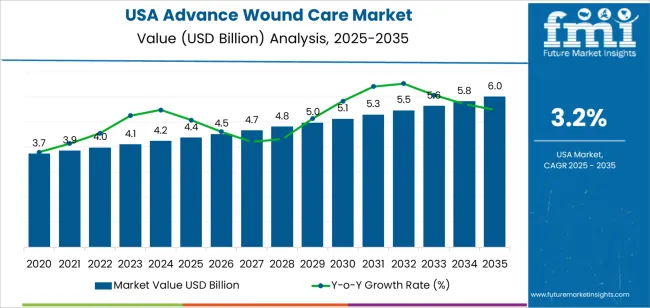

The USA advanced wound care demand is valued at USD 4.4 billion in 2025 and is forecasted to reach USD 6.0 billion by 2035, recording a CAGR of 3.2%. Demand is supported by the prevalence of chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure injuries, along with rising surgical volumes and an aging population. Advanced wound-care products are used to manage moisture balance, support tissue repair, and reduce infection risk in acute and chronic wound settings. Hospitals, outpatient clinics, and home-care providers continue to rely on structured wound-management protocols that incorporate modern dressing technologies.

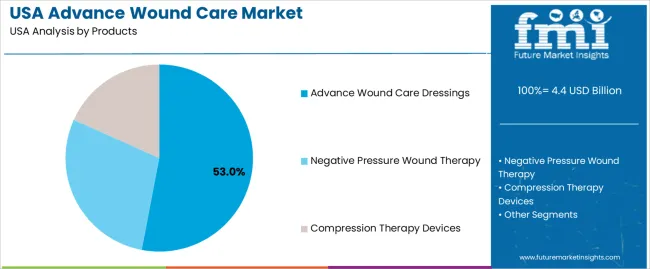

Advanced wound-care dressings represent the leading product category, reflecting their broad use across exudate management, debridement support, and protection of healing tissue. These dressings include foam, hydrocolloid, alginate, hydrogel, and antimicrobial variants designed to maintain controlled wound environments. Improvements in absorbency performance, biocompatibility, and infection-control materials are shaping product development, with greater emphasis on ease of application and patient comfort.

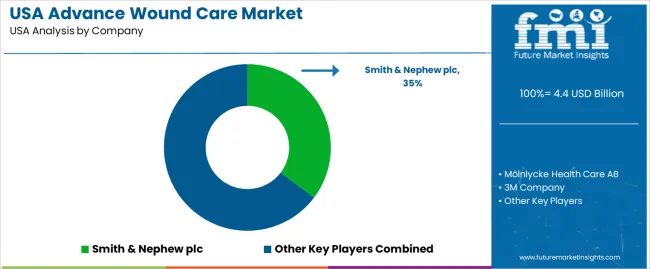

Demand is concentrated in the West, South, and Northeast, where chronic disease incidence, surgical case volumes, and established healthcare networks drive procurement. Key suppliers include Smith & Nephew plc, Mölnlycke Health Care AB, 3M Company, ConvaTec Group, and Coloplast A/S. Their focus areas include dressing performance, product durability, and integrated wound-management solutions used across clinical and home-care settings.

Growth momentum analysis shows a steady trajectory supported by chronic wound prevalence, aging demographics, and consistent adoption of moisture-management and bioactive-healing products. Between 2025 and 2029, momentum will remain firm as hospitals, outpatient centers, and home-care settings expand use of advanced dressings, negative-pressure systems, and antimicrobial solutions. Demand during this phase will be reinforced by rising cases of diabetes-related ulcers and postoperative wounds requiring structured treatment protocols.

From 2030 to 2035, momentum will moderate slightly as product utilization stabilizes across major care providers. Growth will align more closely with replacement cycles, formulary updates, and incremental improvements in dressing materials, exudate-management systems, and sensor-enabled wound-monitoring tools. Broader adoption of standardized wound-care pathways will support consistent procurement without creating significant acceleration. The overall momentum pattern reflects a mature clinical segment characterized by stable demand, long-term treatment requirements, and ongoing integration of evidence-based technologies within USA acute and chronic wound-management practices.

| Metric | Value |

|---|---|

| USA Advance Wound Care Sales Value (2025) | USD 4.4 billion |

| USA Advance Wound Care Forecast Value (2035) | USD 6.0 billion |

| USA Advance Wound Care Forecast CAGR (2025-2035) | 3.2% |

Demand for advanced wound care in the USA is increasing because the prevalence of chronic and complex wounds, such as diabetic foot ulcers, pressure ulcers and surgical wounds, continues to rise with ageing demographics and the incidence of diabetes and obesity. Health-care providers seek more effective treatments that accelerate healing, reduce infection risk and minimise hospital readmissions in high-cost care settings. Technological advances in biologic skin substitutes, negative-pressure wound therapy systems and antimicrobial dressings enhance clinician capability and drive uptake of advanced modalities.

Growth is further supported by expansion of home-health and outpatient wound-care services, which require efficient yet high-performance products that deliver consistent results outside hospital environments. Growth faces constraints because the higher cost of advanced wound-care products and therapies places pressure on reimbursement and provider budgets. The complexity of integrating novel technologies into established care pathways and variable patient compliance in outpatient settings may slow broad adoption.

Demand for advanced wound-care solutions in the United States is shaped by prevalence of chronic conditions, the need for improved healing outcomes, and adoption of specialised wound-management technologies across hospitals and outpatient settings. Industry distribution across product categories, clinical indications, and end-user groups reflects therapeutic complexity, cost considerations, and treatment-protocol requirements.

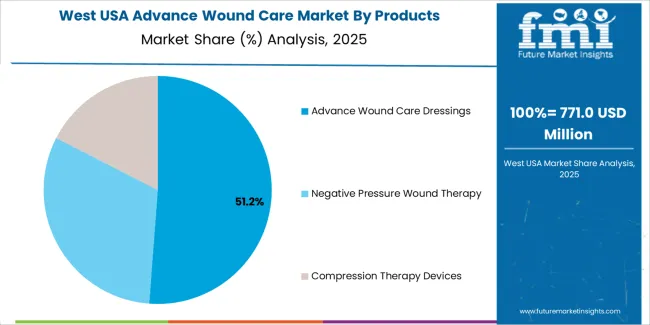

Advanced wound-care dressings hold an estimated 53.0% share and represent the leading product segment. These dressings include hydrocolloids, alginates, foams, and antimicrobial materials designed to maintain optimal moisture balance, support autolytic debridement, and reduce infection risk. Their versatility supports use across chronic, post-surgical, and traumatic wounds. Negative-pressure wound therapy (NPWT) devices account for 32.0%, supporting treatment of complex wounds requiring controlled suction to promote granulation tissue formation and manage exudate. Compression-therapy devices hold 15.0%, primarily used for venous leg ulcers and edema-associated conditions. Product selection reflects wound severity, healing objectives, and clinical practice patterns.

Key drivers and attributes:

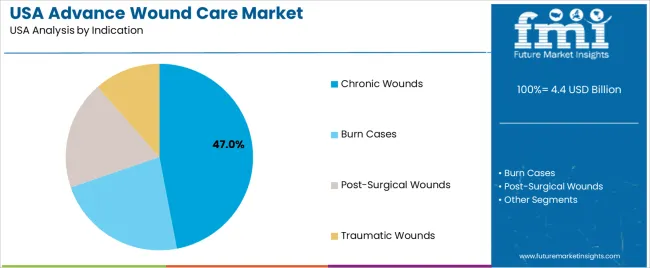

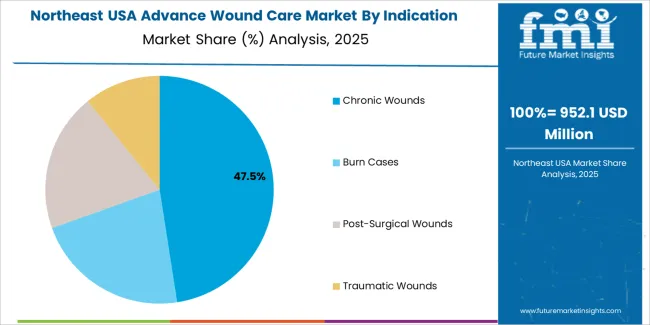

Chronic wounds account for an estimated 47.0% share of USA demand. Diabetic foot ulcers, venous leg ulcers, and pressure ulcers require long-term management due to slow healing and high recurrence rates, increasing reliance on advanced dressings and NPWT systems. Post-surgical wounds represent 24.0%, driven by surgical-site management needs across hospitals and ambulatory centres. Traumatic wounds hold 18.0%, including injuries from accidents and workplace incidents requiring structured wound-care protocols. Burn cases represent 11.0%, where moisture-retentive and antimicrobial dressings are used to reduce infection risk and support tissue recovery. Indication distribution reflects patient demographics, rising chronic-disease prevalence, and treatment protocol adoption.

Key drivers and attributes:

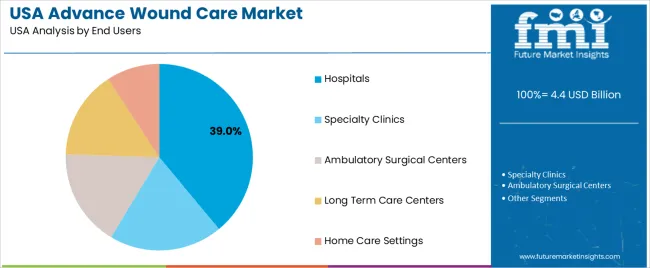

Hospitals represent an estimated 39.0% share of USA demand for advanced wound-care products. They manage high volumes of chronic, surgical, and trauma-related cases requiring specialised dressings and device-based therapies. Specialty clinics hold 23.0%, driven by dedicated wound-management centres treating chronic and complex cases. Ambulatory surgical centres account for 17.0%, focusing on post-operative wound care following outpatient procedures. Long-term care centres represent 12.0%, reflecting demand associated with pressure-ulcer prevention and elderly patient care. Home-care settings account for 9.0%, supported by growing adoption of user-friendly dressings and portable NPWT units.

Key drivers and attributes:

In the United States, demand for advanced wound care products and services is increasing due to a growing prevalence of conditions such as diabetes, peripheral vascular disease, and pressure ulcers that lead to chronic wounds. The volume of surgeries and trauma-related injuries continues to expand, which elevates usage of dressings, skin substitutes, negative-pressure wound therapy systems, and other advanced solutions. The USA healthcare system, with its well-developed hospitals, clinics, reimbursement mechanisms, and access to innovative technologies, supports faster adoption of premium wound care modalities.

Advanced wound care solutions often come at higher unit cost compared with traditional dressings or generic treatments, which can limit uptake among cost-conscious providers or smaller clinics. The complexity of reimbursement pathways and variability across payers may delay procurement or restrict use of novel therapies to specific settings. As care shifts increasingly to outpatient and home-based settings, there may be logistical and training barriers for implementing advanced wound care devices or systems effectively in non-hospital environments. These factors moderate adoption despite underlying need.

The USA industry is seeing rising demand for home-based wound care solutions that allow patients to be treated outside the hospital, including portable negative-pressure wound therapy systems and advanced dressings for self-care or caregiver-assisted use. Digital technologies such as sensors, remote monitoring, and data platforms are being integrated into wound management to enable continuous assessment, predictive alerts, and improved outcomes. Bioengineered skin substitutes, antimicrobial dressings, and tailored wound therapies are gaining traction as clinicians seek faster healing and reduced complications. These trends support steady growth and evolving product profiles in the advanced wound-care industry.

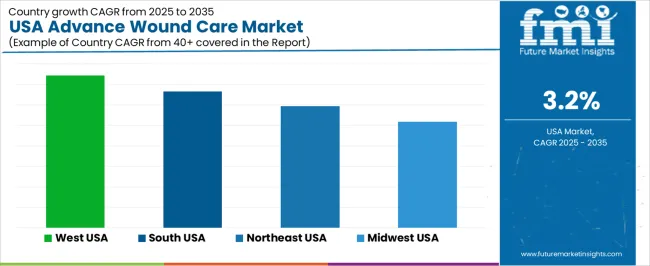

Demand for advanced wound care in the United States is increasing through 2035, driven by rising chronic wound prevalence, expanded outpatient-care networks, and broader adoption of moist-healing technologies, bioengineered dressings, and antimicrobial solutions. Healthcare providers rely on advanced wound-care products for diabetic ulcers, venous ulcers, pressure injuries, and postsurgical management. Growth across regions reflects differences in population health, healthcare-delivery capacity, and the presence of specialized wound-care centers. The West leads with a 3.7% CAGR, followed by the South (3.3%), the Northeast (3.0%), and the Midwest (2.6%). Utilization is reinforced by aging demographics, increasing comorbidities, and ongoing adoption of evidence-based wound-care protocols.

| Region | CAGR (2025-2035) |

|---|---|

| West | 3.7% |

| South | 3.3% |

| Northeast | 3.0% |

| Midwest | 2.6% |

The West grows at 3.7% CAGR, supported by extensive healthcare networks, strong outpatient-care activity, and high treatment volume for chronic wounds across large urban and suburban regions. States such as California, Washington, and Colorado maintain specialized wound-care clinics that employ advanced dressings, negative-pressure therapy, and bioactive materials for managing diabetic ulcers and pressure injuries. Health systems adopt moisture-management products and antimicrobial dressings to reduce complication rates among aging populations. Outpatient surgical centers use advanced wound-care solutions for postoperative healing. Regional research institutions contribute to steady adoption of evidence-based care practices, reinforcing consistent product utilization across hospitals, clinics, and home-care environments.

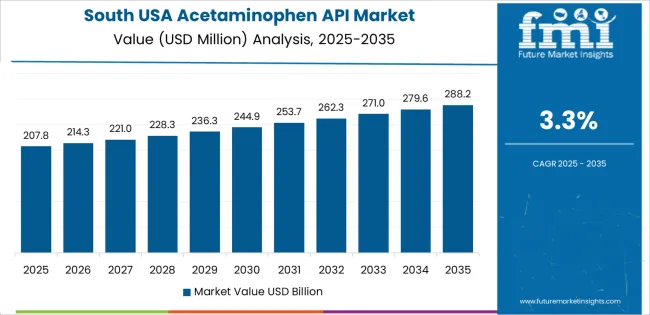

The South grows at 3.3% CAGR, supported by high chronic-wound incidence, large diabetic populations, and wide use of advanced dressings across outpatient wound-care facilities. States such as Texas, Florida, Georgia, and North Carolina operate extensive healthcare systems that treat venous ulcers, pressure injuries, and trauma-related wounds. Hospitals adopt negative-pressure therapy and advanced foam dressings to improve healing outcomes. Home-health organizations use hydrocolloid, alginate, and hydrofiber products for long-term wound management. Rising comorbidity rates reinforce demand for consistent wound-care protocols. Healthcare expansion in fast-growing metropolitan areas contributes to recurring product procurement across clinical environments.

The Northeast grows at 3.0% CAGR, supported by dense hospital networks, academic medical centers, and high wound-care service utilization across aging populations. States such as New York, New Jersey, Massachusetts, and Pennsylvania maintain specialized wound-care programs that rely on advanced dressings, negative-pressure systems, and collagen-based materials. Hospitals integrate evidence-based protocols to manage surgical wounds, venous ulcers, and pressure injuries. Outpatient clinics adopt advanced moisture-control products for chronic wound treatment. Research-driven healthcare facilities promote consistent use of innovative wound-care materials across inpatient and outpatient settings.

The Midwest grows at 2.6% CAGR, supported by established healthcare networks, consistent treatment of chronic wounds, and ongoing adoption of advanced dressings across hospitals and long-term-care facilities. States such as Illinois, Michigan, Ohio, and Wisconsin treat high volumes of diabetic and pressure-related wounds, maintaining demand for moisture-management and antimicrobial products. Long-term-care centers depend on advanced dressings to reduce complications among elderly residents. Regional hospitals integrate negative-pressure therapy into routine wound-management workflows. Although growth is moderate due to mature infrastructure, stable wound-care needs reinforce continuous product usage across clinical settings.

Demand for advanced wound-care products in the USA is shaped by a concentrated group of medical-technology companies supplying dressings, negative-pressure systems, antimicrobial solutions, and moisture-management therapies. Smith & Nephew plc holds the leading position with an estimated 35.3% share, supported by its broad wound-care portfolio, controlled manufacturing standards, and long-established presence in USA hospitals and outpatient centres. Its position is reinforced by dependable clinical performance and strong distribution partnerships.

Mölnlycke Health Care AB and 3M Company follow as major participants, offering foam dressings, antimicrobial products, and advanced adhesive technologies used across acute and chronic wound management. Their strengths include consistent product reliability, extensive clinical data, and wide adoption within surgical and long-term-care settings. ConvaTec Group maintains a significant role through hydrocolloid dressings, skin-protection systems, and negative-pressure solutions designed for complex wound environments.

Coloplast A/S contributes additional capability through dressings and skin-care products widely used in home-health and chronic-care programmes, emphasizing gentle adhesion, moisture balance, and predictable healing support. Competition across this segment centers on exudate control, moisture-management performance, patient comfort, infection-prevention capability, and clinical evidence. Demand is sustained by the prevalence of chronic wounds, increased surgical volumes, and continued adoption of advanced dressing technologies and negative-pressure systems that support faster, more predictable healing outcomes in USA care settings.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Products | Advance Wound Care Dressings, Negative Pressure Wound Therapy, Compression Therapy Devices |

| Indication | Chronic Wounds, Burn Cases, Post-Surgical Wounds, Traumatic Wounds |

| End Users | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Long Term Care Centers, Home Care Settings |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Smith & Nephew plc, Mölnlycke Health Care AB, 3M Company, ConvaTec Group, Coloplast A/S |

| Additional Attributes | Dollar sales by product type, indication, and end-user categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of advanced wound care manufacturers; advancements in moist wound dressings, negative pressure systems, and compression technologies; integration with hospital wound management programs, chronic care settings, and home-based wound care services in the USA. |

The global demand for advance wound care in USA is estimated to be valued at USD 4.4 billion in 2025.

The market size for the demand for advance wound care in USA is projected to reach USD 6.0 billion by 2035.

The demand for advance wound care in USA is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for advance wound care in USA are advance wound care dressings, negative pressure wound therapy and compression therapy devices.

In terms of indication, chronic wounds segment to command 47.0% share in the demand for advance wound care in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advance Wound Care Market Analysis by Advance Wound Dressings, NPWT Devices and Others through 2035

Demand for Advance Wound Care in Japan Size and Share Forecast Outlook 2025 to 2035

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Advanced Wound Management Market Growth - Industry Outlook 2025 to 2035

Advanced Wound Dressing Market by Product, Wound Type, End User and Region 2025 to 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

USA and Canada Pet Care Products Market Analysis – Size, Share and Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Autologous Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Wound Care Market Growth – Trends & Forecast 2023-2033

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Vision Care in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Homecare Medical Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Animal Healthcare in USA Size and Share Forecast Outlook 2025 to 2035

Synthetic Hemostatic & Wound Care Products Market Analysis – Trends & Forecast 2024-2034

Demand for Advanced Mobile UX Design Services in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA