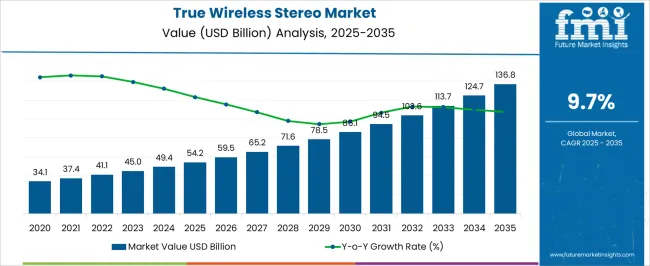

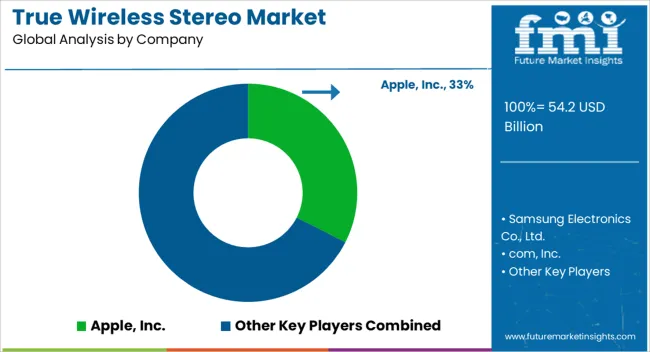

The True Wireless Stereo Market is estimated to be valued at USD 54.2 billion in 2025 and is projected to reach USD 136.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| True Wireless Stereo Market Estimated Value in (2025 E) | USD 54.2 billion |

| True Wireless Stereo Market Forecast Value in (2035 F) | USD 136.8 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The true wireless stereo market is witnessing robust expansion driven by the surge in demand for untethered audio experiences, enhanced sound fidelity, and integrated smart features. Consumer preference is shifting toward compact, high performance earbuds that offer noise cancellation, touch control, voice assistant integration, and seamless connectivity with multiple devices.

The adoption of low latency codecs and advanced Bluetooth standards has further elevated audio quality and user convenience. As consumers become increasingly lifestyle and fitness focused, the demand for water resistant, ergonomic, and high battery performance models has also grown.

Continued innovation from major audio brands and growing music streaming consumption are sustaining this growth trajectory. The outlook for the market remains strong as technology convergence, product personalization, and digital lifestyle trends continue to influence consumer purchasing behavior across both developed and emerging markets.

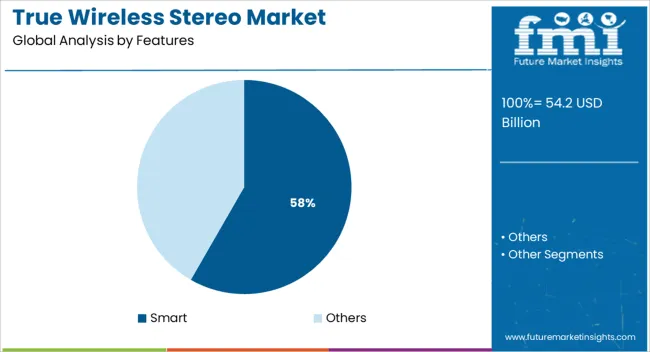

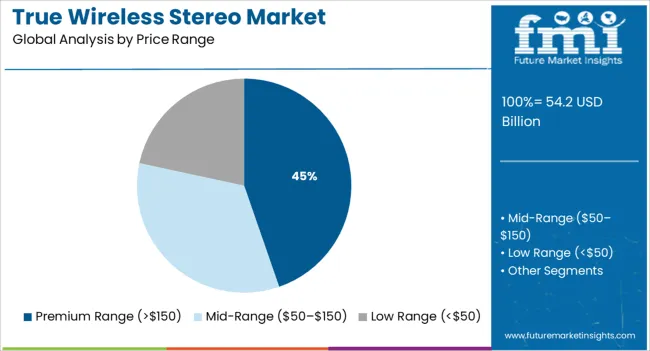

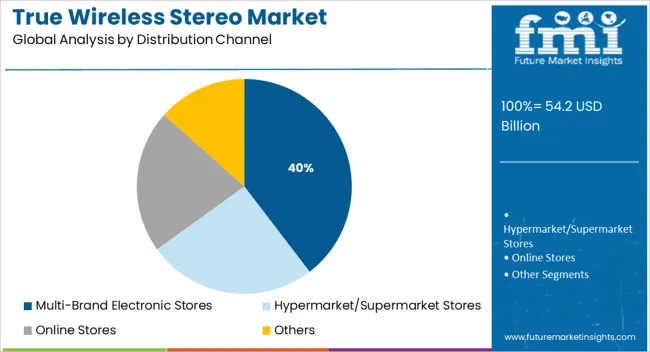

The market is segmented by Features, Price Range, Distribution Channel, and Application and region. By Features, the market is divided into Smart and Others. In terms of Price Range, the market is classified into Premium Range (>$150), Mid-Range ($50–$150), and Low Range (<$50). Based on Distribution Channel, the market is segmented into Multi-Brand Electronic Stores, Hypermarket/Supermarket Stores, Online Stores, and Others. By Application, the market is divided into Music & Entertainment, Fitness, and Gaming. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The smart features segment is anticipated to contribute 58.30% of total market revenue by 2025 within the features category, establishing it as the leading segment. This growth is supported by increasing consumer expectations for hands free operation, AI voice assistance, touch sensors, and integration with mobile apps.

The growing penetration of smart ecosystems has driven demand for earbuds that connect seamlessly with smartphones, smartwatches, and virtual assistants. Manufacturers are prioritizing smart functionality to offer differentiation in a crowded market.

These features enhance usability and deliver personalized audio experiences, especially in fitness, productivity, and travel scenarios. As convenience and connected functionality continue to shape product choices, smart true wireless stereo models have emerged as the consumer favorite in this segment.

The premium price segment valued above 150 dollars is projected to hold 44.70% of total market revenue by 2025 under the price range category. This share is attributed to increasing consumer willingness to invest in high quality audio products that offer advanced noise cancellation, superior acoustic engineering, and longer battery life.

Premium models are also associated with superior build materials, brand prestige, and extended product life cycles. The demand has been further fueled by professionals, audiophiles, and lifestyle buyers who seek high performance products for work and leisure.

Continuous launches by established audio brands and luxury electronics companies have contributed to expanding choices in this price tier. As consumers prioritize sound quality, comfort, and brand credibility, the premium price range remains dominant in revenue contribution.

The multi brand electronic stores segment is expected to account for 39.60% of total revenue by 2025 within the distribution channel category, making it the most significant channel. This dominance is due to consumers’ preference for physically experiencing the product before purchase and the availability of expert assistance.

These stores offer access to multiple brands under one roof, enabling product comparisons, bundled offers, and immediate purchase gratification. In emerging markets, offline retail remains a key channel where customer trust and tactile assurance drive decision making.

Additionally, strategic tie UPS between electronics brands and retail chains have ensured regular stock availability and brand visibility. As multi brand stores continue to evolve with improved customer experience zones and interactive product displays, their importance in the distribution network remains high.

Beneficial characteristics and a wide range of applications associated with the product

One of the main drivers propelling the market growth is the quick spread of smart devices, such as smartphones, tablets, laptops, and portable music players. Due to their increased sound quality, improved comfort, high durability, and absence of audio latency, TWS is frequently used for listening to music, watching movies, taking calls, recording sounds, and playing video games. Additionally, because the product allows for flexibility of movement, water and perspiration resistance, and hands-free characteristics, it is widely used during travel, exercise, hiking, dancing, and playing sports. This is producing a good outlook for the market.

The growing concept of device miniaturization in consumer electronics

Electronic firms now have the option to incorporate sensors and microchips into earbuds and headphones owing to technological developments and miniaturization. Additionally, producers can create stylish designs to draw in young customers because of the downsizing of electronic circuits and sensors. These elements encourage market expansion.

In order to accommodate those with hearing impairments, manufacturers are putting a lot of effort into adding hearing assistance features to their earbuds. Such innovations enable producers to include new characteristics in their goods, which is anticipated to positively affect market expansion in the future.

High-end wireless stereo devices are rising in popularity. The prevalence of counterfeit goods is the biggest barrier to the market for true wireless stereo. Due to the wide availability of counterfeit goods in underground markets at astronomically low rates, the demand for premium products from the leading market players may soon be hampered.

Another aspect that can restrict the market's growth is the rising acceptance of smart and neckband wireless earbuds. The supply chain disruptions due market supply and demand gap will further hinder the market growth.

TWS has evolved beyond simple music or podcast listening, paving the way for new applications including voice-based biometrics and the monitoring of vital signs using audio frequency. In the future, it's also conceivable that consumer-grade TWS devices will incorporate more complex hearing augmentation functions.

In the meanwhile, manufacturers are exploring the use of audio-processing technology for monitoring vital indications including heart rate and respiration rate. Future TWS devices are anticipated to be able to estimate and measure enhanced clinical parameters by combining advanced signal processing with microphones and other sensors.

The mid-range segment has the highest product offerings with versatility and diversification inbuilt and output. The market share has been greatly influenced by businesses like Apple Inc., Samsung Electronics Co. Ltd., and Jabra, among others. It is anticipated that Apple Inc. will continue to dominate the market for genuine wireless stereo earphones throughout the next years.

It is driven by the rising popularity of smartphones and the widespread use of the internet. Additionally, a lot of significant businesses are expanding their online footprint in order to sell more of these technologies. Additionally, the convenience provided by online retailers would accelerate the segment's growth during the forecast period.

Smart technology is likely to dominate the feature segments and is anticipated to command the market in terms of revenue. The use of true wireless stereo is also expected to increase because of its smart capabilities like voice control, motion tracking, activity tracking, and usage detection for music playback and pause. To meet the growing demand from trendy customers, major headset manufacturers are concentrating on offering elegant and distinctive wireless headphones and wireless earbuds.

With a market share of more than 35.0% in 2024, North America had the highest demand in the global market. The popularity of Air Pods has contributed to an increase in TWS demand in North America. A number of smartphone makers have introduced wireless earphones with specific connectivity for their models.

Many customers are seen making associated accessory purchases as the intervals between smartphone replacements grow longer. Expected to take advantage of these opportunities are smartphone manufacturers. High levels of technological adoption and the early accessibility of recently introduced goods are further key variables influencing market expansion.

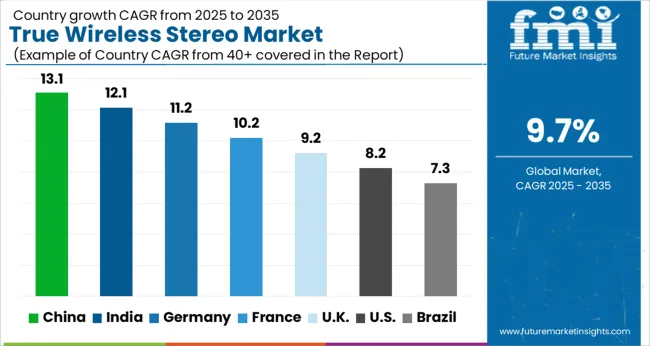

China and India are projected to dominate the Asia Pacific market as a result of the entry of numerous vendors who offer feature-rich products at low prices. Many Chinese and Indian vendors look for opportunities to grow in international markets. The supply chain of well-established vendors is used to boost cross-border e-commerce sales.

These retailers also offer reasonably priced, attractive products that appeal to a wider market. With few entrance hurdles and a sizable customer base, Asia Pacific offers numerous opportunities for market expansion. Due to these factors, Asia Pacific is anticipated to surpass North America in terms of TWS sales from 2025 to 2035.

Boat to lead India’s smart devices battalion

Since market players are primarily focused on introducing distinctive characteristics into their products to enhance the auditory experience, the true wireless stereo sector is competitive. For instance, Apple Inc.'s AirPods include a special vent design that equalizes pressure inside the ear to lessen discomfort, which is typical of in-ear models.

Since the AirPods' debut in December 2020, sales have increased dramatically. However, Chinese suppliers and regional firms that offer unique features at reasonable prices are stealing market share from many premium brands. The following are some of the top companies competing in the worldwide true wireless stereo earbuds market:

Latest Developments in the True Wireless Stereo Market

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 34.6% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Features, By Price Range, By Distribution Channel, By Application |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Apple, Inc.; Samsung Electronics Co., Ltd. (Samsung Group); com, Inc.; Xiaomi Corporation; Sony Corporation; Boat-Lifestyle (Imagine Marketing Private Limited); Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.) (Huawei Device Co. Ltd.); Shure, Inc.; Sennheiser Electronic GmbH & Co. KG; Bose Corporation |

| Customization & Pricing | Available upon Request |

In April 2025, the Danish company Bang & Olufsen, which creates high-end consumer electronics, announced the release of the Beoplay EX, a new set of TWS (truly wireless) earphones. There are noise-canceling earbuds available that are completely waterproof.

Indy ANC, Skullcandy's first completely wireless earphones with ANC, was released in March 2024. The earbuds have a Tile tracker that, in the event that users misplace them, may locate them. They also have Skullcandy's Active Noise Cancelling technology and configurable Personal Sound through the Skullcandy A

The global true wireless stereo market is estimated to be valued at USD 54.2 billion in 2025.

The market size for the true wireless stereo market is projected to reach USD 136.8 billion by 2035.

The true wireless stereo market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in true wireless stereo market are smart and others.

In terms of price range, premium range (>$150) segment to command 44.7% share in the true wireless stereo market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

True Wireless Stereo (TWS) Earbuds Market Report - Growth & Forecast 2025 to 2035

True Random Number Generator TRNG Market Size and Share Forecast Outlook 2025 to 2035

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA