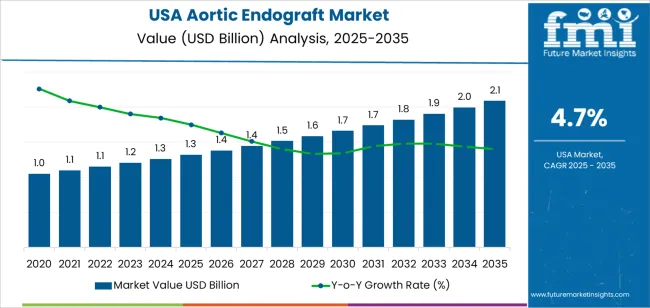

The demand for aortic endografts in the USA is projected to reach USD 2.1 billion by 2035, reflecting an absolute increase of USD 0.8 billion from 2025. Starting at USD 1.3 billion in 2025, the market is expected to grow at a steady CAGR of 4.7%. Aortic endografts are used to treat aortic aneurysms, offering a minimally invasive alternative to traditional open surgery. These devices, which are increasingly favored for their safety and efficiency, provide essential treatment options for patients with life-threatening aortic conditions.

The key growth drivers for this demand include the rising prevalence of aortic aneurysms, particularly in the aging population, along with advancements in endograft technology that improve patient outcomes. As these devices become more advanced, their adoption in clinical settings, especially in vascular surgeries, is expected to grow. The increasing preference for minimally invasive procedures, which reduce recovery times and hospital stays, will drive further demand for aortic endografts. The growing awareness of endovascular therapies as a safer and more effective alternative to traditional surgery will also contribute to the market’s expansion. With ongoing technological innovations and increasing patient comfort, the demand for these devices is expected to rise steadily through 2035.

From 2025 to 2030, the growth rate is expected to be relatively stable, with demand increasing from USD 1.3 billion to USD 1.4 billion, growing at an average rate of approximately 4.7% annually. This phase is characterized by steady adoption, as healthcare providers and patients increasingly turn to endovascular procedures for aortic aneurysm treatment. The technology is still maturing during this phase, and the adoption rate will be driven primarily by awareness, the expansion of endovascular therapies, and advancements in device design. The overall volatility during this phase will be low, given the moderate yet consistent growth expected in the demand for aortic endografts.

From 2030 to 2035, the market is expected to experience more significant volatility, with the growth rate accelerating as demand rises from USD 1.4 billion to USD 2.1 billion. The growth rate during this period will spike, reflecting the increased adoption of aortic endografts as a standard treatment for aortic aneurysms, due to improvements in device technology, patient outcomes, and healthcare policy changes. Innovations in the devices, better patient outcomes, and wider access to endovascular procedures will drive rapid expansion, while competition among manufacturers to produce more effective, cost-efficient devices will also contribute to market volatility.

| Metric | Value |

|---|---|

| USA Aortic Endograft Sales Value (2025) | USD 1.3 billion |

| USA Aortic Endograft Forecast Value (2035) | USD 2.1 billion |

| USA Aortic Endograft Forecast CAGR (2025 to 2035) | 4.70% |

Demand for aortic endografts in the USA is increasing as the prevalence of aortic aneurysms and related vascular disorders rises with the aging population. Aortic endografts minimally invasive vascular implants used to repair aortic aneurysms offer patients a less traumatic alternative to open surgery, with shorter hospital stays and faster recovery. As more clinicians adopt endovascular therapies over traditional surgical approaches, usage of endografts continues to expand.

Improved imaging, navigation systems, and endograft designs are further contributing to increased adoption. Advancements such as branched and fenestrated endografts, better materials, and lower complication rates are enhancing clinical outcomes and willingness to use these devices in more complex anatomies. As physicians become more comfortable with these technologies, endovascular procedures become standard practice for more types of aortic conditions.

Healthcare systems in the USA are increasingly emphasizing value‑based care and patient outcomes, which supports use of minimally invasive options like endografts that reduce perioperative risks and improve recovery times. With further refinements in delivery systems and broader patient awareness, demand for aortic endografts is expected to continue growing steadily through 2035.

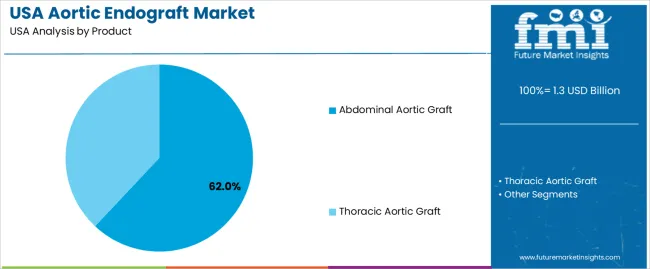

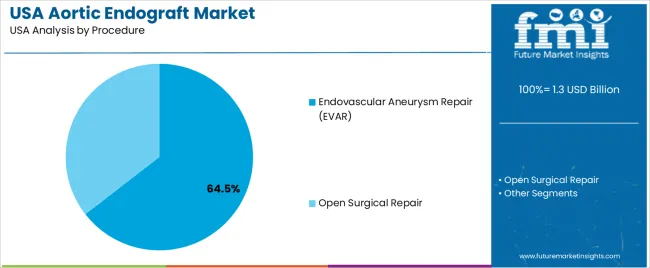

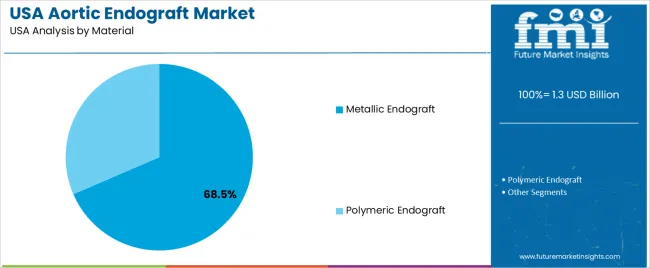

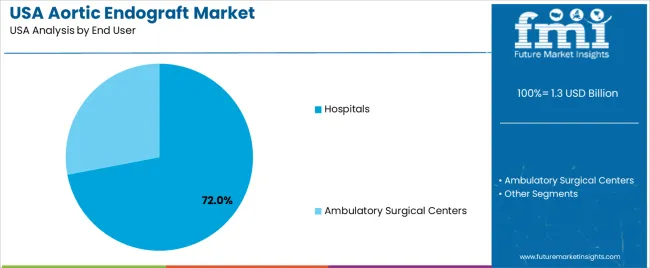

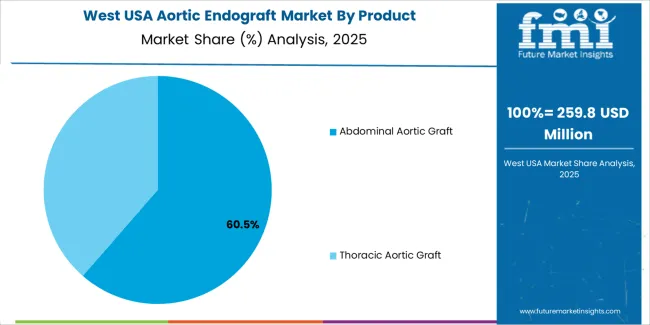

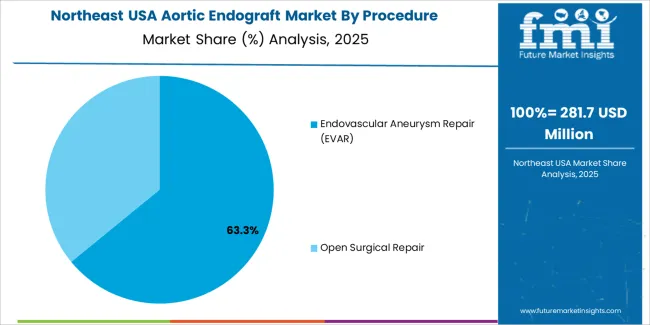

Demand for aortic endografts is segmented by product type, procedure, material, and end user. By product type, demand is divided into abdominal aortic grafts and thoracic aortic grafts, with abdominal aortic grafts holding the largest share. The demand is also segmented by procedure, including endovascular aneurysm repair (EVAR) and open surgical repair, with EVAR accounting for the largest share. In terms of material, metallic endografts lead the demand, followed by polymeric endografts. The end-user segmentation includes hospitals and ambulatory surgical centers, with hospitals accounting for the largest share. Regionally, demand is divided into West, South, Northeast, and Midwest.

Abdominal aortic grafts account for 62% of the demand for aortic endografts in the USA. These grafts are primarily used to treat abdominal aortic aneurysms, which are common and often life-threatening. The high prevalence of abdominal aortic aneurysms, combined with advancements in endovascular procedures, drives the demand for abdominal aortic grafts. These grafts offer a minimally invasive option to repair the aneurysm, reducing recovery times and associated risks compared to traditional open surgery.

The demand for abdominal aortic grafts is further fueled by the growing awareness of the benefits of endovascular repair, including shorter hospital stays, reduced complication rates, and quicker recovery. As the focus on improving patient outcomes and reducing healthcare costs grows, the demand for abdominal aortic grafts will continue to lead in the aortic endograft segment.

Endovascular aneurysm repair (EVAR) accounts for 64.5% of the demand for aortic endografts in the USA. EVAR is a minimally invasive procedure used to treat aneurysms in the aorta by placing a stent graft through small incisions in the groin, offering a quicker recovery and fewer complications compared to open surgery. As the preferred method for treating aortic aneurysms, EVAR has seen widespread adoption due to its reduced mortality rates and faster recovery times.

The growing adoption of EVAR is driven by the increasing demand for minimally invasive procedures, particularly in the treatment of high-risk patients or those with comorbidities. The reduced risk and faster recovery time compared to open surgical repair make EVAR a more appealing option for both patients and healthcare providers, ensuring its continued dominance in the aortic endograft procedure segment.

Metallic endografts account for 68.5% of the demand for aortic endografts in the USA. These endografts are made from durable materials such as stainless steel or cobalt-chromium alloys, offering strength, flexibility, and resistance to rupture or failure. Metallic endografts are commonly used for both abdominal and thoracic aortic aneurysms, providing reliable performance and long-term durability.

The preference for metallic endografts is driven by their proven effectiveness and longevity in the treatment of aortic aneurysms. The ability to provide a secure and stable repair, along with a low risk of graft failure, continues to drive demand for metallic endografts, making them the leading material choice in aortic endograft procedures.

Hospitals account for 72% of the demand for aortic endografts in the USA. Hospitals are the primary healthcare settings for the treatment of aortic aneurysms, as they provide the infrastructure and expertise needed for complex procedures such as EVAR and open surgical repair. The demand for aortic endografts in hospitals is driven by their capacity to handle high-risk patients and provide comprehensive care before, during, and after the procedure.

The dominance of hospitals in the end-user segment is due to their advanced surgical facilities, access to specialized care teams, and the ability to manage patients requiring complex and high-risk interventions. As the treatment of aortic aneurysms continues to be a critical area of focus in healthcare, hospitals will remain the largest consumers of aortic endografts in the USA.

Aortic endografts devices are used in minimally invasive procedures like Endovascular Aneurysm Repair (EVAR) and Thoracic Endovascular Aortic Repair (TEVAR), which replace open‑surgical repair of aneurysms. Key drivers include the growing incidence of abdominal and thoracic aortic aneurysms, a shift toward minimally invasive treatments with lower complication rates and faster recovery, and advances in graft design (such as branched/fenestrated grafts). Restraints include high procedural and device costs, anatomical challenges that limit use of standard grafts in complex cases, reimbursement constraints, and reliance on skilled vascular intervention specialists.

Demand for aortic endografts in the USA is growing because more patients with aortic aneurysms are being identified and many are eligible for endovascular repair rather than open surgery. With an aging demographic and higher prevalence of conditions like hypertension, atherosclerosis and smoking‑related vascular damage, the patient pool for endograft therapies is expanding. Physicians favour less invasive options because they typically yield shorter hospital stays, lower perioperative risk and faster patient recovery. Improved screening and imaging help detect aneurysms earlier, increasing opportunities to intervene using endografts.

Technological innovations are boosting the use of aortic endografts in the USA by increasing the range of anatomies that can be treated and improving clinical outcomes. Newer grafts feature low‑profile delivery systems, branched or fenestrated designs for complex aortic arch/thoracoabdominal cases, and enhanced materials to improve sealing and durability. Integration of 3D imaging and preoperative planning facilitates customized graft selection and placement. These advances expand eligibility and improve procedural success, making more physicians comfortable with using endografts for broader patient groups.

Despite growth, several challenges hinder broader adoption of aortic endografts in the USA. The high cost of devices and associated procedures may limit use, especially in smaller hospitals. Some patients are anatomically unsuitable for standard grafts (for example due to short or highly angulated aortic necks), restricting eligibility. There is also ongoing need for vascular specialists and imaging infrastructure, which not all centres may possess. Reimbursement complexity and long‑term durability concerns (e.g., risk of endoleak or reintervention) add uncertainty for providers and payers.

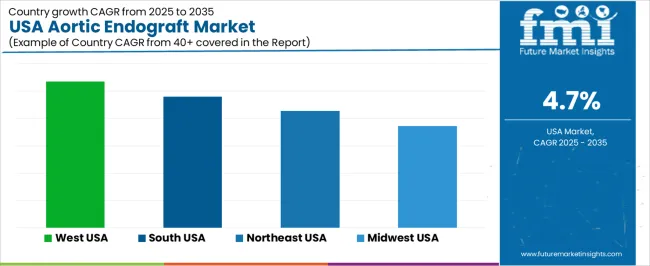

| Region | CAGR (%) |

|---|---|

| West | 5.4% |

| South | 4.8% |

| Northeast | 4.3% |

| Midwest | 3.7% |

The demand for aortic endografts in the USA is growing across all regions, with the West leading at a 5.4% CAGR. This growth is driven by increasing incidences of aortic aneurysms and the rising adoption of minimally invasive treatment methods. The South follows with a 4.8% CAGR, influenced by an expanding healthcare infrastructure and a higher number of cardiovascular procedures. The Northeast shows a 4.3% CAGR, supported by its well-established medical centers. The Midwest experiences moderate growth at 3.7%, driven by improved access to healthcare and ongoing advancements in endovascular surgeries.

The West is seeing the highest demand for aortic endografts, with a 5.4% CAGR, largely due to the region’s leading healthcare infrastructure and technological advancements. Major medical centers in cities like Los Angeles, San Francisco, and Seattle are increasingly adopting minimally invasive procedures for treating aortic aneurysms, such as endovascular aneurysm repair (EVAR), which utilizes aortic endografts. These procedures are becoming the standard treatment due to their lower risk and faster recovery times compared to traditional open surgeries.

The West’s aging population and increasing awareness of cardiovascular health issues are driving the demand for these devices. With growing incidences of aortic aneurysms and other cardiovascular conditions, the West continues to lead the country in adopting advanced surgical technologies, including aortic endografts. The region’s focus on patient-centered care and the increasing availability of specialized cardiovascular centers will likely continue to drive strong growth in the demand for aortic endografts.

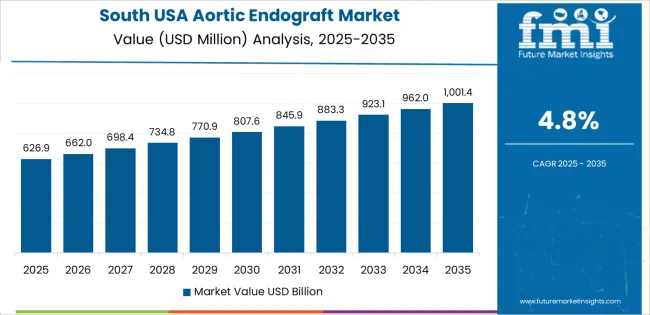

The South is experiencing strong growth in demand for aortic endografts, with a 4.8% CAGR. This growth is influenced by the increasing number of cardiovascular procedures and the rising adoption of minimally invasive techniques, especially in states like Texas, Florida, and Georgia. The South has seen a rise in the number of specialized centers for endovascular treatments, providing patients with access to innovative, life-saving procedures that utilize aortic endografts.

The region's aging population and the increasing prevalence of risk factors such as hypertension and smoking contribute to the rise in aortic aneurysms. With hospitals and healthcare providers in the South continuing to expand their cardiovascular services and integrate advanced endograft technologies into their treatment protocols, the demand for aortic endografts is expected to continue its upward trend. The region’s growing awareness of the benefits of minimally invasive treatments will further drive the adoption of these devices.

The Northeast is seeing steady demand for aortic endografts, with a 4.3% CAGR. The region’s strong healthcare infrastructure, particularly in cities like New York, Boston, and Philadelphia, plays a significant role in driving demand for advanced cardiovascular devices. With some of the country’s leading hospitals and academic medical centers, the Northeast is a key area for the adoption of new medical technologies, including endografts for treating aortic aneurysms.

The region’s focus on offering minimally invasive treatment options for patients is contributing to the increased use of aortic endografts. As the aging population in the Northeast grows, so does the need for treatment options for aortic aneurysms. The adoption of aortic endografts allows for quicker recovery times, fewer complications, and reduced healthcare costs compared to traditional open surgeries. As healthcare providers continue to integrate these technologies into their surgical practices, the Northeast will see steady growth in the demand for aortic endografts.

The Midwest is experiencing moderate growth in the demand for aortic endografts, with a 3.7% CAGR. This growth is driven by ongoing advancements in endovascular treatments and improved access to healthcare, particularly in cities like Chicago, Detroit, and St. Louis. While the Midwest is not growing as quickly as other regions, it has seen a steady increase in the adoption of minimally invasive surgeries, including those utilizing aortic endografts for treating aortic aneurysms.

The region’s healthcare providers are increasingly turning to aortic endografts as a safe and effective treatment for patients with cardiovascular conditions. With an aging population and the rising prevalence of risk factors such as obesity, smoking, and high blood pressure, the demand for these devices is expected to continue growing, albeit at a more moderate pace compared to other regions. The Midwest’s ongoing focus on improving healthcare infrastructure and expanding access to advanced medical technologies will support the steady growth of aortic endografts in the region.

Demand for aortic endografts in the United States is strong and accelerating, propelled by a growing prevalence of aortic aneurysms, an aging population, and the shift toward minimally invasive endovascular surgical techniques. These devices used in procedures such as endovascular aneurysm repair (EVAR) and thoracic endovascular aneurysm repair (TEVAR) are increasingly preferred over open‑surgical methods due to lower perioperative risks, shorter hospital stays, and faster patient recovery.

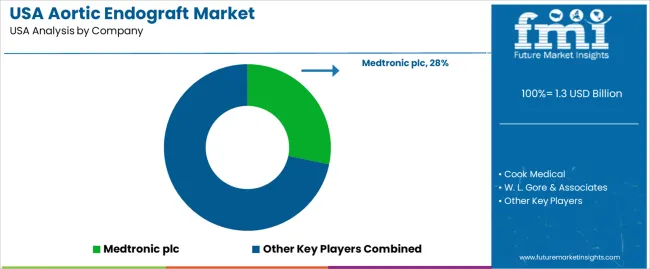

In the USA demand landscape, Medtronic plc holds an estimated 28.2% share, reflecting its leadership through an extensive portfolio of endograft systems, strong clinical outcomes, and established relationships with vascular surgeons and hospital networks. Other major contributors in this space include Cook Medical, W. L. Gore & Associates, Terumo Corporation, and Endologix LLC, each offering advanced graft solutions tailored for varying aortic anatomies, from abdominal to thoracic applications.

Key factors driving this demand include increased early screening and diagnosis of aortic aneurysms, expansion of endovascular-capable hospitals and surgical centers, and ongoing device innovation such as branched/fenestrated grafts and integration with advanced imaging for more complex anatomies. Despite the positive trajectory, challenges remain: high device and procedural costs, reimbursement pressures, and the need for continued surgeon training and long‑term outcome data may moderate uptake in certain hospitals. Nonetheless, the outlook for aortic endograft demand in the USA remains favorable, as the convergence of demographic, technological, and procedural trends supports constant growth.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | Abdominal Aortic Graft, Thoracic Aortic Graft |

| Procedure | Endovascular Aneurysm Repair (EVAR), Open Surgical Repair |

| Material | Metallic Endograft, Polymeric Endograft |

| End User | Hospitals, Ambulatory Surgical Centers |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Medtronic plc, Cook Medical, W. L. Gore & Associates, Terumo Corporation, Endologix LLC |

| Additional Attributes | Dollar sales are driven by key product types like abdominal and thoracic aortic grafts, with procedures such as EVAR and open surgical repair. Material types include metallic and polymeric endografts. Regional trends focus on strong demand across the West, South, Northeast, and Midwest, particularly within hospitals and surgical centers. |

The global demand for aortic endograft in USA is estimated to be valued at USD 1.3 billion in 2025.

The market size for the demand for aortic endograft in USA is projected to reach USD 2.1 billion by 2035.

The demand for aortic endograft in USA is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in demand for aortic endograft in USA are abdominal aortic graft and thoracic aortic graft.

In terms of procedure, endovascular aneurysm repair (evar) segment to command 64.5% share in the demand for aortic endograft in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aortic Endografts Industry Analysis by Product, Procedure, Material, End Users and Regions 2025 to 2035

Demand for Aortic Endograft in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Aortic Stent Grafts Market Analysis - Size, Share, and Forecast 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA